XOMA Royalty Corporation (NASDAQ: XOMA), the biotech royalty

aggregator, reported its second quarter 2024 financial results and

highlighted recent activities.

“The second quarter was marked by pipeline progress, the

realization of several cash milestones, the addition of three

commercial or late-stage programs, and the acquisition of Kinnate

Pharmaceuticals,” stated Owen Hughes, Chief Executive Officer of

XOMA Royalty. “Most important, children suffering from

relapsed or refractory low-grade glioma (pLGG) have a new option

with the approval of Day One’s OJEMDA™, which is now our fifth

commercial royalty. And finally, with a robust cash position

in hand, we look to further solidify our foundation for future

growth via a disciplined approach to capital deployment.”

Key Second Quarter Events

|

Partner |

|

Event |

|

Day One Biopharmaceuticals |

|

The U.S. Food and Drug Administration (FDA) approved Day One’s

OJEMDA™ (tovorafenib) for use in patients with pediatric low-grade

glioma (pLGG). XOMA Royalty earned a $9.0 million milestone

upon the approval and recorded $0.4 million in income resulting

from OJEMDA™ sales in the second quarter of 2024. In

addition, XOMA Royalty received an $8.1 million payment related to

Day One’s sale of its priority review voucher. |

|

Daré

Bioscience |

|

XOMA Royalty added economic interests to three best- or

first-in-category assets to its portfolio. XACIATO™ vaginal

gel 2% is commercially available and marketed by Organon.

Bayer holds the U.S. rights to commercialize Ovaprene®, a

hormone-free monthly intravaginal contraceptive, currently in Phase

3 clinical trials. XOMA Royalty also acquired a synthetic

royalty in Sildenafil Cream, 3.6%, a Phase 3-ready asset for female

sexual arousal disorder. Daré recently published the efficacy

results from its Phase 2b study of Sildenafil Cream, 3.6% in the

publication Obstetrics & Gynecology. |

|

Rezolute |

|

RZ358 - Dosed first patient in its Phase 3 trial

of RZ358; XOMA Royalty earned a $5.0 million milestone associated

with the event. Presented Phase 2 RIZE study sub-analysis at the

2024 Pediatric Endocrine Society Annual Meeting.

RZ402 - Presented positive topline results from

its Phase 2 proof-of-concept study of RZ402 in patients with

diabetic macular edema (DME). The data indicate RZ402 could

be an effective oral therapy for patients with DME prior to

anti-VEGF injections. Rezolute announced its intention to

seek a partner for the next stage of development and future

commercialization activities. |

| Takeda |

|

Announced late-breaking data from

Takeda’s Phase 2b study of mezagitamab demonstrating its potential

to transform the treatment of primary immune

thrombocytopenia1. In the study, patients receiving

mezagitamab showed rapid and sustained increases in platelet counts

that persisted 8 weeks after the last dose through to week

162. |

|

Kinnate Pharmaceuticals |

|

XOMA Royalty added several potential royalty streams, as well as

more than $9.5 million to its cash balance as it completed the

acquisition of Kinnate Pharmaceuticals. |

|

LadRx |

|

Regained development and commercialization rights to aldoxorubicin

from ImmunityBio. XOMA Royalty is eligible to receive a low

single-digit percent royalty on future sales of aldoxorubicin and a

portion of any future milestone payments LadRx receives. |

| |

|

|

Subsequent Events

|

Partner |

|

Event |

|

Zevra Therapeutics |

|

FDA convened a meeting of its Genetic Metabolic Diseases Advisory

Committee (GeMDAC) on August 2, 2024, to discuss the New Drug

Application (NDA) for arimoclomol as a treatment in adults and

pediatric patients 2 years and older with Niemann-Pick Disease Type

C (NPC). The GeMDAC Advisory Committee voted favorably (11

yes, 5 no) that the data support that arimoclomol is effective in

the treatment of patients with NPC. The Committee’s

recommendation will be considered by FDA as it completes its

independent review of the arimoclomol NDA; however, the feedback

from the GeMDAC is not binding upon the Agency. |

| |

|

|

Anticipated 2024 Events of Note

|

Partner |

|

Event |

|

Zevra Therapeutics |

|

September 21, 2024 – FDA PDUFA action date for

arimoclomol NDA |

|

Takeda |

|

In its press release dated June 22, 2024, Takeda announced plans to

initiate a global Phase 3 trial of mezagitamab in ITP in the second

half of fiscal year 2024.1 |

| |

|

|

_______________1

https://www.takeda.com/newsroom/newsreleases/2024/late-breaking-data-from-phase-2b-study-of-mezagitamab/2

