Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

11 Dezember 2023 - 11:02PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on December 11, 2023

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 2)

The Gabelli Equity Trust Inc.

(Name of Subject Company (Issuer))

The Gabelli Equity Trust Inc.

(Name of Filing Person (Issuer))

Series C Auction Rate Cumulative Preferred Stock, Par Value $0.001

Series E Auction Rate Cumulative Preferred Stock, Par Value $0.001

(Title of Classes of Securities)

362397507

362397606

(CUSIP Number of Classes of Securities)

John C. Ball

The Gabelli Equity Trust Inc.

One Corporate Center

Rye, New York 10580-1422

(914) 921-5100

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of the Person(s) Filing Statement)

Copies to:

|

Peter Goldstein, Esq.

The Gabelli Equity Trust Inc.

One Corporate Center

Rye, New York 10580-1422

(914) 921-5100 |

|

P. Jay Spinola, Esq.

Bissie K. Bonner, Esq.

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New York, NY 10019

(212) 728-8000 |

|

☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

☐ |

Third-party tender offer subject to Rule 14d-1. |

|

☒ |

Issuer tender offer subject to Rule 13e-4. |

|

☐ |

Going-private transaction subject to Rule 13e-3. |

|

☐ |

Amendment to Schedule 13D under Rule 13d-2. |

|

☐ |

Check the box if the filing is a final amendment reporting the results of the tender offer. |

INTRODUCTORY STATEMENT

This Amendment No. 2 (this “Amendment No.

2”) amends and supplements the Tender Offer Statement on Schedule TO (together with any subsequent amendments and supplements thereto,

this “Schedule TO”), filed with the Securities and Exchange Commission by The Gabelli Equity Trust Inc., a Maryland corporation

(“GAB” or the “Issuer”), on November 16, 2023, relating to the Issuer’s offer to purchase up to 100%

of the Issuer’s Series C Auction Rate Cumulative Preferred Stock, par value $0.001 and liquidation preference $25,000 per share

(the “Series C Preferred”), and Series E Auction Rate Cumulative Preferred Stock, par value $0.001 and liquidation preference

$25,000 per share (the “Series E Preferred” and together with the Series C Preferred, the “Auction Rate Preferred Shares”),

for cash at price equal to 90% of the $25,000 liquidation preference per Auction Rate Preferred Share (i.e., $22,500 per share, the “Purchase

Price”), plus any accrued and unpaid dividends, on the terms and subject to the conditions set forth in Offer to Purchase, dated

November 16, 2023 (the “Offer to Purchase”), and the related Letter of Transmittal (such transaction, the “Offer”).

Capitalized terms used but not defined herein have the meanings ascribed to them in the Schedule TO, the Offer to Purchase or the Letter

of Transmittal, as applicable.

The Issuer has determined to extend the Expiration

Date of the Offer from 5:00 p.m., New York City time, on December 20, 2023, to 5:00 p.m., New York City time, on January 5, 2024. This

Amendment No. 2 is being filed in satisfaction of the requirements of Rule 13e-4(c)(1) and (c)(3) promulgated under the Securities Exchange

Act of 1934, as amended.

Only those items amended are reported in this

Amendment No. 2. Except as specifically provided herein, the information set forth in the Schedule TO, including all schedules and annexes

thereto that were previously filed therewith, remains unchanged and is incorporated herein by reference, except that such information

is hereby amended and supplemented to the extent specifically provided for herein and to the extent amended and supplemented by the exhibits

filed herewith.

You should read this Amendment No. 2 together

with the Schedule TO, the Offer to Purchase and the Letter of Transmittal.

ITEM 1 THROUGH 9 AND ITEM 11.

