false000145586300014558632024-01-032024-01-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 3, 2024

Americold Realty Trust, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Maryland | 001-34723 | 93-0295215 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | | | | |

| 10 Glenlake Parkway, | South Tower, Suite 600 | |

|

| Atlanta, | Georgia | | 30328 |

(Address of principal executive offices) | | (Zip Code) |

(678) 441-1400

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | COLD | | New York Stock Exchange |

Item 5.02 — Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Chief Financial Officer Transition

On January 3, 2024, Americold Realty Trust, Inc. (the “Company”) announced that it and Marc J. Smernoff, Executive Vice President and Chief Financial Officer, have mutually agreed that Mr. Smernoff’s employment with the Company will terminate effective January 12, 2024.

In connection with his separation, and consistent with the terms of his existing employment agreement, the form of which was previously filed with the Securities and Exchange Commission as Exhibit 10.1 to the Company’s Form 10-Q filed on November 5, 2021, Mr. Smernoff will receive the following: (i) an amount equal to the product of one times the sum of (a) his annual base salary as in effect immediately prior to his termination of employment, plus (b) his annual bonus at Target Percentage (as defined in his employment agreement) as in effect immediately prior to his termination, continued for a period of 12 months; (ii) any unpaid annual bonus for 2023 to be paid at the time the Company pays other bonuses, (iii) prorated annual incentive plan bonus based on the number of days employed during the bonus period (to the extent that performance metrics relating to bonus are met at the end of the bonus period as determined after the year-end audit); (iv) payment or reimbursement of welfare plan coverage (other than long- and short-term disability plans), including COBRA premiums for Mr. Smernoff and his eligible dependents, for up to 12 months; (v) the next installment of his time-based restricted stock units and operating partnership profits units that would have vested on the next scheduled vesting date after January 12, 2024 will vest; and (vi) a prorated portion of his performance-based restricted stock units and operating partnership profits units will remain eligible to vest based on actual performance through the last day of the performance period, based on the number of days during the performance period that Mr. Smernoff was employed, subject to his execution and non-revocation of a release of claims and compliance with post-termination restrictive covenants as set forth in his employment agreement.

On January 3, 2024, the Company also announced that Jay Wells would be joining the Company as Executive Vice President and Chief Financial Officer, effective January 15, 2024.

Mr. Wells, age 61, served as Chief Financial Officer of Primo Water (NYSE:PRMW), Tampa, Florida, from March 2012 through March 2023. Prior to Primo Water, Mr. Wells served in a variety of leadership roles at Molson Coors Beverage Company (NYSE: TAP), Chicago, Illinois, from April 2005 through March 2012, including as Chief Financial Officer (July 2009 through March 2012); Vice President of Strategic Finance, Tax, Treasury (May 2008 to July 2009); Vice President – Global Tax (April 2005 to April 2008). In addition, he served in a variety of positions at Deloitte from September 1990 to April 2005, finally as Partner – International Tax. Mr. Wells is a Certified Public Accountant and received his J.D. Degree from Villanova University and a B.S. in Accounting from Albright College.

There are no family relationships between Mr. Wells and any Company director or executive officer, and no arrangements or understandings between Mr. Wells and any other person pursuant to which he was selected as an officer. Mr. Wells is not a party to any current or proposed transaction with the Company for which disclosure is required under Item 404(a) of Regulation S-K.

In connection with his appointment, Mr. Wells accepted an offer letter dated December 27, 2023 (the “Offer Letter”) pursuant to which he will serve as Executive Vice President and Chief Financial Officer beginning on January 15, 2024. Mr. Wells will receive an initial annual base salary of $575,000. Mr. Wells’ 2024 target bonus opportunity will be 90% of his base salary and he will be eligible to participate in the Company’s 2017 Equity Incentive Plan at such times and in such amounts as the Company’s Compensation Committee shall determine in its sole discretion. For 2024, aligned with the Company’s regular annual grant cycle, Mr. Wells will receive an award with a targeted value of $1,100,000 in the form of a combination of time-based and performance-based restricted stock units or OP Units, at Mr. Wells’ option. Mr. Wells will be eligible to participate in the Company’s standard health and welfare benefit plans and will be covered by the Americold Logistics, LLC Executive Severance Benefit Plan.

The foregoing summary of the Offer Letter is not complete and is qualified in its entirety by the Offer Letter, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Appointment of Presidents

On January 3, 2024, the Company also announced that, effective immediately, Robert S. Chambers, previously serving as Executive Vice President and Chief Commercial Officer, will assume the role of President, Americas and Richard C. Winnall, previously serving as Executive Vice President and Chief Operating Officer – International, will assume the role of President, International.

