0001058290False00010582902023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 1, 2023 Cognizant Technology Solutions Corporation

(Exact Name of Registrant as Specified in Charter) | | | | | | | | |

| | |

| Delaware | 0-24429 | 13-3728359 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| |

| |

| | |

| |

300 Frank W. Burr Blvd.

Teaneck, New Jersey 07666

(Address of Principal Executive Offices including Zip Code)

(201) 801-0233

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report) Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock, $0.01 par value per share | CTSH | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 1, 2023, Cognizant Technology Solutions Corporation (the “Company”), issued a press release to report the Company’s financial results for the quarter ended September 30, 2023. The full text of the press release and the infographic embedded in and part of such press release are attached to this current report on Form 8-K as Exhibits 99.1 and 99.2, respectively.*

Item 7.01. Regulation FD Disclosure.

The Company’s investor presentation containing additional financial information for the quarter ended September 30, 2023 is attached to this current report on Form 8-K as Exhibit 99.3.*

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document). |

| | | | | |

| * | The information in Item 2.02, Item 7.01, Exhibit 99.1, Exhibit 99.2 and Exhibit 99.3 of this current report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION |

| |

By: | /s/ Jan Siegmund |

Name: | Jan Siegmund |

Title: | Chief Financial Officer |

Date: November 1, 2023

Exhibit 99.1

COGNIZANT REPORTS THIRD QUARTER 2023 RESULTS

•Revenue of $4.9 billion increased 0.8% year-over-year, declined 0.2% in constant currency1

•Record trailing 12-month bookings of $26.9 billion, up 16% year-over-year

•Operating cash flow of $828 million; free cash flow1 of $755 million was ~144% of net income

•Share repurchase expectation for 2023 increased by $200 million to $1 billion

•Full-year 2023 revenue guidance narrowed to (0.7%) to flat, as reported and in constant currency1

•Full-year 2023 Adjusted Operating Margin1 guidance now ~14.7%, the high end of prior guidance

TEANECK, N.J., November 1, 2023 - Cognizant (Nasdaq: CTSH), one of the world’s leading professional services companies, today announced its third quarter 2023 financial results.

“We strengthened the company’s fundamentals during the third quarter as reflected in higher customer satisfaction scores, significantly lower voluntary attrition, and continued growth in bookings, despite ongoing economic uncertainty,” said Ravi Kumar S, Chief Executive Officer. “We are investing to put Cognizant in the best position to serve clients as they strive to reduce costs, digitally transform their businesses and embrace generative AI.”

| | | | | | | | | | | | | | | | | | | | |

| Q3 2023 | | Q3 2022 | | | | | | | |

| Revenue (in billions) | $4.90 | | $4.86 | | | | | | | |

| Y/Y Change | 0.8 | % | | 2.4% | | | | | | | |

Y/Y Change CC1 | (0.2 | %) | | 5.6 | % | | | | | | |

| GAAP Operating Margin | 14.0 | % | | 16.4 | % | | | | | | | |

Adjusted Operating Margin1 | 15.5 | % | | 16.4 | % | | | | | | | |

| GAAP Diluted EPS | $1.04 | | $1.22 | | | | | | | |

Adjusted Diluted EPS1 | $1.16 | | $1.17 | | | | | | |

“Cognizant delivered third-quarter revenue within our guidance range along with an adjusted operating margin above our expectations, evidencing progress with our NextGen program,” said Jan Siegmund, Chief Financial Officer. "We have narrowed our full-year revenue guidance range, which now reflects recent discretionary spending pressure and its impact to our near-term revenue expectations. We have also updated our adjusted operating margin guidance to approximately 14.7%, which is the high-end of our prior range, reflecting our continuing focus on enhancing operational discipline.”

1 Constant currency ("CC") revenue growth, Adjusted Operating Margin, Adjusted Diluted Earnings Per Share ("Adjusted Diluted EPS") and free cash flow are not measures of financial performance prepared in accordance with GAAP. A full reconciliation of Adjusted Operating Margin guidance to the corresponding GAAP measures on a forward-looking basis cannot be provided without unreasonable efforts. See “About Non-GAAP Financial Measures and Performance Metrics” for more information and, where applicable, reconciliations to the most directly comparable GAAP financial measures.

Bookings

Bookings in the third quarter grew 9% year-over-year. On a trailing-twelve-month basis, bookings grew 16% year-over-year to $26.9 billion, which represented a book-to-bill of approximately 1.4x.

Employee Metrics

Total headcount at the end of the third quarter was 346,600, an increase of 1,000 from Q2 2023 and a decrease of 2,800 from Q3 2022. Voluntary attrition - Tech Services on a trailing-twelve-month basis, declined to 16.2% from 19.9% in Q2 2023 and 29.2% in Q3 2022.

Return of Capital to Shareholders

The Company repurchased 4.3 million shares for $300 million during the third quarter under its share repurchase program. As of September 30, 2023, there was $2.1 billion remaining under the share repurchase authorization. In October 2023, the Company declared a quarterly cash dividend of $0.29 per share, a 7% increase year-over-year, for shareholders of record on November 21, 2023. This dividend will be payable on November 30, 2023.

Fourth Quarter and Full-Year 2023 Guidance

•Fourth quarter revenue is expected to be $4.69 - $4.82 billion, a decline of 3.1% to 0.3%, or a decline of 4.0% to 1.2% in constant currency.

•Full-year 2023 revenue is expected to be $19.3 - $19.4 billion, or a decline of 0.7% to flat, both as reported and in constant currency.

•Full-year 2023 Adjusted Operating Margin2 is expected to be approximately 14.7%.

•Full-year 2023 Adjusted EPS2 is expected to be in the range of $4.39 to $4.42.

2 A full reconciliation of Adjusted Operating Margin and Adjusted Diluted EPS guidance to the corresponding GAAP measures on a forward-looking basis cannot be provided without unreasonable efforts. See “About Non-GAAP Financial Measures and Performance Metrics” for more information and a partial reconciliation at the end of this release.

Select Client and Partnership Announcements

•Selected by Technicolor Creative Studios, a creative technology company, as its global IT & Digital Transformation partner. Cognizant expects to provide an end-to-end managed service for Technicolor Creative Studios' users, applications, and infrastructure. Cognizant's approach utilizes an integrated operating model covering service desk, end user services, application services, infrastructure, network, and platform services.

•Established a new relationship with Intrum, a global credit management services company headquartered in Sweden, to provide end-to-end digital integration and core modernization services for Intrum's credit management technology platform. Cognizant expects to build and support a core digital system, jointly with Intrum, including working to implement a new integration layer. The system aims to help Intrum reduce total cost of ownership, accelerate modernization of its integration platform and build an agile digital services team to manage its customers' needs across 20 countries in Europe.

