false

0000726958

0000726958

2024-10-30

2024-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 30, 2024

CASEY’S GENERAL STORES, INC.

(Exact name of registrant as specified in its

charter)

Iowa

(State or other jurisdiction of incorporation)

| 001-34700 |

42-0935283 |

| (Commission File Number) |

(I.R.S. Employer Identification Number) |

One SE Convenience Blvd., Ankeny, Iowa

(Address of principal executive offices)

50021

(Zip Code)

(515) 965-6100

(Registrant’s telephone number, including

area code)

NONE

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, no par value per share |

CASY |

The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of

1934 (§240.12b-2 of this chapter). ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act ☐

| Item 1.01. | Entry

into a Material Definitive Agreement. |

Casey’s

General Stores, Inc. (the “Company”) is party to a credit agreement, dated as of April 21, 2023 (the “Existing Credit

Agreement”), with Wells Fargo Bank, National Association, as administrative agent, and the lenders from time to time party thereto.

On October 30, 2024 (the

“Amendment Effective Date”), the Company entered into an amendment to the Existing Credit Agreement (the “Amendment”

and, together with the Existing Credit Agreement, the “Credit Agreement”) , pursuant to which the Company incurred an incremental

term loan in an aggregate principal amount of $850 million (the “Incremental Term Loan”). The proceeds of the Incremental

Term Loan were used to fund the previously announced acquisition of 100% of the equity of Fikes Wholesale, LLC (f/k/a Fikes Wholesale,

Inc.) and Group Petroleum Services, LLC (f/k/a Group Petroleum Services, Inc.), each a Texas limited liability company (the “Fikes

Acquisition”), and the payment of fees and expenses in connection therewith.

The

maturity date of the Incremental Term Loan is October 30, 2029.

Additionally,

pursuant to the Amendment, the limitation on “priority debt” (as defined in the Credit Agreement) was amended to exclude

certain obligations under leases from the definition thereof.

Other

than as described above, the Incremental Term Loan has the same terms as the term loan outstanding under the Existing Credit Agreement

immediately prior to the Amendment Effective Date, and there are no material changes to the covenants, events of default or other terms

in the Credit Agreement as a result of the Amendment.

The

foregoing description of the Amendment is qualified in its entirety by reference to the Amendment, a copy of which is attached as Exhibit

10.1, and is incorporated herein by reference.

| Item 2.02. | Results

of Operations and Financial Condition. |

On

November 5, 2024, the Company issued a press release including a business update with respect to the fuel margin for the second quarter

ended, October 31, 2024, a copy of which is attached hereto as Exhibit 99.1, and is incorporated herein by reference.

| Item 2.03. | Creation

of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement

of a Registrant. |

The

information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

| Item 7.01. | Regulation FD Disclosure. |

On

November 5, 2024, the Company issued a press release announcing the closing of the Fikes Acquisition, a copy which is attached hereto

as Exhibit 99.1, and is incorporated herein by reference.

The

information contained in this Item, including the press release attached as Exhibit 99.1, is being furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities

of that Section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities

Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference

in such filing.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. |

Description |

| 10.1* |

First Amendment to Credit Agreement and Incremental Amendment, dated as of October 30, 2024, among Casey’s General Stores, Inc., the lenders party thereto and Wells Fargo Bank, National Association, as administrative agent |

| 99.1 |

Press Release issued by Casey’s General Stores, Inc., dated November 5, 2024 |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

*Certain schedules and exhibits have been omitted pursuant to Item 601(a)(5)

of Regulation S-K because such schedules and exhibits do not contain information that is material to an investment decision or that is

not otherwise disclosed in the filed agreement. The Company will furnish the omitted schedules and exhibits to the SEC on a confidential

basis upon request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

CASEY’S GENERAL STORES, INC. |

|

| |

|

|

|

| Dated: November 5, 2024 |

By: |

/s/ Stephen P. Bramlage, Jr. |

|

| |

|

Stephen P. Bramlage, Jr. |

|

| |

|

Chief Financial Officer |

|

EXHIBIT 10.1

Execution

Version

FIRST AMENDMENT TO CREDIT AGREEMENT

AND INCREMENTAL AMENDMENT

This FIRST

AMENDMENT TO CREDIT AGREEMENT and Incremental AMENDMENT (this “Amendment”),

dated as of October 30, 2024, is among CASEY’S GENERAL STORES, INC., an Iowa corporation (the “Borrower”), the

Lenders (as defined below) party hereto (including the Incremental Term A-1 Loan Lenders (as defined below)), and WELLS FARGO BANK, NATIONAL

ASSOCIATION, as administrative agent (in such capacity, the “Administrative Agent”). Unless otherwise indicated, all

capitalized terms used herein and not otherwise defined herein shall have the respective meanings provided to such terms in the Credit

Agreement referred to below.

