Highlights include:

- Net income of $13.3 million, or $0.49 per diluted share.

Excluding $3.1 million in pre-tax expenses related to a strategic

opportunity, adjusted net income (non-GAAP) was $15.7 million, or

$0.58 per diluted share.

- Net interest margin of 3.07% increased by 10 bps from 2.97%

in the previous quarter

- Total loans of $5.34 billion decreased by $41.0 million from

the previous quarter

- Core deposits of $5.97 billion increased by $53.9 million

from the previous quarter. Total deposits of $6.58 billion

increased by $0.6 million from the previous quarter, which included

a decrease in government time deposits of $69.1 million.

- Total risk-based capital and common equity tier 1 ratios of

15.3% and 12.1%, respectively

- The CPF Board of Directors approved a quarterly cash

dividend of $0.26 per share

Central Pacific Financial Corp. (NYSE: CPF) (the "Company"),

parent company of Central Pacific Bank (the "Bank" or "CPB"), today

reported net income of $13.3 million, or fully diluted earnings per

share ("EPS") of $0.49 for the third quarter of 2024, compared to

net income of $15.8 million, or EPS of $0.58 in the previous

quarter and net income of $13.1 million, or EPS of $0.49 in the

year-ago quarter. Results for the third quarter of 2024 were

impacted by $3.1 million in pre-tax expenses related to our

evaluation and assessment of a strategic opportunity. While the

parties are no longer currently engaged in discussions, we remain

interested in the opportunity under the right terms and conditions.

Excluding these expenses, adjusted net income and EPS (non-GAAP)

for the quarter was approximately $15.7 million and $0.58,

respectively.

"Our third quarter core results were strong and we continue to

pursue our strategies for future growth and additional internal

operating efficiencies," said Arnold Martines, Chairman, President

and Chief Executive Officer. "Our net interest income and net

interest margin expanded as we successfully managed the balance

sheet and repricing in this evolving interest rate

environment."

"Central Pacific remains committed to supporting our customers

and communities. We were pleased to open a new state-of-the-art

branch in Kahului to support the business and personal financial

needs of the Maui community as we move to expand our presence on

the neighbor islands," Martines said.

Earnings Highlights

Net interest income was $53.9 million for the third quarter of

2024, which increased by $1.9 million, or 3.7% from the previous

quarter, and increased by $1.9 million, or 3.7% from the year-ago

quarter. Net interest margin ("NIM") was 3.07% for the third

quarter of 2024, an increase of 10 basis points ("bp" or "bps")

from the previous quarter and an increase of 19 bp from the

year-ago quarter. The sequential quarter increase in net interest

income and NIM was primarily due to higher average yields earned on

investment securities and loans of 11 and 9 bps, respectively,

combined with a 1 bp decline in average rates paid on

interest-bearing deposits. The higher average yield earned on

investment securities in the third quarter of 2024 includes $1.1

million in income from an interest rate swap that became effective

on March 31, 2024, compared to $0.9 million in the second quarter

of 2024.

The Company recorded a provision for credit losses of $2.8

million in the third quarter of 2024, compared to a provision of

$2.2 million in the previous quarter and a provision of $4.9

million in the year-ago quarter. The provision in the current

quarter consisted of a provision for credit losses on loans of $3.0

million, offset by a credit to the provision for off-balance sheet

exposures of $0.2 million.

Other operating income totaled $12.7 million for the third

quarter of 2024, compared to $12.1 million in the previous quarter

and $10.0 million in the year-ago quarter. The higher other

operating income was primarily due to higher income from bank-owned

life insurance of $0.7 million, partially offset by lower mortgage

banking income of $0.2 million.

Other operating expense totaled $46.7 million for the third

quarter of 2024, compared to $41.2 million in the previous quarter

and $39.6 million in the year-ago quarter. The higher other

operating expense was primarily due to the aforementioned $3.1

million in expenses related to a strategic opportunity (included in

other), higher salaries and employee benefits of $1.1 million, and

higher directors' deferred compensation plan expenses of $1.0

million (included in other).

The efficiency ratio was 70.12% for the third quarter of 2024,

compared to 64.26% in the previous quarter and 63.91% in the

year-ago quarter. Excluding the aforementioned expenses related to

a strategic opportunity, the adjusted efficiency ratio (non-GAAP)

for the third quarter of 2024 was 65.51%.

The effective tax rate was 22.0% for the third quarter of 2024,

compared to 23.4% in the previous quarter and 24.9% in the year-ago

quarter. The decrease in the effective tax rate was primarily due

to higher tax-exempt income from bank-owned life insurance and

additional tax credits recognized.

Balance Sheet Highlights

Total assets of $7.42 billion at September 30, 2024 increased by

$28.5 million, or 0.4% from $7.39 billion at June 30, 2024, and

decreased by $222.5 million, or 2.9% from $7.64 billion at

September 30, 2023. The Company had $326.6 million in cash on its

balance sheet and $2.55 billion in total other liquidity sources,

including available borrowing capacity and unpledged investment

securities at September 30, 2024. Total available sources of

liquidity as a percentage of uninsured and uncollateralized

deposits was 118% at September 30, 2024, compared to 121% at June

30, 2024 and 122% at September 30, 2023. During the third quarter

of 2024, excess balance sheet liquidity was used to pay off $69.1

million in higher cost government time deposits.

Total loans, net of deferred fees and costs, of $5.34 billion at

September 30, 2024 decreased by $41.0 million, or 0.8% from $5.38

billion at June 30, 2024, and decreased by $166.1 million, or 3.0%

from $5.51 billion at September 30, 2023. Average yields earned on

loans during the third quarter of 2024 was 4.89%, compared to 4.80%

in the previous quarter and 4.49% in the year-ago quarter.

Total deposits of $6.58 billion at September 30, 2024 increased

by $0.6 million or 0.01% from $6.58 billion at June 30, 2024, and

decreased by $291.7 million, or 4.2% from $6.87 billion at

September 30, 2023. Core deposits, which include demand deposits,

savings and money market deposits and time deposits up to $250,000,

totaled $5.97 billion at September 30, 2024, and increased by $53.9

million, or 0.9% from $5.91 billion at June 30, 2024. Average rates

paid on total deposits during the third quarter of 2024 was 1.32%,

compared to 1.33% in the previous quarter and 1.07% in the year-ago

quarter. FDIC-insured or fully collateralized deposits represented

approximately 63% of total deposits at September 30, 2024, compared

to 64% at June 30, 2024 and 65% at September 30, 2023.

