Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

18 Oktober 2024 - 5:20PM

Edgar (US Regulatory)

The

notes

to

financial

statements

form

an

integral

part

of

these

statements.

Schedule

of

Investments

(Unaudited)

Schedule

of

investments

(Unaudited)

August

31,

2024

Name

of

Company

Principal

Amount

Value

%

of

Net

Assets

Corporate

Convertible

Bond

Gold

mining,

exploration,

development

and

royalty

companies

Canada

i-80

Gold

Corp.,

8.00%,

2/22/27

(1)

$3,000,000

$

3,011,700

0.7

%

Total

corporate

convertible

bond

(Cost

$2,960,752)

3,011,700

0.7

Name

of

Company

Shares

Value

%

of

Net

Assets

Common

Shares

Gold

mining,

exploration,

development

and

royalty

companies

Australia

Alicanto

Minerals,

Ltd.

(2)

61,150,765

620,849

0.2

Barton

Gold

Holdings,

Ltd.

(2)

10,400,000

1,830,203

0.4

Cygnus

Gold,

Ltd.

(2)

5,631,596

251,575

0.1

Cygnus

Metals,

Ltd.

(2)

19,300,000

862,172

0.2

Emerald

Resources

NL

(2)

14,000,000

37,903,606

9.0

LCL

Resources,

Ltd.

(2)

36,750,000

211,431

0.1

Perseus

Mining,

Ltd.

5,500,000

9,827,863

2.3

Predictive

Discovery,

Ltd.

(2)

106,183,334

16,530,146

3.9

Prodigy

Gold

NL

(2)

116,250,000

157,368

0.0

Westgold

Resources,

Ltd.

9,465,000

19,475,414

4.6

87,670,627

20.8

Canada

Agnico

Eagle

Mines,

Ltd.

165,000

13,442,550

3.2

Alamos

Gold,

Inc.

1,000,000

19,280,000

4.6

American

Pacific

Mining

Corp.

(2)

3,000,000

278,262

0.1

Angel

Wing

Metals,

Inc.

(2)

4,650,000

224,279

0.1

Atex

Resources,

Inc.

(2)

8,700,000

7,940,489

1.9

B2Gold

Corp.

2,000,000

5,600,000

1.3

Barrick

Gold

Corp.

650,000

13,123,500

3.1

Desert

Gold

Ventures,

Inc.

(2)

14,588,264

811,872

0.2

G

Mining

Ventures

Corp.

(2)

5,816,486

36,988,302

8.8

G2

Goldfields,

Inc.

(2)

3,000,000

3,183,319

0.8

GoGold

Resources,

Inc.

(2)

2,857,140

2,522,908

0.6

Gold

Candle,

Ltd.

144A

(1)(2)(3)

1,510,715

1,961,749

0.5

Lahontan

Gold

Corp.

(2)

19,600,000

799,911

0.1

Liberty

Gold

Corp.

(2)

12,482,000

3,519,579

0.8

Lotus

Gold

Corp.

144A

(1)(2)(3)

5,912,500

2,193,633

0.5

Mawson

Gold,

Ltd.

(2)

10,600,000

7,078,989

1.7

Monarch

Mining

Corp.

(1)(2)

7,300,000

0

0.0

Newcore

Gold,

Ltd.

(2)

5,750,000

1,301,339

0.3

O3

Mining,

Inc.

(2)

2,223,000

1,682,529

0.4

Onyx

Gold

Corp.

(2)

750,000

94,609

0.0

Orla

Mining,

Ltd.

(2)

6,200,000

26,040,000

6.2

Prime

Mining

Corp.

(2)

9,200,000

11,195,785

2.6

Probe

Gold,

Inc.

(2)

7,277,500

7,020,183

1.6

Red

Pine

Exploration,

Inc.

(2)

18,945,090

1,616,655

0.4

Robex

Resources,

Inc.

(2)

4,000,000

8,073,313

1.9

Roscan

Gold

Corp.

(2)

10,886,900

646,275

0.