W I T N E S S E T H:

WHEREAS, the Borrower,

the lenders party thereto (the “Lenders”) and the Administrative Agent have entered into that certain Credit Agreement,

dated as of April 21, 2023 (as amended, restated, amended and restated, supplemented or otherwise modified prior to the date hereof, the

“Existing Credit Agreement;” the Existing Credit Agreement, as amended by this Amendment, the “Credit Agreement”);

WHEREAS, the Borrower has

requested an Incremental Term Loan in an aggregate principal amount of $850,000,000 (the “Incremental Term A-1 Loan”)

in accordance with the terms and conditions of Section 5.13 of the Existing Credit Agreement, and each of the Lenders party hereto

and identified on Schedule I hereto (the “Incremental Term A-1 Loan Lenders”) has severally committed to

make the Incremental Term A-1 Loan in the principal amounts set forth opposite such Incremental Term A-1 Loan Lender’s name on Schedule

I hereto (such several commitments, the “Incremental Term A-1 Loan Commitments”);

WHEREAS, Wells Fargo Securities,

LLC, CoBank, ACB, JPMorgan Chase Bank, N.A., BMO Capital Markets Corp., and Coöperatieve Rabobank U.A., New York Branch served as

joint lead arrangers and bookrunners for the Incremental Term A-1 Loan (the “Incremental Term A-1 Loan Arrangers”);

and

WHEREAS, the Borrower has

requested, and subject to the terms and conditions set forth herein, the Administrative Agent and the Lenders party hereto have agreed,

to amend the Existing Credit Agreement as more specifically set forth herein.

NOW, THEREFORE, in consideration

of the foregoing and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, it is agreed

as follows:

Section 1.

Incremental Term A-1 Loan Facility.

(a)

Subject to the terms and conditions of this Amendment and in reliance upon the representations and warranties set forth in this

Amendment, each Incremental Term A-1 Loan Lender severally agrees to make a single term loan in Dollars to the Borrower on the First Amendment

Effective Date (as defined below) in accordance with Section 5.13 of the Existing Credit Agreement and this Amendment in an amount

equal to its Incremental Term A-1 Loan Commitment. The Borrower shall give the Administrative Agent an irrevocable Notice of Borrowing

prior to 11:00 a.m. on the First Amendment Effective Date requesting that the Incremental Term A-1 Loan Lenders make the Incremental Term

A-1 Loan as a Base Rate Loan on such date (provided that the Borrower may request, no later than (i) five (5) U.S. Government Securities

Business Days prior to the First Amendment Effective Date, that the Incremental Term A-1 Loan Lenders make the Incremental Term A-1 Loan

as a Daily Simple SOFR Loan or (ii) three (3) U.S. Government Securities Business Days prior to the First Amendment Effective Date, that

the Incremental Term A-1 Loan Lenders make the Incremental Term A-1 Loan as a Term SOFR Loan;

provided further that, in the case of

any Incremental Term A-1 Loan so requested to be made initially as a SOFR Loan, the Borrower expressly agrees that Section 5.9

of the Existing Credit Agreement shall apply to such borrowing and such requested SOFR Loan in all respects). Upon receipt of such Notice

of Borrowing from the Borrower, the Administrative Agent shall promptly notify each Incremental Term A-1 Loan Lender thereof. Not later

than 1:00 p.m. on the First Amendment Effective Date, each Incremental Term A-1 Loan Lender will make available to the Administrative

Agent for the account of the Borrower, at the Administrative Agent’s Office in immediately available funds, an amount equal to its

Incremental Term A-1 Loan Commitment. The Borrower hereby irrevocably authorizes the Administrative Agent to disburse the proceeds of

the Incremental Term A-1 Loan in immediately available funds by wire transfer to such Person or Persons as may be designated by the Borrower

in writing. Notwithstanding the foregoing, if the total Incremental Term A-1 Loan Commitment as of the First Amendment Effective Date

is not drawn on the First Amendment Effective Date, the undrawn amount shall be automatically cancelled.

(b)

The Borrower shall repay the aggregate outstanding principal amount of the Incremental Term A-1 Loan in consecutive quarterly installments

of $10,625,000 on the last Business Day of each of March, June, September and December commencing March 31, 2025, except as the amounts

of individual installments may be adjusted pursuant to Section 4.4 of the Credit Agreement. If not sooner paid, the Incremental

Term A-1 Loan shall be paid in full, together with accrued interest thereon, on the Term Loan Maturity Date applicable thereto.

(c)

The Applicable Margin with respect to the Incremental Term A-1 Loan shall be the same as the Initial Term Loan and shall be determined

from time to time in the same manner as set forth in the definition of Applicable Margin in Section 1.1 of the Credit Agreement;

provided that the Applicable Margin with respect to the Incremental Term A-1 Loan shall be based on Pricing Level II (as set forth

in the definition of Applicable Margin) until the Calculation Date for the first full fiscal quarter ending after the First Amendment

Effective Date.

(d)

The Borrower shall pay a Facility Fee with respect to the Incremental Term A-1 Loan as contemplated by Section 5.3(a) of

the Credit Agreement.

(e)

Except to the extent otherwise set forth herein, the terms and conditions applicable to the Incremental Term A-1 Loan shall be

the same as the terms and conditions applicable to the Initial Term Loan. Without limiting the generality of the foregoing, the parties

hereto agree that the Incremental Term A-1 Loan shall share ratably in all prepayments with the Initial Term Loan and that (i) any mandatory

prepayments of the Incremental Term A-1 Loan shall be applied as set forth in Section 4.4(b)(iii) of the Credit Agreement and (ii)

any optional prepayments of the Incremental Term A-1 Loan shall be applied as set forth in Section 4.4(a) of the Credit Agreement;

provided that, notwithstanding the foregoing or anything in the Loan Documents to the contrary, if for any reason the consummation

of the First Amendment Acquisition shall not have occurred within three (3) Business Days of the First Amendment Effective Date (the “Acquisition

Closing Period”), in accordance with the certification delivered pursuant to Section 3(g) below, the Borrower shall prepay

the aggregate principal amount of the Incremental Term A-1 Loan by the first Business Day immediately following the end of the Acquisition

Closing Period. Any prepayment pursuant to the foregoing proviso of this Section 1(e) shall be accompanied by all accrued interest

on the amount prepaid, together with any additional amounts required pursuant to Section 5.9 of the Credit Agreement, and shall

be paid to the Incremental Term A-1 Lenders in accordance with their respective Commitment Percentages in respect of the Incremental Term

A-1 Loan.