Asset Quality

Nonperforming assets totaled $11.6 million, or 0.16% of total

assets at September 30, 2024, compared to $10.3 million, or 0.14%

of total assets at June 30, 2024 and $6.7 million, or 0.09% of

total assets at September 30, 2023. The increase in nonperforming

assets was primarily due to the addition of residential mortgage

loans totaling $2.2 million which were well-collateralized with

strong loan-to-value ratios.

Net charge-offs totaled $3.6 million in the third quarter of

2024, compared to net charge-offs of $3.8 million in the previous

quarter, and net charge-offs of $3.9 million in the year-ago

quarter. Annualized net charge-offs as a percentage of average

loans was 0.27%, 0.28% and 0.28% during the three months ended

September 30, 2024, June 30, 2024 and September 30, 2023,

respectively.

The allowance for credit losses, as a percentage of total loans

was 1.15% at September 30, 2024, compared to 1.16% at June 30,

2024, and 1.17% at September 30, 2023.

Capital

Total shareholders' equity was $543.7 million at September 30,

2024, compared to $518.6 million and $468.6 million at June 30,

2024 and September 30, 2023, respectively.

During the third quarter of 2024, the Company did not repurchase

any shares of common stock. As of September 30, 2024, $19.1 million

in share repurchase authorization remained available under the

Company's share repurchase program.

The Company's leverage, common equity tier 1, tier 1 risk-based

capital, and total risk-based capital ratios were 9.5%, 12.1%,

13.1%, and 15.3%, respectively, at September 30, 2024, compared to

9.3%, 11.9%, 12.8%, and 15.1%, respectively, at June 30, 2024.

On October 29, 2024, the Company's Board of Directors declared a

quarterly cash dividend of $0.26 per share on its outstanding

common shares. The dividend will be payable on December 16, 2024 to

shareholders of record at the close of business on November 29,

2024.

Conference Call

The Company's management will host a conference call today at

1:00 p.m. Eastern Time (7:00 a.m. Hawaii Time) to discuss the

quarterly results. Individuals are encouraged to listen to the live

webcast of the presentation by visiting the investor relations page

of the Company's website at http://ir.cpb.bank. Alternatively,

investors may participate in the live call by dialing

1-800-715-9871 (conference ID: 6299769). A playback of the call

will be available through November 29, 2024 by dialing

1-800-770-2030 (playback ID: 6299769) and on the Company's website.

Information which may be discussed in the conference call is

provided in an earnings supplement presentation on the Company's

website at http://ir.cpb.bank.

About Central Pacific Financial Corp.

Central Pacific Financial Corp. is a Hawaii-based bank holding

company with approximately $7.42 billion in assets as of September

30, 2024. Central Pacific Bank, its primary subsidiary, operates 27

branches and 56 ATMs in the State of Hawaii. For additional

information, please visit the Company's website at

http://www.cpb.bank.

Equal Housing Lender Member FDIC NYSE Listed: CPF

Forward-Looking Statements

This document may contain forward-looking statements ("FLS")

concerning: projections of revenues, expenses, income or loss,

earnings or loss per share, capital expenditures, payment or

nonpayment of dividends, capital position, credit losses, net

interest margin or other financial items; statements of plans,

objectives and expectations of Central Pacific Financial Corp. (the

"Company") or its management or Board of Directors, including those

relating to business plans, use of capital resources, products or

services and regulatory developments and regulatory actions;

statements of future economic performance including anticipated

performance results from our business initiatives; or any

statements of the assumptions underlying or relating to any of the

foregoing. Words such as "believe," "plan," "anticipate," "seek,"

"expect," "intend," "forecast," "hope," "target," "continue,"

"remain," "estimate," "will," "should," "may" and other similar

expressions are intended to identify FLS but are not the exclusive

means of identifying such statements.

While we believe that our FLS and the assumptions underlying

them are reasonably based, such statements and assumptions are by

their nature subject to risks and uncertainties, and thus could

later prove to be inaccurate or incorrect. Accordingly, actual

results could differ materially from those statements or

projections for a variety of reasons, including, but not limited

to: the effects of inflation and interest rate fluctuations; the

adverse effects of recent bank failures and the potential impact of

such developments on customer confidence, deposit behavior,

liquidity and regulatory responses thereto; the adverse effects of

the COVID-19 pandemic virus (and its variants) and other pandemic

viruses on local, national and international economies, including,

but not limited to, the adverse impact on tourism and construction

in the State of Hawaii, our borrowers, customers, third-party

contractors, vendors and employees, as well as the effects of

government programs and initiatives in response thereto; supply

chain disruptions; labor contract disputes and potential strikes;

the increase in inventory or adverse conditions in the real estate

market and deterioration in the construction industry; adverse

changes in the financial performance and/or condition of our

borrowers and, as a result, increased loan delinquency rates,

deterioration in asset quality, and losses in our loan portfolio;

the impact of local, national, and international economies and

events (including natural disasters such as wildfires, volcanic

eruptions, hurricanes, tsunamis, storms, and earthquakes) on the

Company's business and operations and on tourism, the military, and

other major industries operating within the Hawaii market and any

other markets in which the Company does business; deterioration or

malaise in domestic economic conditions, including any

destabilization in the financial industry and deterioration of the

real estate market, as well as the impact of declining levels of

consumer and business confidence in the state of the economy in

general and in financial institutions in particular; changes in

estimates of future reserve requirements based upon the periodic

review thereof under relevant regulatory and accounting

requirements; the impact of the Dodd-Frank Wall Street Reform and

Consumer Protection Act, changes in capital standards, other

regulatory reform and federal and state legislation, including but

not limited to regulations promulgated by the Consumer Financial

Protection Bureau, government-sponsored enterprise reform, and any

related rules and regulations which affect our business operations

and competitiveness; the costs and effects of legal and regulatory

developments, including legal proceedings and lawsuits we are or

may become subject to, or regulatory or other governmental

inquiries and proceedings and the resolution thereof; the results

of regulatory examinations or reviews and the effect of, and our

ability to comply with, any regulations or regulatory orders or

actions we are or may become subject to, and the effect of any

recurring or special FDIC assessments; the effect of changes in

accounting policies and practices, as may be adopted by the

regulatory agencies, as well as the PCAOB, the FASB and other

accounting standard setters and the cost and resources required to

implement such changes; the effects of and changes in trade,

monetary and fiscal policies and laws, including the interest rate

policies of the Board of Governors of the Federal Reserve System;

