Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

29 November 2023 - 5:16PM

Edgar (US Regulatory)

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

—

September

30,

2023

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

—

97.9%

Financial

Services

—

11.4%

19,500

Aegon

Ltd.

......................

$

94,464

250

Affiliated

Managers

Group

Inc.

........

32,585

10,850

Ally

Financial

Inc.

.................

289,478

274,400

American

Express

Co.

..............

40,937,736

15,000

Apollo

Global

Management

Inc.

.......

1,346,400

60,000

Avation

plc†

.....................

73,572

6,500

Axis

Capital

Holdings

Ltd.

...........

366,405

7,000

Banco

Bilbao

Vizcaya

Argentaria

SA

....

57,060

75,000

Banco

Santander

SA,

ADR

...........

282,000

60,000

Bank

of

America

Corp.

..............

1,642,800

72,500

Barclays

plc

.....................

140,594

101

Berkshire

Hathaway

Inc.,

Cl. A†

.......

53,679,177

3,250

Berkshire

Hathaway

Inc.,

Cl. B†

.......

1,138,475

44,500

Blackstone

Inc.

...................

4,767,730

132,500

Blue

Owl

Capital

Inc.

...............

1,717,200

1,750

Brookfield

Asset

Management

Ltd.,

Cl. A

.

58,345

7,000

Brookfield

Corp.

..................

218,890

3,070

Capital

One

Financial

Corp.

...........

297,943

87,500

Cipher

Mining

Inc.†

................

203,875

128,870

Citigroup

Inc.

....................

5,300,423

35,500

Commerzbank

AG

.................

404,974

7,000

Compass

Diversified

Holdings

........

131,390

21,745

Credit

Agricole

SA

.................

268,798

5,000

Cullen/Frost

Bankers

Inc.

............

456,050

173,600

Dah

Sing

Banking

Group

Ltd.

.........

114,833

111,400

Dah

Sing

Financial

Holdings

Ltd.

......

235,576

52,900

Daiwa

Securities

Group

Inc.

..........

305,527

30,000

Deutsche

Bank

AG

................

329,700

1,236

Diamond

Hill

Investment

Group

Inc.

....

208,353

67,560

DigitalBridge

Group

Inc.

............

1,187,705

488

E-L

Financial

Corp.

Ltd.

.............

320,124

2,400

EXOR

NV

.......................

212,989

5,000

Federated

Hermes

Inc.

..............

169,350

4,451

First

American

Financial

Corp.

........

251,437

172

First

Citizens

BancShares

Inc.,

Cl. A

....

237,377

25,526

Flushing

Financial

Corp.

.............

335,156

8,000

Franklin

Resources

Inc.

.............

196,640

450,000

GAM

Holding

AG†

.................

222,456

5,000

Icahn

Enterprises

LP

...............

98,900

9,100

ING

Groep

NV

....................

120,743

43,721

Interactive

Brokers

Group

Inc.,

Cl. A

....

3,784,490

7,000

Intercontinental

Exchange

Inc.

........

770,140

74,000

Janus

Henderson

Group

plc

..........

1,910,680

12,800

Japan

Post

Bank

Co.

Ltd.

............

111,435

88,000

Jefferies

Financial

Group

Inc.

.........

3,223,440

35,400

JPMorgan

Chase

&

Co.

.............

5,133,708

5,000

Julius

Baer

Group

Ltd.

..............

321,516

500

Just

Group

plc

...................

439

29,800

Kinnevik

AB,

Cl. A†

................

300,576

14,000

Loews

Corp.

.....................

886,340

Shares

Market

Value

62,500

Marsh

&

McLennan

Companies

Inc.

....

$

11,893,750

3,000

Moelis

&

Co.,

Cl. A

................

135,390

9,250

Moody's

Corp.

...................

2,924,573

24,000

Morgan

Stanley

..................

1,960,080

240

MSCI

Inc.

.......................

123,139

64,535

NatWest

Group

plc

................

185,588

109,429

New

York

Community

Bancorp

Inc.

.....

1,240,925

9,620

NN

Group

NV

....................

309,597

32,000

Polar

Capital

Holdings

plc

...........

181,551

13,078

Prosus

NV†

.....................

386,030

54,700

S&P

Global

Inc.

..................

19,987,927

10,000

Sculptor

Capital

Management

Inc.

......

116,000

12,050

Shinhan

Financial

Group

Co.

Ltd.,

ADR

..

319,205

1,100

Silvercrest

Asset

Management

Group

Inc.,

Cl. A

.........................

17,457

3,000

Societe

Generale

SA

...............

73,093

14,987

Standard

Chartered

plc

.............

138,605

103,400

State

Street

Corp.

.................

6,923,664

30,000

StoneCo

Ltd.,

Cl. A†

...............

320,100

84,700

T.

Rowe

Price

Group

Inc.

............

8,882,489

151,100

The

Bank

of

New

York

Mellon

Corp.

....

6,444,415

10,000

The

Charles

Schwab

Corp.

...........

549,000

9,100

The

Goldman

Sachs

Group

Inc.

.......

2,944,487

42,500

The

Westaim

Corp.†

...............

110,768

17,000

Truist

Financial

Corp.

...............

486,370

11,500

TrustCo

Bank

Corp.

NY

.............

313,835

5,300

UniCredit

SpA

....................

127,366

20,000

W.

R.

Berkley

Corp.

................

1,269,800

1,900

Webster

Financial

Corp.

.............

76,589

207,000

Wells

Fargo

&

Co.

.................

8,458,020

24,781

Westwood

Holdings

Group

Inc.

.......

251,527

212,047,334

Food

and

Beverage

—

10.8%

3,000

Ajinomoto

Co.

Inc.

................

115,712

2,100

Anheuser-Busch

InBev

SA/NV

........

116,584

60,000

BellRing

Brands

Inc.†

..............

2,473,800

93,800

Brown-Forman

Corp.,

Cl. A

..........

5,449,780

49,300

Brown-Forman

Corp.,

Cl. B

..........

2,844,117

62,500

Campbell

Soup

Co.

................

2,567,500

10,000

Chr.

Hansen

Holding

A/S

............

612,946

110,000

ChromaDex

Corp.†

................

160,600

15,000

Coca-Cola

Europacific

Partners

plc

.....

937,200

40,000

Conagra

Brands

Inc.

