Filed by AltC Acquisition Corp.

pursuant to Rule 425 under the Securities Act

of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: AltC Acquisition Corp.

Commission File No. 001-40583

Date: February 2, 2024

1 | Alt C Acquisition Corp.

2 Introduction Video

Safe harbor statement 3 The webcast will be available for replay at oklo.com/investor , where you will also find a copy of this investor presentation. Please note that this morning's webcast contains forward looking statements regarding future events and the future performance of Oklo and AltC. These forward - looking statements are based upon information available to Oklo and AltC today and reflect the current views and expectations of Oklo and AltC. Actual results could differ materially from those contemplated by these forward - looking statements, including, but not limited to the timing of development milestones, potential future customers and revenues, competitive industry outlook, and the timing and completion of the business combination. Please refer to the presentation accompanying this webcast for more information on the risk regarding these forward - looking statements that could cause actual results to differ materially.

Disclaimer This presentation (this “presentation”) is being delivered to you by Oklo Inc. (“Oklo”) and AltC Acquisition Corp. (“AltC”) to assist interested parties in making their own evaluation with respect to a proposed business combination between Oklo and AltC and related transactions (the “proposed business combination”). This presentation is provided for informational purposes only and is being provided to you solely in your capacity as a potential investor in considering an investment in the post - business combination combined company (the “Post - Closing Company”). Any reproduction or distribution of this presentation, in whole or in part, or the disclosure of its contents, without the prior consent of Oklo and AltC, is prohibited. This presentation and any oral statements made in connection with this presentation shall neither constitute an offer to sell nor the solicitation of an offer to buy any securities, or the solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the proposed business combination, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. This communication is restricted by law; it is not intended for distribution to, or use by, any person in any jurisdiction where such distribution or use would be contrary to local law or regulation. No Representations and Warranties This presentation is for informational purposes only and does not purport to contain all of the information that may be required to evaluate a possible investment decision with respect to the proposed business combination. Viewers of this presentation should make their own evaluation of the proposed business combination and of the relevance and adequacy of the information and should make other investigations as they deem necessary. This presentation is not intended to form the basis of any investment decision by any potential investor and does not constitute investment, tax or legal advice. No representations or warranties, express or implied, are or will be given in, or in respect of, this presentation or any other written, oral or other communications transmitted or otherwise made available to any party in the course of its evaluation of the proposed business combination, and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. To the fullest extent permitted by law, in no circumstances will Oklo, AltC or any of their respective subsidiaries, interest holders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. The information contained in this presentation is preliminary in nature and is subject to change, and any such changes may be material. Oklo and AltC disclaim any duty to update the information contained in this presentation. Forward - Looking Statements This presentation includes “forward - looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Oklo’s, AltC’s and the Post - Closing Company’s actual results may differ from their expectations, estimates and projections, and consequently, you should not rely on these forward - looking as predictive of future events. Words such as "anticipate,” “believe,” “continue,” “could,” “designed,” “estimate,” “expect,” "forecast,” “goal,” “intend,” “may,” “might,” "plans,” “possible,” “potential,” “predict,” "project,” “seek,” “should,” “target,” “will,” or “would” or, in each case, their negative or other variations or comparable terminology that predict or indicate future events. These forward - looking statements include all matters that are not historical facts. These forward - looking statements include, without limitation, estimates and forecasts of financial and operational metrics; estimates and projections regarding future manufacturing capacity and plant performance; estimates and projections of market opportunity and market share; estimates and projections of adjacent energy sector opportunities; Oklo’s projected commercialization costs and timeline; Oklo’s ability to demonstrate scientific and engineering feasibility of its technologies; Oklo’s ability to attract, retain, and expand its future customer base; Oklo’s ability to timely and effectively meet construction timelines and scale its production and manufacturing processes; Oklo’s ability to develop products and services and bring them to market in a timely manner; Oklo’s ability to achieve a competitive levelized cost of electricity; Oklo’s ability to compete successfully with fission energy products and solutions offered by other companies, as well as with other sources of clean energy; Oklo’s expectations concerning relationships with strategic partners, suppliers, governments, regulatory bodies and other third parties; Oklo’s ability to maintain, protect, and enhance its intellectual property; future ventures or investments in companies or products, services, or technologies; Oklo’s expectations regarding regulatory framework development; the potential for and timing of receipt of a license to operate nuclear facilities from the U.S. Nuclear Regulatory Commission (the “NRC”); the ability to achieve the results illustrated in the unit economics; the potential benefits of the proposed business combination and expectations related to the terms and timing of the proposed business combination; the success of proposed projects for which Oklo’s powerhouses would provide power, which is outside of Oklo’s control, the construction, ownership and operation by Oklo of power plants, the licensing of such power plant by the NRC, the safety profile of Oklo’s technology, the execution of a definitive power purchase agreements, and the success of Oklo’s power plants; the memorandum of understanding between Oklo and Centrus announced in August 2023, including with respect to the supply of HALEU to Oklo and any of the other components of the collaboration, the consummation of any definitive agreement between Oklo and Centrus, including with respect to Centrus’ purchase of electricity from Oklo; Oklo’s expectations regarding the Aurora Fuel Fabrication Facility at INL and the Aurora advanced fission power plan; Oklo’s and AltC’s expectations with respect to future performance; and the consummation of the proposed business combination between Oklo and AltC. These forward - looking statements are based on information available to Oklo as of the date of this presentation and represent management’s current views and assumptions. Forward - looking statements are not guarantees of future performance, events or results and involve known and unknown risks, uncertainties and other factors, which may be beyond our control. