Argan repaid its bond in an amount of €130m without refinancing needs

06 Juli 2023 - 5:45PM

Argan repaid its bond in an amount of €130m without refinancing

needs

Press release –

Thursday, July 6,

2023

–

5.45pm

Argan repaid

its bond in an amount

of

€130m

without refinancing

needs,thus

confirming tight

control over its

debt

As planned, ARGAN has just proceeded to the

repayment of its bond in an amount of €130m, issued in June 2017,

at a fixed rate of 3.25%. Note that ARGAN had set this amount aside

following the bond in an amount of €500m that was issued at

particularly favourable conditions in November 2021 (with a rate of

1.011% for a maturity in November 2026). Most of Argan’s debt (68%

at end of 2022) is comprised of mortgage loans (asset by asset)

with ongoing amortization, which – as a result – does not require

any refinancing in the short term.

Estimated at

2.4%

for 2023,

the cost of debt remains under

tight control

Moreover, as Argan’s cost of debt is marginally

exposed to Euribor 3-month rate variations (only 8% of the gross

debt at the end of 2022), it thus has very little sensitivity to

the increase of market interest rates observed since the first

half-year of 2022.

As a result, taking into account an average

projected Euribor 3-month rate at 3.4% for the full year 2023, the

average cost of debt would stand at 2.4%.

With a BBB- (stable outlook)

rating that was confirmed last February

by S&P,

ARGAN is thus reinforcing

the quality of its

signature.

Announced

at the start of the year,

Argan’s debt reduction strategy results in

gradual and constant decrease in the

amount of gross debt. This is linked to

a double

effect stemming

from the natural

amortization of

mortgage loans

(about

€100m

/ year)

and,

selectively,

from the proceeds

of targeted sales of

warehouses at the end of 2024 or early 2025,

depending on market conditions.

Financial calendar 2023 (Publication of the

press release after closing of the stock exchange)

- July 19: 2023 Half-year results

- October 2: 2023 3rd quarter sales

About Argan

ARGAN is the only French real estate company

specializing in the DEVELOPMENT & RENTAL OF PREMIUM WAREHOUSES

listed on EURONEXT.As at December 31, 2022, ARGAN’s portfolio

amounted to 3.5 million sq.m, comprising approximately 100

warehouses located exclusively in France, valued at €4.0 billion.

ARGAN is a listed real estate investment company (French SIIC) on

Compartment A of Euronext Paris (ISIN FR0010481960 - ARG) and is

included in the Euronext CAC All-Share, EPRA Europe and IEIF SIIC

France indices.www.argan.fr

| Francis

Albertinelli – CFO Aymar de Germay – General SecretarySamy Bensaid

– Investor RelationsPhone: +33 1 47 47 47 40 E-mail:

contact@argan.frwww.argan.fr |

Marlene Brisset – Media relationsPhone: +33 6 59 42

29 35E-mail: argan@citigatedewerogerson.com |

|

|

- 20230706 - Argan repaid its bond in an amount of €130m without

refinancing needs

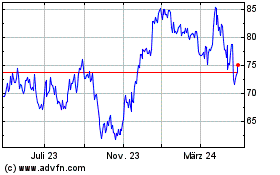

Argan (EU:ARG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Argan (EU:ARG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024