Crown Place VCT PLC Crown Place Vct Plc : Interim Management Statement

03 Mai 2019 - 3:12PM

UK Regulatory

TIDMCRWN

Crown Place VCT PLC

Interim Management Statement

LEI Code: 213800SYIQPA3L3T1Q68

Introduction

I am pleased to present Crown Place VCT PLC's (the "Company's") interim

management statement for the period from 1 January 2019 to 31 March

2019.

Performance and dividends

The Company's unaudited net asset value (NAV) as at 31 March 2019 was

GBP57.32 million or 34.73 pence per share (excluding treasury shares),

after accounting for a dividend of 1 penny per share which was paid on

29 March 2019 to shareholders on the register on 1 March 2019.

After taking account of the total 2.00 pence per share of dividends paid

on 30 November 2018 (1 penny) and 29 March 2019 (1 penny), the

comparable ex-dividend NAV as at 30 June 2018 was 31.50 pence per share.

Therefore, the NAV has risen by 3.23 pence per share or (10.25 per

cent.) since 30 June 2018.

Board composition

The Board announced on 14 February 2019 that, following a formal

selection process, Pam Garside was appointed to the Board with effect

from 1 March 2019. Pam is a highly experienced healthcare entrepreneur

and an advisor to government, NHS and private sector organisations in

the health sector in the UK and US. Pam joins the Board at a time when

increasing numbers of healthcare investment opportunities are being

considered by the Company.

As announced in the Half-yearly Financial Report to 31 December 2018,

Karen Brade will retire from the Board in September 2019. James Agnew

will succeed Karen as chairman of the Audit and Risk Committee.

Share buy-backs

During the period from 1 January 2019 to 31 March 2019, the Company

purchased 566,000 shares for GBP183,000 including stamp duty, at an

average price of 32.25 pence per share. All of the shares are to be held

in treasury.

It remains the Board's policy to buy back shares in the market, subject

to the overall constraint that such purchases are in the Company's

interest, including the maintenance of sufficient resources for

investment in existing and new portfolio companies and the continued

payment of dividends to shareholders.

It is the Board's intention for such buy-backs to be at around a 5 per

cent. discount to net asset value, so far as market conditions and

liquidity permit.

Portfolio

The following material investment has been made during the period from 1

January 2019 to 31 March 2019:

New GBP000s Activity

investment

----------- ------- --------------------------------------------------------

Avora 510 Developer of software to improve decision making through

Limited augmented analytics & machine learning

----------- ------- --------------------------------------------------------

Top ten holdings as at 31 March 2019:

% of

net

Carrying value asset

Investment GBP000s value Activity

------------- -------------- ----- -------------------------------------------------------

Radnor House

School

(Holdings)

Limited 6,725 11.7 Independent schools for children aged 5-18

------------- -------------- ----- -------------------------------------------------------

ELE Advanced

Technologies

Limited 4,557 8.0 Manufacturer of precision engineering components

------------- -------------- ----- -------------------------------------------------------

Shinfield

Lodge Care Owner and operator of a 66 bed care home in Shinfield,

Limited 4,215 7.4 Berkshire

------------- -------------- ----- -------------------------------------------------------

Chonais River

Hydro Owner and operator of a 2 MW hydro-power scheme in

Limited 3,293 5.7 the Scottish Highlands

------------- -------------- ----- -------------------------------------------------------

Active Lives Owner and operator of a 75 bed care home in Cumnor

Care Limited 2,791 4.9 Hill, Oxfordshire

------------- -------------- ----- -------------------------------------------------------

Ryefield

Court Care Owner and operator of a 60 bed care home in Hillingdon,

Limited 2,244 3.9 Middlesex

------------- -------------- ----- -------------------------------------------------------

Proveca

Limited 1,933 3.4 Reformulation of paediatric medicines

------------- -------------- ----- -------------------------------------------------------

Quantexa 1,816 3.2 Network analytics platform to detect financial crime

Limited

------------- -------------- ----- -------------------------------------------------------

Gharagain 1,658 2.9 Owner and operator of a 1 MW hydroelectricity plant

River Hydro in the Scottish Highlands

Limited

------------- -------------- ----- -------------------------------------------------------

Mirada 1,444 2.5 Developer of medical imaging software using Deep

Medical Learning

Limited

------------- -------------- ----- -------------------------------------------------------

A full breakdown of the Company's portfolio can be found on the

Company's webpage on the Manager's website at

https://www.globenewswire.com/Tracker?data=eGTNSX8_5-ir-IStjW6Z2xWZflHgSSuIQo7NtJ2QmYyBskJUl6mBtbV_roPLCrBcE2zaIWP9g3dY4l8d7RPo9sAzUkT891AjF8E5O01DWpgreA7P9tEVOHD70Kwp1KQn

www.albion.capital/funds/CRWN, by following the 'Portfolio of

Investments' link under the 'Fund reports' section.

Material events and transactions after the period end

Portfolio

After the period end, the Company undertook the following investment

transactions:

-- Disposal of Earnside Energy for GBP1.4 million;

-- Loan stock repayment of GBP0.8 million from The Stanwell Hotel;

-- Investment of GBP388,000 in an existing portfolio company, Proveca, which

develops drugs specifically formulated for children;

-- Investment of GBP280,000 in a new portfolio company, Limitless Technology,

which provides a customer service platform powered by crowd and machine

learning technology; and

-- Investment of GBP106,000 in a new portfolio company, Imandra, which

provides automated software testing and an enhanced learning experience

for artificial neural networks.

Albion VCTs prospectus Top Up Offers 2018/19

The Board was delighted to announce on 3 April 2019 that the Company had

reached its GBP8 million limit under its offer pursuant to the

Prospectus dated 7 January 2019, and so was closed. The proceeds of the

Offer will be used to provide further resources at a time when a number

of attractive investment opportunities are being seen.

The Board congratulates Albion Capital for successfully raising the full

GBP48m across the Albion VCTs under the Top Up Offers 2018/19. This is

the largest fundraising that Albion has ever achieved.

The following new Ordinary shares of nominal value 1 penny per share

were allotted under the Albion VCTs prospectus Top Up Offers 2018/19

after 31 March 2019:

Aggregate

Number of nominal value Issue price per

Date of shares of shares share (including Net proceeds

allotment issued GBP'000 costs of issue) GBP'000

--------------- ------------- ------------- ---------------- -------------

1 April 2019 19,551,876 196 34.8 to 35.2 6,709

--------------- ------------- ------------- ---------------- -------------

5 April 2019 1,887,622 19 35.2 648

--------------- ------------- ------------- ---------------- -------------

12 April 2019 1,297,449 13 34.8 to 35.2 445

--------------- ------------- ------------- ---------------- -------------

Total 22,736,947 227 7,802

--------------- ------------- ------------- ---------------- -------------

Further information

The Company continues to offer a Dividend Reinvestment Scheme to

existing shareholders. Details of this Scheme can be found at

https://www.globenewswire.com/Tracker?data=eGTNSX8_5-ir-IStjW6Z2xWZflHgSSuIQo7NtJ2QmYzp5gUSy4FIUD0ZkETr-VbppSTIC-3aWZ56lwx8DRIwCJ3VIaYrsnpGH7m34BGq2J02Ua7uJ_fy2a3iQhx1_QAB

www.albion.capital/funds/CRWN.

Further information regarding historic and current financial performance

and other useful shareholder information can be found on the Company's

webpage on the Manager's website at

https://www.globenewswire.com/Tracker?data=eGTNSX8_5-ir-IStjW6Z2xWZflHgSSuIQo7NtJ2QmYxMIL7cwN_XcRCzNuhgSRtIfnffkvAKIONp3t5U41XSgOABGmBpFjcBOgGwdxezBA-FfRZugAH_BBTTCwNCl-8V

www.albion.capital/funds/CRWN.

Richard Huntingford, Chairman

crownchair@albion.capital

https://www.globenewswire.com/Tracker?data=00K0eR7lLRlQmfmltutmmR2bw4MTdU_6-O93esYxHkTbYPzbA_KyDxbjqqpF1ZoQvUSryMBnW2mOUDCYNtrYqlII9Nl56C-OGGS-NUbQhM65Rfk5jESaAHgNRcIHw0bY

3 May 2019

For further information please contact:

Albion Capital Group LLP -- Tel: 020 7601 1850

(END) Dow Jones Newswires

May 03, 2019 09:12 ET (13:12 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

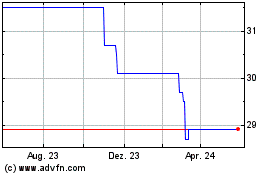

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024