UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. 1)

|

|

|

|

|

Filed by the Registrant |

☒ |

|

Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

|

|

|

☐ |

|

Preliminary Proxy Statement |

|

|

|

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

|

☒ |

|

Revised Definitive Proxy Statement |

|

|

|

☐ |

|

Definitive Additional Materials |

|

|

|

☐ |

|

Soliciting Material Pursuant to § 240.14a-12 |

Aptevo Therapeutics Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply)

|

|

|

☒ |

|

No fee required. |

|

|

|

☐ |

|

Fee paid previously with preliminary materials. |

|

|

|

☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

APTEVO THERAPEUTICS INC.

2401 4th Avenue, Suite 1050

Seattle, Washington 98121

SUPPLEMENT TO THE NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held On February 5, 2024

On December 22, 2023, Aptevo Therapeutics Inc. (the “Company”) filed a definitive proxy statement (the “Proxy Statement”) with the Securities and Exchange Commission relating to the Company’s special meeting of stockholders (the “Special Meeting”). This Amendment No. 1 to the Proxy Statement (this “Amendment”) will be mailed to stockholders on or about January 19, 2024 and (i) changes the date of the Special Meeting to February 5, 2024, and (ii) amends Proposal 1 and Appendix A of the Proxy Statement.

The date of the Special Meeting has changed from the date previously disclosed in the Proxy Statement. The Special Meeting will now be held on February 5, 2024 at 10:00 AM, Pacific Time. As previously disclosed in the Proxy Statement, the Special Meeting will be held in a virtual meeting format only at www.virtualshareholdermeeting.com/APVO2024SM.

The record date for the determination of stockholders who are entitled to notice of and to vote at the Special Meeting, and at any adjournment or postponement thereof, is the close of business on December 8, 2023, which is the same record date specified in the Proxy Statement.

This Amendment revises Proposal 1 and Appendix A of the Proxy Statement to reflect the change to Proposal 1 to provide for an amendment to the Company’s Amended and Restated Certificate of Incorporation, as amended, to effect a reverse stock split of the Company’s common stock at a ratio of not less than 1-for-15 and not more than 1-for-44 (the “Amended Reverse Stock Split”), with the final decision whether to proceed with the filing of the amendment to be determined by the Company’s Board of Directors, in its discretion, following stockholder approval (if received), but no later than September 7, 2024.

This Amendment also includes a revised proxy card, which reflects the changes to the Special Meeting date and Proposal 1.

If a stockholder has already submitted the proxy card included with the original Proxy Statement or otherwise voted his, her or its shares of the Company’s stock “FOR” Proposal 1 related to the approval of the Reverse Stock Split (as defined in the Proxy Statement), and the stockholder does not revoke such proxy or vote a new proxy, then the stockholder will be deemed to have voted “FOR” Proposal 1 as revised by this Amendment to provide for the approval of the Amended Reverse Stock Split.

This Amendment should be read in conjunction with the Proxy Statement. References to sections and subsections herein are references to the corresponding sections and subsections in the Proxy Statement and references to page numbers herein are references to page numbers in the Proxy Statement. Capitalized terms used in this Amendment that are not defined herein have the meanings given to them in the Proxy Statement.

Except as specifically amended or supplemented by the information contained in this Amendment, all information set forth in the Proxy Statement remains accurate and should be considered in casting your vote by proxy at the Special Meeting.

The following replaces Proposal 1, which begins on page 7 of the Proxy Statement, and Appendix A, which begins on page A-1 of the Proxy Statement, in its entirety:

Proposal 1

APPROVAL OF REVERSE STOCK SPLIT OF OUR COMMON STOCK

Background

Our Board has unanimously approved a series of alternate amendments to our Amended and Restated Certificate of Incorporation, which would effect a reverse stock split, or Reverse Stock Split, of all issued and outstanding shares of our common stock, at a ratio ranging from 1-for-15 to 1-for-44, inclusive.

Accordingly, effecting a Reverse Stock Split would reduce the number of outstanding shares of our common stock. The effectiveness of any one of these amendments and the abandonment of the other amendments, or the abandonment of all of these amendments, will be determined by our Board following the Special Meeting and prior to September 7, 2024, which is the latest possible date by which the Company must regain compliance with the minimum closing bid price required by the continued listing requirements of the Nasdaq Capital Market. Our Board has recommended that these proposed amendments be presented to our stockholders for approval.

Our stockholders are being asked to approve these proposed amendments pursuant to Proposal 1, and to grant authorization to our Board to determine, at its option, whether to implement a Reverse Stock Split, including its specific timing and ratio.

Should we receive the required stockholder approvals for Proposal 1, our Board will have the sole authority to elect, at any time on or prior to September 7, 2024, and without the need for any further action on the part of our stockholders, whether to effect a Reverse Stock Split and the number of whole shares of our common stock, between and including 15 and 44, that will be combined into one share of our common stock.

