Dundee Corporation (TSX: DC.A) (the “Corporation”

or “Dundee”) today announced its financial results for the three

months and year ended December 31, 2023. All currency amounts in

this press release are in Canadian dollars, except as otherwise

indicated.

FOURTH QUARTER AND YEAR-END 2023

RESULTS

- Reported a net loss from portfolio

investments for the fourth quarter of 2023 of $0.8 million (2022 –

income of $39.9 million). For the year ended December 31, 2023, the

Corporation reported a net loss from portfolio investments of $23.0

million (2022 – income of $53.6 million). The key driver of

performance during the year was the market depreciation in holdings

of Centaurus Metals Limited, Ausgold Limited, warrants of Magna

Mining Inc. and Reunion Gold Corporation of $11.6 million, $4.1

million, $3.2 million and $1.9 million, respectively.

- Reported consolidated general and

administrative expenses for the current quarter of $2.5 million

(2022 – $7.1 million), representing a 65% year-over-year decline as

Dundee sustains momentum with cost-cutting initiatives. For the

year ended December 31, 2023, the Corporation reported consolidated

general and administrative expenses of $16.1 million (2022 – $25.3

million), representing a 37% decline from the prior year.

- Purchased for cancellation 914,040

of the Corporation’s outstanding Cumulative Floating Rate First

Preference Shares, Series 3 (“Series 3 Shares”), under a

substantial issuer bid for aggregate proceeds of C$18.7 million.

The quantity purchased represented 55.8% of the Series 3 Shares

issued and outstanding before giving effect to the substantial

issuer bid. The Corporation secured loan proceeds of C$14.0 million

to partially fund the purchase and provide more flexibility around

long-term commitments.

- Reported a net loss attributable to

owners of the Corporation for the fourth quarter of 2023 of $2.8

million (2022 – earnings of $26.0 million).

- For the year ended December 31,

2023, the Corporation reported a net loss attributable to owners of

the Corporation of $38.8 million (2022 – earnings of $17.1

million), or a loss of $0.43 per share (2022 – earnings of $0.15

per share).

Jonathan Goodman, President and Chief Executive

Officer of Dundee Corporation, commented:

“Dundee navigated a challenging market landscape

for junior mining in 2023 despite a generally robust environment

for commodity prices. Persistent inflationary pressures, poor

investor sentiment, and lack of capital availability to the junior

mining industry contributed to a notable decrease in risk appetite

in the sector and posed a significant headwind for our investment

portfolio during 2023. Encouragingly, portfolio investment losses

decelerated in the fourth quarter. With the price of gold now

hovering near its all-time high of over $2,100 per ounce, we remain

steadfast in our conviction that the market is underestimating the

value of companies engaged in the discovery and development of

high-quality precious metals, as well as base metals, and strategic

resources. We see substantial opportunities in the sector given the

disconnect between gold prices and the stocks. We remain focused on

investing in top quality projects for the long-term while working

with our investee companies as advisors and partners to maximize

asset value and realize their full potential.”

“Meanwhile, Dundee continued to make progress on

the factors within its control, namely around cost reduction. We

are happy to report a material reduction in our cash general and

administrative expenses during 2023. Further, by retiring more than

half the issued and outstanding Series 3 Shares at the end of the

year, we took a big step towards rightsizing our balance sheet and

reducing long-term cash commitments.”

“In 2023, we continued to move forward with our

strategic plan. Dundee elected to terminate its joint venture

arrangement in Borborema, Inc. in exchange for a net smelter

royalty on the sale of any product from Borborema, up to 2 million

ounces of gold. The royalty gives Dundee a direct line of sight on

anticipated future cash flows from the Borborema project without

any additional capital investment.”

Mr. Goodman concluded: “The entire team at

Dundee continues to work diligently to implement and execute our

strategy across all fronts. I am encouraged by our ability to

sustain and grow our momentum into 2024 as we look forward to the

opportunities ahead of us. Our team remains committed to growing

the core business, streamlining operations, divesting our remaining

non-core businesses and investments, and positioning Dundee to

deliver long-term, sustainable value for our stakeholders,

shareholders and partners. I would like to thank the entire team

for their hard work in navigating a time of continued

evolution.”