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of Oklo and AltC and are not predictions of actual performance. These forward - looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Oklo or AltC. These forward - looking statements are subject to known and unknown risks, uncertainties and assumptions about Oklo that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward - looking statements. Such risks and uncertainties, include risks related to the deployment and future performance of Oklo’s powerhouses; the risk that Oklo is pursuing an emerging market, with no commercial project operating, regulatory uncertainties; the potential need for financing to construct plants, market, financial, political and legal conditions; the inability of the parties to successfully or timely consummate the proposed business combination, including the risk that the approval of the shareholders of AltC or Oklo is not obtained; the effects of competition; changes in applicable laws or regulations; the outcome of any government and regulatory proceedings, investigations and inquiries; each case, under the heading “Risk Factors,” and other documents filed, or to be filed, with the U.S. Securities and Exchange Commission (the “SEC”) by AltC. If any of these risks materialize or Oklo’s assumptions prove incorrect, actual results could differ materially from the results implied by the forward - looking statements relating to Oklo. There may be additional risks that Oklo does not presently know or that Oklo currently believes are immaterial that could also cause actual results to differ from those contained in the forward - looking statements. In addition, forward - looking statements reflect Oklo’s expectations, plans or forecasts of future events and views as of the date of this communication. Oklo anticipates that subsequent events and developments will cause Oklo’s assessments to change. However, while Oklo may elect to update these forward - looking statements at some point in the future, Oklo specifically disclaims any obligation to do so. These forward - looking statements should not be relied upon as representing Oklo’s assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward - looking statements. Use of Projections This presentation contains financial forecasts or projections with respect to Oklo’s projected financial results . Neither Oklo’s nor AltC’s independent auditors have not audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation and, accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this presentation . These projections should not be relied upon as being necessarily indicative of future results . The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information . Accordingly, there can be no assurance that the prospective results are indicative of future performance of Oklo or that actual results will not differ materially from those presented in the prospective financial information . Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved . All projections and estimates included in this presentation are approximations . Financial Information ; Non - GAAP Financial Measures The financial metrics disclosed in this presentation have been prepared on a cash basis . Financial information related to Oklo’s performance and results of operations are based on the information available to Oklo at this time, and are subject to change . These results should not be viewed as a substitute for Oklo’s condensed consolidated financial statements prepared in accordance with GAAP that have been audited and reviewed by Oklo’s independent auditors . Accordingly, you should not place undue reliance on these results and key operating metrics . Valuations are as of the dates provided herein and do not take into account subsequent events, including the ongoing impact of COVID - 19 , the conflicts in Russia and Ukraine and the Israel - Hamas war, and rising inflation and interest rates, which can be expected to have an adverse effect on certain entities identified or contemplated herein . Additional Information About the Business Combination and Where to Find It The proposed business combination will be submitted to shareholders of AltC for their consideration . AltC has filed a registration statement on Form S - 4 (as amended, and may be further amended from time to time, the “Registration Statement”) with the SEC, which includes a preliminary proxy statement/prospectus/consent solicitation statement to be distributed to AltC’s shareholders in connection with AltC’s solicitation for proxies for the vote by AltC’s shareholders in connection with the proposed business combination and other matters described in the Registration Statement, as well as the prospectus relating to the offer of the securities to be issued to Oklo’s shareholders in connection with the completion of the proposed business combination . After the Registration Statement has been declared effective, AltC will mail a definitive proxy statement/prospectus/consent solicitation statement and other relevant documents to its shareholders as of the record date established for voting on the proposed business combination . AltC’s shareholders and other interested persons are advised to read the preliminary proxy statement/prospectus/consent solicitation statement and any amendments thereto and, once available, the definitive proxy statement/prospectus/consent solicitation statement, in connection with AltC’s solicitation of proxies for its special meeting of shareholders to be held to approve, among other things, the proposed business combination, as well as other documents filed with the SEC by AltC in connection with the proposed business combination (the “Special Meeting”), as these documents contain and will contain important information about AltC, Oklo and the proposed business combination . Shareholders may obtain a copy of the preliminary or definitive proxy statement/prospectus/consent solicitation statement, once available, as well as other documents filed by AltC with the SEC, without charge, at the SEC’s website located at www . sec . gov or by directing a written request to AltC Acquisition Corp . , 640 Fifth Avenue, 12 th Floor, New York, NY 10019 . Participants in the Solicitation AltC, Oklo and certain of their respective directors, executive officers and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitation of proxies from AltC’s shareholders in connection with the Special Meeting . Information regarding persons such persons who may, under SEC rules, be deemed participants in the solicitation of AltC’s shareholders in connection with the Special Meeting, is set forth in the preliminary proxy statement/prospectus/consent solicitation statement . Information about the directors and executive officers of Oklo and a description of their direct or indirect interests is set forth in the sections entitled “Certain Relationships and Related Party Transactions – Oklo’s Related Person Transactions” and “Interests of Certain Persons in the Business Combination” included in the Registration Statement . Information about the directors and executive officers of AltC, a description of their direct or indirect interests and their beneficial ownership of AltC’s capital stock is set forth in the sections entitled “Other Information about AltC – Management, Directors and Executive Officers,” “Certain Relationships and Related Party Transactions – AltC’s Related Person Transactions,” “Interests of Certain Persons in the Business Combination” and “Beneficial Ownership of Securities” included in the Registration Statement. The most recent amendment to the Registration Statement was filed on January 30, 2024, and is available at https://www.sec.gov/Archives/edgar/data/1849056/000110465924007900/tm2324337 - 10_s4a.htm. Shareholders, potential investors and other interested persons should read the preliminary proxy statement/prospectus/consent solicitation statement and any amendments thereto carefully before making any voting or investment decisions . You may obtain free copies of these documents from the sources indicated above . No Offer or Solicitation This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . This communication is not, and under no circumstances is to be construed as, a prospectus, an advertisement or a public offering of the securities described herein in the United States or any other jurisdiction . No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended, or exemptions therefrom . INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN . ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE . Industry and Market Data In this presentation, Oklo and AltC rely on and refer to certain information and statistics regarding the markets and industries in which Oklo competes . Such information and statistics are based on Oklo’s management’s estimates and/or obtained from third party sources, including reports by market research firms and company filings . While Oklo and AltC believe such third party information is reliable, there can be no assurance as to the accuracy or completeness of the indicated information . Oklo and AltC have not independently verified the accuracy or completeness of the information provided by the third - party sources . Trademarks This presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners, and Oklo’s and AltC’s use thereof does not imply an affiliation with, or endorsement by, the owners of such trademarks, service marks, trade names and copyrights. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, © or ® symbols, but Oklo, AltC and their affiliates will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. 4 Forward - looking statements

