UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 9)*

ASA Gold & Precious Metals Ltd

(Name of Issuer)

Common Shares, $1 par value

(Title of Class of Securities)

G3156P103

(CUSIP Number)

Saba Capital Management, L.P.

405 Lexington Avenue

58th Floor

New York, NY 10174

Attention: Michael D'Angelo

(212) 542-4635

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

September 19, 2024

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. [X]

(Page 1 of 5 Pages)

______________________________

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

1

|

NAME OF REPORTING PERSON |

| Saba Capital Management, L.P. |

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

(b) ☐ |

3

|

SEC USE ONLY |

| |

4

|

SOURCE OF FUNDS |

| OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

☐ |

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

| Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7

|

SOLE VOTING POWER |

| -0- |

8

|

SHARED VOTING POWER |

| 3,253,837 |

9

|

SOLE DISPOSITIVE POWER |

| -0- |

10

|

SHARED DISPOSITIVE POWER |

| 3,253,837 |

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON |

| 3,253,837 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| 16.87% |

14

|

TYPE OF REPORTING PERSON |

| PN; IA |

The percentages used herein are calculated based upon 19,289,905 shares of common stock outstanding as of 5/31/24, as disclosed in the company's N-CSRS filed 7/29/24

1

|

NAME OF REPORTING PERSON |

| Boaz R. Weinstein |

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

(b) ☐ |

3

|

SEC USE ONLY |

| |

4

|

SOURCE OF FUNDS |

| OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

☐ |

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

| United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7

|

SOLE VOTING POWER |

| -0- |

8

|

SHARED VOTING POWER |

| 3,253,837 |

9

|

SOLE DISPOSITIVE POWER |

| -0- |

10

|

SHARED DISPOSITIVE POWER |

| 3,253,837 |

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON |

| 3,253,837 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| 16.87% |

14

|

TYPE OF REPORTING PERSON |

| IN |

The percentages used herein are calculated based upon 19,289,905 shares of common stock outstanding as of 5/31/24, as disclosed in the company's N-CSRS filed 7/29/24

1

|

NAME OF REPORTING PERSON |

| Saba Capital Management GP, LLC |

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

(b) ☐ |

3

|

SEC USE ONLY |

| |

4

|

SOURCE OF FUNDS |

| OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

☐ |

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

| Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7

|

SOLE VOTING POWER |

| -0- |

8

|

SHARED VOTING POWER |

| 3,253,837 |

9

|

SOLE DISPOSITIVE POWER |

| -0- |

10

|

SHARED DISPOSITIVE POWER |

| 3,253,837 |

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON |

| 3,253,837 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| 16.87% |

14

|

TYPE OF REPORTING PERSON |

| OO |

The percentages used herein are calculated based upon 19,289,905 shares of common stock outstanding as of 5/31/24, as disclosed in the company's N-CSRS filed 7/29/24

| Item 1. |

SECURITY AND ISSUER |

| |

|

| |

This Amendment No. 9 amends and supplements the statement on Schedule 13D filed with the SEC on 10/13/23, as amended by Amendment No. 1 filed 11/16/23, Amendment No. 2 filed 11/24/23, Amendment No. 3 filed 12/5/23, Amendment No. 4 filed 12/21/23, Amendment No. 5 filed 1/26/23, Amendment No. 6 filed 2/1/24, Amendment No. 7 filed 4/30/24, and Amendment No. 8 filed 5/1/24; with respect to the common shares of ASA Gold & Precious Metals Ltd. This Amendment No. 9 amends Items 4, 6, and 7, as set forth below. |

| |

|

| Item 4. |

PURPOSE OF TRANSACTION |

| |

|

|

Item 4 is hereby amended and supplemented as follows:

On September 19, 2024, Saba Capital Master Fund, Ltd., Saba Capital Bluebird Fund, Ltd., Saba Capital CEF Opportunities 2, Ltd., and Saba Capital Carry Neutral Tail Hedge (together, the "Registered Shareholders"), submitted to the Issuer a notice of requisition, pursuant to Section 79 of the Companies Act 1981 of Bermuda, to nominate a slate of persons, Ketu Desai, Paul Kazarian, Karen Caldwell and Neal Neilinger, for election as directors at the Issuer's 2025 annual general meeting of shareholders (the "Annual Meeting"). |

| |

|

| Item 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

Item 6 is hereby amended and supplemented by the addition of the following:

Each of Ms. Caldwell and Mr. Neilinger has entered into a nomination agreement (collectively, the "Nominee Agreement") with Saba Capital substantially in the form attached as Exhibit 4 to this Schedule 13D/A whereby they each agreed to become a member of a slate of nominees and stand for election as a director of the Issuer in connection with a proxy solicitation which may be conducted in respect of the Annual Meeting and whereby Saba Capital has agreed to advance an amount not to exceed $5,000 to cover the reimbursement of fees each of Ms. Caldwell and Mr. Neilinger may incur in connection with his or her respective nomination and defend and indemnify them against, and with respect to, any losses that may be incurred by them in the event they become a party to litigation based on their nomination as candidates for election to the Board and the solicitation of proxies in support of their election. The foregoing summary of the Nominee Agreement is not complete and is qualified in its entirety by reference to the full text of the form of Nominee Agreement, a copy of which is attached as Exhibit 4 and is incorporated by reference herein. |

SIGNATURES

After reasonable inquiry and to the best of his or its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Date: September 23, 2024

| |

SABA CAPITAL MANAGEMENT, L.P.

By: /s/ Michael D'Angelo |

| |

Name: Michael D'Angelo

Title: Chief Compliance Officer |

| |

|

| |

|

| |

SABA CAPITAL MANAGEMENT GP, LLC

By: /s/ Michael D'Angelo

Name: Michael D'Angelo

Title: Authorized Signatory |

| |

|

| |

|

| |

BOAZ R. WEINSTEIN

By: /s/ Michael D'Angelo |

| |

Name: Michael D'Angelo |

| |

Title: Attorney-in-fact* |

| |

|

| |

|

| * Pursuant to a power of attorney dated as of November 16, 2015, which is incorporated herein by reference to Exhibit 2 to the Schedule 13G filed by the Reporting Persons on December 28, 2015, accession number: 0001062993-15-006823 |

|

Exhibit 4

Form of Nominee Agreement

Saba Capital Management, L.P.

405 Lexington Avenue, 58th Floor

New York, NY 10174

Private & Confidential

[Nominee]

[Business Address]

Dear [Nominee]:

This will confirm our understanding as follows:

You agree that you are willing, should we so elect, to become a member of a slate of nominees (the "Slate") of an affiliate of Saba Capital Management, L.P. (the "Nominating Party"), to stand for election as a director of ASA Gold and Precious Metals Limited, a Bermuda corporation (the "Fund"), in connection with a proxy solicitation (the "Proxy Solicitation") to be conducted by the undersigned and certain other parties in respect of the 2025 annual meeting of shareholders of the Fund expected to be held on or about March 2025 (including any adjournment or postponement thereof or any special meeting held in lieu thereof, the "Annual Meeting") or appointment or election by other means. You further agree to serve as a director of the Fund if so elected or appointed. The undersigned agrees to pay all of the costs arising from the Proxy Solicitation (the "Proxy Related Costs"). For the avoidance of doubt, the undersigned shall not be obligated to pay any costs in connection with your role as a director of the Fund. If permissible, the undersigned also agrees to advance to you $5,000 upon our giving written notice to the Fund of our intent to nominate you as a director of the Fund at the Annual Meeting. This advancement is to cover the reimbursement of fees you incurred in connection with your nomination (including, but not limited to, legal fees, FedEx fees, etc.).

