Record Manufacturing Segment Revenue of

$3.4M

Positive Adjusted EBITDA1

Crescita Therapeutics Inc. (TSX: CTX and OTC US: CRRTF)

(“Crescita” or the “Company”), a growth-oriented, innovation-driven

Canadian commercial dermatology company, today reported its

financial results for the first quarter ended March 31, 2022

(“Q1-F2022”). All amounts presented are in thousands of Canadian

dollars (“CAD”) unless otherwise noted.

Financial Highlights

Q1-F2022 vs. Q1-F2021

- Revenue was $4,951 compared to $3,265, up $1,686;

- Gross profit was $2,712 compared to $2,116, up $596;

- Operating expenses were $3,088 compared to $2,413, up

$675;

- Adjusted EBITDA1 was $66 compared to $87, down $21;

- Ending cash was $11,742 compared to $11,331 at the end of

Q4-F2021, representing cash generation of $411 for the

quarter.

“In the quarter, we achieved record revenue of $3.4M in our

manufacturing segment, surpassing the previous mark of $2.9M set

last quarter and significantly higher than the $0.7M recorded in Q1

last year. Manufacturing is an important part of our business. Its

consistent revenue complements our licensing revenue which tends to

be more variable,” commented Serge Verreault, President and CEO of

Crescita. “Optimizing our plant capacity, growing our customer base

and expanding volumes with existing clients are part of our

strategy to increase recurring revenues and margins.

“We are working with our international partners to support the

local regulatory approvals and/or launches of Pliaglis®. Based on

our discussions, our partners expect that Pliaglis will be

commercialized in 35 new countries through 2025. Our commercial

teams are also preparing for the anticipated launch of ART FILLER®,

subject to its approval by Health Canada. Finally, we continue to

seek out product and business acquisition opportunities to enhance

our growth,” concluded Mr. Verreault.

Q1-F2022 and Subsequent Corporate Developments

Launch of Obagi Medical® Product Line in Canada

- We launched the Obagi Medical product line in Canada under our

exclusive distribution agreement with Obagi Cosmeceuticals LLC.

With a history of over 30 years in science, innovation and clinical

experience, Obagi is a category leader within the professional

skincare segment. The Obagi Medical line includes skincare products

designed to restore the skin’s natural radiance by improving skin

tone and texture and diminishing the appearance of premature aging,

photodamaged skin or acne. This new line enhances our medical

skincare portfolio and strengthens our footing in the Canadian

professional aesthetic market. The Obagi products complement our

Pro-Derm® brand which is intended to optimize medical aesthetic

procedures offered by doctors, dermatologists, and plastic

surgeons. We will be promoting and selling the products nationwide

through our existing network.

Q1-F2022 Financial Results

Note: The Management’s Discussion and Analysis

(“MD&A”), Condensed Consolidated Interim Financial Statements

and accompanying notes for the three months ended March 31, 2022

are available at www.crescitatherapeutics.com/financial-reporting

and have been filed with SEDAR at www.sedar.com.

Summary Financial Results

Three months ended March

31,

In thousands of CAD, except per share data

and number of shares

2022

2021

Change

$

$

$

Commercial Skincare

1,536

1,767

(231)

Licensing and Royalties

-

806

(806)

Manufacturing and Services

3,415

692

2,723

Revenues

4,951

3,265

1,686

Cost of goods sold

2,239

1,149

1,090

Gross profit

2,712

2,116

596

Gross margin (%)

54.8%

64.8%

-10.0%

Research and development

127

219

(92)

Selling, general and administrative

2,595

1,863

732

Depreciation and amortization

366

331

35

Total operating expenses

3,088

2,413

675

Operating loss

(376)

(297)

(79)

Total other expenses

86

139

(53)

Share of loss of an associate

(12)

-

(12)

Net loss

(474)

(436)

(38)

Adjusted EBITDA1

66

87

(21)

Earnings per share

Basic and Diluted

$

(0.02)

$

(0.02)

$

-

Weighted average number of common

shares outstanding

Basic and Diluted

20,936,672

20,626,608

310,064

Selected Balance Sheet

Information

Cash and cash equivalents, end of

period

11,742

13,944

(2,202)

Selected Cash Flow Information

Cash provided by (used in) operating

activities

659

(196)

855

Cash used in investing activities

(45)

(4)

(41)

Cash used in financing activities

(168)

(120)

(48)

Revenue

We have three reportable segments: 1) Commercial Skincare

(“Commercial”), which manufactures and sells branded

non-prescription skincare products in the Canadian and

international markets, and also commercializes Pliaglis, NCTF®

Boost 135 HA, and the Obagi Medical product line in Canada; 2)

Licensing and Royalties (“Licensing”), which primarily generates

revenue from licensing our intellectual property related to

Pliaglis or our transdermal delivery technologies; and 3)

Manufacturing and Services (“Manufacturing”), which generates

revenue from contract manufacturing and product development

services.

