false

0001526113

0001526113

2024-02-28

2024-02-28

0001526113

us-gaap:CommonStockMember

2024-02-28

2024-02-28

0001526113

us-gaap:SeriesAPreferredStockMember

2024-02-28

2024-02-28

0001526113

us-gaap:SeriesBPreferredStockMember

2024-02-28

2024-02-28

0001526113

us-gaap:PreferredStockMember

2024-02-28

2024-02-28

0001526113

us-gaap:SeriesEPreferredStockMember

2024-02-28

2024-02-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 28, 2024

Global Net Lease, Inc.

(Exact Name of Registrant as Specified in

Charter)

| Maryland |

|

001-37390 |

|

45-2771978 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

650 Fifth Avenue, 30th Floor

New York, New York 10019

(Address, including zip code, of Principal Executive Offices)

Registrant’s telephone number,

including area code: (332) 265-2020

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

| Common

Stock, $0.01 par value per share |

|

GNL |

|

New York Stock Exchange |

| 7.25%

Series A Cumulative Redeemable Preferred Stock, $0.01 par value per share |

|

GNL PR A |

|

New York Stock Exchange |

| 6.875%

Series B Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share |

|

GNL PR B |

|

New York Stock Exchange |

| 7.50% Series D Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share |

|

GNL PR D |

|

New York Stock Exchange |

| 7.375% Series E Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share |

|

GNL PR E |

|

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 7.01. Regulation FD Disclosure.

Earnings Call Script

On February 28, 2024, Global Net Lease, Inc. (the

“Company”) hosted a conference call to discuss its financial and operating results for the quarter ended December 31, 2023.

A transcript of the pre-recorded portion of the conference call is furnished as Exhibit 99.1 to this Current Report on Form 8-K. As previously

disclosed, a replay of the entire conference call is available through May 28, 2024 by telephone as follows:

Domestic Dial-In (Toll Free): 1-844-512-2921

International Dial-In: 1-412-317-6671

Conference Replay Number: 10185095

The information set forth in this Item 7.01 of

this Current Report on Form 8-K and in the attached Exhibit 99.1 is deemed to be “furnished” and shall not be deemed to be

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or

otherwise subject to the liabilities of that Section and shall not be deemed incorporated by reference into any filing under the Exchange

Act or the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

The statements in this Current Report on Form

8-K that are not historical may be forward-looking statements, including statements regarding the intent, belief or current expectations

of us, our operating partnership and members of our management team, as well as the assumptions on which such statements are based, and

generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,”

“believes,” “estimates,” “projects,” “potential,” “predicts,” “expects,”

“plans,” “intends,” “would,” “could,” “should” or similar expressions are

intended to identify forward-looking statements, although not all forwardlooking statements contain these identifying words. Actual results

may differ materially from those contemplated by such forward-looking statements. These forward-looking statements are subject to risks,

uncertainties and other factors, many of which are outside of the Company’s control, which could cause actual results to differ

materially from the results contemplated by the forward-looking statements. These risks and uncertainties include the risks associated

with the merger with The Necessity Retail REIT, Inc. and the internalization of the Company’s property management and advisory functions;

the geopolitical instability due to the ongoing military conflicts between Russia and Ukraine and Israel and Hamas, including related

sanctions and other penalties imposed by the U.S. and European Union, and the related impact on the Company, the Company’s tenants

and the global economy and financial markets; that any potential future acquisition by the Company is subject to market conditions and

capital availability and may not be identified or completed on favorable terms, or at all. Some of the risks and uncertainties, although

not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward-looking

statements are set forth under “Risk Factors” and “Quantitative and Qualitative Disclosures about Market Risk”

in its Annual Report on Form 10-K , its Quarterly Reports on Form 10-Q, and its other filings with the U.S. Securities and Exchange Commission

after that date, as such risks, uncertainties and other important factors may be updated from time to time in the Company's subsequent

reports. Further, forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update

or revise any forward-looking statement to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating

results over time, unless required by law.

