false

0001591670

0001591670

2024-10-02

2024-10-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report

(Date of earliest event

reported): October 2, 2024

FARMLAND PARTNERS INC.

(Exact name of registrant as specified

in its charter)

|

Maryland

(State or other

jurisdiction

of incorporation) |

|

001-36405

(Commission

File Number) |

|

46-3769850

(IRS Employer

Identification

No.) |

|

4600 S. Syracuse Street, Suite 1450

Denver, Colorado

(Address of principal executive offices) |

|

80237

(Zip Code) |

Registrant’s telephone number,

including area code: (720) 452-3100

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

FPI |

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement.

On October 2, 2024, Farmland Partners Inc. (the

“Company”) and certain of its subsidiaries entered into a purchase and sale agreement (the “Purchase

Agreement”) with Farmland Reserve, Inc., a Utah nonprofit corporation (“Farmland Reserve”) pursuant to which

Farmland Reserve has agreed to purchase, and the Company has agreed to sell, a portfolio of 46 farms comprising 41,554 acres of

farmland (the “Portfolio”) for an aggregate purchase price of $289 million in a single transaction (the

“Transaction”). The Portfolio includes farms in Arkansas, Florida, Louisiana, Mississippi, Nebraska, Oklahoma, North

Carolina and South Carolina.

The Company intends to use the proceeds from the sale to reduce debt

by approximately $140 million, buy back stock, pursue acquisitions and for other corporate purposes.

The Purchase Agreement contains customary representations and warranties,

covenants, termination rights and indemnification provisions for a transaction of this size and nature and is subject to customary closing

conditions. The all-cash Transaction is expected to close on or about October 16, 2024, once all conditions to closing are satisfied.

Item 7.01. Regulation FD Disclosure.

On October 2, 2024, the Company issued a press release announcing

the Transaction. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

The information furnished herewith pursuant to Item 7.01 of this Current

Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall

it be deemed incorporated by reference into any filing made by the Company under the Exchange Act or the Securities Act of 1933, as amended,

except as shall be expressly set forth by specific reference in such a filing.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws, including,

without limitation, statements regarding the timing of the completion of the pending Transaction and the anticipated use of proceeds

therefrom. Forward- looking statements, which are based on certain assumptions and describe future plans, strategies and

expectations of the Company, are generally identifiable by use of the words “believe,” “expect,”

“intend,” “anticipate,” “estimate,” “project” or similar expressions. The

Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Certain

factors that could cause actual results to differ materially from the Company’s expectations include satisfaction of the

closing conditions to the Purchase Agreement described above and other risks detailed under “Risk Factors” in the

Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and in other filings the Company makes

with the Securities and Exchange Commission from time to time. Many of these factors are beyond the Company’s ability to

control or predict. Forward-looking statements are not guarantees of performance. All forward-looking statements speak only as of

the date of this Current Report on Form 8-K. The Company assumes no obligation to update or supplement forward-looking

statements that become untrue after the date of this Current Report on Form 8-K because of subsequent events, circumstances or

changes in expectations except to the extent required by law.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FARMLAND PARTNERS INC. |

| |

|

| Dated: October 3, 2024 |

By: |

/s/ Luca Fabbri |

| |

|

Luca Fabbri |

| |

|

President & Chief Executive Officer |

Exhibit 99.1

Farmland Partners to Sell $289 Million of Farmland

to Farmland Reserve, Inc.

Transaction to Generate an Approximate $50

Million Gain Over Net Book Value

DENVER, October 2, 2024--(BUSINESS WIRE)--Farmland Partners Inc.

(NYSE: FPI) (the “Company” or “FPI”) today announced that it is selling a portfolio of 46 farms, comprising 41,554

acres of farmland (the “Portfolio”), for $289 million in a single transaction (“the “Transaction”) with

Farmland Reserve, Inc. The all-cash deal has been finalized by both parties and is scheduled to close on October 16, 2024, once

all conditions to closing are satisfied.

The Portfolio includes farms across several regions and states, including

Arkansas, Florida, Louisiana, Mississippi, Nebraska, Oklahoma, and the Carolinas. The Transaction does not include any of the Company’s

Illinois farmland, which is among the most valuable land it owns. FPI’s total gain on sale will be approximately $50 million, or

approximately 21 percent over the aggregate net book value of the farms comprising the Portfolio. In 2023, FPI also sold approximately

$200 million of assets at a gain in excess of 20 percent.

Luca Fabbri, FPI’s President and CEO said of the sale: “Farmland

is a ‘total return’ investment, with asset appreciation typically accounting for a majority of the overall return on invested

capital. We have consistently advised shareholders that our company is undervalued due to lack of recognition by the market of the appreciation

in our asset base. As we did last year, we have once again proven our total return thesis and highlighted the unrealized intrinsic value

in our stock by delivering a sizable gain on a representative segment of our overall portfolio. We intend to deploy the resulting capital

to reduce debt by approximately $140 million, to buy back stock, to pursue acquisitions, and for other corporate purposes. Moreover, as

we did last year, we expect to be in a position to make a significant special distribution to shareholders at year-end.”

