false

0001591670

0001591670

2024-05-28

2024-05-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): May 28, 2024

FARMLAND PARTNERS INC.

(Exact name of registrant as specified

in its charter)

|

Maryland

(State or other

jurisdiction

of incorporation) |

|

001-36405

(Commission

File Number) |

|

46-3769850

(IRS Employer

Identification

No.) |

|

4600 S. Syracuse Street, Suite 1450

Denver, Colorado

(Address of principal executive offices) |

|

80237

(Zip Code) |

Registrant’s telephone number,

including area code: (720) 452-3100

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

FPI |

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure

of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers.

On May 28, 2024, Farmland Partners Inc. (the

“Company”) announced that the Company and James Gilligan, the Company’s Chief Financial Officer and Treasurer, mutually

agreed to separate. Mr. Gilligan will remain employed by the Company through June 30, 2024 to assist with the transition of

his duties and responsibilities to the Company’s new Chief Financial Officer and Treasurer. In connection with the separation, Mr. Gilligan

will receive a severance payment calculated as a termination without cause under that certain Employment Agreement, dated October 9,

2021, by and between the Company and Mr. Gilligan. Mr. Gilligan’s departure is not the result of any dispute or disagreement

with the Company, including with respect to any matters relating to the Company’s accounting practices or financial reporting.

On May 28, 2024, the Company also announced

the appointment, effective immediately, of Susan Landi as the Company’s new Chief Financial Officer and Treasurer. Ms. Landi,

age 49, has served as the Company’s Vice President of Finance since October 2019. Prior to her tenure at the Company, Ms. Landi

worked as the Managing Member at SOLE Consulting LLC beginning in October 2018, and prior to that served as Audit Senior Manager

at Moss Adams from 2017 to 2018 and from 2002 to 2017 served as Audit Senior Manager at Hein & Associates. Ms. Landi received

her B.S. in Accounting from Saint Vincent College and her M.B.A. from the University of Colorado, and she is a Certified Public Accountant.

Ms. Landi will be paid an annual base salary

of $220,000 and will be eligible to receive bonus compensation and equity grants as determined by the Compensation Committee of the Company’s

board of directors (the “Board”). Additionally, the Company entered into a change in control agreement with Ms. Landi,

dated May 28, 2024 (the “Change in Control Agreement”). The Change in Control Agreement provides that upon the occurrence

of a Change in Control (as defined in the Change in Control Agreement and summarized below) Ms. Landi will be entitled to (A) an

amount equal to six months of Ms. Landi’s then-current base salary as in effect of immediately prior to the Change in Control

Date; (B) an amount equal to fifty percent (50%) multiplied by the average of the three (3) most recent annual discretionary

incentive bonuses earned by Ms. Landi; (C) an amount equal to fifty percent (50%) multiplied by the average of the three (3) most

recent annual equity grants made to Ms. Landi; (D) the immediate vesting of then outstanding equity-based awards previously

granted to Ms. Landi, and (E) in the event of a termination of Ms. Landi’s employment, reimbursement for the amount

equal to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”) continuation coverage premiums paid

by Ms. Landi for a period of up to six months, subject to certain restrictions.

Pursuant to the terms of the Change in Control

Agreement, “Change in Control” means: (i) any “person” as such term is used in Section 13(d) and

14(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (other than the Company, any trustee or

other fiduciary holding securities under any employee benefit plan of the Company or any corporation owned, directly or indirectly, by

the stockholders of the Company in substantially the same proportion as their ownership of stock of the Company), is or becomes the “beneficial

owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of securities of the Company representing

50% or more of the combined voting power of the Company’s then outstanding voting securities; (ii) a change in the composition

of the Board occurring within a twelve (12) month period, as a result of which fewer than a majority of the directors are Incumbent Directors

(as defined in the Change in Control Agreement); (iii) the consummation of a merger or consolidation of the Company with any other

entity or approve the issuance of voting securities in connection with a merger or consolidation of the Company (or any direct or indirect

subsidiary thereof) pursuant to applicable exchange requirements, other than (A) a merger or consolidation which would result in

the voting securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or

by being converted into voting securities of the surviving or parent entity) at least 50.1% of the combined voting power of the voting

securities of the Company or such surviving or parent entity outstanding immediately after such merger or consolidation or (B) a

merger or consolidation effected to implement a recapitalization of the Company (or similar transaction) in which no “person”

