Osisko Gold Royalties Ltd (the “

Corporation” or

“

Osisko”) (OR: TSX & NYSE) is pleased to

announce that its wholly-owned subsidiary, Osisko Bermuda Limited

(“

OBL”), in partnership with Franco-Nevada

(Barbados) Corporation (“

FNB”), a wholly-owned

subsidiary of Franco-Nevada Corporation

(“

Franco-Nevada”) (FNV: TSX & NYSE), has

entered into a definitive Purchase and Sale Agreement (Gold) (the

“

Gold Stream”) with SolGold plc and certain of its

wholly-owned subsidiaries (collectively,

“

SolGold”) (SOLG: LSE & TSX), with reference

to gold production from SolGold’s 100%-owned Cascabel copper-gold

project located in Ecuador (the “

Project” or

“

Cascabel”). Osisko also holds a 0.6% NSR royalty

on Cascabel which it purchased from SolGold in 2022.

Pursuant to the terms of the Gold Stream, OBL

and FNB (collectively, the “Stream Purchasers”)

will make initial deposits totaling US$100 million to SolGold in

three equal tranches to fund the Project’s pre-construction costs

(the “Pre-Construction Deposit”). The first

tranche of the Pre-Construction Deposit will be funded at closing,

with the two subsequent tranches subject to the achievement of key

development milestones.

Thereafter, the Stream Purchasers will make

additional deposits totaling US$650 million to SolGold to fund

construction costs once the Project is fully financed and further

derisked (the “Construction Deposit”, and together

with the Pre-Construction Deposit, the “Deposit”).

OBL will provide 30% of the Deposit in exchange for a 30% interest

in the Gold Stream and FNB will provide 70% of the Deposit in

exchange for a 70% interest in the Gold Stream.

Jason Attew, President & CEO of Osisko

commented: “Cascabel is a world-class copper-gold project that has

the potential to become a multi-generational mine. SolGold’s focus

on sustainable development has generated very strong support from

the Government of Ecuador and the local communities near the

Project. This new stream investment, which complements Osisko’s

existing royalty on Cascabel, further enhances Osisko’s peer

leading growth profile at an attractive rate of return. We are

excited to be partnering with Franco-Nevada to continue to support

SolGold and the development of this exceptional asset.”

INVESTMENT HIGHLIGHTS

- Increasing

Exposure to a Long Life, Tier-1i

Copper-Gold Asset

- Cascabel represents

one of the most significant copper-gold discoveries in recent

history and one of the few long life, high production projects that

is not currently owned by a major mining company.

- The 2024

pre-feasibility study for the Project’s Alpala deposit (the

“2024 PFS”) estimates total production over an

initial 28-year mine life of 2.9 million tonnes of copper, 6.9

million ounces of gold and 18.4 million ounces of silver at an

all-in sustaining cost of US$0.69 per pound of copper, placing it

in the 1st quartile on the global copper mine cost curve.

- The Exploitation

Contract signed with the Government of Ecuador on June 5, 2024

outlines the fiscal and legal frameworks for the development of

Cascabel.

- SolGold has

demonstrated a strong commitment to responsible and sustainable

operating practices, with the aim of establishing one of the lowest

carbon footprint copper mines globally.

- Potential

to Materially Extend Mine Life through Near-Mine

Exploration

- The initial 28-year

mine life outlined in the 2024 PFS only considers the exploitation

of 18% of the Measured and Indicated Mineral Resources from the

Alpala deposit.

- There are numerous

regional exploration targets that have similar geophysical and

geochemical characteristics to Cascabel’s known mineralized

porphyry clusters.

- The

Tandayama-America deposit, located just 3km north of the Alpala

deposit, has the potential to be exploited by open-pit mining

methods and could provide additional mill feed and project

development flexibility.

- Robust Gold

Stream with Phased Investment as Project Advances

- Based on the 2024

PFS, annual deliveries to OBL over the initial 28-year mine life

are expected to average approximately 12,000 gold equivalent ounces

(“GEOs”), including an average of approximately

23,000 GEOs per annum for the first 10 years.

- OBL’s investment is

staged and based on the achievement of key development milestones,

with US$30 million available pre-construction and the balance

available for construction once the Project is further derisked and

fully financed.

- The Gold Stream

includes adjustment mechanisms to preserve the economics to the

Stream Purchasers in the event of changes to the scale of the

Project or timeline of development.