The Issuer has determined to extend the Expiration

Date of the Offer from 5:00 p.m., New York City time, on December 20, 2023, to 5:00 p.m., New York City time, on January 5, 2024, unless

further extended by the Issuer. Therefore, Item 1 through Item 9 and Item 11 of the Schedule TO, to the extent such Items incorporate

by reference the information contained in the Offer to Purchase, are hereby amended and supplemented by adding the following text thereto:

“On December 11, 2023, the Issuer extended

the Expiration Date of the Offer. The Offer was previously scheduled to expire at 5:00 p.m., New York City time, on December 20, 2023.

The Expiration Date of the Offer has been extended to 5:00 p.m., New York City time, on January 5, 2024, unless further extended by the

Issuer.

As a result of the extension of the Expiration

Date, the Issuer anticipates that the settlement date in respect of Auction Rate Preferred Shares validly surrendered and accepted for

purchase in the Offer will occur on January 11, 2024 (four business days after the Expiration Date).

The press release announcing the extension of

the Expiration Date for the Offer is attached as Exhibit (a)(5)(ii) to the Schedule TO and incorporated herein by reference.”

ITEM 12(a). EXHIBITS.

|

Exhibit No. |

|

Document |

| (a)(1)(i) |

|

Offer to Purchase dated November 16, 2023 is incorporated by reference to Exhibit (a)(1)(i) to the Issuer’s Tender Offer Statement on Schedule TO (File No. 005-84335), filed on November 16, 2023. |

| (a)(1)(ii) |

|

Letter of Transmittal is incorporated by reference to Exhibit (a)(1)(ii) to the Issuer’s Tender Offer Statement on Schedule TO (File No. 005-84335), filed on November 16, 2023. |

| (a)(1)(iii) |

|

Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees is incorporated by reference to Exhibit (a)(1)(iii) to the Issuer’s Tender Offer Statement on Schedule TO (File No. 005-84335), filed on November 16, 2023. |

| (a)(1)(iv) |

|

Letter to Clients is incorporated by reference to Exhibit (a)(1)(iv) to the Issuer’s Tender Offer Statement on Schedule TO (File No. 005-84335), filed on November 16, 2023. |

| (a)(1)(v) |

|

Notice of Guaranteed Delivery is incorporated by reference to Exhibit (a)(1)(v) to the Issuer’s Tender Offer Statement on Schedule TO (File No. 005-84335), filed on November 16, 2023. |

| (a)(5)(i) |

|

Press Release issued on November 22, 2023 is incorporated by reference to Exhibit (a)(5)(i) to the Issuer’s Tender Offer Statement on Schedule TO (File No. 005-84335), filed on November 22, 2023. |

| (a)(5)(ii) |

|

Press Release issued on December 11, 2023 is filed herewith. |

| (b) |

|

Not applicable. |

| (d)(1)(i) |

|

Articles of Incorporation are incorporated by reference to Exhibit (a)(1) to Pre-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 33 3-45951 and 811-04700) as filed with the Securities and Exchange Commission on April 7, 1998. |

| (d)(1)(ii) |

|

Articles Supplementary for the 7.25% Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(2) to Pre-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 33 3-45951 and 811-04700) as filed with the Securities and Exchange Commission on April 7, 1998. |

| (d)(1)(iii) |

|

Articles Supplementary for the 7.20% Tax Advantaged Series B Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(3) to Pre-Effective Amendment No. 1 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-47012 and 811-4700) as filed with the Securities and Exchange Commission on June 11, 2001. |

| (d)(1)(iv) |

|

Articles of Amendment dated June 15, 2001 to the Articles Supplementary for the 7.20% Tax Advantaged Series B Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(2)(B) to Pre-Effective Amendment No. 1 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-47012 and 811-4700) as filed with the Securities and Exchange Commission on June 11, 2001. |

| (d)(1)(v) |

|

Articles Supplementary for the Series C Auction Rate Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(2)(A) to Pre-Effective Amendment No. 3 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-86554 and 811-04700) as filed with the Securities and Exchange Commission on June 25, 2002. |