SEGMENTED FINANCIAL RESULTS

Mining Investments

In the fourth quarter of 2023, the Corporation

reported a net loss from the mining investments segment of $1.6

million (2022 – earnings of $12.0 million). Performance from the

mining investments portfolio incurred a $1.3 million loss (2022 –

income of $12.3 million), which is included in the net loss from

this segment. The share of losses from equity accounted mining

investments during the current quarter of 2023 and 2022 was $0.3

million.

During 2023, the Corporation reported a net loss

from the mining investments segment of $24.0 million (2022 –

earnings of $23.0 million). Performance from the mining investment

portfolio contributed $24.0 million to the net loss in this segment

(2022 – income of $23.5 million). The share of loss from equity

accounted mining investments during 2023 was $2.2 million (2022 –

$0.5 million). Offsetting the loss in this segment, the Corporation

recognized a $2.3 million gain during 2023 relating to the

termination of the Corporation’s 20% equity interest in the

Borborema gold project joint venture in exchange for a net smelter

royalty as non-monetary consideration.

Mining Services

During the three months ended December 31, 2023,

the mining services segment, comprised of the Corporation’s

78%-owned subsidiary, Dundee Sustainable Technologies Inc. (“DST”

or “Dundee Technologies”), reported a pre-tax loss of $1.2 million

(2023 – $1.0 million).

During the year, DST reported a pre-tax loss of

$4.3 million (2022 – $3.5 million), including $3.1 million (2022 –

$3.9 million) revenue generated from technical services to

customers in the mining industry to evaluate processing

alternatives using its proprietary technologies and for general

mineral processing services. In addition, DST recognized a $0.9

million gain on the sale of a non-strategic operation and assets

located at its Thetford Mines technical facilities.

In 2023, Dundee Technologies completed the

detailed engineering of a GlassLock Process™ project with a

top-tier gold producer in Ghana. They also invested $75,000 cash

and a $1.6 million in-kind contribution into Enim Technologies

Inc., a Québec-based company focused on the treatment of electronic

waste material. In addition, Dundee Technologies extended the

maturity date of its convertible debenture to May 15, 2025.

Corporate and others

The Corporation reported a pre-tax loss from the

corporate and others segment, including non-core subsidiaries, of

$0.3 million (2022 – earnings of $22.8 million) during the three

months ended December 31, 2023. During this period, the Corporation

reported head office general and administrative expenses of $2.8

million (2022 – $2.1 million). During the year, the corporate and

others segment reported a pre-tax loss of $12.0 million (2022 –

earnings of $15.1 million). Corporate head office general and

administrative expenses declined to $11.1 million (2022 – $12.9

million) in 2023.

The fair value of portfolio investments in the

corporate and others segment increased by $0.5 million during the

fourth quarter (2022 – $27.6 million). The fair value of portfolio

investments in the corporate and others segment increased by $1.1

million during 2023 (2022 – $30.0 million).

Other subsidiaries and equity accounted

investments reported a loss of $0.1 million and income of $0.3

million, respectively, to this segment’s total pre-tax loss during

the fourth quarter of 2023 (2022 – loss of $4.7 million and income

of $1.3 million, respectively). During the year, other subsidiaries

and equity accounted investments contributed $3.2 million and $1.9

million, respectively, to this segment’s total pre-tax loss (2022 –

loss of $9.2 million and income of $4.8 million, respectively).