•Announced the launch of Telco Assurance 360, a cloud-based, AI-powered solution, built on ServiceNow and designed to help telecommunications companies reimagine their service management strategies to drive growth in the age of AI. Telco Assurance 360 offers telecom firms real-time visibility into network issues, and fast, proactive resolution through AI-powered analytics. The solution advances the two companies’ previously announced strategic partnership in AI-driven automation across industries.

•In partnership with Google Cloud, we supported Bendigo and Adelaide Bank, one of the largest retail banks in Australia, in rebuilding its digital banking system on Google Cloud. The migration to Google Cloud is a key component of the Bank’s wider transformation program to drive simplification, modernization and consolidation through streamlined service offerings.

•Renewed partnership agreements with Aston Martin Aramco Cognizant Formula One® Team (AMF1 Team) and The Football Association (The FA) to support those partners’ ongoing transformation programs. The AMF1 partnership renewal and extension names Cognizant as AMF1’s Global Technology Services Partner, contributing Cognizant's data and machine-learning technology and broader digital transformation expertise to the day-to-day operation of the race team. The expanded relationship with The FA will see Cognizant become the Digital Transformation Partner of The FA, Official Partner of the Emirates FA Cup, Official Partner of the Women’s FA Cup, Official Partner of The FA Community Shield, and Official Partner of England Football.

•Announced launch of a global strategic go-to-market partnership with Vianai to accelerate human-centered generative AI offerings. This partnership leverages Vianai's hila™ Enterprise platform alongside Cognizant's Neuro® AI, creating a seamless, unified interface to unlock predictive, AI-driven decision making. For both companies, this partnership is expected to enable growth opportunities in their respective customer bases, including through Cognizant's plans to resell Vianai solutions.

•Announced a five-year renewal with ISS, a leading workplace experience and facility management company. The extended collaboration will enable Cognizant to continue helping ISS create efficiencies and enhanced innovation within its financial organization across Northern Europe. To date, Cognizant has transitioned multiple and country specific processes and systems into one simplified, consolidated, and automated framework. During the next phase, Cognizant aims to drive continuous innovation and productivity improvements for the customer's financial organization by providing solutions and processes designed to simplify, harmonize, and standardize the way of working with the goal of achieving further cost savings.

Select Analyst Ratings, Company Recognition and Announcements

•Announced an important new training initiative, Synapse, aimed at empowering more than one million individuals with cutting-edge technology skills, including Generative AI, for the digital age. Together with government, academic institutions, businesses, and other strategic partners, Cognizant’s program intends to prepare individuals to participate in the future workforce. Cognizant intends to build a consortium of partners, which then will help employ individuals who are upskilled through the Synapse initiative.

•Opened AI Innovation Hub in London in partnership with Google

•Named to Forbes' World's Best Employers 2023

•Named to Forbes' America's Best Employers in the State of New Jersey for 2023

•Recognized by Pegasystems' as winner of Pega Industry Excellence Award in Telecommunications

•Recognized as Automation Anywhere Innovation Solutions Partner of the Year 2023 - North America

•Recognized as a Leader by Everest Group® in:

•Property & Casualty (P&C) Insurance BPS PEAK Matrix® Assessment, 2023

•Clinical and Care Management Operations Services PEAK Matrix® Assessment, 2023

•Life Sciences Operations Services PEAK Matrix® Assessment 2023

•Market Leader in HFS Horizon 3:

•Services for the Platform Economy, 2023

•Generative Enterprise™ Services, 2023

•Leadership in ISG Provider Lens™

•Workday Ecosystem – U.S. & Europe, 2023

•Google Cloud Partner Ecosystem – U.S. & Europe, 2023

•Next-Gen ADM Services – U.S. & Europe, 2023

•Digital Service Desk and Workplace Support Services – U.S., 2023

•Managed Workplace Services-End-User Technology-Large Accounts – U.S., 2023

•Power and Utilities - Services and Solutions, North America, 2023

•Leadership in Avasant RadarView™

•End-User Computing Services, 2023

•Digital Workplace Services, 2023

•Data Management and Advanced Analytics Services, 2023

Conference Call

Cognizant will host a conference call on November 1, 2023, at 5:00 p.m. (Eastern) to discuss the Company’s third quarter 2023 results. To listen to the conference call, please dial (877) 810-9510 (domestic) or +1 (201) 493-6778 (international) and provide the following conference passcode: “Cognizant Call.”

The conference call will also be available live on the Investor Relations section of the Cognizant website at http://investors.cognizant.com. An earnings supplement will also be available on the Cognizant website at the time of the conference call.

For those who cannot access the live broadcast, a replay will be available. To listen to the replay, please dial (877) 660-6853 (domestically) or +1 (201) 612-7415 (internationally) and enter 13741068 beginning two hours after the end of the call until 11:59 p.m. (Eastern) on Wednesday, November 15, 2023. The replay will also be available at Cognizant’s website www.cognizant.com for 60 days following the call.

About Cognizant

Cognizant (Nasdaq: CTSH) engineers modern businesses. We help our clients modernize technology, reimagine processes and transform experiences so they can stay ahead in our fast-changing world. Together, we’re improving everyday life. See how at www.cognizant.com or @cognizant.

Forward-Looking Statements

This press release includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the accuracy of which are necessarily subject to risks, uncertainties and assumptions as to future events that may not prove to be accurate. These statements include, but are not limited to, express or implied forward-looking statements relating to our strategy, strategic partnerships and collaborations, competitive position and opportunities in the marketplace, investment in and growth of our business, the pace and magnitude of change and client needs related to generative AI, the effectiveness and results of our new Synapse initiative, including our ability to build a consortium of partners for the training program and the number of individuals we expect to reach with the initiative, the effectiveness of our recruiting and talent efforts and related costs, labor market trends, the anticipated amount of capital to be returned to shareholders and our anticipated financial performance. These statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Factors that could cause actual results to differ materially from those expressed or implied include general economic conditions, the competitive and rapidly changing nature of the markets we compete in, the competitive marketplace for talent and its impact on employee recruitment and retention, our ability to successfully implement our NextGen program and the amount of costs, timing of incurring costs and ultimate benefits of such plans, legal, reputational and financial risks resulting from cyberattacks, changes in the regulatory environment, including with respect to immigration and taxes, and the other factors discussed in our most recent Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. Cognizant undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law.

About Non-GAAP Financial Measures and Performance Metrics

Non-GAAP Financial Measures

To supplement our financial results presented in accordance with GAAP, this press release includes references to the following measures defined by the Securities and Exchange Commission as non-GAAP financial measures: Adjusted Operating Margin, Adjusted Diluted EPS, free cash flow, net cash and constant currency revenue growth. These non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP financial measures should be read in conjunction with our financial statements prepared in accordance with GAAP. The reconciliations of our non-GAAP financial measures to the corresponding GAAP measures should be carefully evaluated.