1

STLLR

Gold,

Inc.

(2)

1,291,080

1,063,406

0.2

Talisker

Resources,

Ltd.

(2)

2,500,000

695,656

0.2

TDG

Gold

Corp.

(2)

9,227,925

684,742

0.

1

Thesis

Gold,

Inc.

(2)

15,200,000

8,120,803

2.0

The

notes

to

financial

statements

form

an

integral

part

of

these

statements.

Name

of

Company

Shares

Value

%

of

Net

Assets

Common

Shares

(continued)

Gold

mining,

exploration,

development

and

royalty

companies

(continued)

Canada

(continued)

Westhaven

Gold

Corp.

(2)

5,500,000

$

714,206

0.2

%

187,898,843

44.

5

Cayman

Islands

Endeavour

Mining

PLC

400,000

8,432,457

2.0

South

Africa

Gold

Fields,

Ltd.

ADR

600,000

8,244,000

2

.

0

United

Kingdom

Anglogold

Ashanti

PLC

275,000

8,159,250

1.9

United

States

Laurentian

Mountain

Resources

144A

(1)(2)(3)

3,500,000

3,500,000

0.8

Total

gold

mining,

exploration,

development

and

royalty

companies

(Cost

$191,073,696)

303,905,177

72.

0

Diversified

metals

mining,

exploration,

development

and

royalty

companies

Australia

Bellavista

Resources

ltd

(2)

4,157,475

745,707

0.2

Castile

Resources,

Ltd.

(2)

15,143,255

717,480

0.2

Delta

Lithium,

Ltd.

(2)

14,578,200

2,170,796

0.5

FireFly

Metals,

Ltd.

(2)

7,258,781

4,667,451

1.1

Genesis

Minerals,

Ltd.

(2)

1,166,934

1,792,935

0.4

Geopacific

Resources,

Ltd.

(2)

28,135,714

495,135

0.1

10,589,504

2.5

Canada

Americas

Gold

&

Silver

Corp.

(2)

2,701,028

664,645

0.2

Aya

Gold

&

Silver,

Inc.

(2)

2,600,000

28,881,386

6.8

Bunker

Hill

Mining

Corp.

(2)

19,214,957

2,138,718

0.5

Calibre

Mining

Corp.

(2)

13,938,302

23,581,292

5.6

Culico

Metals,

Inc.

(2)

1,125,000

79,305

0.0

Emerita

Resources

Corp.

(2)

2,750,000

1,224,354

0.3

Evolve

Strategic

Element

Royalties,

Ltd.

144A

(1)(2)(3)

2,154,000

1,038,920

0.

2

Fuerte

Metals

Corp.

(2)

1,900,000

1,395,763

0.3

Huntsman

Exploration,

Inc.

(2)

617,500

16,037

0.0

Integra

Resources

Corp.

(2)

5,524,510

5,277,106

1.

3

Max

Resource

Corp.

(2)

8,200,000

486,773

0.1

Metalla

Royalty

&

Streaming,

Ltd.

(2)

987,086

2,951,387

0.7

Pan

Global

Resources,

Inc.

(2)

6,667,000

643,127

0.1

Ridgeline

Minerals

Corp.

(2)

2,900,000

355,063

0.1

Sable

Resources,

Ltd.

(2)

26,160,000

776,463

0.2

San

Cristobal

Mining,

Inc.

144A

(1)(2)(3)

2,583,332

20,666,656

4.9

90,176,995

21.

3

United

States

Bendito

Resources,

Inc.

144A

(1)(2)(3)

4,288,000

1,072,000

0.3

Lithium

Africa

Resources

Corp.

144A

(1)(2)(3)

72,000

2,016,000

0.5

3,088,000

0.8

Total

diversified

metals

mining,

exploration,

development

and

royalty

companies

(Cost

$89,556,200)

103,854,499

24.

6

Silver

mining,

exploration,

development

and

royalty

companies

Canada

Andean

Precious

Metals

Corp.