SHAREHOLDERS’ EQUITY ON A PER SHARE BASIS*

|

|

|

|

|

|

|

Carrying value as at December 31, |

|

2023 |

|

|

|

2022 |

|

|

Mining Investments |

|

|

|

|

Portfolio investments |

$ |

126,671 |

|

|

$ |

168,598 |

|

|

Equity accounted investments |

|

15,731 |

|

|

|

26,506 |

|

|

Royalty |

|

18,921 |

|

|

|

- |

|

|

|

|

|

161,323 |

|

|

|

195,104 |

|

|

Mining Services |

|

|

|

|

Subsidiaries |

|

2,439 |

|

|

|

3,081 |

|

|

Equity accounted investment |

|

98 |

|

|

|

- |

|

|

|

|

|

2,537 |

|

|

|

3,081 |

|

|

Corporate and Others |

|

|

|

|

Corporate |

|

18,342 |

|

|

|

36,333 |

|

|

Portfolio investments ‒ other |

|

68,482 |

|

|

|

67,455 |

|

|

Equity accounted investments ‒ other |

|

28,874 |

|

|

|

28,557 |

|

|

Real estate joint ventures |

|

2,852 |

|

|

|

6,796 |

|

|

Subsidiaries |

|

7,738 |

|

|

|

16,814 |

|

|

|

|

|

126,288 |

|

|

|

155,955 |

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY |

$ |

290,148 |

|

|

$ |

354,140 |

|

|

Less: Shareholders' equity attributable to holders of: |

|

|

|

|

|

Preference

Shares, series 2 |

|

(27,667 |

) |

|

|

(27,667 |

) |

|

|

Preference

Shares, series 3 |

|

(18,125 |

) |

|

|

(50,423 |

) |

|

SHAREHOLDERS' EQUITY ATTRIBUTABLE TO CLASS A SUBORDINATE

SHARES |

|

|

|

|

AND CLASS B SHARES OF THE CORPORATION |

$ |

244,356 |

|

|

$ |

276,050 |

|

|

|

|

|

|

|

|

Number of shares of the Corporation issued and outstanding: |

|

|

|

|

|

Class A

Subordinate Shares |

|

85,832,805 |

|

|

|

84,968,090 |

|

|

|

Class B

Shares |

|

3,114,491 |

|

|

|

3,114,491 |

|

|

Total number of shares issued and outstanding |

|

88,947,296 |

|

|

|

88,082,581 |

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY ON A PER SHARE BASIS |

$ |

2.75 |

|

|

$ |

3.13 |

|

* Shareholders' Equity on a per share

basis is calculated as total shareholders' equity per the financial

statements, less the carrying amount of preference shares series 2

and series 3 and divided by the total number of Class A and Class B

shares issued and outstanding.

The Corporation’s audited consolidated financial

statements as at and for years ended December 31, 2023 and 2022,

along with the accompanying management’s discussion and analysis,

as well as the Annual Information Form, have been filed on the

System for Electronic Document Analysis and Retrieval (“SEDAR”) and

may be viewed by interested parties under the Corporation’s profile

at www.sedarplus.ca or the Corporation’s website at

www.dundeecorporation.com.

ABOUT DUNDEE CORPORATION:

Dundee Corporation is a public Canadian

independent holding company, listed on the Toronto Stock Exchange

under the symbol “DC.A”. Through its operating subsidiaries, Dundee

Corporation is an active investor focused on delivering

long-term, sustainable value as a trusted partner in the mining

sector with more than 30 years of experience making accretive

mining investments.

FORWARD-LOOKING STATEMENTS:

This press release may contain forward-looking

information within the meaning of applicable securities

legislation, which reflects Dundee Corporation’s current

expectations regarding future events. Forward-looking information

is based on a number of assumptions and is subject to a number of

risks and uncertainties, many of which are beyond Dundee

Corporation’s control, which could cause actual results and events

to differ materially from those that are disclosed in or implied by

such forward-looking information. Such risks and uncertainties

include, but are not limited to, the factors discussed under “Risk

Factors” in the Annual Information Form of Dundee Corporation and

subsequent filings made with securities commissions in Canada.

Dundee Corporation does not undertake any obligation to update such

forward-looking information, whether as a result of new

information, future events or otherwise, except as expressly

required by applicable law.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Investor and Media RelationsT: (416) 864-3584E:

ir@dundeecorporation.com

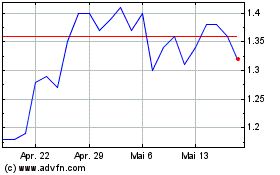

Dundee (TSX:DC.A)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Dundee (TSX:DC.A)

Historical Stock Chart

Von Apr 2023 bis Apr 2024