Global Net Lease Sells Americold Portfolio for $170 Million

27 Juni 2024 - 12:00PM

Global Net Lease, Inc. (NYSE: GNL) (“GNL” or the “Company”) today

announced the successful disposition of a portfolio of nine cold

storage properties that are currently leased to subsidiaries of

Americold Realty Trust, Inc. (NYSE: COLD) for $170 million, at a

7.88% cash cap rate on 3.3 years of weighted average remaining

lease-term.

This disposition is a significant achievement in

GNL’s ongoing strategic disposition initiative and aligns with the

Company’s 2024 full-year guidance, which projected a disposition

cash cap rate range of 7% to 8%. GNL plans to use the net proceeds

from this sale to reduce outstanding debt and further lower the

Company’s leverage. The sale of this portfolio, which GNL acquired

for $153.4 million, is part of the previously announced $567

million1 of closed and pipeline dispositions at a cash cap rate of

7.2%.

“We believe the sale of this portfolio not only

reduces risk within our portfolio by eliminating uncertainty around

tenant renewals but also extends our weighted average remaining

lease term,” said Michael Weil, CEO of GNL. “We intend to use the

net sale proceeds of this disposition to strategically pay down

existing debt, aligning with our goal of lowering our Net Debt to

Adjusted EBITDA to bring it more in line with our peers. We

continue to be extremely pleased with the velocity of our strategic

disposition initiative and we look forward to continuing to execute

on this strategy until we narrow the gap between the value of our

real estate and our stock price.”

About Global Net Lease,

Inc.Global Net Lease, Inc. is a publicly traded real

estate investment trust listed on the NYSE, which focuses on

acquiring and managing a global portfolio of income producing net

lease assets across the United States, and Western and Northern

Europe. Additional information about GNL can be found on its

website at www.globalnetlease.com.

Important NoticeThe statements

in this press release that are not historical facts may be

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements involve risks and uncertainties that could cause the

outcome to be materially different. The words such as "may,"

"will," "seeks," "anticipates," "believes," "expects," "estimates,"

"projects," “potential,” “predicts,” "plans," "intends," “would,”

“could,” "should" and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. These forward-looking

statements are subject to a number of risks, uncertainties and

other factors, many of which are outside of the Company's control,

which could cause actual results to differ materially from the

results contemplated by the forward-looking statements. These risks

and uncertainties include the risks associated with realization of

the anticipated benefits of the merger with The Necessity Retail

REIT, Inc. and the internalization of the Company’s property

management and advisory functions; that any potential future

acquisition or disposition by the Company is subject to market

conditions and capital availability and may not be identified or

completed on favorable terms, or at all. Some of the risks and

uncertainties, although not all risks and uncertainties, that could

cause the Company’s actual results to differ materially from those

presented in the Company’s forward-looking statements are set forth

in the Risk Factors and “Quantitative and Qualitative Disclosures

about Market Risk” in the Company’s Annual Report on Form 10-K, its

Quarterly Reports on Form 10-Q, and all of its other filings with

the U.S. Securities and Exchange Commission, as such risks,

uncertainties and other important factors may be updated from time

to time in the Company’s subsequent reports. Further,

forward-looking statements speak only as of the date they are made,

and the Company undertakes no obligation to update or revise any

forward-looking statement to reflect changed assumptions, the

occurrence of unanticipated events or changes to future operating

results over time, unless required by law.

Contacts:Investor RelationsEmail:

investorrelations@globalnetlease.comPhone: (332) 265-2020

Footnotes:1 As previously

disclosed on GNL’s Current Report Form 8-K filed with the U.S.

Securities and Exchange Commission on June 3, 2024.

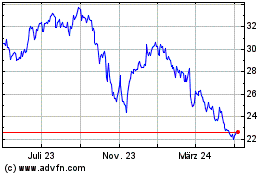

Americold Realty (NYSE:COLD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Americold Realty (NYSE:COLD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024