Dundee Corporation (TSX: DC.A) (the “Corporation”

or “Dundee”) today announced its financial results for the three

and six months ended June 30, 2023. All currency amounts in this

press release are in Canadian dollars except as otherwise

indicated.

SECOND QUARTER 2023 RESULTS

- Reported net income from portfolio

investments for the second quarter of 2023 of $10.1 million (2022 –

loss of $52.9 million). The key driver of performance during the

quarter was the market appreciation in Reunion Gold Corporation by

$20.6 million. The positive performance in the current quarter of

2023 was partially offset by a $3.5 million fair value decline on

the warrants of Magna Mining Inc. Broad-based market weakness for

mining stocks accounted for the remaining decrease. For the six

months ended June 30, 2023, the Corporation reported net income

from portfolio investments of $2.6 million (2022 – loss of $6.3

million).

- Reported consolidated general and

administrative expenses for the current quarter of $4.2 million

(2022 – $5.9 million), representing a 29% year-over-year decline as

Dundee sustains momentum with cost-cutting initiatives. Corporate

head office general and administrative expenses fell to $2.6

million in the second quarter of 2023, declining 16% from $3.1

million incurred from the same period of the prior year.

- Reported share of loss from equity

accounted investments for the second quarter of 2023 of $1.6

million (2022 – income of $2.3 million). For the six months ended

June 30, 2023, Dundee reported a share of loss from equity

accounted investments of $3.5 million (2022 – income of $2.2

million).

- Reported net earnings attributable

to owners of the Corporation for the second quarter of 2023 of $1.8

million (2022 – loss of $44.5 million), or earnings of $0.02 per

share, before the effect of any dilutive securities (2022 – loss of

$0.52 per share).

- For the six months ended June 30,

2023, the Corporation reported a net loss attributable to owners of

the Corporation of $9.5 million (2022 – $13.4 million), or a loss

of $0.11 per share (2022 – $0.17 per share).

Jonathan Goodman, President and Chief Executive

Officer of Dundee Corporation, commented:

“Dundee is pleased to report a profit in an

otherwise challenging market for mining stocks. The unwavering

dedication and relentless efforts of our exceptional technical team

is critical to identifying investments that can perform well in

most market environments. A core holding of Dundee’s, Reunion Gold

Corporation, announced its maiden resource estimate for its Oko

West project during the second quarter and reinforced our

conviction in its world-class stature. The company’s stock

continues to trade near its all-time high. Reunion Gold plans to

release a preliminary economic assessment on Oko West in the fourth

quarter.”

“Subsequent to quarter-end, another core

holding, Magna Mining Inc., announced the results from its

completed preliminary economic assessment ("PEA") on its 100%-owned

Crean Hill Project. The study pointed to potential favorable

economics and paves the way for evaluating the economics of a fully

integrated mining complex with its existing wholly-owned

feasibility stage Shakespeare Project. Refer to Magna’s press

release disseminated on July 31, 2023 for further details.”

“On factors that are within our control in the

short-run, I am pleased to report continued progress in our

cost-cutting initiatives. By continuing to shed non-core assets and

reducing year-over-year general and administrative expenses by

nearly 30% in the second quarter, we free up more resources that

can be deployed to unlock shareholder value.”

“We believe depressed market valuations in the

mining sector create an opportunity for Dundee and its

shareholders, as we hold to our strong conviction that the need for

high quality and sustainably sourced mining assets has never been

greater. We remain focused on investing for the long-term and

working with our investee companies to maximize asset value and

realize their full potential. In addition, our share price trades

at a considerable discount to corporate net asset value per share.

Furthermore, we believe that our public portfolio assets, whose

share prices make up our underlying net asset value, also trade at

a significant discount to their underlying value. This presents a

unique opportunity for our shareholders to acquire a high-quality

portfolio of assets at a significant double discount to their

underlying value with leverage to rising commodity prices.”