You understand that it may be difficult, if not impossible, to replace a nominee who, such as yourself, has agreed to serve on the Slate and, if elected or appointed, as a director of the Fund if such nominee later changes his mind and determines not to serve on the Slate or, if elected or appointed, as a director of the Fund. Accordingly, the undersigned is relying upon your agreement to serve on the Slate and, if elected or appointed, as a director of the Fund. In that regard, you will be supplied with a questionnaire (the "Questionnaire") in which you will provide the undersigned with information necessary for the Nominating Party to use in creating the proxy solicitation materials to be sent to shareholders of the Fund and filed with the Securities and Exchange Commission in connection with the Proxy Solicitation.

You agree that (i) you will promptly complete and sign the Questionnaire, and return a copy to the person indicated in the Questionnaire, (ii) your responses in the Questionnaire will be true, complete and correct in all respects, and (iii) you will provide any additional information as may be reasonably requested by the undersigned. In addition, you agree that, concurrently with your execution of this letter, you will execute and return to the person indicated in the Questionnaire the attached instrument confirming that you consent to being nominated for election as a director of the Fund and, if elected or appointed, consent to serving as a director of the Fund. Upon being notified that we have chosen you, we may forward your consent and your completed Questionnaire (or summary thereof) to the Fund, and we may at any time, in our discretion, disclose such information, as well as the existence and contents of this letter. Furthermore, you understand that we may elect, at our expense, to conduct a background and reference check on you and you agree to complete and execute any necessary authorization forms or other documents required in connection therewith. You agree that the undersigned may use your name in any statement, filing, or other communication to the extent required by law or that is in accordance with applicable law and is reasonably required in connection with the Proxy Solicitation (including, without limitation, in its notice of nominations to the Fund, its proxy statement and its proxy card in connection with the Proxy Solicitation).

You further agree that (i) you will treat confidentially all information relating to the Proxy Solicitation which is non-public, confidential or proprietary in nature; (ii) neither you nor any of your affiliates will acquire or dispose of any securities of the Fund without the prior written approval of the undersigned; (iii) you will not issue, publish or otherwise make any public statement or any other form of communication relating to the Fund or the Proxy Solicitation without the prior written approval of the undersigned; and (iv) you will not agree to serve, or agree to be nominated to stand for election by the Fund or any other shareholder of the Fund (other than the undersigned), as a director of the Fund without the prior approval of the undersigned.

In consideration of your agreement to serve on the Slate, in addition to the Proxy Related Costs, the undersigned, solely on behalf of the private funds and accounts that hold shares of the Fund (excluding, for the avoidance of doubt, any registered investment company advised by the Nominating Party), agree (severally but not jointly) that the undersigned will defend, indemnify and hold you harmless from and against any and all losses, claims, damages, penalties, judgments, awards, settlements, liabilities, costs, expenses and disbursements (including, without limitation, attorneys' fees, costs, expenses and disbursements) ("Losses") incurred by you in the event that you become a party, or are threatened to be made a party, to any civil, criminal, administrative or arbitrative action, suit or proceeding, and any appeal thereof, (i) relating, solely, to your role as a nominee for director of the Fund on the Slate, or (ii) otherwise arising from or in connection with or relating to the Proxy Solicitation. For the avoidance of doubt, the undersigned, solely on behalf of the funds and accounts that hold the Fund, shall not be obligated to indemnify, defend, or hold you harmless from and against any Losses based upon, relating to, arising from, or in connection with your service as a director of the Fund. Your right of indemnification hereunder shall continue after the Annual Meeting has taken place but only for events that occurred prior to the Annual Meeting and subsequent to the date hereof that are based upon, relating to, arising from, or in connection with the Proxy Solicitation. Anything to the contrary herein notwithstanding, the undersigned is not indemnifying you for any action taken by you or on your behalf that occurs from the time you were first contacted by the undersigned up to and before the date hereof or subsequent to the conclusion of the Proxy Solicitation or such earlier time as you are no longer a nominee on the Slate or for any actions taken by you as a director of the Fund, if you are elected or appointed. The indemnification to which you are entitled shall be reduced to the extent, if any, that the claim for indemnification is impacted by (i) you having been found to have engaged in a violation of any provision of state or federal law in connection with the Proxy Solicitation, unless you demonstrate that your action was taken in good faith and in a manner you reasonably believed to be in or not opposed to the best interests of electing the Slate; (ii) you having acted in a manner that constitutes gross negligence, bad faith, fraud, intentional and material violations of law, criminal actions or material breach of the terms of this letter agreement or willful misconduct; (iii) you having provided false or misleading information, or omitted material information, in the Questionnaire or otherwise in connection with the Proxy Solicitation, or (iv) you being in breach of this letter agreement. You shall promptly notify the undersigned in writing in the event of any third-party claims actually made against you or known by you to be threatened if you intend to seek indemnification hereunder in respect of such claims. In addition, upon your delivery of notice with respect to any such claim, the undersigned shall promptly assume control of the defense of such claim with counsel chosen by the undersigned. The undersigned shall not be responsible for any settlement of any claim against you covered by this indemnity without its prior written consent. The undersigned may not enter into any settlement of any claim without your consent unless such settlement includes (i) no admission of liability or guilt by you, and (ii) an unconditional release of you from any and all liability or obligation in respect of such claim.