Brian Gitt Head of Business Development Ed Petit de Mange Director of Fuel Recycling Scott Auerbach Director of Power Engineering Jacob DeWitte Co - Founder and CEO Craig Bealmear Chief Financial Officer Caroline Cochran Co - Founder and COO Michael Klein Co - Founder and Chairman of AltC Acquisition Corp. 5 Sam Altman Chairman of Oklo Co - Founder and CEO of AltC Acquisition Corp. Speakers

Opening Remarks Michael Klein, Co - Founder and Chairman of AltC Acquisition Corp. Introduction to Oklo Jake DeWitte, Co - Founder & CEO The Aurora Powerhouse Jake DeWitte, Co - Founder & CEO Regulatory Path & Progress Caroline Cochran, Co - Founder & COO Q&A Br ea k Market & Customer Development Brian Gitt, Head of Business Development 6 Supply Chain & Deployment Scott Auerbach, Director of Power Engineering Recycling Ed Petit de Mange, Director of Fuel Recycling Asset Returns & Deal Economics Craig Bealmear, CFO Q&A Why Oklo Sam Altman, Chairman of Oklo, Co - Founder and CEO of AltC Acquisition Corp. Closing Remarks Jacob DeWitte, Co - Founder & CEO Agenda

7 MICHAEL KLEIN Co - Founder and Chairman of AltC Acquisition Corp. Opening Remarks

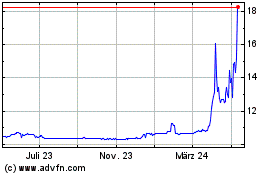

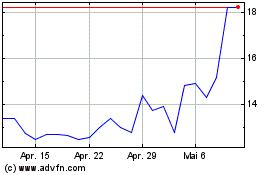

8 AltC Acquisition Corp. Over $300 million (1) of cash in trust Listed in July 2021 Our Mission Taking “early stage” to the next stage to deliver value to AltC shareholders x Leverage our unique access to innovative companies to source a compelling “hard tech” opportunity x Partner with a target company to prepare them for success in the public markets x Utilize our extensive strategic and financial networks to unlock new growth opportunities C hurchill Capital Sponsoring leading companies with a track record of completing unique go public transactions 5 transactions closed with $10+ billion of capital delivered (2)(3) Pioneer in equity vehicles Differentiated business partnership model and first GP team focused purely on public equity vehicles Experienced dealmaker Leading expertise leveraging our strategic and transaction experience on behalf of our partner companies Unique sourcing capability Renowned base of operating partners with extensive access to global network of industry leaders Value creation playbook Lineup of former executives of S&P 500 companies with deep operational expertise across sectors Track record of success Demonstrated history of partnering with transformative high - growth companies to provide capital to scale Management partner Interests aligned with and skills complementary to those of our target’s existing management team Sam Alt man CEO and Co - Founder, OpenAI Former President, Y Combinator Operating Partner, Churchill Capital Corp V, VI, and VII AI research and deployment company focused on ensuring artificial general intelligence is safe and benefits all of humanity. Served as President of Y Combinator from 2014 through 2019 Significantly grew Y Combinator’s cohort size Funded and supported numerous “hard tech” companies Recruited Oklo in Y Combinator in 2014 and has been Chairman since 2015 Sources: Y Combinator website – Startup Directory, Churchill Capital I, II, III, IV and CF Finance Acquisition Corp. public disclosure. Notes: (1) AltC cash - in - trust was $303.6 million as of December 29, 2023 (but reduced to account for payment of excise tax, which tax of approximately $2.2 million will be paid post - closing of the business combination resulting in $301.4 of cash otherwise available). (2) Past performance is not indicative of future results. (3) Represents trust proceeds (net of redemptions) plus incremental capital raised in connection with Churchill Capital I, II, III, IV and CF Finance Acquisition Corp. Alt C Acquisition Corp. (NYSE: ALCC)

9 AltC Acquisition Corp. NYSE: ALCC x Oklo went through Y Combinator in 2014 and Sam Altman has been Chairman since 2015 x Transaction enabled by Sam Altman’s unique understanding of Oklo and validation of its technology through nearly a decade of engagement x AltC and Oklo have been working together on its public company readiness for over a year x Sam Altman to continue as Chairman post transaction Policy support driven by the critical need for nuclear energy Simplified, modern design applied to demonstrated technology Attractive business model targeting recurring cash flow Winning value proposition intended to accelerate customer adoption Embedded potential upside from unique fuel recycling opportunity Strong founder - led team with deep technical expertise Multiple announced project sites with fuel secured for first deployment Oklo represents a compelling “hard tech” opportunity

10 AltC Acquisition Corp. NYSE: ALCC x Demand signals received from data center, industrial, defense, traditional energy, and residential customers x Oklo has robust customer interest with over 700 MWe under non - binding indications of interest x Intensive regulatory work underway to support first deployment in 2026/2027 (1) x Going public now is intended to enable Oklo to accelerate its business plan and develop its project backlog Oklo represents an “information rich” investment thesis x Owner - operator model pursuing customer - backed deployment of many small - scale, low - cost plants which intends to mitigate single project risk x Expected 15 MWe construction and fuel costs of <$70mm with targeted construction time of <1 year (2) x Enables investors to track progress in the business with greater clarity than others pursuing multibillion dollar, multi - year infrastructure projects Illustrative quarterly update framework Backlog de v e l op m e n t Memorandum of Understanding Letter of Intent Power Purchase Agreement Project e x ecu t i o n Idaho, Southern Ohio, other potential sites Supply chain partnerships Long lead - time procurement L i ce n s i ng progress NRC pre - application engagement COLA submission expected in 2024/25 S - COLA submissions 1 2 3 4 Fuel re c y c li n g R&D and licensing updates Fuel partnerships and off - take agreements Fuel recycling site development Notes: (1) Assumes all regulatory approvals have been obtained on the expected timelines. The regulatory process, including necessary NRC approvals and licensing, is a lengthy, complex process and projected timelines could vary materially from the actual time necessary to obtain all the required approvals. (2) Targeted plant costs and construction timeline reflects expected run - rate operations after first deployment is achieved, and relies upon current assumptions of timing and costs, which may change through the regulatory process. Oklo is at an exciting inflection point

11 x All net transaction proceeds to be invested in Oklo x AltC’s sponsor to subject 100% of its retained shares to performance vesting x Staggered 3 - year lock - up for shares owned by Oklo’s founders and AltC’s sponsor x Board to consist of proven business leaders and value creators in the public markets x Single class of shares following the transaction with equal voting rights for all shareholders x No complex corporate structure or special shareholder tax agreements x Sam Altman recused himself from the AltC and Oklo boards with respect to the transaction x Transaction review led by Churchill Capital and the independent directors of AltC who have experience building, operating, and investing in technology companies x Fulsome diligence process undertaken, including advice from numerous subject matter experts across commercial, legal, regulatory, technical, accounting, finance, tax, human resources, IT, and cybersecurity fields x Fairness opinion received prior to AltC board approval Alignment of long - term interest Fulsome transaction review Simple proposed transaction structure

1 2 Introduction to Oklo JACOB DEWITTE Co - Founder and Chief Executive Officer

13 Our mission is to provide clean, reliable, and affordable energy on a global scale We are executing our mission through the design and deployment of next generation fast reactor technology We believe we have an embedded opportunity to enhance our mission with advanced fuel recycling technology to convert spent fuel into clean energy

ission has a uni ue m etitiv e a . · . vanta e com are ith other ener _ . sources A Ii etime o · 0 · 1 · al l o · e n e - r . . i n a uranium

Coal Biomass Combined cycle gas Solar PV Hyd r o Fusion Wind Geothermal Fission 275K kg/GWh 0K 137.5K 412.5K 550K Conc r ete/cement Steel Glass Copper Silver Uranium Fossil fuels (5) L i f e c yc le m a t e ria l u s e (1) ( 2 ) ( 3 )( 4 ) Sources: (1) https: //w ww .energy.gov/sites/prod/files/2017/03/f34/qtr - 2015 - chapter10.pdf Table 10.4 (2) https://whatisnuclear.com/energy - density.html (3) https: //w ww .eia.gov/tools/faqs/faq.php?id=667&t=2 (4) https://energyeducation.ca/encyclopedia/Energy_density (5) https: //w ww .sciencedirect.com/science/article/abs/pii/S0920379615302337 15

( 2 ) ( 3 )( 4 ) L i f e c yc le m a t e ria l u s e (1) 1 6 Sources: (1) https: //w ww .energy.gov/sites/prod/files/2017/03/f34/qtr - 2015 - chapter10.pdf Table 10.4 (2) https://whatisnuclear.com/energy - density.html (3) https: //w ww .eia.gov/tools/faqs/faq.php?id=667&t=2 (4) https://energyeducation.ca/encyclopedia/Energy_density (5) https: //w ww .sciencedirect.com/science/article/abs/pii/S0920379615302337 16

( 2 ) ( 3 )( 4 ) L i f e c yc le m a t e ria l u s e (1) 1 6 Sources: (1) https: //w ww .energy.gov/sites/prod/files/2017/03/f34/qtr - 2015 - chapter10.pdf Table 10.4 (2) https://whatisnuclear.com/energy - density.html (3) https: //w ww .eia.gov/tools/faqs/faq.php?id=667&t=2 (4) https://energyeducation.ca/encyclopedia/Energy_density (5) https: //w ww .sciencedirect.com/science/article/abs/pii/S0920379615302337 17