Mr. Goodman concluded: “The entire team at

Dundee continues to work diligently to implement and execute on our

strategy across all fronts. I am encouraged by our ability to

sustain and grow our momentum in the second half of 2023, and we

are excited by the opportunity set ahead of us. Our team remains

committed to growing the core business, streamlining operations,

divesting our remaining non-core businesses and investments, and

positioning Dundee to deliver long-term, sustainable value for our

stakeholders, shareholders and partners. I would like to thank the

entire team for their hard work in navigating a time of continued

evolution.”

SEGMENTED FINANCIAL

RESULTS

Mining Investments

In the second quarter of 2023, the Corporation

reported net earnings before taxes from the mining investments

segment of $10.6 million (2022 – loss of $53.7 million).

Performance from the mining investment portfolio contributed $11.5

million (2022 – loss of $53.7 million) to net earnings before taxes

in this segment. The share of loss from equity accounted mining

investments during the current quarter of 2023 was $0.9 million

(2022 – $nil).

During the first six months of 2023, the

Corporation reported net earnings before taxes from the mining

investments segment of $0.9 million (2022 – loss of $6.4 million).

Performance from the mining investment portfolio contributed $2.9

million (2022 – loss of $6.4 million) to net earnings before taxes

in this segment. The share of loss from equity accounted mining

investments during the first half of 2023 was $2.0 million (2022 –

$nil).

Mining Services

During the three months ended June 30, 2023, the

mining services segment, comprised of the Corporation’s 78% owned

subsidiary, Dundee Sustainable Technologies (“DST”), reported a

pre-tax loss of $1.2 million (2022 – $0.9 million). Subsequent to

quarter-end, DST announced the sale of non-strategic operations and

assets located at its Thetford Mines technical facilities. DST has

entered into an agreement to sell the remaining portion of its

processing contract and associated processing plant equipment and

utilities (the “Transaction”). As part of the Transaction and under

the asset purchase agreement, Dundee Technologies will receive

total consideration of $0.9 million, in return for the processing

contract and associated plant equipment.

During the first half of 2023, DST incurred a

pre-tax loss of $2.4 million (2022 – $1.6 million).

Corporate and others

The Corporation reported a pre-tax loss from the

corporate and others segment, including non-core subsidiaries, of

$4.9 million (2022 – $1.3 million) during the three months ended

June 30, 2023. During this period, the Corporation reported head

office general and administrative expenses of $2.6 million, which

decreased by 16% from the $3.1 million expense incurred from the

same period of the prior year. During the first half of 2023, the

corporate and others segment reported a pre-tax loss of $8.3

million (2022 – $7.0 million).

The fair value of portfolio investments in the

corporate and others segment decreased by $1.5 million during the

three months ended June 30, 2023 (2022 – increase of $0.7 million).

The decrease was mainly attributable to the investment in TauRx

Pharmaceuticals Ltd., primarily on account of period-over-period

fluctuations in foreign exchange. The fair value of portfolio

investments in the corporate and others segment decreased by $0.3

million during the first half of 2023 (2022 – increase of $0.1

million).

Other subsidiaries and equity accounted

investments contributed $0.7 million and $0.6 million,

respectively, to this segment’s total pre-tax loss during the

second quarter of 2023 (2022 – $1.8 million and pre-tax earnings of

$2.3 million, respectively). During the first half of 2023, other

subsidiaries and equity accounted investments contributed $2.0

million and $1.5 million, respectively, to this segment’s total

pre-tax loss (2022 – $3.4 million and pre-tax earnings of $2.2

million, respectively).

