Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

08 Januar 2024 - 10:31PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on January 8, 2024

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 3)

The Gabelli Equity Trust Inc.

(Name of Subject Company (Issuer))

The Gabelli Equity Trust Inc.

(Name of Filing Person (Issuer))

Series C Auction Rate Cumulative Preferred Stock, Par Value $0.001

Series E Auction Rate Cumulative Preferred Stock, Par Value $0.001

(Title of Classes of Securities)

362397507

362397606

(CUSIP Number of Classes of Securities)

John C. Ball

The Gabelli Equity Trust Inc.

One Corporate Center

Rye, New York 10580-1422

(914) 921-5100

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of the Person(s) Filing Statement)

Copies to:

|

Peter Goldstein, Esq.

The Gabelli Equity Trust Inc.

One Corporate Center

Rye, New York 10580-1422

(914) 921-5100 |

|

P. Jay Spinola, Esq.

Bissie K. Bonner, Esq.

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New York, NY 10019

(212) 728-8000 |

|

☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

☐ |

Third-party tender offer subject to Rule 14d-1. |

|

☒ |

Issuer tender offer subject to Rule 13e-4. |

|

☐ |

Going-private transaction subject to Rule 13e-3. |

|

☐ |

Amendment to Schedule 13D under Rule 13d-2. |

|

☒ |

Check the box if the filing is a final amendment reporting the results of the tender offer. |

INTRODUCTORY STATEMENT

This Amendment No. 3 (this “Final Amendment”) amends and supplements the Tender Offer Statement on Schedule TO (together with any subsequent amendments and supplements thereto, this “Schedule TO”), filed with the Securities and Exchange Commission by The Gabelli Equity Trust Inc., a Maryland corporation (“GAB” or the “Issuer”), on November 16, 2023, relating to the Issuer’s offer to purchase up to 100% of the Issuer’s Series C Auction Rate Cumulative Preferred Stock, par value $0.001 and liquidation preference $25,000 per share (the “Series C Preferred”), and Series E Auction Rate Cumulative Preferred Stock, par value $0.001 and liquidation preference $25,000 per share (the “Series E Preferred” and together with the Series C Preferred, the “Auction Rate Preferred Shares”), for cash at price equal to 90% of the $25,000 liquidation preference per Auction Rate Preferred Share (i.e., $22,500 per share, the “Purchase Price”), plus any accrued and unpaid dividends, on the terms and subject to the conditions set forth in Offer to Purchase, dated November 16, 2023 (the “Offer to Purchase”), and the related Letter of Transmittal (such transaction, the “Offer”). Capitalized terms used but not defined herein have the meanings ascribed to them in the Schedule TO, the Offer to Purchase or the Letter of Transmittal, as applicable.

This Final Amendment is the final amendment to the Schedule TO and is being filed (i) to report the final results of the Offer, which expired at 5:00 p.m. New York City time on January 5, 2024 (the "Expiration Date").

The following information is furnished to satisfy the requirements of Rule 13e-4(c)(4) under the Exchange Act:

| |

1. |

The Exchange Offer expired at 5:00 p.m. New York City time, on January 5, 2024. |

| |

2. |

2,435 shares of Series C Preferred were validly tendered and not withdrawn prior to the expiration of the Exchange Offer and all 2,435 shares of Series C Preferred, representing 97.7% of the outstanding shares of Series C Preferred on the Expiration Date, were accepted for purchase in accordance with the terms of the Offer to Purchase. |

| |

|

|

| |

3. |

894 shares of Series E Preferred were validly tendered and not withdrawn prior to the expiration of the Exchange Offer and all 894 shares of Series E Preferred, representing 80.7% of the outstanding shares of Series E Preferred on the Expiration Date, were accepted for purchase in accordance with the terms of the Offer to Purchase. |

| |

4. |

In exchange for each full and fractional Auction Rate Preferred Share properly tendered (and not validly withdrawn) prior to the Expiration Date and accepted by the Issuer, participating holders of Auction Rate Preferred Shares will receive cash in an amount equal to the Purchase Price, plus any accrued and unpaid dividends. |

Only those items amended are reported in this Final Amendment. Except as specifically provided herein, the information set forth in the Schedule TO, including all schedules and annexes thereto that were previously filed therewith, remains unchanged and is incorporated herein by reference, except that such information is hereby amended and supplemented to the extent specifically provided for herein and to the extent amended and supplemented by the exhibits filed herewith.

ITEM 1 THROUGH ITEM 9 AND ITEM 11.

