Form 8-K - Current report

27 Februar 2024 - 10:39PM

Edgar (US Regulatory)

false

0001526113

0001526113

2024-02-27

2024-02-27

0001526113

us-gaap:CommonStockMember

2024-02-27

2024-02-27

0001526113

us-gaap:SeriesAPreferredStockMember

2024-02-27

2024-02-27

0001526113

us-gaap:SeriesBPreferredStockMember

2024-02-27

2024-02-27

0001526113

us-gaap:PreferredStockMember

2024-02-27

2024-02-27

0001526113

us-gaap:SeriesEPreferredStockMember

2024-02-27

2024-02-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 27, 2024

Global Net Lease, Inc.

(Exact Name of Registrant as Specified in

Charter)

| Maryland |

|

001-37390 |

|

45-2771978 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

650 Fifth Avenue, 30th Floor

New York, New York 10019

(Address, including zip code, of Principal Executive Offices)

Registrant’s telephone number,

including area code: (332) 265-2020

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to section 12(b) of the Act:

| Title of each class |

|

Trading

Symbols |

|

Name of each exchange on

which

registered |

| Common

Stock, $0.01 par value per share |

|

GNL |

|

New York Stock Exchange |

| 7.25%

Series A Cumulative Redeemable Preferred Stock, $0.01 par value per share |

|

GNL PR A |

|

New York Stock Exchange |

| 6.875%

Series B Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share |

|

GNL PR B |

|

New York Stock Exchange |

| 7.50% Series D Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share |

|

GNL PR D |

|

New York Stock Exchange |

| 7.375% Series E Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share |

|

GNL PR E |

|

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 7.01. Regulation FD Disclosure.

Investor Presentation

On February 27, 2024, Global Net Lease, Inc. (the

“Company”) prepared an investor presentation that officers and other representatives of the Company intend to present at conferences

and meetings. A copy of the investor presentation is furnished as Exhibit 99.1 of this Current Report on Form 8-K. The information set

forth in this Item 7.01 of this Current Report on Form 8-K and in the attached Exhibit 99.1 is deemed to be “furnished” and

shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that Section and shall not be deemed incorporated by reference into any filing

under the Exchange Act or the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such

filing.

The statements in this Current Report on Form

8-K that are not historical may be forward-looking statements, including statements regarding the intent, belief or current expectations

of us, our operating partnership and members of our management team, as well as the assumptions on which such statements are based, and

generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,”

“believes,” “estimates,” “projects,” “potential,” “predicts,” “expects,”

“plans,” “intends,” “would,” “could,” “should” or similar expressions are

intended to identify forward-looking statements, although not all forwardlooking statements contain these identifying words. Actual results

may differ materially from those contemplated by such forward-looking statements. These forward-looking statements are subject to risks,

uncertainties and other factors, many of which are outside of the Company’s control, which could cause actual results to differ

materially from the results contemplated by the forward-looking statements. These risks and uncertainties include the risks associated

with the merger with The Necessity Retail REIT, Inc. and the internalization of the Company’s property management and advisory functions;

the geopolitical instability due to the ongoing military conflicts between Russia and Ukraine and Israel and Hamas, including related

sanctions and other penalties imposed by the U.S. and European Union, and the related impact on the Company, the Company’s tenants

and the global economy and financial markets; that any potential future acquisition by the Company is subject to market conditions and

capital availability and may not be identified or completed on favorable terms, or at all. Some of the risks and uncertainties, although

not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward-looking

statements are set forth under “Risk Factors” and “Quantitative and Qualitative Disclosures about Market Risk”

in its Annual Report on Form 10-K , its Quarterly Reports on Form 10-Q, and its other filings with the U.S. Securities and Exchange Commission

after that date, as such risks, uncertainties and other important factors may be updated from time to time in the Company's subsequent

reports. Further, forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update

or revise any forward-looking statement to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating

results over time, unless required by law.

Item 9.01. Financial Statements and Exhibits.

| Exhibit No |

|

Description |

| 99.1 |

|

Investor Presentation |

| 104 |

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GLOBAL NET LEASE, INC. |

| |

|

|

| Date: February 27, 2024 |

By: |

/s/ Edward M. Weil, Jr. |

| |

|

Name: Edward M. Weil, Jr. |

| |

|

Title: Co-Chief Executive Officer

(Co-Principal Executive Officer) |

Exhibit 99.1

| Global Net Lease

Fourth Quarter 2023 Investor Presentation Pictured – McLaren Campus in Woking, U.K. |

| 1

FORWARD LOOKING STATEMENTS

This presentation contains statements that are not historical facts and may be forward-looking statements, including statements regarding the

intent, belief or current expectations of us, our operating partnership and members of our management team, as well as the assumptions on

which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,”

“expects,” “estimates,” “projects,” “potential,” “predicts,” “plans,” “intends,” “would,” “could,” “should” or similar expressions are intended to

identify forward-looking statements, although not all forward-looking statements contain these identifying words. Actual results may differ

materially from those contemplated by such forward-looking statements.

These forward-looking statements are subject to risks, uncertainties, and other factors, many of which are outside of our control, which could

cause actual results to differ materially from the results contemplated by the forward-looking statements. These risks and uncertainties include the

risks associated with the merger with The Necessity Retail REIT, Inc. (“RTL”) and the internalization of our property management and advisory

functions; the geopolitical instability due to the ongoing military conflicts between Russia and Ukraine and Israel and Hamas, including related

sanctions and other penalties imposed by the U.S. and European Union, and the related impact on us, our tenants and the global economy and

financial markets; that any potential future acquisition by the Company is subject to market conditions and capital availability and may not be

identified or completed on favorable terms, or at all. Some of the risks and uncertainties, although not all risks and uncertainties, that could cause

our actual results to differ materially from those presented in our forward-looking statements are set forth under “Risk Factors” and “Quantitative

and Qualitative Disclosures about Market Risk” in our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our other filings

with the U.S Securities and Exchange Commission (“SEC”) as such risks, uncertainties and other important factors may be updated from time to

time in our subsequent reports. Further, forward-looking statements speak only as of the date they are made, and we undertake no obligation to

update or revise any forward-looking statement to reflect changed assumptions, the occurrence of unanticipated events or changes to future

operating results over time, unless required by law. |

| 2

This presentation also includes estimated projections of future operating results. These projections are not prepared in accordance with published

guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of

financial projections. This information is not fact and should not be relied upon as being necessarily indicative of future results; the projections

were prepared in good faith by management and are based on numerous assumptions that may prove to be wrong. All such statements, including

but not limited to estimates of value accretion, synergies, run-rate or annualized figures and results of future operations after making adjustments

to give effect to assumed future operations reflect assumptions as to certain business decisions and events that are subject to change. As a result,

actual results may differ materially from those contained in the estimates. Accordingly, there can be no assurance that the estimates will be realized,

or that the projections described in this presentation will be realized at all.

This presentation also contains estimates and information concerning our industry and tenants, including market position, market size and growth

rates of the markets in which we operate, that are based on industry publications and other third-party reports. This information involves a

number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the

accuracy or completeness of the data contained in these publications and reports. The industry in which we operate is subject to a high degree of

uncertainty and risk due to a variety of factors, including those described in the “Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” and “Quantitative and Qualitative Disclosures about Market Risk” sections of the Company’s

Annual Report on Form 10-K, and all other filings with the SEC after that date, as such risks, uncertainties and other important factors may be

updated from time to time in the Company’s subsequent reports.