For the three months ended March 31, 2022, total revenue was

$4,951 compared to $3,265 for the three months ended March 31,

2021, representing an increase of $1,686. Our Manufacturing segment

revenue increased by $2,723, which was mainly driven by the partial

fulfillment of the approximately $7,000 in additional purchase

orders previously announced. Commercial Skincare sales posted a

decrease of $231 mainly due to lower year-over-year sales of hand

sanitizer and personal protective equipment.

During the quarter, no royalties were recognized above the

previously recognized minimum guaranteed royalties under our

licensing agreements with Cantabria Labs Inc. and Taro

Pharmaceuticals Inc. (“Taro”). In Q1-F2021 we had recorded minimum

guaranteed royalties of $806 (US$637) under our licensing agreement

with Taro for Pliaglis in the United States.

Gross Profit

For the three months ended March 31, 2022, gross profit was

$2,712, representing a gross margin of 54.8%, compared to $2,116

and 64.8%, respectively, for the three months ended March 31, 2021.

The increase in gross profit of $596 was mainly due to the increase

in our Manufacturing revenue year-over-year, while the decrease in

gross margin of 10.0% was mainly driven by the drop in full-margin

Licensing segment revenue, offset in part by the benefit of higher

manufacturing volumes. Gross profit and gross margin were also

negatively impacted by a lower benefit from wage and rent subsidies

under the Canada Emergency Wage Subsidy (“CEWS”) and Canada

Emergency Rent (“CERS”) Subsidy programs year-over-year.

Operating Expenses

For the three months ended March 31, 2022, total operating

expenses were $3,088 compared to $2,413 for the three months ended

March 31, 2021, representing a net increase of $675. The increase

was primarily driven by higher selling, general and administrative

(“SG&A”) expenses of $732, mainly reflecting a lower

year-over-year benefit from wage subsidies under the CEWS program,

as well as higher headcount-related and advertising and promotion

costs as we invest in our business. These additional costs were

partly offset by a decrease in research and development (“R&D”)

spend of $92 mainly driven by lower expenses pertaining to our

product candidate in co-development, CTX-101.

Cash and Cash Equivalents

Cash and cash equivalents were $11,742 at March 31 2022,

reflecting a net increase of $411 for the quarter, mainly due to

the favorable movement in non-cash working capital items.

Non-IFRS Financial Measures

We report our financial results in accordance with International

Financial Reporting Standards (“IFRS”). However, we use certain

non-IFRS financial measures to assess our Company’s performance. We

believe these to be useful to management, investors, and other

financial stakeholders in assessing Crescita’s performance. The

non-IFRS measures used in this press release do not have any

standardized meaning prescribed by IFRS and are therefore not

comparable to similar measures presented by other issuers. These

measures should be considered as supplemental in nature and not as

a substitute for the related financial information prepared in

accordance with IFRS. The following are the Company’s non-IFRS

measures along with their respective definitions:

- EBITDA is defined as earnings before interest, income taxes,

depreciation, and amortization.

- Adjusted EBITDA is defined as earnings before interest, income

taxes, depreciation and amortization, share of (profit) losses of

associates, other (income) expenses, share-based compensation

costs, goodwill and intangible asset impairment, and foreign

exchange (gains) losses, as applicable.

Management believes that Adjusted EBITDA is an important measure

of operating performance and cash flow and provides useful

information to investors as it highlights trends in the underlying

business that may not otherwise be apparent when relying solely on

IFRS measures. Below is a reconciliation of EBITDA and Adjusted

EBITDA to their closest IFRS measures.