Each of us recognizes that, should you be elected or appointed to the Board of Directors of the Fund, all of your activities and decisions as a director will be governed by applicable law and subject to your fiduciary duties, as applicable, to the Fund and to the shareholders of the Fund and, as a result, that there is, and can be, no agreement between you and the undersigned that governs the decisions which you will make as a director of the Fund.

This letter agreement shall automatically terminate on the earliest to occur of (i) the conclusion of the Fund's next annual meeting of shareholders (regardless of the outcome), (ii) your election or appointment to the Board of Directors of the Fund or (iii) our communication to you of either our intent not to proceed with the Proxy Solicitation or to not include you or no longer include you in the Slate.

This letter agreement sets forth the entire agreement between the undersigned and you as to the subject matter contained herein, and cannot be amended, modified or terminated except by a writing executed by the undersigned and you. This letter shall be governed by and construed in accordance with the laws of the State of New York, without giving effect to principles of conflicts of law. This letter may be signed in counterparts each one of which is considered an original, but all of which constitute one and the same instrument.

Each of us hereby irrevocably and unconditionally consents to submit to the non-exclusive jurisdiction of the courts of the State of New York and of the United States of America, in each case located in the County of New York, for any litigation arising out of or relating to this letter, and waives any objection to the laying of venue of any litigation arising out of this letter in the courts of the State of New York or of the United States of America, in each case located in the County of New York, and hereby further irrevocably and unconditionally waives and agrees not to plead or claim in any such court that any such litigation brought in any such court has been brought in an inconvenient forum.

[remainder of this page left intentionally blank]

Should the foregoing agree with your understanding, please so indicate in the space provided below, whereupon this letter will become a binding agreement between us.

| |

Very truly yours, |

| |

|

| |

SABA CAPITAL MANAGEMENT, L.P. |

| |

|

|

| |

|

|

| |

By: |

|

| |

|

Name: Michael D'Angelo |

| |

|

Title: General Counsel |

Agreed to and accepted as

of the date first written above:

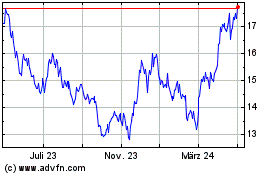

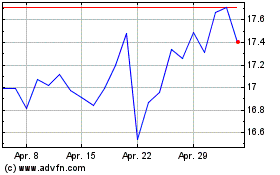

ASA Gold and Precious Me... (NYSE:ASA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

ASA Gold and Precious Me... (NYSE:ASA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024