(as defined in the Change in Control Agreement) is or becomes the beneficial owner, directly or indirectly, of securities of the Company

representing 50% or more of either of the then outstanding shares of common stock or the combined voting power of the Company’s

then outstanding voting securities; or (iv) the consummation of the sale or disposition by the Company of all or substantially all

of its assets (or any transaction or series of transactions within a period of twenty-four (24) months ending on the date of the last

sale or disposition having a similar effect) (a) to any “person” as such term is used in Section 13(d) and

14(d) of the Exchange Act (other any trustee or other fiduciary holding securities under any employee benefit plan of the Company

or any corporation owned, directly or indirectly, by the stockholders of the Company in substantially the same proportion as their ownership

of stock of the Company) or (b) pursuant to a formal or informal plan of liquidation or dissolution (or similar arrangement) that

was approved by the Board or the Company’s stockholders.

The foregoing description of the Change in Control

Agreement does not purport to be complete and is qualified in its entirety by reference to the full and complete terms of the Change in

Control Agreement, a copy of which is filed as Exhibit 10.1 hereto.

There are no other arrangements between Ms. Landi

and any other persons pursuant to which she was appointed to serve as the Company's Chief Financial Officer and Treasurer. There are no

family relationships between Ms. Landi and any director or executive officer of the Company, and she has no direct or indirect material

interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Item 7.01. Regulation FD Disclosure.

On May 28, 2024, the Company issued a press

release announcing Mr. Gilligan’s departure from the Company and the appointment of Ms. Landi as the Company’s new

Chief Financial Officer and Treasurer. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated herein

by reference.

The information furnished herewith pursuant to

Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section, nor shall it be deemed incorporated by reference into any filing made by the Company under the Exchange Act or the Securities

Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

* Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FARMLAND PARTNERS INC. |

| |

|

|

| Date : May 28, 2024 |

By: |

/s/ Luca Fabbri |

| |

|

Luca Fabbri |

| |

|

President and Chief Executive Officer |

Exhibit 10.1

CHANGE IN CONTROL AGREEMENT

This

CHANGE IN CONTROL AGREEMENT (this “Agreement”) is entered into as of this 28th day of May, 2024 (the “Effective

Date”), by and between Farmland Partners Inc., a Maryland corporation (“Farmland”), Farmland Partners

Operating Partnership, LP, a Delaware limited partnership (together with Farmland, the “Company”), and Susan Landi,

a key employee of the Company (the “Employee”).

RECITALS

WHEREAS, the Company recognizes

that the possibility of a change in control of the Company exists and that the uncertainties raised by such a possibility may result in

the distraction or even the premature departure of the Employee to the detriment of the Company and its stockholders. This Agreement is

intended, therefore, to provide for an effective means of providing incentives to induce the retention of key employees.

WHEREAS, the Board of Directors

of the Company (the “Board”) has determined that appropriate steps should be taken to reinforce and encourage the continued

employment and dedication of the Employee without distraction from the possibility of a change in control of the Company and related events

and circumstances.

NOW, THEREFORE, as an inducement

for and in consideration of the Employee commencing and remaining in its employ, the Company agrees that the Employee shall receive the

benefits set forth in this Agreement in the event there is a Change in Control.

I. Key

Definitions.

As used herein, the following

terms shall have the following respective meanings:

A. “Change

in Control” means:

1. any

“person” as such term is used in Section 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”) (other than Farmland, any trustee or other fiduciary holding securities under any employee benefit

plan of Farmland or any corporation owned, directly or indirectly, by the stockholders of Farmland in substantially the same proportion

as their ownership of stock of Farmland), is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange

Act), directly or indirectly, of securities of Farmland representing 50% or more of the combined voting power of Farmland’s then

outstanding voting securities;

2. a

change in the composition of the Board occurring within a twelve (12) month period, as a result of which fewer than a majority of the

directors are Incumbent Directors. “Incumbent Directors” means directors who were members of the Board on the Effective

Date or who were nominated or elected as directors subsequent to the Effective Date by at least a majority of the directors who were Incumbent

Directors at the time of such nomination or election or whose election to the Board was recommended or endorsed by at least a majority

of the directors who were Incumbent Directors at the time of such nomination or election; provided, however, that no director whose election

to the Board was the result of an actual or threatened election contest shall be an Incumbent Director for purposes of this Agreement;