Credit Ratings

A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. Each rating

agency has its own methodology of assigning ratings and, accordingly, each rating should be evaluated independently of any other rating.

PROJECTIONS |

| 3

Long-Term Growth

The planned disposition initiative will drive long-term shareholder value by generating excess cash to

enhance and de-risk the Company’s balance sheet and create a clear path forward to narrow the

valuation discount compared to our net-lease peers

2024 BUSINESS PLAN

GNL is implementing a 2024 business plan focused on delevering its balance sheet, reducing its

exposure to variable rate debt and driving down its net debt to Adjusted EBITDA

Lease-Up Potential

Continued successful lease-up of multi-tenant portfolio with

positive renewal spreads; overall portfolio remains at 96%

occupancy

Proof of Value

Selling assets at cap rates that will provide proof of value to investors

and demonstrate a premium to where the Company is currently trading

on an implied cap rate basis

Lower Cost of Capital

A disposition strategy coupled with a reduction in dividend will increase the amount

of annualized cash available to further reduce leverage, targeting lower cost of capital

providing the Company with increased flexibility in the future

Strategy to Address Near-Term Debt Maturities

GNL has a plan to address the remaining 2024 and 2025 debt maturities through dispositions,

refinancings and availability on the credit facility; GNL anticipates that the second half of 2024

will present a more favorable environment for debt maturities beyond 2024 |

| 4

GLOBAL NET LEASE HIGHLIGHTS

Reduce Leverage

Focused on $400 – $600 million of

strategic dispositions(5), including non-core assets that provide GNL excess

capital to delever our balance sheet

Substantial Synergies

GNL has already recognized $68

million(3) of annualized synergies from the

previously disclosed $75 million as a result

of the Merger and Internalization; GNL is

on track to recognize the full balance by

Q3 2024(4)

Premier Portfolio

GNL’s premier portfolio is comprised

of diversified and high-quality tenants

with the top 10 tenants totaling 21% of

the overall portfolio’s SLR and the largest

tenant contributing only 3.1% of total

SLR, mitigating concentration risk

Quality of Earnings

GNL’s diversified net-lease portfolio

includes 58% of SLR derived from

investment-grade(2) tenants,

underpinning the stability and high-quality of its rental income

Global Presence

The global footprint of GNL provides

the company with the flexibility to

adapt and capitalize on accretive

opportunities, whether in the U.S. or

internationally

Proactive Asset Management

GNL continues to successfully

demonstrate strong asset management

capabilities including 6% renewal

spreads and average annual rent increase

of 1.3% across the portfolio

GNL’s 2024 business plan will reduce leverage through dispositions, including non-core assets and opportunistic

sales. The focus of 2024 for GNL will be to lower our cost of capital, enhance our balance sheet to align with our peers

and increase our AFFO(1) multiple as we show the market our commitment to executing on our full-year plan

1. Please see Disclaimers at the back of this presentation for a definition of AFFO. While we consider AFFO a useful indicator of our performance, we do not consider AFFO as an alternative to net income (loss) or as a measure of liquidity. Furthermore, other

REITs may define AFFO differently than we do. Projected AFFO per share data included in this presentation is for informational purposes only and should not be relied upon as indicative of future dividends or as a measure of future liquidity.

2. As used herein, Investment Grade includes both actual investment grade ratings of the tenant or guarantor, if available, or implied investment grade. Implied investment grade may include actual ratings of tenant parent, guarantor parent (regardless of whether or not

the parent has guaranteed the tenant's obligation under the lease) or by using a proprietary Moody's analytical tool, which generates an implied rating by measuring a company's probability of default. The term "parent" for these purposes includes any entity, including

any governmental entity, owning more than 50% of the voting stock in a tenant. Multi-tenant portfolio includes credit ratings for tenants who occupy 10,000 square feet or more.

3. Captured synergies based on GNL’s general & administrative expenses for the fourth quarter of 2023 following the completion of the Merger and Internalization, as compared to the general & administrative expenses of RTL and GNL for the full year 2022 (inclusive of

RTL’s general & administrative expenses and GNL and RTL advisory and management fees previously paid to the external manager during such period).

4. Please see Disclaimers at the front of this presentation for important information regarding as adjusted figures giving effect to the Merger and the Internalization. There can be no assurance that any of these projected synergies, value accretion estimates or combined

future results of operations will be realized.

5. Please see Projections disclaimers at the front of this presentation. There can be no assurance that these dispositions will occur at the cash cap rate we have assumed or on otherwise favorable terms or if they will occur at all. |

| 5

GNL’s objective is to provide investors with enhanced transparency regarding our financial goals

and projections, and therefore we would like to introduce initial 2024 guidance

2024 INITIAL GUIDANCE

Financial Metric FY 2024

AFFO per Share Range(3) $1.30 to $1.40

2024 Dispositions Amount Range(1) $400 million to $600 million

Occupied Dispositions Cash Cap Rate Range 7.0% to 8.0%

Q4’24 Net Debt / Adjusted EBITDA Range(2)(3) 7.4x to 7.8x

▪ The initial guidance reflects our expectation that projected 2024 dispositions will be in the range of $400

million to $600 million(1)

▪ The majority of the projected dispositions in 2024 will come from occupied non-core sales, where we

anticipate achieving a cash cap rate between 7% and 8%(1)

▪ Starting in April 2024, GNL will reduce its annual dividend from $1.42 to $1.10 which is expected to increase

the amount of annualized cash by $74 million to further reduce leverage

▪ By applying a reasonable and achievable 10x AFFO multiple to our per share guidance, the implied stock price

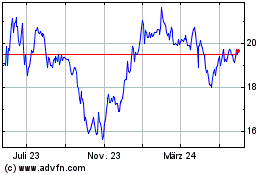

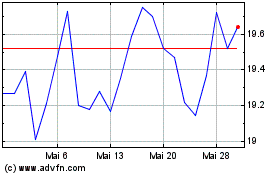

exceeds $13 per share; $20 per share range if we trade to the high-end of the sector at a 15x AFFO multiple

1. Includes $148 million under agreement as of February 19, 2024 and $252 to $452 million of dispositions budgeted but not under contract. Please see Projections disclaimers at the front of this presentation. There can be no assurance that these dispositions

will occur at the cash cap rate we have assumed or on otherwise favorable terms or if they will occur at all.

2. Adjusted EBITDA annualized based on Adjusted EBITDA for the quarter ended December 31, 2024 multiplied by four. Annualized figures based on assumed future operations that reflect assumptions as to certain business decisions and events that are subject

to change. There can be no assurance that these annualized figures will prove to be accurate.