(2)

2,000,000

1,543,428

0.4

Discovery

Silver

Corp.

(2)

1,500

668

0.0

Silver

Mountain

Resources,

Inc.

(2)

13,000,000

627,017

0.1

Silver

Tiger

Metals,

Inc.

(2)

14,795,333

2,140,830

0.5

Total

silver

mining,

exploration,

development

and

royalty

companies

(Cost

$10,883,666)

4,311,943

1.0

Total

common

shares

(Cost

$291,513,562

)

412,071,619

97.

6

Schedule

of

Investments

(Unaudited)

(continued)

August

31,

2024

The

notes

to

financial

statements

form

an

integral

part

of

these

statements.

Name

of

Company

Shares

Value

%

of

Net

Assets

Rights

(1)(2)

Gold

mining,

exploration,

development

and

royalty

companies

Australia

Prodigy

Gold

NL

(Exp.

Date

12/31/49)

58,125,000

$

1

0.0

%

Silver

mining,

exploration,

development

and

royalty

companies

Canada

Pan

American

Silver

Corp.

(Exp.

Date

2/22/29)

393,200

118,483

0.1

Total

rights

(Cost

$136,720)

118,484

0.1

Warrants

(1)(2)

Diversified

metals

mining,

exploration,

development

and

royalty

companies

Australia

Red

Dirt

Metals,

Ltd.

(Exercise

Price

$0.25,

Exp.

Date

11/18/24)

2,834,650

19,186

0.0

Canada

Bunker

Hill

Mining

Corp.

(Exercise

Price

$0.37,

Exp.

Date

4/1/25)

5,000,000

0

0.0

Bunker

Hill

Mining

Corp.

(Exercise

Price

$0.60,

Exp.

Date

2/9/26)

1,250,000

0

0.0

Calibre

Mining

Corp.

(Exercise

Price

$2.19,

Exp.

Date

9/20/24)

1,032,470

107,258

0.0

Integra

Resources

Corp.

(Exercise

Price

$1.20,

Exp.

Date

3/13/27)

275,000

69,380

0.0

Ridgeline

Minerals

Corp.

(Exercise

Price

$0.12,

Exp.

Date

5/7/26)

1,450,000

21,519

0.0

198,157

0.0

Total

diversified

metals

mining,

exploration,

development

and

royalty

companies

(Cost

$533,351)

217,343

0.0

Gold

mining,

exploration,

development

and

royalty

companies

Canada

Angel

Wing

Metals,

Inc.

(Exercise

Price

$0.50,

Exp.

Date

5/4/25)

350,000

0

0.0

Atex

Resources,

Inc.

(Exercise

Price

$1.00,

Exp.

Date

8/31/25)

675,000

140,244

0.0

Desert

Gold

Ventures,

Inc.

(Exercise

Price

$0.25,

Exp.

Date

12/31/24)

594,132

0

0.0

G

Mining

Ventures

Corp.

(Exercise

Price

$7.60,

Exp.

Date

9/9/24)

875,000

675,250

0.2

Lahontan

Gold

Corp.

(Exercise

Price

$0.13,

Exp.

Date

9/1/26)

4,150,000

0

0.0

Lahontan

Gold

Corp.

(Exercise

Price

$0.10,

Exp.

Date

4/30/27)

2,550,000

0

0.0

Lotus

Gold

Corp.

(Exercise

Price

$0.75,

Exp.

Date

8/16/25)

2,200,000

0

0.0

Lotus

Gold

Corp.

(Exercise

Price

$0.75,

Exp.

Date

11/27/25)

506,250

0

0.0

Monarch

Mining

Corp.

(Exercise

Price

$0.95,

Exp.

Date

4/6/27)

1,700,000

0

0.0

Prime

Mining

Corp.

(Exercise

Price

$1.10,

Exp.

Date

6/10/25)

920,000

402,775

0.1

Robex

Resources,

Inc.

(Exercise

Price

$2.55,

Exp.