3. the

consummation of a merger or consolidation of Farmland with any other entity or approve the issuance of voting securities in connection

with a merger or consolidation of Farmland (or any direct or indirect subsidiary thereof) pursuant to applicable exchange requirements,

other than (A) a merger or consolidation which would result in the voting securities of Farmland outstanding immediately prior thereto

continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving or parent entity)

at least 50.1% of the combined voting power of the voting securities of Farmland or such surviving or parent entity outstanding immediately

after such merger or consolidation or (B) a merger or consolidation effected to implement a recapitalization of Farmland (or similar

transaction) in which no “person” (as defined above) is or becomes the beneficial owner, directly or indirectly, of securities

of Farmland representing 50% or more of either of the then outstanding shares of common stock or the combined voting power of Farmland’s

then outstanding voting securities; or

4. the

consummation of the sale or disposition by Farmland of all or substantially all of its assets (or any transaction or series of transactions

within a period of twenty-four (24) months ending on the date of the last sale or disposition having a similar effect) (a) to any

“person” as such term is used in Section 13(d) and 14(d) of the Exchange Act (other any trustee or other fiduciary

holding securities under any employee benefit plan of Farmland or any corporation owned, directly or indirectly, by the stockholders of

Farmland in substantially the same proportion as their ownership of stock of Farmland) or (b) pursuant to a formal or informal plan

of liquidation or dissolution (or similar arrangement) that was approved by the Board or the Company’s stockholders. For purposes

of this paragraph, “all or substantially all” of Farmland’s assets shall mean 80% or more of Farmland’s assets

measured by the value of Farmland’s assets on the date of its balance sheet most recently filed with the Securities and Exchange

Commission at the time of action by the Board or the Company’s stockholders, as applicable.

B. “Change

in Control Date” means the first date on which a Change in Control is consummated.

C. “COBRA”

means the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended.

D. “Code”

means the U.S. Internal Revenue Code of 1986, as amended.

E. “Continued

Coverage Period” means a period of six (6) months, or, if less, until the Employee or his eligible dependents are no longer

entitled to such COBRA coverage.

F. “Continuous

Employment” means that the provision of services to the Company in any capacity as an employee is not interrupted or terminated.

Continuous Employment shall not be considered interrupted in the case of any approved leave of absence. An approved leave of absence shall

include sick leave, military leave or any other authorized personal leave.

G. “Release”

means a general release of claims in favor of the Company in substantially the form attached on Exhibit A hereto.

II. Term

of Agreement. This Agreement, and all rights and obligations of the parties hereunder, shall take effect upon the Effective Date and

shall expire upon the first to occur of:

(a) the

Change of Control Date; or

(b) the

termination of Employee’s Continuous Employment with the Company for any reason.

III. Benefits

to Employee.

A. Change

in Control. If the Employee remains in Continuous Employment with the Company from the Effective Date through the Change of Control

Date, and provided, for the avoidance of doubt, the Change in Control is consummated, the Employee shall be entitled to the following

benefits, provided that (1) the Employee signs and does not revoke the Release within the period required by the Release, inclusive

of any revocation period set forth in the Release, and (2) the Employee is in continued compliance with any restrictive covenants,

including confidentiality, noncompetition, nonsolicitation or noninterference, nondisparagement, to which Employee may be subject:

1. an

amount equal to six months of Employee’s then-current base salary as in effect of immediately prior to the Change in Control Date;

2. an

amount equal to fifty percent (50%) multiplied by the average of the three (3) most recent annual discretionary incentive bonuses

earned by the Employee;

3. an

amount equal to fifty percent (50%) multiplied by the average of the three (3) most recent annual equity grants made to the Employee;

4. all

of the Employee’s equity-based awards that are outstanding on the Change in Control Date shall immediately become fully vested and,

as applicable, exercisable, without any action by the Board or a committee of the Board; and

5. subject

to (A) the Employee’s termination of Continuous Employment with the Company at the time of the Change in Control or within

one month following the Change in Control for any reason, including voluntary resignation by the Employee, and (B) the Employee’s

timely election of continuation coverage under COBRA, Employee shall be reimbursed for the amount equal to the COBRA continuation coverage

premiums paid by the Employee that is required for coverage of the Employee (or his eligible dependents) under the Company’s major

medical group health plan, for the Continued Coverage Period, provided, that if at any time the Company determines that its payment of

Employee’s premiums would result in a violation of the nondiscrimination rules of Section 105(h)(2) of the Code,

or any statute or regulation of similar effect (including but not limited to the 2010 Patient Protection and Affordable Care Act, as amended

by the 2010 Health Care and Education Reconciliation Act), then in lieu of providing the premiums described above, the Company will instead

pay a fully taxable monthly cash payment in an amount such that, after payment by Employee of all taxes on such payment, Employee retains

an amount equal to the applicable premiums for such month, with such monthly payment being made on the last day of each month for the

remainder of the Continued Coverage Period.