The information set forth in the Offer to Purchase and the related Letter of Transmittal is incorporated herein by reference into this Final Amendment in answer to Item 1 through Item 9 and Item 11 of Schedule TO.

ITEM 10. FINANCIAL STATEMENTS.

|

(a) |

Financial Information. |

The financial statements contained in the reports set forth in the section of the Offer to Purchase titled “Incorporation by Reference” is incorporated herein by reference.

A copy of any or all of the documents containing such information and financial statements may be inspected, and copies thereof obtained, upon written or oral request, by contacting the Issuer by telephone at 800-GABELLI (422-3554) or 914-921-5070, or by written request to The Gabelli Equity Trust Inc., One Corporate Center, Rye, New York 10580-1422.

|

(b) |

Pro Forma Information. |

Not applicable.

ITEM 12(a). EXHIBITS.

|

Exhibit No. |

|

Document |

| (a)(1)(i) |

|

Offer to Purchase dated November 16, 2023 is incorporated by reference to Exhibit (a)(1)(i) to the Issuer’s Tender Offer Statement on Schedule TO (File No. 005-84335), filed on November 16, 2023. |

| (a)(1)(ii) |

|

Letter of Transmittal is incorporated by reference to Exhibit (a)(1)(ii) to the Issuer’s Tender Offer Statement on Schedule TO (File No. 005-84335), filed on November 16, 2023. |

| (a)(1)(iii) |

|

Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees is incorporated by reference to Exhibit (a)(1)(iii) to the Issuer’s Tender Offer Statement on Schedule TO (File No. 005-84335), filed on November 16, 2023. |

| (a)(1)(iv) |

|

Letter to Clients is incorporated by reference to Exhibit (a)(1)(iv) to the Issuer’s Tender Offer Statement on Schedule TO (File No. 005-84335), filed on November 16, 2023. |

| (a)(1)(v) |

|

Notice of Guaranteed Delivery is incorporated by reference to Exhibit (a)(1)(v) to the Issuer’s Tender Offer Statement on Schedule TO (File No. 005-84335), filed on November 16, 2023. |

| (a)(5)(i) |

|

Press Release issued on November 22, 2023 is incorporated by reference to Exhibit (a)(5)(i) to the Issuer’s Tender Offer Statement on Schedule TO (File No. 005-84335), filed on November 22, 2023. |

| (a)(5)(ii) |

|

Press Release issued on December 11, 2023 is incorporated by reference to Exhibit (a)(5)(ii) to the Issuer’s Tender Offer Statement on Schedule TO (File No. 005-84335), filed on December 11, 2023. |

| (b) |

|

Not applicable. |

| (d)(1)(i) |

|

Articles of Incorporation are incorporated by reference to Exhibit (a)(1) to Pre-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 33 3-45951 and 811-04700) as filed with the Securities and Exchange Commission on April 7, 1998. |

| (d)(1)(ii) |

|

Articles Supplementary for the 7.25% Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(2) to Pre-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 33 3-45951 and 811-04700) as filed with the Securities and Exchange Commission on April 7, 1998. |

| (d)(1)(iii) |

|

Articles Supplementary for the 7.20% Tax Advantaged Series B Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(3) to Pre-Effective Amendment No. 1 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-47012 and 811-4700) as filed with the Securities and Exchange Commission on June 11, 2001. |

| (d)(1)(iv) |

|

Articles of Amendment dated June 15, 2001 to the Articles Supplementary for the 7.20% Tax Advantaged Series B Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(2)(B) to Pre-Effective Amendment No. 1 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-47012 and 811-4700) as filed with the Securities and Exchange Commission on June 11, 2001. |

| (d)(1)(v) |

|

Articles Supplementary for the Series C Auction Rate Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(2)(A) to Pre-Effective Amendment No. 3 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-86554 and 811-04700) as filed with the Securities and Exchange Commission on June 25, 2002. |

| (d)(1)(vi) |

|

Articles Supplementary for the 5.875% Series D Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(iv) to Pre-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-106081 and 811-04700) as filed with the Securities and Exchange Commission on October 1, 2003. |

| (d)(1)(vii) |

|

Articles Supplementary for the Series E Auction Rate Preferred Stock are incorporated by reference to Exhibit (a)(v) to Pre-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-106081 and 811-04700) as filed with the Securities and Exchange Commission on October 1, 2003. |

| (d)(1)(viii) |

|

Articles Supplementary for the 6.20% Series F Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(vi) to Pre-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-137298 and 811-04700) as filed with the Securities and Exchange Commission on November 6, 2006. |