3. We do not provide guidance on net income. We only provide guidance on AFFO per share and our Net Debt to Adjusted EBITDA ratio and do not provide reconciliations of this forward-looking non-GAAP guidance to net income per share or our debt to net

income due to the inherent difficulty in quantifying certain items necessary to provide such reconciliations as a result of their unknown effect, timing and potential significance. Examples of such items include impairment of assets, gains and losses from sales

of assets, and depreciation and amortization from new acquisitions and other non-recurring expenses. |

| 6

Earnings Summary ($mm) Q4’23

Net Loss Attributable to Common Stockholders ($59.5)

NOI $170.0

Cash NOI(6) $164.9

Core Funds from Operations (Core FFO)(6) $48.3

Adjusted Funds from Operations (AFFO)

(6) $71.7

Core Funds from Operations (Core FFO) per Share $0.21

Adjusted Funds from Operations (AFFO) per Share $0.31

Weighted Average Diluted Shares Outstanding 230.3

FOURTH QUARTER 2023 FINANCIAL HIGHLIGHTS

Key Capitalization Metrics ($mm) Q4’23

Net Debt(3)(4) $5,288

Gross Asset Value(5) $9,183

Net Debt(3)(4) / Adjusted EBITDA 8.4x

Net Debt(3)(4) / Gross Asset Value(5) 57.6%

Fixed Rate Debt 80.0%

Liquidity $136

Debt Capitalization ($mm) Q4’23

Total Secured Debt $2,665

3.75% Senior Notes $500

4.50% Senior Notes $500

Revolving Credit Facility $1,744

Total Unsecured Debt $2,744

Total Debt $5,409

Interest Coverage Ratio(1) 2.4x

Weighted Average Interest Rate Cost(2) 4.8%

GNL will continue to focus on improving its operating metrics including reducing net debt to Adjusted

EBITDA, decreasing interest expense, addressing near-term leases while decreasing our cost of capital and

disposing of non-core assets

1. The interest coverage ratio is calculated by dividing actual adjusted EBITDA for Q4 2023 by cash paid for interest (calculated based on the interest expense less non-cash portion of interest expense and amortization of mortgage (discount) premium, net).

2. The weighted average interest rate cost is based on the outstanding principal of the debt.

3. Represents total debt outstanding of $5.4 billion, less cash and cash equivalents of $122 million.

4. Excludes the effect of discounts and deferred financing costs, net.

5. Gross asset value is defined as total assets plus accumulated depreciation and amortization as of December 31, 2023.

6. Please see Disclaimers at the back of this presentation for a definition of Core FFO and AFFO. While we consider AFFO a useful indicator of our performance, we do not consider AFFO as an alternative to net income (loss) or as a measure of liquidity.

Furthermore, other REITs may define AFFO differently than we do. Projected AFFO per share data included in this presentation is for informational purposes only and should not be relied upon as indicative of future dividends or as a measure of future

liquidity. AFFO for the third quarter also contains a number of adjustments for items that the company believes were non-recurring, one-time items including adjustments for items that were settled in cash such as merger and proxy related expenses.

8.4x

7.6x

2024 AFFO

Guidance Midpoint

Q4’23 Annualized

AFFO

Q4’24 Net Debt /

Adj. EBITDA

Guidance Midpoint

Q4’23 Net Debt

/ Adj. EBITDA

$1.24

$1.35 |

| 7

GNL DISPOSITION AND

BALANCE SHEET STRATEGY

Q4’23 Debt Maturity Schedule ($mm)(1)(2)

Balance Sheet Highlights Planned 2024 Dispositions

1. Excludes the effect of discounts and deferred financing costs, net. Current balances as of December 31, 2023 are shown in the year the debt matures.

2. Assumes GNL exercises its two 6-month extension options on its credit facility.

3. Inclusive of $117 million of signed PSAs and $31 million under LOIs as of February 19, 2024. Assumes signed PSA/LOIs lead to definitive sales on their contemplated terms, which is not assured.

4. Includes dispositions budgeted but not under contract. Please see Projections disclaimers at the front of this presentation. There can be no assurance that these dispositions will occur at the cash cap rate we have assumed or on otherwise favorable terms or if they will occur at

all.

7.5% 12.9% 2.0% 44.5% 19.1% 14.0%

% of Total Debt Outstanding

$405 $699 $110

$163 $531 $757

$1,744

$500

$500

2024 2025 2026 2027 2028 Thereafter

Mortgage Debt Credit Facility Senior Notes

▪ In 2024, GNL will reduce leverage through strategic dispositions,

addressing near-term debt maturities and generating excess cash to

enhance our balance sheet

▪ In Q4’23, GNL closed on $76 million of dispositions with the

proceeds used to begin the debt paydown strategy

▪ $148 million of dispositions are currently under agreement and

scheduled to close in Q1’24 and Q2’24(3)

▪ Subsequent to Q4’23, GNL completed an $80 million refinancing

with Nordea Bank secured by multiple properties in Finland that

extends debt maturities to 2029 at a 4.6% all-in interest rate,

successfully addressing the impending 2024 debt maturity

▪ Current liquidity of $136 million and $206 million of capacity on

credit facility

Weighted Average Debt Maturity: 3.2 years(2)

Status Timing Amount

($mm) Notes

Signed PSA /

Executed

LOIs

Q1’24 – Q2’24 $148(3)

Includes $35 million of occupied

Truist dispositions at a weighted

average cap rate of 6.5%, $50 million

sale of Nimble and various vacant

assets as part of culling the portfolio

post-merger

Opportunistic

Dispositions(4) Q3’24 – Q4’24 $252 to

$452(4)

Anticipate achieving a cash cap rate

between 7% and 8% on occupied

opportunistic sales

2024 Total

Dispositions $400 to $600 |

| 8

Category Description

Internalization Savings

▪ Elimination of asset management fees, property management fees, incentive fees, equity issuance

fees, and reimbursable expenses net of internalized employee compensation, rent and overhead,

and retained 3rd party services

Merger Synergies ▪ Corporate consolidation, public company cost savings, and elimination of other duplicative

services

Net Savings Approximately $75 million(1)

1. Please see Disclaimers at the front of this presentation for important information regarding as adjusted figures giving effect to the Merger and the Internalization. There can be no assurance that any of these projected synergies, value accretion estimates or combined

future results of operations will be realized.

2. Captured synergies based on GNL’s general & administrative expenses for the fourth quarter of 2023 following the completion of the Merger and Internalization, as compared to the general & administrative expenses of RTL and GNL for the full year 2022 (inclusive of RTL’s

general & administrative expenses and GNL and RTL advisory and management fees previously paid to the external manager during such period).

SUBSTANTIAL MERGER SYNERGIES AND

INTERNALIZATION SAVINGS

Synergies Recognized in Q4 2023 (000’s)(2)

Elimination of Operating Fees to Related Parties $72,148

Elimination of Property Management &

Leasing Fees 12,860

Elimination of RTL G&A Expense 32,365

Elimination of GNL G&A Expense 17,737

Less: Q4’23 Annualized GNL G&A Expense (67,468)

Q4’23 Annualized Synergies Recognized(2) $67,642

As a direct result of the Merger, GNL has already recognized $67.6(2) million of annualized cost synergies and is

on track to recognize $75 million that was estimated at transaction close(1)

Q4’23 Annualized

Synergies

Recognized

Remaining

Synergies

Expected

Total Estimated

Synergies

($mm)

$68

$7 $75 |

| 9

Portfolio Overview Q4’23

Properties 1,296

Square Feet (millions) 66.8

% Leased 96%

Weighted Average Remaining Lease Term (“WALT”)(1) 6.8 years

% of SLR Derived from United States & Canada vs. Europe 80% | 20%

Industries 94

Tenants 803

% of SLR derived from Investment Grade Tenants (“IG Rated”)(2)(3) 58%

Top 10 Tenant Concentration 21%

% of Leases with Contractual Rent Increases(4) 78%

Average Annual Rental Increase(3) 1.3%

Metrics as of December 31, 2023.