securities market and monetary fluctuations, including the impact

resulting from the elimination of the LIBOR Index; negative trends

in our market capitalization and adverse changes in the price of

the Company's common stock; the effects of any potential or actual

acquisitions or dispositions we may make or evaluate, and the

related costs, including re-engagement in any potential acquisition

process; political instability; acts of war or terrorism; changes

in consumer spending, borrowings and savings habits; technological

changes and developments; cybersecurity and data privacy breaches

and the consequence therefrom; failure to maintain effective

internal control over financial reporting or disclosure controls

and procedures; our ability to address deficiencies in our internal

controls over financial reporting or disclosure controls and

procedures; changes in the competitive environment among financial

holding companies and other financial service providers; our

ability to successfully implement our initiatives to lower our

efficiency ratio; our ability to attract and retain key personnel;

changes in our personnel, organization, compensation and benefit

plans; our ability to successfully implement and achieve the

objectives of our BaaS initiatives, including adoption of the

initiatives by customers and risks faced by any of our bank

collaborations including reputational and regulatory risk; and our

success at managing the risks involved in the foregoing items.

For further information with respect to factors that could cause

actual results to materially differ from the expectations or

projections stated in the FLS, please see the Company's publicly

available SEC filings, including the Company's Form 10-K for the

last fiscal year and, in particular, the discussion of "Risk

Factors" set forth therein. We urge investors to consider all of

these factors carefully in evaluating the FLS contained in this

document. FLS speak only as of the date on which such statements

are made. We undertake no obligation to update any FLS to reflect

events or circumstances after the date on which such statements are

made, or to reflect the occurrence of unanticipated events except

as required by law.

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Financial Highlights

(Unaudited)

TABLE 1

Three Months Ended

Nine Months Ended

(Dollars in thousands,

Sep 30,

Jun 30,

Mar 31,

Dec 31,

Sep 30,

Sep 30,

except for per share amounts)

2024

2024

2024

2023

2023

2024

2023

CONDENSED INCOME STATEMENT

Net interest income

$

53,851

$

51,921

$

50,187

$

51,142

$

51,928

$

155,959

$

158,858

Provision for credit losses

2,833

2,239

3,936

4,653

4,874

9,008

11,045

Total other operating income

12,734

12,121

11,244

15,172

10,047

36,099

31,491

Total other operating expense

46,687

41,151

40,576

42,522

39,611

128,414

121,621

Income tax expense

3,760

4,835

3,974

4,273

4,349

12,569

13,880

Net income

13,305

15,817

12,945

14,866

13,141

42,067

43,803

Basic earnings per share

$

0.49

$

0.58

$

0.48

$

0.55

$

0.49

$

1.55

$

1.62

Diluted earnings per share

0.49

0.58

0.48

0.55

0.49

1.55

1.62

Dividends declared per share

0.26

0.26

0.26

0.26

0.26

0.78

0.78

PERFORMANCE RATIOS

Return on average assets (ROA) [1]

0.72

%

0.86

%

0.70

%

0.79

%

0.70

%

0.76

%

0.78

%

Return on average shareholders’ equity

(ROE) [1]

10.02

12.42

10.33

12.55

10.95

10.91

12.33

Average shareholders’ equity to average

assets

7.23

6.94

6.73

6.32

6.39

6.97

6.34

Efficiency ratio [2]

70.12

64.26

66.05

64.12

63.91

66.86

63.89

Net interest margin (NIM) [1]

3.07

2.97

2.83

2.84

2.88

2.95

2.98

Dividend payout ratio [3]

53.06

44.83

54.17

47.27

53.06

50.32

48.15

SELECTED AVERAGE BALANCES

Average loans, including loans held for

sale

$

5,330,810

$

5,385,829

$

5,400,558

$

5,458,245

$

5,507,248

$

5,372,247

$

5,525,476

Average interest-earning assets

7,022,910

7,032,515

7,140,264

7,208,613

7,199,866

7,065,075

7,156,270

Average assets

7,347,403

7,338,714

7,449,661

7,498,097

7,510,537

7,378,479

7,472,890

Average deposits

6,535,422

6,542,767

6,659,812

6,730,883

6,738,071

6,579,174

6,689,762

Average interest-bearing liabilities

4,904,460

4,910,998

5,009,542

5,023,321

4,999,820

4,941,530

4,910,190

Average shareholders’ equity

530,928

509,507

501,120

473,708

480,118

513,914

473,856

[1]

ROA and ROE are annualized based

on a 30/360 day convention. Annualized net interest income and

expense in the NIM calculation are based on the day count interest

payment conventions at the interest-earning asset or

interest-bearing liability level (i.e. 30/360, actual/actual).

[2]

Efficiency ratio is defined as

total other operating expense divided by total revenue (net

interest income and total other operating income).

[3]

Dividend payout ratio is defined

as dividends declared per share divided by diluted earnings per

share.

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Financial Highlights

(Unaudited)

TABLE 1 (CONTINUED)

Sep 30,

Jun 30,

Mar 31,

Dec 31,

Sep 30,

2024

2024

2024

2023

2023

REGULATORY CAPITAL RATIOS

Central Pacific Financial Corp.