Our non-GAAP financial measures Adjusted Operating Margin and Adjusted Income from Operations excludes unusual items, such as NextGen charges. Our non-GAAP financial measure Adjusted Diluted EPS excludes unusual items, such as Nextgen charges and the effect of recognition in the third quarter of 2022 of an income tax benefit related to a specific uncertain tax position that was previously unrecognized in our prior-year consolidated financial statements, and net non-operating foreign currency exchange gains or losses and the tax impact of all the applicable adjustments. The income tax impact of each item excluded from Adjusted Diluted EPS is calculated by applying the statutory rate and local tax regulations in the jurisdiction in which the item was incurred. Free cash flow is defined as cash flows from operating activities net of purchases of property and equipment. Net cash is defined as cash and cash equivalents and short-term investments less short-term and long-term debt. Constant currency revenue growth is defined as revenues for a given period restated at the comparative period’s foreign currency exchange rates measured against the comparative period's reported revenues.

Management believes providing investors with an operating view consistent with how we manage the Company provides enhanced transparency into our operating results. For our internal management reporting and budgeting purposes, we use various GAAP and non-GAAP financial measures for financial and operational decision-making, to evaluate period-to-period comparisons, to determine portions of the compensation for our executive officers and for making comparisons of our operating results to those of our competitors. Accordingly, we believe that the presentation of our non-GAAP measures, which exclude certain costs, when read in conjunction with our reported GAAP results, can provide useful supplemental information to our management and investors regarding financial and business trends relating to our financial condition and results of operations.

A limitation of using non-GAAP financial measures versus financial measures calculated in accordance with GAAP is that non-GAAP financial measures do not reflect all of the amounts associated with our operating results as determined in accordance with GAAP and may exclude costs that are recurring such as our net non-operating foreign currency exchange gains or losses. In addition, other companies may calculate non-GAAP financial measures differently than us, thereby limiting the usefulness of these non-GAAP financial measures as a comparative tool. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from our non-GAAP financial measures to allow investors to evaluate such non-GAAP financial measures.

Performance Metrics

Bookings are defined as total contract value (or TCV) of new contracts, including new contract sales as well as renewals and expansions of existing contracts. Bookings can vary significantly quarter to quarter depending in part on the timing of the signing of a small number of large contracts. Our book-to-bill ratio is defined as bookings for the trailing twelve months divided by revenue for the same period. Measuring bookings involves the use of estimates and judgments and there are no independent standards or requirements governing the calculation of bookings. The extent and timing of conversion of bookings to revenues may be impacted by, among other factors, the types of services and solutions sold, contract duration, the pace of client spending, actual volumes of services delivered as compared to the volumes anticipated at the time of sale, and contract modifications, including terminations, over the lifetime of a contract. The majority of our contracts are terminable by the client on short notice often without penalty, and some without notice. We do not update our bookings for subsequent terminations, reductions or foreign currency exchange rate fluctuations. Information regarding our bookings is not comparable to, nor should it be substituted for, an analysis of our reported revenues. However, management believes that it is a key indicator of potential future revenues and provides a useful indicator of the volume of our business over time.

| | | | | | | | | | | | | | |

| Investor Relations Contact: | | | | Media Contact: |

| Tyler Scott | | | | Jeff DeMarrais |

| VP, Investor Relations | | | | VP, Corporate Communications |

| +1 551-220-8246 | | | | +1 475-223-2298 |

| Tyler.Scott@cognizant.com | | | | Jeff.DeMarrais@cognizant.com |

- tables to follow -

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share data) | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues | $ | 4,897 | | | $ | 4,857 | | | $ | 14,595 | | | $ | 14,589 | |

| Operating expenses: | | | | | | | |

| Cost of revenues (exclusive of depreciation and amortization expense shown separately below) | 3,209 | | | 3,080 | | | 9,583 | | | 9,296 | |

| Selling, general and administrative expenses | 801 | | | 838 | | | 2,466 | | | 2,583 | |

| Restructuring charges | 72 | | | — | | | 189 | | | — | |

| Depreciation and amortization expense | 129 | | | 141 | | | 392 | | | 428 | |

| Income from operations | 686 | | | 798 | | | 1,965 | | | 2,282 | |

| Other income (expense), net: | | | | | | | |

| Interest income | 32 | | | 17 | | | 92 | | | 32 | |

| Interest expense | (11) | | | (6) | | | (30) | | | (11) | |

| Foreign currency exchange gains (losses), net | — | | | 3 | | | 3 | | | (1) | |

| Other, net | 6 | | | — | | | 8 | | | — | |

| Total other income (expense), net | 27 | | | 14 | | | 73 | | | 20 | |

| Income before provision for income taxes | 713 | | | 812 | | | 2,038 | | | 2,302 | |

| Provision for income taxes | (191) | | | (183) | | | (473) | | | (537) | |

| Income (loss) from equity method investment | 3 | | | — | | | 3 | | | 4 | |

| Net income | $ | 525 | | | $ | 629 | | | $ | 1,568 | | | $ | 1,769 | |

| Basic earnings per share | $ | 1.04 | | | $ | 1.22 | | | $ | 3.10 | | | $ | 3.40 | |

| Diluted earnings per share | $ | 1.04 | | | $ | 1.22 | | | $ | 3.09 | | | $ | 3.40 | |

| Weighted average number of common shares outstanding - Basic | 504 | | | 516 | | | 506 | | | 520 | |

| Dilutive effect of shares issuable under stock-based compensation plans | 1 | | | 1 | | | 1 | | | 1 | |

| Weighted average number of common shares outstanding - Diluted | 505 | | | 517 | | | 507 | | | 521 | |

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(Unaudited)

| | | | | | | | | | | |

(in millions, except par values) | September 30,

2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 2,204 | | | $ | 2,191 | |

| Short-term investments | 164 | | | 310 | |

| Trade accounts receivable, net | 3,807 | | | 3,796 | |

| Other current assets | 952 | | | 969 | |

| Total current assets | 7,127 | | | 7,266 | |

| Property and equipment, net | 1,048 | | | 1,101 | |

| Operating lease assets, net | 718 | | | 876 | |

| Goodwill | 6,013 | | | 5,710 | |

| Intangible assets, net | 1,174 | | | 1,168 | |

| Deferred income tax assets, net | 935 | | | 642 | |

| Long-term investments | 432 | | | 427 | |

| Other noncurrent assets | 632 | | | 662 | |

| Total assets | $ | 18,079 | | | $ | 17,852 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 325 | | | $ | 360 | |

| Deferred revenue | 302 | | | 398 | |

| Short-term debt | 33 | | | 8 | |

| Operating lease liabilities | 164 | | | 174 | |

| Accrued expenses and other current liabilities | 2,367 | | | 2,407 | |

| Total current liabilities | 3,191 | | | 3,347 | |

| Deferred revenue, noncurrent | 34 | | | 19 | |

| Operating lease liabilities, noncurrent | 634 | | | 714 | |

| Deferred income tax liabilities, net | 220 | | | 180 | |

| Long-term debt | 614 | | | 638 | |

| Long-term income taxes payable | 157 | | | 283 | |

| Other noncurrent liabilities | 347 | | | 362 | |

| Total liabilities | 5,197 | | | 5,543 | |

| Stockholders’ equity: | | | |

| Preferred stock, $0.10 par value, 15 shares authorized, none issued | — | | | — | |