1. Weighted average remaining lease term in years is based on square feet as of December 31, 2023.

2. Refer to Investment Grade Rating definition included in the footnotes on slide 4. Based on annualized SLR and as of December 31, 2023, GNL’s portfolio was 33.4% actual investment grade rated and 24.2% implied investment grade rated.

3. Calculated as of December 31, 2023, using annualized straight-line rent converted from local currency into USD as of December 31, 2023 for the in-place lease on the property on a straight-line basis, which includes tenant concessions such as free rent, as

applicable.

4. The percentage of leases with rent increases is based on straight line rent as of December 31, 2023. Refer to SLR definition included in the footnotes on slide 14. Contractual cash base rent increases average 1.3% per year and include fixed percent or actual

increases, or country CPI-indexed increases, which may include certain floors or caps on rental increases. As of December 31, 2023, and based on straight-line rent, approximately 59.7% are fixed-rate increases, 14.3% are based on the Consumer Price Index,

4.0% are based on other measures and 22.0% do not contain any escalation provisions.

PORTFOLIO SNAPSHOT |

| 10

1. Metric based on annualized SLR as of December 31, 2023. Refer to SLR definition included in the footnotes on slide 14.

2. Based on Annualized Straight-Line Rent. Ratings information as of February 7, 2024. For GNL, 33.4% of the rated tenants were actual Investment Grade rated and 24.2% of the rated tenants were implied Investment Grade rated. Implied Investment

Grade includes ratings of the tenant’s parent (regardless of whether or not the parent has guaranteed the tenant’s obligation under the lease) or lease guarantor. Refer to Investment Grade Rating definition included in the footnotes on slide 4.

Top ten tenants represent 21.0% of SLR with no single tenant accounting for more than 3.1%

Tenant Credit Rating Country Property Type % of SLR(1)

Implied: Baa2 U.S. Single-Tenant Retail 3.1%

Actual: B- U.K. Industrial & Distribution 2.7%

Actual: Baa2 U.S. / Canda Industrial & Distribution 2.7%

Actual: Baa3 U.S. Single-Tenant Retail 2.1%

Actual: Baa1 U.S. / Italy Industrial & Distribution 2.0%

Actual: Baa3 U.S. Industrial & Distribution 1.9%

Actual: A2 U.S. Industrial & Distribution;

Multi-Tenant Retail 1.9%

Actual: A2 U.S. Single-Tenant Retail 1.7%

Actual: Aaa U.S. Single-Tenant Office 1.5%

Implied: B1 U.K. Single-Tenant Office 1.5%

Top 10 Tenants 80.1% IG Rated(2) 21.0%

Top Ten Tenants

HIGH-QUALITY INVESTMENT-GRADE TENANTS |

| 11

MIDWEST

NC

FL

GA AL MS

LA

TX

NM AZ

CA

NV

UT

OR

WA

ID

MT

WY

CO

ND

SD

NE

KS

OK

AR

MO

IA

MN WI

MI

IL IN

OH

KY

TN

SC

NC

WV VA

PA

NY

VT NH

ME

MA

NJ CT

MD

DE

DC

RI

NB

PACIFIC

SOUTHWEST

SOUTHWEST

MID-ATLANTIC

NEW

PACIFIC BRUNSWICK

NORTHWEST

SOUTH

EAST

AK

NORTHEAST

THIRD-LARGEST PUBLICLY TRADED

NET LEASE REIT WITH A GLOBAL PRESENCE

Geographic Presence

Note: Portfolio metrics as of December 31, 2023.

SP

FR

UK

ITL

GER

LUX

NETH

FIN

CI

United States / Canada

US / Canada Total – 80.1% of SLR

⚫ Southeast – 23.4% of SLR

⚫ Midwest – 21.1% of SLR

⚫ Mid-Atlantic – 12.5% of SLR

⚫ Southwest – 10.8% of SLR

⚫ Pacific Southwest – 5.4% of SLR

⚫ Northeast – 5.9% of SLR

⚫ Pacific Northwest – 0.6% of SLR

⚫ New Brunswick, – 0.4% of SLR

Canada

Europe

Europe Total – 19.9% of SLR

⚫ United Kingdom – 11.1% of SLR

⚫ Netherlands – 2.3% of SLR

⚫ Finland – 2.0% of SLR

⚫ Germany – 1.4% of SLR

⚫ France – 1.1% of SLR

⚫ Channel Islands – 0.8% of SLR

⚫ Luxembourg – 0.8% of SLR

⚫ Italy – 0.3% of SLR

⚫ Spain – 0.1% of SLR

|

| 12

4.8%

7.9% 6.9%

10.6%

13.9%

55.9%

2024 2025 2026 2027 2028 2029 +

Lease Maturity Schedule by Property Type (% of Total SF)

ATTRACTIVE LEASE MATURITY SCHEDULE

Unique investment mix of stable, long-term, single-tenant net-leased and strategically located suburban shopping

centers results in a favorable lease maturity schedule and a Weighted Average Remaining Lease Term of 6.8 years(1)

Note: Data as of December 31, 2023.

1. Weighted average remaining lease term in years is based on square feet as of December 31, 2023.

Multi-Tenant

Retail 1.5% 2.7% 2.8% 2.2% 3.5% 9.7%

Single-Tenant

Retail 0.1% 1.3% 0.8% 1.0% 1.3% 7.5%

Single-Tenant

Office 1.6% 1.3% 1.8% 1.1% 1.1% 5.8%

Industrial &

Distribution 1.6% 2.5% 1.5% 6.3% 8.0% 32.9%

6.8 Years Weighted Average Lease Term(1)

Multi-Tenant Retail

Single-Tenant Retail

Single-Tenant Office

Industrial & Distribution |

| 13

Leasing momentum continues in Q4 2023 with 70 lease renewals and new leases, combining for over 2.1 million

square feet and over $19 million of net straight-line rent

Q4 2023(1) Leasing and Renewal Activity

Single-Tenant Portfolio Multi-Tenant Retail Portfolio

New Leases + Renewals Completed 16 54

Q4 2023 Renewal Leasing Spread 8.2% 1.7%(2)

Net Straight-Line Rent on New Leases + Renewals $8.8 million $10.5 million

Square Feet on New Leases + Renewals 1,517,222 655,786

1. Leasing activity from 10/1/2023 through 12/31/2023.

2. Calculated using Annual Base Rent.

CONTINUED LEASING MOMENTUM DRIVEN BY

STRONG ASSET MANAGEMENT CAPABILITIES

Successful Asset Management Capabilities

GNL continued to successfully demonstrate its

asset management capabilities in Q4 2023 with an

average annual rental increase of 1.3% across the

portfolio and an attractive renewal leasing spread

of 6% across the entire portfolio

Notable Recent

Tenant Activity

Executed new 10-year lease in Q4’23

Recently executed a 20,000 square feet

expansion

Executed 125,000 square feet of renewals

with Dick’s in Q4’23 |

| 14

Industrial

WELL POSITIONED PORTFOLIO WITH KEY METRICS

Note: Portfolio metrics as of December 31, 2023.

