Algoma Steel Group Inc. (NASDAQ: ASTL; TSX: ASTL) (“Algoma” or “the

Company”), a leading Canadian producer of hot and cold rolled steel

sheet and plate products, today announced results for its fiscal

third quarter ended December 31, 2023.

Unless otherwise specified, all amounts are in

Canadian dollars.

Business Highlights and Fiscal 2024 to Fiscal 2023 Third

Quarter Comparisons

- Consolidated revenue of $615.4

million, compared to $567.8 million in the prior-year quarter.

- Consolidated loss from operations of

$36.9 million, compared to a loss from operations of $65.7 million

in the prior-year quarter.

- Net loss of $84.8 million, compared

to a net loss of $69.8 million in the prior-year quarter.

- Adjusted EBITDA of $(1.0) million

and Adjusted EBITDA margin of (0.2)%, compared to $(35.9) million

and (6.3)% in the prior-year quarter (See “Non-IFRS Measures”

below).

- Cash flows used in operations of

$47.4 million, compared to cash flows used in operations of $128.6

million in the prior-year quarter.

- Shipments of 516,068 tons, compared

to 458,341 tons in the prior-year quarter.

- Completed extensive planned seasonal

maintenance on time and within budget.

- Paid quarterly dividend of

US$0.05/share.

In addition, subsequent to the quarter end, the

Company restored partial coke-making capabilities and completed

necessary repairs at the blast furnace, following operational

challenges related to the unexpected collapse of a structure

supporting utilities piping at the coke-making plant on January 20,

2024.

Michael Garcia, the Company’s Chief Executive

Officer, commented, “We delivered results in the fiscal third

quarter that were consistent with our previously disclosed outlook,

accomplished against a challenging backdrop that included the

remaining impact of the UAW strike and a heavy seasonal maintenance

quarter. Improved market fundamentals coupled with the settlement

of the strike in October led to a rebound in pricing which based on

the lagging nature of our order book is expected to positively

impact pricing realizations beginning in our fiscal fourth

quarter.”

Mr. Garcia added, “As an update to our January

20th and January 23rd announcements regarding the collapse of a

structure supporting utilities piping at our coke-making plant

corridor, limited coke making operations continue and, as we

develop our revised production plan, we will continue to evaluate

our requirement for purchased coke to supplement our current

inventories. We’ve finished all of the necessary repairs at the

blast furnace following the related operational outage and have

begun gradually restarting the furnace, increasing energy input as

conditions permit. Based on our current assessment, we anticipate

producing usable hot metal within the next seven days. We aim to

return to full production within the next two weeks. The outage at

the blast furnace and limited coke production are collectively

expected to negatively impact shipments, costs and profitability in

the fourth fiscal quarter.”

“Our transformative EAF project continues to

advance in line with our expectations with commissioning expected

to start by late 2024. As of December 31, 2023, we had invested a

total of $509.9 million in its development, which represents

approximately 60% of the anticipated total project cost.

Importantly, project commitments to date total approximately $750

million with approximately 7% tied to time and material contracts,

while the balance is fixed price in nature. We expect to contract

the majority of the remaining costs by the end of the current

quarter. We look forward to what promises to be an important and

exciting year in the story of Algoma.”

Third Quarter Fiscal 2024 Financial

Results

Third quarter revenue totaled $615.4 million,

compared to $567.8 million in the prior year quarter. As compared

with the prior year quarter, steel revenue was $556.9 million,

compared to $512.0 million, and revenue per ton of steel sold was

$1,192, compared to $1,239. Loss from operations was $36.9 million,

compared to a loss of $65.7 million in the prior-year quarter.

The year over year improvement was primarily due

to increased steel shipment volumes as a result of improved market

conditions and resolving the temporary downstream finishing

constraints for plate that occurred during the three-month period

ended December 31, 2022. Further, higher cost of steel revenue as a

result of increased shipment volumes was partially offset by a

decrease in pricing for natural gas, purchased coke, alloys and

power.

Net loss in the third quarter was $84.8 million,

compared to a loss of $69.8 million in the prior-year quarter. The

increase was primarily due to the change in fair value of warrant

liabilities, share-based compensation liabilities, and earnout

liabilities, a decrease in income tax recovery, an increase in

foreign exchange losses, and an increase in financing charges,

which more than offset the improvements in loss from

operations.

Adjusted EBITDA in the third quarter was $(1.0)

million, compared with $(35.9) million for the prior-year quarter.

This resulted in an Adjusted EBITDA margin of (0.2)%. Average

realized price of steel net of freight and non-steel revenue was

$1,079 per ton, compared to $1,116 per ton in the prior-year

quarter. Cost per ton of steel products sold was $1,027, compared

to $1,157 in the prior-year quarter. Shipments for the third

quarter increased by 12.6% to 516,068 tons, compared to 458,341

tons in the prior-year quarter due primarily to the reasons

mentioned above. See “Non-IFRS Measures” below for an explanation

of Adjusted EBITDA and a reconciliation of net income (loss) to

Adjusted EBITDA.

Coke-making Plant Utilities Structure

Update

As previously disclosed, on January 20, 2024,

there was a collapse of a structure supporting utilities piping at

the Company’s coke-making plant. No injuries occurred during the

event. Additionally, for safety reasons, blast furnace operations

were suspended at the time of the incident. The blast furnace

experienced operational challenges upon initial restart due to

unforeseen impacts related to the piping collapse.

