Filed by AltC Acquisition Corp.

pursuant to Rule 425 under the Securities Act

of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: AltC Acquisition Corp.

Commission File No. 001-40583

Date: February 2, 2024

On July 11, 2023, AltC Acquisition Corp.

(“AltC”) and Oklo Inc. (“Oklo”) entered into an agreement for a proposed business combination

(the “proposed business combination”). On February 2, 2024, Oklo held an investor webcast (the

“Webcast”) to provide an update on its business and the proposed business combination. The Webcast included video

presentations from Jacob DeWitte, Caroline Cochran and R. Craig Bealmear embedded in the investor presentation presented during the

Webcast. The following is a transcript of Mr. DeWitte, Ms. Cochran and Mr. Bealmear’s video presentation:

| Jacob DeWitte: |

Oklo is an advanced nuclear technology developer, but ultimately what we do is provide power from these systems. We can sell electric power, we can also sell just heat, or we can sell a combination. That means we make it easier for customers to buy what they really want from these systems, which is the clean, reliable, affordable power and heat, while also providing a platform for us to take technology and scale our lessons learned through a whole sort of fleet of them as we build out and grow. |

| |

|

| Caroline Cochran: |

What we're seeing is utilities moving more into transmission and distribution as opposed to generation. Huge power plants built, owned, and operated by large utilities that maybe spend 20 billion dollars. There's just not a lot of appetite for that. |

| |

|

| Craig Bealmear: |

Oklo is a unique company. We are building our entire design on something called the experimental breeder reactor two. |

| |

|

| Jacob DeWitte: |

The selection of the technology bases we're building off has inherent advantages to it, but also the model where we have more numbers of smaller plants gives us more data and experience that we can build from an iterate accordingly forward from, and that gives us a huge advantage because again, nothing beats having real world experience with your real machines and your product. |

| |

|

| |

One of the things that I personally am most excited about is what the recycling piece enables because it's that fundamental approach that allows you to think about not just powering the country for over 150 years but effectively be able to produce power for several billion years at planetary scales. It's a pretty inspiring and exciting enabler. |

| |

|

| Caroline Cochran: |

The amount of electricity that is needed by AI, by data centers, is astronomical. And a lot of times people want to spend money on clean power, but if it's a lot more expensive, they may not be able to do that. So that's a huge part of our mission is to make it affordable. And recycling nuclear waste does that. |

| |

|

| Craig Bealmear: |

The other thing that makes us unique is our reoccurring revenue model. We are going to sell power to our customers through something called a Power Purchase Agreement or PPA. What is great from the customer side is they are getting reliable power from us. What is great from the CFO perspective is that PPA means we will get reoccurring revenue back in the other direction. |

| |

|

| Jacob DeWitte: |

That also works very well for investors as they think about the benefits and stability of recurring revenues and then therefore the growth that can occur as you get growing recurring revenues. It's a great outcome and a great structure that can be realized with this model. |

| |

|

| |

One thing we're very excited about at Oklo is the partners we've built external to the organization. They have fundamental capabilities, resources, expertise that is just world class and it's awesome to be able to work with them. |

| Caroline Cochran: |

We are really excited about the partnership with Siemens. |

| |

|

| Craig Bealmear: |

Siemens is going to be providing Oklo with our steam turbine generator. |

| |

|

| Caroline Cochran: |

And it's unique that we are actually able to outsource that because of the size of our power plants and also because of the safety of our power plants. |

| |

|

| Jacob DeWitte: |

We're excited about our partnerships with Centrus, one of the leading enrichers in the world. |

| |

|

| Caroline Cochran: |

We're also working with Centrus on them purchasing power from our power plants so they can decarbonize their own enrichment, which requires a tremendous amount of power. |

| |

|

| Jaocb DeWitte: |

The mission drive is what I think keeps everyone going and keeping coming back to this. When we talk about what we're developing here, it's literally a technology set that can fundamentally be an energy solution at scale for the entire planet. That's something that's pretty easy to get people out of bed to work on things, right? People will come to Oklo because they know that they can make a massive impact on the world working here, and that makes you feel pretty confident about helping create a better planet going forward. |