Notwithstanding approval of Proposal 1 by our stockholders, our Board may, at its sole option, abandon the proposed amendments and determine prior to the effectiveness of any filing with the Secretary of State of the State of Delaware not to effect any Reverse Stock Split, as permitted under Section 242(c) of the General Corporation Law of the State of Delaware. If our Board does not implement a Reverse Stock Split on or prior to September 7, 2024, stockholder approval would again be required prior to implementing any Reverse Stock Split, and we may be out of compliance with the minimum closing bid price required by the continued listing requirements of the Nasdaq Capital Market.

By approving Proposal 1, our stockholders will: (a) approve a series of alternate amendments to our Amended and Restated Certificate of Incorporation pursuant to which any whole number of outstanding shares of common stock between and including fifteen (15) and forty-four (44) could be combined into one share of common stock; and (b) authorize our Board to file only one such amendment, as determined by the Board at its sole option, and to abandon each amendment not selected by the Board. Our Board may also elect not to undertake any Reverse Stock Split and therefore abandon all amendments.

APPROVAL OF REVERSE STOCK SPLIT OF OUR COMMON STOCK (PROPOSAL 1)

Our Board has adopted and is recommending that our stockholders approve a series of alternate amendments to our Amended and Restated Certificate of Incorporation to effect a Reverse Stock Split. The text of the proposed form of Certificate of Amendment to our Amended and Restated Certificate of Incorporation, which we refer to as the Certificate of Amendment, is attached hereto as Appendix A.

We are proposing that our Board have the discretion to select the Reverse Stock Split ratio from within a range between and including 1-for-15 and 1-for-44, rather than proposing that stockholders approve a specific ratio at this time, in order to give our Board the flexibility to implement a Reverse Stock Split at a ratio that reflects the Board’s then-current assessment of the factors described below under “Criteria to be Used for Determining Whether to Implement the Reverse Stock Split.” If the Board decides to implement a Reverse Stock Split, we will file the Certificate of Amendment with the Secretary of State of the State of Delaware and the Reverse Stock Split will be effective at 5:01 p.m., Eastern Time, on the date of filing of a Certificate of Amendment with the office of the Secretary of State of the State of Delaware, or such later date as is chosen by the Board and set forth in the Certificate of Amendment. Except for adjustments that may result from the treatment of fractional shares as described below, each of our stockholders

1

will hold the same percentage of our outstanding common stock immediately following the Reverse Stock Split as such stockholder holds immediately prior to the Reverse Stock Split.

To maintain our listing on The Nasdaq Capital Market. By potentially increasing our stock price, the Reverse Stock Split would reduce the risk that our common stock could be delisted from The Nasdaq Capital Market. Our common stock is publicly traded and listed on Nasdaq under the symbol "APVO." To continue our listing on The Nasdaq Capital Market, we must comply with Nasdaq Marketplace Rules, which requirements include a minimum bid price of $1.00 per share. On September 13, 2023, we were notified by the Nasdaq Listing Qualifications Department that we do not comply with the $1.00 minimum bid price requirement (the "Bid Price Requirement") as our common stock had traded below the $1.00 minimum bid price for 30 consecutive business days. We were automatically provided with a 180 calendar day period, ending on March 11, 2024 (the "Compliance Date"), to regain compliance with the Bid Price Requirement. To regain compliance, the closing bid price of our common stock must meet or exceed $1.00 per share for a minimum of 10 consecutive business days before the Compliance Date. If the Company does not regain compliance with the Bid Price Requirement by the Compliance Date, the Company may be eligible for an additional 180-day period (until September 7, 2024) to regain compliance if the Company meets the continued listing requirement for market value of publicly held shares and all other initial listing standards of The Nasdaq Capital Market, with the exception of the bid price requirement, and provides written notice to Nasdaq of its intention to cure the deficiency during the second compliance period, by effecting a reverse stock split. If the Company does not regain compliance with the Bid Price Requirement by the Compliance Date and is not eligible for an additional compliance period at that time, the Nasdaq Listing Qualifications Panel (the "Panel") will provide written notification to the Company that its common stock will be delisted. At that time, the Company may appeal the delisting determination to Nasdaq. In the event of an appeal, our common stock would remain listed on The Nasdaq Capital Market pending a written decision by the Panel following a hearing. However, there would be no assurance that, if the Company receives a delisting notice and appeals the delisting determination, such appeal would be successful. In the event that the Panel determines not to continue our listing and we are delisted from The Nasdaq Capital Market, our common stock may be delisted and trade on the OTC Bulletin Board or other small trading markets, such as the pink sheets, depending on our ability to meet the specific listing requirements of those trading markets.

