Badger Meter, Inc. (NYSE: BMI) today reported record results for

the first quarter ended March 31, 2024.

First Quarter 2024 Highlights

- Record total sales of $196.3 million, 23% higher than the prior

year’s $159.1 million.

- Operating profit increased 46% year-over-year, with operating

profit margins expanding 290 basis points to a record 18.6% from

15.7%.

- Diluted earnings per share (EPS) increased 50% to $0.99, up

from $0.66 in the comparable prior year quarter.

- Completed the acquisition of the Telog/Unity remote network

monitoring offering at the start of the year.

“The continued strength in both customer demand and operating

execution drove exceptional performance in our first quarter, with

record quarterly revenue, operating profit and EPS results. These

record results are reflective of ongoing favorable industry

fundamentals, driving robust customer demand for our innovative

smart water solutions. Our operating profit margins benefited from

higher volumes, solid operating execution and selling, engineering

and administration (SEA) expense leverage. Additionally, we

completed the acquisition of the Telog/Unity network monitoring

offering at the beginning of the year with seamless integration of

their hardware and software teams well underway,” said Kenneth C.

Bockhorst, Chairman, President and Chief Executive Officer. “I am

pleased with our collective achievements to start off the year and

want to thank our world-class employees for their dedication and

commitment to serving our customers.”

First Quarter Operating Results

Utility water sales increased 29% year-over-year reflecting

continued customer adoption across our broad and expanding

portfolio of smart water solutions. This encompasses our cellular

AMI offering, inclusive of ORION® Cellular endpoints and BEACON®

Software as a Service (SaaS) revenues coupled with increased water

meter volumes including E-Series® Ultrasonic meters. The growth

also extends to water quality, pressure and network monitoring

solutions which increased sales year-over-year.

Sales of flow instrumentation products increased sequentially

yet declined 3% year-over-year against a difficult prior year

comparison which benefited from backlog conversion on improved

supply chain dynamics a year ago. Water-focused end markets

continued to experience solid order demand.

Operating earnings increased 46% year-over-year, with operating

profit margins reaching a record 18.6% in the first quarter of

2024, a 290 basis point improvement from the prior year’s 15.7%.

Gross margin dollars increased $14.4 million year-over-year, and

gross margin as a percent of sales was 39.3%, up 10 basis points

sequentially and within our normalized range. The stable gross

margin range reflects the continued benefits of positive sales mix

and higher volumes, despite inflationary cost pressures.

SEA expenses in the first quarter of 2024 were $40.6 million,

$2.8 million higher than the comparable prior year quarter and up

$1.2 million sequentially from the fourth quarter. As a percent of

sales, SEA improved by 300 basis points to 20.7% versus 23.7% in

the comparable prior year quarter. The year-over-year increase in

SEA expenses was the result of growth investments including higher

personnel-related costs such as headcount, salaries, and incentive

compensation.

The tax rate for the first quarter of 2024 was 23.5%, modestly

below the prior year’s 24.3%. As a result of the above, combined

with increased interest income, EPS was a record $0.99, up 50%

compared to $0.66 in the comparable prior year period.

Outlook

Bockhorst continued, “Our first quarter results demonstrate our

continued adeptness in capitalizing on the resilient macro trends

within the water industry. While we face more difficult prior year

comparisons as the year progresses, we have confidence in the

durability of our end markets, the appeal of our innovative

offerings and strength of our execution to drive sales and earnings

growth.

“Our expanding suite of end-to-end smart water offerings

provides our customers with the ability to customize and tailor

solutions to best meet their water management needs. Our proven

strategy and strong balance sheet support our ongoing capital

allocation priorities including value-added, disciplined

acquisitions to continue to differentiate our offerings.

“We were proud to be named for the second consecutive year to

Barron's 2024 list of 100 Most Sustainable Companies. Additionally,

we were named a 2024 USA Top Workplace. We believe these types of

recognition demonstrate our longstanding philosophy that both

managing and enabling sustainability drives long-term shareholder

value and world-class employee engagement.”

Bockhorst concluded, “Badger Meter remains committed to serving

our customers, executing our strategy and investing for long-term

profitable growth which in turn enables us to preserve the world’s

most precious resource.”

Conference Call and Webcast

Information

Badger Meter management will hold a conference call to discuss

the Company’s first quarter 2024 results today, Thursday, April 18,

2024 at 10:00 AM Central/11:00 AM Eastern time. The listen-only

webcast and related presentation can be accessed via the Investor

section of our website. Participants can also register to take part

in the call using this online registration link:

https://www.netroadshow.com/events/login?show=3351168b&confId=63073

Safe Harbor Statement

Certain statements contained in this news release, as well as

other information provided from time to time by Badger Meter, Inc.