1. Calculated as of December 31, 2023, using annualized straight-line rent (“SLR”) converted from local currency into USD as of December 31, 2023 for the in-place lease on the property on a straight-line basis, includes tenant concessions such as free rent,

as applicable.

2. Metric calculated based on square feet as of December 31, 2023.

3. Metric based on annualized SLR as of December 31, 2023.

4. Refer to Investment Grade definition included in the footnotes on slide 4.

+

Number of

Properties

Square Feet

(millions)

SLR

($ millions)

% Leased(2)

WALT(3)

% IG Rated

Tenants(3)(4)

+ +

Industrial &

Distribution

219

33.9

$235

100%

7.7 Years

57%

Multi-Tenant

Retail

109

16.4

$200

88%

5.2 Years

38%

Single-Tenant

Retail

878

7.9

$154

98%

8.3 Years

66%

Single-Tenant

Office

90

8.6

$143

94%

5.0 Years

68%

Total Portfolio(1)

1,296

66.8

$731

96%

6.8 Years

58%

Rent

Escalations(3) 78% 92% 45% 85% 93%

GNL’s competitive advantage of having a global presence and diversified portfolio gives the

Company the flexibility to focus on attractive opportunities in multiple segments and markets that

will contribute long-term value |

| 15

Healthcare, 6%

Financial Services, 6%

Auto Manufacturing, 5%

Discount Retail, 5%

Specialty Retail, 4%

Gas/Convenience, 4%

Freight, 3%

Consumer Goods, 3%

Home Improvement, 3%

Retail Banking, 3%

Quick Service Restaurant, 3%

Other, 54%

Industrial &

Distribution

32%

Multi-Tenant

Retail

27%

Single-Tenant

Retail

21%

Single-Tenant

Office

20%

Grocery

Anchored

21%

Power Center

57%

Anchored

Center

22%

$730.9

million

Total Portfolio Annualized SLR by Segment

Industry Exposure(1)

Credit Rating Asset Diversification (1)(2)

Note: Portfolio metrics as of December 31, 2023.

1. Metric based on annualized SLR as of December 31, 2023. Refer to SLR definition included in the footnotes on slide 14.

2. Refer to Investment Grade Rating definition included in the footnotes on slide 4.

3. “All Other” represents the aggregate of all industries with less than three percent exposure.

DIVERSIFIED AND STABLE TENANT BASE

Single-Tenant Portfolio Multi-Tenant Retail Portfolio

$531.4

million

$199.7

million

Single-Tenant

73%

Investment Grade

58%

Non-Investment

Grade

36%

Not Rated

6%

(2)

(3)

Single-Tenant

Office

27%

Retail

29%

Industrial & Distribution

44% |

| 16

United States

77%

Europe

7%

United Kingdom

15%

Canada

1%

Segment Highlights Lease Maturity Schedule (% of Total SF)

Geographic Breakdown (% of Total SLR) Top Five Tenants

Tenant Credit Rating Country % of SLR

Actual: B- U.K. 2.7%

Actual: Baa2 U.S. / Canada 2.7%

Actual: Baa1 U.S. / Italy 2.0%

Actual: Baa3 U.S. 1.9%

Implied: Baa2 U.S. 1.4%

Top 5 Tenants 74.8% IG Rated(2)(3) 10.7%

32%

Total Portfolio(1)

219

Properties

33.9M

Square Feet

18%

CPI Increases(1)

100%

Leased

7.7 Years

WALT

57%

IG Tenants(1)

92%

Rent Escalators(1)

1.5%

Average Annual

Rental Increase(1)

Note: Portfolio metrics as of December 31, 2023.

1. Based on Annualized Straight-Line Rent.

2. Refer to Investment Grade Rating definition included in the footnotes on slide 4.

3. Calculated by adding the Investment Grade tenants’ percentage of SLR and dividing by the total SLR amount.

INDUSTRIAL & DISTRIBUTION OVERVIEW

7.7 Years Weighted Average Lease Term

1.4% 2.5% 1.5%

6.3% 8.0%

32.9%

2024 2025 2026 2027 2028 2029 + |

| 17

1.5%

2.7% 2.8% 2.2%

3.5%

9.7%

2024 2025 2026 2027 2028 2029 +

90.0%

87.6%

90.5%

Q3'23 Occupancy Q4'23 Occupancy

Multi-Tenant Leasing Is Expected To Increase Occupancy to 90.5%

Q4’23 +

Executed Occupancy

& Leasing Pipeline

MULTI-TENANT RETAIL OVERVIEW

Tenant Credit Rating Country % of SLR

Actual: B1 U.S. 1.4%

Actual: Baa3 U.S. 1.2%

Actual: A3 U.S. 1.1%

Actual: Ba2 U.S. 1.0%

Actual: A2 U.S. 1.0%

Top 5 Tenants 75.4% IG Rated(3)(4) 5.7%

Segment Highlights Lease Maturity Schedule (% of Total SF)

Leasing Pipeline (000’s) Top Five Tenants

27%

Total Portfolio(1)

109

Properties

16.4M

Square Feet

$200M

SLR

90.5%

Leased + Pipeline

5.2 Years

WALT

38%

IG Tenants(1)

1.7%

Leasing Spread(2)

61%

Sunbelt(1)

Q4’23 Occupancy

Q4’23 Executed Occupancy

Q4’23 Leasing Pipeline

14,368 SF

196 SF

289 SF

Note: Portfolio metrics as of December 31, 2023. Leasing Pipeline data as of January 31, 2024. Assumes executed leases commence and signed LOIs lead to definitive leases on their contemplated terms, which is not assured.

1. Based on Annualized Straight-Line Rent.

2. Calculated using Annual Base Rent.

3. Refer to Investment Grade Rating definition included in the footnotes on slide 4.

4. Calculated by adding the Investment Grade tenants’ percentage of SLR and dividing by the total SLR amount.

5.2 Years Weighted Average Lease Term

Anchor Tenants:

5.5 Years

In-Line Tenants:

4.0 Years |

| 18

0.1%

1.3% 0.8% 1.0% 1.3%

7.5%

2024 2025 2026 2027 2028 2029 +

United States

89%

Europe

4%

United Kingdom

7%

SINGLE-TENANT RETAIL OVERVIEW

Tenant Credit Rating Country % of SLR

Implied: Baa2 U.S. 3.1%

Actual: Baa3 U.S. 2.1%

Actual: A2 U.S. 1.7%

Actual: Baa2 U.S. 1.3%

Actual: Baa1 U.S. 0.9%

Top 5 Tenants 100.0% IG Rated(2)(3) 9.1%

Segment Highlights Lease Maturity Schedule (% of Total SF)

Geographic Breakdown (% of Total SLR) Top Five Tenants

21%

Total Portfolio(1)

878

Properties

7.9M

Square Feet

$154M

SLR

98%

Leased

8.3 Years

WALT

66%

IG Tenants(1)

85%

Rent Escalators(1)

1.6%

Average Annual

Rental Increase(1)

Note: Portfolio metrics as of December 31, 2023.

