UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-A/Amendment

No. 2

Tier

ii offering

Offering

Statement UNDER THE SECURITIES ACT OF 1933 CURRENT REPORT

C2 Blockchain,

INC.

(Exact name of registrant as specified in its

charter)

Date: January 26, 2024

| Nevada |

6199 |

00-0000000 |

|

(State or Other Jurisdiction

of Incorporation) |

(Primary Standard Classification Code) |

(IRS Employer

Identification No.)

|

123 SE 3rd Avenue, #130

Miami, Florida

Telephone: 888-4373432

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

THIS OFFERING STATEMENT SHALL ONLY BE QUALIFIED

UPON ORDER OF THE COMMISSION, UNLESS A SUBSEQUENT AMENDMENT IS FILED INDICATING THE INTENTION TO BECOME QUALIFIED BY OPERATION OF THE

TERMS OF REGULATION A.

PART I - NOTIFICATION

Part I should be read in

conjunction with the attached XML Document for Items 1-6

PART I - END

An offering

statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information

contained in this Preliminary Offering Circular is subject to completion or amendment. The securities referenced herein may not be sold,

nor may offers to buy be accepted, before the offering statement filed with the Securities and Exchange Commission is qualified. This

Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy, nor may there be any sales

of the securities referenced herein in any state in which such offer, solicitation or sale would be unlawful before registration or qualification

under the laws of such state. The issuer of the securities referenced herein may elect to satisfy its obligation to deliver a Final Offering

Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Offering

Circular was filed may be obtained.

PRELIMINARY OFFERING CIRCULAR DATED

JANUARY 26, 2024

UP TO A MAXIMUM OF 200,000,000 SHARES OF COMMON

STOCK

SEE “SECURITIES BEING OFFERED” AT PAGE

3.

MINIMUM INDIVIDUAL INVESTMENT: None

| |

Price Per Share to Public* |

Underwriting discount and commissions |

Proceeds to issuer |

| Common Stock |

|

|

|

*The offering of the

Company’s common stock will commence within two calendar days after the qualification date by the

Commission.

The Company reserves the right to change the fixed Price Per

Share to public during the course of the offering and will file a post-qualification offering circular amendment or an offering circular

supplement to the Offering Statement at the time depending if any changes are determined to be substantive or not.

The Company is offering, on a best-efforts, self-underwritten

basis, a number of shares of our common stock at a fixed priced per share between $.001 and $.30 with no minimum amount to be sold up

to a maximum of 200,000,000 shares. Upon the filing of a final offering circular by the Company with the Commission, all of the shares

registered in this offering will be freely transferable without restriction or further registration under Rule 251 unless such shares

are purchased by “affiliates” as that term is defined in Rule 144 under the Securities Act.

The offering will terminate at the earlier of the date at

which the maximum offering amount has been sold or the date at which the offering is earlier terminated by the Company in its sole discretion.

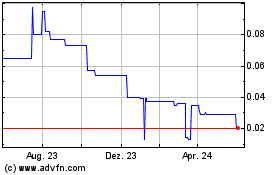

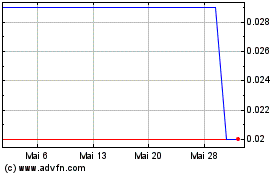

Our ticker symbol is CBLO and we are quoted and traded in

the OTC MarketPlace pink market tier. Our shares are thinly traded meaning our shares cannot be easily sold and have low volume of shares

trading per day which can lead to volatile changes in price per share.

The Company expects that the amount of expenses of the offering

that it will pay will be approximately $10,000.

The offering is being conducted on a best-efforts basis without

any minimum aggregate investment target. The Company may undertake one or more closings on a rolling basis. After each closing, funds

tendered by investors will be available to the Company.

INVESTMENT IN SMALL BUSINESSES INVOLVES A HIGH DEGREE OF RISK, AND INVESTORS SHOULD NOT INVEST

ANY FUNDS IN THIS OFFERING UNLESS THEY CAN AFFORD TO LOSE THEIR ENTIRE INVESTMENT. SEE THE SECTION ENTITLED “RISK FACTORS.”

IN MAKING AN INVESTMENT DECISION INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER AND

THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED OR APPROVED BY ANY FEDERAL

OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THESE AUTHORITIES HAVE NOT PASSED UPON THE ACCURACY OR ADEQUACY OF

THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION

DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY

OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION

WITH THE COMMISSION; HOWEVER THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING

IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED

INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE

YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

This offering is inherently risky. See “Risk

Factors” beginning on page 6.

Sales of these securities will commence on approximately

____ , 2024.

The Company is following the “Offering Circular”

format of disclosure under Regulation A.

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING

TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR

IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT

FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF

AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL

BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL

OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF THE COMPANY’S SALE TO YOU THAT CONTAINS

THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

In this public offering we, “C2 Blockchain, Inc.” are offering

up to a maximum of 200,000,000 shares of our common stock. We will receive all of the proceeds from the sale of shares. The

offering is being made on a self-underwritten, “best efforts” basis notwithstanding shares may be sold to or through underwriters

or dealers, directly to purchasers or through agents designated from time to time. For additional information regarding the methods of

sale, you should refer to the section entitled “Plan of Distribution” in this offering. There is no minimum number of shares

required to be purchased by each investor. The shares offered by the Company will be sold on our behalf by our sole director and

Chief Executive Officer, Levi Jacobson. Mr. Jacobson is deemed to be an underwriter of this offering. He will not receive any commissions

or proceeds for selling the registered shares on our behalf. There is uncertainty that we will be able to sell any of the shares

being offered herein by the Company.

Currently, we have 253,936,005 common shares issued and outstanding.

Mr. Jacobson indirectly owns 200,000,000 common shares of the Company by and through Mendel Holdings, LLC, a Delaware Limited Liability

company whereas he is the sole member resulting in control and representing a voting percentage of 78.760 %.

The Company qualifies as an “emerging growth company” as

defined in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject to reduced public company reporting

requirements.

-1-

The following table of contents has been designed to

help you find important information contained in this offering circular. We encourage you to read the entire offering circular.

TABLE

OF CONTENTS

In this Offering Circular, the term “C2 Blockchain,”

“CBLO” “we,” “us,” “our” or “the Company” refers to C2 Blockchain, Inc. The

term ‘‘common stock’’ refers to shares of the Company’s common stock.

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING

STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING

STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN

USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,”

“INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE

FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO

RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING

STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON

WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS

OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

Table of Contents

PART - II

offering

circular SUMMARY

GLOSSARY OF DEFINED TERMS AND INDUSTRY

DATA

In this Offering Circular, each of the following quoted terms

has the meanings set forth after such term:

“Bitcoin” — A type of digital asset based

on an open source math-based protocol existing onthe Bitcoin Network and utilizing cryptographic security.

“Bitcoin Exchange” — An electronic marketplace

where exchange participants may trade, buyand sell bitcoins based on bid-ask trading. The largest Bitcoin Exchanges are online and typically

trade on a 24-hour basis, publishing transaction prices and volume data.