Fabbri explained that the Company was excited to work with Farmland

Reserve on this Transaction.

“We are pleased to transition our long-standing tenant relationships

to a high-quality institutional investor that values relationships as we do,” he said. “Farmland Reserve is highly respected

in the farmland community as a best-in-class owner that manages farms expertly and deals honestly and ethically with its farmer tenants.

We strongly believe that our farmer tenants will have an excellent partner moving forward.”

“We are grateful for the opportunity to work with Farmland Partners

to acquire this unique portfolio of high-quality farmland,” said Doug Rose, CEO of Farmland Reserve. “We’re also gratified

they saw us as the right buyer for these properties and the farmer tenant relationships that come with them. As an investor with

a long-term vision, we look forward to leasing these productive farms to local farmers for many years to come.”

About Farmland Partners Inc.

Farmland Partners Inc. is an internally managed real estate company

that owns and seeks to acquire high-quality North American farmland and makes loans to farmers secured by farm real estate. Assuming

that the pending Transaction closes, the Company is expected to own and/or manage more than 140,000 acres of farmland in 15 states, including

Arkansas, California, Colorado, Illinois, Indiana, Iowa, Kansas, Louisiana, Michigan, Mississippi, Missouri, Nebraska,

North Carolina, South Carolina, and Texas. In addition, the Company owns land and buildings for four agriculture equipment dealerships

in Ohio leased to Ag Pro under the John Deere brand. The Company elected to be taxed as a real estate investment trust, or REIT, for

U.S. federal income tax purposes, commencing with the taxable year ended December 31, 2014. Additional information: www.farmlandpartners.com

or (720) 452-3100.

About Farmland Reserve, Inc.

Farmland Reserve, https://farmlandreserve.org, is an integrated

investment auxiliary of The Church of Jesus Christ of Latter-day Saints. Farmland Reserve’s earnings support the mission of the

Church and its religious, humanitarian, educational, and charitable good works.

Forward-Looking Statements

This press release includes “forward-looking statements”

within the meaning of the federal securities laws, including, without limitation, statements with respect to our outlook and the outlook

for the farm economy generally, proposed and pending acquisitions and dispositions, financing activities, crop yields and prices and anticipated

rental rates. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,”

“should,” “could,” “would,” “predicts,” “potential,” “continue,”

“expects,” “anticipates,” “future,” “intends,” “plans,” “believes,”

“estimates” or similar expressions or their negatives, as well as statements in future tense. Although the Company believes

that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, beliefs and expectations, such

forward-looking statements are not predictions of future events or guarantees of future performance, and our actual results could differ

materially from those set forth in the forward-looking statements. Some factors that might cause such a difference include the following:

the possibility that the Transaction will not close due to the failure to satisfy one or more closing conditions or for other reasons;

the amount and timing of receipt, and the benefits to be realized in connection with the intended use, of the expected proceeds from the

Transaction; market factors and other considerations that could result in the Company deciding not to declare and pay a special dividend

or to declare and pay a special dividend that is less than shareholders anticipate; the ongoing war in Ukraine and the ongoing conflict

in the Middle East and their impacts on the world agriculture market, world food supply, the farm economy generally, and our tenants’

businesses; changes in trade policies in the United States and other countries that import agricultural products from the United States;

high inflation and elevated interest rates; the onset of an economic recession in the United States and other countries that impact the

farm economy; extreme weather events, such as droughts, tornadoes, hurricanes or floods; the impact of future public health crises on

our business and on the economy and capital markets generally; general volatility of the capital markets and the market price of the Company’s

common stock; changes in the Company’s business strategy, availability, terms and deployment of capital; the Company’s ability

to refinance existing indebtedness at or prior to maturity on favorable terms, or at all; availability of qualified personnel; changes

in the Company’s industry, interest rates or the general economy; adverse developments related to crop yields or crop prices; the

degree and nature of the Company’s competition; the outcomes of ongoing litigation; the timing, price or amount of repurchases,

if any, under the Company's share repurchase program; the ability to consummate acquisitions or dispositions under contract; and the other

factors described in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023, and the Company’s other filings with the Securities and Exchange Commission. Any forward-looking information

presented herein is made only as of the date of this press release, and the Company does not undertake any obligation to update or revise

any forward-looking information to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise.

Contact:

Phillip Hayes

phayes@farmlandpartners.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

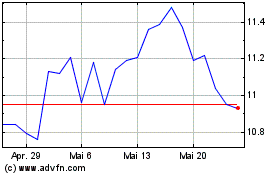

Farmland Partners (NYSE:FPI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Farmland Partners (NYSE:FPI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024