...............

1,096,800

25,600

Constellation

Brands

Inc.,

Cl. A

........

6,434,048

25,000

Crimson

Wine

Group

Ltd.†

...........

150,125

190,500

Danone

SA

......................

10,525,484

840,000

Davide

Campari-Milano

NV

..........

9,915,525

4,250

Diageo

plc

......................

157,326

144,000

Diageo

plc,

ADR

..................

21,481,920

98,083

Farmer

Brothers

Co.†

..............

253,054

90,000

Flowers

Foods

Inc.

................

1,996,200

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

(Continued)

—

September

30,

2023

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Food

and

Beverage

(Continued)

86,500

Fomento

Economico

Mexicano

SAB

de

CV,

ADR

.........................

$

9,441,475

15,000

General

Mills

Inc.

.................

959,850

10,000

Glanbia

plc

......................

165,037

1,848,400

Grupo

Bimbo

SAB

de

CV,

Cl. A

........

8,885,896

43,050

Heineken

NV

....................

3,798,649

9,000

Ingredion

Inc.

....................

885,600

105,000

ITO

EN

Ltd.

.....................

3,378,915

57,200

Kerry

Group

plc,

Cl. A

..............

4,691,325

2,000

Kerry

Group

plc,

Cl. A

..............

167,426

1,800

Laurent-Perrier

...................

227,414

9,550

LVMH

Moet

Hennessy

Louis

Vuitton

SE

..

7,233,303

45,000

Maple

Leaf

Foods

Inc.

..............

864,716

35,000

Molson

Coors

Beverage

Co.,

Cl. B

......

2,225,650

220,000

Mondelēz

International

Inc.,

Cl. A

......

15,268,000

14,000

Morinaga

Milk

Industry

Co.

Ltd.

.......

527,155

41,000

Nestlé

SA

.......................

4,646,681

13,000

Nomad

Foods

Ltd.†

................

197,860

121,000

PepsiCo

Inc.

.....................

20,502,240

39,200

Pernod

Ricard

SA

.................

6,541,967

40,000

Post

Holdings

Inc.†

................

3,429,600

40,000

Remy

Cointreau

SA

................

4,890,838

3,400

The

Boston

Beer

Co.

Inc.,

Cl. A†

.......

1,324,402

70,000

The

Coca-Cola

Co.

................

3,918,600

28,000

The

J.M.

Smucker

Co.

..............

3,441,480

156,000

The

Kraft

Heinz

Co.

................

5,247,840

5,000

The

Simply

Good

Foods

Co.†

.........

172,600

42,230

Tootsie

Roll

Industries

Inc.

...........

1,260,988

24,000

TreeHouse

Foods

Inc.†

.............

1,045,920

40,000

Tyson

Foods

Inc.,

Cl. A

.............

2,019,600

664,000

Yakult

Honsha

Co.

Ltd.

.............

16,142,345

200,792,093

Equipment

and

Supplies

—

7.7%

325,500

AMETEK

Inc.

....................

48,095,880

14,000

Amphenol

Corp.,

Cl. A

..............

1,175,860

25,000

Ardagh

Group

SA†

................

92,625

38,000

Ardagh

Metal

Packaging

SA

..........

118,940

2,800

Crown

Holdings

Inc.

...............

247,744

500

Danaher

Corp.

...................

124,050

292,500

Donaldson

Co.

Inc.

................

17,444,700

22,000

DS

Smith

plc

....................

77,064

163,300

Flowserve

Corp.

..................

6,494,441

36,700

Franklin

Electric

Co.

Inc.

............

3,274,741

15,000

Hubbell

Inc.

.....................

4,701,150

125,000

IDEX

Corp.

......................

26,002,500

30,000

Ilika

plc†

.......................

11,530

15,525

Kimball

Electronics

Inc.†

............

425,074

93,500

Mueller

Industries

Inc.

..............

7,027,460

41,000

Mueller

Water

Products

Inc.,

Cl. A

.....

519,880

Shares

Market

Value

8,000

Sealed

Air

Corp.

..................

$

262,880

20,000

Tenaris

SA,

ADR

..................

632,000

270,000

The

L.S.

Starrett

Co.,

Cl. A†

..........

2,902,500

80,000

The

Timken

Co.

...................

5,879,200

59,600

The

Weir

Group

plc

................

1,382,732

97,500

Watts

Water

Technologies

Inc.,

Cl. A

....

16,849,950

143,742,901

Diversified

Industrial

—

6.2%

4,000

Agilent

Technologies

Inc.

............

447,280

418,844

Ampco-Pittsburgh

Corp.†

...........

1,101,560

42,006

AZZ

Inc.

........................

1,914,633

159,100

Crane

Co.

.......................

14,134,444

100,000

Crane

NXT

Co.

...................

5,557,000

780

Eaton

Corp.

plc

...................

166,358

4,999

Esab

Corp.

......................

351,030

26,500

General

Electric

Co.

................

2,929,575

122,700

Greif

Inc.,

Cl. A

...................

8,197,587

11,600

Greif

Inc.,

Cl. B

...................

772,096

63,000

Griffon

Corp.

....................

2,499,210

143,000

Honeywell

International

Inc.

..........

26,417,820

29,000

Ingersoll

Rand

Inc.

................

1,847,880

87,000

ITT

Inc.

........................

8,518,170

35,000

Kennametal

Inc.

..................

870,800

50,000

Myers

Industries

Inc.

..............

896,500

30,000

nVent

Electric

plc

.................

1,589,700

100,000

Park-Ohio

Holdings

Corp.

...........

1,991,000

9,454

Proto

Labs

Inc.†

..................

249,586

1,600

Rheinmetall

AG

...................

412,581

500

Roper

Technologies

Inc.

............

242,140

1,850

Siemens

AG

.....................

265,339

400,000

Steel

Partners

Holdings

LP†

..........

17,008,040

5,000

Stratasys

Ltd.†

...................

68,050

11,000

Sulzer

AG

.......................

1,053,313

83,000

Textron

Inc.

.....................

6,485,620

3,100

The

Eastern

Co.

..................

56,265

100,000

Toray

Industries

Inc.

...............

520,610

31,500

Trane

Technologies

plc

.............

6,391,665

25,000

Tredegar

Corp.

...................

135,250

90,000

Trinity

Industries

Inc.