Class A common stock, $0.01 par value, 1,000 shares authorized, 501 and 509 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | 5 | | | 5 | |

| Additional paid-in capital | 16 | | | 15 | |

| Retained earnings | 13,146 | | | 12,588 | |

| Accumulated other comprehensive income (loss) | (285) | | | (299) | |

| Total stockholders’ equity | 12,882 | | | 12,309 | |

| Total liabilities and stockholders’ equity | $ | 18,079 | | | $ | 17,852 | |

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

Reconciliations of Non-GAAP Financial Measures

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in millions, except per share amounts) | Three Months Ended

September 30, | | Nine Months Ended

September 30, | | | | Guidance |

| | 2023 | | 2022 | | 2023 | | 2022 | | | | Full Year 2023 (1) |

| GAAP income from operations | $ | 686 | | | $ | 798 | | | $ | 1,965 | | | $ | 2,282 | | | | | |

NextGen charges(a) | 72 | | | — | | | 189 | | | — | | | | | |

| Adjusted Income From Operations | $ | 758 | | | $ | 798 | | | $ | 2,154 | | | $ | 2,282 | | | | | |

| | | | | | | | | | | |

| GAAP operating margin | 14.0 | % | | 16.4 | % | | 13.5 | % | | 15.6 | % | | | | |

| NextGen charges | 1.5 | | | — | | | 1.3 | | | — | | | | | 1.0% - 1.1% |

Adjusted Operating Margin | 15.5 | % | | 16.4 | % | | 14.8 | % | | 15.6 | % | | | | ~14.7% |

| | | | | | | | | | | |

| GAAP diluted earnings per share | $ | 1.04 | | | $ | 1.22 | | | $ | 3.09 | | | $ | 3.40 | | | | | |

| Effect of NextGen charges, pre-tax | 0.14 | | | — | | | 0.37 | | | — | | | | | (a) |

Non-operating foreign currency exchange (gains) losses, pre-tax(b) | — | | | (0.01) | | | (0.01) | | | — | | | | | (b) |

Tax effect of above adjustments(c) | (0.02) | | | 0.03 | | | (0.08) | | | 0.07 | | | | | (a) (b) |

Effect of recognition of income tax benefit related to an uncertain tax position(d) | — | | | (0.07) | | | — | | | (0.07) | | | | | — |

| Adjusted Diluted Earnings Per Share | $ | 1.16 | | | $ | 1.17 | | | $ | 3.37 | | | $ | 3.40 | | | | | $4.39 - $4.42 |

(1) A full reconciliation of Adjusted Operating Margin and Adjusted Diluted Earnings Per Share guidance to the corresponding GAAP measures on a forward-looking basis cannot be provided without unreasonable efforts, as we are unable to provide reconciling information with respect to unusual items, net non-operating foreign currency exchange gains or losses and the tax effects of these adjustments, and such adjustments may be significant.

Notes:

(a)NextGen charges for the three months ended September 30, 2023 include $15 million of employee separation costs, $55 million of facility exit costs and $2 million of third party and other costs. NextGen charges for the nine months ended September 30, 2023 include $93 million of employee separation costs, $92 million of facility exit costs and $4 million of third party and other costs. We expect to incur total costs of approximately $300 million in connection with the NextGen program, with approximately $200 million of such costs anticipated in 2023 and approximately $100 million in 2024. The total costs related to the NextGen program are reported in "Restructuring charges" in our unaudited consolidated statements of operations. Our guidance anticipates pre-tax charges in the range of $0.39 to $0.42 per diluted share for the full year 2023. The tax effect of these charges is expected to be approximately $0.11 per diluted share for the full year 2023.

(b)Non-operating foreign currency exchange gains and losses, inclusive of gains and losses on related foreign exchange forward contracts not designated as hedging instruments for accounting purposes, are reported in "Foreign currency exchange gains (losses), net" in our unaudited consolidated statements of operations. Non-operating foreign currency exchange gains and losses are subject to high variability and low visibility and therefore cannot be provided on a forward-looking basis without unreasonable efforts.

(c)Presented below are the tax impacts of our non-GAAP adjustment to pre-tax income for the:

| | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | Three Months Ended

September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Non-GAAP income tax benefit (expense) related to: | | | | | | | |

| NextGen charges | $ | 18 | | | $ | — | | | $ | 49 | | | $ | — | |

Foreign currency exchange gains and losses | (7) | | | (15) | | | (2) | | | (35) | |

The effective tax rate related to non-operating foreign currency exchange gains and losses varies depending on the jurisdictions in which such income and expenses are generated and the statutory rates applicable in those jurisdictions. As such, the income tax effect of non-operating foreign currency exchange gains and losses shown in the above table may not appear proportionate to the net pre-tax foreign currency exchange gains and losses reported in our unaudited consolidated statements of operations.

(d)As previously reported in our Annual Report on Form 10-K, during the three months ended September 30, 2022, we recognized an income tax benefit of $36 million related to a specific uncertain tax position that was previously

unrecognized in our prior-year consolidated financial statements. The recognition of the benefit in the third quarter of 2022 was based on management’s reassessment regarding whether this unrecognized tax benefit met the more-likely-than-not threshold in light of the lapse in the statute of limitations as to a portion of such benefit.

Reconciliations of Net Cash

(Unaudited)

| | | | | | | | | | | | | | |

(in millions) | | September 30, 2023 | | December 31, 2022 |

| Cash and cash equivalents | | $ | 2,204 | | | $ | 2,191 | |

| Short-term investments | | 164 | | | 310 | |

| Less: | | | | |

| Short-term debt | | 33 | | | 8 | |

| Long-term debt | | 614 | | | 638 | |

| Net cash | | $ | 1,721 | | | $ | 1,855 | |

The above tables serve to reconcile the Non-GAAP financial measures to the most directly comparable GAAP measures. Refer to the “About Non-GAAP Financial Measures and Performance Metrics” section of our press release for further information on the use of these Non-GAAP measures.