Mr. Chambers, age 41 re-joined Americold in January of 2020 as Executive Vice President and Chief Commercial Officer. Prior to that he served as the Chief Financial Officer of Saia LTL Freight (NASDAQ: SAIA) from May of 2019 through January of 2020. Mr. Chambers previously served as Americold’s Vice President, Commercial Finance from September of 2013 through April of 2019. Before originally joining Americold, Mr. Chambers was the Senior Director of Finance for CEVA Logistics from 2010 through 2013. Prior to that, he was a Manager in the Audit and Advisory practice at KPMG. Mr. Chambers is a Certified Public Accountant. He received both his bachelor’s degree and his Masters of Accounting degree from Stetson University.

In connection with his appointment, Mr. Chambers will receive an increase in his annual base salary to $550,000 from $500,000. Mr. Chambers’ 2024 target bonus opportunity will remain 90% of his base salary. He will continue to be eligible to participate in the Company’s 2017 Equity Incentive Plan at such times and in such amounts as the Company’s Compensation Committee shall determine, with a target award of up to $1,100,000 for 2024. Mr. Chambers will also continue to be eligible to participate in the Company’s standard health and welfare benefit plans and the terms of his existing employment agreement with the Company remain unchanged.

There are no family relationships between Mr. Chambers and any Company director or executive officer, and no arrangements or understandings between Mr. Chambers and any other person pursuant to which he was selected as an officer. Mr. Chambers is not a party to any current or proposed transaction with the Company for which disclosure is required under Item 404(a) of Regulation S-K.

Mr. Winnall, age 50, was appointed Chief Operating Officer, International in August 2022. He joined Americold in January of 2019 as the Managing Director, International and held the role of Managing Director, Asia Pacific and Latin America prior to his appointment as Chief Operating Officer, International. Mr. Winnall is responsible for leading Americold’s International operations and critical support functions to enable the organization to drive efficiency and provide best-in-class service to customers. Mr. Winnall has worked at some of the largest logistics companies in the world, having previously served at DHL Supply Chain (DPDHL Group) in Asia Pacific and Europe, Middle East & Africa, and Linfox in the Asia Pacific region. He holds a Master of Science Management, Intermodal Transport from the University of Denver, Colorado, and a Master of International Business from Swinburne University, Melbourne, and is a graduate of the GAICD International Company Directors Program.

In connection with his appointment, Mr. Winnall will receive an increase in his annual base salary to AUD$610,000 from AUD$535,000. Mr. Winnall’s 2024 target bonus opportunity will be increased to 75%, from 60%, of his base salary and he will continue to be eligible to participate in the Company’s 2017 Equity Incentive Plan at such times and in such amounts as the Company’s Compensation Committee shall determine, with a target award of up to USD$750,000 for 2024. Mr. Winnall’s terms of his existing employment agreement with the Company remain unchanged.

There are no family relationships between Mr. Winnall and any Company director or executive officer, and no arrangements or understandings between Mr. Winnall and any other person pursuant to which he was selected as an officer. Mr. Winnall is not a party to any current or proposed transaction with the Company for which disclosure is required under Item 404(a) of Regulation S-K.

Appointment of Executive Vice President and Chief Operating Officer, Americas

Also on January 3, 2023, the Company announced that, effective immediately, M. Bryan Verbarendse, previously serving as Executive Vice President and Chief Operating Officer, North America, will assume the role of Executive Vice President and Chief Operating Officer, Americas.

Mr. Verbarendse, age 50, was appointed Executive Vice President and Chief Operating Officer – North America on August 28, 2023. Mr. Verbarendse has more than 31 years of experience in retail and wholesale grocery supply chain management. Prior to joining the Company, he served in various positions at Albertson’s Companies, Inc. from 1992 to 2023, including General Manager roles at Albertson’s and SUPERVALU. Group Vice President of Distribution and finally as Senior Vice President of Distribution and Replenishment for Albertson’s. The terms of Mr. Verbarendse’s employment with the Company remain unchanged.