Kuter D, Pulanic D, et al. Safety, tolerability, and efficacy of

mezagitamab (TAK-079) in chronic or persistent primary immune

thrombocytopenia: Interim results from a phase 2, randomized,

double-blind, placebo-controlled study. In: International Society

on Thrombosis and Haemostasis (ISTH) Congress; June 22-26, 2024;

Bangkok, Thailand. Abstract LB 01.1.

Second Quarter 2024 Financial

Results

XOMA Royalty recorded total income and revenues of $11.1 million

for the second quarter of 2024, which included $4.9 million in

estimated income associated with two commercial products in our

portfolio, $0.5 million in income from the $9.0 million milestone

payment received from the FDA approval of OJEMDA, and $5.0 million

in revenue from contracts with customers related to a milestone

payment from Rezolute. In the second quarter of 2023, XOMA

Royalty reported total income and revenue of $1.7 million, which

included $1.1 million of revenue from contracts with customers

related to a milestone earned from Janssen.

Research and development (R&D) expenses were $1.2 million in

the second quarter of 2024, reflecting the ongoing clinical

activities related to Kinnate’s Phase 1 clinical trial of KIN-3248,

which XOMA Royalty assumed upon completing the Kinnate

merger. The Company expects to incur additional R&D costs

as this trial winds down in the second half of 2024. R&D

expenses in the second quarter of 2023 were $39,000.

General and administrative (“G&A”) expenses were $11.0

million for the second quarter of 2024 compared with $5.8 million

in the second quarter of 2023. The increase of $5.2 million

was driven primarily by expenses associated with our acquisition of

Kinnate, which included $3.6 million in severance costs paid to

Kinnate senior leadership, $1.0 million in consulting fees, and

$0.8 million in other administrative costs.

In the second quarter of 2024, as a result of communications

with Aronora, XOMA Royalty evaluated the status of the partnered

programs for potential impairment and recorded a one-time, non-cash

impairment charge of $9.0 million and a reduction of royalty

receivables of $9.0 million associated with Aronora. In 2023,

as a result of the announcement by Bioasis to suspend its

operations and the termination of its research collaboration and

license agreement with Chiesi, XOMA Royalty recorded a one-time,

non-cash impairment charge of $1.6 million and a reduction of $1.6

million under long-term royalty receivables in the second quarter

of 2023.

In the second quarters of 2024 and 2023, G&A expenses

included $2.7 million and $2.2 million, respectively, in non-cash

stock-based compensation expenses.

XOMA Royalty recorded a $19.3 million gain on the acquisition of

Kinnate in the second quarter of 2024 due to the fair value of net

assets that exceeded total purchase consideration.

During the second quarter of 2024, XOMA Royalty recognized an

$8.1 million change in the fair value of an embedded derivative

related to the payment of $8.1 million for the sale of a priority

review voucher by Day One that was earned pursuant to XOMA

Royalty’s RPA with Viracta.

Interest expense in the second quarter of 2024 was $3.4 million,

representing interest related to the Blue Owl Loan established in

December 2023.

The Company reported total other income, net, of $2.1 million in

the second quarter of 2024, as compared to total other income, net,

of $0.6 million in the corresponding period of 2023. The $1.5

million increase reflects a $1.2 million increase in investment

income due to higher cash balances and higher market interest rates

on our investments, as well as the change in the market price of

Rezolute’s common stock.

Net income for the second quarter of 2024 was $16.0 million,

compared to a net loss of $5.4 million for the second quarter of

2023.

On June 30, 2024, XOMA Royalty had cash and cash equivalents of

$149.9 million (including $6.0 million in restricted cash).

On December 31, 2023, XOMA Royalty had cash and cash equivalents of

$159.6 million (including $6.3 million in restricted cash).

During the second quarter of 2024, XOMA Royalty received

$22.6 million in cash from royalty and milestone payments and

deployed $22.0 million to acquire new royalty and milestone

economic interests. Net cash used in operating activities

during the quarter was $2.2 million. On July 15, 2024, the

Company paid a total of $1.4 million in cash dividends on the

8.625% Series A Cumulative Perpetual Preferred Stock (Nasdaq:

XOMAP) and the 8.375% Series B Cumulative Perpetual Preferred Stock

(Nasdaq: XOMAO).