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

Revenue by Business Segment and Geography

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in millions) | Three Months Ended September 30, 2023 |

| | | | | Year over Year |

| | $ | | % of total | | % Change | | Constant Currency % Change (a) |

| Revenues by Segment: | | | | | | | |

| Financial Services | $ | 1,475 | | | 30.1 | % | | (3.0) | % | | (4.0) | % |

| Health Sciences | 1,405 | | | 28.7 | % | | — | % | | (0.8) | % |

| Products and Resources | 1,170 | | | 23.9 | % | | 1.9 | % | | 0.6 | % |

| Communications, Media and Technology | 847 | | | 17.3 | % | | 8.2 | % | | 7.3 | % |

| Total Revenues | $ | 4,897 | | | | | 0.8 | % | | (0.2) | % |

| Revenues by Geography: | | | | | | | |

| North America | $ | 3,599 | | | 73.5 | % | | (0.6) | % | | (0.6) | % |

| United Kingdom | 486 | | | 9.9 | % | | 9.0 | % | | 2.2 | % |

| Continental Europe | 484 | | | 9.9 | % | | 10.5 | % | | 3.7 | % |

Europe - Total | 970 | | | 19.8 | % | | 9.7 | % | | 3.0 | % |

| Rest of World | 328 | | | 6.7 | % | | (6.8) | % | | (3.4) | % |

| Total Revenues | $ | 4,897 | | | | | 0.8 | % | | (0.2) | % |

| | | | | | | |

| | Nine Months Ended September 30, 2023 |

| | | | | Year over Year |

| | $ | | % of total | | % Change | | Constant Currency % Change (a) |

| Revenues by Segment: | | | | | | | |

| Financial Services | $ | 4,414 | | | 30.3 | % | | (3.9) | % | | (3.4) | % |

| Health Sciences | 4,278 | | | 29.3 | % | | 1.7 | % | | 1.6 | % |

| Products and Resources | 3,465 | | | 23.7 | % | | 1.4 | % | | 1.9 | % |

| Communications, Media and Technology | 2,438 | | | 16.7 | % | | 2.7 | % | | 3.5 | % |

| Total Revenues | $ | 14,595 | | | | | — | % | | 0.4 | % |

| Revenues by Geography: | | | | | | | |

| North America | $ | 10,733 | | | 73.5 | % | | (1.0) | % | | (1.0) | % |

| United Kingdom | 1,437 | | | 9.8 | % | | 5.9 | % | | 6.6 | % |

| Continental Europe | 1,439 | | | 9.9 | % | | 7.2 | % | | 6.1 | % |

| Europe - Total | 2,876 | | | 19.7 | % | | 6.6 | % | | 6.4 | % |

| Rest of World | 986 | | | 6.8 | % | | (5.6) | % | | (0.8) | % |

| Total Revenues | $ | 14,595 | | | | | — | % | | 0.4 | % |

Notes:

(a)Constant currency revenue growth is not a measure of financial performance prepared in accordance with GAAP. See “About Non-GAAP Financial Measures and Performance Metrics” section of our press release for further information.

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

(in millions) | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities: | | | | | | | |

| Net income | $ | 525 | | | $ | 629 | | | $ | 1,568 | | | $ | 1,769 | |

| Adjustments for non-cash income and expenses | 47 | | | 175 | | | 322 | | | 584 | |

| Changes in assets and liabilities | 256 | | | 228 | | | (297) | | | (487) | |

| Net cash provided by operating activities | 828 | | | 1,032 | | | 1,593 | | | 1,866 | |

| Cash flows from investing activities: | | | | | | | |

| Purchases of property and equipment | (73) | | | (79) | | | (239) | | | (242) | |

| Net (purchases) maturities of investments | (126) | | | (187) | | | 149 | | | 186 | |

| Proceeds from sales of businesses | — | | | 9 | | | — | | | 28 | |

| Payments for business combinations, net of cash acquired | — | | | — | | | (409) | | | — | |

| Net cash (used in) investing activities | (199) | | | (257) | | | (499) | | | (28) | |

| Cash flows from financing activities: | | | | | | | |

| Repurchases of common stock | (315) | | | (315) | | | (751) | | | (1,107) | |

| Repayment of Term Loan borrowings and finance lease and earnout obligations | (4) | | | (21) | | | (15) | | | (47) | |

| | | | | | | |

| Dividends paid | (147) | | | (141) | | | (445) | | | (425) | |

| Issuance of common stock under stock-based compensation plans | 16 | | | 19 | | | 57 | | | 71 | |

| Net cash (used in) financing activities | (450) | | | (458) | | | (1,154) | | | (1,508) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (30) | | | (43) | | | (30) | | | (80) | |

| Increase (decrease) in cash, cash equivalents and restricted cash | 149 | | | 274 | | | (90) | | | 250 | |

| Cash, cash equivalents and restricted cash, beginning of period | 2,055 | | | 1,768 | | | 2,294 | | | 1,792 | |

| Cash and cash equivalents, end of period | $ | 2,204 | | | $ | 2,042 | | | $ | 2,204 | | | $ | 2,042 | |

SUPPLEMENTAL CASH FLOW INFORMATION

| | | | | | | | | | | | | | |

| (in millions) | | Three Months Ended

September 30, |

| Stock Repurchases under Board of Directors' authorized stock repurchase program: | | 2023 | | 2022 |

| Number of shares repurchased | | 4.3 | | | 4.6 | |

| | | | |

Remaining authorized balance as of September 30, 2023 | | $ | 2,075 | | | |

Reconciliation of Free Cash Flow Non-GAAP Financial Measure

| | | | | | | | | | | | | | | | | | | | | | | |

(in millions) | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net cash provided by operating activities | $ | 828 | | | $ | 1,032 | | | $ | 1,593 | | | $ | 1,866 | |

Purchases of property and equipment | (73) | | | (79) | | | (239) | | | (242) | |

| Free cash flow | $ | 755 | | | $ | 953 | | | $ | 1,354 | | | $ | 1,624 | |

We strengthened the company’s fundamentals during the third quarter as reflected in higher customer satisfaction scores, significantly lower voluntary attrition, and continued growth in bookings, despite ongoing economic uncertainty. We are investing to put Cognizant in the best position to serve clients as they strive to reduce costs, digitally transform their businesses and embrace generative AI. Q3 2023 Ravi Kumar S | Chief Executive Officer ” Revenue $4.9 billion Reported YoY é 0.8% Constant Currency YoY ê 0.2% GAAP Operating Margin | 14.0% GAAP EPS | $1.04 $3.6$1.0 $0.3 Rest of World 6.8% Revenue by Geography ($ In billions) Reported YoY | Constant Currency YoY Year-to-Date Cash Flow Cash Flow From Operations $1,593 Free Cash Flow $1,354 Year-to-Date Capital Return Dividends $445M Share Repurchases $751M $0.87/share Revenue by Segment ($ In billions) Reported YoY | Constant Currency YoY Europe North America 3.4% $1.5 $1.4 $1.2 $0.8 Products & Resources Health Sciences Financial Services Communications, Media & Technology 9.7% 3.0% 0.6% 0.6% 8.2% 7.3% 1.9% 0.6% 3.0% 4.0% —% (0.8)% Total Employees 346,600 ” For non-GAAP financial reconciliations refer to Cognizant's 2023 third quarter earnings release issued on November 1, 2023, which accompanies this presentation and is available at investors.cognizant.com. Exhibit 99.2 +1,000 QoQ (2,800) YoY Voluntary - Tech Services Attrition (Trailing 12-Month) 16.2% é é é é é é é é é é é Adjusted Diluted EPS | $1.16 Employee Metrics Down 13 pts. YoY Adjusted Operating Margin | 15.5% é é Announcements & Recognition é Named to Forbes' America's Best Employers in the State of New Jersey for 2023 Named to Forbes' World's Best Employers 2023 Opened AI Innovation Hub in London in partnership with Google Recognized by Pegasystems' as winner of Pega Industry Excellence Award in Telecommunications Recognized as Automation Anywhere Innovation Solutions Partner of the Year 2023 - North America