“Bitcoin Exchange Market” — The global

Bitcoin Exchange market for the trading of bitcoins, which consists of transactions on electronic Bitcoin Exchanges.

“Bitcoin Network” — The online, end-user-to-end-user

network hosting the public transaction ledger, known as the Blockchain, and the source code comprising the basis for the math-based protocols

and cryptographic security governing the Bitcoin Network.

“Blockchain” — The public transaction

ledger of the Bitcoin Network on which miners or mining pools solve algorithmic equations, allowing them to add records of recent transactions

(called “blocks”) to the chain of transactions in exchange for an award of bitcoins from the Bitcoin Network and the payment

of transaction fees, if any, from users whose transactions are recorded in the block being added.

“CEA” — Commodity Exchange Act of 1936,

as amended.

“CFTC” — The US Commodity Futures Trading

Commission, an independent agency with the mandate to regulate commodity futures and option markets in the United States.

“Code” — The US Internal Revenue Code

of 1986, as amended.

“Digital Asset” — Collectively, all digital

assets based upon a computer-generated math-based and/or cryptographic protocol that may, among other things, be used to buy and sell

goods or pay for services. Bitcoins represent one type of digital asset.

“DDoS Attack” — Distributed denial of

service attacks are coordinated hacking attempts to disrupt websites, web servers or computer networks in which an attacker bombards

an online target with a large quantity of external requests, thus precluding the target from processing requests from genuine users.

“Exchange Act” — The Securities Exchange

Act of 1934, as amended.

“FDIC” — The Federal Deposit Insurance

Corporation.

“FinCEN” — The Financial Crimes Enforcement

Network, a bureau of the US Department of the Treasury.

“FINRA” — The Financial Industry Regulatory

Authority, Inc., which is the primary regulator in the United States for broker-dealers.

“Fiat Currency” — Currency that a government

has declared to be legal tender but is not backed by a physical commodity. The value of fiat money is derived from the relationship between

supply and demand rather than the value of the material that the money is made of.

“Hash Rate”— A measure of the computational

power on a blockchain network. Hash rate is determined by how many guesses are made per second. The overall hash rate helps determine

the security and mining difficulty of a blockchain network.

“IRS” — The US Internal Revenue Service,

a bureau of the US Department of the Treasury.

“Mining” — The process by which Bitcoins

are created involving programmers solving complex math problems with the computers in the Bitcoin Network.

“Proprietary Hash Rate” — Our own hash

rate generation from self-mining cryptocurrency.

“Proprietary Mining” — Self-mining for

cryptocurrency for our own account.

“SEC” — The US Securities and Exchange

Commission.

“Securities Act” — The Securities Act

of 1933, as amended.

“SIPC” — The Securities Investor Protection

Corporation.

Background

C2 Blockchain, Inc., a Nevada corporation was incorporated

on June 30, 2021 under the laws of the state of Nevada.

On March 28, 2022, the Company entered into a “Agreement

and Plan of Merger”, whereas it agreed to, and subsequently participated in, a Nevada holding company reorganization pursuant to

NRS 92A.180, NRS 92A.200, NRS 92A.230 and NRS 92A.250 (“Reorganization”). There was no shareholder vote required and there

was no shareholder meeting. The constituent corporations in the Reorganization were American Estate Management Company, (“AEMC”

or “Predecessor”), C2 Blockchain, Inc. (“CBLO” or“Successor”), and AEMC Merger Sub, Inc. (“Merger

Sub”). Our director, Levi Jacobson was, the sole director/officer of each constituent corporation in the Reorganization.

Pursuant

to the reorganization, the Company issued 1,000 common shares of its common stock to Predecessor and Merger Sub issued 1,000 shares of

its common stock to the Company immediately prior to the Reorganization. Immediately prior to the merger, the Company was a wholly owned

direct subsidiary of AEMC and Merger Sub was a wholly owned and direct subsidiary of the Company. The legal effective date of the Reorganization

was April 1, 2022 (the “Effective Time”). At the Effective Time, Predecessor was merged with and into Merger Sub (the “Merger),

and Predecessor was the surviving corporation. Each share of Predecessor common stock issued and outstanding immediately prior to the

Effective Time was converted into one validly issued, fully paid and non-assessable share of CBLO common stock.

At

the Effective Time, CBLO as successor issuer to AEMC continued to trade in the OTC MarketPlace under the previous ticker symbol of “AEMC”

until a new ticker symbol "CBLO” for the Company was released into the OTC MarketPlace on May 20, 2022. The market

effective date of the corporate action was May 23, 2022. The Company was given a CUSIP Number by CUSIP Global Services for its common

stock of 12675R109.

On

April 1, 2022, immediately after the completion of the Reorganization, we cancelled all of the stock held in AEMC resulting in AEMC as

a stand-alone company.

Our Common Stock is quoted on the OTC Markets Group Inc.’s

Pink® Open Market under the ticker symbol “CBLO”.

The Company believes that the Reorganization, was not

a transaction of the type described in subparagraph (a) of Rule 145 under the Securities Act of 1933 and the consummation of the Reorganization

will not be deemed to involve an “offer”, “offer to sell”, “offer for sale” or “sale”

within the meaning of Section 2(3) of the Securities Act of 1933. The Reorganization was consummated without the vote or consent of the

Company’s stockholders. In addition, the provisions of NRS 92A.180 did not provide a stockholder of the Company with appraisal rights

in connection with the Reorganization. The Company believes that in the absence of any right of any of the Company’s stockholders

to vote with respect to the Reorganization or to insist that their shares be purchased for fair value, the Reorganization could not be

deemed to involve an “offer” “offer to sell”; or “sale” within the meaning of Section 2(3) of the

Securities Act of 1933.

Currently, Mendel Holdings LLC, a Delaware Limited

Liability company solely owned and controlled by Levi Jacobson, our sole officer and director is our controlling shareholder, owning 200,000,000

shares of our restricted common stock representing approximately 78.760% voting control.

Company Information

On June 30, 2021, Levi Jacobson was appointed

President, Secretary, Treasurer and director of CBLO.

The Company’s business plan is to concentrate

on cryptocurrency mining, primarily Bitcoins, for our own account. We have not commenced our planned principal operations.

Business

Description:

We plan to mine for Bitcoin in Atlanta, Georgia. Atlanta

has abundant access to low-cost electricity and suitable environmental conditions for cooling mining equipment. The facility will be

custom designed with proper ventilation and cooling systems to ensure optimal performance and longevity of mining hardware. The facility

will be connected to the local power grid as its primary source of electricity. While grid power might be more expensive compared to

renewable sources like hydroelectric or solar power, it offers stability and constant availability, reducing the risk of interruptions

in mining operations.

We plan to utilize the latest generation of ASIC (Application-

Specific Integrated Circuit) miners, specifically the S19 XP model. These miners are highly specialized and designed to efficiently mine

cryptocurrencies that use the SHA-256 algorithm, such as Bitcoin. The mining operation will be designed with scalability in mind. As

the operation grows and more funds become available, additional mining hardware can be purchased and integrated into the existing setup.