| (d)(1)(vi) |

|

Articles Supplementary for the 5.875% Series D Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(iv) to Pre-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-106081 and 811-04700) as filed with the Securities and Exchange Commission on October 1, 2003. |

| (d)(1)(vii) |

|

Articles Supplementary for the Series E Auction Rate Preferred Stock are incorporated by reference to Exhibit (a)(v) to Pre-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-106081 and 811-04700) as filed with the Securities and Exchange Commission on October 1, 2003. |

| (d)(1)(viii) |

|

Articles Supplementary for the 6.20% Series F Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(vi) to Pre-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-137298 and 811-04700) as filed with the Securities and Exchange Commission on November 6, 2006. |

| (d)(1)(ix) |

|

Articles Supplementary for election to be subject to Section 3-804(c) of the Maryland General Corporation Law are incorporated by reference to Exhibit (3)(i) to the Issuer’s filing on Form 8-K (File No. 811-04700) as filed with the Securities and Exchange Commission on December 9, 2010. |

| (d)(1)(x) |

|

Articles of Amendment dated May 12, 2004 to the Articles of Incorporation are incorporated by reference to Exhibit (f) to the Issuer’s Registration Statement on Form N-14 (File No. 333-126111) as filed with the Securities and Exchange Commission on June 24, 2005. |

| (d)(1)(xi) |

|

Articles of Amendment dated September 12, 2005 to the Articles of Incorporation are incorporated by reference to Exhibit (a)(v) to Pre-Effective Amendment No. 1 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-127724 and 811-04700) as filed with the Securities and Exchange Commission on September 15, 2005. |

| (d)(1)(xii) |

|

Articles of Amendment dated May 29, 2009 to the Articles Supplementary for the Series C Auction Rate Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(ix) to Pre-Effective Amendment No. 1 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on June 22, 2011. |

| (d)(1)(xiii) |

|

Articles of Amendment dated May 29, 2009 to the Articles Supplementary for the 5.875% Series D Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(x) to Pre-Effective Amendment No. 1 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on June 22, 2011. |

| (d)(1)(xiv) |

|

Articles of Amendment dated May 29, 2009 to the Articles Supplementary for the Series E Auction Rate Preferred Stock are incorporated by reference to Exhibit (a)(xi) to Pre-Effective Amendment No. 1 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on June 22, 2011. |

| (d)(1)(xv) |

|

Articles of Amendment dated May 29, 2009 to the Articles Supplementary for the 6.20% Series F Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xii) to Pre-Effective Amendment No. 1 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on June 22, 2011. |

| (d)(1)(xvi) |

|

Articles Supplementary for the Series G Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xiii) to Post-Effective Amendment No. 3 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on June 21, 2012. |

| (d)(1)(xvii) |

|

Articles Supplementary for the 5.00% Series H Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xiv) to Post-Effective Amendment No. 4 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on September 26, 2012. |

| (d)(1)(xviii) |

|

Articles of Amendment dated November 15, 2012 to the Articles Supplementary for the Series C Auction Rate Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xv) to Post-Effective Amendment No. 5 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on March 25, 2013. |

| (d)(1)(xix) |

|

Articles of Amendment dated November 15, 2012 to the Articles Supplementary for the 5.875% Series D Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xvi) to Post-Effective Amendment No. 5 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on March 25, 2013. |

| (d)(1)(xx) |

|

Articles of Amendment dated November 15, 2012 to the Articles Supplementary for the Series E Auction Rate Preferred Stock are incorporated by reference to Exhibit (a)(xvii) to Post-Effective Amendment No. 5 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on March 25, 2013. |

| (d)(1)(xxi) |

|

Articles of Amendment dated January 23, 2014 to the Articles Supplementary for the Series C Auction Rate Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xviii) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-195247 and 811-04700) as filed with the Securities and Exchange Commission on April 14, 2014. |

