Gold Bull Resources Corp. (TSX-V: GBRC) (“

Gold

Bull” or the “

Company”) is pleased to

announce a Mineral Resource Estimate (MRE) for the Sandman Project,

located near the town of Winnemucca in Nevada, USA.

The effective date of this MRE is January 20,

2021 and the associated NI 43-101 technical report will be filed on

the Company’s website and SEDAR within 45 days of this disclosure.

For additional Sandman maps & figures please view the

Company’s website.

HIGHLIGHTS:

- Sandman NI43-101 resource

estimate increased by 60% from the 2007 estimate

- 21.8Mt @ 0.7g/t gold,

comprising of:

- Indicated Resource of

18,550kt @ 0.73g/t gold for

433kozs of gold

- Inferred Resource of

3,246kt @ 0.58g/t gold for 61kozs

of gold

- Resource extension

potential – several resources remain open in multiple

directions

- Majority of mineralisation

<100m from surface

Gold Bull CEO, Cherie Leeden, commented:

This resource estimate incorporated

the additional drilling that has been completed at the project

since the 2007 resource estimate which totalled 309,000 ounces.

Since acquiring the project from Newmont in December 2020, it is a

fantastic outcome to have grown our resource base to 494,000 ounces

of gold (comprised of 433,000 ounces of Indicated plus 61,000

ounces of Inferred) before we even commence our drill program!

Future resource estimates may also

consider silver, which tends to be associated with the gold at a

ratio of about 10:1 and has not been adequately investigated

yet.

The Mineral Resource Estimate (MRE), for the

Sandman Project, was completed by Steven Olsen, who is an

Independent Consultant and is a qualified person under NI 43-101.

This MRE was derived from 249 historical surface diamond drill

holes and 650 RC drill holes totaling 20,201 m of diamond drilling

and 75,573.3 of RC drilling.

Pit Constrained Resources

The MRE was constrained within an open pit

design which was used for the purpose of restricting the MRE to

gold mineralization that has “reasonable prospects” for eventual

economic extraction. The MRE has been reported from within this

open pit constraint, and all material outside of this pit

constraint has been excluded from the MRE (Table 1 and Table

2).

The cut-off grade applied to the MRE is based on

estimated processing costs and gold recoveries which are

commensurate with a gold price of approximately US$1,800 per ounce

(US$1690 for fresh and US$1814 for oxide).

Metallurgical information completed to date from

Sandman indicates that different processing methods and operating

costs will be required for the oxidized rock compared with the

unoxidized rock, also known as fresh rock. A cut-off grade of

0.15g/t gold has been applied to the oxide rock which compares with

the cut-off grade for unoxidized (fresh) rock of 0.30g/t gold.

Table 1: Indicated and Inferred

pit-constrained resources.

https://www.globenewswire.com/NewsRoom/AttachmentNg/483cbd53-b4da-4df7-b873-d670c26cc1ce

Table 2: Detailed Indicated and Inferred

pit-constrained resources broken into deposits.

https://www.globenewswire.com/NewsRoom/AttachmentNg/0f7c5ed4-b4c2-4c34-a0b8-19055684f0f2

Sandman Gold Property Mineral Resource

Estimate Notes:

The mineral resources disclosed in this press

release were estimated using the Canadian Institute of Mining,

Metallurgy and Petroleum (“CIM”) standards on mineral resources and

reserves definitions, and guidelines prepared by the CIM standing

committee on reserve definitions and adopted by the CIM

council.

-

Mineral resources are not mineral reserves and do not have

demonstrated economic viability. There is no certainty that all or

any part of the mineral resources estimated will be converted into

mineral reserves.

-

As defined by NI 43-101, the Independent and Qualified Person for

the Sandman MRE is Steven Olsen has reviewed and validated the

Sandman MRE. The effective date of the MRE is January 20,

2021.

-

Resources are reported in-situ and undiluted within an open pit

constraint and are considered to have reasonable prospects for

eventual economic extraction.

-

In accordance with NI 43-101 recommendations, the number of metric

tonnes was rounded to the nearest thousand. Any discrepancies in

the totals are due to rounding effects.

-

Metallurgical recoveries of 80% for oxide (assuming heap leach

processing at a cost of US$7 per tonne) and 92% (assuming

convention grinding and CIL processing at a cost of US$15 per

tonne) for fresh rock were utilized in the determination of cut-off

grades and also used as input assumptions for the pit

constraints.