The facility will be built to accommodate future expansions efficiently.

The energy consumption of ASIC S19 XP miners varies depending

on their efficiency and the power settings used. Each individual S19 XP miner typically consumes around 3010 Watts of electricity when

running at maximum capacity. To calculate the total energy consumption for our mining operation, we consider the number of miners and

their total power consumption. For example, To calculate the energy consumption of ten ASIC S19 XP miners at the industrial electric

rate, in the state of Georgia, of approximately $0.06 per kilowatt-hour (kWh),1 we look at the following.

The power consumption of a single ASIC S19 XP miner is approximately

3010 Watts (3.010 kW).

Total power consumption = Number of miners * Power consumption

per miner

Total power consumption = 10 miners * 3.010 kW per miner

Total power consumption = 30.10 kW

Converting the total power consumption from kilowatts (kW)

to kilowatt-hours (kWh) to find the total energy usage over time.

Assuming the miners run for 24 hours a day:

Total energy consumption in kWh = Total power consumption

in kW * Hours of operation

Total energy consumption in kWh of a single ASIC S19 XP

miner = 3.010 kW * 24 hours Total energy consumption in kWh = 72.24 kWh

The total cost per day to run one ASIC S19 XP miner = 72.24

kWh * $.06/kWh = $4.3344

The total energy consumption of ten ASIC S19 XP miners at

an electric rate of $0.06 per kWh is approximately 722.4 kilowatt-hours. To calculate the total cost, we multiply the total energy consumption

by the electric rate:

Total cost per day = Total energy consumption in kWh * Electric

rate Total cost = 722.4 kWh * $0.06/kWh

Total cost per day to run ten ASIC S19 XP miners = $43.34

Total cost per month to run ten ASIC S19 XP miners is $186.36.

Time

Frames:

At an approximate BTC price of $41,000, electricity

price of $0.06 kWh, hash rate of 140 TH/s, each Antminer S19 XP generates about $6.08 in earnings per day, $312.35 earnings per month

or $2,218.24 in earnings per year. Estimated time line for return on investment for each Antminer S19 XP or breakeven point is approximately

3.16 years For further discussion on break even and bitcoin mining analysis, see our disclosure on Page 20 of the Offering Circular

and our Risk Factors, Page 6.

We

plan to purchase at least 10 mining machines and estimate that we will require two hundred thousand dollars to commence operations. We

plan to utilize such net proceeds to purchase ASIC S19 XP miners and to obtain all necessary permits and licenses from local authorities

in Atlanta, Georgia. Depending on our capital raise, we will make a determination of how many mining machines to purchase.

First:

Site Selection: We need to identify a suitable location in Atlanta, Georgia where we plan to conduct our mining operation. We have not

identified any suitable locations at this time and have had no negotiations.

Second:

Obtain all necessary permits and licenses from local authorities to ensure legal operation.

Third:

Develop a detailed plan for the layout, power distribution, cooling systems, and security measures of the mining facility.

Fourth:

Purchase specialized mining hardware (ASIC) and related components for efficient cryptocurrency mining.

Fifth:

Build the physical infrastructure according to the facility design, including installing electrical systems and cooling solutions.

Sixth:

Testing and Optimization: Conduct thorough testing and fine-tuning to ensure our mining facility's efficiency and stability.

Seventh:

Recruit and train staff to manage and maintain the mining equipment.

Eighth:

We estimate that it will take a least six months to a year to complete all the steps mentioned above.

Ninth:

The costs for building a cryptocurrency mining facility can be substantial. It will need to include expenses for land acquisition, construction

materials, mining hardware, electrical infrastructure, cooling systems, regulatory compliance, and labor costs.

The principal address of the Company is

123 SE 3rd Avenue, #130, Miami, Florida 33131. Our phone number is 888-437-3432.

The Company has elected June 30th as its

fiscal year end.

We have no employees.

Intellectual Property

We have

no intellectual property, patents, patent applications or trade secrets.

1Atlanta,

GA, Electricity Rates/Industrial (2023). Retrieved November 9, 2023, from https://www.electricitylocal.com/states/georgia/atlanta/

-2-

Table of Contents

Our Offering

The Company is offering, on a best-efforts, self-underwritten

basis, a number of shares of our common stock at a fixed priced per share between $.001 and $.30 with no minimum amount to be sold up

to a maximum of 200,000,000 shares, but not to exceed $60,000,000 in gross proceeds. The fixed price per share determined upon qualification

shall be fixed for the duration of the Offering unless a post-effective amendment is filed to reset the price per share and approved

by the Commission. There is no minimum investment required from any individual investor. The shares are intended to be sold directly

through the efforts of our officer and director.

We have authorized capital stock consisting of the following.

The total number of shares of capital stock which the Corporation shall have authority to issue is: five hundred twenty million (520,000,000).

These shares shall be divided into two classes with five hundred million (500,000,000) shares designated as common stock at $.001 par

value (the "Common Stock") and twenty million (20,000,000) shares designated as preferred stock at $.001 par value (the "Preferred Stock").The

Preferred Stock of the Corporation shall be issuable by authority of the Board of Director(s) of the Corporation in one or more classes

or one or more series within any class and such classes or series shall have such voting powers, full or limited, or no voting powers,

and such designations, preferences, limitations or restrictions as the Board of Directors of the Corporation may determine, from time

to time.

We have 253,936,005 shares of Common Stock and no shares

of Preferred Stock issued and outstanding. We will receive all proceeds from the sale of our common stock.

Our Chief Executive Officer, Levi Jacobson will be selling

shares of common stock on behalf of the Company.

The Company is quoted in the OTC Pink market with a ticker

symbol of CBLO. The offering price of the shares has been determined arbitrarily by us. The price does not bear any relationship to our

assets, book value, earnings, or other established criteria for valuing a privately held company. In determining the number of shares

to be offered and the offering price, we took into consideration our capital structure and the amount of money we would need to implement

our business plans. Accordingly, the offering price should not be considered an indication of the actual value of our securities.

The offering is being conducted

on a self-underwritten, best efforts basis, which means our management will attempt to sell the shares being offered hereby on behalf

of the Company. There is no underwriter for this offering. However, we may engage various securities brokers to place shares of common

stock in this Offering with investors on a commission basis. As there is no minimum offering, upon the approval of any subscription

to this Offering Circular, the Company shall immediately deposit said proceeds into the bank account of the Company and may dispose of

the proceeds in accordance with the Use of Proceeds.

Completion of this offering is not

subject to us raising a minimum offering amount. We do not have an arrangement to place the proceeds from this offering in an escrow,

trust or similar account. Any funds raised from the offering will be immediately available to us for our immediate use. We have provided

an estimate below of the gross proceeds to be received by the Company if 25%, 50%, 75%, and 100% of the common shares registered in the

offering are sold at the midpoint offering price of $.15 per share resulting in gross proceeds received by the Company in the amount of

$30,000,000.