The Board has considered the potential harm to us and our stockholders should Nasdaq delist our common stock from The Nasdaq Capital Market. Delisting would likely reduce the visibility, liquidity, and value of our common stock, reduce institutional investor interest in our company, and may increase the volatility of our common stock. Alternatives, such as the OTC Bulletin Board and the pink sheets, are generally considered to be less efficient markets. An investor likely would find it less convenient to sell, or to obtain accurate quotations in seeking to buy, our common stock on an over-the-counter market. Many investors likely would not buy or sell our common stock due to difficulty in accessing over-the-counter markets, policies preventing them from trading in securities not listed on a national exchange, transaction costs that represent a higher percentage of total share value than would be the case if our share price were higher or for other reasons. Delisting could also cause a loss of confidence of potential industry partners, lenders, and employees, which could further harm our business and our future prospects. In addition, the delisting of our common stock from the Nasdaq Capital Market would restrict our ability to sell shares of our common stock under an at the market equity agreement and the Purchase Agreement with Lincoln Park Capital Fund, LLC ("Lincoln Park") dated February 16, 2022.

The Board believes that the proposed Reverse Stock Split is a potentially effective means for us to maintain compliance with the $1.00 minimum bid requirement and to avoid, or at least mitigate, the likely adverse consequences of our common stock being delisted from The Nasdaq Capital Market by producing the immediate effect of increasing the bid price of our common stock.

To potentially improve the marketability and liquidity of our common stock. Our Board believes that the increased market price of our common stock expected as a result of implementing a Reverse Stock Split could improve the marketability and liquidity of our common stock and encourage interest and trading in our common stock.

• Stock Price Requirements: We understand that many brokerage houses, institutional investors and funds have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers or by restricting or limiting the ability to purchase such stocks on margin. Additionally, a Reverse Stock Split could help increase analyst and broker interest in our common stock as their internal policies might discourage them from following or recommending companies with low stock prices.

2

• Stock Price Volatility: Because of the trading volatility often associated with low-priced stocks, many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Some of those policies and practices may make the processing of trades in low-priced stocks economically unattractive to brokers.

• Transaction Costs: Investors may be dissuaded from purchasing stocks below certain prices because brokers’ commissions, as a percentage of the total transaction value, can be higher for low-priced stocks.

To provide greater flexibility to issue shares of common stock in connection with possible future financings. The Reverse Stock Split would have the effect of increasing the number of shares of common stock available for issuance under our Amended and Restated Certificate of Incorporation, as amended. The Board believes that such an increase is in our stockholders’ best interests as it would provide us with greater flexibility to issue shares of common stock in connection with possible future financings as well as under our equity incentive plans and for other general corporate purposes.

Criteria to be Used for Determining Whether to Implement Reverse Stock Split

In determining whether to implement the Reverse Stock Split and which Reverse Stock Split ratio to implement, if any, following receipt of stockholder approval of Proposal 1, our Board may consider, among other things, various factors, such as:

• the negative perception of reverse stock splits held by many investors, analysts, and other stock market participants and the fact that the stock price of some companies that have effected reverse stock splits has subsequently declined back to pre-reverse split levels;

• Nasdaq's minimum price per share requirements;

• the historical trading price and trading volume of our common stock;

• the then-prevailing trading price and trading volume of our common stock and the expected impact of the Reverse Stock Split on the trading market for our common stock in the short- and long-term;

• our ability to maintain our listing on The Nasdaq Capital Market;

• which Reverse Stock Split ratio would result in the least administrative cost to us;

• business developments affecting us;

• prevailing general market and economic conditions; and

• whether and when our Board desires to have the additional authorized but unissued shares of common stock that will result from the implementation of a Reverse Stock Split available to provide the flexibility to use our common stock for business and/or financial purposes, as well as to accommodate the shares of our common stock to be authorized and reserved for future equity awards.

Certain Risks and Potential Disadvantages Associated with Reverse Stock Split

We cannot assure you that the proposed Reverse Stock Split will increase our stock price and have the desired effect of maintaining compliance with Nasdaq Marketplace Rules. We expect that the Reverse Stock Split will increase the market price of our common stock so that we may be able to regain and maintain compliance with the Nasdaq $1.00 minimum bid price requirement. However, the effect of the Reverse Stock Split upon the market price of our common stock cannot be predicted with any certainty, and the history of similar reverse stock splits for companies in like circumstances is varied, particularly since some investors may view a reverse stock split negatively. It is possible that the per share price of our common stock after the Reverse Stock Split will not rise in proportion to the reduction in the number of shares of our common stock outstanding resulting from the Reverse Stock Split, and the market price

3

per post-Reverse Stock Split share may not exceed or remain in excess of the $1.00 minimum bid price for a sustained period of time, and the Reverse Stock Split may not result in a per share price that would attract brokers and investors who do not trade in lower priced stocks. In addition, although we believe the Reverse Stock Split may enhance the desirability of our common stock to certain potential investors, we cannot assure you that, if implemented, our common stock will be more attractive to institutional and other long-term investors. Even if we implement the Reverse Stock Split, the market price of our common stock may decrease due to factors unrelated to the Reverse Stock Split. In any case, the market price of our common stock may also be based on other factors which may be unrelated to the number of shares outstanding, including our future performance. If the Reverse Stock Split is consummated and the trading price of the common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split. Even if the market price per post-Reverse Stock Split share of our common stock remains in excess of $1.00 per share, we may be delisted due to a failure to meet other continued listing requirements, including Nasdaq requirements related to the minimum number of shares that must be in the public float, the minimum market value of the public float, minimum equity and the minimum number of “round lot” holders.