| (d)(1)(xxii) |

|

Articles of Amendment dated January 23, 2014 to the Articles Supplementary for the Series E Auction Rate Preferred Stock are incorporated by reference to Exhibit (a)(xix) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-195247 and 811-04700) as filed with the Securities and Exchange Commission on April 14, 2014. |

| (d)(1)(xxiii) |

|

Articles of Amendment dated January 23, 2014 to the Articles Supplementary for the 5.00% Series H Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xx) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-195247 and 811-04700) as filed with the Securities and Exchange Commission on April 14, 2014. |

| (d)(1)(xxiv) |

|

Articles Supplementary for the 5.45% Series J Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xxi) to Post-Effective Amendment No. 3 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-195247 and 811-04700) as filed with the Securities and Exchange Commission on March 29, 2016. |

| (d)(1)(xxv) |

|

Articles of Amendment dated October 17, 2017 to the Issuer’s Articles of Incorporation are incorporated by reference to Exhibit (a)(xxii) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on October 20, 2017. |

| (d)(1)(xxvi) |

|

Articles Supplementary for the 5.00% Series K Cumulative Preferred stock are incorporated by reference to Exhibit (a)(xxii) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on December 11, 2019. |

| (d)(2) |

|

Amended and Restated By-Laws of the Issuer incorporated by reference to Exhibit (3)(ii) to the Issuer’s filing on Form 8-K (File No. 811-04700) as filed with the Commission on December 9, 2010. |

| (d)(3) |

|

Automatic Dividend Reinvestment and Voluntary Cash Purchase Plan of the Issuer is incorporated by reference to Exhibit 2(e) to Pre-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 33 3-45951 and 811-04700) as filed with the Commission on April 7, 1998. |

| (d)(4) |

|

Investment Advisory Agreement between the Issuer and Gabelli Funds, LLC is incorporated by reference to Exhibit (2)(g) to Pre-Effective Amendment No. 1 to the Issuer’s Registration Statement on Form N-2 (File Nos. 033-62323 and 811-04700) as filed with the Commission on October 13, 1995. |

| (d)(5) |

|

Custodian Contract between the Issuer and The Bank of New York Mellon is incorporated by reference to Exhibit (j) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Commission on April 29, 2011. |

| (d)(6)(i) |

|

Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on April 29, 2011. |

| (d)(6)(ii) |

|

Amendment No. 1 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(a) to Post-Effective Amendment No. 4 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on September 26, 2012. |

| (d)(6)(iii) |

|

Amendment No. 2 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(b) to Post-Effective Amendment No. 4 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on September 26, 2012. |

| (d)(6)(iv) |

|

Amendment No. 3 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(c) to Post-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-195247 and 811-04700) as filed with the Securities and Exchange Commission on March 18, 2016. |

| (d)(6)(v) |

|

Amendment No. 4 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(d) to Post-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-195247 and 811-04700) as filed with the Securities and Exchange Commission on March 18, 2016. |

| (d)(6)(vi) |

|

Amendment No. 5 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(e) to Post-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-195247 and 811-04700) as filed with the Securities and Exchange Commission on March 18, 2016. |

| (d)(6)(vii) |

|

Amendment No. 6 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(f) to Post-Effective Amendment No. 3 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-195247 and 811-04700) as filed with the Securities and Exchange Commission on March 29, 2016. |

| (d)(6)(viii) |

|

Amendment No. 7 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(g) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on August 29, 2017. |

| (d)(6)(ix) |

|

Amendment No. 8 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(h) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on August 29, 2017. |

| (d)(6)(x) |

|

Amendment No. 9 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(i) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on August 29, 2017. |

| (d)(6)(xi) |

|

Amendment No. 10 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(j) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on October 20, 2017. |

| (d)(6)(xii) |

|

Amendment No. 11 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(k) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on October 20, 2017. |

| (d)(6)(xiii) |

|

Amendment No. 12 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(l) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on September 24, 2019. |

| (d)(6)(xiv) |

|

Amendment No. 13 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(m) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on September 24, 2019. |