(f)

The proceeds of the Incremental Term A-1 Loan shall be used by the Borrower solely to finance (i) the consummation of the acquisition

(the “First Amendment Acquisition”) of 100% of the Equity Interests of Fikes Wholesale, Inc., a Texas corporation,

and Group Petroleum Services, Inc., a Texas corporation (collectively, the “First Amendment Target Companies”) pursuant

to that certain Equity

Purchase Agreement dated July 25, 2024 by and

among, inter alia, the Borrower, the First Amendment Target Companies and the Sellers (as defined therein) (the “Equity

Purchase Agreement”) and (ii) the payment of fees, commissions and expenses in connection with the Incremental Term A-1 Loan

and the First Amendment Acquisition.

(g)

On and as of the First Amendment Effective Date, (i) the Incremental Term A-1 Loan Commitments are “Incremental Term Loan

Commitments”, “Commitments” and “Term Loan Commitments”, the Incremental Term A-1 Loan Lenders are “Incremental

Lenders”, “Term Loan Lenders” and “Lenders”, and the Incremental Term A-1 Loan is an “Incremental

Term Loan”, a “Loan” and a “Term Loan”, in each case pursuant to Section 5.13 of the Credit Agreement,

and (ii) each Incremental Term A-1 Loan Lender shall be deemed to be a “Lender”, a “Term Loan Lender” and an “Incremental

Lender” with an “Incremental Term Loan Commitment”, including, without limitation, in connection with any determination

of “Required Lenders” or “Required Term Loan Lenders”, in each case as defined in the Credit Agreement, and shall

perform all of the obligations that are required to be performed by it as such, and shall be entitled to the benefits, rights and remedies

as such, set forth in the Loan Documents. In addition, each of the parties hereto acknowledges and agrees that the Incremental Term A-1

Loan Arrangers have acted as joint lead arrangers and joint bookrunners with respect to the Incremental Term A-1 Loan and, as a result

thereof, from and after the First Amendment Effective Date, each Incremental Term A-1 Loan Arranger shall be an “Arranger”

under the Credit Agreement and entitled to the benefits that such designation provides under the Loan Documents (including, without limitation,

for purposes of this Amendment and Sections 8.1, 12.1(e), 12.3(c), 12.16 and Article XI of the Credit

Agreement).

Section 2.

Amendments to Existing Credit Agreement. Effective as of the First Amendment Effective Date and subject to the terms and

conditions set forth herein and in reliance upon the representations and warranties set forth herein, the Existing Credit Agreement is

hereby amended as follows:

(a)

The cover page is hereby amended to include in the top right corner under the Term Loan CUSIP Number, the following:

| |

Incremental Term A-1 Loan |

| |

CUSIP Number: 14752UAH7 |

(b)

The following new defined terms are added to Section 1.1 (in appropriate alphabetical order) to read in their respective

entireties as follows:

“Excluded

Liabilities” has the meaning assigned thereto in the definition of “Capital Lease Obligations”.

“First Amendment”

means that certain First Amendment to Credit Agreement and Incremental Amendment dated as of the First Amendment Effective Date, by and

among the Borrower, the Lenders party thereto and the Administrative Agent, pursuant to which the Incremental Term A-1 Loan was established

and which constitutes an Incremental Amendment effectuating the Incremental Term A-1 Loan.

“First Amendment

Effective Date” means October 30, 2024.

“Incremental

Term A-1 Loan” has the meaning assigned thereto in the First Amendment.

(c)

The definition of “Applicable Margin” in Section 1.1 is amended by inserting the following parenthetical immediately

following the reference therein to “the Applicable Margin shall be based on Pricing Level II until the Calculation Date for the

second full fiscal quarter ending after the Closing Date”:

“(or, solely in the case of

the Incremental Term A-1 Loan, until the Calculation Date for the first full fiscal quarter ending after the First Amendment Effective

Date)”

(d)

The definition of “Capital Lease Obligation” in Section 1.1 is amended by inserting the following proviso immediately

before the period therein:

; provided that,

notwithstanding the provisions of Section 1.3(a), obligations or liabilities of any Person to pay rent or other amounts under any

lease of (or other arrangement conveying the right to use) real or personal property, or a combination thereof, which obligations would

be required to be classified and accounted for as an operating lease under GAAP as existing prior to December 31, 2018 but which are characterized

or recharacterized as capitalized leases due to a change in GAAP after December 31, 2018 shall not be treated as capitalized leases for

any purpose under this Agreement, but instead shall be accounted for as if they were operating leases for all purposes under this Agreement

as determined under GAAP as in effect on December 31, 2018 (such deemed operating leases, the “Excluded Liabilities”)

(e)

The definition of “Priority Debt” in Section 1.1 is amended by inserting the following words immediately before

the period therein:

, in each case, other than any Excluded

Liabilities

(f)

The definition of “Privately Placed Notes” in Section 1.1 is amended by deleting the word “and”

therein and inserting the following words immediately before the period therein:

, (i) 5.23% Senior

Notes, Series I due November 2, 2031, and (j) 5.43% Senior Notes, Series J due November 2, 2034

(g)

