UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): March 10, 2009 (March 10, 2009)

Brown-Forman Corporation

(Exact name of registrant as specified in its charter)

Delaware 002-26821 61-0143150

(State or other (Commission (I.R.S. Employer

jurisdiction of File Number) Identification No.)

incorporation)

|

850 Dixie Highway, Louisville, Kentucky 40210

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code (502) 585-1100

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition

Brown-Forman Corporation issued a press release today, March 10, 2009, reporting

results of its operations for the fiscal quarter and nine-month period ended

January 31, 2009. A copy of this Brown-Forman Corporation press release is

attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits

(a) Not applicable.

(b) Not applicable.

(c) Exhibits

99.1 Press Release dated March 10, 2009.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Brown-Forman Corporation

(Registrant)

Date: March 10, 2009 By: /s/ Nelea A. Absher

Nelea A. Absher

Vice President, Associate

General Counsel and Assistant

Corporate Secretary

|

Exhibit Index

99.1 Press Release, dated March 10, 2009, issued by Brown-Forman Corporation,

reporting results of operations for the fiscal quarter and nine-month

period ended January 31, 2009.

Exhibit 99.1

FOR IMMEDIATE RELEASE

BROWN-FORMAN REPORTS GROWTH IN EARNINGS PER SHARE: 9% IN THIRD QUARTER; 7% FOR

THE FIRST NINE MONTHS OF FISCAL 2009

Louisville, KY, March 10, 2009 - Brown-Forman Corporation reported diluted

earnings per share(1) increased 9% to $0.81 for its fiscal 2009 third quarter

ending January 31, 2009. For the first nine months of the fiscal year, diluted

earnings per share increased 7% to $2.34. Reported operating income decreased 2%

to $177 million for the quarter and decreased 2% to $540 million fiscal

year-to-date. Adjusting for items in Schedule A of this press release, most

notably the impact of foreign exchange, underlying(2) operating income grew 8%

for the third quarter and 5% for the first nine months of fiscal 2009. In

addition, reported operating margin (operating income as a percent of net sales)

remained relatively consistent at nearly 22% when comparing the first nine

months of fiscal 2009 to the same prior year period.

Paul Varga, the company's chief executive officer stated, "We are pleased to

report solid underlying growth in net sales and operating income through the

first nine months of our fiscal 2009. While the global economic slowdown

affected our sales in the third quarter, we continued to run the company in a

manner we believe is appropriate for this environment. Like most companies

today, we are cautious regarding the short-term outlook given the extreme

difficulty and uncertainty in the global economy. At the same time, however, we

believe the strength of our brands and the health of our balance sheet places

Brown-Forman in a strong position both today and as conditions improve.

(1) All per share amounts have been adjusted to reflect the October 27, 2008

Class B common stock distribution. For every four shares of Class A or

Class B common stock, one Class B share was issued.

(2) Underlying growth represents the percentage growth in reported financial

results in accordance with GAAP, adjusted for certain items.

A reconciliation from reported to underlying net sales, gross profit,

advertising expense, SG&A, and operating income (non-GAAP measures) growth

for the quarter and the first nine months of the fiscal year, and the

reasons why management believes these adjustments to be useful to the

reader, are included in Schedule A and the notes to this press release.

The company's reported net sales of $2.5 billion for the nine months ended

January 31, 2009 were flat when compared with the first nine months of last

year. Adjusting for movements in foreign exchange rates, estimated changes in

global distributor inventories, discontinued agency relationships, and the

Australian ready-to-drink excise tax increase, underlying net sales grew 4%

versus the same prior year period. For the third quarter, reported net sales

decreased 11% due primarily to the impact of foreign exchange, while underlying

net sales grew 1%.

- Net sales for the Jack Daniel' s Family of Whiskey Brands, excluding

ready-to-drink products, were flat on a reported basis but grew in the

mid-single digits on a constant currency(3) basis for the first nine months

of the fiscal year. Global depletions(4) grew in the low single digits for

the first nine months of fiscal 2009 as gains in the U.S., Eastern Europe,

Australia, and Latin America were partially offset by declines in Germany,

Spain, South Africa, Italy, and Turkey. Third quarter depletion results

were down in the low single digits due primarily to significant inventory

reductions around the world. For the first nine months of fiscal 2009,

reported net sales for Jack Daniel's Tennessee Whiskey decreased at a low

single digit rate, while on a constant currency basis the brand's net sales

grew at a low single digit rate. Gentleman Jack's net sales grew at a

double-digit rate on both a reported and a constant currency basis for the

nine month period.

