Vallourec expects full year 2023 results to exceed its prior outlook

01 Februar 2024 - 6:00PM

Press release

Vallourec expects full year 2023 results

to exceed its prior outlook

Estimated figures indicate full year 2023

EBITDA will exceed €1,190 million and net debt will be below €580

million

Meudon (France), 1 February

2024 – Vallourec, a world leader in premium tubular

solutions, announces today that it expects full year 2023 results

to exceed management’s prior outlook.

As part of Vallourec’s Q3 2023 financial

communication, Vallourec provided its full year 2023 outlook as

follows:

- Full year 2023 EBITDA was expected

to range between €1,075 million and €1,175 million

- Total cash generation was expected

to be positive in the fourth quarter 2023, excluding any potential

benefit of asset sales

- Net debt was expected to decline

further versus the third quarter 2023 level of €741 million,

excluding any potential benefit of asset sales

Though audits are underway and accounts are not

yet approved by the Vallourec Board1, Vallourec now confirms the

following estimated results:

- Full year 2023 EBITDA is expected

to exceed €1,190 million, with fourth quarter 2023 EBITDA exceeding

€275 million

- Total cash generation in the fourth

quarter 2023 is expected to exceed €140 million, which includes the

approximately €37 million cash inflow from the sale of Vallourec’s

Mülheim facility

- Vallourec’s net debt at the end of

December 2023 is expected to be less than €580 million

This sequential improvement in EBITDA was

attributable to an increase in sales volumes, driven by higher

shipments in both North America and Eastern Hemisphere. Higher

sales volumes in North America more than offset pricing declines in

the region, and improved execution in South America drove

sequentially higher EBITDA. Results also benefitted to a lesser

extent from favorable iron ore pricing and sequentially improved

EBITDA in Germany, which led to a slightly positive EBITDA

contribution from Germany in 2023. Relative to Vallourec’s prior

outlook, results exceeded expectations in both main segments, but

particularly in the Tubes results in the Americas.

Vallourec’s net debt declined substantially in

the fourth quarter to less than €580 million. As expected,

restructuring cash out was a significant headwind, but cash flow

was supported by strong EBITDA and further working capital release.

Vallourec expects to further deleverage its balance sheet and

achieve zero net debt by year-end 2025 at the latest.

Philippe Guillemot, Chairman and CEO of

Vallourec, said: "Our fourth quarter results bring a

highly successful year for Vallourec to a close. In addition to

efficiently executing multiple global workstreams related to the

New Vallourec plan, the Group delivered its best EBITDA and cash

generation in nearly 15 years. We have now completed the shutdown

of our German operations, and I thank the team there for their

commitment to delivering quality results and products throughout

this operation’s final year. Moreover, I would like to thank all

Vallourec employees for their tireless efforts to improve our

business and execute the New Vallourec plan. While we are proud of

our accomplishments, we see many more opportunities to enhance our

profitability ahead. We remain on track to reach zero net debt by

year end 2025 at the latest. Following our deleveraging, we aim to

return significant capital to our shareholders, potentially as

early as 2025.2”

A summary of estimated key financial metrics is

presented below.

|

in € million, unless noted |

Q4 2022 |

Q1 2023 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

FY 2022 |

FY 2023 |

|

Tubes volume sold (k tonnes) |

514 |

431 |

396 |

343 |

~380 |

1,804 |

~1,550 |

|

Iron ore volume sold (m tonnes) |

1.4 |

1.5 |

1.9 |

1.8 |

~1.7 |

4.0 |

~6.9 |

|

Group revenues |

1,541 |

1,338 |

1,358 |

1,142 |

> 1,270 |

4,883 |

> 5,110 |

|

Group EBITDA |

312 |

320 |

374 |

222 |

> 275 |

715 |

> 1,190 |

|

(as a % of revenue) |

20.2% |

23.9% |

27.5% |

19.4% |

~22% |

14.6% |

~23% |

|

Tubes EBITDA |

285 |

279 |

330 |

193 |

> 240 |

638 |

> 1,040 |

|

Mine & Forest EBITDA |

22 |

48 |

50 |

39 |

> 35 |

113 |

> 170 |

|

Total cash generation |

323 |

151 |

118 |

150 |

> 140 |

(200) |

> 560 |

|

Net debt |

1,130 |

1,000 |

868 |

741 |

< 580 |

1,130 |

< 580 |

About Vallourec

Vallourec is a world leader in premium tubular

solutions for the energy markets and for demanding industrial

applications such as oil & gas wells in harsh environments, new

generation power plants, challenging architectural projects, and

high-performance mechanical equipment. Vallourec’s pioneering

spirit and cutting edge R&D open new technological frontiers.

With close to 14,000 dedicated and passionate employees in more

than 20 countries, Vallourec works hand-in-hand with its customers

to offer more than just tubes: Vallourec delivers innovative, safe,

competitive and smart tubular solutions, to make every project

possible.

Listed on Euronext in Paris (ISIN code:

FR0013506730, Ticker VK), Vallourec is part of the CAC Mid 60, SBF

120 and Next 150 indices and is eligible for Deferred Settlement

Service.

In the United States, Vallourec has established

a sponsored Level 1 American Depositary Receipt (ADR) program (ISIN

code: US92023R4074, Ticker: VLOWY). Parity between ADR and a

Vallourec ordinary share has been set at 5:1.

For further information, please

contact:

|

Investor Relations Connor LynaghTel: +1 (713)

409-7842connor.lynagh@vallourec.com |

Press relations Héloïse RothenbühlerTel.: +33 (0)6

45 45 19 67heloise.rothenbuhler@vallourec.com |

|

Individual shareholder relationsToll-free number:

0 805 65 10 10actionnaires@vallourec.com |

|

1 Auditors’ review of 2023 full year financial

statements is in progress. These financial statements will be

examined by the Board of Directors on February 29, 2024 and will be

released on March 1, 2024.2 Vallourec’s dividend policy would in

any event be conditional upon the Board’s decision taking into

account Vallourec’s results, its financial position including the

deleveraging target and the potential restrictions applicable to

the payment of dividends. Dividends and share repurchases would

also be subject to shareholders’ approval.

- Vallourec - Press Release - Q4 2023 Trading Update

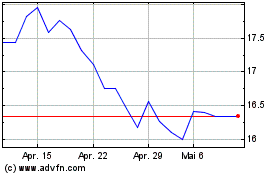

Vallourec (EU:VK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Vallourec (EU:VK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024