Each of the definitions of “Term Loan Commitment”, “Term Loan Maturity Date”, “Term Loan Percentage”

and “U.S. Government Securities Business Day” in Section 1.1 is hereby amended and restated in its entirety to read

as follows:

“Term Loan

Commitment” means (a) as to any Term Loan Lender, the obligation of such Term Loan Lender to make a portion of the Initial

Term Loan and/or Incremental Term Loans, as applicable, to the account of the Borrower hereunder on the Closing Date (in the case of the

Initial Term Loan) or the applicable borrowing date (in the case of any Incremental Term Loan) in an aggregate principal amount not to

exceed the amount set forth opposite such Lender’s name on Schedule 1.1 (in the case of the Initial Term Loan) or the

amount set forth in the applicable Incremental Amendment (in the case of any Incremental Term Loan), as such amount may be increased,

reduced or otherwise modified at any time or from time to time pursuant to the terms hereof and (b) as to all Term Loan Lenders,

the aggregate commitment of all Term Loan Lenders to make such Term Loans. The aggregate Term Loan Commitment with respect to the Initial

Term Loan of all Term Loan Lenders on the Closing Date shall be $250,000,000. The Term Loan Commitment of each Term Loan Lender with respect

to the Initial Term Loan as of the Closing Date is set forth opposite the name of such Term Loan Lender on Schedule 1.1. The aggregate

Term Loan Commitment with respect to the Incremental Term A-1 Loan of all Term Loan Lenders on the First Amendment Effective Date shall

be $850,000,000. The Term Loan Commitment of each Term Loan Lender with respect to the Incremental Term A-1 Loan as of the First Amendment

Effective Date is set forth opposite

the name of such Term Loan Lender on Schedule I to the First Amendment.

“Term Loan

Maturity Date” means the first to occur of (a) with respect to the Initial Term Loan, (i) April 21, 2028, and (ii) the

date of acceleration of the Initial Term Loan pursuant to Section 10.2(a), and (b) with respect to the Incremental Term A-1

Loan, (i) October 30, 2029, and (ii) the date of acceleration of the Incremental Term A-1 Loan pursuant to Section 10.2(a).

“Term Loan

Percentage” means, with respect to any Term Loan Lender at any time and with respect to any Class at any time, the percentage

of the total outstanding principal balance of the Term Loans of such Class represented by the outstanding principal balance of such Term

Loan Lender’s Term Loans of such Class. The Term Loan Percentage of each Term Loan Lender with respect to the Initial Term Loan

as of the Closing Date is set forth opposite the name of such Lender on Schedule 1.1. The Term Loan Percentage of each Term Loan

Lender with respect to the Incremental Term A-1 Loan as of the First Amendment Effective Date is set forth opposite the name of such Lender

on Schedule I to the First Amendment.

“U.S. Government

Securities Business Day” means any day except for (a) a Saturday, (b) a Sunday or (c) a day on which the Securities Industry

and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes

of trading in United States government securities; provided, that for purposes of notice requirements in Sections 2.3(a),

2.4(c), 4.2(a), 4.4(a) and 5.2, in each case, such day is also a Business Day.

(h)

The second sentence of Section 4.4(a) is hereby amended and restated in its entirety to read as follows:

Each optional prepayment

of the Term Loans hereunder shall be in an aggregate principal amount of at least $5,000,000 or any whole multiple of $500,000 in excess

thereof (or, if less, the remaining outstanding principal amount thereof) and shall be applied to prepay the Initial Term Loan and, if

applicable, any Incremental Term Loans, in the amounts as allocated in the applicable Notice of Prepayment (each such prepayment to be

applied to reduce the scheduled principal amortization payments under (x) Section 4.3(a) with respect to the Initial Term Loan

and (y) the applicable Incremental Amendment with respect to any Incremental Term Loans, as directed by the Borrower (and in the absence

of such direction, in direct order of maturity of such scheduled principal amortization payments)).

(i)

Section 5.3(a) is hereby amended and restated in its entirety to read as follows:

(a) Facility

Fees. The Borrower shall pay to the Administrative Agent in Dollars (i) for the account of each Revolving Credit Lender, a facility

fee, which shall accrue at a rate per annum equal to the Applicable Margin on the average daily amount of the Revolving Credit Commitment

of such Lender (or, if the Revolving Credit Commitment of such Lender has terminated, on the average daily amount of the Revolving Credit

Exposure of such Lender) during the period from and including the Closing Date to but excluding the date on which such Revolving Credit

Commitment terminates and such Lender’s Revolving Credit Exposure has been reduced to zero, regardless of usage, subject to adjustment

as provided in Section 5.15(a)(iii)(A), (ii) for the account of each Term Loan Lender in respect of the Initial Term Loan, a facility

fee, which shall accrue at a rate per annum equal to the Applicable Margin on such Lender’s portion of the Initial Term Loan during

the period from and including the Closing Date to but excluding the date on which the outstanding principal amount of the Initial Term

Loan is repaid in full, and (iii) for the

account of each Term Loan Lender in respect

of the Incremental Term A-1 Loan, a facility fee (collectively with the facility fees described in clauses (i) and (ii), the “Facility

Fees” and each, a “Facility Fee”), which shall accrue at a rate per annum equal to the Applicable Margin

on such Lender’s portion of the Incremental Term A-1 Loan during the period from and including the First Amendment Effective Date

to but excluding the date on which the outstanding principal amount of the Incremental Term A-1 Loan is repaid in full. The Facility Fees

shall be payable in arrears on the last Business Day of each calendar quarter during the term of this Agreement commencing June 30, 2023