There are no family relationships between Mr. Verbarendse and any Company director or executive officer, and no arrangements or understandings between Mr. Verbarendse and any other person pursuant to which he was selected as an officer. Mr. Verbarendse is not a party to any current or proposed transaction with the Company for which disclosure is required under Item 404(a) of Regulation S-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit No. | | Description |

| | Press Release dated January 3, 2024 |

| | Offer Letter by and between Americold Logistics, LLC and Jay Wells dated December 27, 2023 |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 3, 2024

| | | | | | | | |

| Americold Realty Trust, Inc. |

| | |

| By: | /s/ Nathan H. Harwell |

| | Name: Nathan H. Harwell |

| | Title: Chief Legal Officer and Executive Vice President |

| | |

December 27, 2023

Jay Wells

Delivered via email

Dear Jay,

It is my pleasure to submit to you this employment offer with Americold. We believe you bring the breadth and depth of experience that will support solid growth for our company. Based on your position within our company, the following offer provisions should be attractive and can be summarized within these points:

The position being offered is Executive Vice President & Chief Financial Officer, effective on January 15, 2024.

You will report to our Chief Executive Officer, George Chappelle, and be based out of the Atlanta office. You will be offered relocation in accordance with our relocation policy that will be provided to you separately.

The annual base salary for this position is $575,000.00, which on a bi-weekly basis is $22,115.38.

The annual incentive compensation opportunity for meeting stated performance goals is targeted at 90% of your base salary effective the month in which you start and paid in accordance with the terms of the Annual Incentive Plan (“AIP”).

You will be eligible to participate in the Americold Realty Trust 2017 Equity Incentive Plan (the “Plan”) in such amounts and at such times as the Compensation Committee of the Board of Directors shall determine at its sole discretion. All awards will be subject to the terms and conditions of the Plan. Subject to the final approval of the Compensation Committee and Board of Directors, the terms of the Plan and associated grant documentation:

oIt is anticipated that your 2024 annual grant, which includes a combination of time-based and performance Restricted Stock Units, will have a target value of $1,100,000.

You will be provided with a competitive benefit plan which includes paid medical/dental/vision for you and your dependents through our Executive Health program. Additionally, we offer life insurance, disability, 401(k) and other benefits. Your healthcare benefits coverage will be effective the first (1st) day of the month following your start date.

You will be eligible for 25 days Paid Time Off per calendar year on a prorated basis in accordance with the company’s policy, as well as 7 paid holidays and 2 floating holidays.

Additional details such as notice to leave the Company and any other termination provisions will be found in our Executive Severance Benefits Plan, which will be provided to you separately.

The Company reserves the right to modify benefits and offerings due to plan amendments. This offer and your continued employment are contingent on you passing our pre-employment drug screen, background verifications, receiving favorable references and presenting timely and valid documentation as required by the Immigration Reform and Control Act to ensure you are authorized to work in the United States. In addition, you will need to complete our conflict of interest questionnaire and apply for the required SEC codes.

Please note that Americold is an “at will” employer. You have the right to review this job offer with anyone you choose, at your cost. This offer shall remain open until December 29th, 2023.

Jay, all of us are excited about the opportunities ahead and the contributions we see you making with our company. We are convinced you will add significant value to the success of Americold. The team looks forward to making your transition to your new position within the Americold family as smooth as possible.

With best regards,

Samantha Charleston

10 Glenlake Parkway | Suite 600, South Tower | Atlanta, GA 30328 | USA | p. +1.678.441.1400 | f. +1.678.441.6824 | www.americold.com

Samantha “Sam” Charleston

EVP & Chief Human Resources Officer

cc: George Chappelle, Lisa Chasey

| | | | | | | | | | | |

Please sign below to confirm your understanding and acceptance of the above terms and conditions of the employment offer.

|

| Signature: | /s/ Jay Wells | Date: | 12/27/2023 |

10 Glenlake Parkway | Suite 600, South Tower | Atlanta, GA 30328 | USA | p. +1.678.441.1400 | f. +1.678.441.6824 | www.americold.com

For Immediate Release

Americold Announces Leadership Updates

Marc Smernoff Departing as Chief Financial Officer, Effective January 12, 2024

Jay Wells Appointed Chief Financial Officer, Effective January 15, 2024

Realigns Leadership Team to Establish Further Performance Ownership Across Geographies

ATLANTA, GA, Jan. 3, 2023 -- Americold Realty Trust, Inc. (NYSE: COLD) (the “Company”), a global leader in temperature-controlled logistics, real estate, and value-added services focused on the ownership, operation, acquisition, and development of temperature-controlled warehouses, today announced a series of leadership updates. As part of these changes, the Company and Marc J. Smernoff, Executive Vice President and Chief Financial Officer, have mutually agreed that Mr. Smernoff’s employment with the Company will terminate, effective January 12, 2024. Jay Wells has been appointed to succeed Mr. Smernoff as Executive Vice President and Chief Financial Officer, effective January 15, 2024.