The proposed Reverse Stock Split may decrease the liquidity of our common stock and result in higher transaction costs. The liquidity of our common stock may be negatively impacted by a Reverse Stock Split, given the reduced number of shares that would be outstanding after the Reverse Stock Split, particularly if the stock price does not increase as a result of the Reverse Stock Split. In addition, if a Reverse Stock Split is implemented, it will increase the number of our stockholders who own “odd lots” of fewer than 100 shares of common stock. Brokerage commission and other costs of transactions in odd lots are generally higher than the costs of transactions of more than 100 shares of common stock. Accordingly, a Reverse Stock Split may not achieve the desired results of increasing marketability and liquidity of our common stock described above.

Effects of Reverse Stock Split

After the effective date of any Reverse Stock Split that our Board elects to implement, each stockholder will own a reduced number of shares of common stock. However, any Reverse Stock Split will affect all of our stockholders uniformly and will not affect any stockholder’s percentage ownership interests in Aptevo, except to the extent that the Reverse Stock Split results in any of our stockholders owning a fractional share as described below. Voting rights and other rights and preferences of the holders of our common stock will not be affected by a Reverse Stock Split (other than as a result of the payment of cash in lieu of fractional shares). For example, a holder of 2% of the voting power of the outstanding shares of our common stock immediately prior to a Reverse Stock Split would continue to hold 2% (assuming there is no impact as a result of the payment of cash in lieu of issuing fractional shares) of the voting power of the outstanding shares of our common stock immediately after such Reverse Stock Split. The number of stockholders of record will not be affected by a Reverse Stock Split (except to the extent that any stockholder holds only a fractional share interest and receives cash for such interest after such Reverse Stock Split).

The principal effects of a Reverse Stock Split will be that:

• depending on the Reverse Stock Split ratio selected by the Board, each 15 to 44 shares of our common stock owned by a stockholder will be combined into one new share of our common stock;

• no fractional shares of common stock will be issued in connection with any Reverse Stock Split; instead, holders of common stock who would otherwise receive a fractional share of common stock pursuant to the Reverse Stock Split will receive cash in lieu of the fractional share as explained more fully below;

• the total number of authorized shares of our common stock will remain at 500,000,000, resulting in an effective increase in the authorized number of shares of our common stock;

• the total number of authorized shares of our preferred stock will remain at 15,000,000;

• based upon the Reverse Stock Split ratio selected by the Board, proportionate adjustments will be made to the per share exercise price and/or the number of shares issuable upon the exercise or vesting of all then outstanding stock options, restricted stock units and warrants, which will result in a proportional decrease in the number of shares of our common stock reserved for issuance upon exercise or vesting of such stock options, restricted stock units and warrants, and, in the case of stock options and warrants, a proportional increase in the exercise price of all such stock options and warrants; and

4

• the number of shares then reserved for issuance under our equity compensation plans will be reduced proportionately based upon the Reverse Stock Split ratio selected by the Board.

The following table contains approximate information, based on share information as of January 5, 2024, relating to our outstanding common stock based on the proposed Reverse Stock Split ratios (without giving effect to the treatment of fractional shares):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Status |

|

Number of Shares of Common Stock Authorized |

|

|

Number of

Shares of

Common Stock

Issued and

Outstanding |

|

|

Number of

Shares of

Common

Stock

Reserved

for

Future

Issuance(1) |

|

|

Number of

Shares of

Common

Stock

Authorized

but Unissued

and

Unreserved |

|

Pre-Reverse Stock Split |

|

|

500,000,000 |

|

|

|

22,333,796 |

|

|

|

39,659,958 |

|

|

|

477,666,204 |

|

Post-Reverse Stock Split 1:15 |

|

|

500,000,000 |

|

|

|

1,488,920 |

|

|

|

2,643,997 |

|

|

|

498,511,080 |

|

Post-Reverse Stock Split 1:20 |

|

|

500,000,000 |

|

|

|

1,116,690 |

|

|

|

1,982,998 |

|

|

|

498,883,310 |

|

Post-Reverse Stock Split 1:25 |

|

|

500,000,000 |

|

|

|

893,352 |

|

|

|

1,586,398 |

|

|

|

499,106,648 |

|

Post-Reverse Stock Split 1:30 |

|

|

500,000,000 |

|

|

|

744,460 |

|

|

|

1,321,999 |

|

|

|

499,255,540 |

|

Post-Reverse Stock Split 1:35 |

|

|

500,000,000 |

|

|

|

638,108 |

|

|

|

1,133,142 |

|

|

|

499,361,892 |

|

Post-Reverse Stock Split 1:44 |

|

|

500,000,000 |

|

|

|

507,586 |

|

|

|

901,363 |

|

|

|

499,492,414 |

|

(1) The pre-reverse stock split number of shares of common stock reserved for future issuance includes the following:

a. 350,589 shares of Common Stock reserved for issuance upon exercise of common warrants outstanding related to our 2019 public offering at a weighted average exercise price of $18.20 per share;