(or, solely in the case of the Incremental Term A-1 Loan, December 31, 2024), and ending on the date upon which all Obligations (other

than contingent indemnification obligations not then due) arising under the Revolving Credit Facility shall have been indefeasibly and

irrevocably paid and satisfied in full, all Letters of Credit have been terminated or expired (or been Cash Collateralized) and the Revolving

Credit Commitment has been terminated or all Obligations arising under the applicable Term Loan shall have been indefeasibly and irrevocably

paid and satisfied in full, as applicable. The Facility Fees shall be distributed by the Administrative Agent to the Revolving Credit

Lenders pro rata in accordance with the Revolving Credit Lenders’ respective Revolving Credit Commitment Percentages and

to the applicable Term Loan Lenders pro rata in accordance with such Term Loan Lenders’ respective Term Loan Percentages.

(j)

Clause (1) of Section 5.15(a)(iii)(A) is hereby amended and restated in its entirety to read as follows:

the outstanding principal

amount of the Revolving Credit Loans, Initial Term Loan and any Incremental Term Loan funded by it, and

(k)

Section 11.7 is hereby amended and restated in its entirety to read as follows:

Section 11.7 Non-Reliance

on Administrative Agent and Other Lenders. Each Lender and each Issuing Lender expressly acknowledges that none of the Administrative

Agent, any Arranger or any of their respective Related Parties has made any representations or warranties to it and that no act taken

or failure to act by the Administrative Agent, any Arranger or any of their respective Related Parties, including any consent to, and

acceptance of any assignment or review of the affairs of the Borrower and its Subsidiaries or Affiliates shall be deemed to constitute

a representation or warranty of the Administrative Agent, any Arranger or any of their respective Related Parties to any Lender, any Issuing

Lender or any other Secured Party as to any matter, including whether the Administrative Agent, any Arranger or any of their respective

Related Parties have disclosed material information in their (or their respective Related Parties’) possession. Each Lender and

each Issuing Lender expressly acknowledges, represents and warrants to the Administrative Agent and each Arranger that (a) the Loan Documents

set forth the terms of a commercial lending facility, (b) it is engaged in making, acquiring, purchasing or holding commercial loans in

the ordinary course and is entering into this Agreement and the other Loan Documents to which it is a party as a Lender for the purpose

of making, acquiring, purchasing and/or holding the commercial loans set forth herein as may be applicable to it, and not for the purpose

of investing in the general performance or operations of the Borrower and its Subsidiaries, or for the purpose of making, acquiring, purchasing

or holding any other type of financial instrument such as a security, (c) it is sophisticated with respect to decisions to make, acquire,

purchase or hold the commercial loans applicable to it and either it or the Person exercising discretion in making its decisions to make,

acquire, purchase or hold such commercial loans is experienced in making, acquiring, purchasing or holding commercial loans, (d) it has,

independently and without reliance upon the Administrative Agent, any Arranger, any other Lender or any of their respective Related Parties

and based on such documents and information as it has deemed appropriate, made its own credit analysis and appraisal of, and investigations

into, the

business, prospects, operations, property,

assets, liabilities, financial and other condition and creditworthiness of the Borrower and its Subsidiaries, all applicable bank or other

regulatory Applicable Laws relating to the Transactions and the transactions contemplated by this Agreement and the other Loan Documents

and (e) it has made its own independent decision to enter into this Agreement and the other Loan Documents to which it is a party and

to extend credit hereunder and thereunder. Each Lender and each Issuing Lender also acknowledges and agrees that (i) it will, independently

and without reliance upon the Administrative Agent, any Arranger or any other Lender or any of their respective Related Parties (A) continue

to make its own credit analysis, appraisals and decisions in taking or not taking action under or based upon this Agreement, any other

Loan Document or any related agreement or any document furnished hereunder or thereunder based on such documents and information as it

shall from time to time deem appropriate and its own independent investigations and (B) continue to make such investigations and inquiries

as it deems necessary to inform itself as to the Borrower and its Subsidiaries and (ii) it will not assert any claim under any federal

or state securities law or otherwise in contravention of this Section 11.7.

The amendments set forth

above are limited to the extent specifically set forth above and no other terms, covenants or provisions of the Existing Credit Agreement,

the Credit Agreement or any other Loan Document are intended to be affected hereby.

Section 3.

Conditions to Effectiveness of this Amendment. This Amendment shall become effective, and the Incremental Term A-1 Loan

Lenders shall be obligated to make the Incremental Term A-1 Loan pursuant to, and in accordance with, this Amendment and the Credit Agreement,

on the date first set forth above (such date, the “First Amendment Effective Date”) when the following conditions shall

have been satisfied (or waived by the Incremental Term A-1 Loan Lenders, the Required Lenders and/or the Administrative Agent, as applicable,

in each case to the extent such conditions can be waived by such Person(s) under the Existing Credit Agreement):

(a)

Documentation. The Administrative Agent’s receipt of each of the following, each in form and substance reasonably

satisfactory to the Administrative Agent:

(i)

this Amendment, duly executed by the Borrower, the Administrative Agent, the Incremental Term A-1 Loan Lenders, the Required Lenders

and the Required Term Loan Lenders;

(ii)

a Term Loan Note in favor of each Incremental Term A-1 Loan Lender that has requested a Term Loan Note, duly executed by the Borrower;

(iii)

a Compliance Certificate demonstrating that the Borrower is in compliance with the financial covenant(s) set forth in Section

9.9 of the Credit Agreement based on the financial statements for the most recently completed Test Period, after giving effect on

a Pro Forma Basis to the incurrence of the Incremental Term A-1 Loan and the First Amendment Acquisition and each other event consummated

in connection therewith giving rise to a Pro Forma Basis adjustment; and

(iv)

a signed certificate of a Responsible Officer of the Borrower (A) stating that the conditions set forth in Sections 3(e)

and (f) are satisfied as of the First Amendment Effective Date and (B) attaching true, correct and complete copies of the Equity

Purchase Agreement and the note purchase agreement for the Privately Placed Notes referenced in clauses (i) and (j) of the definition

thereof (the “Note Purchase Agreement”), in each case, that have been filed with the Securities and Exchange Commission,

including all amendments, modifications or waivers to any of the foregoing.