| (d)(6)(xv) |

|

Amendment No. 14 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to the Issuer’s Registration Statement on Form N-2 of Gabelli Utility Trust (File Nos. 333-236449 and 811-09243) as filed with the Securities and Exchange Commission on February 14, 2020. |

| (d)(6)(xvi) |

|

Amendment No. 15 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(n) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on December 11, 2019. |

| (d)(6)(xvii) |

|

Amendment No. 16 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(1)(xvi) to the Issuer’s Registration Statement on Form N-2 of Gabelli Utility Trust (File Nos. 333-236449 and 811-09243) as filed with the Securities and Exchange Commission on February 14, 2020. |

| (d)(6)(xviii) |

|

Amendment No. 17 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (d)(5)(xviii) to the Tender Offer Statement on Schedule TO of The Gabelli Dividend & Income Trust (File No. 005-84324), filed on March 17, 2021. |

| (d)(6)(xix) |

|

Amendment No. 18 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(r) to Post-Effective Amendment No. 1 to the Registration Statement on Form N-2 of The Gabelli Dividend & Income Trust (File Nos. 333-259726 and 811-21423) as filed with the Securities and Exchange Commission on October 5, 2021. |

| (d)(6)(xx) |

|

Amendment No. 19 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(s) to Post-Effective Amendment No. 1 to the Registration Statement on Form N-2 of The Gabelli Dividend & Income Trust (File Nos. 333-259726 and 811-21423) as filed with the Securities and Exchange Commission on October 5, 2021. |

| (d)(6)(xxi) |

|

Amendment No. 20 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (d)(5)(xxi) to the Tender Offer Statement on Schedule TO of The Gabelli Utility Trust (File No. 005-84420) as filed with the Securities and Exchange Commission on September 6, 2023. |

| (d)(6)(xxii) |

|

Amendment No. 21 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (d)(5)(xxii) to the Tender Offer Statement on Schedule TO of The Gabelli Utility Trust (File No. 005-84420) as filed with the Securities and Exchange Commission on September 6, 2023. |

| (d)(6)(xxiii) |

|

Amendment No. 22 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (d)(5)(xxiii) to the Tender Offer Statement on Schedule TO of The Gabelli Utility Trust (File No. 005-84420) as filed with the Securities and Exchange Commission on September 6, 2023. |

| (d)(6)(xxiv) |

|

Amendment No. 23 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (d)(5)(xxiv) to the Tender Offer Statement on Schedule TO of The Gabelli Utility Trust (File No. 005-84420) as filed with the Securities and Exchange Commission on September 6, 2023. |

| (d)(6)(xxv) |

|

Amendment No. 24 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (d)(5)(xxv) to the Tender Offer Statement on Schedule TO of The Gabelli Utility Trust (File No. 005-84420) as filed with the Securities and Exchange Commission on September 6, 2023. |

| (d)(8) |

|

Share Tender Agreement, dated November 14, 2023, between The Gabelli Equity Trust Inc. and Sunrise Partners Limited Partnership is incorporated by reference to Exhibit (d)(8) to the Issuer’s Tender Offer Statement on Schedule TO (File No. 005-84335), filed on November 16, 2023. |

| (g) |

|

Not applicable. |

| (h) |

|

Not applicable. |

ITEM 12(b).

FILING FEES

Filing Fee Exhibit is incorporated by reference to the Filing Fee Exhibit to the Issuer’s Tender Offer Statement on Schedule TO (File No. 005-84335), filed on November 16, 2023.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

THE GABELLI EQUITY TRUST INC. |

| |

|

|

| |

By: |

/s/ John C. Ball |

| |

Name: |

John C. Ball |

| |

Title: |

President |

Dated: December 11, 2023

Exhibit (a)(5)(ii)

|

THE GABELLI EQUITY TRUST

Investor Relations Contact:

Molly Marion

(914) 921-5681

mmarion@gabelli.com |

Press

Release

For Immediate Release

GABELLI EQUITY TRUST EXTENDS

EXPIRATION DATE OF TENDER OFFER TO JANUARY 5, 2024

FOR SERIES C AND SERIES E AUCTION RATE PREFERRED STOCK

Rye, NY – December 11, 2023 – The Board of Directors of The Gabelli Equity Trust Inc. (NYSE: GAB) (the

“Fund”) has extended the expiration date of the tender offer (the “Offer”) for all of the Fund’s outstanding Series C Auction Rate Cumulative Preferred Stock and Series E Auction

Rate Cumulative Preferred Stock (the “Preferred Stock”) to January 5, 2024.

Under the terms of the Offer owners of the Preferred Stock may tender their Preferred Stock for cash in the amount of $22,500 for each share of Preferred Stock validly tendered and not withdrawn pursuant to the Offer. For holders that tender Preferred Stock accepted for tender, all accrued and unpaid dividends on such Preferred Stock as of the expiration of the Offer will be paid in cash.

The terms and conditions of the Offer are set forth in the Offer to Purchase and the

accompanying Letter of Transmittal and related documents, each as may be amended or supplemented from time to time. The Fund filed a tender offer statement on Schedule TO with the Securities and Exchange Commission, which includes the Offer to Purchase and the Letter of Transmittal.

Important Notice

This press release is for informational purposes only and shall not constitute an offer or a solicitation to buy any Series C Auction Rate Cumulative Preferred Stock or Series E Auction Rate

Cumulative Preferred Stock. The offer to purchase Series C Auction Rate Cumulative Preferred Stock and Series E Auction Rate Cumulative Preferred Stock is being made only pursuant to an offer on Schedule

TO.

HOLDERS OF SERIES C AUCTION RATE CUMLATIVE

PREFERRED STOCK AND SERIES E AUCTION RATE CUMULATIVE PREFERRED STOCK ARE URGED TO READ THE OFFER TO PURCHASE AND ANY

SOLICITATION/RECOMMENDATION STATEMENT REGARDING THE OFFER, AS THEY MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, BECAUSE THEY

CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF SERIES C AUCTION RATE CUMLATIVE PREFERRED STOCK AND SERIES E AUCTION RATE CUMULATIVE

PREFERRED STOCK SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES. Holders of Series C Auction Rate

Cumulative Preferred Stock and Series E Auction Rate Cumulative Preferred Stock may obtain a free copy of any of these statements

and other documents after they are filed with the SEC at the website maintained by the SEC at www.sec.gov or by directing such

requests to the Fund by calling 800-GABELLI (800-422-3554), visiting www.gabelli.com, or emailing ClosedEnd@gabelli.com.

About The Gabelli Equity Trust

The Gabelli Equity Trust Inc. is a

diversified, closed-end management investment company with $1.9 billion in total net assets whose primary investment objective is

long-term growth of capital, with income as a secondary objective. The Fund is managed by Gabelli Funds, LLC, a subsidiary of GAMCO

Investors, Inc. (OTCQX: GAMI).

Investors in the Fund should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. More information about the Fund is available by calling 800-GABELLI (800-422-3554), visiting www.gabelli.com, or emailing ClosedEnd@gabelli.com.

NYSE – GAB

CUSIP – 362397101

For information:

Molly Marion

(914) 921-5057

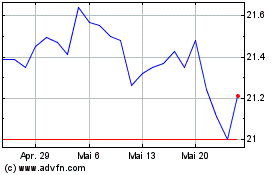

Gabelli Equity (NYSE:GAB-K)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

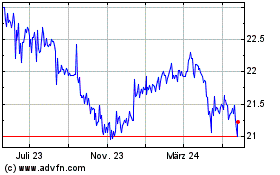

Gabelli Equity (NYSE:GAB-K)

Historical Stock Chart

Von Mai 2023 bis Mai 2024