B. Form and

Timing of Payment. The payments and benefits detailed in Section III.A.1-3 above shall be paid or made to the Employee by the

Company, in full, in a lump sum within sixty (60) days after the Change of Control Date; provided, however, that to the extent required

by Section 409A, if the sixty (60) day period begins in one calendar year and ends in a second calendar year, payment shall be made

in the second calendar year.

IV. Employment

Status.

A. Not

an Employment Contract. The Employee acknowledges that this Agreement does not constitute a contract of employment or impose on the

Company any obligation to retain the Employee as an employee and that this Agreement does not prevent the Employee from terminating employment

at any time. If the Employee’s employment with the Company terminates for any reason and subsequently a Change in Control occurs,

the Employee shall not be entitled to any benefits hereunder.

V. Code

Section 280G. If the Employee is a “disqualified individual,” as defined in Code Section 280G(c), then, notwithstanding

any other provision of this Agreement or of any other agreement, contract, or understanding heretofore or hereafter entered into by the

Employee with the Company (an “Other Agreement”), and notwithstanding any formal or informal plan or other arrangement

for the direct or indirect provision of compensation to the Employee (including groups or classes of employees or beneficiaries of which

the Employee is a member), whether or not such compensation is deferred, is in cash or equity, or is in the form of a benefit to or for

the Employee (a “Benefit Arrangement”), any right to exercise, vesting, payment or benefit to the Employee under this

Agreement, any Other Agreement and/or any Benefit Arrangement shall be reduced or eliminated:

A. to

the extent that such right to exercise, vesting, payment, or benefit, taking into account all other rights, payments, or benefits to or

for the Employee under this Agreement, all Other Agreements, and all Benefit Arrangements, would cause any exercise, vesting, payment

or benefit to the Employee under this Agreement to be considered a “parachute payment” within the meaning of Code Section 280G(b)(2) as

then in effect (a “Parachute Payment”); and

B. if,

as a result of receiving such Parachute Payment, the aggregate after-tax amounts received by the Employee from the Company under this

Agreement, all Other Agreements, and all Benefit Arrangements would be less than the maximum after-tax amount that would be received by

the Employee if reduced or eliminated so that no such payment or benefit would be considered a Parachute Payment; such determination to

be made by an accounting firm selected and paid for by the Company.

The Company shall accomplish such reduction by

first reducing or eliminating any cash payments (with the payments to be made furthest in the future being reduced first), then by reducing

or eliminating any accelerated vesting of performance awards, then by reducing or eliminating any accelerated vesting of options or stock

appreciation rights, then by reducing or eliminating any accelerated vesting of restricted stock or stock units, then by reducing or eliminating

any other remaining Parachute Payments. If there is any question as to the ordering of any reduction pursuant to this paragraph, the accounting

firm selected by the Company shall determine the order in which amounts shall be reduced.

VI. Successors;

Binding Agreement.

A. Successors.

The Company shall require any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all or substantially

all of the business or assets of the Company to assume this Agreement to the same extent that the Company would be required to perform

it if no such succession had taken place. As used in this Agreement, “Company” shall mean the Company as defined above and

any successor to its business or assets as aforesaid that assumes and agrees to perform this Agreement, by operation of law or otherwise.

B. Binding

Agreement. This Agreement shall inure to the benefit of and be enforceable by the Employee’s personal or legal representatives,

executors, administrators, successors, heirs, distributees, devisees and legatees.

VII. Notice.

For purposes of this Agreement, notices and all other communications provided for in this Agreement shall be in writing and shall be deemed

to have been duly given (a) on the date of delivery, if delivered by hand, (b) on the date of transmission, if delivered by

confirmed facsimile or electronic mail, (c) on the first business day following the date of deposit, if delivered by guaranteed overnight

delivery service, or (d) on the fourth business day following the date delivered or mailed by United States registered or certified

mail, return receipt requested, postage prepaid, addressed as follows:

If to the Employee:

At the address (or to the facsimile

number) shown in the books and records of the Company.

If to the Company:

4600 S. Syracuse Street, Suite 1450

Denver, CO 80237

Attention: Chief Executive Officer

or to such other address as either party may have

furnished to the other in writing in accordance herewith, except that notices of change of address shall be effective only upon receipt.

VIII. Miscellaneous.

A. Severability.

The provisions of this Agreement shall be deemed severable. The invalidity or unenforceability of any provision of this Agreement in any

jurisdiction shall not affect the validity, legality or enforceability of the remainder of this Agreement in such jurisdiction or the

validity, legality or enforceability of any provision of this Agreement in any other jurisdiction, it being intended that all rights and

obligations of the parties hereunder shall be enforceable to the fullest extent permitted by applicable law.