Item 9.01. Financial Statements and Exhibits.

| Exhibit No |

|

Description |

| 99.1 |

|

Transcript |

| 104 |

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GLOBAL NET LEASE, INC. |

| |

|

|

| Date: February 28, 2024 |

By: |

/s/ Edward M. Weil, Jr. |

| |

|

Name: Edward M. Weil, Jr. |

| |

|

Title: Co-Chief Executive Officer

(Co-Principal Executive Officer) |

Exhibit 99.1

Operator

Good afternoon and welcome to the Global Net Lease

Fourth Quarter 2023 Earnings Call. [Operator Instructions]. I would now like to turn the conference over to Jordyn Schoenfeld, Associate

at Global Net Lease. Please go ahead.

Jordyn Schoenfeld

Thank you. Good afternoon, everyone and thank

you for joining us for GNL's fourth quarter 2023 Earnings Call. Joining me today on the call are Mike Weil and Jim Nelson, GNL’s

co-Chief Executive Officers, and Chris Masterson, GNL’s Chief Financial Officer.

The following information contains forward-looking

statements, which are subject to risks and uncertainties. Should one or more of these risks or uncertainties materialize, actual results

may differ materially from those expressed or implied by the forward-looking statements. We refer all of you to our SEC filings including

the Form 10-K and our periodic and current reports filed with the SEC after that date for a more detailed discussion of the risk factors

that could cause these differences.

Any forward-looking statements provided during

this conference call are only made as of the date of this call. As stated in our SEC filings, GNL disclaims any intent or obligation to

update or revise these forward-looking statements except as required by law. Any guidance or statements referring to our pipeline or the

future value of an investment in GNL, including any adjustments giving effect to the recently completed merger with The Necessity Retail

REIT Inc. (“RTL”) and the internalization of both GNL’s and RTL’s advisory and property management functions,

as well as any projections about future success following the merger and internalization, are also forward-looking statements. Also, during

today's call, we will discuss non-GAAP financial measures, which we believe can be useful in evaluating the company's financial performance.

These measures should not be considered in isolation or as a substitute for our financial results prepared in accordance with GAAP. A

reconciliation of these measures to the most directly comparable GAAP measure is available in our earnings release and supplement which

are posted to our website. Please note that we do not provide guidance on net income. We only provide guidance on AFFO per share and our

Net Debt to Adjusted EBITDA ratio and do not provide reconciliations of this forward-looking non-GAAP guidance to net income per share

or our debt to net income due to the inherent difficulty in quantifying certain items necessary to provide such reconciliations as a result

of their unknown effect, timing and potential significance. Examples of such items include impairments of assets, gains and losses from

sales of assets, and depreciation and amortization from new acquisitions and other non-recurring expenses. Please also refer to our earnings

release for more information about what we consider to be implied investment grade tenants, a term we will use throughout today's call.

I'll now turn the call over to our co-CEO, Mike

Weil. Mike?

Mike Weil

Thanks, Jordyn. Good morning and thank you all

for joining us today.

GNL is now the third largest publicly traded net

lease REIT with a global presence and features a diversified portfolio of high quality, primarily investment grade tenants. GNL's focus

on investment-grade tenants as compared to our peers highlights the stability and high-quality of our rental income. The largest tenant

in the portfolio only accounts for 3.1% of the total straight-line rent with the top ten tenants totaling just 21% of the portfolio, effectively

mitigating concentration risk within the portfolio. We believe our diverse portfolio provides us with the flexibility and capacity to

capitalize on numerous market opportunities, maximizing shareholder value over the long-term.

2023 was a transformative year for GNL that included

the internalization of management and enhanced corporate governance, further aligning GNL with its net-lease peers. In addition to the

merger and internalization, 2023 also highlighted GNL’s strong asset management platform capabilities with continued leasing momentum.

As a direct result of the merger, GNL has also recognized significant synergies, as outlined in our investor deck, and we are currently

on track to achieve our stated $75 million of annualized cost savings by the third quarter of 2024.

GNL is implementing a 2024 business plan focused

on deleveraging its balance sheet, reducing its exposure to variable rate debt and driving down its net debt to adjusted EBITDA. Our near-term

strategic priority will focus on reducing leverage through select dispositions, prioritizing non-core assets and opportunistic sales.