b. 1,930,516 shares of Common Stock reserved for issuance upon exercise of Series A and Series B common warrants outstanding related to our August 2023 public offering at a weighted average exercise price of $0.62 per share;

c. 7,523,996 shares of Common Stock in abeyance from the exercise of Series A and Series B common warrants related to our August 2023 public offering;

d. 462,640 shares of Common Stock issuable upon the exercise of stock options outstanding at a weighted average exercise price of $12.59 per share;

e. 278,387 shares of Common Stock issuable upon the vesting of outstanding restricted stock units at a weighted average fair value per unit of $4.65 per share;

f. 28,397,036 shares of Common Stock issuable upon the exercise of Series A-1, Series A-2, Series B-1 and Series B-2 common warrants related to our November 2023 offering at a weighted average exercise price of $0.233 per share;

g. 581,826 shares of Common Stock reserved for issuance pursuant to our 2022 Purchase Agreement and Registration Rights Amendment with Lincoln Park; and

h. 134,968 shares of Common Stock reserved for future grants of equity-based awards under our equity incentive plans.

After the effective date of any Reverse Stock Split that our Board elects to implement, our common stock would have a new committee on uniform securities identification procedures, or CUSIP number, a number used to identify our common stock. Stock certificates with the older CUSIP numbers will need to be exchanged for stock certificates with the new CUSIP numbers by following the procedures described below.

Our common stock is currently registered under Section 12(b) of the Securities Exchange Act, or the Exchange Act, and we are subject to the periodic reporting and other requirements of the Exchange Act. The implementation of any proposed Reverse Stock Split will not affect the registration of our common stock under the Exchange Act. Our common stock would continue to be listed on The Nasdaq Capital Market under the symbol “APVO” immediately following the Reverse Stock Split, although it is likely that Nasdaq would add the letter “D” to the end of the trading symbol for a period of twenty trading days after the effective date of the Reverse Stock Split to indicate that the Reverse Stock Split had occurred.

Our directors and executive officers have no substantial interests, directly or indirectly, in the matters set forth in the Reverse Stock Split, except to the extent of their ownership in shares of our common stock and securities exercisable for our common stock, which shares and securities would be subject to the same proportionate adjustment in accordance with the terms of the Reverse Stock Split as all other outstanding shares of our common stock and securities exercisable for our common stock.

5

By increasing the number of authorized but unissued shares of common stock, the Reverse Stock Split could, under certain circumstances, have an anti-takeover effect, although this is not the intent of the Board. For example, the Board might be able to delay or impede a takeover or transfer of control of our company by causing such additional authorized but unissued shares to be issued to holders who might side with the Board in opposing a takeover bid that the Board determines is not in the best interests of our Company or our stockholders. The Reverse Stock Split could therefore have the effect of discouraging unsolicited takeover attempts. By potentially discouraging initiation of any such unsolicited takeover attempts the Reverse Stock Split could limit the opportunity for our stockholders to dispose of their shares at the higher price generally available in takeover attempts or that may be available under a merger proposal. The Reverse Stock Split could have the effect of permitting our current management, including our current Board, to retain its position, and place it in a better position to resist changes that stockholders may wish to make if they are dissatisfied with the conduct of our business. However, other than as previously disclosed, our Board is not aware of any attempt to take control of our company and the Board did not authorize the Reverse Stock Split with the intent that it be utilized as a type of anti-takeover device.

Effective Date

The proposed Reverse Stock Split would become effective at 5:01 p.m., Eastern Time, on the date of filing of a Certificate of Amendment with the office of the Secretary of State of the State of Delaware, or such later date as is chosen by the Board and set forth in the Certificate of Amendment, which date we refer to in this Proposal 1 as the Effective Date. Except as explained below with respect to fractional shares, effective as of 5:01 p.m., Eastern Time, on the Effective Date, shares of common stock issued and outstanding immediately prior thereto will be combined, automatically and without any action on the part of us or our stockholders, into a lesser number of new shares of our common stock in accordance with the Reverse Stock Split ratio determined by our Board within the limits set forth in this Proposal 1.

Cash Payment In Lieu of Fractional Shares

No fractional shares of common stock will be issued as a result of any Reverse Stock Split. Instead, in lieu of any fractional shares to which a stockholder of record would otherwise be entitled as a result of the Reverse Stock Split, Aptevo will pay cash (without interest) equal to such fraction multiplied by the average of the closing sales prices of the common stock on The Nasdaq Capital Market during regular trading hours for the five consecutive trading days immediately preceding the Effective Date (with such average closing sales prices being adjusted to give effect to the Reverse Stock Split). After the Reverse Stock Split, a stockholder otherwise entitled to a fractional interest will not have any voting, dividend or other rights with respect to such fractional interest except to receive payment as described above.