Leverage ratio

9.5

%

9.3

%

9.0

%

8.8

%

8.7

%

Common equity tier 1 capital ratio

12.1

11.9

11.6

11.4

11.0

Tier 1 risk-based capital ratio

13.1

12.8

12.6

12.4

11.9

Total risk-based capital ratio

15.3

15.1

14.8

14.6

14.1

Central Pacific Bank

Leverage ratio

9.8

9.6

9.4

9.2

9.1

Common equity tier 1 capital ratio

13.6

13.3

13.1

12.9

12.4

Tier 1 risk-based capital ratio

13.6

13.3

13.1

12.9

12.4

Total risk-based capital ratio

14.8

14.5

14.3

14.1

13.7

Sep 30,

Jun 30,

Mar 31,

Dec 31,

Sep 30,

(dollars in thousands, except for per

share amounts)

2024

2024

2024

2023

2023

BALANCE SHEET

Total loans, net of deferred fees and

costs

$

5,342,609

$

5,383,644

$

5,401,417

$

5,438,982

$

5,508,710

Total assets

7,415,430

7,386,952

7,409,999

7,642,796

7,637,924

Total deposits

6,583,013

6,582,455

6,618,854

6,847,592

6,874,745

Long-term debt

156,284

156,223

156,163

156,102

156,041

Total shareholders’ equity

543,725

518,647

507,203

503,815

468,598

Total shareholders’ equity to total

assets

7.33

%

7.02

%

6.84

%

6.59

%

6.14

%

ASSET QUALITY

Allowance for credit losses (ACL)

$

61,647

$

62,225

$

63,532

$

63,934

$

64,517

Nonaccrual loans

11,597

10,257

10,132

7,008

6,652

Non-performing assets (NPA)

11,597

10,257

10,132

7,008

6,652

Ratio of ACL to total loans

1.15

%

1.16

%

1.18

%

1.18

%

1.17

%

Ratio of NPA to total assets

0.16

%

0.14

%

0.14

%

0.09

%

0.09

%

PER SHARE OF COMMON STOCK OUTSTANDING

Book value per common share

$

20.09

$

19.16

$

18.76

$

18.63

$

17.33

Closing market price per common share

29.51

21.20

19.75

19.68

16.68

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Consolidated Balance Sheets

(Unaudited)

TABLE 2

Sep 30,

Jun 30,

Mar 31,

Dec 31,

Sep 30,

(Dollars in thousands, except share

data)

2024

2024

2024

2023

2023

ASSETS

Cash and due from financial

institutions

$

100,064

$

103,829

$

98,410

$

116,181

$

108,818

Interest-bearing deposits in other

financial institutions

226,505

195,062

214,472

406,256

329,913

Investment securities:

Available-for-sale debt securities, at

fair value

723,453

676,719

660,833

647,210

625,253

Held-to-maturity debt securities, at

amortized cost; fair value of: $546,990 at September 30, 2024,

$528,088 at June 30, 2024, $541,685 at March 31, 2024, $565,178 at

December 31, 2023, and $531,887 at September 30, 2023

606,117

615,867

624,948

632,338

640,053

Total investment securities

1,329,570

1,292,586

1,285,781

1,279,548

1,265,306

Loans held for sale

1,609

3,950

755

1,778

—

Loans, net of deferred fees and costs

5,342,609

5,383,644

5,401,417

5,438,982

5,508,710

Less: allowance for credit losses

(61,647

)

(62,225

)

(63,532

)

(63,934

)

(64,517

)

Loans, net of allowance for credit

losses

5,280,962

5,321,419

5,337,885

5,375,048

5,444,193

Premises and equipment, net

104,575

100,646

97,688

96,184

97,378

Accrued interest receivable

23,942

23,184

21,957

21,511

21,529

Investment in unconsolidated entities

54,836

40,155

40,780

41,546

42,523

Mortgage servicing rights

8,513

8,636

8,599

8,696

8,797

Bank-owned life insurance

175,914

173,716

172,228

170,706

168,543

Federal Home Loan Bank of Des Moines

("FHLB") stock

6,929

6,925

6,921

6,793

10,995

Right-of-use lease assets

32,192

32,081

32,079

29,720

32,294

Other assets

69,819

84,763

92,444

88,829

107,635

Total assets

$

7,415,430

$

7,386,952

$

7,409,999

$

7,642,796

$

7,637,924

LIABILITIES

Deposits:

Noninterest-bearing demand

$

1,838,009

$

1,847,173

$

1,848,554

$

1,913,379

$

1,969,523

Interest-bearing demand

1,255,382

1,283,669

1,290,321

1,329,189

1,345,843

Savings and money market

2,336,323

2,234,111

2,211,966

2,209,733

2,209,550

Time

1,153,299

1,217,502

1,268,013

1,395,291

1,349,829

Total deposits

6,583,013

6,582,455

6,618,854

6,847,592

6,874,745

Long-term debt, net of unamortized debt

issuance costs of: $263 at September 30, 2024, $324 at June 30,

2024, $384 at March 31, 2024, $445 at December 31, 2023, and $506

at September 30, 2023

156,284

156,223

156,163

156,102

156,041

Lease liabilities

33,807

33,422

33,169

30,634

33,186

Accrued interest payable

12,980

14,998

16,654

18,948

16,752

Other liabilities

85,621

81,207

77,956

85,705

88,602

Total liabilities

6,871,705

6,868,305

6,902,796

7,138,981

7,169,326

EQUITY

Shareholders' equity:

Preferred stock, no par value, authorized

1,000,000 shares; issued and outstanding: none at September 30,

2024, June 30, 2024, March 31, 2024, December 31, 2023, and

September 30, 2023

—

—

—

—

—

Common stock, no par value, authorized

185,000,000 shares; issued and outstanding: 27,064,501 at September

30, 2024, 27,063,644 at June 30, 2024, 27,042,326 at March 31,

2024, 27,045,033 at December 31, 2023, and 27,043,169 at September

30, 2023

404,494

404,494

404,494

405,439

405,439

Additional paid-in capital

104,794

104,161

103,130

102,982

102,550

Retained earnings

138,951

132,683

123,902

117,990

110,156

Accumulated other comprehensive loss

(104,514

)

(122,691

)

(124,323

)

(122,596

)

(149,547

)

Total shareholders' equity

543,725

518,647

507,203

503,815

468,598

Total liabilities and equity

$

7,415,430

$

7,386,952

$

7,409,999

$

7,642,796

$

7,637,924

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Consolidated Statements of

Income

(Unaudited)