(the “Company”) or its employees, may contain forward-looking

statements that involve risks and uncertainties that could cause

actual results to differ materially from those statements. The

Company’s results are subject to general economic conditions,

variation in demand from customers, continued market acceptance of

new products, the successful integration of acquisitions,

competitive pricing and operating efficiencies, supply chain risk,

material and labor cost increases, tax reform and foreign currency

risk. See the Company’s Annual Report on Form 10-K filed with the

Securities and Exchange Commission for further information

regarding risk factors, which are incorporated herein by reference.

Badger Meter disclaims any obligation to publicly update or revise

any forward-looking statements as a result of new information,

future events or any other reason.

About Badger Meter

With more than a century of water technology innovation, Badger

Meter is a global provider of industry leading water solutions

encompassing flow measurement, quality and other system parameters.

These offerings provide our customers with the data and analytics

essential to optimize their operations and contribute to the

sustainable use and protection of the world’s most precious

resource. For more information, visit www.badgermeter.com.

BADGER METER, INC.

CONSOLIDATED CONDENSED STATEMENTS

OF OPERATIONS

(in thousands, except share and

earnings per share data)

Three Months Ended March 31,

2024

2023

(Unaudited)

(Unaudited)

Net sales

$

196,280

$

159,101

Cost of sales

119,102

96,285

Gross margin

77,178

62,816

Selling, engineering and

administration

40,600

37,770

Operating earnings

36,578

25,046

Interest income, net

(1,526

)

(622

)

Other pension and postretirement costs

12

32

Earnings before income taxes

38,092

25,636

Provision for income taxes

8,961

6,221

Net earnings

$

29,131

$

19,415

Earnings per share:

Basic

$

0.99

$

0.66

Diluted

$

0.99

$

0.66

Shares used in computation of earnings per

share:

Basic

29,320,483

29,255,184

Diluted

29,494,488

29,420,954

BADGER METER, INC.

CONSOLIDATED CONDENSED BALANCE

SHEETS

(in thousands)

Assets

March 31,

December 31,

2024

2023

(Unaudited)

Cash and cash equivalents

$

199,310

$

191,782

Receivables

92,287

83,507

Inventories

160,444

153,674

Prepaid expenses and other current

assets

18,557

13,214

Total current assets

470,598

442,177

Net property, plant and equipment

72,934

73,878

Intangible assets, at cost less

accumulated amortization

52,471

53,737

Other long-term assets

33,997

33,964

Goodwill

113,474

113,163

Total assets

$

743,474

$

716,919

Liabilities

and Shareholders' Equity

Payables

$

90,617

$

81,807

Accrued compensation and employee

benefits

15,588

29,871

Other current liabilities

28,889

20,270

Total current liabilities

135,094

131,948

Deferred income taxes

4,894

5,061

Long-term employee benefits and other

67,919

63,428

Shareholders' equity

535,567

516,482

Total liabilities and shareholders'

equity

$

743,474

$

716,919

BADGER METER, INC.

CONSOLIDATED CONDENSED STATEMENTS

OF CASH FLOWS

(in thousands)

Three Months Ended March 31,

2024

2023

(Unaudited)

(Unaudited)

Operating activities:

Net earnings

$

29,131

$

19,415

Adjustments to reconcile net earnings to

net cash provided by operations:

Depreciation

2,892

2,663

Amortization

5,118

4,284

Deferred income taxes

-

(10

)

Noncurrent employee benefits

1

(37

)

Stock-based compensation expense

1,271

1,006

Changes in:

Receivables

(9,164

)

(6,843

)

Inventories

(6,405

)

(11,439

)

Payables

7,960

6,959

Prepaid expenses and other assets

(8,065

)

(2,133

)

Other liabilities

(1,279

)

4,105

Total adjustments

(7,671

)

(1,445

)

Net cash provided by operations

21,460

17,970

Investing activities:

Property, plant and equipment

expenditures

(2,676

)

(4,271

)

Acquisitions, net of cash acquired

(3,000

)

(17,052

)

Net cash used for investing activities

(5,676

)

(21,323

)

Financing activities:

Dividends paid

(7,942

)

(6,626

)

Proceeds from exercise of stock

options

230

58

Net cash used for financing activities

(7,712

)

(6,568

)

Effect of foreign exchange rates on

cash

(544

)

230

Increase (decrease) in cash and cash

equivalents

7,528

(9,691

)

Cash and cash equivalents - beginning of

period

191,782

138,052

Cash and cash equivalents - end of

period

$

199,310

$

128,361

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240418011680/en/

Karen Bauer (414) 371-7276 kbauer@badgermeter.com

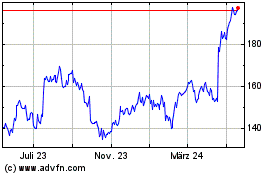

Badger Meter (NYSE:BMI)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

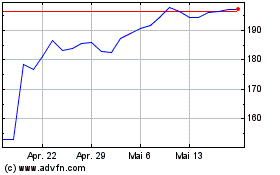

Badger Meter (NYSE:BMI)

Historical Stock Chart

Von Jan 2024 bis Jan 2025