1. Based on Annualized Straight-Line Rent.

2. Refer to Investment Grade Rating definition included in the footnotes on slide 4.

3. Calculated by adding the Investment Grade tenants’ percentage of SLR and dividing by the total SLR amount.

8.3 Years Weighted Average Lease Term |

| 19

United States

47%

Europe

29%

United Kingdom

24%

SINGLE-TENANT OFFICE OVERVIEW

Tenant Credit Rating Country % of SLR

Actual: Aaa U.S. 1.5%

Implied: B1 U.K. 1.5%

Actual: Aa3 Netherlands 1.4%

Implied: A Luxembourg 0.8%

Implied: Baa2 Finland 0.8%

Top 5 Tenants 75.0% IG Rated(3)(4) 6.0%

Segment Highlights Lease Maturity Schedule (% of Total SF)

20%

Total Portfolio(1)

90

Properties

8.6M

Square Feet

$143M

SLR

94%

Leased

68%

IG Tenants(1)

1.7%

Average Annual

Rental Increase(1)

93%

Rent Escalators(1)

70.0%

Mission Critical(2)

Geographic Breakdown (% of Total SLR) Top Five Tenants

Note: Portfolio metrics as of December 31 2023.

1. Based on Annualized Straight-Line Rent.

2. Mission critical includes HQ, Lab, and R&D facilities and is calculated based on square feet.

3. Refer to Investment Grade Rating definition included in the footnotes on slide 4.

4. Calculated by adding the Investment Grade tenants’ percentage of SLR and dividing by the total SLR amount.

5.0 Years Weighted Average Lease Term

1.1% 1.3% 1.8% 1.1% 1.1%

5.8%

2024 2025 2026 2027 2028 2029 + |

| 20

LEADERSHIP OVERVIEW

Management Board of Directors

Michael Weil, Director

Refer to “Management” section for Michael Weil’s biography

Michael Weil, Co-Chief Executive Officer

Previously served as CEO of The Necessity Retail REIT

Member of the Board of Directors of Global Net Lease,

Inc. since 2012

Served as President of the Board of Directors of the Real

Estate Investment Securities Association (n/k/a ADISA)

James Nelson, President & Co-Chief Executive Officer

Joined GNL Board in March 2017

Previously served as Chairman of the Board of Xerox

Holdings Corporation. Also currently serves as an

independent director and chair of the audit committee for

Chewy, Inc.

Chris Masterson, Chief Financial Officer

Previously served as Chief Accounting Officer of GNL

Past experience includes accounting positions with

Goldman Sachs and KPMG

Sue Perrotty, Non-Executive Chairperson of the Board of Directors

Currently serves as President and Chief Executive Officer of AFM Financial

Services and Tower Health

James Nelson, Director

Refer to “Management” section for James Nelson’s biography

Edward Rendell, Independent Director

Previously served as the 45th Governor of the Commonwealth of Pennsylvania and

as the Mayor of Philadelphia, and as a member of the board of directors of The

Necessity Retail REIT

Lisa Kabnick, Independent Director

Retired Partner at Troutman Pepper Hamilton Sanders LLP, and previously served

as a member of the board of directors of The Necessity Retail REIT

Therese Antone, Independent Director

Currently serves as the Chancellor of Salve Regina University since her appointment

in 2009

Leslie Michelson, Independent Director

Currently serves as lead independent director of Franklin BSP Franklin Lending

Corporation, and previously served as a member of the board of directors of The

Necessity Retail REIT

Stanley Perla, Independent Director

Previously served as a member of the board of directors and the chair of the audit

committee of Madison Harbor Balanced Strategies, Inc, and previously served as a

member of the board of directors on the Necessity Retail REIT

Independent Directors

Inside Directors

Jesse Galloway, Executive Vice President & General Counsel

Joined GNL in September 2023

25 years of legal experience representing large real estate

companies and financial institutions, including 10 years as

General Counsel and 15 years in private practice

Jason Slear, Executive Vice President

Responsible for sourcing, negotiating, and closing GNL’s

real estate acquisitions and dispositions

Oversaw the acquisition of over $3.5 billion of real estate

assets and the lease-up of over 10 million square feet

during professional career

Ori Kravel, Senior Vice President

Responsible for corporate development and business

strategy

Executed over $12 billion of capital market transactions

and over $25 billion of M&A transactions |

| 21

FINANCIAL DEFINITIONS

Non-GAAP Financial Measures

This section discusses non-GAAP financial measures we use to evaluate our performance, including Funds from Operations (“FFO”), Core Funds from Operations

(“Core FFO”), Adjusted Funds from Operations (“AFFO”), Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”), Net

Operating Income (“NOI”) and Cash Net Operating Income (“Cash NOI”). While NOI is a property-level measure, AFFO is based on total Company performance

and therefore reflects the impact of other items not specifically associated with NOI such as, interest expense, general and administrative expenses and operating fees

to related parties. Additionally, NOI as defined herein, does not reflect an adjustment for straight-line rent but AFFO does include this adjustment. A description of

these non-GAAP measures and reconciliations to the most directly comparable GAAP measure, which is net income, is provided below.

Caution on Use of Non-GAAP Measures

FFO, Core FFO, AFFO, Adjusted EBITDA, NOI, and Cash NOI should not be construed to be more relevant or accurate than the current GAAP methodology in

calculating net income or in its applicability in evaluating our operating performance. The method utilized to evaluate the value and performance of real estate under

GAAP should be construed as a more relevant measure of operational performance and considered more prominently than the non-GAAP measures.

Other REITs may not define FFO in accordance with the current National Association of Real Estate Investment Trusts (“NAREIT”) definition (as we do), or may

interpret the current NAREIT definition differently than we do, or may calculate Core FFO or AFFO differently than we do. Consequently, our presentation of FFO,

Core FFO and AFFO may not be comparable to other similarly-titled measures presented by other REITs.

We consider FFO, Core FFO and AFFO useful indicators of our performance. Because FFO, Core FFO and AFFO calculations exclude such factors as depreciation

and amortization of real estate assets and gain or loss from sales of operating real estate assets (which can vary among owners of identical assets in similar conditions

based on historical cost accounting and useful-life estimates), FFO, Core FFO and AFFO presentations facilitate comparisons of operating performance between

periods and between other REITs in our peer group. |

| 22

Funds from Operations, Core Funds from Operations and Adjusted Funds from Operations

Funds From Operations

Due to certain unique operating characteristics of real estate companies, as discussed below, NAREIT, an industry trade group, has promulgated a measure known as

FFO, which we believe to be an appropriate supplemental measure to reflect the operating performance of a REIT. FFO is not equivalent to net income or loss as

determined under GAAP.

We calculate FFO, a non-GAAP measure, consistent with the standards established over time by the Board of Governors of NAREIT, as restated in a White Paper

approved by the Board of Governors of NAREIT effective in December 2018 (the “White Paper”). The White Paper defines FFO as net income or loss computed in

accordance with GAAP, excluding depreciation and amortization related to real estate, gain and loss from the sale of certain real estate assets, gain and loss from

change in control and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the

value of depreciable real estate held by the entity. Adjustments for unconsolidated partnerships and joint ventures are calculated to exclude the proportionate share of

the non-controlling interest to arrive at FFO, Core FFO, AFFO and NOI attributable to stockholders, as applicable. Our FFO calculation complies with NAREIT’s

definition.