-

The mining assumptions used for the pit constraints included an

overall pit slope angle of 50 degrees, a mining cost per tonne of

US$2 and a General and Administrative (G&A) charge of US$1 per

tonne processed.

Figure 1. Sandman Plan of Operations boundary

showing resource locations.

https://www.globenewswire.com/NewsRoom/AttachmentNg/623ae43d-a522-4129-bdf3-14836945f1ee

Location

Sandman is located in Townships 36 and 37 North,

Ranges 35 and 36 East, Mount Diablo Meridian, Humboldt County,

Nevada, USA. The property is situated south of the Slumbering Hills

and west of the Tenmile Hills, circa 24 km northwest of the town of

Winnemucca, Nevada (Figure 2). The property lies 23 km south of the

Sleeper Mine. Sandman is accessed by driving west from the town of

Winnemucca on Jungo Road for 15 km, and then an additional eight km

to the north on dirt roads that lie largely within the property

boundaries.

Figure 2. Sandman Property area location and

access relative to the closest regional township of Winnemucca and

the closest city center of Reno.

https://www.globenewswire.com/NewsRoom/AttachmentNg/3986d6e1-8395-4ddc-a277-0f467d442bc1

General Geology

The Sandman deposits belong to a series of

deposits that are dated between 14 and 17 million years old. Many

of these deposits have formed on major regional faults or rift

zones and are interpreted to have formed as a result of the same

geological rifting event (Figure 3).

The Sandman deposit is located on a large

regional fault known as the Central Northern Nevada Rift (NNRC) and

is located some 23 km south of the significant Sleeper deposit on

the same interpreted major structure.

Figure 3. Location of the Sandman deposit and

surrounding gold deposits which are interpreted to have formed as

part of the same geological event (after Saunders and Hames, 2015).

Reference to other mines and producing properties is for

information purposes only and there are no assurances that the

Company will achieve the same results.

https://www.globenewswire.com/NewsRoom/AttachmentNg/1ec0d437-265f-410b-a5d3-cebb0d9838b6

The Southeast Pediment, Silica Ridge, North

Hill, and Abel Knoll Au+Ag mineralization at Sandman are classified

as low-sulfidation, quartz-adularia, epithermal deposits. The

mineralization is hosted by Tertiary volcanic rocks, primarily in

tuffaceous units, andesite porphyry, tuffaceous sedimentary units,

and basalt. Northwestern Nevada contains a number of similar middle

Miocene Au-Ag deposits that occur in silicic volcanic or

subvolcanic rocks, including the Sleeper, Tenmile, National, and

Hog Ranch deposits (Conrad et al., 1993).

In general, higher-grade gold mineralization at

Sandman can be stratigraphically controlled along contacts between

basalt flows, interbedded fluvial conglomerates and tuffaceous

rocks (e.g., North Hill Deposit), or structurally controlled as

lens-shaped pods, with high-continuity, lower-grade disseminated

gold in sediments and volcanics (e.g., Silica Ridge and SE

Pediments Deposits). Quartz-adularia alteration dominates the ore

zones, whereas propylitic, argillic, and sericitic alteration are

associated with the known resource areas more distally.

Much of the property area is covered by

windblown sand deposits which effectively covers the underlying

prospective rocks to the gold mineralisation. Mapping, exploration

drilling, and shallow auger drilling through the sand indicate that

they are underlain by the hosts to the gold mineralisation of

Tertiary tuffaceous rocks and andesite, which in turn overlie Late

Triassic to early Jurassic metasedimentary clastic and subordinate

carbonate rocks (Figure 4).

Figure 4. Sandman Property geology.

https://www.globenewswire.com/NewsRoom/AttachmentNg/79763f37-ba22-4e75-aec1-ba3c7dadd6f2

Next Steps

Gold Bull has identified 42 drill hole targets

for approximately 8000 m. The Company will commence with a Phase 1

drill program consisting of 3000 m for 17 drill holes in February

2021 (or as soon as permit transfers have been completed). The

initial drill program will consist of 1500 m of resource

development drilling aimed at extending known resources and 1500 m

of exploration drilling aimed at testing undrilled targets. The

Company will then seek to obtain assay results for the initial 3000

m prior to embarking on Phase 2 drill program.