TABLE 3

Three Months Ended

Nine Months Ended

Sep 30,

Jun 30,

Mar 31,

Dec 31,

Sep 30,

Sep 30,

(Dollars in thousands, except per share

data)

2024

2024

2024

2023

2023

2024

2023

Interest income:

Interest and fees on loans

$

65,469

$

64,422

$

62,819

$

62,429

$

62,162

$

192,710

$

180,886

Interest and dividends on investment

securities:

Taxable investment securities

8,975

8,466

7,211

7,292

7,016

24,652

21,497

Tax-exempt investment securities

551

598

655

686

709

1,804

2,226

Interest on deposits in other financial

institutions

2,775

2,203

3,611

3,597

2,412

8,589

3,566

Dividend income on FHLB stock

127

151

106

109

113

384

369

Total interest income

77,897

75,840

74,402

74,113

72,412

228,139

208,544

Interest expense:

Interest on deposits:

Interest-bearing demand

484

490

499

467

460

1,473

1,234

Savings and money market

10,235

8,977

8,443

7,459

6,464

27,655

14,520

Time

11,040

12,173

12,990

12,741

11,268

36,203

26,464

Interest on short-term borrowings

—

1

—

—

—

1

1,139

Interest on long-term debt

2,287

2,278

2,283

2,304

2,292

6,848

6,329

Total interest expense

24,046

23,919

24,215

22,971

20,484

72,180

49,686

Net interest income

53,851

51,921

50,187

51,142

51,928

155,959

158,858

Provision for credit losses

2,833

2,239

3,936

4,653

4,874

9,008

11,045

Net interest income after provision for

credit losses

51,018

49,682

46,251

46,489

47,054

146,951

147,813

Other operating income:

Mortgage banking income

822

1,040

613

611

765

2,475

1,981

Service charges on deposit accounts

2,167

2,135

2,103

2,312

2,193

6,405

6,441

Other service charges and fees

5,947

5,869

5,261

5,349

5,203

17,077

15,182

Income from fiduciary activities

1,447

1,449

1,435

1,272

1,234

4,331

3,623

Income from bank-owned life insurance

1,897

1,234

1,522

2,015

379

4,653

2,855

Net loss on sales of investment

securities

—

—

—

(1,939

)

(135

)

—

(135

)

Other

454

394

310

5,552

408

1,158

1,544

Total other operating income

12,734

12,121

11,244

15,172

10,047

36,099

31,491

Other operating expense:

Salaries and employee benefits

22,299

21,246

20,735

20,164

19,015

64,280

61,886

Net occupancy

4,612

4,597

4,600

4,676

4,725

13,809

13,509

Computer software

4,590

4,381

4,287

4,026

4,473

13,258

13,700

Legal and professional services

2,460

2,506

2,320

2,245

2,359

7,286

7,714

Equipment

972

995

1,010

968

1,112

2,977

2,990

Advertising

889

901

914

1,045

968

2,704

2,843

Communication

740

657

837

632

809

2,234

2,378

Other

10,125

5,868

5,873

8,766

6,150

21,866

16,601

Total other operating expense

46,687

41,151

40,576

42,522

39,611

128,414

121,621

Income before income taxes

17,065

20,652

16,919

19,139

17,490

54,636

57,683

Income tax expense

3,760

4,835

3,974

4,273

4,349

12,569

13,880

Net income

$

13,305

$

15,817

$

12,945

$

14,866

$

13,141

$

42,067

$

43,803

Per common share data:

Basic earnings per share

$

0.49

$

0.58

$

0.48

$

0.55

$

0.49

$

1.55

$

1.62

Diluted earnings per share

0.49

0.58

0.48

0.55

0.49

1.55

1.62

Cash dividends declared

0.26

0.26

0.26

0.26

0.26

0.78

0.78

Basic weighted average shares

outstanding

27,064,035

27,053,549

27,046,525

27,044,121

27,042,762

27,054,737

27,022,141

Diluted weighted average shares

outstanding

27,194,625

27,116,349

27,099,101

27,097,285

27,079,484

27,137,985

27,081,541

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Average Balances, Interest Income &

Expense, Yields and Rates (Taxable Equivalent)

(Unaudited)

TABLE 4

Three Months Ended

Three Months Ended

Three Months Ended

September 30, 2024

June 30, 2024

September 30, 2023

Average

Average

Average

Average

Average

Average

(Dollars in thousands)

Balance

Yield/Rate

Interest

Balance

Yield/Rate

Interest

Balance

Yield/Rate

Interest

ASSETS

Interest-earning assets:

Interest-bearing deposits in other

financial institutions

$

203,657

5.42

%

$

2,775

$

162,393

5.46

%

$

2,203

$

177,780

5.38

%

$

2,412

Investment securities:

Taxable

1,340,347

2.68

8,975

1,335,100

2.54

8,466

1,354,039

2.07

7,016

Tax-exempt [1]

141,168

1.98

697

142,268

2.13

757

149,824

2.40

897

Total investment securities

1,481,515

2.61

9,672

1,477,368

2.50

9,223

1,503,863

2.10

7,913

Loans, including loans held for sale

5,330,810

4.89

65,469

5,385,829

4.80

64,422

5,507,248

4.49

62,162

FHLB stock

6,928

7.31

127

6,925

8.71

151

10,975

4.09

113

Total interest-earning assets

7,022,910

4.43

78,043

7,032,515

4.34

75,999

7,199,866

4.01

72,600

Noninterest-earning assets

324,493

306,199

310,671

Total assets

$

7,347,403

$

7,338,714

$

7,510,537

LIABILITIES AND EQUITY

Interest-bearing liabilities:

Interest-bearing demand deposits

$

1,267,135

0.15

%

$

484

$

1,273,901

0.15

%

$

490

$

1,339,294

0.14

%

$

460

Savings and money market deposits

2,298,853

1.77

10,235

2,221,754

1.63

8,977

2,209,835

1.16

6,464

Time deposits up to $250,000

534,497

3.15

4,238

555,809

3.29

4,548

449,844

2.33

2,637

Time deposits over $250,000

647,728

4.18

6,802

703,280

4.36

7,625

844,842

4.05

8,631

Total interest-bearing deposits

4,748,213

1.82

21,759

4,754,744

1.83

21,640

4,843,815

1.49

18,192

FHLB advances and other short-term

borrowings

—

—

—

66

5.60

1

—

—

—

Long-term debt

156,247

5.82

2,287

156,188

5.86

2,278

156,005

5.83

2,292

Total interest-bearing liabilities

4,904,460

1.95

24,046

4,910,998

1.96

23,919

4,999,820

1.63

20,484

Noninterest-bearing deposits

1,787,209

1,788,023

1,894,256

Other liabilities

124,806

130,186

136,343

Total liabilities

6,816,475

6,829,207

7,030,419

Total equity

530,928

509,507

480,118

Total liabilities and equity

$

7,347,403

$

7,338,714

$

7,510,537

Net interest income

$

53,997

$

52,080

$

52,116

Interest rate spread

2.48

%

2.38

%

2.38

%

Net interest margin

3.07

%

2.97

%

2.88

%

[1]

Interest income and resultant

yield information for tax-exempt investment securities is expressed

on a taxable-equivalent basis using a federal statutory tax rate of

21%.

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Average Balances, Interest Income &

Expense, Yields and Rates (Taxable Equivalent)

(Unaudited)

TABLE 5

Nine Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

Average

Average

Average

Average

(Dollars in thousands)

Balance

Yield/Rate

Interest

Balance

Yield/Rate

Interest

ASSETS

Interest-earning assets:

Interest-bearing deposits in other

financial institutions

$

210,464

5.45

%

$

8,589

$

91,202

5.23

%

$

3,566

Investment securities:

Taxable

1,333,394

2.47

24,652

1,376,294

2.08

21,497

Tax-exempt [1]

142,085

2.14

2,284

151,611

2.48

2,818

Total investment securities

1,475,479

2.43

26,936

1,527,905

2.12

24,315

Loans, including loans held for sale

5,372,247

4.79

192,710

5,525,476

4.37

180,886

FHLB stock

6,885

7.43

384

11,687

4.21

369

Total interest-earning assets

7,065,075

4.32

228,619

7,156,270

3.90

209,136

Noninterest-earning assets

313,404

316,620

Total assets

$

7,378,479

$

7,472,890

LIABILITIES AND EQUITY

Interest-bearing liabilities:

Interest-bearing demand deposits

$

1,279,256

0.15

%

$

1,473

$

1,373,831

0.12

%

$

1,234

Savings and money market deposits

2,246,478

1.64

27,655

2,188,585

0.89

14,520

Time deposits up to $250,000

544,823

3.22

13,125

394,464

1.88

5,544

Time deposits over $250,000

714,763

4.31

23,078

775,615

3.61

20,920

Total interest-bearing deposits

4,785,320

1.82

65,331

4,732,495

1.19

42,218

FHLB advances and other short-term

borrowings

22

5.60

1

31,182

4.88

1,139

Long-term debt

156,188

5.86

6,848

146,513

5.78

6,329

Total interest-bearing liabilities

4,941,530

1.95

72,180

4,910,190

1.35

49,686

Noninterest-bearing deposits

1,793,854

1,957,267

Other liabilities

129,181

131,577

Total liabilities

6,864,565

6,999,034

Total equity

513,914

473,856

Total liabilities and equity

$

7,378,479

$

7,472,890

Net interest income

$

156,439

$

159,450

Interest rate spread

2.37

%

2.55

%

Net interest margin

2.95

%

2.98

%

[1]

Interest income and resultant

yield information for tax-exempt investment securities is expressed

on a taxable-equivalent basis using a federal statutory tax rate of

21%.

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Loans by Geographic

Distribution

(Unaudited)

TABLE 6

Sep 30,

Jun 30,

Mar 31,

Dec 31,

Sep 30,

(Dollars in thousands)

2024

2024

2024

2023

2023

HAWAII:

Commercial and industrial

$

411,209

$

415,538

$

420,009

$

421,736

$

406,433

Real estate:

Construction

134,043

147,657

145,213

163,337

174,057

Residential mortgage

1,897,919

1,913,177

1,924,889

1,927,789

1,930,740

Home equity

697,123

706,811

729,210

736,524

753,980

Commercial mortgage

1,157,625

1,150,703

1,103,174

1,063,969

1,045,625

Consumer

277,849

287,295

306,563

322,346

338,248

Total loans, net of deferred fees and

costs

4,575,768

4,621,181

4,629,058

4,635,701

4,649,083

Less: Allowance for credit losses

(47,789

)

(47,902

)

(48,739

)

(48,189

)

(48,105

)

Loans, net of allowance for credit

losses

$

4,527,979

$

4,573,279

$

4,580,319

$

4,587,512

$

4,600,978

U.S. MAINLAND: [1]

Commercial and industrial

$

188,238

$

169,318

$

156,087

$

153,971

$

157,373

Real estate:

Construction

24,083

23,865

23,356

22,182

37,455

Commercial mortgage

312,685

314,667

319,088

318,933

319,802

Consumer

241,835

254,613

273,828

308,195

344,997

Total loans, net of deferred fees and

costs

766,841

762,463

772,359

803,281

859,627

Less: Allowance for credit losses

(13,858

)

(14,323

)

(14,793

)

(15,745

)

(16,412

)

Loans, net of allowance for credit

losses

$

752,983

$

748,140

$

757,566

$

787,536

$

843,215

TOTAL:

Commercial and industrial

$

599,447

$

584,856

$

576,096

$

575,707

$

563,806

Real estate:

Construction

158,126

171,522

168,569

185,519

211,512

Residential mortgage

1,897,919

1,913,177

1,924,889

1,927,789

1,930,740

Home equity

697,123

706,811

729,210

736,524

753,980

Commercial mortgage

1,470,310

1,465,370

1,422,262

1,382,902

1,365,427

Consumer

519,684

541,908

580,391

630,541

683,245

Total loans, net of deferred fees and

costs

5,342,609

5,383,644

5,401,417

5,438,982

5,508,710

Less: Allowance for credit losses

(61,647

)

(62,225

)

(63,532

)

(63,934

)

(64,517

)

Loans, net of allowance for credit

losses

$

5,280,962

$

5,321,419

$

5,337,885

$

5,375,048

$

5,444,193

[1]

U.S. Mainland includes

territories of the United States.