Exhibit 99.3 Third Quarter 2023 Financial Results and Highlights © 2023 Cognizant November 1, 2023

© 2023 Cognizant Forward-looking statements This earnings supplement includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the accuracy of which are necessarily subject to risks, uncertainties and assumptions as to future events that may not prove to be accurate. These statements include, but are not limited to, express or implied forward-looking statements relating to our expectations regarding our strategy, competitive position and opportunities in the marketplace, investment in and growth of our business, the pace and magnitude of change and client needs related to generative AI, the effectiveness and results of our new Synapse initiative, including our ability to build a consortium of partners for the training program and the number of individuals we expect to reach with the initiative, the effectiveness of our recruiting and talent efforts and related costs, labor market trends, the anticipated amount of capital to be returned to shareholders and our anticipated financial performance. These statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Factors that could cause actual results to differ materially from those expressed or implied include general economic conditions, the competitive and rapidly changing nature of the markets we compete in, the competitive marketplace for talent and its impact on employee recruitment and retention, our ability to successfully implement our NextGen program and the amount of costs, timing of incurring costs and ultimate benefits of such plans, legal, reputational and financial risks resulting from cyberattacks, changes in the regulatory environment, including with respect to immigration and taxes, and the other factors discussed in our most recent Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. Cognizant undertakes no obligation to update or revise any forward looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law. 2

© 2023 Cognizant Results Summary: Q3 2023 1 See “About Non-GAAP Financial Measures and Performance Metrics” at the end of this earnings supplement for more information and reconciliations to the most directly comparable GAAP financial measures, as applicable. Revenue Up 0.8% Y/Y as reported, and down 0.2% Y/Y in constant currency1 GAAP and Adjusted Operating Margin1 Cash Flow 3 $4,857M $4,897M Q3 '22 Q3 '23 Diluted Earnings Per Share (EPS) 16.4% 14.0% Q3 '22 Q3 '23 16.4% 15.5% Q3 '22 Q3 '23 $1,032M $828M Q3 '22 Q3 '23 $953M $755M Q3 '22 Q3 '23 $1.22 $1.04 Q3 '22 Q3 '23 $1.17 $1.16 Q3 '22 Q3 '23 Adjusted Operating Margin1 GAAP Diluted EPS Adjusted Diluted EPS1 Operating Cash Flow Free Cash Flow1 GAAP Operating Margin Adjusted Operating Margin1

© 2023 Cognizant $4,826 $4,906 $4,857 $4,839 $4,812 $4,886 $4,897 $1.08 $1.14 $1.17 $1.01 $1.11 $1.10 $1.16 Revenue Adjusted Diluted EPS Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 $ in millions except per share amounts Q1 '22 Q2 '22 Q3 '22 Q4 '221 Q1 '23 Q2 '23 Q3 '23 Y/Y 9.7% 7.0% 2.4% 1.3% (0.3%) (0.4%) 0.8% Y/Y CC 10.9% 9.5% 5.6% 4.1% 1.5% (0.1%) (0.2%) GAAP Operating Margin 15.0% 15.5% 16.4% 14.2% 14.6% 11.8% 14.0% Adjusted Operating Margin 15.0% 15.5% 16.4% 14.2% 14.6% 14.2% 15.5% GAAP Diluted EPS $1.07 $1.11 $1.22 $1.02 $1.14 $0.91 $1.04 Adjusted Diluted EPS $1.08 $1.14 $1.17 $1.01 $1.11 $1.10 $1.16 Revenue, Operating Margin and EPS Revenue Growth, Operating Margin and EPS 1 Q4 2022 included a $59 million impairment of capitalized costs related to a large volume-based contract with a Health Sciences customer. This charge negatively impacted each of Q4 2022 GAAP and Adjusted Operating Margin by 120 basis points . Q4 2022 GAAP and Adjusted Earnings per share were each negatively impacted by $0.08. 4 1

© 2023 Cognizant $3,599 $970 $328 $1,475 $1,405 $1,170 $847 Revenue Performance: Q3 2023 Products & Resources Communications, Media & Technology Health Sciences Financial Services North America Europe Rest of World Segments $ in millions Geography $ in millions +8.2% Y/Y +7.3% Y/Y CC +1.9% Y/Y +0.6% Y/Y CC —% Y/Y (0.8%) Y/Y CC (3.0%) Y/Y (4.0%) Y/Y CC +9.7% Y/Y +3.0% Y/Y CC (6.8%) Y/Y (3.4%) Y/Y CC (0.6%) Y/Y and CC 5

© 2023 Cognizant $1,040 $307 $128 Financial Services North America Europe Rest of World Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Y/Y 4.8% 2.7% (1.5%) (4.3%) (3.4%) (5.1%) (3.0%) Y/Y CC 6.0% 5.1% 1.6% (1.4%) (1.4%) (4.8%) (4.0%) (11.1%) Y/Y (9.1%) Y/Y CC +5.5% Y/Y (0.9%) Y/Y CC Revenue1 Revenue growth1 $ in millions $ in millions Q3 2023 Geography (4.2%) Y/Y (4.1%) Y/Y CC $1,528 $1,542 $1,521 $1,481 $1,476 $1,463 $1,475 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 6 1 The sale of the Samlink subsidiary, which was completed on February 1, 2022, impacted our Q1, Q2, Q3 and Q4 2022 Y/Y revenue growth in total Financial Services by -1.3, -1.9, -1.8 and -1.8 percentage points.

© 2023 Cognizant $1,194 $182 $29 Health Sciences North America Europe Rest of World (12.1%) Y/Y (8.8%) Y/Y CC +13.8% Y/Y +6.3% Y/Y CC (1.5%) Y/Y and CC Revenue $ in millions Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Y/Y 8.1% 6.3% 3.8% 4.1% 2.9% 2.3% —% Y/Y CC 8.8% 7.6% 5.5% 5.4% 3.5% 2.1% (0.8%) $1,392 $1,408 $1,405 $1,426 $1,433 $1,440 $1,405 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 7 Revenue growth $ in millions Q3 2023 Geography

© 2023 Cognizant $785 $290 $95 North America Europe Products & Resources +0.8% Y/Y +0.6% Y/Y CC +6.2% Y/Y +0.1% Y/Y CC (1.0%) Y/Y +1.2% Y/Y CC Rest of World Revenue $ in millions Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Y/Y 13.2% 8.1% 3.7% 2.9% (1.1%) 3.2% 1.9% Y/Y CC 14.9% 11.6% 8.2% 6.8% 1.4% 3.7% 0.6% $1,130 $1,140 $1,148 $1,148 $1,118 $1,177 $1,170 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 8 Revenue growth $ in millions Q3 2023 Geography