Proceeds to Company in Offering

| |

|

Number

of

Shares |

|

|

Offering

Price (1) |

|

|

Underwriting

Discounts

&

Commissions |

|

|

Approximate Gross

Proceeds |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

| 25% of Offering Sold |

|

|

25,000,000 |

|

|

$ |

.15 |

|

|

$ |

0 |

|

|

$ |

3,750,000 |

|

| 50% of Offering sold |

|

|

100,000,000 |

|

|

$ |

.15 |

|

|

$ |

0 |

|

|

$ |

15,000,000 |

|

| 75% of Offering Sold |

|

|

150,000,000 |

|

|

$ |

.15 |

|

|

$ |

0 |

|

|

$ |

22,500,000 |

|

| Maximum Offering sold |

|

|

200,000,000 |

|

|

$ |

.15 |

|

|

$ |

0 |

|

|

$ |

30,000,000 |

|

| |

(1) |

Assuming an initial public midpoint offering price of $.15 per share, as set forth on the cover page of this offering circular. |

| |

|

| Securities being offered by the Company |

Up to a Maximum 200,000,000 shares of common stock, at a fixed price per

share between $.001 and $.30 per share per share with no minimum amount to be sold but not to exceed $60,000,000 in gross proceeds. A

final fixed price will be determined upon qualification or in a final or supplemental offering circular supplement at the time of sale

of our Common Stock. Our stock will be offered by us through our director in a direct offering. The offering will terminate at the earlier

of the date at which the maximum offering amount has been sold or the date at which the offering is earlier terminated by the Company

in its sole discretion.

|

| |

|

| Offering price per share |

We will sell the shares at a final fixed price per share to be determined at time of qualification or in a final or supplemental offering circular supplement at the time of sale of our common stock between the price range of $.001 and $.30 per share. |

| |

|

| Number of shares of common stock outstanding before the offering of common stock |

There are 253,936,005 common shares issued and outstanding. |

| |

|

| Number of shares of common stock outstanding after the offering of common stock |

___ common shares will be issued and outstanding if we sell all of the common shares we are offering at a offering price of $____ per share. |

| |

|

| Number of shares of preferred stock outstanding before the offering of common stock |

No preferred shares are currently issued and outstanding. |

| |

|

| Number of shares of preferred stock outstanding after the offering of common stock |

No preferred shares will be issued and outstanding. |

| |

|

The minimum number of shares to be

sold in this offering |

None. |

| |

|

| Market for the common shares |

Our common shares are quoted and traded in the OTC Marketplace in the Pink Market tier. Our ticker symbol is CBLO. |

| |

|

| |

|

-3-

Table of Contents

| |

|

| Use of Proceeds |

We

intend to use the gross proceeds to us for the purchase of land and buildout of the Company’s cryptocurrency facility,

mining machines, working capital and for any other general

corporate purpose. See “Use of Proceeds” for more details.

|

| |

|

| Termination of the Offering |

The offering will terminate at the earlier of the date at which the maximum offering amount has been sold or the date at which the offering is earlier terminated by the Company in its sole discretion. |

| |

|

| Terms of the Offering |

Our Chief Executive Officer, Levi Jacobson will sell the shares of common stock on behalf of the company, upon qualification of this Offering Statement, on a BEST EFFORTS basis. |

| Subscriptions: |

All subscriptions once accepted by us are irrevocable.

|

| Registration Costs |

We estimate our total offering registration costs to be approximately $10,000.

|

| Risk Factors: |

See “Risk Factors” and the other information in this offering circular for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

You should rely only upon the information

contained in this offering circular. We have not authorized anyone to provide you with information different from that which is contained

in this offering circular. We are offering to sell common stock and seeking offers to common stock only in jurisdictions where offers

and sales are permitted.

-4-

Table of Contents

SUMMARY OF OUR FINANCIAL INFORMATION

The following table sets forth selected financial information, which should

be read in conjunction with the information set forth in the “Management’s Discussion and Analysis of Financial Position and

Results of Operations” section and the accompanying financial statements and related notes included elsewhere in this offering circular.

The tables and information below are derived from

some our most recent financial statements filed with the SEC as of September 30, 2023 respectively.

C2 Blockchain, Inc.

Balance Sheet

| |

|

September 30, 2023 (Unaudited) |

|

|

June 30,

2023 |

| |

|

|

|

|

|

| TOTAL ASSETS |

$ |

- |

|

$ |

- |

| |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

| Loan to Company - related party |

$ |

40,714 |

|

$ |

31,164 |

| TOTAL LIABILITIES |

$ |

40,714 |

|

$ |

31,164 |

| |

|

|

|

|

|

| Stockholders’ Equity (Deficit) |

|

|

|

|

|

| Preferred stock ($.001 par value, 20,000,000 shares authorized; none issued and outstanding as of September 30, 2023 and June 30, 2023) |

|

- |

|

|

- |

| |

|

|

|

|

|

| Common stock ($.001 par value, 500,000,000 shares authorized, 253,936,005 shares issued and outstanding as of September 30, 2023 and June 30, 2023) |

|

253,936 |

|

|

253,936 |

| Additional paid-in capital |

|

(252,601) |

|

|

(252,601) |

| Accumulated deficit |

|

(42,049) |

|

|

(32,499) |

| Total Stockholders’ Equity (Deficit) |

|

(40,714) |

|

|

(31,164) |

| |

|

|

|

|

|

| TOTAL LIABILITIES & STOCKHOLDERS’ EQUITY (DEFICIT) |

$ |

- |

|

$ |

- |

Table of Contents

C2 Blockchain,

Inc.

Statement

of Operations

(Unaudited)

| |

|

|

Three Months Ended September 30, 2023 |

|

|

Three Months Ended September 30, 2022 |

|

| |

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| General and administrative expenses |

|

$ |

9,550 |

|

$ |

4,869 |

|

| Total operating expenses |

|

|

9,550 |

|

|

4,869 |

|

| |

|

|

|

|

$ |

|

|

| Net loss |

|

$ |

(9,550) |

|

|

(4,869) |

|

| |

|

|

|

|

$ |

|

|

| Basic and Diluted net loss per common share |

|

$ |

(0.00) |

|

|

(0.00) |

|

| |

|

|

|

|

|

|

|

| Weighted average number of common shares outstanding - Basic and Diluted |

|

|

253,936,005 |

|

|

253,936,005 |

|

The Company is electing to not opt out of JOBS Act extended accounting

transition period. This may make its financial statements more difficult to compare to other companies.

Pursuant to the JOBS Act of 2012, as an emerging growth company the

Company can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the PCAOB

or the SEC. The Company has elected not to opt out of such extended transition period, which means that when a standard is issued or revised

and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the standard

for the private company. This may make comparison of the Company’s financial statements with any other public company which is not

either an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult

or impossible as possible different or revised standards may be used.