The historical accounting convention used for real estate assets requires straight-line depreciation of buildings and improvements, and straight-line amortization of

intangibles, which implies that the value of a real estate asset diminishes predictably over time. We believe that, because real estate values historically rise and fall with

market conditions, including inflation, interest rates, unemployment and consumer spending, presentations of operating results for a REIT using historical accounting

for depreciation and certain other items may be less informative. Historical accounting for real estate involves the use of GAAP. Any other method of accounting for

real estate such as the fair value method cannot be construed to be any more accurate or relevant than the comparable methodologies of real estate valuation found in

GAAP. Nevertheless, we believe that the use of FFO, which excludes the impact of real estate related depreciation and amortization, among other things, provides a

more complete understanding of our performance to investors and to management, and, when compared year over year, reflects the impact on our operations from

trends in occupancy rates, rental rates, operating costs, general and administrative expenses, and interest costs, which may not be immediately apparent from net

income.

FINANCIAL DEFINITIONS |

| 23

Funds from Operations, Core Funds from Operations and Adjusted Funds from Operations (Cont’d)

Core Funds From Operations

In calculating Core FFO, we start with FFO, then we exclude certain non-core items such as merger, transaction and other costs, settlement costs related to our

Blackwells/Related Parties litigation, as well as certain other costs that are considered to be non-core, such as debt extinguishment costs, fire loss and other costs

related to damages at our properties. The purchase of properties, and the corresponding expenses associated with that process, is a key operational feature of our core

business plan to generate operational income and cash flows in order to make dividend payments to stockholders. In evaluating investments in real estate, we

differentiate the costs to acquire the investment from the subsequent operations of the investment. We also add back non-cash write-offs of deferred financing costs

and prepayment penalties incurred with the early extinguishment of debt which are included in net income but are considered financing cash flows when paid in the

statement of cash flows. We consider these write-offs and prepayment penalties to be capital transactions and not indicative of operations. By excluding expensed

acquisition, transaction and other costs as well as non-core costs, we believe Core FFO provides useful supplemental information that is comparable for each type of

real estate investment and is consistent with management’s analysis of the investing and operating performance of our properties.

Adjusted Funds From Operations

In calculating AFFO, we start with Core FFO, then we exclude certain income or expense items from AFFO that we consider more reflective of investing activities,

other non-cash income and expense items and the income and expense effects of other activities or items including items that were paid in cash that are not a

fundamental attribute of our business plan or were one time or non-recurring items. These items include early extinguishment of debt and other items excluded in Core

FFO as well as unrealized gain and loss, which may not ultimately be realized, such as gain or loss on derivative instruments, gain or loss on foreign currency

transactions, and gain or loss on investments. In addition, by excluding non-cash income and expense items such as amortization of above-market and below-market

leases intangibles, amortization of deferred financing costs, straight-line rent and equity-based compensation from AFFO, we believe we provide useful information

regarding income and expense items which have a direct impact on our ongoing operating performance. We also exclude revenue attributable to the reimbursement by

third parties of financing costs that we originally incurred because these revenues are not, in our view, related to operating performance. We also include the realized

gain or loss on foreign currency exchange contracts for AFFO as such items are part of our ongoing operations and affect our current operating performance.

FINANCIAL DEFINITIONS |

| 24

Funds from Operations, Core Funds from Operations and Adjusted Funds from Operations (Cont’d)

Adjusted Funds From Operations (cont’d)

In calculating AFFO, we exclude certain expenses which under GAAP are characterized as operating expenses in determining operating net income. All paid and

accrued acquisition, transaction and other costs (including prepayment penalties for debt extinguishments and merger related expenses) and certain other expenses,

including expenses incurred for the 2023 proxy contest and related Blackwells/Related Parties litigation, expenses related to our European tax restructuring and

transition costs related to the Mergers, negatively impact our operating performance during the period in which expenses are incurred or properties are acquired and

will also have negative effects on returns to investors, but are excluded by us as we believe they are not reflective of our on-going performance. Further, under GAAP,

certain contemplated non-cash fair value and other non-cash adjustments are considered operating non-cash adjustments to net income. In addition, as discussed

above, we view gain and loss from fair value adjustments as items which are unrealized and may not ultimately be realized and not reflective of ongoing operations and

are therefore typically adjusted for when assessing operating performance. Excluding income and expense items detailed above from our calculation of AFFO provides

information consistent with management’s analysis of our operating performance. Additionally, fair value adjustments, which are based on the impact of current market

fluctuations and underlying assessments of general market conditions, but can also result from operational factors such as rental and occupancy rates, may not be

directly related or attributable to our current operating performance. By excluding such changes that may reflect anticipated and unrealized gain or loss, we believe

AFFO provides useful supplemental information. By providing AFFO, we believe we are presenting useful information that can be used to, among other things, assess

our performance without the impact of transactions or other items that are not related to our portfolio of properties. AFFO presented by us may not be comparable to

AFFO reported by other REITs that define AFFO differently. Furthermore, we believe that in order to facilitate a clear understanding of our operating results, AFFO

should be examined in conjunction with net income (loss) calculated in accordance with GAAP and presented in our consolidated financial statements. AFFO should

not be considered as an alternative to net income (loss) as an indication of our performance or to cash flows as a measure of our liquidity or ability to make

distributions.

FINANCIAL DEFINITIONS |

| 25

Adjusted Earnings before Interest, Taxes, Depreciation and Amortization, Net Operating Income, and Cash Net Operating Income.

We believe that Adjusted EBITDA, which is defined as earnings before interest, taxes, depreciation and amortization adjusted for acquisition, transaction and other

costs, other non-cash items and including our pro-rata share from unconsolidated joint ventures, is an appropriate measure of our ability to incur and service debt. We

also exclude revenue attributable to the reimbursement by third parties of financing costs that we originally incurred because these revenues are not, in our view, related

to operating performance. All paid and accrued acquisition, transaction and other costs (including prepayment penalties for debt extinguishments) and certain other

expenses, including general and administrative expenses incurred for the 2023 proxy contest and related Blackwells/Related Parties litigation, expenses related to our

European tax restructuring and transition costs related to the Merger and Internalization, negatively impact our operating performance during the period in which

expenses are incurred or properties are acquired and will also have negative effects on returns to investors, but are not reflective of on-going performance. Due to the

increase in general and administrative expenses as a result of the 2023 proxy contest and related litigation as a portion of our total general and administrative expenses

in the first quarter of 2023, we began including this adjustment to arrive at Adjusted EBITDA in order to better reflect our operating performance. Adjusted EBITDA

should not be considered as an alternative to cash flows from operating activities, as a measure of our liquidity or as an alternative to net income as an indicator of our

operating activities. Other REITs may calculate Adjusted EBITDA differently and our calculation should not be compared to that of other REITs.

NOI is a non-GAAP financial measure equal to net income (loss), the most directly comparable GAAP financial measure, less discontinued operations, interest, other

income and income from preferred equity investments and investment securities, plus corporate general and administrative expense, acquisition, transaction and other

costs, depreciation and amortization, other noncash expenses and interest expense. We use NOI internally as a performance measure and believe NOI provides useful

information to investors regarding our financial condition and results of operations because it reflects only those income and expense items that are incurred at the

property level. Therefore, we believe NOI is a useful measure for evaluating the operating performance of our real estate assets and to make decisions about resource

allocations. Further, we believe NOI is useful to investors as a performance measure because, when compared across periods, NOI reflects the impact on operations

from trends in occupancy rates, rental rates, operating costs and acquisition activity on an unlevered basis, providing perspective not immediately apparent from net

income. NOI excludes certain components from net income in order to provide results that are more closely related to a property’s results of operations. For example,

interest expense is not necessarily linked to the operating performance of a real estate asset and is often incurred at the corporate level as opposed to the property level.