...............

2,191,500

4,000

Valmont

Industries

Inc.

.............

960,840

116,243,442

Automotive:

Parts

and

Accessories

—

5.0%

4,500

Aptiv

plc†

......................

443,655

2,500

Atmus

Filtration

Technologies

Inc.†

.....

52,125

88,600

BorgWarner

Inc.

..................

3,576,782

303,400

Dana

Inc.

.......................

4,450,878

200,000

Dowlais

Group

plc

.................

262,077

212,604

Garrett

Motion

Inc.†

...............

1,675,320

201,500

Genuine

Parts

Co.

.................

29,092,570

268,000

Modine

Manufacturing

Co.†

..........

12,261,000

39,500

O'Reilly

Automotive

Inc.†

............

35,899,970

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

(Continued)

—

September

30,

2023

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Automotive:

Parts

and

Accessories

(Continued)

17,720

Phinia

Inc.

......................

$

474,719

105,000

Standard

Motor

Products

Inc.

........

3,530,100

26,600

Strattec

Security

Corp.†

.............

614,460

105,000

Superior

Industries

International

Inc.†

...

319,200

92,652,856

Health

Care

—

4.9%

7,000

2seventy

bio

Inc.†

.................

27,440

3,500

Abbott

Laboratories

...............

338,975

3,450

AbbVie

Inc.

.....................

514,257

16,200

Alcon

Inc.

......................

1,248,372

25,000

Amgen

Inc.

.....................

6,719,000

1,000

Avantor

Inc.†

....................

21,080

3,000

Axogen

Inc.†

....................

15,000

12,000

Bausch

+

Lomb

Corp.†

.............

203,400

13,000

Baxter

International

Inc.

.............

490,620

1,000

Becton

Dickinson

&

Co.

.............

258,530

6,800

Biogen

Inc.†

.....................

1,747,668

3,600

BioMarin

Pharmaceutical

Inc.†

........

318,528

13,000

Bluebird

Bio

Inc.†

.................

39,520

115,000

Boston

Scientific

Corp.†

............

6,072,000

89,500

Bristol-Myers

Squibb

Co.

............

5,194,580

6,500

Cencora

Inc.

.....................

1,169,805

400

Charles

River

Laboratories

International

Inc.†

........................

78,392

1,300

Chemed

Corp.

...................

675,610

11,500

Cutera

Inc.†

.....................

69,230

6,000

CVS

Group

plc

...................

119,399

242,000

Demant

A/S†

....................

10,037,522

300

Elevance

Health

Inc.

...............

130,626

820

Eli

Lilly

&

Co.

....................

440,447

80

Embecta

Corp.

...................

1,204

2,300

Enovis

Corp.†

....................

121,279

11,990

Exact

Sciences

Corp.†

..............

817,958

400

Fortrea

Holdings

Inc.†

..............

11,436

3,100

Fresenius

SE

&

Co.

KGaA

............

96,554

5,000

GE

HealthCare

Technologies

Inc.

.......

340,200

1,390

Gerresheimer

AG

.................

146,150

2,000

Gilead

Sciences

Inc.

...............

149,880

3,000

Glaukos

Corp.†

...................

225,750

30,000

Haleon

plc

......................

124,761

2,300

HCA

Healthcare

Inc.

...............

565,754

69,000

Henry

Schein

Inc.†

................

5,123,250

1,400

Hologic

Inc.†

....................

97,160

200

Illumina

Inc.†

....................

27,456

7,300

Incyte

Corp.†

....................

421,721

9,360

Indivior

plc†

.....................

203,164

555

Intuitive

Surgical

Inc.†

..............

162,221

200

iRhythm

Technologies

Inc.†

..........

18,852

24,100

Johnson

&

Johnson

...............

3,753,575

Shares

Market

Value

400

Laboratory

Corp.

of

America

Holdings

...

$

80,420

5,800

Medmix

AG

.....................

147,321

700

Medpace

Holdings

Inc.†

............

169,491

83,500

Merck

&

Co.

Inc.

..................

8,596,325

200

Moderna

Inc.†

...................

20,658

1,000

Neogen

Corp.†

...................

18,540

3,000

NeoGenomics

Inc.†

................

36,900

1,275

Novartis

AG

.....................

130,753

77,500

Novartis

AG,

ADR

.................

7,894,150

70,000

Option

Care

Health

Inc.†

............

2,264,500

5,000

OraSure

Technologies

Inc.†

..........

29,650

130

Organon

&

Co.

...................

2,257

28,000

Perrigo

Co.

plc

...................

894,600

2,000

Pfizer

Inc.

......................

66,340

1,200

PhenomeX

Inc.†

..................

1,198

1,500

QIAGEN

NV†

....................

60,750

500

Quest

Diagnostics

Inc.

..............

60,930

5,500

QuidelOrtho

Corp.†

................

401,720

300

Repligen

Corp.†

..................

47,703

600

Revvity

Inc.

.....................

66,420

1,200

Roche

Holding

AG,

Genusschein

.......

328,333

2,100

Sanofi

.........................

225,308

1,000

Siemens

Healthineers

AG

............

50,748

26,200

SmileDirectClub

Inc.†

..............

10,873

3,000

Takeda

Pharmaceutical

Co.

Ltd.

.......

93,168

3,000

Teva

Pharmaceutical

Industries

Ltd.,

ADR†

30,600

2,300

The

Cigna

Group

..................

657,961

15,700

Tristel

plc

.......................

85,242

30,360

UnitedHealth

Group

Inc.

............

15,307,208

11,996

Valeritas

Holdings

Inc.†(a)

...........

0

300

Vertex

Pharmaceuticals

Inc.†

.........

104,322

4,000

Waters

Corp.†

...................

1,096,840

16,600

Zimmer

Biomet

Holdings

Inc.

.........

1,862,852

20,060

Zimvie

Inc.†

.....................

188,765

14,920

Zoetis

Inc.

......................

2,595,782

608

Zosano

Pharma

Corp.†(a)

...........

0

91,966,954

Energy

and

Utilities

—

4.8%

46,500

APA

Corp.

......................

1,911,150

24,000

Avangrid

Inc.

....................

724,080

63,000

Baker

Hughes

Co.

.................

2,225,160

21,000

BP

plc,

ADR

.....................

813,120

16,000

CMS

Energy

Corp.