- Reported net sales for the Jack Daniel's & Cola ready-to-drink brand declined

in the low single digits while constant currency net sales increased in the

high single digits for the nine months ended January 31, 2009. Depletions

increased at a healthy double-digit rate in the third quarter, nearly erasing

the declines experienced in the first half of the year associated with the

substantial increase of ready-to-drink excise taxes in Australia.

(3) Constant currency represents reported net sales with the cost/benefit of

currency movements removed. Management uses the measure to understand the

growth of the business on a constant dollar basis, as fluctuations in

exchange rates can distort the underlying growth of the business both

positively and negatively.

(4) Depletions are shipments direct to retail or from distributors to wholesale

and retail customers, and are commonly regarded in the industry as an

approximate measure of consumer demand.

- Finlandia Vodka's net sales continued to grow at double-digit rates on both

a reported and a constant currency basis for the nine month period,

reflecting higher shipments and pricing gains. Led by Eastern Europe, global

depletions advanced at double-digit rates for both the three and nine month

periods. During the third quarter, Finlandia's depletions passed the 3

million case mark on a rolling twelve month basis.

- Southern Comfort's net sales decreased at a high single-digit rate on a

reported basis and contracted at a low single-digit rate on a constant

currency basis during the first nine months of fiscal 2009. The brand

continued to be negatively affected by the consumer switch to off-premise

channels, particularly in the U.S., as well as reductions in inventory

levels. Third quarter depletion gains in Australia and Germany were more

than offset by declines in the U.S. and the U.K.

- Reported and constant currency net sales grew at double-digit rates for

Sonoma-Cutrer, in the high single digits for Bonterra and Woodford Reserve,

and in the low single digits for Tuaca for the nine month period. Reported

net sales for the Casa Herradura portfolio declined in the low single digits

for the nine month period while constant currency sales grew in the low

single digits. Chambord's reported net sales decreased in low single digits

and remained flat on a constant currency basis for the nine month period

through January 2009. During the third quarter, the company's super-premium

brands experienced softer depletion trends when compared to the first half

as they were increasingly impacted by the global economic downturn and

resulting inventory reductions.

For the first nine months of the year, reported gross profit declined 6%, while

underlying gross profit increased 1% after adjusting for foreign exchange rate

movements, changes in global distributor inventories, discontinued agency

relationships, and the non-cash agave inventory charge recognized earlier this

fiscal year. Underlying gross profit growth lagged underlying net sales trends,

due in part to increased value-added packaging costs and higher grain and fuel

costs when compared to the first nine months of last year. For the third

quarter, reported gross profit decreased 14% and underlying gross profit

declined 2%. The significant strengthening of the U.S. dollar and inventory

reductions for our brands in many markets around the world were the major

factors contributing to these declines.

Reported advertising investments contracted 6% for the first nine months of the

year compared to the same period last year. Adjusting for foreign exchange

movements and spending behind discontinued agency brands, underlying advertising

investments decreased 2% for the first nine months of fiscal 2009. The company

continued to reallocate spending and adjust its promotional mix to those brands,

markets, and channels where it believes the consumer and trade are most

responsive to the investments, which included increased spending for value-added

packaging that is reflected in cost of goods and selective discounting programs,

which affects net sales.

Selling, general, and administrative (SG&A) expenses were down 8% for the first

nine months when compared with the same period of last year as the company

benefited from continued tight management of discretionary spending as well as

lower performance-related costs, such as incentive compensation. Adjusting for

changes in foreign exchange rates, transition costs related to the fiscal 2007

Casa Herradura acquisition, and the expenses incurred related to our Italian

wines divestiture, SG&A decreased 6% for the nine months ended January 31, 2009.

Brown-Forman's balance sheet remained strong and the company continued to

operate during the nine month period with an "A2" rating from Moody's and an "A"

rating from Standard & Poor's. On January 9, 2009 the company completed the sale

of $250 million in aggregate principal amount of 5% Notes due February 1, 2014.