STREAM DETAILS (ATTRIBUTABLE TO

OBL)

-

Pre-Construction Deposit: OBL will make initial

cash deposits totaling US$30 million to SolGold to fund

pre-construction costs of the Project, including:

- US$10 million on

closing; and

- two additional

staged deposits of US$10 million each, subject to satisfaction of

key development milestones and other conditions precedent.

-

Construction Deposit: OBL will provide additional

deposits to SolGold totaling US$195 million to fund construction

costs of the Project, subject to customary conditions including

execution by SolGold of an Investment Protection Agreement with the

Government of Ecuador related to the construction and development

of the Project, receipt of all material permits, a board-approved

construction decision and the balance of the construction financing

being available.

- Streamed

Metal: OBL will purchase refined gold equal to 6% of the

contained gold produced from the Project until 225,000 ounces of

gold have been delivered to it, and 3.6% thereafter for the

remaining life of the mine. Over the initial 28-year mine life,

SolGold estimates contained gold production from the Project to

average approximately 253,000 ounces per annum, including an

average of approximately 392,000 ounces per annum for the first 10

years.

- Production

Payments: OBL will make ongoing cash payments for refined

gold delivered equal to 20% of the spot price of gold at the time

of delivery.

- SolGold

Change of Control: In the event of a change of control of

SolGold:

- the Stream

Purchasers have the option to terminate the Gold Stream and receive

repayment of the Deposit that has been advanced by such date plus a

return (the “Purchaser Termination Option”);

or

- if the Purchaser

Termination Option is not exercised, then:

- prior to the third

anniversary of closing, an acquiror of SolGold shall have the

one-time right to repurchase 50% of the Gold Stream; or

- subsequent to the

third anniversary of closing but prior to the fifth anniversary of

closing, an acquiror of SolGold shall have the one-time right to

repurchase 33% of the Gold Stream, in each case, for a one-time

payment of gold equal to 50% or 33% (as applicable) of the then

advanced amount of the Deposit plus an amount equating to a 15%

internal rate of return on the portion of the Deposit being bought

back, plus a change of control fee.

- Other

Considerations:

- OBL has agreed to

commit funds to support environmental and social initiatives being

advanced by SolGold in relation to the Project.

- The Gold Stream is

referenced to production from the entire Cascabel concession as

well as any production from other properties owned by SolGold that

is processed through the Cascabel plant and associated

facilities.

- SolGold has granted

the Stream Purchasers a right of first refusal in respect of the

sale or transfer of any royalty, stream or similar interest in the

Project.

- SolGold and certain

of its subsidiaries have provided the Stream Purchasers with

corporate guarantees and security over their assets related to the

Project.

CASCABEL PROJECT OVERVIEW

Cascabel hosts one of the largest undeveloped

copper-gold mineral resources in the world. The Project is located

in the Imbabura province of northern Ecuador, approximately 100

kilometers (“km”) north of the capital city of Quito and 50 km

north-northwest of the provincial capital of Ibarra, and is in

proximity to power, water and deep-water port infrastructure.

Three significant deposits have been identified

thus far at Cascabel, namely the Alpala porphyry copper-gold-silver

deposit, the Tandayama-America porphyry copper-gold deposit, and

the Aguinaga porphyry copper-gold deposit. These mineralised

systems are hosted within the Andean Porphyry Belt that extends

from southern Chile right through to Ecuador and Colombia to

Panama. The Andean Porphyry Belt hosts the largest concentrations

of copper in the world, including numerous deposits with active

mining operations.

In March 2024, SolGold released the results of

the 2024 PFS for the Alpala deposit at Cascabel. The 2024 PFS

outlined an initial 28-year mine life based on the exploitation of

only 18% of the Alpala Measured and Indicated Mineral Resource. The

2024 PFS envisages the phased development of an underground mine

exploited using the block caving mining method. The target

extraction rate in phase one is estimated to be approximately 12

million tonnes per annum, with production expanding to 24 million

tonnes per annum in year six of the mine life. The proposed process

flowsheet includes a conventional copper-gold flotation process

consisting of a single rougher stage and a multi-stage cleaning

circuit to produce a clean copper-gold-silver concentrate. Over the

current life of mine, the plant is expected to produce 2.9 million

tonnes of copper, 6.9 million ounces of gold and 18.4 million

ounces of silver.