................

849,760

174,100

ConocoPhillips

...................

20,857,180

11,000

Dril-Quip

Inc.†

...................

309,870

98,400

Enbridge

Inc.

....................

3,265,896

81,000

Energy

Transfer

LP

................

1,136,430

70,000

Enterprise

Products

Partners

LP

.......

1,915,900

1,500

Eos

Energy

Enterprises

Inc.†

.........

3,225

45,000

Evergy

Inc.

......................

2,281,500

31,500

Eversource

Energy

................

1,831,725

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

(Continued)

—

September

30,

2023

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Energy

and

Utilities

(Continued)

42,600

Exxon

Mobil

Corp.

................

$

5,008,908

237,000

Halliburton

Co.

...................

9,598,500

35,000

Kinder

Morgan

Inc.

................

580,300

4,000

Marathon

Oil

Corp.

................

107,000

8,000

Marathon

Petroleum

Corp.

...........

1,210,720

50,000

National

Fuel

Gas

Co.

..............

2,595,500

35,000

New

Fortress

Energy

Inc.

............

1,147,300

96,000

NextEra

Energy

Inc.

................

5,499,840

92,128

NextEra

Energy

Partners

LP

..........

2,736,202

4,000

Niko

Resources

Ltd.†

..............

1

44,000

Occidental

Petroleum

Corp.

..........

2,854,720

95,000

Oceaneering

International

Inc.†

.......

2,443,400

90,000

PG&E

Corp.†

....................

1,451,700

17,000

Phillips

66

......................

2,042,550

25,000

Portland

General

Electric

Co.

.........

1,012,000

70,000

RPC

Inc.

.......................

625,800

97,500

Schlumberger

NV

.................

5,684,250

49,000

Southwest

Gas

Holdings

Inc.

.........

2,960,090

106,000

The

AES

Corp.

...................

1,611,200

34,000

UGI

Corp.

.......................

782,000

23,356

Vitesse

Energy

Inc.

................

534,619

3,300

Weatherford

International

plc†

........

298,089

88,909,685

Entertainment

—

4.2%

4,500

Activision

Blizzard

Inc.

..............

421,335

115,000

Atlanta

Braves

Holdings

Inc.,

Cl. A†

....

4,493,050

179,517

Atlanta

Braves

Holdings

Inc.,

Cl. C†

....

6,414,142

19,358

Charter

Communications

Inc.,

Cl. A†

....

8,514,035

1,000

Electronic

Arts

Inc.

................

120,400

90,000

Genting

Singapore

Ltd.

.............

55,633

1,043,000

Grupo

Televisa

SAB,

ADR

............

3,181,150

11,000

International

Game

Technology

plc

.....

333,520

14,573

Liberty

Media

Corp.-Liberty

Live,

Cl. A†

..

465,170

30,927

Liberty

Media

Corp.-Liberty

Live,

Cl. C†

..

992,757

10,000

Lions

Gate

Entertainment

Corp.,

Cl. B†

..

78,700

146,974

Madison

Square

Garden

Entertainment

Corp.†

.......................

4,836,914

97,817

Madison

Square

Garden

Sports

Corp.

...

17,245,137

2,170

Netflix

Inc.†

.....................

819,392

399,000

Paramount

Global,

Cl. A

.............

6,300,210

16,000

Paramount

Global,

Cl. B

.............

206,400

167,974

Sphere

Entertainment

Co.†

..........

6,241,914

11,000

Take-Two

Interactive

Software

Inc.†

....

1,544,290

40,000

TBS

Holdings

Inc.

.................

673,046

82,500

The

Walt

Disney

Co.†

..............

6,686,625

60,000

Universal

Entertainment

Corp.

........

885,707

11,000

Universal

Music

Group

NV

...........

287,604

597,000

Vivendi

SE

......................

5,236,255

271,447

Warner

Bros

Discovery

Inc.†

.........

2,947,914

Shares

Market

Value

1,700

Xilam

Animation

SA†

...............

$

24,444

79,005,744

Business

Services

—

4.2%

10,000

Allegion

plc

.....................

1,042,000

425,000

Clear

Channel

Outdoor

Holdings

Inc.†

...

671,500

3,000

Edenred

SE

.....................

188,021

16,000

Jardine

Matheson

Holdings

Ltd.

.......

742,720

11,000

Lamar

Advertising

Co.,

Cl. A,

REIT

.....

918,170

146,930

Mastercard

Inc.,

Cl. A

..............

58,171,056

44,000

Network

International

Holdings

plc†

....

209,476

85,000

Paysafe

Ltd.†

....................

1,019,150

10,000

Pitney

Bowes

Inc.

.................

30,200

10,000

Rentokil

Initial

plc,

ADR

.............

370,500

135,000

Resideo

Technologies

Inc.†

..........

2,133,000

131,388

Steel

Connect

Inc.†

................

1,405,852

20,000

The

Brink's

Co.

...................

1,452,800

195,000

The

Interpublic

Group

of

Companies

Inc.

.

5,588,700

5,000

United

Parcel

Service

Inc.,

Cl. B

.......

779,350

1,000

Vestis

Corp.†

....................

19,300

13,500

Visa

Inc.,

Cl. A

...................

3,105,135

25,000

Willdan

Group

Inc.†

...............

510,750

5,200

Worldline

SA†

...................

146,514

78,504,194

Machinery

—

3.9%

25,000

Astec

Industries

Inc.

...............

1,177,750

12,800

Caterpillar

Inc.

...................

3,494,400

369,010

CNH

Industrial

NV

.................

4,465,021

131,400

Deere

&

Co.

.....................

49,587,732

14,291

Intevac

Inc.†

....................

44,445

6,688

Regal

Rexnord

Corp.

...............

955,581

147,000

Xylem

Inc.

......................

13,381,410

73,106,339

Electronics

—

2.8%

6,000

Allient

Inc.

......................

185,520

30,000

Arlo

Technologies

Inc.†

.............

309,000

39,300

Bel

Fuse

Inc.,

Cl. A

................

1,852,209

62,991

Bel

Fuse

Inc.,

Cl. B

................

3,005,930

2,000

CTS

Corp.

......................

83,480

110,000

Flex

Ltd.†

.......................

2,967,800

4,000

Hitachi

Ltd.,

ADR

.................

497,720

56,500

Intel

Corp.