(b)

Certificate of Secretary of the Borrower. The Administrative Agent shall have received such customary closing documents

and certificates as the Administrative Agent or its counsel may reasonably request relating to the organization, existence and good standing

of the Borrower, the authorization of the transactions contemplated hereby and any other legal matters relating to the Borrower, all in

form and substance reasonably satisfactory to the Administrative Agent and its counsel.

(c)

Opinions of Counsel. The Administrative Agent shall have received the executed legal opinions of counsel to the Borrower,

including opinions of local counsel as may be reasonably requested by the Administrative Agent, addressed to the Administrative Agent

and the Lenders with respect to the Borrower, this Amendment, the other Loan Documents and such other matters as the Administrative Agent

shall reasonably request.

(d)

Payment at Closing. The Administrative Agent, the Arrangers and the Lenders shall have received all fees and other amounts

due and payable on or prior to the First Amendment Effective Date, including (i) those fees and expenses due under that certain Engagement

Letter, dated as of July 25, 2024, by and among the Borrower, the Administrative Agent and Wells Fargo Securities, LLC, and (ii) to the

extent invoiced at least three (3) Business Days before the First Amendment Effective Date or set forth in a funds flow or settlement

statement executed by the Borrower, reimbursement or payment of all reasonable out-of-pocket expenses required to be reimbursed or paid

by the Borrower hereunder (provided that any such invoice, funds flow or settlement statement shall not thereafter preclude a final settling

of accounts between the Borrower and the Administrative Agent).

(e)

No Default or Event of Default. No Default or Event of Default shall exist on the First Amendment Effective Date, either

immediately prior to, or after giving effect to, this Amendment and the Incremental Increase and other amendments contemplated hereby

and the making of any Extensions of Credit on the First Amendment Effective Date pursuant hereto.

(f)

Accuracy of Representations and Warranties. The representations and warranties of the Loan Parties set forth in the Credit

Agreement and the other Loan Documents shall be true and correct in all material respects on and as of the First Amendment Effective Date;

provided that (i) where any representation and warranty is expressly made as of a specific earlier date, such representation and

warranty shall be true and correct in all material respects as of any such earlier date and (ii) if any representation and warranty is

qualified by or subject to a “material adverse effect”, “material adverse change” or similar term or qualification,

such representation and warranty shall be true and correct as written.

(g)

First Amendment Acquisition and Funding of New Privately Placed Notes. The Administrative Agent shall have received a signed

certificate of a Responsible Officer of the Borrower stating that the Borrower has determined in good faith that (i) the First Amendment

Acquisition will be consummated within three (3) Business Days of the First Amendment Effective Date, in accordance with the Equity Purchase

Agreement and Applicable Law, without giving effect to any amendment, modification or waiver that is materially adverse to the interests

of the Incremental Term A-1 Loan Lenders (in their capacity as such) unless such amendment, modification or waiver is approved by the

Incremental Term A-1 Loan Lenders and (ii) the Privately Placed Notes referenced in clauses (i) and (j) of the definition thereof, shall

have been issued and the proceeds thereof received by the issuer thereof, in each case on or about the First Amendment Effective Date,

in accordance with the Note Purchase Agreement and Applicable Law.

(h)

Miscellaneous.

(i)

Notice of Borrowing. The Administrative Agent shall have received a Notice of Borrowing with respect to the Incremental

Term A-1 Loan.

(ii)

PATRIOT Act, etc.

(A)

The Administrative Agent and the Incremental Term A-1 Loan Lenders shall have received, at least five (5) Business Days prior to

the First Amendment Effective Date, all documentation and other information requested by the Administrative Agent or any Incremental Term

A-1 Loan Lender or required by regulatory authorities in order for the Administrative Agent and the Incremental Term A-1 Loan Lenders

to comply with requirements of any Anti-Money Laundering Laws, including the PATRIOT Act and any applicable “know your customer”

rules and regulations.

(B)

The Borrower shall have delivered to the Administrative Agent, and directly to any Incremental Term A-1 Loan Lender requesting

the same, a Beneficial Ownership Certification in relation to it (or a certification that such Borrower qualifies for an express exclusion

from the “legal entity customer” definition under the Beneficial Ownership Regulations), in each case at least five (5) Business

Days prior to the First Amendment Effective Date.

Without limiting the generality

of the provisions of Section 11.3(c) and Section 11.4 of the Existing Credit Agreement or the Credit Agreement, as

applicable, for purposes of determining compliance with the conditions specified in this Section 3, the Administrative Agent

and each Lender that has signed this Amendment shall be deemed to have consented to, approved or accepted or to be satisfied with, each

document or other matter required thereunder to be consented to or approved by or acceptable or satisfactory to a Lender unless the Administrative

Agent shall have received notice from such Lender prior to the proposed First Amendment Effective Date specifying its objection thereto.