In June 2024, SolGold announced the signing of

the Exploitation Contract for Cascabel with the Government of

Ecuador. The Exploitation Contract and existing legislation and

regulations establish the legal and financial terms and conditions

required for the Project's development.

SolGold has made considerable efforts to

undertake environmental studies and community engagement to

facilitate the advancement of the Project. Several environmental

baseline studies have been initiated in support of future

permitting associated with mine development and submission of an

Environmental and Social Impact Assessment. Cascabel is expected to

bring substantial long-term benefits to the Ecuadorian economy and

local communities through significant investment, job creation, and

sustainable growth.

For more information, please refer to SolGold’s

continuous disclosure documents filed on SEDAR+ at

www.sedarplus.ca.

About SolGold plc

SolGold is a leading resources company focused

on the discovery, definition and development of world-class copper

and gold deposits. SolGold operates with transparency and in

accordance with international best practices. SolGold is committed

to delivering value to its shareholders while simultaneously

providing economic and social benefits to impacted communities,

fostering a healthy and safe workplace, and minimizing

environmental impact.

For more information, please visit SolGold’s

corporate website at https://solgold.com.au/.

Qualified Person

The scientific and technical content of this

news release has been reviewed and approved by Guy Desharnais,

Ph.D., P.Geo., Vice President, Project Evaluation at Osisko Gold

Royalties Ltd, who is a “qualified person” as defined by National

Instrument 43-101 – Standards of Disclosure for Mineral

Projects.

About Osisko Gold Royalties Ltd

Osisko is an intermediate precious metal royalty

company focused on the Americas that commenced activities in June

2014. Osisko holds a North American focused portfolio of over 185

royalties, streams and precious metal offtakes. Osisko’s portfolio

is anchored by its cornerstone asset, a 3-5% net smelter return

royalty on the Canadian Malartic Complex, which is home to one of

Canada’s largest gold mines.

|

Osisko Gold Royalties Ltd1100, av. des

Canadiens-de-MontrealSuite 300, P.O. Box 211Montreal, QC, H3B

2S2 |

Osisko Bermuda LimitedCumberland House1 Victoria

Street, 5th FloorHamilton HM11Bermuda |

| For further

information, please contact Osisko Gold Royalties

Ltd: |

|

Grant MoentingVice President, Capital MarketsTel: (514) 940-0670

x116Cell: (365) 275-1954 Email: gmoenting@osiskogr.com |

Heather TaylorVice President, Sustainability and CommunicationsTel:

(514) 940-0670 x105Email: htaylor@osiskogr.com |

Cautionary Statement Regarding Forward-looking

Statements

Certain statements contained in this press

release may be deemed “forward-looking statements” within the

meaning of the United States Private Securities Litigation Reform

Act of 1995 and “forward-looking information” within the meaning of

applicable Canadian securities legislation. Forward-looking

statements are statements other than statements of historical fact,

that address, without limitation, future events, and in particular

that the potential of the Project to become a multi-generational

mine and to generate attractive returns, that the project will

continue to be developed in accordance with the 2024 PFS, that the

hypothesis and conclusion of the 2024 PFS will be confirmed by

additional technical studies, that sustainable mining practices

will be implemented at the Project, that regional exploration will

be successful and that additional deposits will be found or will

provide additional mill feed, that expected deliveries to OBL will

be met, that all conditions will be met to release all tranches of

the Deposit, the occurrence of a change of control of SolGold, that

the right of first refusal granted by SolGold to the Purchaser will

ever be exercised, that the expected benefits of the Project to the

Ecuadorian economy will materialize, production estimates of

Osisko’s assets (including increase of production), timely

developments of mining properties over which Osisko has royalties,

streams, offtakes and investments, management’s expectations

regarding Osisko’s growth, results of operations, estimated future

revenues, production costs, carrying value of assets, ability to

continue to pay dividend, requirements for additional capital,

business prospects and opportunities future demand for and

fluctuation of prices of commodities (including outlook on gold,

silver, diamonds, other commodities) currency markets and general

market conditions. In addition, statements and estimates (including

data in tables) relating to mineral reserves and resources and gold

equivalent ounces are forward-looking statements, as they involve

implied assessment, based on certain estimates and assumptions, and

no assurance can be given that the estimates will be realized.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