The Company recently completed a ground

geophysics (induced polarization) survey at the project and is

awaiting the data. This data is anticipated to guide Phase 2 drill

targets.

Gold Bull Background

Gold Bull’s Nevada based geology team conducted

a comprehensive project generation review of the regional geology

surrounding Sandman. The Company has increased its land holding to

capture previously open Bureau of Land Management (BLM) ground that

is considered highly prospective to host gold mineralisation, based

on scientific datasets such as geochemistry, geophysics, and

geological mapping. The Company conducted site visits to verify the

prospectivity of the targets. The new targets are adjoining to the

Company’s Sandman project. Gold Bull’s Sandman land holding now

covers >11709 hectares (>117 km2).

Qualified Person

The NI 43-101 Mineral Resource estimate for the

Sandman Gold Property was prepared under the direction of Steven

Olsen, a Qualified Person under NI 43-101, who has reviewed and

consented to the information in this news release that relates to

the reported Mineral Resource estimate.

Mr. Olsen is an independent consultant and has

no affiliations with Gold Bull except that of an independent

consultant/client relationship. Mr. Olsen is a member of the

Australian Institute of Geoscientists (AIG) and is the Qualified

Person under NI 43-101, Standards of Disclosure for Mineral

Projects, who has reviewed and approved the scientific and

technical content of this press release.

About Gold Bull Resources

Corp.

Gold Bull Resources Corp. is a gold focused

mineral exploration company that strives to generate and advance

high-reward project acquisitions in regions with proven mineral

wealth. Gold Bull’s mission is to grow into a US focussed mid-tier

gold development Company. The company’s exploration hub is based in

Nevada, USA, a top-tier mineral district that contain significant

historical production, existing mining infrastructure and an

established mining culture.

Gold Bull is led by a Board and Management team

with a track record of exploration and acquisition success. Gold

Bull’s objective is to generate stakeholder value and superior

investment returns through the discovery and responsible

development of mineral resources.

Cherie LeedenPresident and CEO, Gold Bull

Resources Corp.

For further information regarding Gold Bull

Resources Corp., please visit our website at www.goldbull.ca or

email admin@goldbull.ca.

Cautionary Note Regarding Forward-Looking

StatementsNeither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release contains certain statements

that may be deemed “forward-looking statements” with respect to the

Company within the meaning of applicable securities laws.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

“expects”, “plans”, “anticipates”, “believes”, “intends”,

“estimates”, “projects”, “potential”, “indicates”, “opportunity”,

“possible” and similar expressions, or that events or conditions

“will”, “would”, “may”, “could” or “should” occur. Although Gold

Bull believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance, are subject to risks and

uncertainties, and actual results or realities may differ

materially from those in the forward-looking statements. Such

material risks and uncertainties include, but are not limited to,

the Company’s ability to raise sufficient capital to fund its

obligations under its property agreements going forward, to

maintain its mineral tenures and concessions in good standing, to

explore and develop its projects, to repay its debt and for general

working capital purposes; changes in economic conditions or

financial markets; the inherent hazards associates with mineral

exploration and mining operations, future prices of copper and

other metals, changes in general economic conditions, accuracy of

mineral resource and reserve estimates, the potential for new

discoveries, the ability of the Company to obtain the necessary

permits and consents required to explore, drill and develop the

projects and if obtained, to obtain such permits and consents in a

timely fashion relative to the Company’s plans and business

objectives for the projects; the general ability of the Company to

monetize its mineral resources; and changes in environmental and

other laws or regulations that could have an impact on the

Company’s operations, compliance with environmental laws and

regulations, dependence on key management personnel and general

competition in the mining industry. Forward-looking statements are

based on the reasonable beliefs, estimates and opinions of the

Company’s management on the date the statements are made. Except as

required by law, the Company undertakes no obligation to update

these forward-looking statements in the event that management’s

beliefs, estimates or opinions, or other factors, should

change.

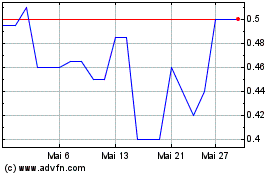

Gold Bull Resources (TSXV:GBRC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Gold Bull Resources (TSXV:GBRC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024