Date

6/26/26)

4,000,000

2,285,460

0.6

Thesis

Gold,

Inc.

(Exercise

Price

$1.69,

Exp.

Date

9/28/24)

576,923

0

0.0

3,503,729

0.9

United

States

Bendito

Resources,

Inc.

(Exercise

Price

$1.00,

Exp.

Date

12/20/24)

4,000,000

1,000,000

0.2

Laurentian

Mountain

Resources

(Exercise

Price

$1.00,

Exp.

Date

12/31/49)

3,500,000

0

0.0

1,000,000

0.2

Total

gold

mining,

exploration,

development

and

royalty

companies

(Cost

$2,990,457)

4,503,729

1.1

Silver

mining,

exploration,

development

and

royalty

companies

Canada

Silver

Mountain

Resources,

Inc.

(Exercise

Price

$0.14,

Exp.

Date

4/24/28)

3,000,000

22,261

0.0

Total

silver

mining,

exploration,

development

and

royalty

companies

(Cost

$65,879)

22,261

0.0

Total

warrants

(Cost

$3,589,687)

4,743,333

1.1

Money

Market

Fund

Federated

Hermes

US

Treasury

Cash

Reserve

Fund

-

Institutional

Shares,

5.10%

(4)

3,787,520

3,787,520

0.9

Total

money

market

fund

(Cost

$3,787,520)

3,787,520

0.9

Investments,

at

value

(Cost

$301,988,241)

423,732,656

100.

4

Cash,

receivables

and

other

assets

less

other

liabilities

(1,

509

,

312

)

(0.

4

)

Net

assets

$

42

2,

223

,

344

100.0%

ADR

American

Depositary

Receipt

PLC

Public

Limited

Company

Schedule

of

Investments

(Unaudited)

(continued)

August

31,

2024

The

notes

to

financial

statements

form

an

integral

part

of

these

statements.

Portfolio

Statistics

(Unaudited)

Portfolio

statistics

(Unaudited)

August

31,

2024

*Geographic

breakdown,

which

is

based

on

company

domiciles,

is

expressed

as

a

percentage

of

total

net

assets

including

cash.

(1)

Security

fair

valued

in

accordance

with

procedures

adopted

by

the

Board

of

Directors.

At

the

period

end,

the

value

of

these

securities

amounted

to

$40,322,475

or

9.6%

of

net

assets.

(2)

Non-income

producing

security.

(3)

Security

exempt

from

registration

under

Rule

144A

under

the

Securities

Act

of

1933.

At

the

period

end,

the

value

of

these

securities

amounted

to

$32,448,958

or

7.7

%

of

net

assets.

(4)

Dividend

yield

changes

daily

to

reflect

current

market

conditions.

Rate

was

the

quoted

yield

as

of

August

31,

2024.

Geographic

Breakdown*

Australia

23.3

%

Canada

68.

5

Cayman

Islands

2.0

South

Africa

2

.

0

United

Kingdom

1.

9

United

States

1.

8

Other

assets

less

other

liabilities

0.

5

100.0%

Schedule

of

Investments

(Unaudited)

(continued)

August

31,

2024

Notes

to

Financial

Statements

(Unaudited)

Nine

months

ended

August

31,

2024

1.

Organization

ASA

Gold

and

Precious

Metals

Limited

(the

“Company”)

is

a

non-diversified,

closed-end

investment

company

registered

under

the

Investment

Company

Act

of

1940,

as

amended

(the

“1940

Act”).

The

Company

was

initially

organized

as

a

public

limited

liability

company

in

the

Republic

of

South

Africa

in

June

1958.

On

November

11,

2004,

the

Company’s

shareholders

approved

a

proposal

to

move

the

Company’s

place

of

incorporation

from

the

Republic

of

South

Africa

to

the

Commonwealth

of

Bermuda

by

reorganizing

itself

into

an

exempted

limited

liability

company

formed

in

Bermuda.