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Deposits

(Unaudited)

TABLE 7

Sep 30,

Jun 30,

Mar 31,

Dec 31,

Sep 30,

(Dollars in thousands)

2024

2024

2024

2023

2023

Noninterest-bearing demand

$

1,838,009

$

1,847,173

$

1,848,554

$

1,913,379

$

1,969,523

Interest-bearing demand

1,255,382

1,283,669

1,290,321

1,329,189

1,345,843

Savings and money market

2,336,323

2,234,111

2,211,966

2,209,733

2,209,550

Time deposits up to $250,000

536,316

547,212

544,600

533,898

465,543

Core deposits

5,966,030

5,912,165

5,895,441

5,986,199

5,990,459

Other time deposits greater than

$250,000

492,221

476,457

487,950

486,812

484,156

Government time deposits

124,762

193,833

235,463

374,581

400,130

Total time deposits greater than

$250,000

616,983

670,290

723,413

861,393

884,286

Total deposits

$

6,583,013

$

6,582,455

$

6,618,854

$

6,847,592

$

6,874,745

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Nonperforming Assets and Accruing Loans

90+ Days Past Due

(Unaudited)

TABLE 8

Sep 30,

Jun 30,

Mar 31,

Dec 31,

Sep 30,

(Dollars in thousands)

2024

2024

2024

2023

2023

Nonaccrual loans:

Commercial and industrial

$

376

$

355

$

357

$

432

$

352

Real estate:

Residential mortgage

9,680

7,991

7,979

4,962

4,949

Home equity

915

1,247

929

834

677

Commercial mortgage

—

77

77

77

77

Consumer

626

587

790

703

597

Total nonaccrual loans

11,597

10,257

10,132

7,008

6,652

Other real estate owned ("OREO")

—

—

—

—

—

Total nonperforming assets ("NPAs")

11,597

10,257

10,132

7,008

6,652

Accruing loans 90+ days past due:

Real estate:

Construction

—

—

588

—

—

Residential mortgage

13

1,273

386

—

794

Home equity

135

135

560

229

—

Consumer

481

896

924

1,083

2,120

Total accruing loans 90+ days past due

629

2,304

2,458

1,312

2,914

Total NPAs and accruing loans 90+ days

past due

$

12,226

$

12,561

$

12,590

$

8,320

$

9,566

Ratio of total nonaccrual loans to total

loans

0.22

%

0.19

%

0.19

%

0.13

%

0.12

%

Ratio of total NPAs to total assets

0.16

0.14

0.14

0.09

0.09

Ratio of total NPAs to total loans and

OREO

0.22

0.19

0.19

0.13

0.12

Ratio of total NPAs and accruing loans 90+

days past due to total loans and OREO

0.23

0.23

0.23

0.15

0.17

Quarter-to-quarter changes in NPAs:

Balance at beginning of quarter

$

10,257

$

10,132

$

7,008

$

6,652

$

11,061

Additions

3,484

1,920

4,792

1,836

2,311

Reductions:

Payments

(602

)

(363

)

(263

)

(268

)

(5,718

)

Return to accrual status

(354

)

(27

)

(198

)

(137

)

(207

)

Charge-offs, valuation and other

adjustments

(1,188

)

(1,405

)

(1,207

)

(1,075

)

(795

)

Total reductions

(2,144

)

(1,795

)

(1,668

)

(1,480

)

(6,720

)

Balance at end of quarter

$

11,597

$

10,257

$

10,132

$

7,008

$

6,652

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Allowance for Credit Losses on

Loans

(Unaudited)

TABLE 9

Three Months Ended

Nine Months Ended

Sep 30,

Jun 30,

Mar 31,

Dec 31,

Sep 30,

Sep 30,

(Dollars in thousands)

2024

2024

2024

2023

2023

2024

2023

Allowance for credit losses:

Balance at beginning of period

$

62,225

$

63,532

$

63,934

$

64,517

$

63,849

$

63,934

$

63,738

Provision for credit losses on loans

3,040

2,448

4,121

4,959

4,526

9,609

10,276

Charge-offs:

Commercial and industrial

(663

)

(519

)

(682

)

(419

)

(402

)

(1,864

)

(1,543

)

Real estate:

Residential mortgage

(99

)

(284

)

—

—

—

(383

)

—

Consumer

(3,956

)

(4,345

)

(4,838

)

(5,976

)

(4,710

)

(13,139

)

(11,269

)

Total charge-offs

(4,718

)

(5,148

)

(5,520

)

(6,395

)

(5,112

)

(15,386

)

(12,812

)

Recoveries:

Commercial and industrial

158

130

90

84

261

378

636

Real estate:

Construction

—

—

—

—

1

—

1

Residential mortgage

8

9

8

7

10

25

70

Home equity

—

—

6

42

—

6

15

Consumer

934

1,254

893

720

982

3,081

2,593

Total recoveries

1,100

1,393

997

853

1,254

3,490

3,315

Net charge-offs

(3,618

)

(3,755

)

(4,523

)

(5,542

)

(3,858

)

(11,896

)

(9,497

)

Balance at end of period

$

61,647

$

62,225

$

63,532

$

63,934

$

64,517

$

61,647

$

64,517

Average loans, net of deferred fees and

costs

$

5,330,810

$

5,385,829

$

5,400,558

$

5,458,245

$

5,507,248

$

5,372,247

$

5,525,476

Ratio of annualized net charge-offs to

average loans

0.27

%

0.28

%

0.34

%

0.41

%

0.28

%

0.30

%

0.23

%

Ratio of ACL to total loans

1.15

1.16

1.18

1.18

1.17

1.15

%

1.17

%

CENTRAL PACIFIC FINANCIAL CORP. AND

SUBSIDIARIES

Reconciliation of Non-GAAP Financial

Measures

(Unaudited)

TABLE 10

The Company uses certain non-GAAP financial measures in addition

to our GAAP results to provide useful information which we believe

are better indicators of the Company's core activities. This

information should be considered as supplemental in nature and

should not be considered in isolation or as a substitute for the

related financial information prepared in accordance with GAAP. In

addition, these non-GAAP financial measures may not be comparable

to similarly entitled measures reported by other companies.