B. Governing

Law. This Agreement, the rights and obligations of the parties hereto, and any claims or disputes relating thereto, shall be governed

by and construed in accordance with the laws of the State of Colorado (without regard to its choice of law provisions).

C. Amendments;

Waivers; Entire Agreement. No provision of this Agreement may be modified, waived or discharged unless such waiver, modification or

discharge is agreed to in writing and signed by the Employee and such officer or director as may be designated by the Board. No waiver

by either party hereto at any time of any breach by the other party hereto of, or compliance with, any condition or provision of this

Agreement to be performed by such other party shall be deemed a waiver of similar or dissimilar provisions or conditions at the same or

at any prior or subsequent time. This Agreement together with all exhibits hereto sets forth the entire agreement of the parties hereto

in respect of the subject matter contained herein and supersedes any and all prior agreements or understandings between the Employee and

the Company with respect to the subject matter hereof. No agreements or representations, oral or otherwise, express or implied, with respect

to the subject matter hereof have been made by either party which are not expressly set forth in this Agreement.

D. Counterparts.

This Agreement may be executed in several counterparts, each of which shall be deemed to be an original but all of which together will

constitute one and the same instrument.

E. Tax

Withholding. The Company may withhold from any and all amounts payable under this Agreement or otherwise such federal, state and local

taxes as may be required to be withheld pursuant to any applicable law or regulation.

F. Section 409A

Compliance. This Agreement is intended to comply with Section 409A of the Code and the treasury regulations and other official

guidance promulgated thereunder (“Section 409A”), and shall be construed and interpreted in accordance with such

intent. The Change in Control payments and benefits set forth in this Agreement are intended to fit within the “short-term deferral

exception” to Section 409A, and shall at all times be interpreted and administered in furtherance of this intent. In no event

whatsoever shall the Company (or its officers, directors, employees, agents, advisors or representatives) be liable for any additional

tax, interest or penalty that may be imposed on the Employee by Section 409A or damages for failing to comply with Section 409A.

For purposes of Section 409A, the Employee’s right to receive any installment payments pursuant to this Agreement shall be

treated as a right to receive a series of separate and distinct payments. Each

payment under this Agreement shall be treated as a separate payment for purposes of Section 409A. Whenever a payment under

this Agreement specifies a payment period with reference to a number of days, the actual date of payment within the specified period shall

be within the sole discretion of the Company. To the extent that reimbursements

or other in-kind benefits under this Agreement constitute “nonqualified deferred compensation” for purposes of Section 409A,

(A) all expenses or other reimbursements hereunder shall be made on or prior to the last day of the taxable year following the taxable

year in which such expenses were incurred by the Employee, (B) any right to reimbursement or in-kind benefits shall not be subject

to liquidation or exchange for another benefit, and (C) no such reimbursement, expenses eligible for reimbursement, or in-kind benefits

provided in any taxable year shall in any way affect the expenses eligible for reimbursement, or in-kind benefits to be provided, in any

other taxable year. To the extent any compensation or benefits under this Agreement constitutes “nonqualified deferred compensation”

for purposes of Section 409A, if required to comply with Section 409A, a Change in Control shall not be deemed to have occurred

unless the transaction or event constituting the Change in Control also constitutes a “change in ownership,” a “change

in effective control” or a “change in the ownership of a substantial portion of the assets” of the Company within the

meaning of Section 409A.

IN WITNESS WHEREOF, the parties

hereto have executed this Agreement as of the day and year first set forth above.

| COMPANY: |

|

| |

|

| FARMLAND PARTNERS INC. |

|

|

|

| By: |

/s/ Luca Fabbri |

|

| Name: |

Luca Fabbri |

|

| Title: |

President & Chief Executive Officer |

|

| |

|

| EMPLOYEE: |

|

| |

|

| /s/ Susan Landi |

|

| Susan Landi |

|

EXHIBIT A

GENERAL RELEASE

I,_____ , in consideration

of and subject to the performance by Farmland Partners Inc., a Maryland corporation (“Farmland”), and Farmland Partners Operating

Partnership, LP, a Delaware limited partnership (the “Operating Partnership” and, together with the Farmland and its

subsidiaries, the “Company”), of its obligations under the Change in Control Agreement dated as of [ ], 2024 (the “Agreement”),

do hereby release and forever discharge as of the date hereof the Company and its respective affiliates and all present, former and future

managers, directors, officers, employees, attorneys, advisors, successors and assigns of the Company and its affiliates and direct or

indirect owners (collectively, the “Released Parties”) to the extent provided below (this “General

Release”). The Released Parties are intended to be third-party beneficiaries of this General Release, and this General Release

may be enforced by each of them in accordance with the terms hereof in respect of the rights granted to such Released Parties hereunder.