The

Company

is

registered

with

the

Securities

and

Exchange

Commission

(the

“SEC”)

pursuant

to

an

order

under

Section

7(d)

of

the

1940

Act.

The

Company

seeks

long-term

capital

appreciation

primarily

through

investing

in

companies

engaged

in

the

exploration

for,

development

of

projects

or

mining

of

precious

metals

and

minerals.

The

Company

is

managed

by

Merk

Investments

LLC

(the

“Adviser”).

2.

Summary

of

significant

accounting

policies

The

following

is

a

summary

of

the

significant

accounting

policies:

A.

Security

valuation

The

net

asset

value

of

the

Company

generally

is

determined

as

of

the

close

of

regular

trading

on

the

New

York

Stock

Exchange

(the

“NYSE”)

on

the

date

for

which

the

valuation

is

being

made

(the

“Valuation

Time”).

Portfolio

securities

listed

on

U.S.

and

foreign

stock

exchanges

generally

are

valued

at

the

last

reported

sale

price

as

of

the

Valuation

Time

on

the

exchange

on

which

the

securities

are

primarily

traded,

or

the

last

reported

bid

price

if

a

sale

price

is

not

available.

Pursuant

to

Rule

2a-5

under

the

Investment

Company

Act,

the

Company’s

Board

of

Directors

(the

"Board")

has

designated

the

Adviser,

as

defined

in

Note

1,

as

the

Company’s

valuation

designee

to

perform

any

fair

value

determinations

for

securities

and

other

assets

held

by

the

Company.

The

Adviser

is

subject

to

the

oversight

of

the

Board

and

certain

reporting

and

other

requirements

intended

to

provide

the

Board

the

information

needed

to

oversee

the

Adviser's

fair

value

determinations.

The

Adviser

is

responsible

for

determining

the

fair

value

of

investments

in

accordance

with

policies

and

procedures

that

have

been

approved

by

the

Board.

Under

these

procedures,

the

Adviser

convenes

on

a

regular

and

ad

hoc

basis

to

review

such

investments

and

considers

a

number

of

factors,

including

valuation

methodologies

and

unobservable

inputs,

when

arriving

at

fair

value.

The

Board

has

approved

the

Adviser’s

fair

valuation

procedures

as

a

part

of

the

Company’s

compliance

program

and

will

review

any

changes

made

to

the

procedures.

Securities

traded

over

the

counter

are

valued

at

the

last

reported

sale

price

or

the

last

reported

bid

price

if

a

sale

price

is

not

available.

Securities

listed

on

foreign

stock

exchanges

may

be

fair

valued

at

a

value

other

than

the

last

reported

sale

price

or

last

reported

bid

price

based

on

significant

events

that

have

occurred

subsequent

to

the

close

of

the

foreign

markets.

Shares

of

non-exchange

traded

open-end

mutual

funds

are

valued

at

net

asset

value

(“NAV”).

To

value

its

warrants,

the

Company's

valuation

designee

typically

utilizes

the

Black-Scholes

model

using

the

listed

price

for

the

underlying

common

shares.

The

valuation

is

a

combination

of

value

of

the

stock

price

less

the

exercise

price,

plus

some

value

related

to

the

volatility

of

the

stock

over

the

remaining

time

period

prior

to

expiration.

Securities

for

which

current

market

quotations

are

not

readily

available

are

valued

at

their

fair

value

as

determined

in

accordance

with

procedures

approved

by

the

Board.

If

a

security

is

valued

at

a

“fair

value,”

that

value

may

be

different

from

the

last

quoted

price

for

the

security.

Various

factors

may

be

reviewed

in

order

to

make

a

good

faith

determination

of

a

security’s

fair

value.

These

factors

include,

but

are

not

limited

to,

the

nature

of

the

security;

relevant

financial

or

business

developments

of

the

issuer;

actively

traded

similar

or

related

securities;

conversion

rights

on

the

security;

and

changes

in

overall

market

conditions.

The

difference

between

cost

and

market

value

is

reflected

separately

as

net

unrealized

appreciation

(depreciation)

on

investments.