We have strategically reviewed our portfolio and identified assets where we believe there is beneficial opportunity to divest. This includes

assets that are non-core or have near-term debt maturities or near-term lease expirations. We expect a total of $400 million to $600 million

of strategic dispositions in 2024. This disposition program will drive long-term shareholder value by generating cash to enhance and de-risk

our balance sheet and create a clear path forward for us to potentially narrow the trading discount compared to our net-lease peers. Selling

assets at attractive cap rates will also provide proof of value to investors and demonstrate a significant premium compared to where the

Company is currently trading on an implied cap rate basis. Driving down leverage through measured opportunistic dispositions is the proper

approach to maximize long-term shareholder value with proceeds used to lower our net debt to adjusted EBITDA.

Our near-term strategic approach also involves

a planned reduction of GNL’s annual dividend from $1.42 to $1.10 per share, increasing the amount of annualized cash by $74 million

to further reduce leverage. This reflects the Company’s continued commitment to strengthening its balance sheet while maintaining

a disciplined dividend policy.

Turning to our portfolio,

at year end 2023 we had approximately 1,300 properties spanning nearly 67 million square feet, with a gross asset value of $9.2 billion.

The diverse composition of our net lease portfolio is unmatched whether measured by geography, asset type, tenant or industry, and positions

GNL to effectively navigate external macro challenges as we move ahead. The portfolio maintained occupancy of 96% with a weighted

average remaining lease term of 6.8 years. Geographically, 80% of our straight-line rent is earned in North America, while 20% comes from

Europe. The portfolio also features a stable tenant base and a high-quality of earnings with an industry-leading 58% of tenants receiving

an investment-grade or implied investment-grade credit rating. From a growth perspective, the portfolio includes an average annual

contractual rental increase of 1.3%.

I am again highlighting the strong asset management

capabilities we demonstrated as we continue our leasing and renewal efforts. In particular, our fourth quarter leasing and renewal activity

included over 2.1 million square feet across the entire portfolio with attractive leasing spreads on renewals that were 6% higher than

the expiring rents. New leases that were completed in the fourth quarter of 2023 have a weighted average lease term of 9.2 years, while

the renewals that were completed in the fourth quarter of 2023 have a weighted average lease term of 6.1 years.

The largest segment of our portfolio is industrial

and distribution with 219 properties that span over 33.9 million square feet that contributed $235 million to annualized straight-line

rent. 92% of the leases in this portfolio include rent escalations with an average annual rental increase of 1.5%, positioning the portfolio

to benefit from annual rental income while having a 7.7 year weighted average lease term. Our single-tenant retail segment is the largest

by property count with 878 properties that span over 7.9 million square feet and contributed $154 million to annualized straight-line

rent. The single-tenant retail segment comprises 66% investment-grade or implied investment-grade rated tenants and features an 8.3 year

weighted average lease term.

The multi-tenant suburban retail segment consists

of 109 properties that span over 16.4 million square feet that contributed $200 million in annualized straight-line rent. The portfolio

has a weighted average remaining lease term of 5.2 years and includes 21% of grocery anchored centers which are 90% leased. This segment

is predominately comprised of triple-net leases with incremental lease up potential and attractive leasing spreads. Additionally, 61%

of the straight line rent in this portfolio comes from Sunbelt markets which continue to grow and have favorable demographic tailwinds.

Our smallest segment

by straight-line rent, single-tenant office, includes 90 properties that span 8.6 million square feet, and contributed $143 million to

annualized straight-line rent and have a 5.0 year weighted average lease term. One of the metrics that differentiates GNL's single-tenant

office portfolio is that it is comprised of 70% mission critical facilities, which we define as headquarters, lab or R&D facilities

and features 68% investment-grade or implied investment-grade tenants, which we believe provides our portfolio with rent stability and

low level of default risk. Given GNL’s successful track record of lease renewals, the single-tenant office segment also includes

limited near-term lease maturities, minimizing the risk of vacancy.

A fundamental aspect of our comprehensive portfolio

strategy involves limiting concentration risk. The combined annual straight-line rent from our top 10 tenants amounts to only 21% of our

overall portfolio, with our largest tenant contributing just 3.1%. Our approach to mitigating concentration risk also extends to every

segment of our portfolio, ensuring diversity among the top 5 tenants within each segment which we have highlighted in the investor deck.