✓ Power sales model ✓ Technology ✓ Size Keys to Oklo’s deployment 1 8 18

Now, recaps on some exciting recent announcements 19

Oklo was selected for access to the fuel material through a competitive process launched in 2019 by INL. The SDS marks the initial stage in a comprehensive DOE approval process prior to the operation of the Aurora Fuel Fabrication Facility. U.S. DOE Approves the Safety Design Strategy for the Oklo Aurora Fuel Fabrication Facility 21

2 2 Oklo announced a land rights agreement 1 with Southern Ohio Diversification Initiative (SODI), that provides for an option to purchase land for the two planned powerhouses Notes: (1) Option and Right of First Refusal to Purchase Real Estate between Oklo and SODI Land procurement 22

2 3 The Aurora Powerhouse JACOB DEWITTE Co - Founder and Chief Executive Officer

What is the Aurora? 24

The Aurora Next generation fission power Small fast reactor Based on demonstrated technology Designed to be inherently safe Simple, modern, streamlined design 25

Small, pre - fabricated, non - pressurized components Designed to use readily available materials and components from existing supply chains Inherent and passive safety characteristics, coupled with technology maturity, is designed to allow Oklo’s technology to break the light water reactor (LWR) paradigm Liquid metal technology 26

Core Contains metallic fuel and reflectors Naturally self - stabilizing and self - controlling Intermediate heat exchangers Heat is transferred to external cooling loop to produce steam for power generation Reactor vessel cooling system Air naturally cools reactor 27 How it works

Core Coolant heats up as it removes heat from fuel Hot coolant rises 28 Intermediate heat exchangers Coolant cools down as it transfers heat through intermediate heat exchangers Cold coolant sinks How it works

Air heats up as it rises along vessel Cold air flows down outside vessel Reactor vessel cooling system Air naturally cools reactor vessel and removes excess heat 29 How it works

Reactor module Power conversion system Steam generators How it works 30

31 Fast reactors have over 400 reactor - years of operating experience (1) Oklo specifically uses data from the Experimental Breeder Reactor II (EBR - II) EBR - II produced about 20 megawatts electric (MWe) and operated for 30 years Well demonstrated technology EBR - II proved: Inherent safety performance (2) Favorable operating and maintenance characteristics Ability to run on fresh or recycled fuel Notes: (1) Data from World Nuclear Association and independently verified. Online: https:// www.world - nuclear.org/information - library/current - and - future - generation/fast - neutron - reactors.aspx (2) Inherent safety can include any or all of the following characteristics: self - stabilizing, self - controlling, cooled by natural forces, walk - away safe.

32 Estimated construction time Estimated plant design life <1 year <$70 million 40+ years Estimated fuel & construction costs (2) <2 acres of land required (3) Reduced plant complexity, cost, and construction time 15 MWe Scalable to 50 MWe (1) Notes: (1) Oklo’s initial focus is on the design and deployment of 15 MWe and 50 MWe plant sizes. (2) Targeted plant costs and construction timeline reflects expected run - rate operations after first deployment is achieved, and relies upon current assumptions of timing and costs, which may change through the regulatory process. (3) Inclusive of the Emergency Planning Zone, which for the Aurora reactor is expected to be bounded within the powerhouse building structure. Aurora powerhouse design

3 3 Regulatory Path & Progress CAROLINE COCHRAN Co - Founder and Chief Operating Officer

34 Historically, the regulatory path for new nuclear plants has been long and has led to high costs in design, construction, and operation. • Old reactor technologies (generally water - cooled reactors) are burdened with immense and relatively inflexible precedent in regulatory guidance. • New reactors have been stuck in a catch - 22: the regulator requires data in order to license a new reactor, and in order to get data, a new reactor must be licensed (if only as a research reactor) and operated for many years. Oklo set out to solve historical challenges by meeting existing regulations through using a proven technology with inherent safety. Oklo started formal engagement with the U.S. Nuclear Regulatory Commission (NRC) in 2016. At the time, Oklo was the only non - water - cooled reactor developer in formal interactions with the NRC. We have invested in the NRC review process because it is essential to reach the U.S. market and, because of the NRC’s global role in nuclear regulatory leadership, work with the NRC supports Oklo’s ultimate global expansion goals. Although challenging, the NRC has shown ability to approve licenses, having issued 63 licenses since 1975. (1) Solving historical regulatory challenges Notes: (1) Information compiled from NRC NUREG 1350, Volume 4. Online: https:// www.nrc.gov/reading - rm/doc - collections/nuregs/staff/sr1350/index.html

35 Design Construction permit Operations license Prior to 1989, in the “Part 50” process, Construction Permits were only granted separately from Operations Licenses. (1) This created risk of constructing something that would not be granted an operations license in a timely manner or at all. There were early forms of design approvals, but design certifications did not exist in the “Part 50” process. Regulatory process Notes: (1) 10 CFR Part 52 was adopted in 1989.

36 Because most nuclear technology designers are developers only, they may seek NRC approval of the design which they can sell to utilities. For example, NuScale (1) and AP1000 (2) sought NRC design certifications. The duration of design certification reviews has ranged between 6 - 10 years. (3) Design Construction permit Operations license Regulatory process Notes: (1) The NuScale design certification review was just over 6 years, as it was submitted in January 2017 and certified February 2023 (2) The AP1 000 design certification review duration was 8.4 years, as it was submitted in March 2002 and certified December 2011 (3) Design certification review timelines to date have ranged from 6.1 years to 9.6 years.

37 The Combined License Process was developed, which allowed for simultaneous licensing of construction and operation . However, it was not fully utilized as one step because developers did the design step first and utilities did the construction and operations steps second. For instance, the AP1000s at the Vogtle Nuclear Power Plant. Design Construction permit Operations license Regulatory process

38 Oklo intends to build, own and operate, not just sell a design to utilities. Oklo is the first company to have piloted (in 2018) and then submitted (in 2020) a custom combined license application (COLA) for design, construction, and operations all together. The custom COLA is not only expected to be more efficient (COLA review timelines are given by NRC as 30 - 36 months), (1) but also a repeatable process. Design Construction permit Operations license Notes: (1) As discussed in subsequent slides, the application submitted in 2020 was denied in 2022 without prejudice by the NRC, requesting additional information Regulatory process

39 Future COLAs can be filed as “subsequent COLAs” (S - COLAs) to the initial “reference COLA" (R - COLA) Sites D esi g n Construction permit Operations license Nuclear fuel Oklo granted Site Use Department of Energy (DOE) ✓ Permit at INL (1) by the Fuel allocation provided by DOE DOE approved Safety Design Strategy for fuel fab facility ض ض • Fresh or recycled fuel • Centrus partnership • Other strategic fuel partnerships ض Other sites INL plant Previous a p p li ca t i o n e x p er i en ce Other plants Notes: (1) Idaho National Laboratory ("INL"), a Department of Energy national laboratory, is the nation's leading center for nuclear energy research and development. Regulatory and permitting process