Emerging Growth Company

The recently enacted JOBS Act is intended to reduce the regulatory burden

on emerging growth companies. The Company meets the definition of an emerging growth company and so long as it qualifies as an “emerging

growth company,” it will, among other things:

| |

|

| · |

be temporarily exempted from the internal control audit requirements Section 404(b) of the Sarbanes-Oxley Act; |

| |

|

| · |

be temporarily exempted from various existing and forthcoming executive compensation-related disclosures, for example: “say-on-pay”, “pay-for-performance”, and “CEO pay ratio”; |

| |

|

| · |

be temporarily exempted from any rules that might be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or supplemental auditor discussion and analysis reporting; |

| |

|

| · |

be temporarily exempted from having to solicit advisory say-on-pay, say-on-frequency and say-on-golden-parachute shareholder votes on executive compensation under Section 14A of the Securities Exchange Act of 1934, as amended; |

| |

|

| · |

be permitted to comply with the SEC’s detailed executive compensation disclosure requirements on the same basis as a smaller reporting company; and, |

| |

|

| · |

be permitted to adopt any new or revised accounting standards using the same timeframe as private companies (if the standard applies to private companies). |

Our company will continue to be an emerging growth company until the earliest

of:

| |

|

| · |

the last day of the fiscal year during which we have annual total gross revenues of $1,070,000,000 or more; |

| |

|

| · |

the last day of the fiscal year following the fifth anniversary of the first sale of our common equity securities in an offering registered under the Securities Act; |

| |

|

| · |

the date on which we issue more than $1 billion in non-convertible debt securities during a previous three-year period; or |

| |

|

| · |

the date on which we become a large accelerated filer, which generally is a company with a public float of at least $700 million (Exchange Act Rule 12b-2). |

-5-

Table of Contents

RISK FACTORS

Please consider the following risk factors and other information in this

offering circular relating to our business before deciding to invest in our common stock. Many of the following risk factors are stated

in the context that we are operating when in fact we are not.

This offering and any investment in our common stock involves a high degree

of risk. You should carefully consider the risks described below and all of the information contained in this offering circular before

deciding whether to purchase our common stock. If any of the following risks actually occur, our business, financial condition and results

of operations could be harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or

part of your investment.

We consider the following to be the material risks for an investor regarding

this offering. Our company should be viewed as a high-risk investment and speculative in nature. An investment in our common stock may

result in a complete loss of the invested amount.

An investment in our common stock is highly speculative,

and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk

factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks actually

occur, our business and financial results could be negatively affected to a significant extent.

Risks Relating to Our Business, Securities, Operations,

Industry and Financial Condition

Coronavirus Impact.

The COVID-19 pandemic has caused, and is likely to

continue to cause, severe economic, market and other disruptions worldwide. We cannot assure you that conditions in the bank lending,

capital and other financial markets will not continue to deteriorate as a result of the pandemic, or that our access to capital and other

sources of funding will not become constrained, which could adversely affect the availability and terms of future borrowings. In addition,

the deterioration of global economic conditions as a result of the pandemic may ultimately decrease the availability of computers and

other hardware that we need to begin our mining operation.

The extent of the COVID-19 pandemic’s effect on our operational

and financial performance will depend on future developments, including the duration, spread and intensity of the outbreak, all of which

are uncertain and difficult to predict. Due to the speed with which the situation is developing, we are not able at this time to estimate

the effect of these factors on our business, but the adverse impact on our business, results of operations, financial condition and cash

flows could be material.

Our common stock may be deemed a “penny

stock,” which would make it more difficult for our investors to sell their shares.

Our common stock is currently

subject to the “penny stock” rules adopted under Section 15(g) of the Exchange Act. The penny stock rules generally apply

to companies whose common stock is not listed on The Nasdaq Stock Market or another national securities exchange and trades at less than

$4.00 per share, other than companies that have had average revenues of at least $6,000,000 for the last three years or that have tangible

net worth of at least $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require, among other

things, that brokers who trade penny stock to persons other than “established customers” complete certain documentation, make

suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk

disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of

the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in these securities

is limited. If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if

any, for our securities. If our securities are subject to the penny stock rules, investors will find it more difficult to dispose of our

securities.

Holding Company Reorganization.

The Company believes that the Reorganization,

deemed effective on April 1, 2022, was not a transaction of the type described in subparagraph (a) of Rule 145 under the Securities Act

of 1933 and the consummation of the Reorganization will not be deemed to involve an “offer”, “offer to sell”,

“offer for sale” or “sale” within the meaning of Section 2(3) of the Securities Act of 1933. The Reorganization

was consummated without the vote or consent of the Company’s stockholders. However, If the Company’s beliefs are later determined

to be incorrect whereas the Company may have been required to register the transaction under Section 5 of the Securities Act, shareholders

as a result may have a right of rescission under Section 12(a)(1) of the Securities Act. Those

consequences may have a substantive impact on our liquidity now or at any future time. The SEC could initiate proceedings against

the Company and any person that sold securities in violation of Section 5 of the 1933 Securities Act. Section 5 of the Securities Act

of 1933 prohibits the sale or delivery of unregistered securities unless a registration statement is in effect as to a security. Section

5 makes it unlawful for any person, directly or indirectly to sell such security through the use of a prospectus or to use any means for

the purpose of sale or for delivery of a sale.

Our lack of an operating history makes evaluating our business

and future prospects difficult, and may increase the risk of your investment.

We have no operating history and no revenue. We may never raise enough

cash to execute our business plan. Therefore, you could lose your entire investment in the Company.

The time

frame to breakeven on the cost of one ASIC S19 XP mining machine is approximately 3.16 years based on approximate BTC market price

of $41,000.

At an approximate BTC price of $41,000, electricity

price of $0.06 kWh, hash rate of 140 TH/s, each Antminer S19 XP generates about $6.08 in earnings per day, $312.35 earnings per

month or $2,218.24 in earnings per year. Estimated time line for return on investment for each Antminer S19 XP or breakeven point is

approximately 3.16 years. Our assumptions in our breakeven analysis on page 20 may turn out to be inaccurate because the price of

bitcoin and network hash rate are dynamic and not static as our snapshot and subject to significant swings. The result may be that we never make a return on our investment. Therefore, you could lose your entire investment

in the Company.

-6-

Our auditor has issued a “going concern”

opinion.

Our auditor has issued a “going concern”

opinion on our financial statements, which means that the auditor is not sure if we will be able to succeed as a business without additional

financing.

To date, we do not operate and have not generated

revenues from our anticipated principal operations and have sustained losses since inception. Losses will continue until such time that

we can open our mining facility and begin mining for Bitcoin and earn revenue for completing the block transactions.

These factors, among others, raise substantial doubt

about our ability to continue as a going concern within one year after the date that the financial statements are issued.

Throughout 2023, we intend to fund our operations

through the sale of our securities to third parties and related parties. If we cannot raise additional capital, we may consume all the

cash reserved for operations. There are no assurances that management will be able to raise capital on terms acceptable to us. If we are

unable to obtain sufficient amounts of additional capital, we may be required to reduce the scope of our planned operations, which could

harm our business, financial condition and operating results. The financial statements do not include any adjustments that might result

from these uncertainties.

If we cannot raise sufficient funds, we

will not succeed or will require significant additional capital infusions.