......................

2,008,575

34,473

Koninklijke

Philips

NV†

.............

687,392

1,300

Mettler-Toledo

International

Inc.†

......

1,440,491

275,000

Mirion

Technologies

Inc.†

...........

2,054,250

87,500

Plug

Power

Inc.†

.................

665,000

28,249

Sony

Group

Corp.,

ADR

.............

2,328,000

40,000

TE

Connectivity

Ltd.

...............

4,941,200

181,000

Texas

Instruments

Inc.

.............

28,780,810

615

Thermo

Fisher

Scientific

Inc.

.........

311,295

1,000

Universal

Display

Corp.

.............

156,990

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

(Continued)

—

September

30,

2023

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Electronics

(Continued)

5,000

Vishay

Precision

Group

Inc.†

.........

$

167,900

52,443,562

Retail

—

2.8%

20,000

Arko

Corp.

......................

143,000

53,000

AutoNation

Inc.†

..................

8,024,200

2,500

Beacon

Roofing

Supply

Inc.†

.........

192,925

7,500

Casey's

General

Stores

Inc.

..........

2,036,400

70

Chipotle

Mexican

Grill

Inc.†

..........

128,228

20,000

Copart

Inc.†

.....................

861,800

31,390

Costco

Wholesale

Corp.

.............

17,734,094

91,900

CVS

Health

Corp.

.................

6,416,458

16,000

Lowe's

Companies

Inc.

.............

3,325,440

125,000

Macy's

Inc.

.....................

1,451,250

1,500

Petco

Health

&

Wellness

Co.

Inc.†

.....

6,135

100,720

PetIQ

Inc.†

......................

1,984,184

15,000

Pets

at

Home

Group

plc

.............

61,274

125,000

Qurate

Retail

Inc.,

Cl. A†

............

75,825

35,000

Sally

Beauty

Holdings

Inc.†

..........

293,300

12,500

Shake

Shack

Inc.,

Cl. A†

............

725,875

117,000

The

Wendy's

Co.

..................

2,387,970

70,000

Walgreens

Boots

Alliance

Inc.

........

1,556,800

30,000

Walmart

Inc.

....................

4,797,900

52,203,058

Environmental

Services

—

2.7%

2,000

Clean

Harbors

Inc.†

...............

334,720

25,000

Darling

Ingredients

Inc.†

............

1,305,000

30,000

Pentair

plc

......................

1,942,500

210,500

Republic

Services

Inc.

..............

29,998,355

15,620

Veolia

Environnement

SA

............

452,986

103,600

Waste

Management

Inc.

............

15,792,784

29,500

Zurn

Elkay

Water

Solutions

Corp.

......

826,590

50,652,935

Consumer

Services

—

2.6%

16,500

Amazon.com

Inc.†

................

2,097,480

383,500

Bollore

SE

......................

2,063,768

30

Booking

Holdings

Inc.†

.............

92,519

2,000

Deutsche

Post

AG

.................

81,482

11,000

eBay

Inc.

.......................

484,990

36,200

IAC

Inc.†

.......................

1,824,118

58,900

Matthews

International

Corp.,

Cl. A

.....

2,291,799

1,045,500

Rollins

Inc.

......................

39,028,515

4,000

Travel

+

Leisure

Co.

................

146,920

455,000

Vroom

Inc.†

.....................

509,600

48,621,191

Consumer

Products

—

2.2%

34,180

American

Outdoor

Brands

Inc.†

.......

334,280

13,100

Christian

Dior

SE

.................

9,653,433

27,000

Church

&

Dwight

Co.

Inc.

...........

2,474,010

Shares

Market

Value

194,000

Edgewell

Personal

Care

Co.

..........

$

7,170,240

73,000

Energizer

Holdings

Inc.

.............

2,338,920

35,500

Essity

AB,

Cl. B

...................

766,502

2,100

Givaudan

SA

....................

6,868,848

80,000

Hanesbrands

Inc.

.................

316,800

23,800

Harley-Davidson

Inc.

...............

786,828

1,270

Hermes

International

SCA

...........

2,322,615

1,035

HNI

Corp.

.......................

35,842

4,000

Johnson

Outdoors

Inc.,

Cl. A

.........

218,760

25,000

Mattel

Inc.†

.....................

550,750

13,000

National

Presto

Industries

Inc.

........

941,980

12,500

Oil-Dri

Corp.

of

America

.............

771,875

49,900

Reckitt

Benckiser

Group

plc

..........

3,527,560

7,000

Spectrum

Brands

Holdings

Inc.

.......

548,450

27,600

Svenska

Cellulosa

AB

SCA,

Cl. B

.......

378,802

7,000

The

Estee

Lauder

Companies

Inc.,

Cl. A

..

1,011,850

4,280

Unilever

plc

.....................

212,119

7,200

Zalando

SE†

.....................

160,846

41,391,310

Computer

Software

and

Services

—

2.1%

10,000

3D

Systems

Corp.†

................

49,100

615

Adobe

Inc.†

.....................

313,589

1,000

Akamai

Technologies

Inc.†

...........

106,540

1,000

Alibaba

Group

Holding

Ltd.,

ADR†

.....

86,740

18,000

Alphabet

Inc.,

Cl. A†

...............

2,355,480

81,850

Alphabet

Inc.,

Cl. C†

...............

10,791,923

4,400

Atos

SE†

.......................

30,740

11,000

Avid

Technology

Inc.†

..............

295,570

1,500

Backblaze

Inc.,

Cl. A†

..............

8,250

5,000

Check

Point

Software

Technologies

Ltd.†

.

666,400

300

Cloudflare

Inc.,

Cl. A†

..............

18,912

1,230

CrowdStrike

Holdings

Inc.,

Cl. A†

......

205,877

16,500

Fiserv

Inc.†

.....................

1,863,840

2,000

Fortinet

Inc.†

....................

117,360

90,000

Hewlett

Packard

Enterprise

Co.

........

1,563,300

46,000

I3

Verticals

Inc.,

Cl. A†

.............

972,440

270

Intuit

Inc.

.......................

137,954

29,659

Kyndryl

Holdings

Inc.†

.............

447,851

23,750

Meta

Platforms

Inc.,

Cl. A†

..........

7,129,988

4,000

Micron

Technology

Inc.

.............

272,120

4,870

Microsoft

Corp.