40 Oklo has one of the longest continuous regulatory engagements of any non - water - cooled reactor company First ever advanced reactor COLA submitted ✓ NRC engagement initiated in 2016 ✓ COLA submitted on March 11, 2020 - the day WHO declared COVID - 19 a pandemic ✓ Deep engagement with the NRC staff in 2020 through 2022 during the COLA review process ✓ NRC approved Oklo’s Quality Assurance Program Description ✓ NRC approved Oklo’s Safeguards Information Handling and Protection Program This application was denied further review, but valuable experience is being leveraged with intent to improve probability of success Intensive work underway in preparation for the next application filing ✓ Substantially expanded the licensing and regulatory team to bring in - house former NRC staff and regulatory experts – Nearly 10% of Oklo’s current employees are former NRC staff members ✓ Frequent engagement and information sharing from 2022 to date: – At least 15 formal pre - application meetings held on 30 key licensing topics – Over 70 coordination meetings held – Over 50 licensing - related documents shared – 16 docketed reports, including 7 licensing project plans Oklo intends to pursue a pre - application readiness review in 2024 Application submission targeted for late 2024 / early 2025 Oklo is deeply appreciative of the NRC staff’s hard work and commitment to advancing safe nuclear solutions Regulatory overview and next steps

4 1 Q&A Jake DeWitte | Caroline Cochran

Break 42 15 minutes

F uel recycl i ng services M e g a w a t t - ho urs and joules Str e a m li n i ng d ep l o y m ent 43

4 4 Market & Customer Development BRIAN GITT Head of Business Development

45 ~70% of global internet traffic runs through Northern Virginia (1) 30 million sq ft and more than ~3,400 MW market size (2) 0.2% availability rate (2) Data Center Alley - Northern, Virginia Notes: (1) Source: https://rga.lis.virginia.gov/Published/2019/RD109/PDF (2) Source: https:// www.nmrk.com/storage - nmrk/uploads/documents/2023 - U.S. - Data - Center - Markets.pdf

46 Source: Boston Consulting Group, The Impact of GenAI on Electricity: How GenAI is Fueling the Data Center Boom in the U.S. Tripling power use by 2030

47 Data centers consumed 50% more electricity in 2023 than 2020, with power use projected to grow 3x by 2030 $481 billion in commitments for new US industrial & manufacturing facilities since 2021 200 US manufacturing facilities announced in 2023 Energy users hungry for clean, reliable, affordable power Oklo target markets D e f e n se Off - g r i d / rural Utilitie s ض Data ce n t ers ض Factories ض ض ض Industrial ض Active dialogues with potential customers ض Notes: National Load Growth Report by Grid Strategies shows data center and manufacturing growth. Omdia Report 2023 Market opportunities

48 Serves 65 million people in 13 Mid - Atlantic & Midwest states Power demand is growing — data center hubs increasing as high as 7% annually Tough climate policies forcing fossil - fuel plant retirement faster than they're being replaced 21% of PJM’s current installed capacity is at risk of retirement by 2030 New services queue consists primarily of renewables ( 94 % ) and gas ( 6 % ) — historical rate of completion for renewable projects has been ~ 5 % Notes: (1) Source: Energy Transition in PJM: Resource Retirements, Replacements & Risk . There is no current agreement for Oklo with respect to PJM. This is illustrative only as a potential area in which Oklo believes customers would benefit from its offering. ( 1 ) Case study: PJM

Historically, there were 3 main options to provide power: 1. Build more transmission lines 2. Build more generation 3. Go to a new location with available power 49 Today’s solution needs to be timely, clean, reliable, and low - cost Limited options

Energy off - take through power purchase agreements Streamlined 1 - step licensing process (versus 2 - steps) Simplifies buying reliable, clean power for energy users Oklo target markets Data ce n t ers D e f e n se Factories Industrial Off - g r i d / rural Utilitie s ض ض ض ض ض ض Active dialogues with potential customers ض 50 Why potential customers like Oklo

5 1 Supply Chain & Deployment SCOTT AUERBACH Director of Power Engineering

Non - pressurized vessels Avoids expensive forging costs Non - exotic materials Increases availability of raw manufacturing materials Inherent safety features Results in less safety - related equipment Focus on commercial off the shelf Reduces development costs and increases reliability 52 Designed to leverage well - established supply chains

Because the Aurora is designed to be scalable and inherently safe, Oklo can partner with major supplier s like Siemens Energy to scale the power generation system to: • Leverage an established industrial steam turbines product line; • Utilize a mature product with extensive operating experience; and • Benefit from a large worldwide presence to support deployments and maintenance. 53 Potential supply chain partnerships

Scaled deployment of the same equipment across Oklo’s planned powerhouses is expected to lead to potential efficiencies: • Allows the purchase of large quantities, enabling volume discounts • Spare parts intended to be shared across all planned powerhouses, reducing maintenance downtime • Anticipated cost savings from efficiencies in manufacturing, construction, operations, and maintenance are multiplied across deployments Supply chain benefits multiply at scale 5 4 54

5 5 Recycling ED PETIT DE MANGE Director of Fuel Recycling

56 Recycling fuel using proven technology Oklo is investing in developing commercial - scale recycling of existing used nuclear fuel waste in order to potentially save 80% on fuel costs, in addition to creating large possible revenue streams. But this is not just for the future, it is already a proven technology, and Oklo is currently collaborating to fabricate recycled fuel at the Aurora Fuel Fabrication Facility at INL. Oklo is collaborating with the U.S. DOE on commercialization of recycling through four DOE cost - share awards totaling more than $17 million.

Resource recovery 57 Notes: Source for used fuel constituents: https://info.ornl.gov/sites/publications/Files/Pub37993.pdf

Resource recovery 58 Notes: Source for used fuel constituents: https://info.ornl.gov/sites/publications/Files/Pub37993.pdf

Resource recovery In 500,000 kg of used fuel: 43,000 kg of U/TRU fuel Selected commercial radioisotopes: Transuranics: 59 Notes: Source for used fuel constituents: https://info.ornl.gov/sites/publications/Files/Pub37993.pdf 290 kg 358 kg Np - 237 A m - 241 Fission products: 175 kg 538 kg Sr - 90 Cs - 137 365,000 kg of excess uranium

Produce power in reactor Cast U/TRU into new fuel Partition heavy metals via e l ect r oche mist r y Receive used fuel Disassemble Closing the fuel cycle Excess u r an i um Radioisotopes 90,000 MT of used fuel in storage in the 60 Notes: (1) https:// www.energy.gov/ne/articles/5 - fast - facts - about - spent - nuclear - fuel United States (1)

61 Potential revenues and savings from recycling Np - 237 A m - 241 ~$280,000/kg - $660,000/kg ~$150,000/kg - $1,500,000/kg With U/TRU we can potentially reduce our fuel costs by over 80% Opportunities to charge fees for recycling services Radioisotopes also have commercial value Transuranics: Fission products: Sr - 90 Cs - 137 ~$2,800,000/kg - $5,000,000/kg ~$9,000/kg Excess uranium has potential to be cheaper than mined uranium Notes: Sr - 90: market discussions from radioisotope conference with users and potential users of material, and http://large.stanford.edu/courses/2011/ph240/kumar2/docs/dpst - 82 - 842.pdf Am - 241: https://edu.rsc.org/elements/americium/2020001.article#:~:text=This%20isotope%20costs%20around%20%241500,is%20100%20times%20m ore %20expensive. Np - 237: https: //w ww .corrosionsource.com/PeriodicTable/Neptunium#:~:text=The%20O.R.N.L.%20has%20237Np%20available,a%20price%20of%20%24280%2Fg & http://www.chemistry.pomona.edu/chemistry/periodic_table/elements/neptunium/the%20facts.htm Cs - 137: https: //w ww .osti.gov/biblio/5712006

