Solvay second quarter 2024 results

31 Juli 2024 - 7:00AM

UK Regulatory

Solvay second quarter 2024 results

Press release - Regulated information published on

July 31, 2024, at 7:00 a.m. CEST

Sequentially improved EBITDA and margin with

solid cash performance

supported by cost savings initiatives

Highlights

- Net sales in Q2 2024 stabilized sequentially

reaching €1,194 million.

Net Sales were down -6.7% organically versus Q2 2023, with a

positive impact from volumes for the second consecutive quarter,

while prices were down year over year.

- Underlying EBITDA in Q2 2024 increased

sequentially by 2.6% reaching €272 million while the EBITDA margin

improved sequentially for the second quarter in a row reaching

22.8%.

Underlying EBITDA in Q2 was -17.2% lower organically compared to a

record Q2 2023, with negative Net pricing partially offset by

positive volume impact and further fixed costs improvements.

- Structural cost

savings initiatives delivered solid results, with €46

million in H1 2024, and are expected to reach €80 million for the

full year.

- Underlying net

profit from continuing operations was €116 million in Q2

2024 vs. €211 million in Q2 2023.

- Free Cash

Flow1 was strong at €120

million in Q2 2024, from solid EBITDA performance combined with

continued prudence on Capex and discipline on working capital.

- ROCE was 17.6% in

Q2 2024.

- Underlying Net

Debt at €1.6 billion, implying a leverage ratio of

1.5x.

- 2024 Outlook:

Solvay tightens its guidance of organic growth of the underlying

EBITDA to “-10% to -15%”. The guidance for Free Cash

Flow1 is upgraded to “higher than €300 million”,

including Capex between €300 million and €350 million in 2024.

| |

Second quarter |

First quarter |

First half |

Underlying

(in € million) |

2024 |

2023 |

% yoy |

% organic |

2024 |

2023 |

2024 |

2023 |

% yoy |

% organic |

|

Net sales |

1,194 |

1,274 |

-6.3% |

-6.7% |

1,201 |

1,355 |

2,396 |

2,629 |

-8.9% |

-9.4% |

|

EBITDA |

272 |

357 |

-23.7% |

-17.2% |

265 |

365 |

538 |

722 |

-25.5% |

-15.5% |

|

EBITDA margin |

22.8% |

28.0% |

-5.2pp |

- |

22.1% |

26.9% |

22.5% |

27.4% |

-5.0pp |

- |

|

FCF 1 |

120 |

516 |

-76.7% |

- |

2 123 |

-130 |

246 |

386 |

-36.2% |

- |

|

ROCE |

|

|

|

|

|

|

17.6% |

N/A |

n.m |

- |

Note: 2023 figures were restated to reflect the

changes mentioned in the Financial performance

introduction.

Philippe Kehren, Solvay CEO

“We continued to deliver a solid performance

in the second quarter, in what continues to be a challenging

environment. Our focus on deploying our cost-saving initiatives was

key, and the €46 million of structural cost savings achieved so far

are a testimony of the hard work of our teams. The new operating

model is becoming a reality and will make our organization more

agile and efficient. I am also particularly happy to see our

employees embracing the change and playing an active role in our

transformation.

Thanks to our proactivity and prudence in the first six months,

we are now in a position to tighten our guidance and accelerate our

investments in digitalization and in our future growth.”

2024 outlook

Solvay expects demand to remain broadly flat in

the second half. Following the good performance in the first half

and the accelerated delivery of cost savings, Solvay tightens its

guidance of underlying EBITDA to -10% to -15% organic growth

(previously -10% to -20%), which means circa €975 million to €1,040

million, at a 1.10 EUR/USD exchange rate. This is supported by €80

million expected cost savings for the full year.

Solvay upgrades its guidance of Free Cash

Flow3, which is now expected to be higher than €300

million. That includes an acceleration of the Capex in the second

half, which is expected to be between €300 million and €350 million

in 2024.

Financial calendar

- November 6, 2024: First nine months 2024 earnings

- Link to Solvay’s financial

calendar

Details of analysts and investors conference

call

- Time: July 31, 2024 - 2pm CEST

- Registration: register to the

webcast here.

Contacts

| Media

relations |

Investor

relations |

Peter Boelaert

+32 479 30 91 59

Laetitia Van Minnenbruggen

+32 484 65 30 47

Kimberly King

+ 1 470 464 4336

media.relations@solvay.com |

Boris

Cambon-Lalanne

+32 471 55 37 49

Geoffroy d’Oultremont

+32 478 88 32 96

Vincent Toussaint

+33 6 74 87 85 65

investor.relations@solvay.com |

About Solvay

Solvay, a pioneering chemical company with a

legacy rooted in founder Ernest Solvay's pivotal innovations in the

soda ash process, is dedicated to delivering essential solutions

globally through its workforce of over 9,000 employees. Since 1863,

Solvay harnesses the power of chemistry to create innovative,

sustainable solutions that answer the world’s most essential needs

such as purifying the air we breathe and the water we use,

preserving our food supplies, protecting our health and well-being,

creating eco-friendly clothing, making the tires of our cars more

sustainable and cleaning and protecting our homes. Solvay’s

unwavering commitment drives the transition to a carbon-neutral

future by 2050, underscoring its dedication to sustainability and a

fair and just transition. As a world-leading company with €4.9

billion in net sales in 2023, Solvay is listed on Euronext Brussels

and Paris (SOLB). For more information about Solvay, please visit

solvay.com or follow Solvay on Linkedin.

Safe harbor

This press release may contain forward-looking

information. Forward-looking statements describe expectations,

plans, strategies, goals, future events or intentions. The

achievement of forward-looking statements contained in this press

release is subject to risks and uncertainties relating to a number

of factors, including general economic factors, interest rate and

foreign currency exchange rate fluctuations, changing market

conditions, product competition, the nature of product development,

impact of acquisitions and divestitures, restructurings, products

withdrawals, regulatory approval processes, all-in scenario of

R&I projects and other unusual items. Consequently, actual

results or future events may differ materially from those expressed

or implied by such forward-looking statements. Should known or

unknown risks or uncertainties materialize, or should our

assumptions prove inaccurate, actual results could vary materially

from those anticipated. The Company undertakes no obligation to

publicly update or revise any forward-looking statements.

1 Free Cash Flow (FCF) here is the free cash to

Solvay shareholders from continuing operations.

2 Solvay is applying the change in all its APMs since Q2

2024. The change in APM for Q1 has been applied to H1 numbers, and

represents €2 million of FCF. FCF in Q1 2024, with the change in

APM, would have been €126 million instead of €123 million.

3 Free Cash Flow (FCF) here is the free cash to Solvay

shareholders from continuing operations.

- Press release

- Financial report

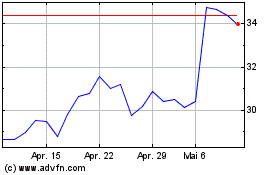

Solvay (EU:SOLB)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Solvay (EU:SOLB)

Historical Stock Chart

Von Dez 2023 bis Dez 2024