..................

1,537,702

9,000

MKS

Instruments

Inc.

..............

778,860

25,000

Movella

Holdings

Inc.†

.............

13,407

32,400

N-able

Inc.†

.....................

417,960

670

NVIDIA

Corp.

....................

291,443

140,000

Oxford

Metrics

plc

................

154,587

45,800

PAR

Technology

Corp.†

.............

1,765,132

20,000

Playtech

plc†

....................

110,297

4,700

PSI

Software

SE

..................

121,991

18,000

Rockwell

Automation

Inc.

...........

5,145,660

700

Salesforce

Inc.†

..................

141,946

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

(Continued)

—

September

30,

2023

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Computer

Software

and

Services

(Continued)

1,800

SAP

SE,

ADR

....................

$

232,776

365

ServiceNow

Inc.†

.................

204,020

21,000

SolarWinds

Corp.†

................

198,240

800

Splunk

Inc.†

.....................

117,000

2,600

Temenos

AG

.....................

182,981

7,500

Unity

Software

Inc.†

...............

235,425

400

Veeva

Systems

Inc.,

Cl. A†

...........

81,380

88,000

Vimeo

Inc.†

.....................

311,520

2,700

VMware

Inc.,

Cl. A†

................

449,496

39,925,797

Cable

and

Satellite

—

2.0%

28,000

AMC

Networks

Inc.,

Cl. A†

...........

329,840

215,980

Comcast

Corp.,

Cl. A

...............

9,576,553

65,000

DISH

Network

Corp.,

Cl. A†

..........

380,900

173,796

EchoStar

Corp.,

Cl. A†

..............

2,911,083

130,045

Liberty

Global

plc,

Cl. A†

............

2,226,370

333,564

Liberty

Global

plc,

Cl. C†

............

6,190,948

85,000

Liberty

Latin

America

Ltd.,

Cl. A†

......

693,600

377,500

Rogers

Communications

Inc.,

Cl. B

.....

14,492,225

36,801,519

Aerospace

and

Defense

—

2.0%

15,000

Avio

SpA†

......................

128,773

70,000

FTAI

Aviation

Ltd.

.................

2,488,500

14,000

Howmet

Aerospace

Inc.

.............

647,500

500

IQVIA

Holdings

Inc.†

...............

98,375

45,400

Kaman

Corp.

....................

892,110

4,000

Kratos

Defense

&

Security

Solutions

Inc.†

60,080

12,000

L3Harris

Technologies

Inc.

...........

2,089,440

17,600

Northrop

Grumman

Corp.

...........

7,747,344

3,915,666

Rolls-Royce

Holdings

plc†

...........

10,553,506

14,000

RTX

Corp.

......................

1,007,580

1,500

Thales

SA

......................

211,080

55,000

The

Boeing

Co.†

..................

10,542,400

36,466,688

Building

and

Construction

—

1.7%

25,500

Arcosa

Inc.

......................

1,833,450

4,500

Ashtead

Group

plc

................

274,632

18,000

Assa

Abloy

AB,

Cl. B

...............

392,438

31,650

Canfor

Corp.†

....................

393,106

3,000

Carrier

Global

Corp.

...............

165,600

4,000

Cie

de

Saint-Gobain

SA

.............

240,546

44,000

Fortune

Brands

Innovations

Inc.

.......

2,735,040

36,000

Gencor

Industries

Inc.†

.............

508,680

3,000

H&E

Equipment

Services

Inc.

.........

129,570

51,600

Herc

Holdings

Inc.

................

6,137,304

35,200

Ibstock

plc

......................

61,200

220,000

Johnson

Controls

International

plc

.....

11,706,200

14,000

KBR

Inc.

.......................

825,160

Shares

Market

Value

31,000

Knife

River

Corp.†

.................

$

1,513,730

36,000

Masterbrand

Inc.†

.................

437,400

20,000

PGT

Innovations

Inc.†

..............

555,000

12,000

Sika

AG

........................

3,055,880

3,000

Vulcan

Materials

Co.

...............

606,060

31,570,996

Broadcasting

—

1.6%

2,000

Cogeco

Inc.

.....................

72,549

24,000

Corus

Entertainment

Inc.,

OTC,

Cl. B

.....................

18,355

107,500

Fox

Corp.,

Cl. A

...................

3,354,000

60,000

Fox

Corp.,

Cl. B

...................

1,732,800

16,000

Gray

Television

Inc.

................

110,720

19,250

Liberty

Broadband

Corp.,

Cl. A†

.......

1,750,017

82,172

Liberty

Broadband

Corp.,

Cl. C†

.......

7,503,947

31,750

Liberty

Media

Corp.-Liberty

Formula

One,

Cl. A†

........................

1,795,145

36,750

Liberty

Media

Corp.-Liberty

Formula

One,

Cl. C†

........................

2,289,525

163,449

Liberty

Media

Corp.-Liberty

SiriusXM†

..

4,161,412

55,000

Liberty

Media

Corp.-Liberty

SiriusXM,

Cl. A†

........................

1,399,750

23,000

Nexstar

Media

Group

Inc.

...........

3,297,510

80,000

Sinclair

Inc.

.....................

897,600

118,000

TEGNA

Inc.

.....................

1,719,260

80,000

Television

Broadcasts

Ltd.†

..........

32,589

30,135,179

Hotels

and

Gaming

—

1.6%

16,000

Accor

SA

.......................

540,297

102,624

Bally's

Corp.†

....................

1,345,401

18,000

Better

Collective

A/S†

..............

403,641

25,800

Caesars

Entertainment

Inc.†

..........

1,195,830

82,500

Entain

plc

.......................

938,940

2,500

Flutter

Entertainment

plc†

...........

408,428

26,000

Gambling.com

Group

Ltd.†

..........

340,080

11,000

GAN

Ltd.†

......................

12,760

46,000

Genius

Sports

Ltd.†

...............

245,180

7,000

Hyatt

Hotels

Corp.,

Cl. A

............

742,560

14,000

Las

Vegas

Sands

Corp.

.............

641,760

4,138,500

Mandarin

Oriental

International

Ltd.

....

7,056,143

9,000

Marriott

International

Inc.,

Cl. A

.......

1,769,040

70,000

MGM

China

Holdings

Ltd.†

..........

91,534

80,000

MGM

Resorts

International

..........