© 2023 Cognizant $580 $191 $76 $776 $816 $783 $784 $785 $806 $847 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Communications, Media & Technology North America Rest of World (3.8%) Y/Y +3.7% Y/Y CC +19.4% Y/Y +11.5% Y/Y CC +6.6% Y/Y and CC Europe Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Y/Y 18.1% 16.1% 6.0% 5.4% 1.2% (1.2%) 8.2% Y/Y CC 19.9% 19.5% 10.4% 9.3% 3.9% (0.4%) 7.3% 9 Revenue growth Revenue $ in millions $ in millions Q3 2023 Geography

© 2023 Cognizant $23.1 $24.1 $25.6 $26.4 $26.9 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Trailing Twelve Month Bookings1 10 Q3 2023 bookings increased 9% year-over-year Trailing twelve month bookings of $26.9 billion, which represented a book-to-bill of 1.4x $ in billions 1 See “About Non-GAAP Financial Measures and Performance Metrics” at the end of this earnings supplement for more information.

© 2023 Cognizant Employee Metrics 340.4 341.3 349.4 355.3 351.5 345.6 346.6 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 11 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Trailing 12-Month Voluntary Attrition - Tech Services 29.8% 31.1% 29.2% 25.6% 23.1% 19.9% 16.2% Additional Employee Metrics Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Offshore Utilization, Excluding Trainees 82% 83% 83% 81% 79% 80% 80% Onsite Utilization 91% 91% 90% 88% 88% 89% 89% Utilization Headcount in thousands

© 2023 Cognizant $509 $564 $584 $970 $367 $776 $771 $1,422 $1,066 FY 2021 FY 2022 Trailing 12-Months Acquisitions Share Repurchases $141 $139 $150 $148 $147 $367 $409$315 $315 $222 $214 $315 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Cash Flow, Balance Sheet & Capital Allocation Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '231 Q3 '23 Operating Cash Flow $306 $528 $1,032 $702 $729 $36 $828 Free Cash Flow $186 $485 $953 $612 $631 ($32) $755 Cash and Short-Term Investments $2,319 $2,320 $2,731 $2,501 $2,481 $2,095 $2,368 Total Debt $655 $646 $636 $646 $646 $646 $647 Annual Quarterly Dividends 12 $ in millions $ in millions 1 The decrease in free cash flow in Q2 2023 was primarily driven by an increase in income tax payments. In the second quarter of 2023, we made tax payments related to the mandatory capitalization of research and experimental expenditures for the 2022 tax year as well as the estimated tax payment for the six months ended June 30, 2023.

© 2023 Cognizant Fourth Quarter and Full-Year 2023 Guidance1 1 Guidance is as of November 1, 2023 2 A full reconciliation of Adjusted Operating Margin, Adjusted Diluted EPS and Adjusted effective tax rate guidance to the corresponding GAAP measures on a forward-looking basis cannot be provided without unreasonable efforts as we are unable to provide reconciling information with respect to unusual items, net non-operating foreign currency exchange gains or losses, and the tax effects of these adjustments. See “About Non-GAAP Financial Measures and Performance Metrics” for more information, the definition of Adjusted effective tax rate and a partial reconciliation to the most directly comparable GAAP financial measures at the end of this earnings supplement. Q4 2023 Guidance Assumptions Revenue $4.69 to $4.82B (3.1%)-(0.3%) Y/Y or (4.0%)-(1.2%) Y/Y CC Includes ~100 of inorganic contribution 13 FY 2023 Guidance Assumptions Revenue $19.3 to $19.4B (0.7%)-flat Y/Y and Y/Y CC Includes ~110 bps of inorganic contribution Adjusted Operating Margin2 ~14.7% Interest Income ~$115M Adjusted effective tax rate2 ~24% Share Count 506M Adjusted Diluted EPS2 $4.39 to $4.42

APPENDIX: About Non-GAAP Financial Measures and Performance Metrics

© 2023 Cognizant Non-GAAP Financial Measures To supplement our financial results presented in accordance with GAAP, this earnings supplement includes references to the following measures defined by the Securities and Exchange Commission as non-GAAP financial measures: Adjusted Operating Margin, Adjusted Diluted EPS, free cash flow and constant currency revenue growth. These non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and may be different from non- GAAP financial measures used by other companies. In addition, these non-GAAP financial measures should be read in conjunction with our financial statements prepared in accordance with GAAP. The reconciliations of our non-GAAP financial measures to the corresponding GAAP measures should be carefully evaluated. Our non-GAAP financial measures Adjusted Operating Margin and Adjusted Income from Operations excludes unusual items, such as NextGen charges. Our non-GAAP financial measure Adjusted Diluted EPS excludes unusual items, such as NextGen charges and the effect of recognition in the third quarter of 2022 of an income tax benefit related to a specific uncertain tax position that was previously unrecognized in our prior-year consolidated financial statements, and net non-operating foreign currency exchange gains or losses and the tax impact of all the applicable adjustments. The income tax impact of each item excluded from Adjusted Diluted EPS is calculated by applying the statutory rate and local tax regulations in the jurisdiction in which the item was incurred. Free cash flow is defined as cash flows from operating activities net of purchases of property and equipment. Constant currency revenue growth is defined as revenues for a given period restated at the comparative period’s foreign currency exchange rates measured against the comparative period's reported revenues. Adjusted effective tax rate reflects a tax rate commensurate with our non-GAAP Adjusted EPS. Management believes providing investors with an operating view consistent with how we manage the Company provides enhanced transparency into our operating results. For our internal management reporting and budgeting purposes, we use various GAAP and non-GAAP financial measures for financial and operational decision-making, to evaluate period-to-period comparisons, to determine portions of the compensation for our executive officers and for making comparisons of our operating results to those of our competitors. Accordingly, we believe that the presentation of our non-GAAP measures, which exclude certain costs, when read in conjunction with our reported GAAP results, can provide useful supplemental information to our management and investors regarding financial and business trends relating to our financial condition and results of operations. A limitation of using non-GAAP financial measures versus financial measures calculated in accordance with GAAP is that non-GAAP financial measures do not reflect all of the amounts associated with our operating results as determined in accordance with GAAP and may exclude costs that are recurring such as our net non-operating foreign currency exchange gains or losses. In addition, other companies may calculate non-GAAP financial measures differently than us, thereby limiting the usefulness of these non-GAAP financial measures as a comparative tool. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from our non-GAAP financial measures to allow investors to evaluate such non-GAAP financial measures. Performance Metrics Bookings are defined as total contract value (or TCV) of new contracts, including new contract sales as well as renewals and expansions of existing contracts. Bookings can vary significantly quarter to quarter depending in part on the timing of the signing of a small number of large contracts. Our book-to-bill ratio is defined as bookings for the trailing twelve months divided by revenue for the same period. Measuring bookings involves the use of estimates and judgments and there are no independent standards or requirements governing the calculation of bookings. The extent and timing of conversion of bookings to revenues may be impacted by, among other factors, the types of services and solutions sold, contract duration, the pace of client spending, actual volumes of services delivered as compared to the volumes anticipated at the time of sale, and contract modifications, including terminations, over the lifetime of a contract. The majority of our contracts are terminable by the client on short notice often without penalty, and some without notice. We do not update our bookings for subsequent terminations, reductions or foreign currency exchange rate fluctuations. Information regarding our bookings is not comparable to, nor should it be substituted for, an analysis of our reported revenues. However, management believes that it is a key indicator of potential future revenues and provides a useful indicator of the volume of our business over time. About Non-GAAP Financial Measures and Performance Metrics 15