The

net

realized

gain

or

loss

from

the

sale

of

securities

is

determined

for

accounting

purposes

on

the

identified

cost

basis.

B.

Fair

value

measurement

In

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(“U.S.

GAAP”),

fair

value

is

defined

as

the

price

that

the

Company

would

receive

to

sell

an

investment

or

pay

to

transfer

a

liability

in

a

timely

transaction

with

an

independent

buyer

in

the

principal

market,

or

in

the

absence

of

a

principal

market

the

most

advantageous

market

for

the

investment

or

liability.

U.S.

GAAP

establishes

a

three-tier

hierarchy

to

distinguish

between

(1)

inputs

that

reflect

the

assumptions

market

participants

would

use

in

pricing

an

asset

or

liability

developed

based

on

Notes

to

Financial

Statements

(Unaudited)

(continued)

Nine

months

ended

August

31,

2024

market

data

obtained

from

sources

independent

of

the

reporting

entity

(observable

inputs)

and

(2)

inputs

that

reflect

the

reporting

entity’s

own

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

an

asset

or

liability

developed

based

on

the

best

information

available

in

the

circumstances

(unobservable

inputs)

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Various

inputs

are

used

in

determining

the

value

of

the

Company’s

investments.

The

inputs

are

summarized

in

the

three

broad

levels

listed

below.

Level

1

–

Unadjusted

quoted

prices

in

active

markets

for

identical

assets

or

liabilities

that

the

Company

has

the

ability

to

access.

Level

2

–

Observable

inputs

other

than

quoted

prices

included

in

level

1

that

are

observable

for

the

asset

or

liability

either

directly

or

indirectly.

These

inputs

may

include

quoted

prices

for

identical

instruments

on

an

inactive

market,

prices

for

similar

investments,

interest

rates,

prepayment

speeds,

credit

risk,

yield

curves,

default

rates,

and

similar

data.

Level

3

–

Unobservable

inputs

for

the

assets

or

liability

to

the

extent

that

relevant

observable

inputs

are

not

available,

representing

the

Company’s

own

assumptions

about

the

assumptions

that

a

market

participant

would

use

in

valuing

the

asset

or

liability,

and

that

would

be

based

on

the

best

information

available.

The

inputs

or

methodology

used

for

valuing

securities

are

not

necessarily

an

indication

of

the

risk

associated

with

investing

in

those

securities.

The

following

is

a

summary

of

the

inputs

used

as

of

August

31,

2024

in

valuing

the

Company’s

investments

at

fair

value:

Investment

in

Securities

(1)

Measurements

at

August

31,

2024

Level

1

Level

2

Level

3

Total

Corporate

Convertible

Bond

Gold

mining,

exploration,

development

and

royalty

companies

$

–

$

–

$

3

,

011

,

7

00

$

3

,

011

,

7

00

Common

Shares

Gold

mining,

exploration,

development

and

royalty

companies

296

,

249

,

795

–

7

,65

5

,

38

2

303

,

905

,

177

Diversified

metals

mining,

exploration,

development

and

royalty

companies

79

,

060

,

92

3

–

24,

793

,

576

10

3

,

854

,

499

Silver

mining,

exploration,

development

and

royalty

companies

4,311,943

–

–

4,311,943

Rights

Gold

mining,

exploration,

development

and

royalty

companies

–

–

1

1

Silver

mining,

exploration,

development

and

royalty

companies

–

–

118,483

118,483

Warrants

Diversified

metals

mining,

exploration,

development

and

royalty

companies

–

–

217,343

217,343

Gold

mining,

exploration,

development

and

royalty

companies

–

–

4,503,729

4,503,729

Silver

mining,

exploration,

development

and

royalty

companies

–

–

22,261

22,261

Money

Market

Fund

3,787,520

–

–

3,787,520

Total

Investments

$

383,410,181

$

–

$

40,322,475

$

423,732,656

(1)

See

schedule

of

investments

for

country

classifications.