6 2 Asset Returns & Deal Economics CRAIG BEALMEAR Chief Financial Officer

63 Recurring cash flow from long duration contracts Capital efficient powerhouse deployment Attractive asset returns with embedded upside Strong balance sheet to enable growth Low - cost op e r a t i n g ethos Targeted financial attributes Owner - operator business model enables attractive financial attributes

Illustrative cash flow sensitivity (1)(2) Notes: (1) For illustrative purposes only. Actual results may differ materially. Cash flow figures rounded to the nearest $5 million. (2) Excludes corporate, general, and administrative costs. 64 $ millions Number of 15 MWe units deployed 5 10 15 20 25 $40 $80 $125 $165 $210 Targeting recurring revenue model • Creating a platform designed to grow revenue and cash flow as we scale the deployment of our powerhouses

Illustrative cash flow sensitivity (1)(2) Notes: (1) For illustrative purposes only. Actual results may differ materially. Cash flow figures rounded to the nearest $5 million. (2) Excludes corporate, general, and administrative costs. 65 $ millions Number of 15 MWe units deployed 5 10 15 20 25 Number of 50 MWe units deployed 0 $40 $80 $125 $165 $210 5 $175 10 $310 15 $445 20 $580 Targeting recurring revenue model • Creating a platform designed to grow revenue and cash flow as we scale the deployment of our powerhouses • The potential for growth only improves as our deployment mix of 15 MWe and 50 MWe powerhouses changes

Illustrative cash flow sensitivity (1)(2) Notes: (1) For illustrative purposes only. Actual results may differ materially. Cash flow figures rounded to the nearest $5 million. (2) Excludes corporate, general, and administrative costs. 66 $ millions Number of 15 MWe units deployed 5 10 15 20 25 Number of 50 MWe units deployed 0 $40 $80 $125 $165 $210 5 $175 $215 $260 $300 $345 10 $310 $350 $395 $435 $480 15 $445 $485 $530 $570 $615 20 $580 $620 $665 $705 $750 Targeting recurring revenue model • Creating a platform designed to grow revenue and cash flow as we scale the deployment of our powerhouses • The potential for growth only improves as our deployment mix of 15 MWe and 50 MWe powerhouses changes • Each powerhouse expected to be underpinned by customer power purchase agreements ranging from 20 - 40 years in duration

Targeting recurring revenue model • Creating a platform designed to grow revenue and cash flow as we scale the deployment of our powerhouses • The potential for growth only improves as our deployment mix of 15 MWe and 50 MWe powerhouses changes • Each powerhouse expected to be underpinned by customer power purchase agreements ranging from 20 - 40 years in duration • Cash flow expected to improve from fuel recycling Illustrative cash flow sensitivity (1)(2) Notes: (1) For illustrative purposes only. Actual results may differ materially. Cash flow figures rounded to the nearest $5 million. (2) Excludes corporate, general, and administrative costs. 67 $ millions Number of 15 MWe units deployed 5 10 15 20 25 Number of 50 MWe units deployed 0 $40 $80 $125 $165 $210 5 $175 $215 $260 $300 $345 10 $310 $350 $395 $435 $480 15 $445 $485 $530 $570 $615 20 $580 $620 $665 $705 $750

Illustrative unit economics Targeting strong asset based returns Unit economics do not include potential benefits from investment tax credits, project finance, or fuel recycling • Investment costs are expected at lower scale vs. traditional nuclear 6 8 68 Notes: (1) Assumes all regulatory approvals have been obtained on the expected timelines. The regulatory process, including necessary NRC approvals and licensing, is a lengthy, complex process and projected timelines could vary materially from the actual time necessary to obtain all the required approvals. The unit economics provided herein are for illustrative purposes only. Actual results may differ materially. (2) Run - rate of 20 units is expected requirement to achieve NOAK unit economics. (3) Excludes ongoing refueling requirements, which is expected to take place every 10 years.

Illustrative unit economics Unit economics do not include potential benefits from investment tax credits, project finance, or fuel recycling Targeting strong asset based returns • Investment costs are expected at lower scale vs. traditional nuclear • Costs expected to improve as execution capability advances 6 8 69 Notes: (1) Assumes all regulatory approvals have been obtained on the expected timelines. The regulatory process, including necessary NRC approvals and licensing, is a lengthy, complex process and projected timelines could vary materially from the actual time necessary to obtain all the required approvals. The unit economics provided herein are for illustrative purposes only. Actual results may differ materially. (2) Run - rate of 20 units is expected requirement to achieve NOAK unit economics. (3) Excludes ongoing refueling requirements, which is expected to take place every 10 years.

Illustrative unit economics Unit economics do not include potential benefits from investment tax credits, project finance, or fuel recycling Targeting strong asset based returns • Investment costs are expected at lower scale vs. traditional nuclear • Costs expected to improve as execution capability advances • Moving from 15 MWe to 50 MWe powerhouses intended to drive scale economies 6 8 70 Notes: (1) Assumes all regulatory approvals have been obtained on the expected timelines. The regulatory process, including necessary NRC approvals and licensing, is a lengthy, complex process and projected timelines could vary materially from the actual time necessary to obtain all the required approvals. The unit economics provided herein are for illustrative purposes only. Actual results may differ materially. (2) Run - rate of 20 units is expected requirement to achieve NOAK unit economics. (3) Excludes ongoing refueling requirements, which is expected to take place every 10 years.

Illustrative unit economics Unit economics do not include potential benefits from investment tax credits, project finance, or fuel recycling Targeting strong asset based returns • Investment costs are expected at lower scale vs. traditional nuclear • Costs expected to improve as execution capability advances • Moving from 15 MWe to 50 MWe powerhouses intended to drive scale economies • Creates a platform designed to produce strong returns 6 8 71 Notes: (1) Assumes all regulatory approvals have been obtained on the expected timelines. The regulatory process, including necessary NRC approvals and licensing, is a lengthy, complex process and projected timelines could vary materially from the actual time necessary to obtain all the required approvals. The unit economics provided herein are for illustrative purposes only. Actual results may differ materially. (2) Run - rate of 20 units is expected requirement to achieve NOAK unit economics. (3) Excludes ongoing refueling requirements, which is expected to take place every 10 years.

• Investment costs are expected at lower scale vs. traditional nuclear • Costs expected to improve as execution capability advances • Moving from 15 MWe to 50 MWe powerhouses intended to drive scale economies • Creates a platform designed to produce strong returns • Recycling, investment tax credits, and project financing are expected to improve these results Illustrative unit economics Unit economics do not include potential benefits from investment tax credits, project finance, or fuel recycling Targeting strong asset based returns 6 8 72 Notes: (1) Assumes all regulatory approvals have been obtained on the expected timelines. The regulatory process, including necessary NRC approvals and licensing, is a lengthy, complex process and projected timelines could vary materially from the actual time necessary to obtain all the required approvals. The unit economics provided herein are for illustrative purposes only. Actual results may differ materially. (2) Run - rate of 20 units is expected requirement to achieve NOAK unit economics. (3) Excludes ongoing refueling requirements, which is expected to take place every 10 years.