As of December 8, 2023, there were 112 stockholders of record of our common stock. Upon stockholder approval of this Proposal 1, if our Board elects to implement the proposed Reverse Stock Split, stockholders owning, prior to the Reverse Stock Split, less than the number of whole shares of common stock that will be combined into one share of common stock in the Reverse Stock Split would no longer be stockholders. For example, if a stockholder held five shares of common stock immediately prior to the Reverse Stock Split and the Reverse Stock Split ratio selected by the Board was 1-for-15, then such stockholder would cease to be a stockholder of Aptevo following the Reverse Stock Split and would not have any voting, dividend or other rights except to receive payment for the fractional share as described above. Based on our stockholders of record as of December 8, 2023, and assuming a Reverse Stock Split ratio of 1-for-15, we expect that cashing out fractional stockholders would not reduce the number of stockholders of record. In addition, we do not intend for this transaction to be the first step in a series of plans or proposals of a “going private transaction” within the meaning of Rule 13e-3 of the Exchange Act.

Procedure for Effecting a Reverse Stock Split and Exchange of Stock Certificates

If this Proposal 1 is approved by our stockholders and our Board elects to implement a Reverse Stock Split, we will file with the Secretary of State of the State of Delaware a certificate of amendment to our Amended and Restated Certificate of Incorporation, as amended, in the form attached hereto as Appendix A, or the Certificate of Amendment, reflecting such reverse stock split ratio determined by the board of directors. Beginning on the Effective Date, each certificate representing shares of common stock will be deemed for all corporate purposes to evidence ownership of the number of whole shares into which the shares previously represented by the certificate were combined pursuant to the Reverse Stock Split.

6

If this Proposal 1 is approved by our stockholders and our Board elects to implement a Reverse Stock Split, stockholders of record holding all of their shares of our common stock electronically in book-entry form under the direct registration system for securities will be automatically exchanged by the exchange agent and will receive a transaction statement at their address of record indicating the number of new post-split shares of our common stock they hold after the Reverse Stock Split along with payment in lieu of any fractional shares. Non-registered stockholders holding common stock through a bank, broker or other nominee should note that such banks, brokers or other nominees may have different procedures for processing the Reverse Stock Split and making payment for fractional shares than those that would be put in place by us for registered stockholders. If you hold your shares with such a bank, broker or other nominee and if you have questions in this regard, you are encouraged to contact your nominee.

If this Proposal 1 is approved by our stockholders and our Board elects to implement a Reverse Stock Split, stockholders of record holding some or all of their shares in certificate form will receive a letter of transmittal from Aptevo or its exchange agent, as soon as practicable after the effective date of the Reverse Stock Split. Our transfer agent is expected to act as “exchange agent” for the purpose of implementing the exchange of stock certificates. Holders of pre-Reverse Stock Split shares will be asked to surrender to the exchange agent certificates representing pre-Reverse Stock Split shares in exchange for post-Reverse Stock Split shares and payment in lieu of fractional shares (if any) in accordance with the procedures to be set forth in the letter of transmittal. No new post-Reverse Stock Split share certificates will be issued to a stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s) together with the properly completed and executed letter of transmittal to the exchange agent. Any old shares submitted for exchange, whether pursuant to a sale, other disposition or otherwise, will automatically be exchanged for new shares. Our common stock will also receive a new CUSIP number.

STOCKHOLDERS SHOULD NOT DESTROY ANY PRE-SPLIT STOCK CERTIFICATE AND SHOULD NOT SUBMIT ANY CERTIFICATES UNTIL THEY ARE REQUESTED TO DO SO.

Accounting Consequences

The par value per share of our common stock would remain unchanged at $0.001 per share after any Reverse Stock Split. As a result, on the Effective Date, the stated capital on our balance sheet attributable to the common stock would be reduced proportionally, based on the actual Reverse Stock Split ratio, from its present amount, and the additional paid-in capital account would be credited with the amount by which the stated capital would be reduced. The net income or loss per share of common stock would be increased because there would be fewer shares of common stock outstanding. The Reverse Stock Split would be reflected retroactively in certain of our consolidated financial statements. We do not anticipate that any other accounting consequences would arise as a result of any Reverse Stock Split.

No Appraisal Rights

Our stockholders are not entitled to dissenters’ or appraisal rights under the General Corporation Law of the State of Delaware with respect to the proposed alternate amendments to our Amended and Restated Certificate of Incorporation to allow for a Reverse Stock Split.

Material Federal Income Tax Consequences

The following is a summary of the material U.S. federal income tax consequences of a Reverse Stock Split to our stockholders. The summary is based on the Internal Revenue Code of 1986, as amended, or the Code, applicable Treasury Regulations promulgated thereunder, judicial authority and current administrative rulings and practices as in effect on the date of this proxy statement. Changes to the laws could alter the tax consequences described below, possibly with retroactive effect. We have not sought and will not seek an opinion of counsel or a ruling from the Internal Revenue Service regarding the federal income tax consequences of a Reverse Stock Split. This discussion is for general information only and does not discuss the tax consequences which may apply to special classes of taxpayers (e.g., non-resident aliens, broker/dealers or insurance companies). The state and local tax consequences of a Reverse Stock Split may vary significantly as to each stockholder, depending upon the jurisdiction in which such stockholder resides. Stockholders are urged to consult their own tax advisors to determine the particular consequences to them.