IMPORTANT LEGAL INFORMATION

Forward-Looking Statements

This transcript includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform

Act of 1995. Oklo’s, AltC’s and the post-closing company’s actual results may differ from their expectations, estimates

and projections, and consequently, you should not rely on these forward-looking as predictive of future events. Words such as "anticipate,”

“believe,” “continue,” “could,” “designed,” “estimate,” “expect,”

"forecast,” “goal,” “intend,” “may,” “might,” "plans,” “possible,”

“potential,” “predict,” "project,” “seek,” “should,” “target,”

“will,” or “would” or, in each case, their negative or other variations or comparable terminology that predict

or indicate future events. These forward-looking statements include all matters that are not historical facts. These forward-looking statements

include, without limitation, estimates and projections regarding future manufacturing capacity and plant performance; Oklo’s ability

to demonstrate scientific and engineering feasibility of its technologies; Oklo’s ability to attract, retain, and expand its future

customer base; Oklo’s ability to timely and effectively meet construction timelines and scale its production and manufacturing processes;

Oklo’s ability to develop products and services and bring them to market in a timely manner; Oklo’s ability to achieve a competitive

levelized cost of electricity; Oklo’s ability to compete successfully with fission energy products and solutions offered by other

companies, as well as with other sources of clean energy; Oklo’s expectations concerning relationships with strategic partners,

suppliers, governments, regulatory bodies and other third parties; the success of proposed projects for which Oklo’s powerhouses

would provide power, which is outside of Oklo’s control, the construction, ownership and operation by Oklo of power plants, the

licensing of such power plant by the NRC, the safety profile of Oklo’s technology, the execution of definitive power purchase agreements,

and the success of Oklo’s power plants; the memorandum of understanding between Oklo and Centrus, including with respect to the

supply of HALEU to Oklo and any of the other components of the collaboration, the consummation of any definitive agreement between Oklo

and Centrus, including with respect to Centrus’ purchase of electricity from Oklo; Oklo’s partnership with Siemens,

including with respect to Siemens supplying a steam turbine generator to Oklo; Oklo’s expectations

regarding the Aurora Fuel Fabrication Facility at INL and the Aurora advanced fission power plan; and Oklo’s and AltC’s expectations

with respect to future performance. These forward-looking statements are based on information available to Oklo as of the date of this

transcript and represent management’s current views and assumptions. Forward-looking statements are not guarantees of future performance,

events or results and involve known and unknown risks, uncertainties and other factors, which may be beyond our control. These statements

are based on various assumptions, whether or not identified in this transcript, and on the current expectations of Oklo and AltC and are

not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended

to serve as and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or

probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions.

Many actual events and circumstances are beyond the

control of Oklo or AltC. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions about

Oklo that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results,

levels of activity, performance or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties,

include risks related to the deployment and future performance of Oklo’s powerhouses; the risk that Oklo is pursuing an emerging

market, with no commercial project operating, regulatory uncertainties; the potential need for financing to construct plants, market,

financial, political and legal conditions; the inability of the parties to successfully or timely consummate the proposed business combination,

including the risk that the approval of the shareholders of AltC or Oklo is not obtained; the effects of competition; changes in applicable

laws or regulations; the outcome of any government and regulatory proceedings, investigations and inquiries; each case, under the heading

“Risk Factors,” and other documents filed, or to be filed, with the U.S. Securities and Exchange Commission (the “SEC”)

by AltC. If any of these risks materialize or Oklo’s assumptions prove incorrect, actual results could differ materially from the

results implied by the forward-looking statements relating to Oklo. There may be additional risks that Oklo does not presently know or

that Oklo currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking

statements. In addition, forward-looking statements reflect Oklo’s expectations, plans or forecasts of future events and views as

of the date of this communication. Oklo anticipates that subsequent events and developments will cause Oklo’s assessments to change.