“expects”, “plans”, “anticipates”, “believes”, “intends”,

“estimates”, “projects”, “potential”, “scheduled” and similar

expressions or variations (including negative variations), or that

events or conditions “will”, “would”, “may”, “could” or “should”

occur. Forward-looking statements are subject to known and unknown

risks, uncertainties and other factors, most of which are beyond

the control of Osisko, and actual results may accordingly differ

materially from those in forward-looking statements. Such risk

factors include, without limitation, (i) with respect to properties

in which Osisko holds a royalty, stream or other interest; risks

related to: (a) the operators of the properties, (b) timely

development, permitting, construction, commencement of production,

ramp-up (including operating and technical challenges), (c)

differences in rate and timing of production from resource

estimates or production forecasts by operators, (d) differences in

conversion rate from resources to reserves and ability to replace

resources, (e) the unfavorable outcome of any challenges or

litigation relating title, permit or license, (f) hazards and

uncertainty associated with the business of exploring, development

and mining including, but not limited to unusual or unexpected

geological and metallurgical conditions, slope failures or

cave-ins, flooding and other natural disasters or civil unrest or

other uninsured risks; (g) that further technical studies

materially depart from the 2024 PFS; (ii) with respect to external

factors: (a) fluctuations in the prices of the commodities that

drive royalties, streams, offtakes and investments held by Osisko,

(b) fluctuations in the value of the Canadian dollar relative to

the U.S. dollar, (c) regulatory changes by national and local

governments, including permitting and licensing regimes and

taxation policies; regulations and political or economic

developments in any of the countries where properties in which

Osisko holds a royalty, stream or other interest are located or

through which they are held, (d) continued availability of capital

and financing and general economic, market or business conditions,

(e) responses of relevant governments to infectious diseases

outbreaks and the effectiveness of such response and the potential

impact of such outbreaks on Osisko’s business, operations and

financial condition;(iii) with respect to internal factors: (a)

business opportunities that may or not become available to, or are

pursued by Osisko or (b) the integration of acquired assets, (c)

the determination of Osisko’s PFIC status (d) Osisko’s ability to

deliver on its climate strategy. The forward-looking statements

contained in this press release are based upon assumptions

management believes to be reasonable, including, without

limitation: the absence of significant change in the Corporation’s

ongoing income and assets relating to determination of its Passive

Foreign Investment Company (“PFIC”) status; the absence of any

other factors that could cause actions, events or results to differ

from those anticipated, estimated or intended and, with respect to

properties in which Osisko holds a royalty, stream or other

interest, (i) the ongoing development and operation of the

properties by the owners or operators of such properties in a

manner consistent with past practice and with public disclosure

(including forecast of production), (ii) the accuracy of public

statements and disclosures made by the owners or operators of such

underlying properties (including expectations for the development

of underlying properties that are not yet in production), (iii) no

adverse development in respect of any significant property, (iv)

that statements and estimates relating to mineral reserves and

resources by owners and operators are accurate and (v) the

implementation of an adequate plan for integration of acquired

assets. All forward-looking statements contained in this press

release are expressly qualified in their entirety by the cautionary

statements contained or referred to in this section.

For additional information on risks,

uncertainties and assumptions, please refer to the most recent

Annual Information Form of Osisko filed on SEDAR+ at

www.sedarplus.ca and EDGAR at www.sec.gov which also provides

additional general assumptions in connection with these statements.

Osisko cautions that the foregoing list of risk and uncertainties

is not exhaustive. Investors and others should carefully consider

the above factors as well as the uncertainties they represent and

the risk they entail. Osisko believes that the assumptions

reflected in those forward-looking statements are reasonable, but

no assurance can be given that these expectations will prove to be

accurate as actual results and prospective events could materially

differ from those anticipated such the forward-looking statements

and such forward-looking statements included in this press release

are not guarantee of future performance and should not be unduly

relied upon. These statements speak only as of the date of this

press release. In this press release, Osisko relies on information

publicly disclosed by other issuers and third parties pertaining to

its assets and, therefore, assumes no liability for such

third-party public disclosure. Osisko undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, other

than as required by applicable law.

i Please see SolGold’s press release titled Key Financial

Developments dated May 14, 2024 available on SolGold’s SEDAR+

profile at www.sedarplus.ca.

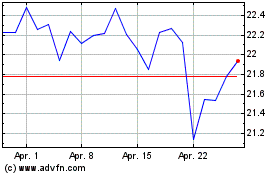

Osisko Gold Royalties (TSX:OR)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Osisko Gold Royalties (TSX:OR)

Historical Stock Chart

Von Dez 2023 bis Dez 2024