This diversified and investment-grade tenant base not only ensures stability but also offers predictability in rental income, laying a

solid foundation for our future growth. The quality and reliability of our tenants underscore the resilience and longevity of our business

model.

Our leasing results continue to illustrate the

quality of our assets, driving leasing rates higher even in the current environment. The single-tenant segment completed 16 new leases

and renewals and showcased a positive 8% renewal leasing spread, demonstrating the strong renewal demand for our mission critical assets

while adding nearly $9 million to net straight-line rent. The multi-tenant segment completed 54 new leases and renewals resulting in a

2% renewal spread, consistent with the high demand we are experiencing at our suburban shopping centers, which increased net straight-line

rent by over $10.5 million. New leases that were completed in the fourth quarter of 2023 have a weighted average lease term of 9.2 years,

while the renewals that were completed in the fourth quarter of 2023 have a weighted average lease term of 6.1 years. Our executed leases

at the end of the fourth quarter 2023, combined with our leasing pipeline as of February 15, 2024 will bring occupancy in our multi-tenant

portfolio from 88% to 91%. To put that in perspective, the multi-tenant portfolio represents only 27% of total straight-line rent in our

portfolio and GNL's overall portfolio occupancy stands at 96%. The fourth quarter 2023 highlighted our commitment to expanding relationships

with existing tenants including new leases and renewals with Burlington, H-E-B Grocery and Dick’s Sporting Goods.

Looking ahead, we remain committed to executing

on our systematic and prudent approach to achieving our financial objectives, which revolve around reducing net debt to adjusted EBITDA

while organically enhancing NOI through lease-up initiatives and contractual rent growth. A pivotal component of this strategy involves

non-core dispositions and opportunistic sales, which should provide us with capital to deleverage our balance sheet. We believe this strategy

will pave the way to reducing the valuation gap with our net lease peers.

I'll turn the call over to Chris to walk through

the financial results in more detail. Chris?

Chris Masterson

Thanks, Mike.

Typically, we would provide year-over-year financial

comparisons, however that would not be meaningful at this time given the recent merger and internalization. Going forward, we will begin

comparing to prior quarters until Q4 2024 when we will have a full year of a merged and internalized GNL.

For the fourth quarter 2023 we recorded

revenue of $206.7 million, and a net loss attributable to common stockholders of $59.5 million. Core FFO was $48.3 million or $0.21

per share, and AFFO was $71.7 million or $0.31 per share. In Q4 2023, we incurred an elevated

$5.5 million European income tax expense in the quarter and $2.3 million one-time write offs primarily related to reimbursements. We have

completed a European Tax restructure that we expect will reduce the Company's income tax expense beginning in Q1 2024.

As always, a reconciliation of GAAP net income

to the non-GAAP measures can be found in our earnings release, which is posted on our website.

Looking at our balance sheet, it’s worth

noting that while only 20% of our debt is subject to variable rates, the current sustained high interest rate environment does have a

temporary effect on the portion of our debt that isn’t fixed or swapped. To mitigate this, we seek to reduce our exposure to variable

rate debt as we move through the year. As part of our strategy to address 2024 debt maturities and subsequent to the fourth quarter, we

completed an $80 million refinancing agreement with Nordea Bank secured by multiple properties in Finland that extend the debt maturities

of these assets to 2029 at a 4.6% interest rate. GNL has a plan to address the remaining 2024 debt maturities through dispositions, refinancings

and availability on the credit facility. We will continue to address the 2025 maturities and anticipate that the second half of 2024 will

present a more favorable environment for debt maturities beyond 2024 but we remain confident in our ability to refinance these assets.

Our net debt to adjusted EBITDA ratio was 8.4x.

We ended the fourth quarter with net debt of $5.3 billion at a weighted-average interest rate of 4.8%, and had liquidity of approximately

$135.7 million and $206 million of capacity on our credit facility. The weighted-average maturity at the end of the fourth quarter 2023

was 3.2 years with minimal debt maturity due in 2024.