However, while Oklo may elect to update these forward-looking statements at some point in the future, Oklo specifically disclaims any

obligation to do so. These forward-looking statements should not be relied upon as representing Oklo’s assessments as of any date

subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Additional Information About the Business Combination

and Where to Find It

The proposed business combination will be submitted

to shareholders of AltC for their consideration. AltC has filed a registration statement on Form S-4 (as amended, and may be further amended

from time to time, the “Registration Statement”) with the SEC, which includes a preliminary proxy statement/prospectus/consent

solicitation statement to be distributed to AltC’s shareholders in connection with AltC’s solicitation for proxies for the

vote by AltC’s shareholders in connection with the proposed business combination and other matters described in the Registration

Statement, as well as the prospectus relating to the offer of the securities to be issued to Oklo’s shareholders in connection with

the completion of the proposed business combination. After the Registration Statement has been declared effective, AltC will mail a definitive

proxy statement/prospectus/consent solicitation statement and other relevant documents to its shareholders as of the record date established

for voting on the proposed business combination.

AltC’s shareholders and other interested persons

are advised to read the preliminary proxy statement/prospectus/consent solicitation statement and any amendments thereto and, once available,

the definitive proxy statement/prospectus/consent solicitation statement, in connection with AltC’s solicitation of proxies for

its special meeting of shareholders to be held to approve, among other things, the proposed business combination, as well as other documents

filed with the SEC by AltC in connection with the proposed business combination (the “Special Meeting”), as these documents

contain and will contain important information about AltC, Oklo and the proposed business combination.

Shareholders may obtain a copy of the preliminary or

definitive proxy statement/prospectus/consent solicitation statement, once available, as well as other documents filed by AltC with the

SEC, without charge, at the SEC’s website located at www.sec.gov or by directing a written request to AltC Acquisition Corp., 640

Fifth Avenue, 12th Floor, New York, NY 10019.

Participants in the Solicitation

AltC, Oklo and certain of their respective directors,

executive officers and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitation

of proxies from AltC’s shareholders in connection with the Special Meeting. Information regarding persons such persons who may,

under SEC rules, be deemed participants in the solicitation of AltC’s shareholders in connection with the Special Meeting, is set

forth in the preliminary proxy statement/prospectus/consent solicitation statement.

Information about the directors and executive officers

of Oklo and a description of their direct or indirect interests is set forth in the sections entitled “Certain Relationships and

Related Party Transactions – Oklo’s Related Person Transactions” and “Interests of Certain Persons in the Business

Combination” included in the Registration Statement.

Information about the directors and executive

officers of AltC, a description of their direct or indirect interests and their beneficial ownership of AltC’s capital stock is

set forth in the sections entitled “Other Information about AltC – Management, Directors and Executive Officers,” “Certain

Relationships and Related Party Transactions – AltC’s Related Person Transactions,” “Interests of Certain Persons

in the Business Combination” and “Beneficial Ownership of Securities” included in the Registration Statement. The most

recent amendment to the Registration Statement was filed on January 30, 2024, and is available at https://www.sec.gov/Archives/edgar/data/1849056/000110465924007900/tm2324337-10_s4a.htm.

Shareholders, potential investors and other interested

persons should read the preliminary proxy statement/prospectus/consent solicitation statement and any amendments thereto carefully before

making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above.

No Offer or Solicitation

This communication does not constitute an offer to

sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction. This communication is not, and under no circumstances is to be construed as, a prospectus,

an advertisement or a public offering of the securities described herein in the United States or any other jurisdiction. No offer of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or exemptions

therefrom. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY

AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION

TO THE CONTRARY IS A CRIMINAL OFFENSE.

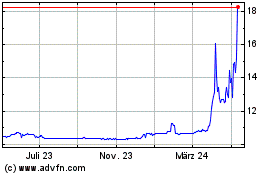

AltC Acquisition (NYSE:ALCC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

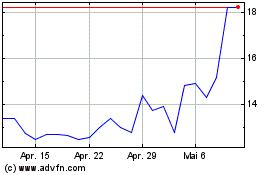

AltC Acquisition (NYSE:ALCC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024