In general, the federal income tax consequences of a Reverse Stock Split will vary among stockholders depending upon whether they receive cash for fractional shares or solely a reduced number of shares of common stock in exchange for their old shares of common stock. We believe that because the Reverse Stock Split is not part of a plan to increase periodically a stockholder’s proportionate interest in our assets or earnings and profits, the Reverse Stock Split should have the following federal income tax effects. A stockholder who receives solely a reduced number of

7

shares of common stock will not recognize gain or loss. In the aggregate, such a stockholder’s basis in the reduced number of shares of common stock will equal the stockholder’s basis in its old shares of common stock and such stockholder’s holding period in the reduced number of shares will include the holding period in its old shares exchanged. A stockholder who receives cash in lieu of a fractional share as a result of the Reverse Stock Split should generally be treated as having received the payment as a distribution in redemption of the fractional share, as provided in Section 302(a) of the Code. Generally, if redemption of the fractional shares of all stockholders reduces the percentage of the total voting power held by a particular redeemed stockholder (determined by including the voting power held by certain related persons), the particular stockholder should recognize gain or loss equal to the difference, if any, between the amount of cash received and the stockholder’s basis in the fractional share. In the aggregate, such a stockholder’s basis in the reduced number of shares of common stock will equal the stockholder’s basis in its old shares of common stock decreased by the basis allocated to the fractional share for which such stockholder is entitled to receive cash, and the holding period of the reduced number of shares received will include the holding period of the old shares exchanged. If the redemption of the fractional shares of all stockholders leaves the particular redeemed stockholder with no reduction in the stockholder’s percentage of total voting power (determined by including the voting power held by certain related persons), it is likely that cash received in lieu of a fractional share would be treated as a distribution under Section 301 of the Code. Stockholders should consult their own tax advisors regarding the tax consequences to them of a payment for fractional shares.

We will not recognize any gain or loss as a result of the proposed Reverse Stock Split.

Other

The Reverse Stock Split Proposal is separate from and unrelated to, and is not contingent upon, the Stock Issuance Proposal.

Required Vote

Stockholder approval of this Proposal 1 requires a “FOR” vote of a majority of the votes cast by the holders of all of the shares of common stock present or represented by proxy at the Special Meeting.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR”

THE APPROVAL OF A REVERSE STOCK SPLIT AS SET FORTH IN PROPOSAL 1.

8

Appendix A

CERTIFICATE OF AMENDMENT OF THE

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF

APTEVO THERAPEUTICS INC.

APTEVO THERAPEUTICS Inc., a corporation organized and existing under the laws of the State of Delaware, hereby certifies as follows:

First: The name of this corporation is Aptevo Therapeutics Inc. (the “Company”).

Second: The date on which the Company’s Certificate of Incorporation was originally filed with the Secretary of State of the State of Delaware is February 22, 2016.

Third: The Board of Directors of the Company, acting in accordance with the provisions of Sections 242 and 245 of the General Corporation Law of the State of Delaware, adopted resolutions amending its Amended and Restated Certificate of Incorporation, as heretofore amended (the “Certificate of Incorporation”), as follows:

Effective as of the effective time of 5:01 p.m., Eastern time, on the date this Certificate of Amendment is filed with the Secretary of State of the State of Delaware (the “Effective Time”), fifteen (15) to forty-four (44) shares of the Company’s Common Stock, par value $0.001 per share, issued and outstanding immediately prior to the Effective Time shall, automatically and without any action on the part of the Company or the respective holders thereof, be combined into one (1) share of Common Stock without increasing or decreasing the par value of each share of Common Stock (the “Reverse Split”); provided, however, no fractional shares of Common Stock shall be issued as a result of the Reverse Split and, in lieu thereof, upon receipt after the Effective Time by the exchange agent selected by the Company of a properly completed and duly executed transmittal letter and, where shares are held in certificated form, the surrender of the stock certificate(s) formerly representing shares of pre-Reverse Split Common Stock, any stockholder who would otherwise be entitled to a fractional share of post-Reverse Split Common Stock as a result of the Reverse Split, following the Effective Time (after taking into account all fractional shares of post-Reverse Split Common Stock otherwise issuable to such stockholder), shall be entitled to receive a cash payment (without interest) equal to the fractional share of post-Reverse Split Common Stock to which such stockholder would otherwise be entitled multiplied by the average of the closing sales prices of a share of the Company’s Common Stock (as adjusted to give effect to the Reverse Split) on The Nasdaq Capital Market during regular trading hours for the five (5) consecutive trading days immediately preceding the date this Certificate of Amendment is filed with the Secretary of State of the State of Delaware. Each stock certificate that, immediately prior to the Effective Time, represented shares of pre-Reverse Split Common Stock shall, from and after the Effective Time, automatically and without any action on the part of the Company or the respective holders thereof, represent that number of whole shares of post-Reverse Split Common Stock into which the shares of pre-Reverse Split Common Stock represented by such certificate shall have been combined (as well as the right to receive cash in lieu of any fractional shares of post-Reverse Split Common Stock as set forth above); provided, however, that each holder of record of a certificate that represented shares of pre-Reverse Split Common Stock shall receive, upon surrender of such certificate, a new certificate representing the number of whole shares of post-Reverse Split Common Stock into which the shares of pre-Reverse Split Common Stock represented by such certificate shall have been combined pursuant to the Reverse Split, as well as any cash in lieu of fractional shares of post-Reverse Split Common Stock to which such holder may be entitled as set forth above. The Reverse Split shall be effected on a record holder-by-record holder basis, such that any fractional shares of post-Reverse Split Common Stock resulting from the Reverse Split and held by a single record holder shall be aggregated.

Fourth: The foregoing amendment was submitted to the stockholders of the Company for their approval, and was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware and shall be effective as of 5:01 p.m., Eastern time, on the date this Certificate of Amendment is filed with the Secretary of State of the State of Delaware.

A-1

In Witness Whereof, Aptevo Therapeutics Inc. has caused this Certificate of Amendment to be signed by its President and Chief Executive Officer this day of , 2024.

|

|

|

|

|

|

|

|

|

|

|

Aptevo Therapeutics Inc.

|

|

|

By: |

|

|

|

|

Marvin L. White |

|

|

|

President and Chief Executive Officer |

|

A-2

Aptevo Therapeutics APTEVO THERAPEUTICS INC.C/O BROADRIDGE CORPORATE ISSUER SOLUTIONS 2401 FOURTH AVE., SUITE 1050 SEATTLE, WA 98121 SCAN TO VIEW MATERIALS & VOTE VOTE BY INTERNET Before The Meeting - Go to www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time on February 4, 2024. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting - Go to www.virtualshareholdermeeting.com/APVO2024SMYou may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on February 4, 2024. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: V25530-S75877 KEEP THIS PORTION FOR YOUR RECORDS THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. DETACH AND RETURN THIS PORTION ONLY APTEVO THERAPEUTICS INC The Board of Directors recommends you vote FOR Proposals 1, 2, 3 and 4: For Against Abstain 1. To approve an amendment to Aptevo Therapeutics Inc.’s (the “Company”) Amended and Restated Certificate of Incorporation, as amended, to effect < < < a reverse stock split of the Company’s common stock at a ratio of between 1-for-15 to 1-for-44, with such ratio to be determined at the sole discretion of the Board of Directors and with such reverse stock split to be effected at such time and date, if at all, as determined by the Board of Directors in its sole discretion. 2. To approve, in accordance with Nasdaq Listing Rule 5635(d), the issuance of more than 19.99% of the Company’s outstanding common stock, par value $0.001 per share, issuable upon the exercise of New Series A-2 Warrants and New Series B-2 Warrants with the right for such potential exercise to occur immediately following the date upon which stockholders approve this proposal. 3. To approve an amendment and restatement of the Company’s Amended and Restated 2018 Stock Incentive Plan to authorize an additional 11,300,000 < < < new shares for issuance thereunder. 4. To authorize an adjournment of the meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies if there are not sufficient < < < votes in favor of Proposal 1, Proposal 2 or Proposal 3. NOTE: Such other business as may properly come before the meeting or any adjournment or postponement thereof. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting: The Proxy Statement is available at www.proxyvote.com. V25531-S75877 APTEVO THERAPEUTICS INC. THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS SPECIAL MEETING OF STOCKHOLDERS FEBRUARY 5, 2024 at 10:00 AM, PACIFIC TIME The stockholder(s) hereby appoint(s) SoYoung Kwon and Daphne Taylor, or either of them, as proxies, each with the power to appoint her substitute, and hereby authorize(s) them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of Common Stock of Aptevo Therapeutics Inc. that the stockholder(s) is/are entitled to vote at the virtual Special Meeting of Stockholders to be held at 10:00 a.m., Pacific Time on Monday, February 5, 2024, and any adjournment or postponement thereof. THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS DIRECTED BY THE STOCKHOLDER(S). IF NO SUCH DIRECTIONS ARE MADE, THIS PROXY WILL BE VOTED "FOR" PROPOSAL 1, PROPOSAL 2, PROPOSAL 3 AND PROPOSAL 4. IN THEIR DISCRETION, THESE PROXIES OF THE UNDERSIGNED ARE AUTHORIZED TO VOTE UPON ANY AND ALL OTHER MATTERS THAT MAY PROPERLY COME BEFORE THE MEETING. PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED REPLY ENVELOPE CONTINUED AND TO BE SIGNED ON REVERSE SIDE

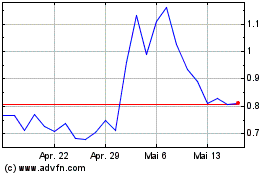

Aptevo Therapeutics (NASDAQ:APVO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Aptevo Therapeutics (NASDAQ:APVO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024