| (d)(1)(ix) |

|

Articles Supplementary for election to be subject to Section 3-804(c) of the Maryland General Corporation Law are incorporated by reference to Exhibit (3)(i) to the Issuer’s filing on Form 8-K (File No. 811-04700) as filed with the Securities and Exchange Commission on December 9, 2010. |

| (d)(1)(x) |

|

Articles of Amendment dated May 12, 2004 to the Articles of Incorporation are incorporated by reference to Exhibit (f) to the Issuer’s Registration Statement on Form N-14 (File No. 333-126111) as filed with the Securities and Exchange Commission on June 24, 2005. |

| (d)(1)(xi) |

|

Articles of Amendment dated September 12, 2005 to the Articles of Incorporation are incorporated by reference to Exhibit (a)(v) to Pre-Effective Amendment No. 1 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-127724 and 811-04700) as filed with the Securities and Exchange Commission on September 15, 2005. |

| (d)(1)(xii) |

|

Articles of Amendment dated May 29, 2009 to the Articles Supplementary for the Series C Auction Rate Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(ix) to Pre-Effective Amendment No. 1 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on June 22, 2011. |

| (d)(1)(xiii) |

|

Articles of Amendment dated May 29, 2009 to the Articles Supplementary for the 5.875% Series D Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(x) to Pre-Effective Amendment No. 1 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on June 22, 2011. |

| (d)(1)(xiv) |

|

Articles of Amendment dated May 29, 2009 to the Articles Supplementary for the Series E Auction Rate Preferred Stock are incorporated by reference to Exhibit (a)(xi) to Pre-Effective Amendment No. 1 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on June 22, 2011. |

| (d)(1)(xv) |

|

Articles of Amendment dated May 29, 2009 to the Articles Supplementary for the 6.20% Series F Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xii) to Pre-Effective Amendment No. 1 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on June 22, 2011. |

| (d)(1)(xvi) |

|

Articles Supplementary for the Series G Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xiii) to Post-Effective Amendment No. 3 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on June 21, 2012. |

| (d)(1)(xvii) |

|

Articles Supplementary for the 5.00% Series H Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xiv) to Post-Effective Amendment No. 4 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on September 26, 2012. |

| (d)(1)(xviii) |

|

Articles of Amendment dated November 15, 2012 to the Articles Supplementary for the Series C Auction Rate Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xv) to Post-Effective Amendment No. 5 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on March 25, 2013. |

| (d)(1)(xix) |

|

Articles of Amendment dated November 15, 2012 to the Articles Supplementary for the 5.875% Series D Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xvi) to Post-Effective Amendment No. 5 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on March 25, 2013. |

| (d)(1)(xx) |

|

Articles of Amendment dated November 15, 2012 to the Articles Supplementary for the Series E Auction Rate Preferred Stock are incorporated by reference to Exhibit (a)(xvii) to Post-Effective Amendment No. 5 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on March 25, 2013. |

| (d)(1)(xxi) |

|

Articles of Amendment dated January 23, 2014 to the Articles Supplementary for the Series C Auction Rate Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xviii) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-195247 and 811-04700) as filed with the Securities and Exchange Commission on April 14, 2014. |

| (d)(1)(xxii) |

|

Articles of Amendment dated January 23, 2014 to the Articles Supplementary for the Series E Auction Rate Preferred Stock are incorporated by reference to Exhibit (a)(xix) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-195247 and 811-04700) as filed with the Securities and Exchange Commission on April 14, 2014. |

| (d)(1)(xxiii) |

|

Articles of Amendment dated January 23, 2014 to the Articles Supplementary for the 5.00% Series H Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xx) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-195247 and 811-04700) as filed with the Securities and Exchange Commission on April 14, 2014. |

| (d)(1)(xxiv) |

|

Articles Supplementary for the 5.45% Series J Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xxi) to Post-Effective Amendment No. 3 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-195247 and 811-04700) as filed with the Securities and Exchange Commission on March 29, 2016. |

| (d)(1)(xxv) |

|

Articles of Amendment dated October 17, 2017 to the Issuer’s Articles of Incorporation are incorporated by reference to Exhibit (a)(xxii) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on October 20, 2017. |

| (d)(1)(xxvi) |

|

Articles Supplementary for the 5.00% Series K Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xxii) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on December 11, 2019. |

| (d)(1)(xxvii) |

|

Articles Supplementary for the 4.25% Series M Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xxiv) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-276314 and 811-04700) as filed with the Securities and Exchange Commission on December 29, 2023. |