SHAREHOLDERS’ EQUITY ON A PER SHARE BASIS

|

|

|

Carrying Value |

|

Carrying Value |

|

|

|

June 30, 2023 |

|

December 31, 2022 |

|

Mining Investments |

|

|

|

|

Portfolio investments |

$ |

169,798 |

|

|

$ |

168,598 |

|

|

Equity accounted investments |

|

24,664 |

|

|

|

26,506 |

|

|

|

|

|

194,462 |

|

|

|

195,104 |

|

|

Mining Services |

|

|

|

|

Subsidiaries |

|

3,797 |

|

|

|

3,081 |

|

|

|

|

|

3,797 |

|

|

|

3,081 |

|

|

Corporate and Others |

|

|

|

|

Corporate |

|

29,336 |

|

|

|

36,333 |

|

|

Portfolio investments ‒ other |

|

67,100 |

|

|

|

67,455 |

|

|

Equity accounted investments ‒ other |

|

28,318 |

|

|

|

28,557 |

|

|

Real estate joint ventures |

|

6,194 |

|

|

|

6,796 |

|

|

Subsidiaries |

|

10,319 |

|

|

|

16,814 |

|

|

|

|

|

141,267 |

|

|

|

155,955 |

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY |

$ |

339,526 |

|

|

$ |

354,140 |

|

|

Less: Shareholders' equity attributable to holders of: |

|

|

|

|

|

Preference Shares, series 2 |

|

(27,667 |

) |

|

|

(27,667 |

) |

|

|

Preference Shares, series 3 |

|

(40,976 |

) |

|

|

(50,423 |

) |

|

SHAREHOLDERS' EQUITY ATTRIBUTABLE TO CLASS A SUBORDINATE

SHARES |

|

|

|

AND CLASS B SHARES OF THE CORPORATION |

$ |

270,883 |

|

|

$ |

276,050 |

|

|

|

|

|

|

|

|

Number of shares of the Corporation issued and outstanding: |

|

|

|

|

|

Class A

Subordinate Shares |

|

85,377,729 |

|

|

|

84,968,090 |

|

|

|

Class B

Shares |

|

3,114,491 |

|

|

|

3,114,491 |

|

|

Total number of shares issued and outstanding |

|

88,492,220 |

|

|

|

88,082,581 |

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY ON A PER SHARE BASIS* |

$ |

3.06 |

|

|

$ |

3.13 |

|

* Shareholders' Equity on a per share basis is

calculated as total shareholders' equity per the financial

statements, less the carrying amount of preference shares series 2

and series 3, and divided by the total number of Class A and Class

B shares issued and outstanding

The Corporation’s unaudited interim consolidated

financial statements as at and for the three and six months ended

June 30, 2023 and 2022, along with the accompanying management’s

discussion and analysis have been filed on the System for

Electronic Document Analysis and Retrieval (“SEDAR”) and may be

viewed by interested parties under the Corporation’s profile at

www.sedarplus.ca or the Corporation’s website at

www.dundeecorporation.com.

ABOUT DUNDEE CORPORATION:

Dundee Corporation is a public Canadian

independent holding company, listed on the Toronto Stock Exchange

under the symbol “DC.A”. Through its operating subsidiaries, Dundee

Corporation is an active investor focused on delivering

long-term, sustainable value as a trusted partner in the mining

sector with more than 30 years of experience making accretive

mining investments.

FORWARD-LOOKING STATEMENTS:

This press release may contain forward-looking

information within the meaning of applicable securities

legislation, which reflects Dundee Corporation’s current

expectations regarding future events. Forward-looking information

is based on a number of assumptions and is subject to a number of

risks and uncertainties, many of which are beyond Dundee

Corporation’s control, which could cause actual results and events

to differ materially from those that are disclosed in or implied by

such forward-looking information. Such risks and uncertainties

include, but are not limited to, the factors discussed under “Risk

Factors” in the Annual Information Form of Dundee Corporation and

subsequent filings made with securities commissions in Canada.

Dundee Corporation does not undertake any obligation to update such

forward-looking information, whether as a result of new

information, future events or otherwise, except as expressly

required by applicable law.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Investor and Media RelationsT: (416) 864-3584E:

ir@dundeecorporation.com

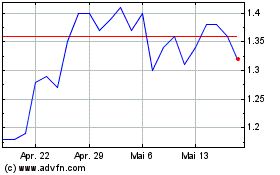

Dundee (TSX:DC.A)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Dundee (TSX:DC.A)

Historical Stock Chart

Von Apr 2023 bis Apr 2024