About XOMA Royalty CorporationXOMA Royalty is a

biotechnology royalty aggregator playing a distinctive role in

helping biotech companies achieve their goal of improving human

health. XOMA Royalty acquires the potential future economics

associated with pre-commercial and commercial therapeutic

candidates that have been licensed to pharmaceutical or

biotechnology companies. When XOMA Royalty acquires the

future economics, the seller receives non-dilutive, non-recourse

funding they can use to advance their internal drug candidate(s) or

for general corporate purposes. The Company has an extensive

and growing portfolio of assets (asset defined as the right to

receive potential future economics associated with the advancement

of an underlying therapeutic candidate). For more information

about the Company and its portfolio, please visit www.xoma.com or

follow XOMA Royalty Corporation on LinkedIn.

Forward-Looking Statements/Explanatory

NotesCertain statements contained in this press release

are forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, including statements regarding the timing and

amount of potential commercial payments to XOMA Royalty and other

developments related to VABYSMO® (faricimab-svoa), OJEMDA™

(tovorafenib), XACIATO™ (clindamycin phosphate) vaginal gel 2%,

IXINITY® [coagulation factor IX (recombinant)], DSUVIA® (sufentanil

sublingual tablet), and arimoclomol; the potential occurrences of

the events listed under “Anticipated 2024 Events of Note”; the

anticipated timings of regulatory filings and approvals related to

assets in XOMA Royalty’s portfolio; and the potential of XOMA

Royalty’s portfolio of partnered programs and licensed technologies

generating substantial milestone and royalty proceeds over

time. In some cases, you can identify such forward-looking

statements by terminology such as “anticipate,” “intend,”

“believe,” “estimate,” “plan,” “seek,” “project,” “expect,” “may,”

“will”, “would,” “could” or “should,” the negative of these terms

or similar expressions. These forward-looking statements are

not a guarantee of XOMA Royalty’s performance, and you

should not place undue reliance on such statements. These

statements are based on assumptions that may not prove accurate,

and actual results could differ materially from those anticipated

due to certain risks inherent in the biotechnology industry,

including those related to the fact that our product candidates

subject to out-license agreements are still being developed, and

our licensees may require substantial funds to continue development

which may not be available; we do not know whether there will be,

or will continue to be, a viable market for the products in which

we have an ownership or royalty interest; and if the therapeutic

product candidates to which we have a royalty interest do not

receive regulatory approval, our third-party licensees will not be

able to market them. Other potential risks to XOMA Royalty

meeting these expectations are described in more detail in XOMA

Royalty's most recent filing on Form 10-Q and in other filings with

the Securities and Exchange Commission. Consider such risks

carefully when considering XOMA Royalty's prospects. Any

forward-looking statement in this press release represents XOMA

Royalty's beliefs and assumptions only as of the date of this press

release and should not be relied upon as representing its views as

of any subsequent date. XOMA Royalty disclaims any obligation

to update any forward-looking statement, except as required by

applicable law.

EXPLANATORY NOTE: Any references to “portfolio” in this press

release refer strictly to milestone and/or royalty rights

associated with a basket of drug products in development. Any

references to “assets” in this press release refer strictly to

milestone and/or royalty rights associated with individual drug

products in development.

As of the date of this press release, the commercial assets in

XOMA Royalty’s milestone and royalty portfolio are VABYSMO®

(faricimab-svoa), OJEMDA™ (tovorafenib), XACIATO™ (clindamycin

phosphate) vaginal gel 2%, IXINITY® [coagulation factor IX

(recombinant)], and DSUVIA® (sufentanil sublingual tablet).

