Starknet: Long Positions Liquidated Lead To 16% Losses

07 Oktober 2024 - 8:00AM

NEWSBTC

Starknet (STRK) faces huge losses as it follows the market-wide

correction phase that shook investor portfolios. The unexpected

movement caused the token to fall by nearly 16% causing a whopping

$87k wipeout of STRK long positions in the past 24 hours.

Related Reading: Bittensor (TAO) Soars 130% – What’s Behind The

Altcoin’s Recent Surge? The market’s current positioning puts many

investors at risk with big losses for the bulls if investor

sentiment does not flip bullish in the coming days. With no solid

backing for a bull run this week, STRK starts weakly as investors

continue to be cautious of the market’s volatility. Surprise

For Investors Despite the market’s bearishness, STRK bulls pulled a

small win in the shape of a localized breakthrough on the $0.3891

resistance level which might translate to big gains in the coming

days. However, this can only occur if the token stabilizes above

$0.3891 in the short to medium term. With the token possibly

entering a crucial crossover point hinted at by STRK’s relative

strength index, a bullish reversal might be around the corner for

investors. But this may only come if the market flips on the side

of the bulls. As of writing, Bitcoin, the biggest

cryptocurrency in the world, is currently moving in the same zone

as well. The broader financial market’s current bullishness

might leak to the crypto market through Bitcoin’s correlation with

major finance indices like the S&P 500 and Dow Jones index,

both are up a few hundred points in the past 24 hours. But

with investors split between investing or pulling out of the

market, it might take a while before STRK experiences a jump in

price that will wipe out last week’s losses. For the current losses

to be completely reversed, the token needs to attempt a

breakthrough on the $0.5083 resistance level. However, STRK’s

current trajectory may only permit a move above the $0.3891 support

level. Once the token stabilizes on this support level, STRK bulls

might find new strength, targeting $0.4628 in the medium to long

term. Related Reading: Shiba Inu Burn Rate Shoots Up 1,000% –

Are New ATH Levels Just Around The Corner? New Developments Might

Solidify Investor Sentiment Despite the market’s bearishness,

several developments happened that will help investor sentiment

remain on the side of Starknet in the long run. what they

doin’ ova there?@strkfarm TVL goes ballistic

pic.twitter.com/dMtzvfopiZ — 0d1n fr33 (@odin_free) October 5, 2024

Since the start of October, several X personalities have noticed

that the Starknet total value locked (TVL) has grown significantly.

From September 6th’s $128.47k to over $1.05 million today,

representing a nearly 700% increase in under a month. This

came in line with Starknet’s initial step in decentralizing the

network. In this initial phase, community members can enter two

roles: delegators and validators. However, investors should not

expect much from the current implementation of decentralization as

the timeline for this is not yet defined and will undoubtedly take

some time to implement. Featured image from Medium, chart

from TradingView

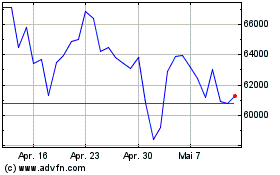

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024