Terms used herein but not otherwise defined shall have the meanings given to them in the Agreement.

1. I understand that any payments

or benefits paid or granted to me under Section III of the Agreement represent, in part, consideration for signing this General Release

and are not salary, wages or benefits to which I was already entitled. I understand and agree that I will not receive certain of the payments

and benefits specified in Section III of the Agreement unless I execute this General Release and do not revoke this General Release

within the time period permitted hereafter. Such payments and benefits will not be considered compensation for purposes of any employee

benefit plan, program, policy or arrangement maintained or hereafter established by the Company or its affiliates.

2. Except as provided in paragraphs

4 and 5 below and except for the provisions of the Agreement which expressly survive the termination of my employment with the Company, I

knowingly and voluntarily (for myself, my heirs, executors, administrators and assigns) release and forever discharge the Company and

the other Released Parties from any and all claims, suits, controversies, actions, causes of action, cross-claims, counter-claims, demands,

debts, compensatory damages, liquidated damages, punitive or exemplary damages, other damages, claims for costs and attorneys’ fees,

or liabilities of any nature whatsoever in law and in equity, both past and present (through the date that this General Release becomes

effective and enforceable) and whether known or unknown, suspected, or claimed against the Company or any of the Released Parties which

I, my spouse, or any of my heirs, executors, administrators or assigns, may have, which arise out of or are connected with my employment

with, or my separation or termination from, the Company (including, but not limited to, any allegation, claim or violation, arising under:

the Prior Agreement, Title VII of the Civil Rights Act of 1964, as amended; the Civil Rights Act of 1991; the Age Discrimination in Employment

Act of 1967, as amended (including the Older Workers Benefit Protection Act); the Equal Pay Act of 1963, as amended; the Americans with

Disabilities Act of 1990; the Family and Medical Leave Act of 1993; the Worker Adjustment Retraining and Notification Act; the Employee

Retirement Income Security Act of 1974; any applicable Executive Order Programs; the Fair Labor Standards Act; or their state or local

counterparts; or under any other federal, state or local civil or human rights law, or under any other local, state, or federal law, regulation

or ordinance; or under any public policy, contract or tort, or under common law; or arising under any policies, practices or procedures

of the Company; or any claim for wrongful discharge, breach of contract, infliction of emotional distress, defamation; or any claim for

costs, fees, or other expenses, including attorneys’ fees incurred in these matters) (all of the foregoing collectively referred

to herein as the “Claims”).

3. I represent that I have

made no assignment or transfer of any right, claim, demand, cause of action or other matters covered by paragraph 2 above.

4. I agree that this General

Release does not waive or release any rights or claims that I may have under the Age Discrimination in Employment Act of 1967 which arise

after the date I execute this General Release. I acknowledge and agree that my separation from employment with the Company in compliance

with the terms of the Agreement shall not serve as the basis for any claim or action (including, without limitation, any claim under the

Age Discrimination in Employment Act of 1967).

5. I agree that I hereby waive

all rights to sue or obtain equitable, remedial or punitive relief from any or all Released Parties of any kind whatsoever in respect

of any Claims, including, without limitation, reinstatement, back pay, front pay, and any form of injunctive relief. Notwithstanding the

above, I further acknowledge that I am not waiving and am not being required to waive any right that cannot be waived under law,

including the right to file an administrative charge or participate in an administrative investigation or proceeding; provided,

however, that I disclaim and waive any right to share or participate in any monetary award resulting from the prosecution of such

charge or investigation or proceeding. Additionally, I am not waiving (i) any right to any accrued benefits or severance benefits

to which I may be entitled under the Agreement, (ii) any claim relating to directors’ and officers’ liability insurance

coverage or any right of indemnification under the Company’s organizational documents or otherwise, or (iii) my rights as an

equity or security holder in the Company or its affiliates.