Section 4.

Representations and Warranties. In order to induce the Administrative Agent and the Lenders to enter into this Amendment,

the Borrower represents and warrants to the Administrative Agent and the Lenders as follows:

(a)

The representations and warranties of the Loan Parties set forth in the Credit Agreement and the other Loan Documents are true and correct

in all material respects on and as of the First Amendment Effective Date; provided that (i) where any representation and warranty

is expressly made as of a specific earlier date, such representation and warranty is true and correct in all material respects as of any

such earlier date and (ii) if any representation and warranty is qualified by or subject to a “material adverse effect”, “material

adverse change” or similar term or qualification, such representation and warranty is true and correct as written.

(b) No

Default or Event of Default exists as of the First Amendment Effective Date, either immediately prior to, or after giving effect to, this

Amendment and the Incremental Increase and other amendments contemplated hereby and the making of any Extensions of Credit on the First

Amendment Effective Date pursuant hereto.

(c) The

execution and delivery of this Amendment and each other document executed in connection herewith by the Borrower and the performance by

the Borrower thereof are within the Borrower’s corporate powers and have been duly authorized by all necessary corporate and, if

required, stockholder action.

(d) This

Amendment and each other document executed in connection herewith has been duly executed and delivered by the Borrower and constitute

legal, valid and binding obligations of the Borrower, enforceable against the Borrower in accordance with their terms, subject to applicable

bankruptcy,

insolvency, reorganization, moratorium or other

laws affecting creditors’ rights generally and subject to the general principles of equity, regardless of whether considered in

a proceeding in equity or at law.

Section 5.

Ratification and Confirmation of Loan Documents. The Borrower hereby consents, acknowledges and agrees to the amendments

and other agreements set forth herein and hereby confirms and ratifies in all respects the Loan Documents to which it is a party (including

without limitation, the continuation of its payment and performance obligations under the Loan Documents to which it is a party), in each

case upon and after the effectiveness of the amendments and the other agreements contemplated hereby.

Section 6.

Costs and Expenses. The Borrower hereby reconfirms its obligations pursuant to Section 12.3 of the Credit Agreement,

including, without limitation, its payment and reimbursement obligations thereunder with respect to all reasonable and documented out

of pocket expenses incurred by the Administrative Agent and its Affiliates in connection with this Amendment.

Section 7.

Governing Law; Jurisdiction; Waiver of Jury Trial; Etc. This Amendment shall be governed by, and construed in accordance

with, the laws of the State of New York, and shall be further subject to the provisions of Sections 12.5 and 12.6 of the

Credit Agreement.

Section 8.

Counterparts; Integration; Effectiveness; Electronic Execution. This Amendment may be executed in counterparts (and by different

parties hereto in different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute

a single contract. This Amendment and the other Loan Documents, and any separate letter agreements with respect to fees payable to the

Administrative Agent, any Issuing Lender, the Swingline Lender and/or any Arranger, constitute the entire contract among the parties relating

to the subject matter hereof and supersede any and all previous agreements and understandings, oral or written, relating to the subject

matter hereof. Except as provided in Section 3, this Amendment shall become effective when it shall have been executed by the Administrative

Agent and when the Administrative Agent shall have received counterparts hereof that, when taken together, bear the signatures of each

of the other parties hereto. Delivery of an executed counterpart of a signature page of this Amendment by facsimile or in electronic (i.e.,

“pdf” or “tif”) format shall be effective as delivery of a manually executed counterpart of this Amendment. None

of the terms or conditions of this Amendment may be changed, modified, waived or canceled orally or otherwise except in a writing and

in accordance with Section 12.2 of the Credit Agreement. This Amendment is a Loan Document.

Section 9.

Severability of Provisions. Any provision of this Amendment which is prohibited or unenforceable in any jurisdiction shall,

as to such jurisdiction, be ineffective only to the extent of such prohibition or unenforceability without invalidating the remainder

of such provision or the remaining provisions hereof or thereof or affecting the validity or enforceability of such provision in any other

jurisdiction. In the event that any provision is held to be so prohibited or unenforceable in any jurisdiction, the Administrative Agent,

the Lenders party hereto and the Borrower shall negotiate in good faith to amend such provision to preserve the original intent thereof

in such jurisdiction (subject to the approval of the Required Lenders, if applicable).

Section 10.

Successors and Assigns. This Amendment shall be binding on and inure to the benefit of the parties hereto and their respective

successors and assigns (subject to Section 12.9 of the Credit Agreement).

[Signature pages follow]

IN WITNESS WHEREOF, the parties

hereto have caused their duly authorized signatories to execute and deliver this Amendment as of the date first above written.

| |

CASEY’S GENERAL STORES, INC., as Borrower |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Stephen P. Bramlage, Jr. |

|

| |

|

Name: |

Stephen P. Bramlage, Jr. |

|

| |

|

Title: |

Chief Financial Officer |

|

Casey’s General Stores, Inc.

First Amendment to Credit Agreement and Incremental

Amendment

Signature Page

| |

wells fargo bank, national association, as

Administrative Agent and a Lender |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Todd Alcantara |

|

| |

|

Name: |

Todd Alcantara |

|

| |

|

Title: |

Managing Director |

|

Casey’s General Stores, Inc.

First Amendment to Credit Agreement and Incremental

Amendment

Signature Page

| |

COBANK, ACB, as a Lender |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Jasmeet Minhas |

|

| |

|

Name: |

Jasmeet Minhas |

|

| |

|

Title: |

Lead RM-VP-GABG |

|

Casey’s General Stores, Inc.