We are offering Common Stock in the amount of up to

$60,000,000 in this offering, but may sell much less. Even if the maximum amount is raised, we may need additional funds in the future

in order to grow, and if we cannot raise those funds for whatever reason, including reasons outside our control, such as another significant

downturn in the economy, we may not survive. If we do not sell all of the Common Stock we are offering, we will have to find other sources

of funding in order to develop our business.

Even if we are successful in selling all of the Common

Stock being offered, our proposed business may require significant additional capital infusions, before we can achieve profitability.

Furthermore, in order to expand, we are likely to raise funds again in the future, either by offerings of securities or through borrowing

from banks or other sources. The terms of future capital infusions may include covenants that give creditors rights over our financial

resources or sales of equity securities that will dilute the holders of our Common Stock.

This Offering is being conducted on a “best

efforts” basis and does not require a minimum amount to be raised. As a result, we may not be able to raise enough funds to fully

implement our business plan and our investors may lose their entire investment.

The Offering is on a “best efforts” basis

and does not require a minimum amount to be raised. If we are not able to raise sufficient funds, we may not be able to fund our operations

as planned, and our growth opportunities may be materially adversely affected. This could increase the likelihood that an investor may

lose their entire investment.

We have no operating history. We have no revenue and no cash which

makes it difficult to accurately evaluate our business prospects.

We have limited assets, no operating history, and

no operating revenue to date. We have no experience mining bitcoin or any other digital asset. Thus, our proposed business is subject

to all the risks inherent in a new business venture with inexperienced officers/directors.

-7-

Terms of subsequent financings may adversely

impact your investment.

We may need to engage in common equity, debt, or preferred

stock financing in the future. Interest on debt securities could increase costs and negatively impact operating results. Preferred stock

could be issued in series from time to time with such designations, rights, preferences, and limitations as needed to raise capital. The

terms of preferred stock could be more advantageous to those investors than to the holders of Common Stock. In addition, if we need to

raise more equity capital from the sale of Common Stock, institutional or other investors may negotiate terms at least as, and possibly

more, favorable than the terms of your investment. Shares of Common Stock which we sell could be sold into any market which develops,

which could adversely affect the market price.

Risks of borrowing.

We may have to seek loans from financial institutions.

Typical loan agreements might contain restrictive covenants which may impair our operating flexibility. A default under any loan agreement

could result in a charging order that would have a material adverse effect on our business, results of operations or financial condition.

We depend on our sole director who has

no experience in the cryptocurrency mining business.

Our future success depends on our sole director, Mr.

Levi Jacobson. Mr. Jacobson has no experience in the cryptocurrency mining business. His inexperience or the loss of his services may

have a serious adverse effect on us and you could lose your entire investment. Mr. Jacobson does not work

exclusively for us, and will divide his time with his other business activities that consume 20 hours per week.

Management Discretion as to Use of Proceeds.

Our success will be substantially dependent upon the

discretion and judgment of our management team with respect to the application and allocation of the proceeds of this Offering. The use

of proceeds described below is an estimate based on our current business plan. We, however, may find it necessary or advisable to re-allocate

portions of the net proceeds reserved for one category to another, and we will have broad discretion in doing so.

Limited Liquidity.

Our common stock is quoted and thinly traded in OTC

Markets Group’s platform known as the Pink Market tier under the ticker symbol CBLO. Investors should assume that they may not be

able to liquidate their investment for a long time.

-8-

The

cryptocurrency industry in which we plan to operate is characterized by constant changes. If we fail to continuously update our technology

to mine cryptocurrency, we may not be able to solve the required computational problems of increasing complexity that allows us to make

money.

The cryptocurrency industry

in which we plan to operate is characterized by constant changes, including rapid technological evolution, continual shifts in customer

demands, frequent introductions of new products and solutions and constant emergence of new industry standards and practices. Thus, our

success will depend, in part, on our ability to respond to these changes in a cost-effective and timely manner. Advances in Bitcoin mining-related

technology have led to increased demand for higher speed and power efficiency for solving computational problems of increasing complexity.

We may need to frequently invest in new mining hardware/machines often to stay competitive in the market. Otherwise, we may become obsolete

and thus our financial condition would be materially and adversely affected.

Our results of operations

are expected to be significantly impacted by Bitcoin’s price fluctuation.

Our

ability to generate economic benefits (i.e., positive cash flow or profits) from Bitcoin mining is directly affected by the market

price of Bitcoin. The Bitcoin price may impact the rewards we get from our mining machines. When the market price of a Bitcoin drops below

certain thresholds, the anticipated operation of existing mining machines may not be economically beneficial for us. Any future significant

reductions in the price of Bitcoin will likely have a material and adverse effect on our results of operations and financial condition.

The

supply of Bitcoins available for mining is limited and we may not be able to quickly adapt to new businesses when all the Bitcoins have

been mined.

There

is a limited supply of bitcoins that can ever exist with a total cap of 21 million with “halving” mechanism. Currently, around

19 million Bitcoins have been mined as of September 28, 2023 and are in circulation, leaving approximately 2 million left to be

mined. It's estimated that all bitcoins will be mined by the year 2140, at which point the last block reward will be released2.

The number of blocks that can be

solved in a year is designed to be fixed, and the number of Bitcoins awarded for solving a block in the blockchain halves approximately

every four years until the estimated complete depletion of Bitcoin available for mining by around 2140. When the Bitcoin network

was first launched, the reward for validating a new block was 50 Bitcoins. In November 2012, the reward for validating a new block

was reduced to 25 Bitcoins. In July 2016, the reward for validating a new block was reduced to 12.5 Bitcoins, and in May 2020,

the reward was further reduced to 6.25 Bitcoins. The next halving for Bitcoin is expected in 2024 at block 840,000, when the reward will

reduce to 3.125 Bitcoins. While the remaining Bitcoins are not designed to be entirely depleted in the near future, a decrease in the

reward for solving a block or an increase in the transaction fees may result in a decrease in incentives for miners to continue their

mining activities and the loss of Bitcoin’s dominant position among the cryptocurrencies, thereby reducing the demand for Bitcoin

mining related services of CBLO. We may not be able to quickly adapt to new businesses or expand to other cryptocurrencies when all the

Bitcoins have been discovered or Bitcoin is replaced by other cryptocurrencies as the mainstream cryptocurrency, which will result in

a significant negative impact on our business and results of operations.

The halving will have the impact of cutting miners’

bitcoin compensation per block reward in half. We expect that will cause many less efficient miners to shut off their miners unless the

price of bitcoin significantly appreciates before then. The impact on us is difficult to assess. Certainly, without a corresponding increase

in the price of bitcoin, our revenue will be impacted negatively. If the price of bitcoin and the network hashrate remain flat, our corresponding

revenue would be cut in half subsequent to the halving. Management’s expectation is that there will be a drop in hashrate as less

efficient miners shut down, consequently reducing competition. We also anticipate that the price of bitcoin will appreciate post the

halving as it has in the past two halvings. However, how these two factors play out is difficult to forecast. Management is actively

seeking ways to mitigate these industry specific factors including keeping operations lean and optimizing its hardware and electricity

consumption.

