Transaction to Generate an Approximate $50

Million Gain Over Net Book Value

Farmland Partners Inc. (NYSE: FPI) (the “Company” or “FPI”)

today announced that it is selling a portfolio of 46 farms,

comprising 41,554 acres of farmland (the “Portfolio”), for $289

million in a single transaction (“the “Transaction”) with Farmland

Reserve, Inc. The all-cash deal has been finalized by both parties

and is scheduled to close on October 16, 2024, once all conditions

to closing are satisfied.

The Portfolio includes farms across several regions and states,

including Arkansas, Florida, Louisiana, Mississippi, Nebraska,

Oklahoma, and the Carolinas. The Transaction does not include any

of the Company’s Illinois farmland, which is among the most

valuable land it owns. FPI’s total gain on sale will be

approximately $50 million, or approximately 21 percent over the

aggregate net book value of the farms comprising the Portfolio. In

2023, FPI also sold approximately $200 million of assets at a gain

in excess of 20 percent.

Luca Fabbri, FPI’s President and CEO said of the sale: “Farmland

is a ‘total return’ investment, with asset appreciation typically

accounting for a majority of the overall return on invested

capital. We have consistently advised shareholders that our company

is undervalued due to lack of recognition by the market of the

appreciation in our asset base. As we did last year, we have once

again proven our total return thesis and highlighted the unrealized

intrinsic value in our stock by delivering a sizable gain on a

representative segment of our overall portfolio. We intend to

deploy the resulting capital to reduce debt by approximately $140

million, to buy back stock, to pursue acquisitions, and for other

corporate purposes. Moreover, as we did last year, we expect to be

in a position to make a significant special distribution to

shareholders at year-end.”

Fabbri explained that the Company was excited to work with

Farmland Reserve on this Transaction.

“We are pleased to transition our long-standing tenant

relationships to a high-quality institutional investor that values

relationships as we do,” he said. “Farmland Reserve is highly

respected in the farmland community as a best-in-class owner that

manages farms expertly and deals honestly and ethically with its

farmer tenants. We strongly believe that our farmer tenants will

have an excellent partner moving forward.”

“We are grateful for the opportunity to work with Farmland

Partners to acquire this unique portfolio of high-quality

farmland,” said Doug Rose, CEO of Farmland Reserve. “We’re also

gratified they saw us as the right buyer for these properties and

the farmer tenant relationships that come with them. As an investor

with a long-term vision, we look forward to leasing these

productive farms to local farmers for many years to come.”

About Farmland Partners Inc.

Farmland Partners Inc. is an internally managed real estate

company that owns and seeks to acquire high-quality North American

farmland and makes loans to farmers secured by farm real estate.

Assuming that the pending Transaction closes, the Company is

expected to own and/or manage more than 140,000 acres of farmland

in 15 states, including Arkansas, California, Colorado, Illinois,

Indiana, Iowa, Kansas, Louisiana, Michigan, Mississippi, Missouri,

Nebraska, North Carolina, South Carolina, and Texas. In addition,

the Company owns land and buildings for four agriculture equipment

dealerships in Ohio leased to Ag Pro under the John Deere brand.

The Company elected to be taxed as a real estate investment trust,

or REIT, for U.S. federal income tax purposes, commencing with the

taxable year ended December 31, 2014. Additional information:

www.farmlandpartners.com or (720) 452-3100.

About Farmland Reserve, Inc.

Farmland Reserve, https://farmlandreserve.org, is an integrated

investment auxiliary of The Church of Jesus Christ of Latter-day

Saints. Farmland Reserve’s earnings support the mission of the

Church and its religious, humanitarian, educational, and charitable

good works.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the federal securities laws, including, without

limitation, statements with respect to our outlook and the outlook

for the farm economy generally, proposed and pending acquisitions

and dispositions, financing activities, crop yields and prices and

anticipated rental rates. Forward-looking statements generally can

be identified by the use of forward-looking terminology such as

“may,” “should,” “could,” “would,” “predicts,” “potential,”

“continue,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates” or similar expressions or their negatives,

as well as statements in future tense. Although the Company

believes that the expectations reflected in such forward-looking

statements are based upon reasonable assumptions, beliefs and

expectations, such forward-looking statements are not predictions

of future events or guarantees of future performance, and our

actual results could differ materially from those set forth in the

forward-looking statements. Some factors that might cause such a

difference include the following: the possibility that the

Transaction will not close due to the failure to satisfy one or

more closing conditions or for other reasons; the amount and timing

of receipt, and the benefits to be realized in connection with the

intended use, of the expected proceeds from the Transaction; market

factors and other considerations that could result in the Company

deciding not to declare and pay a special dividend or to declare

and pay a special dividend that is less than shareholders

anticipate; the ongoing war in Ukraine and the ongoing conflict in

the Middle East and their impacts on the world agriculture market,

world food supply, the farm economy generally, and our tenants’

businesses; changes in trade policies in the United States and

other countries that import agricultural products from the United

States; high inflation and elevated interest rates; the onset of an

economic recession in the United States and other countries that

impact the farm economy; extreme weather events, such as droughts,

tornadoes, hurricanes or floods; the impact of future public health

crises on our business and on the economy and capital markets

generally; general volatility of the capital markets and the market

price of the Company’s common stock; changes in the Company’s

business strategy, availability, terms and deployment of capital;

the Company’s ability to refinance existing indebtedness at or

prior to maturity on favorable terms, or at all; availability of

qualified personnel; changes in the Company’s industry, interest

rates or the general economy; adverse developments related to crop

yields or crop prices; the degree and nature of the Company’s

competition; the outcomes of ongoing litigation; the timing, price

or amount of repurchases, if any, under the Company's share

repurchase program; the ability to consummate acquisitions or

dispositions under contract; and the other factors described in the

section entitled “Risk Factors” in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2023, and the Company’s

other filings with the Securities and Exchange Commission. Any

forward-looking information presented herein is made only as of the

date of this press release, and the Company does not undertake any

obligation to update or revise any forward-looking information to

reflect changes in assumptions, the occurrence of unanticipated

events, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241002913968/en/

Phillip Hayes phayes@farmlandpartners.com

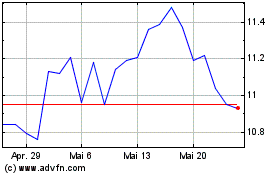

Farmland Partners (NYSE:FPI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Farmland Partners (NYSE:FPI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024