In thousands of CAD dollars

Three months ended March

31,

2022

2021

Change

$

$

$

Net loss

(474)

(436)

(38)

Adjust for:

Depreciation and amortization

366

331

35

Interest (income) expense, net

15

(12)

27

EBITDA

(93)

(117)

24

Adjust for:

Share of loss of an associate

12

-

12

Share-based compensation

76

53

23

Foreign exchange loss

71

151

(80)

Adjusted EBITDA

66

87

(21)

Caution Concerning Limitations of Summary Financial Results

Press Release

This summary earnings press release contains limited information

meant to assist the reader in assessing Crescita’s performance, but

it is not a suitable source of information for readers who are

unfamiliar with Crescita and is not in any way a substitute for the

Company's Consolidated Audited Financial Statements and notes

thereto, MD&A and latest Annual Information Form (“AIF”) which

can be found on the Company’s profile on SEDAR at

www.sedar.com.

About Crescita Therapeutics Inc.

Crescita (TSX: CTX and OTC US: CRRTF) is a growth-oriented,

innovation-driven Canadian commercial dermatology company with

in-house R&D and manufacturing capabilities. The Company offers

a portfolio of high-quality, science-based non-prescription

skincare products and early to commercial stage prescription

products. We also own multiple proprietary transdermal delivery

platforms that support the development of patented formulations to

facilitate the delivery of active ingredients into or through the

skin. For more information, visit www.crescitatherapeutics.com.

Forward-looking Statements

This press release contains “forward-looking information” within

the meaning of applicable securities laws (collectively,

“forward-looking statements”). Forward-looking statements can be

identified by words such as: “anticipate”, “intend”, “plan”,

“goal”, “seek”, “believe”, “project”, “estimate”, “expect”,

“strategy”, “future”, “likely”, “may”, “should”, “will” and similar

references to future periods. Examples of forward-looking

statements include, but are not limited to, statements regarding

the Company’s objectives, plans, goals, strategies, growth,

performance, operating results, strategy for customer retention,

product development, market position, business prospects,

opportunities and industry trends and similar statements concerning

anticipated future events, results, circumstances, performance or

expectations. Forward-looking statements are neither historical

facts nor assurances of future performance. Instead, they are based

only on current beliefs, expectations and assumptions regarding the

future of the Company’s business, future plans and strategies,

projections, anticipated events and trends, the economy and other

future conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict and many of

which are outside of the Company’s control. Crescita’s actual

results and financial condition may differ materially from those

indicated in the forward-looking statements. Therefore, you should

not unduly rely on any of these forward-looking statements.

Important factors that could cause Crescita’s actual results and

financial condition to differ materially from those indicated in

the forward-looking statements include, among others: economic and

market conditions, the impact of the COVID-19 pandemic and the

response thereto of governments and consumers, the Company’s

ability to execute its growth strategies, reliance on third parties

for clinical trials, marketing, distribution and commercialization,

the impact of changing conditions in the regulatory environment and

product development processes, manufacturing and supply risks,

increasing competition in the industries in which the Company

operates, the Company’s ability to meet its debt commitments, the

impact of unexpected product liability matters, the impact of

litigation involving the Company and/or its products, the impact of

changes in relationships with customers and suppliers, the degree

of intellectual property protection of the Company’s products, the

degree of market acceptance of the Company’s products, developments

and changes in applicable laws and regulations, as well as other

risk factors discussed in the “Risk Factors” sections of the

Company’s most recent annual MD&A for the year ended December

31, 2021 and the Company’s AIF dated March 22, 2022. Any

forward-looking statement made in this press release is based only

on information currently available and speaks only as of the date

on which it is made. Except as required by applicable securities

laws, Crescita undertakes no obligation to publicly update any

forward-looking statement, whether written or oral, that may be

made from time to time, whether as a result of new information,

future developments or otherwise.

______________________ 1 Please refer to the Non-IFRS Financial

Measures section of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220511005421/en/

Crescita Therapeutics Investor Relations Linda Kisa, CPA,

CA Email: lkisa@crescitatx.com

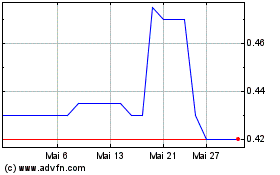

Crescita Therapeutics (TSX:CTX)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Crescita Therapeutics (TSX:CTX)

Historical Stock Chart

Von Dez 2023 bis Dez 2024