| (d)(1)(xxviii) |

|

Articles Supplementary for the 5.25% Series N Cumulative Preferred Stock are incorporated by reference to Exhibit (a)(xxv) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-276314 and 811-04700) as filed with the Securities and Exchange Commission on December 29, 2023. |

| (d)(2) |

|

Amended and Restated By-Laws of the Issuer incorporated by reference to Exhibit (3)(ii) to the Issuer’s filing on Form 8-K (File No. 811-04700) as filed with the Commission on December 9, 2010. |

| (d)(3) |

|

Automatic Dividend Reinvestment and Voluntary Cash Purchase Plan of the Issuer is incorporated by reference to Exhibit 2(e) to Pre-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 33 3-45951 and 811-04700) as filed with the Commission on April 7, 1998. |

| (d)(4) |

|

Investment Advisory Agreement between the Issuer and Gabelli Funds, LLC is incorporated by reference to Exhibit (2)(g) to Pre-Effective Amendment No. 1 to the Issuer’s Registration Statement on Form N-2 (File Nos. 033-62323 and 811-04700) as filed with the Commission on October 13, 1995. |

| (d)(5) |

|

Custodian Contract between the Issuer and The Bank of New York Mellon is incorporated by reference to Exhibit (j) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Commission on April 29, 2011. |

| (d)(6)(i) |

|

Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on April 29, 2011. |

| (d)(6)(ii) |

|

Amendment No. 1 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(a) to Post-Effective Amendment No. 4 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on September 26, 2012. |

| (d)(6)(iii) |

|

Amendment No. 2 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(b) to Post-Effective Amendment No. 4 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-173819 and 811-04700) as filed with the Securities and Exchange Commission on September 26, 2012. |

| (d)(6)(iv) |

|

Amendment No. 3 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(c) to Post-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-195247 and 811-04700) as filed with the Securities and Exchange Commission on March 18, 2016. |

| (d)(6)(v) |

|

Amendment No. 4 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(d) to Post-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-195247 and 811-04700) as filed with the Securities and Exchange Commission on March 18, 2016. |

| (d)(6)(vi) |

|

Amendment No. 5 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(e) to Post-Effective Amendment No. 2 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-195247 and 811-04700) as filed with the Securities and Exchange Commission on March 18, 2016. |

| (d)(6)(vii) |

|

Amendment No. 6 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(f) to Post-Effective Amendment No. 3 to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-195247 and 811-04700) as filed with the Securities and Exchange Commission on March 29, 2016. |

| (d)(6)(viii) |

|

Amendment No. 7 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(g) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on August 29, 2017. |

| (d)(6)(ix) |

|

Amendment No. 8 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(h) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on August 29, 2017. |

| (d)(6)(x) |

|

Amendment No. 9 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(i) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on August 29, 2017. |

| (d)(6)(xi) |

|

Amendment No. 10 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(j) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on October 20, 2017. |

| (d)(6)(xii) |

|

Amendment No. 11 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(k) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on October 20, 2017. |

| (d)(6)(xiii) |

|

Amendment No. 12 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(l) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on September 24, 2019. |

| (d)(6)(xiv) |

|

Amendment No. 13 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(m) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on September 24, 2019. |

| (d)(6)(xv) |

|

Amendment No. 14 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to the Issuer’s Registration Statement on Form N-2 of Gabelli Utility Trust (File Nos. 333-236449 and 811-09243) as filed with the Securities and Exchange Commission on February 14, 2020. |

| (d)(6)(xvi) |

|

Amendment No. 15 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(n) to the Issuer’s Registration Statement on Form N-2 (File Nos. 333-220232 and 811-04700) as filed with the Securities and Exchange Commission on December 11, 2019. |

| (d)(6)(xvii) |

|

Amendment No. 16 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(1)(xvi) to the Issuer’s Registration Statement on Form N-2 of Gabelli Utility Trust (File Nos. 333-236449 and 811-09243) as filed with the Securities and Exchange Commission on February 14, 2020. |

| (d)(6)(xviii) |

|

Amendment No. 17 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (d)(5)(xviii) to the Tender Offer Statement on Schedule TO of The Gabelli Dividend & Income Trust (File No. 005-84324), filed on March 17, 2021. |

| (d)(6)(xix) |

|

Amendment No. 18 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(r) to Post-Effective Amendment No. 1 to the Registration Statement on Form N-2 of The Gabelli Dividend & Income Trust (File Nos. 333-259726 and 811-21423) as filed with the Securities and Exchange Commission on October 5, 2021. |