First Amendment to Credit Agreement and Incremental

Amendment

Signature Page

| |

JPMORGAN CHASE BANK, N.A.,

as a Lender |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Kyle O’Donnell |

|

| |

|

Name: |

Kyle O’Donnell |

|

| |

|

Title: |

Vice

President |

|

Casey’s General Stores, Inc.

First Amendment to Credit Agreement and Incremental

Amendment

Signature Page

| |

BMO BANK N.A., as a Lender |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Jonathan Sarmini |

|

| |

|

Name: |

Jonathan Sarmini |

|

| |

|

Title: |

Vice

President |

|

Casey’s General Stores, Inc.

First Amendment to Credit Agreement and Incremental

Amendment

Signature Page

| |

COÖPERATIEVE RABOBANK U.A., NEW YORK BRANCH, as a Lender |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Piet Hein Knook |

|

| |

|

Name: |

Piet Hein Knook |

|

| |

|

Title: |

Executive Director |

|

| |

|

|

|

|

| |

By: |

/s/ John Dansdill |

|

| |

|

Name: |

John Dansdill |

|

| |

|

Title: |

Vice President |

|

Casey’s General Stores, Inc.

First Amendment to Credit Agreement and Incremental

Amendment

Signature Page

| |

CIBC BANK USA, as a Lender |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Kelly Barrick |

|

| |

|

Name: |

Kelly Barrick |

|

| |

|

Title: |

Managing Director |

|

Casey’s General Stores, Inc.

First Amendment to Credit Agreement and Incremental

Amendment

Signature Page

| |

UMB BANK, N.A., as a Lender |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Josh Heinrich |

|

| |

|

Name: |

Josh Heinrich |

|

| |

|

Title: |

Senior Vice President |

|

EXHIBIT 99.1

Casey's

Announces the Closing of the Fikes Wholesale Acquisition and Provides a Business Update

ANKENY, Iowa,

November 5, 2024 – (Business Wire) – Casey’s General Stores, Inc. (“Casey’s” or the “Company”)

(Nasdaq: CASY), one of the leading convenience store chains in the United States, today announced the closing of the previously announced

acquisition of Fikes Wholesale (“Fikes”), owner of CEFCO Convenience Stores (“CEFCO”), on November 1, 2024. The

acquisition will bring 148 additional stores to Texas, which is a highly strategic market for Casey’s, as well as 50 stores in the southern states of Alabama, Florida, and Mississippi. This acquisition brings the total store count to approximately

2,900 stores.

“This acquisition

is the largest in Casey’s history and in line with the strategic plan laid out at the June 2023 Investor Day,” said Darren

Rebelez, Board Chair, President and Chief Executive Officer of Casey’s. “We are thrilled to complete this transaction, welcome

Fikes to the Casey’s team, and look forward to bringing Casey’s pizza to these high-volume stores.”

Business

Update

Casey’s expects

the fuel margin for the second quarter ended, October 31, 2024, to be approximately 40 cents per gallon.

About Casey’s

General Stores

Casey’s is

a Fortune 500 company (Nasdaq: CASY) operating approximately 2,900 convenience stores.

Founded more than 50 years ago, the company has grown to become the third-largest convenience store retailer and the fifth-largest pizza

chain in the United States. Casey’s provides freshly prepared foods, quality fuel and

friendly service at its locations. Guests can enjoy pizza, donuts, other assorted bakery

items, and a wide selection of beverages and snacks. Learn more and order online at www.caseys.com,

or in the mobile app.

Investor Relations

Contact:

Brian Johnson (515) 446-6587

Brian.johnson@caseys.com

Media Relations

Contact:

Katie Petru (515) 446-6772

Katie.petru@caseys.com

Forward-Looking

Statements

This communication

contains statements that may constitute “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, including those related to the potential impact of consummation of the transaction on relationships with third parties,

expectations for future periods, possible or assumed future results of operations, financial conditions, liquidity and related sources

or needs, business and/or integration strategies, plans and synergies, supply chain, growth opportunities, and performance at the Company’s

stores. There are a number of known and unknown risks, uncertainties, and other factors that may cause the Company’s actual results

to differ materially from any results expressed or implied by these forward-looking statements, including but not limited to the execution

of the Company’s strategic plan, the integration and financial performance of acquired stores, wholesale fuel, inventory and ingredient

costs, distribution challenges and disruptions, the impact and duration of the conflict in Ukraine or other geopolitical disruptions,

as well as other risks, uncertainties and factors which are described in the Company’s most recent annual report on Form 10-K and

quarterly reports on Form 10-Q, as filed with the Securities and Exchange Commission and available on the Company’s website. Any

forward-looking statements contained in this communication represent our current views as of the date of this communication with respect

to future events, and the Company disclaims any intention or obligation to update or revise any forward-looking statements in this communication

whether as a result of new information, future events, or otherwise.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

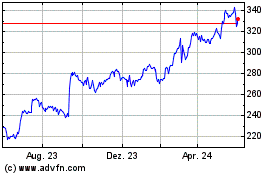

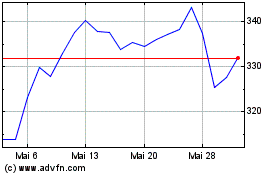

Caseys General Stores (NASDAQ:CASY)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Caseys General Stores (NASDAQ:CASY)

Historical Stock Chart

Von Dez 2023 bis Dez 2024