Mining Difficulty and Hashrate: The Bitcoin network adjusts

its mining difficulty approximately every two weeks to ensure that blocks are mined, on average, every 10 minutes. This adjustment is

based on the total computational power (hashrate) of the network. If the network's hashrate increases, the mining difficulty adjusts

upwards to make solving the cryptographic puzzles more challenging. Conversely, if the hashrate decreases, the difficulty adjusts downwards

to maintain the 10-minute block time.

Efficiency of Mining Hardware: Mining operations use various

hardware, with different levels of efficiency. Newer ASIC (Application-Specific Integrated Circuit) miners are typically more efficient

and powerful than older models. Miners operating less efficient hardware may struggle to remain profitable, especially when competing

with miners using more advanced and energy- efficient equipment.

Impact on Mining Difficulty: A drop in hashrate due to

less efficient miners shutting down results in a lower total computational power on the network. As a consequence, the mining difficulty

adjusts downward during the regular difficulty adjustment period, making it easier for remaining miners to solve blocks.

Our crypto mining business

will be capital intensive. We may need additional capital but may not be able to obtain it in a timely manner and on favorable terms

or at all.

The costs of constructing,

developing, operating and maintaining cryptocurrency mining facilities, and owning and operating the latest generation mining equipment

are substantial. Our anticipated operations may require additional capital or financing from time to time in order to achieve growth.

We may require additional cash resources due to the future growth and development of our business. Our future capital requirements may

be substantial as we seek to expand operations, and pursue acquisitions and equity investments. Our cash resources are insufficient to

satisfy our cash requirements, and therefore we may seek to issue additional equity or debt securities or obtain new or expanded credit

facilities.

Our ability to obtain external

financing in the future may be subject to a variety of uncertainties, including our future financial condition, results of operations,

cash flows and the liquidity of capital and lending markets. Our proprietary mining business is nevertheless capital intensive. We may

need additional capital if Bitcoin price increases as it will likely push up prices for supplies required for its proprietary mining

business. However, in light of conditions impacting the industry, it may be more difficult for us to obtain equity or debt financing

currently and/or in the future. Specifically, the crypto assets industry has been negatively impacted by recent events such as the bankruptcies

of Compute North, Core Scientific, Alameda Research LLC, BlockFi, Celsius Network, Voyager Digital, Three Arrows and FTX. In response

to these events, the digital asset markets, including the market for Bitcoin specifically, have experienced extreme price volatility

and several other entities in the digital asset industry have been, and may continue to be, negatively affected, further undermining

confidence in the digital assets markets and in Bitcoin. Any indebtedness that we may incur in the future may also contain operating

and financial covenants that could further restrict operations. There can be no assurance that financing will be available in a timely

manner or in amounts or on terms acceptable to us, or at all. A large amount of debt borrowings may result in a significant increase

in interest expense while at the same time exposing us to increased interest rate risks. Equity financings could result in dilution to

our shareholders, and the securities issued in future financings may have rights, preferences and privileges that are senior to those

of our common shares. Any failure to raise needed funds on terms favorable to us, or at all, could severely restrict our liquidity as

well as have a material adverse effect on our business, financial condition and results of operations.

2Blockchain Council (2023) by Ayushi Abrol. Retrieved

October 9, 2023, from https://www.blockchain-council.org/cryptocurrency/how-many-bitcoins-are-left.

-9-

We may

not be able to compete as cryptocurrency networks experience increases in the total network hash rate.

As the relative market price

of a cryptocurrency, such as Bitcoin, increases, more companies are encouraged to mine for that cryptocurrency and as more mining machines

are added to the network, its total hash rate increases. In order for us to have a competitive position under such circumstances, we

must increase our hash rate by acquiring and deploying more mining machines, including new mining machines with higher hash rates. There

are currently only a few companies capable of producing a sufficient number of machines with adequate quality to address the increased

demand. If we are not able to acquire and deploy additional mining machines on a timely basis, our proportion of the overall network

hash rate will decrease and we will have a lower chance of solving new blocks which will have an adverse effect on our business and results

of operations. We may experience in the future hash rate loss during our operations

due to factors beyond our control. We plan to generate hash rate through operating our proprietary mining datacenters. To efficiently

increase managing hash rate (i.e., proprietary hash rate), our efforts may include constructing and expanding mining datacenters in prime

locations globally, purchasing the latest mining machine models and continually optimizing operational efficiency of our mining machines.

However, hash rate generation is affected by factors beyond our control, including temperature, humidity, mining machine quality, the

depreciation and deterioration of mining machines, the location of our mining machines, spare parts supply quality, quantity and timeliness,

sudden surge in power price or sudden power outage, maintenance team members lack of experience, unseen computer virus attack, etc. In

the future, we expect the risks of hash rate loss will remain, which may affect our business and results of operations.

We are subject

to risks associated with our need for significant electric power and the limited availability of power resources, which could have a material

adverse effect on our business, financial condition and results of operations.

Our business requires a significant

amount of electric power. The costs of electric power will account for a significant portion of our cost of revenue. We require a significant

electric power supply to conduct our anticipated mining activity, such as powering and cooling our servers and network equipment and operating

critical mining infrastructure.

There has been a substantial

increase in the demand for electricity for cryptocurrency mining, and this has had varying impacts on local electricity supply. We plan

on using renewable sources of power in the future. Renewable power is generally an intermittent and variable source of electricity, which

may not always be available. Because the electrical grid has very little storage capacity, the balance between electricity supply and

demand must be maintained at all times to avoid a blackout or other cascading problem. Intermittent sources of renewable power are challenging

because they disrupt the conventional methods for planning the daily operation of the electrical grid. Their power fluctuates over multiple

time horizons, forcing the grid operator to adjust its day-ahead, hour-ahead, and real-time operating procedures.

The amount of power required

by us will increase commensurately with the increase in mining machines that we plan to operate for ourselves. Should our operations require

more electricity than can be supplied in the area where we plan to build our mining facilities or should the electrical transmission grid

and distribution systems be unable to provide the continuous, steady supply of electricity required, we may have to limit or suspend activities

or reduce the speed of any proposed expansion, either voluntarily or as a result of either quotas imposed by energy companies or governments,

or increased prices for certain users (such as us). If we are unable to procure electricity at a suitable price, we may have to shut down

our operations in that particular jurisdiction either temporarily or permanently. Therefore, increased power costs and limited availability

and curtailment of power resources will reduce our revenue and have a material and adverse effect on our cost of revenue and results of

operations. Although we aim to build and operate energy efficient facilities, there can be no assurance such facilities will be able to

deliver sufficient power to meet anticipated growing needs of our business. If we are unable to receive adequate power supply and forced

to reduce our operations due to the availability or cost of electrical power, our business would experience materially negative impacts.

Certain government regulators

have begun to intervene with the supply of electrical energy to cryptocurrency miners. Governments or government regulators may potentially

restrict electricity suppliers from providing electricity to mining datacenters in times of electricity shortage or may otherwise potentially

restrict or prohibit the provision of electricity to businesses like us. In the event government regulators issue moratoriums or impose

bans or restrictions involving transaction processing in jurisdictions in which it operates, we will not be able to continue our operations

in such jurisdictions. A moratorium ban or restriction could have a material adverse effect on our business, financial condition and results

of operations.