7 3 Notes: (1) Upper limit LCOE based on FOAK single unit plant without investment tax credit (“ITC") benefit. Lower limit LCOE based on NOAK single unit plant with ITC benefit. (2) Estimates for Oklo LCOE range assume: (i) All regulatory approvals have been obtained on expected timelines; (ii) a run - rate of 20 units to achieve NOAK unit economics; (iii) 30% ITC with 90% transferability; (iv) power outputs of 15 - 50 MWe; total refueling capital expenditures over the expected 40 - year life of the Aurora powerhouse assumed to be $53 - 84mm; (v) excludes overnight cost contingency or decommissioning cost; (vi) levelized average lifetime cost approach, using the discounted cash flow (“DCF”) method; and (vii) a weighted - average - cost of capital of 8% based on the International Energy Agency sensitivity analysis range of 4 - 8%. Oklo positioned to deliver emission - free energy at highly competitive cost • Targeting streamlined deployment • Business model targeting large addressable markets Oklo’s estimated Leveled Cost of Electricity (LCOE) $ / MWh (1) • Strategically small • Modern design approach • Investment tax credits • Economies of scale 73

7 4 Notes: (1) Upper limit LCOE based on FOAK single unit plant without investment tax credit (“ITC") benefit. Lower limit LCOE based on NOAK single unit plant with ITC benefit. (2) For illustrative purposes only. The assumptions used to determine the LCOE estimates for advanced nuclear, renewables with battery storage, and natural gas with carbon capture are not currently available. Accordingly, the respective LCOE figures presented herein may not provide a suitable basis for comparison with Oklo estimates. Actual results may differ materially. (3) Estimates for Oklo LCOE range assume: (i) All regulatory approvals have been obtained on expected timelines; (ii) a run - rate of 20 units to achieve NOAK unit economics; (iii) 30% ITC with 90% transferability; (iv) power outputs of 15 - 50 MWe; total refueling capital expenditures over the expected 40 - year life of the Aurora powerhouse assumed to be $53 - 84mm; (v) excludes overnight cost contingency or decommissioning cost; (vi) levelized average lifetime cost approach, using the discounted cash flow (“DCF”) method; and (vii) a weighted - average - cost of capital of 8% based on the International Energy Agency sensitivity analysis range of 4 - 8%. (4) Department of Energy (Pathway to Commercial Liftoff: Advanced Nuclear report - March 2023). Nuclear is a reliable clean energy solution deployable at scale today Other clean, firm energy options are not deployable at scale today ض غ Estimated LCOE of clean, firm energy resources ($/MWh) (1)(2) Oklo positioned to deliver emission - free energy at highly competitive cost 74

75 Efficiently managing operating expenses for maximum effectiveness ~$10.5 million of G&A in 2023 (adjusted cost) Focused Head Count Strategy Head count growth aligned with our operational needs Strategic Partnerships Leveraging partnerships to advance asset plans without significant internal resource investment Methodical Growth Prioritizing efficiency in operations We currently estimate $35 - $55 million in operating expenses in 2024 Low - cost operating ethos

• Pre - money equity value of $850 million Proposed transaction overview Transaction highlights Estimated transaction sources and uses Sources $ Millions AltC cash and investments held in trust (1)(2) 301.4 Total Sources $301.4 Uses $ Millions Cash to balance sheet (3) 259.4 Transaction expenses (4) 42.0 Total Uses $301.4 Pro forma ownership 67% Notes: (1) Assumes a trust account balance of $303.6 million as of December 29, 2023 (but reduced to account for payment of excise tax, which tax of approximately $2.2 million will be paid post - closing of the business combination resulting in $301.4 of cash otherwise available). (2) Assumes no AltC shareholders exercise their redemption rights to receive cash from the trust account prior to closing. (3) Represents AltC cash - in - trust less transaction expenses. (4) Includes estimated AltC transaction expenses of $28.4 million and estimated Oklo transaction expenses of $13.6 million. (5) Assumes 86.7 million shares held by existing Oklo equityholders following the closing of the business combination, which includes 10.3 million shares underlying stock options and excludes the impact of potential earnout shares. (6) Assumes 43.1 million shares held by AltC shareholders following the closing of the business combination. Includes 30.6 million AltC Class A shares and the potential dilutive impact of 12.5 million founder shares, which convert to Class A shares of the post - closing company upon closing of the business combination (the “founder shares”). AltC’s sponsor will subject 100% of founder shares to the following performance vesting schedule: (i) 6.250 million founder shares will vest if the post - closing share price remains at or above $10.00 per share, (ii) 3.125 million founder shares will vest at $12.00 per share, (iii) 3.125 million founder shares will vest ratably at $14.00 per share and $16.00 per share, in each case the per share price must be attained for 20 of 60 days within 5 years of closing 76 33% Existing Oklo shareholders (5) AltC shareholders (2)(6)

• Pre - money equity value of $850 million • All net transaction proceeds to go directly to Oklo’s balance sheet to accelerate its business delivery Proposed transaction overview Transaction highlights Estimated transaction sources and uses Sources AltC cash and investments held in trust (1)(2) $ Millions 301.4 Total Sources $301.4 Uses $ Millions Cash to balance sheet (3) 259.4 Transaction expenses (4) 42.0 Total Uses $301.4 Pro forma ownership 67% Notes: (1) Assumes a trust account balance of $303.6 million as of December 29, 2023 (but reduced to account for payment of excise tax, which tax of approximately $2.2 million will be paid post - closing of the business combination resulting in $301.4 of cash otherwise available). (2) Assumes no AltC shareholders exercise their redemption rights to receive cash from the trust account prior to closing. (3) Represents AltC cash - in - trust less transaction expenses. (4) Includes estimated AltC transaction expenses of $28.4 million and estimated Oklo transaction expenses of $13.6 million. (5) Assumes 86.7 million shares held by existing Oklo equityholders following the closing of the business combination, which includes 10.3 million shares underlying stock options and excludes the impact of potential earnout shares. (6) Assumes 43.1 million shares held by AltC shareholders following the closing of the business combination. Includes 30.6 million AltC Class A shares and the potential dilutive impact of 12.5 million founder shares, which convert to Class A shares of the post - closing company upon closing of the business combination (the “founder shares”). AltC’s sponsor will subject 100% of founder shares to the following performance vesting schedule: (i) 6.250 million founder shares will vest if the post - closing share price remains at or above $10.00 per share, (ii) 3.125 million founder shares will vest at $12.00 per share, (iii) 3.125 million founder shares will vest ratably at $14.00 per share and $16.00 per share, in each case the per share price must be attained for 20 of 60 days within 5 years of closing 77 33% Existing Oklo shareholders (5) AltC shareholders (2)(6)