The following reconciling adjustments from GAAP or reported

financial measures to non-GAAP adjusted financial measures are

limited to the $3.1 million in pre-tax expenses related to our

evaluation and assessment of a strategic opportunity. Management

does not consider these expenses to be representative of the

Company's core earnings.

Three Months Ended September 30,

2024

Nine Months Ended September 30,

2024

(dollars in thousands,

Non-GAAP

Non-GAAP

except per share data)

Reported

Adjustment

Adjusted

Reported

Adjustment

Adjusted

Financial measures:

Net income

$

13,305

$

2,362

$

15,667

$

42,067

$

2,362

$

44,429

Diluted earnings per share ("EPS")

$

0.49

$

0.09

$

0.58

$

1.55

$

0.09

$

1.64

Pre-provision net revenue (non-GAAP)

$

19,898

$

3,068

$

22,966

$

63,644

$

3,068

$

66,712

Efficiency ratio (non-GAAP)

70.12

%

(4.61

)%

65.51

%

66.86

%

(1.60

)%

65.26

%

Return on average assets ("ROA")

0.72

%

0.13

%

0.85

%

0.76

%

0.04

%

0.80

%

Return on average shareholders' equity

("ROE")

10.02

%

1.73

%

11.75

%

10.91

%

0.60

%

11.51

%

As of September 30, 2024:

Tangible common equity ratio

(non-GAAP)

7.31

%

0.03

%

7.34

%

The following tables present a recalculation of the non-GAAP

financial measures presented above.

Three Months Ended

Nine Months Ended

(dollars in thousands, except per share

data)

September 30, 2024

September 30, 2024

GAAP net income

$

13,305

$

42,067

Add: Pre-tax expenses related to a

strategic opportunity

3,068

3,068

Less: Income tax effect (assumes 23%

ETR)

(706

)

(706

)

Expenses related to a strategic

opportunity, net of tax

2,362

2,362

Adjusted net income (non-GAAP)

$

15,667

$

44,429

Diluted weighted average shares

outstanding

27,194,625

27,137,985

GAAP EPS

$

0.49

$

1.55

Add: Expenses related to a strategic

opportunity, net of tax

0.09

0.09

Adjusted EPS (non-GAAP)

$

0.58

$

1.64

CENTRAL PACIFIC FINANCIAL CORP. AND

SUBSIDIARIES

Reconciliation of Non-GAAP Financial

Measures

(Unaudited)

TABLE 10 (CONTINUED)

Three Months Ended

Nine Months Ended

(dollars in thousands)

September 30, 2024

September 30, 2024

GAAP net income

$

13,305

$

42,067

Add: Income tax expense

3,760

12,569

GAAP pre-tax income

17,065

54,636

Add: Provision for credit losses

2,833

9,008

Pre-provision net revenue ("PPNR")

(non-GAAP)

19,898

63,644

Add: Pre-tax expenses related to a

strategic opportunity

3,068

3,068

Adjusted PPNR (non-GAAP)

$

22,966

$

66,712

Three Months Ended

Nine Months Ended

(dollars in thousands)

September 30, 2024

September 30, 2024

Total other operating expense

$

46,687

$

128,414

Less: Expenses related to a strategic

opportunity

(3,068

)

(3,068

)

Adjusted total other operating expense

(non-GAAP)

$

43,619

$

125,346

Net interest income

$

53,851

$

155,959

Total other operating income

12,734

36,099

Total revenue

$

66,585

$

192,058

Efficiency ratio (non-GAAP)

70.12

%

66.86

%

Less: Expenses related to a strategic

opportunity

(4.61

)%

(1.60

)%

Adjusted efficiency ratio (non-GAAP)

65.51

%

65.26

%

Three Months Ended

Nine Months Ended

(dollars in thousands)

September 30, 2024

September 30, 2024

Average assets

$

7,347,403

$

7,378,479

Add: Expenses related to a strategic

opportunity, net of tax

2,362

787

Adjusted average assets (non-GAAP)

$

7,349,765

$

7,379,266

ROA (GAAP net income divided by average

assets)

0.72

%

0.76

%

Add: Expenses related to a strategic

opportunity, net of tax

0.13

0.04

Adjusted ROA (non-GAAP)

0.85

%

0.80

%

Average shareholders' equity

$

530,928

$

513,914

Add: Expenses related to a strategic

opportunity, net of tax

2,362

787

Adjusted average shareholders' equity

(non-GAAP)

$

533,290

$

514,701

ROE (GAAP net income divided by average

shareholders' equity)

10.02

%

10.91

%

Add: Expenses related to a strategic

opportunity, net of tax

1.73

0.60

Adjusted ROE (non-GAAP)

11.75

%

11.51

%

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Reconciliation of Non-GAAP Financial

Measures

(Unaudited)

TABLE 10 (CONTINUED)

(dollars in thousands)

September 30, 2024

Total shareholders' equity

$

543,725

Less: Intangible assets

(1,390

)

Tangible common equity ("TCE")

542,335

Add: Expenses related to a strategic

opportunity, net of tax

2,362

Adjusted TCE (non-GAAP)

$

544,697

Total assets

$

7,415,430

Less: Intangible assets

(1,390

)

Tangible assets

7,414,040

Add: Expenses related to a strategic

opportunity, net of tax

2,362

Adjusted tangible assets (non-GAAP)

$

7,416,402

TCE ratio (non-GAAP) (TCE divided by

tangible assets)

7.31

%

Add: Expenses related to a strategic

opportunity, net of tax

0.03

Adjusted TCE ratio (non-GAAP)

7.34

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030600615/en/

Investor Contact: Ian Tanaka SVP, Treasury Manager (808)

544-3646 ian.tanaka@cpb.bank Media Contact: Tim Sakahara

AVP, Corporate Communications Manager (808) 544-5125

tim.sakahara@cpb.bank

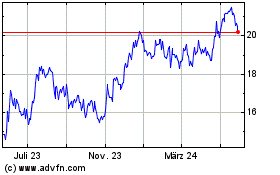

Central Pacific Financial (NYSE:CPF)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Central Pacific Financial (NYSE:CPF)

Historical Stock Chart

Von Jan 2024 bis Jan 2025