| (d)(6)(xx) |

|

Amendment No. 19 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (k)(i)(s) to Post-Effective Amendment No. 1 to the Registration Statement on Form N-2 of The Gabelli Dividend & Income Trust (File Nos. 333-259726 and 811-21423) as filed with the Securities and Exchange Commission on October 5, 2021. |

| (d)(6)(xxi) |

|

Amendment No. 20 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (d)(5)(xxi) to the Tender Offer Statement on Schedule TO of The Gabelli Utility Trust (File No. 005-84420) as filed with the Securities and Exchange Commission on September 6, 2023. |

| (d)(6)(xxii) |

|

Amendment No. 21 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (d)(5)(xxii) to the Tender Offer Statement on Schedule TO of The Gabelli Utility Trust (File No. 005-84420) as filed with the Securities and Exchange Commission on September 6, 2023. |

| (d)(6)(xxiii) |

|

Amendment No. 22 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (d)(5)(xxiii) to the Tender Offer Statement on Schedule TO of The Gabelli Utility Trust (File No. 005-84420) as filed with the Securities and Exchange Commission on September 6, 2023. |

| (d)(6)(xxiv) |

|

Amendment No. 23 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (d)(5)(xxiv) to the Tender Offer Statement on Schedule TO of The Gabelli Utility Trust (File No. 005-84420) as filed with the Securities and Exchange Commission on September 6, 2023. |

| (d)(6)(xxv) |

|

Amendment No. 24 to Transfer Agency and Service Agreement among Issuer, Computershare Trust Company, N.A. and Computershare Inc. is incorporated by reference to Exhibit (d)(5)(xxv) to the Tender Offer Statement on Schedule TO of The Gabelli Utility Trust (File No. 005-84420) as filed with the Securities and Exchange Commission on September 6, 2023. |

| (d)(8) |

|

Share Tender Agreement, dated November 14, 2023, between The Gabelli Equity Trust Inc. and Sunrise Partners Limited Partnership is incorporated by reference to Exhibit (d)(8) to the Issuer’s Tender Offer Statement on Schedule TO (File No. 005-84335), filed on November 16, 2023. |

| (g) |

|

Not applicable. |

| (h) |

|

Not applicable. |

ITEM 12(b). FILING FEES

Filing Fee Exhibit is filed herewith.

ITEM 13. INFORMATION REQUIRED BY SCHEDULE 13E-3.

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

THE GABELLI EQUITY TRUST INC. |

| |

|

|

| |

By: |

/s/ John C. Ball |

| |

Name: |

John C. Ball |

| |

Title: |

President |

Dated: January 8, 2024

EX-FILING

FEES

Calculation

of Filing Fee Table

SC

TO-I/A

(Form

Type)

THE

GABELLI EQUITY TRUST INC.

(Exact

Name of Registrant as Specified in its Charter)

Table

1: Transaction Valuation

| |

Transaction

Valuation |

Fee

rate |

Amount

of

Filing Fee |

| Fees

to Be Paid |

— |

0.0001476% |

— |

| Fees

Previously Paid |

$81,000,000(1) |

|

$11,955.60(2) |

| Total

Transaction Valuation |

$81,000,000(1) |

|

|

| Total

Fees Due for Filing |

|

|

$11,955.60 |

| Total

Fees Previously Paid |

|

|

$11,955.60 |

| Total

Fee Offsets |

|

|

—

|

| Net

Fee Due |

|

|

$0 |

| (1) |

The transaction value is calculated as the aggregate

maximum purchase price for Auction Rate Preferred Shares that could be purchased in the tender offer, based upon a purchase price

equal to 90.0% of the liquidation preference of $25,000 per Auction Rate Preferred Share (i.e., $22,500 per share). The fee of $11,955.60

was paid in connection with the filing of the Schedule TO-I by the Gabelli Equity Trust Inc. (File No. 005-84335) on November 16,

2023 (the “Schedule TO”). This is the final amendment to the Schedule TO and is being filed to report the results of

the offer. |

| (2) |

Calculated at $147.60 per $1,000,000 of the Transaction

Value. |

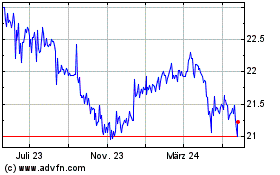

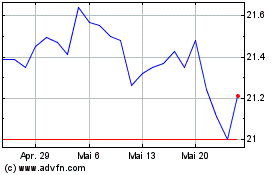

Gabelli Equity (NYSE:GAB-K)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Gabelli Equity (NYSE:GAB-K)

Historical Stock Chart

Von Mai 2023 bis Mai 2024