6. In signing this General

Release, I acknowledge and intend that it shall be effective as a bar to each and every one of the Claims hereinabove mentioned or

implied. I expressly consent that this General Release shall be given full force and effect according to each and all of its express terms

and provisions, including those relating to unknown and unsuspected Claims (notwithstanding any state or local statute that expressly

limits the effectiveness of a general release of unknown, unsuspected and unanticipated Claims), if any, as well as those relating to

any other Claims hereinabove mentioned or implied. I acknowledge and agree that this waiver is an essential and material term of this

General Release and that without such waiver the Company would not have agreed to the terms of the Agreement. I further agree that in

the event I should bring a Claim seeking damages against the Company, or in the event I should seek to recover against the Company in

any Claim brought by a governmental agency on my behalf, this General Release shall serve as a complete defense to such Claims to the

maximum extent permitted by law. I further agree that I am not aware of any pending claim of the type described in paragraph 2 above as

of the execution of this General Release.

I agree that neither this

General Release, nor the furnishing of the consideration for this General Release, shall be deemed or construed at any time to be an admission

by the Company, any Released Party or myself of any improper or unlawful conduct.

8. I agree that if I violate

this General Release by suing the Company or the other Released Parties, I will pay all costs and expenses of defending against the

suit incurred by the Released Parties, including reasonable attorneys’ fees.

9. I agree that this General

Release and the Agreement are confidential and agree not to disclose any information regarding the terms of this General Release or the

Agreement, except to my immediate family and any tax, legal or other counsel I have consulted regarding the meaning or effect hereof or

as required by law, and I will instruct each of the foregoing not to disclose the same to anyone.

10.

Any non-disclosure provision in this General Release does not prohibit or restrict me (or my attorney) from responding to any inquiry

about this General Release or its underlying facts and circumstances by the Securities and Exchange Commission (SEC), the Financial Industry

Regulatory Authority (FINRA), any other self-regulatory organization or any governmental entity. In addition, nothing in this General

Release shall limit my rights to make truthful statements to any regulators, including, without limitation, the SEC, voluntarily or in

response to legal process, required governmental testimony or filings, or administrative or arbitral proceedings (including, without limitation,

depositions in connection with such proceedings). Moreover, notwithstanding any other provision of this Agreement:

(A) I will not be held criminally or civilly liable under any federal or state trade secret law for any disclosure of a trade secret

that is made: (1) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney,

and solely for the purpose of reporting or investigating a suspected violation of law; or (2) in a complaint or other document that

is filed under seal in a lawsuit or other proceeding. (B) If I file a lawsuit for retaliation by the Company for reporting a suspected

violation of law, I may disclose the Company's trade secrets to the my attorney and use the trade secret information in the court

proceeding if: (1) I file any document containing the trade secret under seal; and (2) I do not disclose the trade secret, except

pursuant to court order.

11. I represent that I am

not aware of any claim by me other than the claims that are released by this General Release. I acknowledge that I may hereafter discover

claims or facts in addition to or different than those which I now know or believe to exist with respect to the subject matter of the

release set forth in paragraph 2 above and which, if known or suspected at the time of entering into this General Release, may have materially

affected this General Release and my decision to enter into it.

13. Notwithstanding anything

in this General Release to the contrary, this General Release shall not relinquish, diminish, or in any way affect any rights or claims

arising out of any breach by the Company or by any Released Party of the Agreement after the date hereof.

14. Whenever possible, each

provision of this General Release shall be interpreted in, such manner as to be effective and valid under applicable law, but if any provision

of this General Release is held to be invalid, illegal or unenforceable in any respect under any applicable law or rule in any jurisdiction,

such invalidity, illegality or unenforceability shall not affect any other provision or any other jurisdiction, but this General Release

shall be reformed, construed and enforced in such jurisdiction as if such invalid, illegal or unenforceable provision had never been contained

herein.

BY SIGNING THIS GENERAL RELEASE, I REPRESENT

AND AGREE THAT:

1. I HAVE READ IT

CAREFULLY;

2. I UNDERSTAND ALL OF ITS

TERMS AND KNOW THAT I AM GIVING UP IMPORTANT RIGHTS, INCLUDING BUT NOT LIMITED TO, RIGHTS UNDER THE AGE DISCRIMINATION IN EMPLOYMENT

ACT OF 1967, AS AMENDED, TITLE VII OF THE CIVIL RIGHTS ACT OF 1964, AS AMENDED; THE EQUAL PAY ACT OF 1963, THE AMERICANS WITH DISABILITIES

ACT OF 1990; AND THE EMPLOYEE RETIREMENT INCOME SECURITY ACT OF 1974, AS AMENDED;

3. I VOLUNTARILY CONSENT TO

EVERYTHING IN IT;

4. I HAVE BEEN ADVISED TO

CONSULT WITH AN ATTORNEY BEFORE EXECUTING IT AND I HAVE DONE SO OR, AFTER CAREFUL READING AND CONSIDERATION, I HAVE CHOSEN NOT TO