© 2023 Cognizant Reconciliations of Non-GAAP Financial Measures Please refer to page 17 and 18 of this earnings supplement for corresponding Non-GAAP notes. 16 (in millions, except per share amounts) Three Months Ended: Mar 31, 2022 Jun 30, 2022 Sep 30, 2022 Dec 31, 2022 Mar 31, 2023 Jun 30, 2023 Sep 30, 2023 Guidance Full Year 2023(1) GAAP income from operations $ 724 $ 760 $ 798 $ 686 $ 702 $ 577 $ 686 NextGen charges(a) — — — — — 117 72 Adjusted income from operations $ 724 $ 760 $ 798 $ 686 $ 702 $ 694 $ 758 GAAP operating margin 15.0 % 15.5 % 16.4 % 14.2 % 14.6 % 11.8 % 14.0 % NextGen charges(a) — — — — — 2.4 1.5 1.0% - 1.1% Adjusted operating margin 15.0 % 15.5 % 16.4 % 14.2 % 14.6 % 14.2 % 15.5 % ~14.7% GAAP diluted earnings per share $ 1.07 $ 1.11 $ 1.22 $ 1.02 $ 1.14 $ 0.91 $ 1.04 Effect of above NextGen charges, pre-tax — — — — — 0.23 0.14 (a) Effect of non-operating foreign currency exchange (gains) loss, pre-tax(b) — 0.01 (0.01) (0.02) (0.02) 0.02 — (b) Tax effect of above adjustments(c) 0.01 0.02 0.03 0.01 (0.01) (0.06) (0.02) (a) (b) Effect of recognition of income tax benefit related to an uncertain tax position(d) — — (0.07) — — — — — Adjusted diluted earnings per share $ 1.08 $ 1.14 $ 1.17 $ 1.01 $ 1.11 $ 1.10 $ 1.16 $4.39 - $4.42 (1) A full reconciliation of Adjusted Operating Margin and Adjusted Diluted Earnings Per Share guidance to the corresponding GAAP measures on a forward-looking basis cannot be provided without unreasonable efforts, as we are unable to provide reconciling information with respect to unusual items, net non-operating foreign currency exchange gains or losses and the tax effects of these adjustments, and such adjustments may be significant.

© 2023 Cognizant Reconciliations of Non-GAAP Financial Measures Notes: (a) NextGen charges for the three months ended September 30, 2023 include $15 million of employee separation costs, $55 million of facility exit costs and $2 million of third party and other costs. NextGen charges for the three months ended June 30, 2023 include $78 million of employee separation costs, $37 million of facility exit costs and $2 million of third party and other costs. We expect to incur total costs of approximately $300 million in connection with the NextGen program, with approximately $200 million of such costs anticipated in 2023 and approximately $100 million in 2024. The total costs related to the NextGen program are reported in "Restructuring charges" in our unaudited consolidated statements of operations. Our guidance anticipates pre-tax charges in the range of $0.39 to $0.42 per diluted share for the full year 2023. The tax effect of these charges is expected to be approximately $0.11 per diluted share for the full year 2023. (b) Non-operating foreign currency exchange gains and losses, inclusive of gains and losses related to foreign exchange forward contracts not designated as hedging instruments for accounting purposes, are reported in "Foreign currency exchange gains (losses), net" in our unaudited consolidated statements of operations. Non-operating foreign currency exchange gains and losses are subject to high variability and low visibility and therefore cannot be provided on a forward-looking basis without unreasonable efforts. 17 (d) During the three months ended September 30, 2022, we recognized an income tax benefit previously unrecognized in our consolidated financial statements related to a specific uncertain tax position of $36 million. The recognition of the benefit in the third quarter of 2022 was based on management’s reassessment regarding whether this unrecognized tax benefit met the more-likely-than-not threshold in light of the lapse in the statute of limitations as to a portion of such benefit. 2022 2023 Three months ended: Mar 31 Jun 30 Sep 30 Dec 31 Mar 31 Jun 30 Sep 30 Non-GAAP income tax benefit (expense) related to: NextGen charges $ — $ — $ — $ — $ — $ 31 $ 18 Tax impact of foreign currency exchange gain and losses (6) (14) (15) (4) 5 — (7) (c) Presented below are the tax impacts of our non-GAAP adjustments to pre-tax income: The effective tax rate related to non-operating foreign currency exchange gains and losses varies depending on the jurisdictions in which such income and expenses are generated and the statutory rates applicable in those jurisdictions. As such, the income tax effect of non-operating foreign currency exchange gains and losses shown in the above table may not appear proportionate to the net pre-tax foreign currency exchange gains and losses reported in our consolidated statements of operations.

© 2023 Cognizant Reconciliations of Non-GAAP Financial Measures 18 Reconciliation of free cash flow Three Months Ended (in millions) Mar 31, 2022 June 30, 2022 Sep 30, 2022 Dec 31, 2022 Mar 31, 2023 Jun 30, 2023 Sep 30, 2023 Net cash provided by operating activities $ 306 $ 528 $ 1,032 $ 702 $ 729 $ 36 $ 828 Purchases of property and equipment (120) (43) (79) (90) (98) (68) (73) Free cash flow $ 186 $ 485 $ 953 $ 612 $ 631 $ (32) $ 755 Adjusted Effective Tax Rate Reconciliation Q3 2023 Guidance FY 2023 GAAP effective tax rate 26.8 % Effect of non-operating foreign currency exchange (gains) losses (b) (0.9) (b) Effect of NextGen charges (a) (0.2) (0.2) Adjusted effective tax rate 25.7 % ~24% The notes referenced in the above table are located on page 17.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

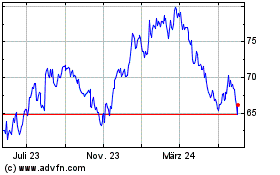

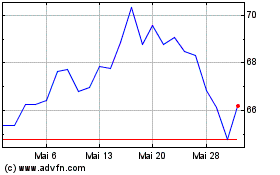

Cognizant Technology Sol... (NASDAQ:CTSH)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Cognizant Technology Sol... (NASDAQ:CTSH)

Historical Stock Chart

Von Jul 2023 bis Jul 2024