The company enjoyed continued access to commercial paper markets throughout the

quarter. The strength of the balance sheet was supported through strong positive

operating cash flows of $343 million for the first nine months of fiscal 2009.

During the third quarter, Brown-Forman paid a cash dividend of $0.2875 per share

on its Class A and Class B Common Stock, a 6% increase over the dividend paid

the prior quarter.

Full-Year Outlook

Due to the impact of foreign exchange and global inventory reductions, and our

assumption that these factors will impact our reported results further in the

fourth quarter, we are revising our fiscal year 2009 full year earnings per

share guidance downward to a range of $2.70 to $2.90. This new range represents

a potential reported decline of 5% to possible growth of 2% over prior year

earnings per share of $2.84. The updated range reflects our cautious outlook

about the global economic environment and its continued effect on our business

throughout the remainder of our fiscal year. Additionally, our guidance includes

the impact of the noncash agave write off and the gain on the sale of Italian

wines announced earlier this fiscal year. This outlook also incorporates

expectations for continued tight management of discretionary expenses, lower

performance-related costs, and a lower effective tax rate in the fourth quarter

when compared to the first nine months of the fiscal year.

Commenting on the updated guidance, Varga said "The condition of the global

economy today and the mood of people over the last fifteen months, particularly

the last six months, are obvious causes for concern. And while this may temper

shorter-term growth rates for everyone, including Brown-Forman, we do not

believe it diminishes the wonderful long-term opportunities which still exist to

build our brands over time for the immense benefit of our shareholders."

Brown-Forman will host a conference call to discuss the results at 9:30 a.m.

(EST) this morning. All interested parties in the U.S. are invited to join the

conference call by dialing 888-624-9285 and asking for the Brown-Forman call.

International callers should dial 706-679-3410 and ask for the Brown-Forman

call. No password is required. The company suggests that participants dial in

approximately ten minutes in advance of the 9:30 a.m. start of the conference

call.

A live audio broadcast of the conference call will also be available via

Brown-Forman's Internet Web site, www.brown-forman.com, through a link to

"Investor Relations." For those unable to participate in the live call, a replay

will be available by calling 800-642-1687 (U.S.) or 706-645-9291

(international). The identification code is 87273422. A digital audio recording

of the conference call will also be available on the Web site approximately one

hour after the conclusion of the conference call. The replay will be available

for at least 30 days following the conference call.

Brown-Forman Corporation is a producer and marketer of fine quality beverage

alcohol brands, including Jack Daniel's, Southern Comfort, Finlandia, Canadian

Mist, Fetzer, Korbel, Gentleman Jack, el Jimador, Tequila Herradura,

Sonoma-Cutrer, Chambord, Tuaca, Woodford Reserve, and Bonterra.

IMPORTANT NOTE ON FORWARD-LOOKING STATEMENTS:

This release contains statements, estimates, or projections that constitute

"forward-looking statements" as defined under U.S. federal securities laws.

Generally, the words "expect," "believe," "intend," "estimate," "will,"

"anticipate," and "project," and similar expressions identify a forward-looking

statement, which speaks only as of the date the statement is made. Except as

required by law, we do not intend to update or revise any forward-looking

statements, whether as a result of new information, future events, or otherwise.

We believe that the expectations and assumptions with respect to our

forward-looking statements are reasonable. But by their nature, forward-looking

statements involve known and unknown risks, uncertainties and other factors that

in some cases are out of our control. These factors could cause our actual

results to differ materially from Brown-Forman's historical experience or our

present expectations or projections. Here is a non-exclusive list of such risks

and uncertainties:

- Continuation of the global economic downturn or turmoil in world financial

and equity markets (and related credit and capital market instability and

illiquidity; decreased consumer and trade spending; higher unemployment;

supplier, customer and consumer credit or other financial problems, inventory

reductions by distributors, wholesalers, and retailers, bank failures or

governmental nationalizations, etc.);

- pricing, marketing, products, and other competitive activity focused against

our major brands;

- continued or further decline in consumer confidence or spending, whether

related to global economic conditions, war, natural disasters, terrorist

attacks or other factors;

- tax increases, changes in tax rules or accounting standards (e.g., LIFO

treatment for inventory), tariff barriers and/or other restrictions affecting

beverage alcohol, whether at the U.S. federal or state level or in other

major markets around the world, and the unpredictability or suddenness with

which they can occur;