• Pre - money equity value of $850 million • All net transaction proceeds to go directly to Oklo’s balance sheet to accelerate its business delivery • 100% of existing Oklo shares roll into shares of the post - closing company Proposed transaction overview Transaction highlights Estimated transaction sources and uses Sources AltC cash and investments held in trust (1)(2) $ Millions 301.4 Total Sources $301.4 Uses Cash to balance sheet (3) Transaction expenses (4) $ Millions 259.4 42.0 Total Uses $301.4 Pro forma ownership 67% Notes: (1) Assumes a trust account balance of $303.6 million as of December 29, 2023 (but reduced to account for payment of excise tax, which tax of approximately $2.2 million will be paid post - closing of the business combination resulting in $301.4 of cash otherwise available). (2) Assumes no AltC shareholders exercise their redemption rights to receive cash from the trust account prior to closing. (3) Represents AltC cash - in - trust less transaction expenses. (4) Includes estimated AltC transaction expenses of $28.4 million and estimated Oklo transaction expenses of $13.6 million. (5) Assumes 86.7 million shares held by existing Oklo equityholders following the closing of the business combination, which includes 10.3 million shares underlying stock options and excludes the impact of potential earnout shares. (6) Assumes 43.1 million shares held by AltC shareholders following the closing of the business combination. Includes 30.6 million AltC Class A shares and the potential dilutive impact of 12.5 million founder shares, which convert to Class A shares of the post - closing company upon closing of the business combination (the “founder shares”). AltC’s sponsor will subject 100% of founder shares to the following performance vesting schedule: (i) 6.250 million founder shares will vest if the post - closing share price remains at or above $10.00 per share, (ii) 3.125 million founder shares will vest at $12.00 per share, (iii) 3.125 million founder shares will vest ratably at $14.00 per share and $16.00 per share, in each case the per share price must be attained for 20 of 60 days within 5 years of closing 78 33% Existing Oklo shareholders (5) AltC shareholders (2)(6)

• Pre - money equity value of $850 million • All net transaction proceeds to go directly to Oklo’s balance sheet to accelerate its business delivery • 100% of existing Oklo shares roll into shares of the post - closing company • AltC’s sponsor will subject 100% of retained shares to performance vesting Proposed transaction overview Transaction highlights Estimated transaction sources and uses Sources AltC cash and investments held in trust (1)(2) $ Millions 301.4 Total Sources $301.4 Uses Cash to balance sheet (3) Transaction expenses (4) $ Millions 259.4 42.0 Total Uses $301.4 Pro forma ownership 67% Notes: (1) Assumes a trust account balance of $303.6 million as of December 29, 2023 (but reduced to account for payment of excise tax, which tax of approximately $2.2 million will be paid post - closing of the business combination resulting in $301.4 of cash otherwise available). (2) Assumes no AltC shareholders exercise their redemption rights to receive cash from the trust account prior to closing. (3) Represents AltC cash - in - trust less transaction expenses. (4) Includes estimated AltC transaction expenses of $28.4 million and estimated Oklo transaction expenses of $13.6 million. (5) Assumes 86.7 million shares held by existing Oklo equityholders following the closing of the business combination, which includes 10.3 million shares underlying stock options and excludes the impact of potential earnout shares. (6) Assumes 43.1 million shares held by AltC shareholders following the closing of the business combination. Includes 30.6 million AltC Class A shares and the potential dilutive impact of 12.5 million founder shares, which convert to Class A shares of the post - closing company upon closing of the business combination (the “founder shares”). AltC’s sponsor will subject 100% of founder shares to the following performance vesting schedule: (i) 6.250 million founder shares will vest if the post - closing share price remains at or above $10.00 per share, (ii) 3.125 million founder shares will vest at $12.00 per share, (iii) 3.125 million founder shares will vest ratably at $14.00 per share and $16.00 per share, in each case the per share price must be attained for 20 of 60 days within 5 years of closing 79 33% Existing Oklo shareholders (5) AltC shareholders (2)(6)

80 Notes: (1) Assumes a trust account balance of $303.6 million as of December 29, 2023 (but reduced to account for payment of excise tax, which tax of approximately $2.2 million will be paid post - closing of the business combination resulting in $301.4 of cash otherwise available). (2) Assumes no AltC shareholders exercise their redemption rights to receive cash from the trust account prior to closing. (3) Represents AltC cash - in - trust less transaction expenses. (4) Includes estimated AltC transaction expenses of $28.4 million and estimated Oklo transaction expenses of $13.6 million. (5) Assumes 86.7 million shares held by existing Oklo equityholders following the closing of the business combination, which includes 10.3 million shares underlying stock options and excludes the impact of potential earnout shares. (6) Assumes 43.1 million shares held by AltC shareholders following the closing of the business combination. Includes 30.6 million AltC Class A shares and the potential dilutive impact of 12.5 million founder shares, which convert to Class A shares of the post - closing company upon closing of the business combination (the “founder shares”). AltC’s sponsor will subject 100% of founder shares to the following performance vesting schedule: (i) 6.250 million founder shares will vest if the post - closing share price remains at or above $10.00 per share, (ii) 3.125 million founder shares will vest at $12.00 per share, (iii) 3.125 million founder shares will vest ratably at $14.00 per share and $16.00 per share, in each case the per share price must be attained for 20 of 60 days within 5 years of closing. (7) Existing Oklo shareholder earnout shares vest ratably if the post - closing share price remains at or above $12.00, $14.00, and $16.00 per share for 20 of 60 days within 5 - years of closing. Transaction highlights • Pre - money equity value of $850 million • All net transaction proceeds to go directly to Oklo’s balance sheet to accelerate its business delivery • 100% of existing Oklo shares roll into shares of the post - closing company • AltC’s sponsor will subject 100% of retained shares to performance vesting • Oklo’s founders and AltC’s sponsor shares will be subject to a staggered lock - up over 3 years following the closing of the business combination • 15.0 million earnout shares available for existing Oklo shareholders (earned at $12, $14 and $16 per share) (7) Proposed transaction overview Estimated transaction sources and uses Sources $ Millions AltC cash and investments held in trust (1)(2) 301.4 Total Sources $301.4 Uses $ Millions Cash to balance sheet (3) 259.4 Transaction expenses (4) 42.0 Total Uses $301.4 Pro forma ownership 67% 33% Existing Oklo shareholders (5) AltC shareholders (2)(6)

81 Recurring cash flow from long duration contracts Capital efficient powerhouse deployment Attractive asset returns with embedded upside Strong balance sheet to enable growth Low - cost op e r a t i n g ethos Oklo is seeking 20 to 40 year customer power purchase agreements <$70 million (1) estimated construction & fuel cost <1 year (1) estimated construction time Projected double - digit unlevered returns Upside: tax credits, project finance, and fuel recycling $35 – 55 million estimated operating expenses in 2024 Expected $250+ million of pro forma cash post business combination Targeted financial attributes Owner - operator business model enables attractive financial attributes Notes: (1) Targeted plant costs and construction timeline reflects expected run - rate operations after first deployment is achieved, and relies upon current assumptions of timing and costs, which may change through the regulatory process.

8 2 Q&A Jake DeWitte | Caroline Cochran Craig Bealmear | Nicholas Johnson

8 3 Why Oklo SAM ALTMAN Chairman of Oklo and Co - Founder and CEO of AltC Acquisition Corp.

8 4 Closing Remarks JACOB DEWITTE Co - Founder and Chief Executive Officer

Strong product market fit Clear regulatory pathway Massive market interest Scalable supply chains Clear path on fuel supply Valued with upside to come Closing remarks 8 5 85