Chorus Aviation Announces $100 Million Bought Deal Public Offering

20 Februar 2018 - 10:18PM

Delivering regional aviation to the world

Chorus Aviation Inc. ('Chorus') (TSX:CHR) announced today that it

has entered into an agreement with a syndicate of underwriters led

by RBC Capital Markets and CIBC Capital Markets, as joint

bookrunners, under which they have agreed to purchase from Chorus

and sell to the public 11,628,000 common shares of Chorus,

which, for greater certainty, shall mean for Canadian investors in

the offering, Class B Voting Shares of Chorus, and for non-Canadian

investors in the offering, Class A Variable Voting Shares of Chorus

(collectively, the ‘Shares’). The underwriters will also have the

option to purchase up to an additional 1,744,200 Shares to

cover over-allotments, if any, and for market stabilization

purposes, during the 30 days following the closing of the offering

(the ‘Over-Allotment Option’).

The purchase price of $8.60 per Share will

result in gross proceeds to Chorus of $100,000,800 ($115,000,920 if

the Over-Allotment Option is exercised in full).

The net proceeds of the offering will be used to

fund the growth of Chorus Aviation Capital, Chorus’ aircraft

leasing business, including the acquisition of aircraft intended

for or currently on lease to third parties, as well as for working

capital requirements and other general corporate purposes.

“The successful launch of Chorus Aviation

Capital and its rapid build to a global business has propelled the

value of Chorus' portfolio of leased aircraft to over one billion

dollars and demonstrated the strength of our growth and

diversification strategy. We have already invested approximately

70% of the $200 million of proceeds from the private placement of

convertible debt units announced on December 19, 2016. Today’s

equity capital raise will allow us to further invest in growth

opportunities, based on our ongoing active negotiations and an

identified pipeline of potential transactions,” said Joe Randell,

President and Chief Executive Officer, Chorus.

Closing is expected to occur on or about March

13, 2018, and is subject to the receipt of all required regulatory

approvals including that of the Toronto Stock Exchange.

The Shares will be offered by way of a short

form prospectus in all of the provinces and territories of Canada

and may also be offered by way of private placement in the United

States. This news release shall not constitute an offer to sell or

the solicitation of an offer to buy, nor shall there be any offer,

solicitation or sale of the securities in any province, state or

jurisdiction in which such offer, solicitation or sale would be

unlawful. The Shares have not been registered under the U.S.

Securities Act of 1933, as amended, and may not be offered or sold

in the United States absent registration or an applicable exemption

from the registration requirements of the U.S. Securities Act of

1933 and other applicable securities laws.

About Chorus

Headquartered in Halifax, Nova Scotia, Chorus

was incorporated on September 27, 2010. Chorus’ vision is to

deliver regional aviation to the world. Chorus has been leasing its

owned regional aircraft into Jazz’s Air Canada Express operation

since 2009, and established Chorus Aviation Capital to become a

leading, global provider of regional aircraft leases and support

services. Chorus also owns Jazz Aviation and Voyageur

Aviation – companies that have long histories of safe and solid

operations that deliver excellent customer service in the areas of

contract flying operations, engineering, fleet management, and

maintenance, repair and overhaul. Chorus Class A Variable

Voting Shares and Class B Voting Shares trade on the Toronto Stock

Exchange under the trading symbol ‘CHR’. www.chorusaviation.ca

Forward-Looking Information

This news release contains 'forward-looking

information' as defined under applicable Canadian securities

legislation. Forward-looking information is identified by the use

of terms and phrases such as "anticipate", "believe", "could",

"estimate", "expect", "intend", "may", "plan", "predict",

"potential", "project", "will", "would", and similar terms and

phrases, including references to assumptions. Forward-looking

information involves known and unknown risks, uncertainties and

other factors that may cause actual results, performance or

achievements to differ materially from those expressed in the

forward-looking information. Examples of statements containing

forward-looking information in this news release include the

anticipated closing and closing date of the offering and

anticipated use of proceeds. Results indicated in forward-looking

information may differ materially from actual results for a number

of reasons, including those described in Chorus' Annual Information

Form dated February 14, 2018 and Management's Discussion and

Analysis of Results of Operations and Financial Condition dated

February 14, 2018. Statements containing forward-looking

information in this news release are made as of the date of this

news release and Chorus does not undertake any obligation to

publicly update such statements to reflect new information,

subsequent events or otherwise unless required by applicable

securities laws.

Chorus Media Contacts: Manon Stuart, Halifax,

Nova Scotia, (902) 873-5054, mstuart@chorusaviation.ca Debra

Williams, Toronto, Ontario, (905) 671-7769,

dwilliams@chorusaviation.ca

Analyst Contact: Nathalie Megann, Halifax, Nova

Scotia, (902) 873-5094, nmegann@chorusaviation.ca

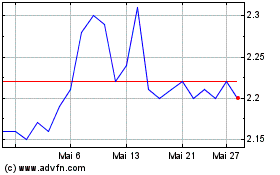

Chorus Aviation (TSX:CHR)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

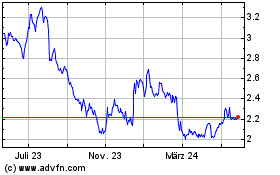

Chorus Aviation (TSX:CHR)

Historical Stock Chart

Von Nov 2023 bis Nov 2024