- limitations and restrictions on distribution of products and alcohol

marketing, including advertising and promotion, as a result of stricter

governmental policies adopted either in the United States or in our other

major markets;

- changes in and obligations for employees, former employees and retirees cost

of benefits, and lower returns on pension assets;

- fluctuations in the U.S. Dollar against foreign currencies, especially the

British Pound, Euro, Australian Dollar, Polish Zloty, South African Rand,

Japanese Yen, Russian Ruble and Mexican Peso;

- reduced bar, restaurant, hotel and other on-premise business, consumer shifts

to discount stores and other price sensitive purchases and venues;

- longer-term, changes in consumer preferences, societal attitudes or cultural

trends that result in reduced consumption of our premium spirits brands or

ready-to-drink products;

- distribution arrangement changes in major markets that affect the timing of

our sales or limit our ability to market or sell our products successfully;

- adverse impacts as a consequence of our acquisitions, joint ventures,

business partnerships, acquisition strategies, integration of acquired

businesses, or conforming them to the company's trade practice standards,

financial controls environment and U.S. public company requirements;

- price increases in energy or raw materials, such as grapes, grain, agave,

wood, glass, and plastic;

- changes in climate conditions, agricultural uncertainties, our suppliers'

financial hardships or other supply limitations that adversely affect supply,

price, availability, quality, or health of grapes, agave, grain, glass,

closures or wood;

- negative public media related to our company, brands, personnel, operations,

business performance or prospects;

- counterfeit production, tampering, or contamination of our products and any

resulting negative effect on our sales, intellectual property rights, or

brand equity;

- consumer and trade acceptance of product line extensions and new marketing

initiatives;

- adverse developments stemming from state or federal investigations of

beverage alcohol industry marketing or trade practices of suppliers,

distributors or retailers; and

- impairment in the recorded value of inventory, fixed assets, goodwill or

other acquired intangibles.

Brown-Forman Corporation

Unaudited Consolidated Statements of Operations

(Dollars in millions, except per share amounts)

Three Months Ended

January 31,

2008 2009 Change

------ ------ ------

CONTINUING OPERATIONS

Net sales $877.4 $784.1 (11%)

Excise taxes 205.0 191.7 (6%)

Cost of sales 239.8 221.8 (7%)

------ ------

Gross profit 432.6 370.6 (14%)

Advertising expenses 107.6 87.0 (19%)

Selling, general, and

administrative expenses 143.3 113.1 (21%)

Amortization expense 1.3 1.3

Other (income), net (1.2) (8.0)

------ ------

Operating income 181.6 177.2 (2%)

Interest expense, net 9.1 8.1

------ ------

Income before income taxes 172.5 169.1 (2%)

Income taxes 56.6 45.7

------ ------

Net income $115.9 $123.4 6%

====== ======

Earnings per share:

Basic 0.76 0.82 9%

Diluted 0.75 0.81 9%

|

DISCONTINUED OPERATIONS

Net income $ 0.1 $ --

Earnings per share:

Basic -- --

Diluted -- --

|

TOTAL COMPANY

Net income $116.0 $123.4 6%

Earnings per share:

Basic 0.76 0.82 8%

Diluted 0.75 0.81 9%

(more)

|

Brown-Forman Corporation

Unaudited Consolidated Statements of Operations

(Dollars in millions, except per share amounts)

Nine Months Ended

January 31,

2008 2009 Change

------ ------ ------

CONTINUING OPERATIONS

Net sales $2,509.9 $2,508.9 0%

Excise taxes 534.8 564.7 6%

Cost of sales 681.5 726.1 7%

------ ------

Gross profit 1,293.6 1,218.1 (6%)

Advertising expenses 314.2 294.1 (6%)

Selling, general, and

administrative expenses 433.1 397.2 (8%)

Amortization expense 3.8 3.8

Other (income), net (7.2) (16.6)

------ ------

Operating income 549.7 539.6 (2%)

Interest expense, net 32.5 23.5

------ ------

Income before income taxes 517.2 516.1 0%

Income taxes 176.5 161.3

------ ------

Net income $340.7 $354.8 4%

====== ======

Earnings per share:

Basic 2.21 2.36 6%

Diluted 2.19 2.34 7%

|

DISCONTINUED OPERATIONS

Net income $ -- $ --

Earnings per share:

Basic -- --

Diluted -- --

|

TOTAL COMPANY

Net income $340.7 $354.8 4%

Earnings per share:

Basic 2.21 2.36 6%

Diluted 2.19 2.34 7%

(more)

|

Brown-Forman Corporation

Unaudited Condensed Consolidated Balance Sheets

(Dollars in millions)

April 30, January 31,

2008 2009

------- -------

Assets:

Cash and cash equivalents $118.9 $334.7

Accounts receivable, net 453.2 413.5

Inventories 684.5 643.2

Other current assets 199.4 203.1

------- -------

Total current assets 1,456.0 1,594.5

Property, plant, and equipment, net 501.4 479.5

Goodwill 688.0 673.2

Other intangible assets 698.8 686.4

Prepaid pension cost 22.8 26.3

Other assets 38.0 39.9

------- -------

Total assets $3,405.0 $3,499.8

======= =======

Liabilities:

Accounts payable and accrued expenses $379.7 $299.5

Accrued income taxes 14.7 6.0

Dividends payable -- 43.3

Short-term borrowings 589.6 397.2

------- -------

Total current liabilities 984.0 746.0

Long-term debt 417.0 660.6

Deferred income taxes 88.8 108.4

Accrued postretirement benefits 121.2 115.9

Other liabilities 68.8 57.3

------- -------

Total liabilities 1,679.8 1,688.2

Stockholders' equity 1,725.2 1,811.6

------- -------

Total liabilities and stockholders' equity $3,405.0 $3,499.8

======= =======

(more)

|

Brown-Forman Corporation

Unaudited Condensed Consolidated Statements of Cash Flows

(Dollars in millions)

Nine Months Ended

January 31,

2008 2009

------ ------

Cash provided by operating activities $397.3 $342.9

Cash flows from investing activities:

Acquisition of brand names and trademarks (12.0) --

Sale of brand names and trademarks -- 16.8

Sale of short-term investments 85.6 --

Additions to property, plant, and equipment (31.6) (37.1)

Other (3.6) (2.5)

------ ------

Cash provided by (used for)

investing activities 38.4 (22.8)

Cash flows from financing activities:

Net (repayment) issuance of debt (164.4) 66.5

Acquisition of treasury stock (122.0) (22.8)

Special distribution to stockholders (203.7) --

Dividends paid (116.6) (125.6)

Other 19.7 (3.1)

------ ------

Cash used for financing activities (587.0) (85.0)

Effect of exchange rate changes

on cash and cash equivalents 5.1 (19.3)

------ ------

Net (decrease) increase in

cash and cash equivalents (146.2) 215.8

Cash and cash equivalents, beginning of period 282.8 118.9

------ ------

Cash and cash equivalents, end of period $136.6 $334.7

====== ======

(more)

|

Brown-Forman Corporation

Supplemental Information (Unaudited)

(Dollars in millions, except per share amounts)

Three Months Ended

January 31,

2008 2009

------ ------

Gross margin 49.3% 47.3%

Operating margin 20.7% 22.6%

Effective tax rate 32.8% 27.0%

Cash dividends paid per common share $0.2720 $0.2875

Shares (in thousands) used in the

calculation of earnings per share

- Basic 153,545 150,544

- Diluted 154,968 151,486

Nine Months Ended

January 31,

2008 2009

------ ------

Gross margin 51.5% 48.6%

Operating margin 21.9% 21.5%

Effective tax rate 34.1% 31.2%

Cash dividends paid per common share $0.7560 $0.8315

Shares (in thousands) used in the

calculation of earnings per share

- Basic 153,856 150,592

- Diluted 155,348 151,739

|

These figures have been prepared in accordance with the company's customary

accounting practices.