Additionally, our cryptocurrency

mining machines would be materially adversely affected by a power outage. Energy costs and availability are vulnerable to risks of outages

and power grid damage as a result of inclement weather, animal incursion, sabotage and other events out of our control. Because of our

mining business consumes a large amount of energy, it is not practical or economical for our operations to run on back-up generators in

the event of a power outage, which may be caused by weather, acts of God, wild fires, pandemics, falling trees, falling distribution poles

and transmission towers, transmission and distribution cable cuts, other force majeure events in the electricity and natural gas markets

and/or the negligence or malfeasance of others. Any system downtime resulting from insufficient power resources or power outages could

have a material adverse effect on our business, financial condition and results of operations.

-10-

There

are uncertainties over the outcome of our anticipated mining operations.

Our anticipated cryptocurrency

mining operation comprises blockchain mining technologies that depend on a network of computers to run certain software programs to solve

complex transactions in competition with other mining operations and to process transactions. Because of this less centralized model

and the complexity of our anticipated mining operation, there are uncertainties over the likelihood of winning a block reward and hence

the outcome of our mining operations. While we plan to participate in mining pools to combine our mining operations with other mining

participants to increase processing power to solve blocks, there can be no assurance that such pools will adequately address this risk.

A crypto mining pool is a group of miners that work collectively

to generate new blocks. They achieve this by contributing computing power and sharing rewards in proportion to their contribution. The

pool is made up of several bodies, such as pool managers. The manager is tasked with managing mining-related activities-recording work

done by each miner, assigning reward shares, and managing hashes. In return for their labor, miners must pay a small fee to the pool

manager. Mining pools are of immense benefit to small-scale investors. It allows them to join a collection of like-minded individuals

that combine resources to attempt to mine blocks successfully. The more computing power, the higher a pool's chances of mining new blocks.

Generally, mining pools run on three core factors-cooperative work protocol, mining software, and cooperative mining services.

Cooperative Work Protocol: this algorithm permits multiple

miners or participants to work on a block simultaneously. A server is linked directly to each participant in the block to track progress.

The mining software creates a connection between the pool and server, garners data for mathematical equations, and immediately starts

solving them. And when a solution is found, it sends the answer to the miner and works on the next block. Each software is distinct in

feature and functionality. Cooperative Mining Software: a cooperative mining server connects and permits multiple miners to pool resources

collectively in real-time. Mining pools reward/payment models. Crypto mining pools also use an array of reward systems. Some of these

include:

Pay-per-share (PPS) mining.

The pay-per-share mining reward system is a straightforward

model. And as the name implies, participants receive mining rewards based solely on each share contributed to a new block. This reward

system always rewards miners, even if no new block is found collectively.

Full Pay-per-share (FPPS) mining.

Also known as a pay-per-share plus, FPPS is similar to the

popular PPS reward model. However, this model rewards miners with a transaction fee if a new block is added. In the standard PPS system,

participants only receive a mining reward based on their contribution. The FPPS, on the other hand, offers a mining reward and a transaction

fee reward.

Pay-per-last N Share (PPLNS)

The Pay-per-last N Share model only pays participants when

a new block is found and added. The mining pool goes back to look for deposited shares before discovering each winning block. Only shares

provided within the timeframe are tallied and rewarded.

Double Geometric Method (DGM) mining.

The double geometric method is a hybrid of PPLNS and Geometric

reward that permits an operator to take on variance risks. Since miners do not know when a new block would be found, rewards for shares

pooled may vary based on certain factors. DGM is designed to ensure the average reward to be received is equal to what they get in a

PPS model.

Proportional mining

In this mining reward model, miners earn shares until a

new block is added. Expressly, proportional mining means that all shares contributed by pool members are equal, but the value is only

calculated at the end of each block discovering round.

Benefits of crypto mining pools

Crypto mining pools augment pooled resources and guarantee

a higher chance of completing new blocks and earning rewards. There are other benefits of this collective mining process, which include:

Better chances of earning rewards

Mining pools enable participants to compete with large-scale

mining companies, thus increasing their chance of mining a block. With more computing power, manpower, and an additional efficiency level,

mining pools can record faster block completion rates.

Reduced cost

One standout benefit of crypto mining pools is that small-scale

miners do not need to acquire expensive mining rigs to attempt blocks. Most application-specific integrated circuit (ASIC) mining rigs,

like the AntMiner S19 Pro cost about $7,000, a steep price for a rig. Mining pools dispel the need to undertake a mining activity alone,

allowing miners to earn from collective effort.

Disadvantages of crypto mining pools

Heightened energy usage

Electricity accounts for 75% of the operational cost of

running large mining pools. And while electricity price depends on the host country, miners pay an estimated average of $0.046 per Kwh.

In addition to cost, the environmental effects of crypto mining cannot be overlooked. According to reports, Bitcoin mining alone accounts

for 0.1% of global greenhouse gas emissions.

Establishes a centralized structure

Pooled mining transforms the crypto transaction validation

process into a centralized setting. It gives control to the largest mining pools with more resource-replete participants. This type of

system contradicts the decentralized structure that the crypto industry tries to promote.

Constant fees

While cryptocurrency mining pools are considered cheaper,

these pools will require us to pay between 1-3% recurring pooling fees. Fees would be paid from our share of the reward.

We are subject

to risks associated with legal, political or other conditions or developments regarding holding, using or mining of cryptocurrencies,

in particular Bitcoins, which could negatively affect our business, results of operations and financial position.

Changes in government

policies, taxes, general economic and fiscal conditions, as well as political, diplomatic or social events, expose us to financial and

business risks. In particular, changes in policies and laws regarding holding, using and/or mining of Bitcoins could result in an adverse

effect on our business operations and results of operations.

There are significant uncertainties

regarding future regulations pertaining to the holding, using or mining of Bitcoins, which may adversely affect our results of operations.

While Bitcoin has gradually gained more market acceptance and attention, it is anonymous and may be used for black market transactions,

money laundering, illegal activities or tax evasion. As a result, governments may seek to regulate, restrict, control or ban the mining,

use and holding of Bitcoins. We do not have any existing policies and procedures for the detection and prevention of money laundering

and terrorism-funding.

Therefore, our services

to complete a transaction may be used by other parties to engage in money laundering and other illegal or improper activities. We will

be subject to anti-money laundering laws. We cannot assure you that there will not be a failure in detecting money laundering or other

illegal or improper activities which may adversely affect our reputation, business, financial condition and results of operations.

With advances in technology,

cryptocurrencies are likely to undergo significant changes in the future. It remains uncertain whether Bitcoin will be able to cope with,

or benefit from, those changes. In addition, as Bitcoin mining employs sophisticated and high computing power devices that need to consume

a lot of electricity to operate, future developments in the regulation of energy consumption, including possible restrictions on energy

usage in the jurisdictions where we plan to mine may also affect our business operations. There have been public backlashes surrounding