2.

Summary

of

significant

accounting

policies

(continued)

B.

Fair

value

measurement

(continued)

Notes

to

Financial

Statements

(Unaudited)

(continued)

Nine

months

ended

August

31,

2024

The

following

is

a

reconciliation

of

Level

3

investments

for

which

significant

unobservable

inputs

were

used

to

determine

fair

value.

*

The

change

in

unrealized

appreciation/(depreciation)

is

included

in

net

change

in

unrealized

appreciation/(depreciation)

of

investments

in

the

accompanying

Statement

of

Operations.

Significant

unobservable

inputs

developed

by

the

valuation

designee

for

Level

3

investments

held

at

August

31,

2024

are

as

follows:

1

This

column

represents

the

directional

change

in

the

fair

value

of

the

level

3

investments

that

would

result

from

an

increase

to

the

corresponding

unobservable

input.

A

decrease

to

the

unobservable

input

would

have

the

opposite

effect

2

Fair

valued

corporate

convertible

bonds

are

valued

based

on

applying

a

fixed

discount

rate

to

the

fixed

income

portion,

which

represents

the

implied

interest

rate

that

would

have

valued

the

entire

corporate

convertible

bond

at

the

time

of

issuance.

3

Fair

valued

common

shares

with

no

public

market

are

valued

based

on

transaction

cost

or

latest

round

of

financing.

4

Fair

valued

rights

are

valued

based

on

the

specifics

of

the

rights

at

a

discount

to

the

market

price

of

the

underlying

security.

5

Warrants

are

priced

based

on

the

Black

Scholes

Method;

the

key

input

to

this

method

is

modeled

volatility

of

the

investment;

the

lower

the

modeled

volatility,

the

lower

the

valuation

of

the

warrant.

Corporate

Convertible

Bond

Common

Stock

Rights

Warrants

Balance

November

30,

2023

$

2,889,300

$

9,477,500

$

91,808

$

1,208,510

Purchases

-

7,

901

,

849

-

2

,

343

,

456

Sales

-

-

-

-

Realized

loss

-

-

-

(

1,048,200

)

Accretion

of

discount

11

,

939

-

-

-

Net

change

in

unrealized

appreciation

(depreciation)

110

,

461

15

,

069

,

609

26

,

676

2

,

239

,

567

Balance

August

31,

2024

$

3

,

011

,

7

00

$

3

2

,

448

,

958

$

1

1

8

,

484

$

4,743,333

Net

change

in

unrealized

appreciation

(depreciation)

from

investments

held

as

of

August

31,

2024

*

$

110

,

461

$

1

5

,

069

,

609

$

26

,

676

$

847,794

Asset

Categories

Fair

Value

Valuation

Technique(s)

Unobservable

Input

Range

(Weighted

Average)

Impact

to

Valuation

from

an

Increase

in

Input

1

Corporate

Convertible

Bond

2

$

3

,

011

,

7

00

Implied

Interest

Rate

Discount

0.4

%

(

0.4

%)

De

crease

Common

Shares

3

3

2

,

448

,

958

Transaction

Cost/

Latest

Round

of

Financing

None

None

None

Rights

4

118

,

484

Market

T

ransaction

Discount

70%

(70%)

De

crease

Warrants

5

4

,

743

,

333

Black

Scholes

Method

Volatility

0

%

-

50

%

(

32

%)

Increase

2.

Summary

of

significant

accounting

policies

(continued)

B.

Fair

value

measurement

(continued)

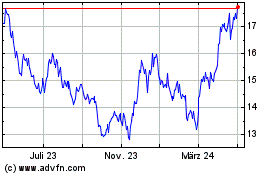

ASA Gold and Precious Me... (NYSE:ASA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

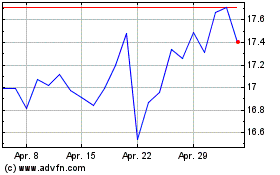

ASA Gold and Precious Me... (NYSE:ASA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024