All other assets in the milestone and royalty portfolio are

investigational compounds. Efficacy and safety have not been

established. There is no guarantee that any of the

investigational compounds will become commercially available.

|

XOMA ROYALTY CORPORATION |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS |

|

(unaudited) |

|

(in thousands, except per share amounts) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Income and revenues: |

|

|

|

|

|

|

|

|

Income from purchased receivables |

$ |

5,432 |

|

|

$ |

— |

|

|

$ |

5,432 |

|

|

$ |

— |

|

|

Revenue from contracts with customers |

|

5,025 |

|

|

|

1,125 |

|

|

|

6,025 |

|

|

|

1,125 |

|

|

Revenue recognized under units-of-revenue method |

|

629 |

|

|

|

533 |

|

|

|

1,119 |

|

|

|

970 |

|

|

Total income and revenues |

|

11,086 |

|

|

|

1,658 |

|

|

|

12,576 |

|

|

|

2,095 |

|

| |

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

1,161 |

|

|

|

39 |

|

|

|

1,194 |

|

|

|

93 |

|

|

General and administrative |

|

11,004 |

|

|

|

5,777 |

|

|

|

19,465 |

|

|

|

11,973 |

|

|

Royalty purchase agreement asset impairment |

|

9,000 |

|

|

|

1,575 |

|

|

|

9,000 |

|

|

|

1,575 |

|

|

Arbitration settlement costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,132 |

|

|

Amortization of intangible assets |

|

— |

|

|

|

224 |

|

|

|

— |

|

|

|

449 |

|

|

Total operating expenses |

|

21,165 |

|

|

|

7,615 |

|

|

|

29,659 |

|

|

|

18,222 |

|

|

Loss from operations |

|

(10,079 |

) |

|

|

(5,957 |

) |

|

|

(17,083 |

) |

|

|

(16,127 |

) |

| |

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

Gain on the acquisition of Kinnate |

|

19,316 |

|

|

|

— |

|

|

|

19,316 |

|

|

|

— |

|

|

Change in fair value of embedded derivative related to

RPA |

|

8,100 |

|

|

|

— |

|

|

|

8,100 |

|

|

|

— |

|

|

Interest expense |

|

(3,402 |

) |

|

|

— |

|

|

|

(6,953 |

) |

|

|

— |

|

|

Other income (expense), net |

|

2,050 |

|

|

|

557 |

|

|

|

4,010 |

|

|

|

914 |

|

| Net income (loss) and

comprehensive income (loss) |

$ |

15,985 |

|

|

$ |

(5,400 |

) |

|

$ |

7,390 |

|

|

$ |

(15,213 |

) |

| |

|

|

|

|

|

|

|

| Net income (loss) available to

(attributable to) common stockholders, basic |

$ |

10,224 |

|

|

$ |

(6,768 |

) |

|

$ |

3,253 |

|

|

$ |

(17,949 |

) |

| Basic net income (loss) per

share available to (attributable to) common stockholders |

$ |

0.88 |

|

|

$ |

(0.59 |

) |

|

$ |

0.28 |

|

|

$ |

(1.57 |

) |

| Weighted average shares used

in computing basic net income (loss) per share available to

(attributable) to common stockholders |

|

11,643 |

|

|

|

11,466 |

|

|

|

11,611 |

|

|

|

11,463 |

|

| |

|

|

|

|

|

|

|

| Net income (loss) available to

(attributable to) common stockholders, diluted |

$ |

14,617 |

|

|

$ |

(6,768 |

) |

|

$ |

4,654 |

|

|

$ |

(17,949 |

) |

| Diluted net income (loss) per

share available to (attributable to) common stockholders |

$ |

0.84 |

|

|

$ |

(0.59 |

) |

|

$ |

0.27 |

|

|

$ |

(1.57 |

) |

| Weighted average shares used

in computing diluted net income (loss) per share available to

(attributable) to common stockholders |

|

17,321 |

|

|

|

11,466 |

|

|

|

17,263 |

|

|

|

11,463 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

XOMA ROYALTY CORPORATION |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(in thousands, except share and per share

