XOMA Raises up to $140 Million in Non-Dilutive, Non-Recourse Financing from Funds Managed by Blue Owl Capital Backed by VABYSMO® Royalties

19 Dezember 2023 - 1:30PM

XOMA Corporation (Nasdaq: XOMA), the biotech royalty aggregator,

today announced it entered into a non-dilutive, non-recourse,

royalty-backed loan for up to $140 million of capital with certain

funds managed by the credit platform of Blue Owl Capital Inc.

(NYSE: OWL).

“The Blue Owl financing provides us with significant

non-dilutive capital to drive shareholder value through stock

repurchases and additional royalty and milestone acquisitions,”

stated Brad Sitko, Chief Investment Officer of XOMA. “This

capital infusion comes at an opportune time given the existing

state of the biotech funding market, providing us with an

opportunity to accelerate the growth of our royalty and milestones

portfolio, which currently consists of two marketed products, two

programs in or near registration, five assets in Phase 3

development, and over 60 assets in earlier stages of

development.”

“Blue Owl’s Life Science efforts are focused on credit, royalty,

and equity investments in innovative healthcare and life sciences

companies and products. We recognize the value embedded in

XOMA’s differentiated royalty and milestone aggregation business

strategy. Our long-established relationship with XOMA’s

management team gives us confidence that they can continue building

a balanced portfolio of current and future royalty-generating

assets. This financing establishes a long-term partnership

with XOMA, as we help broaden their access to capital for royalty

and milestone monetization opportunities,” said Sandip Agarwala,

Managing Director at Blue Owl Capital.

Terms of the AgreementXOMA has drawn down $130

million in principal from Blue Owl and has the option to draw

another $10 million should the royalties received from VABYSMO®

(faricimab) sales on or prior to March 15, 2026, exceed a

predetermined amount. XOMA is obligated to make semi-annual

interest payments at a fixed rate of 9.875% per year until the

royalty-backed loan is repaid, at which time VABYSMO® royalty

payments will revert back to XOMA. The loan is repayable over

a 15-year period, although XOMA may repay it in full at any time

during that period, subject to the terms of the loan. Additionally,

XOMA has issued to Blue Owl warrants to purchase an aggregate of up

to 120,000 shares of XOMA’s common stock in three equal tranches

with strike prices of $35.00, $42.50, and $50.00 per share,

respectively, resulting in implied premiums of 122%, 170%, and 217%

to the price of XOMA’s common stock at closing, respectively.

AdvisorsGibson, Dunn & Crutcher LLP served

as XOMA’s legal advisor while Blue Owl was advised by Cooley

LLP.

About XOMA CorporationXOMA is a biotechnology

royalty aggregator playing a distinctive role in helping biotech

companies achieve their goal of improving human health. XOMA

acquires the potential future economics associated with

pre-commercial and commercial therapeutic candidates that have been

licensed to pharmaceutical or biotechnology companies. When

XOMA acquires the future economics, the seller receives

non-dilutive, non-recourse funding they can use to advance their

internal drug candidate(s) or for general corporate purposes.

The Company has an extensive and growing portfolio with more than

70 assets (asset defined as the right to receive potential future

economics associated with the advancement of an underlying

therapeutic candidate). For more information about the

Company and its portfolio, please visit www.xoma.com.

About Blue Owl Capital Inc.Blue Owl (NYSE: OWL)

is a leading asset manager that is redefining alternatives.

With $157 billion in assets under management1, we invest across

three multi-strategy platforms: Credit, GP Strategic Capital,

and Real Estate. Anchored by a strong permanent capital base, we

provide businesses with private capital solutions to drive

long-term growth and offer institutional and individual investors

differentiated alternative investment opportunities that aim to

deliver strong performance, risk-adjusted returns, and capital

preservation. Together with over 650 experienced

professionals in more than 10 offices globally, Blue Owl brings the

vision and discipline to create the exceptional. To learn

more, visit www.blueowl.com.

1 As of September 30, 2023

Forward-Looking Statements/Explanatory

NotesCertain statements contained in this press release

are forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, including statements regarding XOMA driving

shareholder value through stock repurchases and royalty

acquisitions; the timing and amount of potential commercial

payments to XOMA and other developments related to VABYSMO®

(faricimab); the anticipated timings of regulatory filings and

approvals related to assets in XOMA’s portfolio; and the ability of

XOMA to continue building a balanced portfolio of current and

future royalty generating assets. In some cases, you can identify

such forward-looking statements by terminology such as

“anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,”

“project,” “expect,” “may,” “will”, “would,” “could” or “should,”

the negative of these terms or similar expressions. These

forward-looking statements are not a guarantee

of XOMA’s performance, and you should not place undue

reliance on such statements. These statements are based on

assumptions that may not prove accurate, and actual results could

differ materially from those anticipated due to certain risks

inherent in the biotechnology industry, including those related to

the fact that our product candidates subject to out-license

agreements are still being developed, and our licensees may require

substantial funds to continue development which may not be

available; we do not know whether there will be, or will continue

to be, a viable market for the products in which we have an

ownership or royalty interest; if the therapeutic product

candidates to which we have a royalty interest do not receive

regulatory approval, our third-party licensees will not be able to

market them; and the impact to the global economy as a result of

the COVID-19 pandemic. Other potential risks to XOMA meeting

these expectations are described in more detail in XOMA's most

recent filing on Form 10-Q and in other filings with the Securities

and Exchange Commission. Consider such risks carefully when

considering XOMA's prospects. Any forward-looking statement

in this press release represents XOMA's beliefs and assumptions

only as of the date of this press release and should not be relied

upon as representing its views as of any subsequent date.

XOMA disclaims any obligation to update any forward-looking

statement, except as required by applicable law.

EXPLANATORY NOTE: Any references to “portfolio” in this press

release refer strictly to milestone and/or royalty rights

associated with a basket of drug products in development. Any

references to XOMA’s “assets” in this press release refer strictly

to milestone and/or royalty rights associated with individual drug

products in development.

As of the date of this press release, all assets in XOMA’s

milestone and royalty portfolio, except VABYSMO® (faricimab) and

IXINITY® [coagulation factor IX (recombinant)], are investigational

compounds. Efficacy and safety have not been established. There is

no guarantee that any of the investigational compounds will become

commercially available.

|

Investor contact: |

|

Media

contact: |

| Juliane Snowden |

|

Kathy Vincent |

| XOMA |

|

KV Consulting & Management |

| +1-646-438-9754 |

|

+1-310-403-8951 |

| juliane.snowden@xoma.com |

|

kathy@kathyvincent.com |

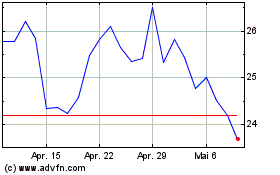

XOMA Royalty (NASDAQ:XOMA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

XOMA Royalty (NASDAQ:XOMA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024