In addition, depreciation and amortization, because of historical cost accounting and useful life estimates, may distort operating performance at the property level. NOI

presented by us may not be comparable to NOI reported by other REITs that define NOI differently. We believe that in order to facilitate a clear understanding of our

operating results, NOI should be examined in conjunction with net income (loss) as presented in our consolidated financial statements. NOI should not be considered

as an alternative to net income (loss) as an indication of our performance or to cash flows as a measure of our liquidity.

FINANCIAL DEFINITIONS |

| 26

Adjusted Earnings before Interest, Taxes, Depreciation and Amortization, Net Operating Income, and Cash Net Operating Income (Cont’d)

Cash NOI is a non-GAAP financial measure that is intended to reflect the performance of our properties. We define Cash NOI as net operating income (which is

separately defined herein) excluding amortization of above/below market lease intangibles and straight-line adjustments that are included in GAAP lease revenues. We

believe that Cash NOI is a helpful measure that both investors and management can use to evaluate the current financial performance of our properties and it allows

for comparison of our operating performance between periods and to other REITs. Cash NOI should not be considered as an alternative to net income, as an

indication of our financial performance, or to cash flows as a measure of liquidity or our ability to fund all needs. The method by which we calculate and present Cash

NOI may not be directly comparable to the way other REITs calculate and present Cash NOI.

Cash Paid for Interest is calculated based on the interest expense less non-cash portion of interest expense and amortization of mortgage (discount) premium, net.

Management believes that Cash Paid for Interest provides useful information to investors to assess our overall solvency and financial flexibility. Cash Paid for Interest

should not be considered as an alternative to interest expense as determined in accordance with GAAP or any other GAAP financial measures and should only be

considered together with and as a supplement to our financial information prepared in accordance with GAAP.

FINANCIAL DEFINITIONS |

| 27

NON – GAAP RECONCILIATIONS

1. Amount relates to costs incurred related to the tax restructuring of our European entities. We do not consider these expenses to be part of our normal operating performance and have, accordingly, increased Adjusted EBITDA for this

amount.

2. Amount includes costs related to (i) compensation incurred for our retiring Co-Chief Executive Officer; (ii) a transition service agreement with the former Advisor and; (iii) insurance premiums related to expiring directors and officers of

former RTL directors. We do not consider these expenses to be part of our normal operating performance and have, accordingly, increased Adjusted EBITDA for this amount.

(Amounts in thousands) Three Months Ended

31-Dec-23

EBITDA:

Net loss $(48,578)

Depreciation and amortization 98,713

Interest expense 83,575

Income tax expense 5,459

EBITDA 139,169

Impairment charges 2,978

Equity-based compensation 1,058

Merger, transaction and other costs 4,349

Loss on dispositions of real estate investments 988

Loss on derivative instruments 4,478

Loss on extinguishment of debt 817

Other income (435)

Expenses attributable to European tax restructuring(1) 2,169

Transition costs related to the Merger and Internalization(2) 2,484

Adjusted EBITDA 158,055

Operating fees to related parties (580)

General and administrative 16,867

Expenses attributable to European tax restructuring(1) (2,169)

Transition costs related to the Merger and Internalization(2) (2,484)

NOI $169,689

Amortization of above- and below- market leases and ground lease intangibles and right-of-use assets, net 1,907

Straight-line rent (6,720)

Cash NOI $164,876

Cash Paid for Interest:

Interest Expense $83,575

Non-cash portion of interest expense (2,408)

Amortization of mortgage discounts (15,078)

Total Cash Paid for Interest $66,089 |

| 28

(Amounts in thousands) Three Months Ended

31-Dec-23

Funds from operations (FFO):

Net loss attributable to common stockholders (in accordance with GAAP) $(59,514)

Impairment charges 2,978

Depreciation and amortization 98,713

Loss on disposition of real estate investments 988

FFO (as defined by NAREIT) attributable to stockholders $43,165

Merger, transaction and other costs(1) 4,349

Loss on extinguishment of debt 817

Core FFO attributable to stockholders $48,331

Non-cash equity-based compensation 1,058

Non-cash portion of interest expense 2,408

Amortization related to above- and below- market lease intangibles and right-of-use assets, net 1,907

Straight-line rent (6,720)

Eliminate unrealized losses on foreign currency transactions(2) 4,941

Amortization of mortgage discounts 15,078

Expenses attributable to European tax restructuring(3) 2,169

Transition costs related to the Merger and Internalization(4) 2,484

Adjusted funds from operations (AFFO) attributable to stockholders $71,656

Weighted-average shares outstanding – Basic and Diluted 230,320

Net loss per share attributable to common stockholders $(0.26)

FFO per share $0.19

Core FFO per share $0.21

AFFO per share $0.31

Dividends declared $81,891

NON – GAAP RECONCILIATIONS

1. For the three months ended December 31, 2023, these costs primarily consist of advisory, legal and other professional costs that were directly related to the Merger and Internalization.

2. For AFFO purposes, we add back unrealized (gains) losses. For the three months ended December 31, 2023, the loss on derivative instruments was $4.5 million, which consisted of unrealized losses of $4.9 million and realized gains of

$0.4 million.

3. Amount relates to costs incurred related to the tax restructuring of our European entities. We do not consider these expenses to be part of our normal operating performance and have, accordingly, increased AFFO for this amount.

4. Amount includes costs related to (i) compensation incurred for our retiring Co-Chief Executive Officer; (ii) a transition service agreement with the former Advisor and; (iii) insurance premiums related to expiring directors and officers of

former RTL directors. We do not consider these expenses to be part of our normal operating performance and have, accordingly, increased AFFO for this amount. |

Cover

|

Feb. 27, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 27, 2024

|

| Entity File Number |

001-37390

|

| Entity Registrant Name |

Global Net Lease, Inc.

|

| Entity Central Index Key |

0001526113

|

| Entity Tax Identification Number |

45-2771978

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

650 Fifth Avenue

|

| Entity Address, Address Line Two |

30th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10019

|

| City Area Code |

332

|

| Local Phone Number |

265-2020

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common

Stock, $0.01 par value per share

|

| Trading Symbol |

GNL

|

| Security Exchange Name |

NYSE

|

| Series A Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.25%

Series A Cumulative Redeemable Preferred Stock, $0.01 par value per share

|

| Trading Symbol |

GNL PR A

|

| Security Exchange Name |

NYSE

|

| Series B Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.875%

Series B Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share

|

| Trading Symbol |

GNL PR B

|

| Security Exchange Name |

NYSE

|

| Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.50% Series D Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share

|

| Trading Symbol |

GNL PR D

|

| Security Exchange Name |

NYSE

|

| Series E Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.375% Series E Cumulative Redeemable Perpetual Preferred Stock, $0.01 par value per share

|

| Trading Symbol |

GNL PR E

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |