Crypto Bloodbath: Over $500 Million Liquidated As Bitcoin Slides To $92K – Report

26 November 2024 - 10:00AM

NEWSBTC

In the last few days, there have been big changes in crypto land.

In just 24 hours, more than $550 million was liquidated. When

Bitcoin fell to its weekly low, it caused a flood of sell-offs that

caused about 170,000 traders to lose money on their accounts.

Related Reading: Solana (SOL) ATH Sparks $309 Price Prediction

Frenzy – Details Coinglass reports such tremendous losses to be

placed at $118 million in BTC longs, $54 million in ETH longs, and

even $25 million in Dogecoin long positions. This surge in

liquidations, in conjunction with a decrease in market

capitalization and trading volume, emphasizes the volatility that

traders have come to anticipate. This is perceived by analysts as a

component of a more extensive pattern of corrections that have

occurred in the wake of Bitcoin’s recent rally to near-record

levels. Bitcoin Dominance & Liquidation Trends Bitcoin’s

dominance remains robust, with a current market capitalization of

$3.23 trillion, which accounts for over 56% of the total crypto

market. The highest liquidation of the day was a $4.67 million

BTC/USDT exchange on Binance, which is indicative of the high

stakes involved in leveraged trading. Additionally, altcoins were

not spared. Significant declines were observed in tokens with a

smaller market capitalization, with the broader market losing

approximately $100 million. Some analysts think this is just

another usual correction, following the hefty close to 44% rise in

Bitcoin price since early November. At present, the crypto Fear and

Greed Index stands at 82, suggesting that the prevailing dominance

in the market is still “Extreme Greed.” Ethereum And Altcoins

Maintain Their Poise Ethereum remains resilient, despite the fact

that it was not spared from the day’s losses. The uncertain

sentiment surrounding the second-largest cryptocurrency was

underscored by a combination of long and short liquidations in ETH

positions. In the interim, altcoins such as Dogecoin, which were

frequently bolstered by meme-driven enthusiasm, experienced the

repercussions of market corrections, a warning to traders who were

seeking rapid profits. An industry analyst named Miles Deutscher

noticed that more traders are reactivating their wallets after not

using them for months. They are doing this because they are

interested in the possibility of altcoins and Bitcoin’s strong

performance. As the market continues to follow its usual trends,

this increase in activity could lead to both growth and volatility.

Related Reading: XRP Below $1? Not Happening, Claims Millionaire

Analyst The Road Ahead For Bitcoin At $92,801, Bitcoin still lags

somewhat behind its all-time high of $99,750, attained earlier this

month. The next action divides analysts; some believe the market is

ready for consolidation prior to another surge beyond $100,000.

Others caution that overlevers may cause short-term greater

volatility. Investors are keenly monitoring market mood and

macroeconomic factors. Although current conditions may promote

bullish momentum, the crypto market’s severe price volatility and

huge leverage risks remind us of its unpredictable nature. Featured

image from DALL-E, chart from TradingView

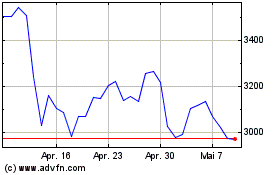

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024