Our debt comprises $1.0 billion in senior notes,

$1.7 billion on the multi-currency revolving credit facility and $2.7 billion of outstanding gross mortgage debt. Our debt was 80% fixed

rate, which includes floating rate debt with in-place interest rate swaps, and our interest coverage ratio was 2.4x. As of December 31,

2023 we had approximately 230.9 million common shares outstanding. On a weighted average basis, there were approximately 230.3 million

shares outstanding during the fourth quarter of 2023.

Lastly, it is our objective to provide investors

with enhanced transparency regarding our financial goals and projections, and therefore we would like to introduce initial 2024 guidance

today with an AFFO per share guidance range of $1.30 to $1.40 and a Net Debt to Adjusted EBITDA range of 7.4x to 7.8x. The initial guidance

reflects our assumption, mentioned earlier, that our projected 2024 dispositions will be in the range of $400 million to $600 million.

The majority of these dispositions will come from occupied opportunistic sales, where we anticipate achieving a cash cap rate between

7% and 8%.

I'll now turn the call back to Mike for some closing

remarks.

Mike Weil

Thanks, Chris.

Before I conclude, I would like to express my gratitude to Jim Nelson,

the President and Co-CEO of GNL for all of his hard work and contributions during his time at the Company. He is a great friend and partner

and on behalf the entire Company, we extend our best wishes for a well deserved and enjoyable retirement.

We take great pride in our achievements at GNL

throughout 2023. With the merger and internalization behind us, we remain focused on positioning ourselves as an industry leader with

a global, diversified and investment-grade portfolio. We want to reiterate that we strongly believe that the best path forward for GNL

is reducing leverage through non-core and strategic dispositions to enhance our balance sheet as we aim to lower our cost of capital to

position the Company for future growth. Our planned dividend reduction is expected to increase the amount of annualized cash by $74 million

to further reduce leverage. Additionally, disposing of assets at a premium to our current assumed implied cap rate will provide investors

with proof of value of our leading investment-grade worthy portfolio. As we've taken a conservative approach, our strategy for deleveraging

is designed to be earnings neutral, with the expectation that our net debt to adjusted EBITDA will decrease by approximately one full

turn. By applying a reasonable and achievable 10x AFFO multiple to our per share guidance, the implied stock price exceeds $13 per share;

$20 per share range if we trade to the high-end of the sector at a 15x AFFO multiple. This outlook aligns with our goal of narrowing the

trading discount and we believe these strategic initiatives will position GNL for future success that maximizes shareholder value. As

always, we are available to answer any questions you may have on this quarter after the call.

Operator, please open the line for questions.

Question-and-Answer Session

Operator

[Operator Instructions].

v3.24.0.1

Cover

|

Feb. 28, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 28, 2024

|

| Entity File Number |

001-37390

|

| Entity Registrant Name |

Global Net Lease, Inc.

|

| Entity Central Index Key |

0001526113

|

| Entity Tax Identification Number |

45-2771978

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

650 Fifth Avenue

|

| Entity Address, Address Line Two |

30th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10019

|

| City Area Code |

332

|

| Local Phone Number |

265-2020

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common

Stock, $0.01 par value per share

|

| Trading Symbol |

GNL

|

| Security Exchange Name |

NYSE

|

| Series A Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.25%

Series A Cumulative Redeemable Preferred Stock, $0.01 par value per share

|

| Trading Symbol |

GNL PR A

|

| Security Exchange Name |

NYSE

|

| Series B Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.875%

Series B Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share

|

| Trading Symbol |

GNL PR B

|

| Security Exchange Name |

NYSE

|

| Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.50% Series D Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share

|

| Trading Symbol |

GNL PR D

|

| Security Exchange Name |

NYSE

|

| Series E Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.375% Series E Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share

|

| Trading Symbol |

GNL PR E

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesBPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesEPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

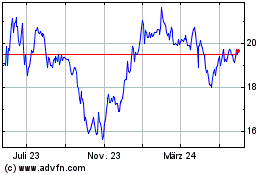

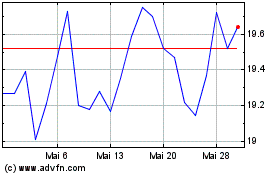

Global Net Lease (NYSE:GNL-B)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Global Net Lease (NYSE:GNL-B)

Historical Stock Chart

Von Mai 2023 bis Mai 2024