Schedule A

Brown-Forman Corporation

Continuing Operations Only

Supplemental Information (Unaudited)

Three Months Ended Nine Months Ended

January 31, 2009 January 31, 2009

REPORTED CHANGE IN NET SALES (11%) 0%

Australian excise tax (1%) (1%)

Net sales from agency brands 1% 1%

Estimated net change in distributor inventories 2% 1%

Impact of foreign currencies 10% 3%

----- -----

UNDERLYING CHANGE IN NET SALES 1% 4%

===== =====

REPORTED CHANGE IN GROSS PROFIT (14%) (6%)

Non-cash agave charge - 1%

Gross profit from agency brands 1% 1%

Estimated net change in distributor inventories 3% 1%

Impact of foreign currencies 8% 4%

----- -----

UNDERLYING CHANGE IN GROSS PROFIT (2%) 1%

===== =====

REPORTED CHANGE IN ADVERTISING (19%) (6%)

Advertising from agency brands 2% 2%

Impact of foreign currencies 9% 2%

----- -----

UNDERLYING CHANGE IN ADVERTISING (8%) (2%)

===== =====

REPORTED CHANGE IN SG&A (21%) (8%)

Impact from Italian wines divestiture (1%) -

Transition expenses from acquisitions 1% 1%

Impact of foreign currencies 6% 1%

----- -----

UNDERLYING CHANGE IN SG&A (15%) (6%)

===== =====

REPORTED CHANGE IN OPERATING INCOME (2%) (2%)

Operating income from agency brands - 1%

Non-cash agave charge - 4%

Impact from Italian wines divestiture (11%) (4%)

Transition expenses from acquisitions (1%) (1%)

Estimated net change in distributor inventories 6% 1%

Impact of foreign currencies 16% 6%

----- -----

UNDERLYING CHANGE IN OPERATING INCOME 8% 5%

===== =====

|

Notes:

Australian excise tax - Refers to the impact of the 70% increase in excise tax

of ready-to-drink products in Australia, implemented on April 27, 2008. Since

net sales are recorded including excise tax, we believe it is important to make

this adjustment to better understand our underlying sales trends.

Agency brands - Refers to the impact of certain agency brands distributed in

various geographies, primarily Appleton, Amarula, Durbanville Hills, and Red

Bull, which exited Brown-Forman's portfolio during fiscal 2008.

Estimated net change in distributor inventories - Refers to the estimated

financial impact of changes in distributor inventories for the company's brands.

We compute this effect using our estimated depletion trends and separately

identify trade inventory changes in the variance analysis for our key measures.

Based on the estimated depletions and the fluctuations in distributor inventory

levels, we then adjust the percentage variances from prior to current periods

for our key measures. We believe it is important to make this adjustment in

order for management and investors to understand the results of our business

without distortions that can arise from varying levels of distributor

inventories.

Impact of foreign currencies - Refers to net gains and losses incurred by the

company relating to sales and purchases in currencies other than the U.S.

Dollar. We use the measure to understand the growth of the business on a

constant dollar basis as fluctuations in exchange rates can distort the

underlying growth of our business (both positively and negatively). To

neutralize the effect of foreign exchange fluctuations, we have historically

translated current year results at prior year rates. While we recognize that

foreign exchange volatility is a reality for a global company, we routinely

review our company performance on a constant dollar basis. We believe this

allows both management and our investors to understand better our company's

growth trends.

Non-cash agave charge - Refers to an abnormal number of agave plants identified

during the first quarter as dead or dying. Although agricultural uncertainties

are inherent in our tequila or any other business that includes the growth and

harvesting of raw materials, we believe that the magnitude of this item distorts

the underlying trends of our business. Therefore, we believe that excluding this

non-cash charge allows for a better understanding of operating income growth

trends.

Italian wines divestiture - Refers to the company's December 2008 sale of its

Bolla and Fontana Candida Italian wine brands to Gruppo Italiano Vini (GIV). We

believe that excluding the net gain on the sales of these Italian wine brands

provides helpful information in forecasting and planning the growth expectations

of the company.

Acquisitions - Refers to transition related expenses from the acquisition of the

Casa Herradura brands in January 2007, thus making comparisons difficult to

understand. We believe that excluding transition expenses related to the

acquisition provides helpful information in forecasting and planning the growth

expectations of the company.

The company cautions that non-GAAP measures may be considered in addition to,

but not as a substitute for, the company's reported GAAP results.

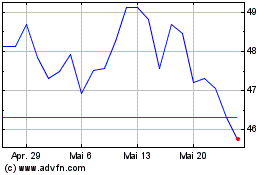

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024