“I would like to thank Marc for his considerable contributions to Americold’s evolution over the last nearly 20 years,” stated George Chappelle, Chief Executive Officer of Americold Realty Trust. “Marc played a key role in guiding us through our initial public offering, building a best-in-class finance organization and strengthening our financial structure to fuel our growth. On behalf of the Board and leadership team, I wish him all the best in his future endeavors.”

Mr. Wells is a veteran public company financial executive with more than 30 years of experience building and leading international teams, and considerable financial planning and transaction expertise. He joins Americold from Primo Water (NYSE: PRMW), a leading, publicly-traded water company focused on the US and Canada, where he served as Chief Financial Officer from 2012 to 2023. Prior to his time at Primo Water, he was the Chief Financial Officer of the Canada Division of Molson Coors Beverages. Earlier in his career, he spent 15 years as a partner at Deloitte, where he oversaw the development and implementation of complex tax strategies on behalf of his client base and developed significant expertise in cross-border financing.

“We are pleased to welcome Jay to the Americold team,” stated Mr. Chappelle. “Jay is a results-oriented executive with a track record of driving profitable growth. I am confident that his keen strategic mindset and experience in prudent capital management make him the right fit for Americold as we continue to pursue our disciplined growth strategy. I look forward to working with Jay to build on our momentum and deliver enhanced value for our shareholders.”

“Americold has built a leading global portfolio with a best-in-class operating platform, and I am honored to join their business as CFO,” said Jay Wells. “I look forward to working with the team

to continue to strengthen Americold’s financial foundation and position the business for future success.”

Leadership Team Realignment

Americold also announced that it would realign its executive leadership team to establish further ownership of financial performance across geographies:

•Rob Chambers, Americold’s Executive Vice President and Chief Commercial Officer, will assume the role of President, Americas, effective immediately.

•Richard Winnall, Executive Vice President and Chief Operating Officer, International, will assume the role of President, International, effective immediately.

Both Mr. Chambers and Mr. Winnall will continue to report directly to Mr. Chappelle.

Mr. Chappelle concluded, “These changes to our leadership structure reflect our continued international expansion and will allow our team to more effectively implement strategic initiatives and take control of business performance across our markets.”

About Americold Realty Trust, Inc.

Americold is a global leader in temperature-controlled logistics real estate and value-added services. Focused on the ownership, operation, acquisition, and development of temperature-controlled warehouses, Americold owns and/or operates 243 temperature-controlled warehouses, with approximately 1.5 billion refrigerated cubic feet of storage, in North America, Europe, Asia-Pacific, and South America. Americold’s facilities are an integral component of the supply chain connecting food producers, processors, distributors, and retailers to consumers.

Forward-Looking Statements

Statements contained in this press release that are not statements of historical fact, including those that refer to the Company’s management changes, growth strategy and the impact on shareholder value are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are based on our beliefs, assumptions and expectations of our future financial and operating performance and growth plans, taking into account the information currently available to us. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties that may cause our actual results to differ materially from the expectations of future results we express or imply in any forward-looking statements, and you should not place undue reliance on such statements. Information about potential risks and uncertainties that could affect the Company’s business and financial results is included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other documents the Company files with the Securities and Exchange Commission. The Company undertakes no obligation to update or revise any forward-looking statements to reflect subsequent events or circumstances, except as required by applicable law or regulation.

Contacts:

Americold Realty Trust, Inc.

Media Relations

Email: mediarelations@americold.com

Investor Relations

Email: investor.relations@americold.com

v3.23.4

Cover Page Document

|

Jan. 03, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 03, 2024

|

| Entity Registrant Name |

Americold Realty Trust, Inc.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-34723

|

| Entity Tax Identification Number |

93-0295215

|

| Entity Address, Address Line One |

10 Glenlake Parkway,

|

| Entity Address, Address Line Two |

South Tower, Suite 600

|

| Entity Address, City or Town |

Atlanta,

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30328

|

| City Area Code |

678

|

| Local Phone Number |

441-1400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

COLD

|

| Security Exchange Name |

NYSE

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001455863

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

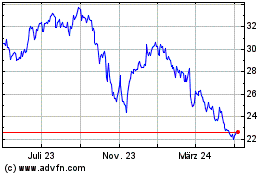

Americold Realty (NYSE:COLD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Americold Realty (NYSE:COLD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024