amounts) |

|

|

|

|

|

| |

June 30, |

|

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

ASSETS |

(unaudited) |

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

143,904 |

|

|

$ |

153,290 |

|

|

Short-term restricted cash |

|

— |

|

|

|

160 |

|

|

Short-term equity securities |

|

696 |

|

|

|

161 |

|

|

Trade and other receivables, net |

|

526 |

|

|

|

1,004 |

|

|

Short-term royalty and commercial payment receivables |

|

14,257 |

|

|

|

14,215 |

|

|

Prepaid expenses and other current assets |

|

2,820 |

|

|

|

483 |

|

|

Total current assets |

|

162,203 |

|

|

|

169,313 |

|

| Long-term restricted cash |

|

6,016 |

|

|

|

6,100 |

|

| Property and equipment,

net |

|

37 |

|

|

|

25 |

|

| Operating lease right-of-use

assets |

|

349 |

|

|

|

378 |

|

| Long-term royalty and

commercial payment receivables |

|

69,731 |

|

|

|

57,952 |

|

| Exarafenib milestone

asset |

|

2,922 |

|

|

|

— |

|

| Other assets - long term |

|

2,022 |

|

|

|

533 |

|

|

Total assets |

$ |

243,280 |

|

|

$ |

234,301 |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

982 |

|

|

$ |

653 |

|

|

Accrued and other liabilities |

|

4,869 |

|

|

|

2,768 |

|

|

Contingent consideration under RPAs, AAAs and CPPAs |

|

3,000 |

|

|

|

7,000 |

|

|

Operating lease liabilities |

|

421 |

|

|

|

54 |

|

|

Unearned revenue recognized under units-of-revenue method |

|

2,259 |

|

|

|

2,113 |

|

|

Preferred stock dividend accrual |

|

1,368 |

|

|

|

1,368 |

|

|

Current portion of long-term debt |

|

5,716 |

|

|

|

5,543 |

|

|

Total current liabilities |

|

18,615 |

|

|

|

19,499 |

|

| Unearned revenue recognized

under units-of-revenue method – long-term |

|

5,963 |

|

|

|

7,228 |

|

| Exarafenib milestone

contingent consideration |

|

2,922 |

|

|

|

— |

|

| Long-term operating lease

liabilities |

|

710 |

|

|

|

335 |

|

| Long-term debt |

|

115,077 |

|

|

|

118,518 |

|

|

Total liabilities |

|

143,287 |

|

|

|

145,580 |

|

| |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Preferred Stock, $0.05 par value, 1,000,000 shares authorized: |

|

|

|

|

8.625% Series A cumulative, perpetual preferred stock, 984,000

shares issued and outstanding at June 30, 2024 and December 31,

2023 |

|

49 |

|

|

|

49 |

|

|

8.375% Series B cumulative, perpetual preferred stock, 1,600 shares

issued and outstanding at June 30, 2024 and December 31, 2023 |

|

— |

|

|

|

— |

|

|

Convertible preferred stock, 5,003 issued and outstanding at June

30, 2024 and December 31, 2023 |

|

— |

|

|

|

— |

|

|

Common stock, $0.0075 par value, 277,333,332 shares authorized,

11,658,383 and 11,495,492 shares issued and outstanding at June 30,

2024 and December 31, 2023, respectively |

|

87 |

|

|

|

86 |

|

|

Additional paid-in capital |

|

1,315,703 |

|

|

|

1,311,809 |

|

|

Accumulated deficit |

|

(1,215,846 |

) |

|

|

(1,223,223 |

) |

|

Total stockholders’ equity |

|

99,993 |

|

|

|

88,721 |

|

|

Total liabilities and stockholders’ equity |

$ |

243,280 |

|

|

$ |

234,301 |

|

|

|

|

|

|

|

|

|

|

|

XOMA ROYALTY CORPORATION |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(unaudited) |

|

(in thousands) |

| |

|

|

|

|

|

| |

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

Net income (loss) |

$ |

7,390 |

|

|

$ |

(15,213 |

) |

|

Adjustments to reconcile net income (loss) to net cash used in

operating activities: |

|

|

|

|

|

|

Income from purchased receivables under effective interest rate

method |

|

(4,562 |

) |

|

|

— |

|

|

Stock-based compensation expense |

|

5,546 |

|

|

|

3,733 |

|

|

Royalty purchase agreement asset impairment |

|

9,000 |

|

|

|

1,575 |

|

|

Gain on the acquisition of Kinnate |

|

(19,316 |

) |

|

|

— |

|

|

Change in fair value of contingent consideration under RPAs, AAAs,

and CPPAs |

|

— |

|

|

|

(75 |

) |

|

Common stock contribution to 401(k) |

|

118 |

|

|

|

123 |

|

|

Amortization of intangible assets |

|

— |

|

|

|

449 |

|

|

Depreciation |

|

5 |

|

|

|

2 |

|

|

Accretion of long-term debt discount and debt issuance costs |

|

508 |

|

|

|

— |

|

|

Non-cash lease expense |

|

29 |

|

|

|

97 |

|

|

Change in fair value of equity securities |

|

(535 |

) |

|

|

15 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Trade and other receivables, net |