DO SO OF MY OWN VOLITION;

5. I HAVE HAD AT LEAST [21][45]

DAYS FROM THE DATE OF MY RECEIPT OF THIS RELEASE TO CONSIDER IT, AND THE CHANGES MADE SINCE MY RECEIPT OF THIS RELEASE ARE NOT MATERIAL

OR WERE MADE AT MY REQUEST AND WILL NOT RESTART THE REQUIRED [21][45]-DAY PERIOD;

6. I UNDERSTAND THAT I HAVE

SEVEN (7) DAYS AFTER THE EXECUTION OF THIS RELEASE TO REVOKE IT AND THAT THIS RELEASE SHALL NOT BECOME EFFECTIVE OR ENFORCEABLE UNTIL

THE REVOCATION PERIOD HAS EXPIRED;

7. I HAVE SIGNED THIS GENERAL

RELEASE KNOWINGLY AND VOLUNTARILY AND WITH THE ADVICE OF ANY COUNSEL RETAINED TO ADVISE ME WITH RESPECT TO IT; AND

8. I AGREE THAT THE PROVISIONS

OF THIS GENERAL RELEASE MAY NOT BE AMENDED, WAIVED, CHANGED OR MODIFIED EXCEPT BY AN INSTRUMENT IN WRITING SIGNED BY AN AUTHORIZED

REPRESENTATIVE OF THE COMPANY AND BY ME.

Exhibit 99.1

Farmland Partners Announces Appointment of Susan

Landi as CFO

Staff Transition Part of Company’s

Cost-Cutting Initiative

DENVER, May 28, 2024 (BUSINESS WIRE) -- Farmland Partners Inc.

(NYSE: FPI) (the “Company” or “FPI”) today announced that Susan Landi has been appointed to the Company’s

executive team as Chief Financial Officer (“CFO”) and Treasurer. Ms. Landi, the senior accounting professional at FPI

for over four years, assumed her new role on May 28, 2024. Ms. Landi’s responsibilities will include overseeing the Company's

finance, accounting, treasury, and SEC financial reporting functions.

Ms. Landi succeeds James Gilligan, who has stepped down as CFO

upon mutual agreement with the Company and will remain as an employee with the Company through June 30, 2024 to ensure a smooth transition.

“Susan is the perfect person to build upon the great work James

did during his tenure. Susan knows FPI’s finances and the farmland business well, she has a strong track record of driving positive

results, and she’s already proven herself to be an invaluable member of our close-knit team. I’m excited for Susan and look

forward to working with her as CFO,” said FPI Chief Executive Officer Luca Fabbri. “James is a consummate professional who

should be proud of the job he’s done leading FPI’s finance department since October 2021. We wish him nothing but success

moving forward.”

Mr. Fabbri, who also served as the Company’s CFO from 2014

to 2021, explained that the staffing change is part of the Company’s ongoing efforts to reduce expenses and improve shareholder

returns.

Ms. Landi

has been an accounting and audit professional since 2002, serving at Moss Adams and Hein & Associates prior to joining the Company

in 2019. She received a B.S. in Accounting from Saint Vincent College and a M.B.A. from the University of Colorado, and she is a Certified

Public Accountant.

About Farmland Partners Inc.

Farmland

Partners Inc. is an internally managed real estate company that owns and seeks to acquire high-quality North American farmland and makes

loans to farmers secured by farm real estate. As of the date of this release, the Company owns and/or manages approximately 177,400 acres

in 17 states, including Arkansas, California, Colorado, Florida, Illinois, Indiana, Iowa, Kansas, Louisiana, Mississippi,

Missouri, Nebraska, North Carolina, Ohio, Oklahoma, South Carolina, and Texas. In addition, the Company owns land and buildings for four

agriculture equipment dealerships in Ohio leased to Ag Pro under the John Deere brand. The Company has approximately 26 crop types and

over 100 tenants. The Company elected to be taxed as a real estate investment trust, or REIT, for U.S. federal income tax purposes, commencing

with the taxable year ended December 31, 2014. Additional information: www.farmlandpartners.com or (720) 452-3100.

Contact:

Phillip Hayes

phayes@farmlandpartners.com

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

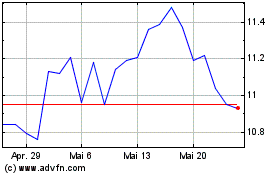

Farmland Partners (NYSE:FPI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Farmland Partners (NYSE:FPI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024