2,940,800

6,000

Penn

Entertainment

Inc.†

............

137,700

25,000

PlayAGS

Inc.†

...................

163,000

109,800

Ryman

Hospitality

Properties

Inc.,

REIT

.

9,144,144

200,000

The

Hongkong

&

Shanghai

Hotels

Ltd.†

.

160,645

4,000

Wyndham

Hotels

&

Resorts

Inc.

.......

278,160

7,400

Wynn

Resorts

Ltd.

................

683,834

29,239,877

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

(Continued)

—

September

30,

2023

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Aviation:

Parts

and

Services

—

1.4%

40,000

Astronics

Corp.†

..................

$

634,400

127,500

Curtiss-Wright

Corp.

...............

24,942,825

4,000

John

Bean

Technologies

Corp.

........

420,560

25,997,785

Telecommunications

—

1.4%

105,000

America

Movil

SAB

de

CV,

ADR

.......

1,818,600

8,200

AT&T

Inc.

.......................

123,164

55,400

BCE

Inc.

........................

2,114,618

834,200

BT

Group

plc,

Cl. A

................

1,187,781

7,040,836

Cable

&

Wireless

Jamaica

Ltd.†(a)

.....

52,793

6,000

Cisco

Systems

Inc.

................

322,560

30,000

Comtech

Telecommunications

Corp.

....

262,500

21,000

Deutsche

Telekom

AG

..............

441,114

125,000

Deutsche

Telekom

AG,

ADR

..........

2,620,000

53,000

GCI

Liberty

Inc.,

Escrow†

...........

0

36,000

Hellenic

Telecommunications

Organization

SA

..........................

526,003

15,000

Hellenic

Telecommunications

Organization

SA,

ADR

......................

105,150

264,732

Koninklijke

KPN

NV

................

872,970

90,000

Lumen

Technologies

Inc.†

...........

127,800

1,100,000

NII

Holdings

Inc.,

Escrow†

...........

385,000

16,000

Oi

SA,

ADR†

.....................

7

4,267

Oi

SA,

ADR†

.....................

7

21,000

Telecom

Argentina

SA,

ADR

..........

100,590

300,000

Telecom

Italia

SpA†

................

93,916

70,000

Telefonica

Brasil

SA,

ADR

...........

598,500

320,000

Telefonica

SA,

ADR

................

1,302,400

367,300

Telephone

and

Data

Systems

Inc.

......

6,725,263

50,000

TELUS

Corp.

....................

816,492

46,075

TIM

SA,

ADR

....................

686,517

3,040

VEON

Ltd.,

ADR†

.................

59,280

94,000

Verizon

Communications

Inc.

.........

3,046,540

174,000

Vodafone

Group

plc

...............

163,087

100,000

Vodafone

Group

plc,

ADR

...........

948,000

25,500,652

Real

Estate

—

1.3%

13,800

American

Tower

Corp.,

REIT

..........

2,269,410

47,500

Blackstone

Mortgage

Trust

Inc.,

Cl. A,

REIT

1,033,125

8,000

Bresler

&

Reiner

Inc.†

..............

200

10,267

Gaming

and

Leisure

Properties

Inc.,

REIT

467,662

17,000

Rayonier

Inc.,

REIT

................

483,820

60,000

Seritage

Growth

Properties,

Cl. A,

REIT†

.

464,400

7,250

Simon

Property

Group

Inc.,

REIT

......

783,217

10,000

Tejon

Ranch

Co.†

.................

162,200

317,000

The

St.

Joe

Co.

...................

17,222,610

27,415

VICI

Properties

Inc.,

REIT

...........

797,777

Shares

Market

Value

9,000

Weyerhaeuser

Co.,

REIT

............

$

275,940

23,960,361

Specialty

Chemicals

—

1.2%

10,900

AdvanSix

Inc.

....................

338,772

2,500

DSM-Firmenich

AG

................

211,793

100,000

DuPont

de

Nemours

Inc.

............

7,459,000

25,000

FMC

Corp.

......................

1,674,250

15,000

H.B.

Fuller

Co.

...................

1,029,150

40,500

International

Flavors

&

Fragrances

Inc.

..

2,760,885

2,800

Johnson

Matthey

plc

...............

55,617

16,100

Rogers

Corp.†

...................

2,116,667

99,900

Sensient

Technologies

Corp.

.........

5,842,152

13,000

SGL

Carbon

SE†

..................

90,781

2,000

The

Chemours

Co.

................

56,100

12,500

Treatt

plc

.......................

77,324

21,712,491

Agriculture

—

0.9%

166,500

Archer-Daniels-Midland

Co.

..........

12,557,430

50,000

Philip

Morris

International

Inc.

........

4,629,000

7,000

The

Mosaic

Co.

...................

249,200

17,435,630

Automotive

—

0.8%

21,400

Daimler

Truck

Holding

AG

...........

742,557

53,500

General

Motors

Co.

................

1,763,895

76,000

Iveco

Group

NV†

.................

712,071

3,550

Mercedes-Benz

Group

AG

...........

247,301

104,000

PACCAR

Inc.

....................

8,842,080

40,000

Piaggio

&

C

SpA

..................

127,970

32,500

Stellantis

NV

....................

621,725

860

Tesla

Inc.†

......................

215,189

8,000

The

Shyft

Group

Inc.

...............

119,760

1,450

Toyota

Motor

Corp.,

ADR

............

260,637

49,000

Traton

SE

.......................

1,032,479

14,685,664

Transportation

—

0.8%

100,000

FTAI

Infrastructure

Inc.

.............

322,000

130,200

GATX

Corp.

.....................

14,169,666

500

Union

Pacific

Corp.

................

101,815

14,593,481

Metals

and

Mining

—

0.8%

37,400

Agnico

Eagle

Mines

Ltd.

............

1,699,830

200

Alliance

Resource

Partners

LP

........

4,506

41,000

Barrick

Gold

Corp.

................

596,550

30,000

Cleveland-Cliffs

Inc.†

...............

468,900

127,500

Freeport-McMoRan

Inc.

.............

4,754,475

25,239

Livent

Corp.†

....................

464,650

3,500

Materion

Corp.

...................

356,685

50,000

New

Hope

Corp.

Ltd.

...............

204,137

115,000

Newmont

Corp.

..................