|

478 |

|

|

|

(900 |

) |

|

Prepaid expenses and other assets |

|

(603 |

) |

|

|

(97 |

) |

|

Accounts payable and accrued liabilities |

|

921 |

|

|

|

(769 |

) |

|

Operating lease liabilities |

|

(82 |

) |

|

|

(102 |

) |

|

Unearned revenue recognized under units-of-revenue method |

|

(1,117 |

) |

|

|

(970 |

) |

|

Net cash used in operating activities |

|

(2,220 |

) |

|

|

(12,132 |

) |

| |

|

|

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

Net cash acquired in Kinnate acquisition |

|

18,926 |

|

|

|

— |

|

|

Payments of consideration under RPAs, AAAs and CPPAs |

|

(37,000 |

) |

|

|

(14,650 |

) |

|

Receipts under RPAs, AAAs and CPPAs |

|

16,741 |

|

|

|

2,934 |

|

|

Purchase of property and equipment |

|

(17 |

) |

|

|

— |

|

|

Net cash used in investing activities |

|

(1,350 |

) |

|

|

(11,716 |

) |

| |

|

|

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

|

|

Principal payments — debt |

|

(3,616 |

) |

|

|

— |

|

|

Debt issuance costs and loan fees paid in connection with long-term

debt |

|

(661 |

) |

|

|

— |

|

|

Payment of preferred stock dividends |

|

(2,736 |

) |

|

|

(2,736 |

) |

|

Repurchases of common stock |

|

(13 |

) |

|

|

— |

|

|

Proceeds from exercise of options and other share-based

compensation |

|

2,353 |

|

|

|

208 |

|

|

Taxes paid related to net share settlement of equity awards |

|

(1,387 |

) |

|

|

(5 |

) |

|

Net cash used in financing activities |

|

(6,060 |

) |

|

|

(2,533 |

) |

| |

|

|

|

|

|

| Net decrease in cash, cash

equivalents and restricted cash |

|

(9,630 |

) |

|

|

(26,381 |

) |

| Cash, cash equivalents and

restricted cash as of the beginning of the period |

|

159,550 |

|

|

|

57,826 |

|

| Cash, cash equivalents and

restricted cash as of the end of the period |

$ |

149,920 |

|

|

$ |

31,445 |

|

| |

|

|

|

|

|

| Supplemental Cash Flow

Information: |

|

|

|

|

|

Cash paid for interest |

$ |

3,780 |

|

|

$ |

— |

|

|

Right-of-use assets obtained in exchange for operating lease

liabilities |

$ |

— |

|

|

$ |

85 |

|

| Non-cash investing and

financing activities: |

|

|

|

|

|

Estimated fair value of the Exarafenib milestone asset |

$ |

2,922 |

|

|

$ |

— |

|

|

Estimated fair value of the Exarafenib milestone contingent

consideration |

$ |

2,922 |

|

|

$ |

— |

|

|

Right-of-use assets obtained in exchange for operating lease

liabilities in Kinnate acquisition |

$ |

824 |

|

|

$ |

— |

|

|

Relative fair value basis reduction of right-of-use assets in

Kinnate acquisition |

$ |

(824 |

) |

|

$ |

— |

|

|

Accrual of contingent consideration under the Affitech CPPA |

$ |

3,000 |

|

|

$ |

— |

|

|

Estimated fair value of contingent consideration under the LadRx

Agreements |

$ |

— |

|

|

$ |

1,000 |

|

|

Preferred stock dividend accrual |

$ |

1,368 |

|

|

$ |

1,368 |

|

|

|

|

|

|

|

|

|

|

| Investor contact:Juliane SnowdenXOMA

Royalty+1-646-438-9754juliane.snowden@xoma.com |

|

Media contact:Kathy VincentKV Consulting &

Management+1-310-403-8951kathy@kathyvincent.com |

| |

|

|

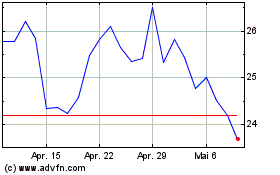

XOMA Royalty (NASDAQ:XOMA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

XOMA Royalty (NASDAQ:XOMA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024