4,249,250

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

(Continued)

—

September

30,

2023

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Metals

and

Mining

(Continued)

60,000

TimkenSteel

Corp.†

................

$

1,303,200

10,000

Vale

SA,

ADR

....................

134,000

14,236,183

Wireless

Communications

—

0.7%

20,000

Anterix

Inc.†

.....................

627,600

105,000

Millicom

International

Cellular

SA,

SDR†

.

1,631,383

105,000

Operadora

De

Sites

Mexicanos

SAB

de

CV

86,699

39,500

T-Mobile

US

Inc.†

.................

5,531,975

114,000

United

States

Cellular

Corp.†

.........

4,898,580

12,776,237

Communications

Equipment

—

0.6%

9,440

Apple

Inc.

......................

1,616,222

3,250

Arista

Networks

Inc.†

..............

597,773

238,000

Corning

Inc.

.....................

7,251,860

415,800

Edgio

Inc.†

......................

354,303

2,500

Motorola

Solutions

Inc.

.............

680,600

4,500

QUALCOMM

Inc.

.................

499,770

30,000

Telesat

Corp.†

...................

429,000

11,429,528

Manufactured

Housing

and

Recreational

Vehicles

—

0.3%

1,370

Cavco

Industries

Inc.†

..............

363,954

12,314

Legacy

Housing

Corp.†

.............

239,015

5,000

Martin

Marietta

Materials

Inc.

.........

2,052,400

40,413

Nobility

Homes

Inc.

................

1,206,934

40,000

Skyline

Champion

Corp.†

............

2,548,800

2,500

The

AZEK

Co.

Inc.†

................

74,350

6,485,453

Publishing

—

0.3%

1,400

Graham

Holdings

Co.,

Cl. B

..........

816,200

105,000

News

Corp.,

Cl. A

.................

2,106,300

92,000

News

Corp.,

Cl. B

.................

1,920,040

70,000

The

E.W.

Scripps

Co.,

Cl. A†

..........

383,600

5,226,140

Semiconductors

—

0.1%

8,000

Advanced

Micro

Devices

Inc.†

........

822,560

40,000

Alphawave

IP

Group

plc†

............

55,734

2,000

Applied

Materials

Inc.

..............

276,900

100

ARM

Holdings

plc,

ADR†

............

5,352

215

ASML

Holding

NV

.................

126,562

1,200

Axcelis

Technologies

Inc.†

...........

195,660

500

Azenta

Inc.†

.....................

25,095

200

Lam

Research

Corp.

...............

125,354

1,200

Lattice

Semiconductor

Corp.†

........

103,116

3,000

nLight

Inc.†

.....................

31,200

2,200

NXP

Semiconductors

NV

............

439,824

22,483

SkyWater

Technology

Inc.†

..........

135,348

Shares

Market

Value

3,000

Taiwan

Semiconductor

Manufacturing

Co.

Ltd.,

ADR

.....................

$

260,700

2,603,405

Computer

Hardware

—

0.1%

11,000

Dell

Technologies

Inc.,

Cl. C

..........

757,900

5,500

HP

Inc.

........................

141,350

3,000

NETGEAR

Inc.†

...................

37,770

937,020

TOTAL

COMMON

STOCKS

.........

1,824,003,684

CLOSED-END

FUNDS

—

0.2%

245,000

Altaba

Inc.,

Escrow†

...............

573,300

4,285

Royce

Global

Value

Trust

Inc.

.........

37,325

46,158

Royce

Value

Trust

Inc.

..............

594,053

90,000

SuRo

Capital

Corp.†

...............

325,800

95,000

The

Central

Europe,

Russia,

and

Turkey

Fund

Inc.

.............

817,000

159,000

The

New

Germany

Fund

Inc.

.........

1,299,030

3,646,508

TOTAL

CLOSED-END

FUNDS

........

3,646,508

PREFERRED

STOCKS

—

0.2%

Diversified

Industrial

—

0.1%

77,500

Steel

Partners

Holdings

LP,

Ser.

A,

6.000%,

02/07/26

......................

1,804,200

Retail

—

0.1%

61,500

Qurate

Retail

Inc.,

8.000%,

03/15/31

....

1,761,975

TOTAL

PREFERRED

STOCKS

........

3,566,175

WARRANTS

—

0.0%

Diversified

Industrial

—

0.0%

379,000

Ampco-Pittsburgh

Corp.,

expire

08/01/25†

121,280

Energy

and

Utilities

—

0.0%

2,504

Occidental

Petroleum

Corp.,

expire

08/03/27†

.....................

108,298

TOTAL

WARRANTS

..............

229,578

Principal

Amount

U.S.

GOVERNMENT

OBLIGATIONS

—

1.7%

$

31,741,000

U.S.

Treasury

Bills,

5.293%

to

5.465%††,

11/24/23

to

03/14/24

......................

31,368,699

TOTAL

INVESTMENTS

—

100.0%

....

(Cost

$1,176,892,958)

............

$

1,862,814,644

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

(Continued)

—

September

30,

2023

(Unaudited)

(a)

Security

is

valued

using

significant

unobservable

inputs

and

is

classified

as

Level

3

in

the

fair

value

hierarchy.

†

Non-income

producing

security.

††

Represents

annualized

yields

at

dates

of

purchase.

ADR

American

Depositary

Receipt

REIT

Real

Estate

Investment

Trust

SDR

Swedish

Depositary

Receipt

Geographic

Diversification

%

of

Total

Investments

Market

Value

North

America

......................

85.8

%

$

1,598,067,212

Europe

..............................

10.9

203,800,693

Japan

...............................

1.4

25,839,976

Latin

America

.......................

1.4

25,764,273

Asia/Pacific

.........................

0.5

9,342,490

Total

Investments

...................

100.0%

$

1,862,814,644

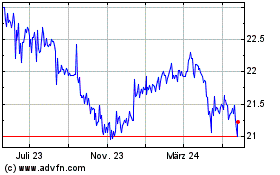

Gabelli Equity (NYSE:GAB-K)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

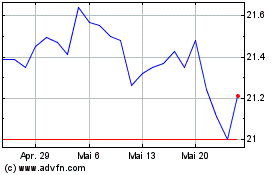

Gabelli Equity (NYSE:GAB-K)

Historical Stock Chart

Von Mai 2023 bis Mai 2024