Limited production of coke resumed at three

coke-production units on January 23, which, when combined with

inventories on hand and the availability of third-party coke

supplies, is currently expected to fulfill the Company’s

requirements for normal steelmaking production while the repair

plan is developed. All necessary repairs to the blast furnace have

been completed, and the furnace is now undergoing a gradual restart

process. Additional energy will be added to the furnace as

conditions permit. Based on current information, usable hot metal

is expected to be produced within the next seven days, with a

return to full production anticipated within the next two weeks.

Algoma has standard insurance coverage that is intended to address

circumstances such as these, including business interruption

insurance. The Company is in the process of submitting claims under

its insurance policies for covered losses.

Mr. Garcia commented, “Thanks to the fast

response and hard work of our entire team, we were able to quickly

resume limited coke-making capacity, and as of today we have

restarted the blast furnace and continue ramping to normal

production levels. The outage at the blast furnace and limited coke

production are, however, collectively expected to negatively impact

shipments, costs and profitability in the fiscal fourth

quarter.”

Electric Arc Furnace

The Company has made substantial progress on the

construction of two new state-of-the-art electric arc furnaces

(“EAF”) to replace its existing blast furnace and basic oxygen

steelmaking operations. The anticipated project timing and budget

remain consistent with the outlook provided in the fiscal fourth

quarter 2023 earnings release. As of December 31, 2023, the

cumulative investment was approximately $509.9 million of the total

projected cost of $825 million to $875 million. Project commitments

to date total approximately $750 million with approximately 7% tied

to time and material contracts, while the balance is fixed price in

nature. We believe that we remain on track for commissioning late

in calendar 2024. Following the transformation to EAF steelmaking,

Algoma’s facility is expected to reach an annual raw steel

production capacity of approximately 3.7 million tons, matching its

downstream finishing capacity, and to generate an approximate 70%

reduction in the Company’s annual carbon emissions.

Quarterly Dividend

The Board has declared a regular quarterly

dividend in the amount of US$0.05 on each common share outstanding,

payable on March 29, 2024, to holders of record of common shares of

the Company as of the close of business on February 29, 2024. This

dividend is designated as an “eligible dividend” for Canadian

income tax purposes.

Conference Call and Webcast

Details

A webcast and conference call will be held on

Wednesday, February 7, 2024 at 11:00 a.m. EDT to review the

Company’s fiscal third quarter results, discuss recent events, and

conduct a question-and-answer session.

The live webcast and archived replay of the

conference call can be accessed on the Investors section of the

Company’s website at www.algoma.com. For those unable to access the

webcast, the conference call will be accessible domestically or

internationally by dialing 877-425-9470 or 201-389-0878,

respectively. Upon dialing in, please request to join the Algoma

Steel Third Quarter Conference Call. To access the replay of the

call, dial 844-512-2921 (domestic) or 412-317-6671 (international)

with passcode 13743566.

Consolidated Financial Statements and

Management's Discussion and Analysis

The Company's unaudited condensed interim

consolidated financial statements for the three and nine months

ended December 31, 2023, and Management’s Discussion & Analysis

thereon are available under the Company’s profile on the U.S.

Securities and Exchange Commission’s (“SEC”) EDGAR website at

www.sec.gov and under the Company’s profile on SEDAR+ at

www.sedarplus.ca.

Cautionary Statement Regarding

Forward-Looking Statements

This news release contains “forward-looking

information” under applicable Canadian securities legislation and

“forward-looking statements” within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995 (collectively,

“forward-looking statements”), including statements regarding

trends in the pricing of steel, price realizations and other key

inputs in the steelmaking process, the restart of coke making

operations, the anticipated timing to restart the blast furnace,

produce usable hot metal and return to full production, Algoma’s

expectation to continue to pay a quarterly dividend, Algoma’s

transition to EAF steelmaking, including the progress, costs and

timing of completion of the Company’s EAF project, Algoma’s future

as a leading producer of green steel, Algoma’s modernization of its

plate mill facilities and the status and timing thereof,

transformation journey, ability to deliver greater and long-term

value, ability to offer North America a secure steel supply and a

sustainable future, and investment in its people, and processes,

statements regarding the Company’s intended use of cash on hand,

cash from operations and proceeds from the Company’s credit

facilities, and the Company’s strategy, plans or future financial

or operating performance. These forward-looking statements

generally are identified by the words “believe,” “project,”

“expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “design,” “pipeline,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,”

and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions. Many

factors could cause actual future events to differ materially from

the forward-looking statements in this document. Readers should

also consider the other risks and uncertainties set forth in the

section entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Information” in Algoma’s Annual Information Form,

filed by Algoma with applicable Canadian securities regulatory

authorities (available under the company’s SEDAR+ profile at

www.sedarplus.ca) and with the SEC, as part of Algoma’s Annual

Report on Form 40-F (available at www.sec.gov), as well as in

Algoma’s current reports with the Canadian securities regulatory

authorities and SEC. Forward-looking statements speak only as of

the date they are made. Readers are cautioned not to put undue

reliance on forward-looking statements, and Algoma assumes no

obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise.

Non-IFRS Financial

Measures

To supplement our financial statements, which

are prepared in accordance with International Financial Reporting

Standards as issued by the International Accounting Standards Board

(“IFRS”), we use certain non-IFRS measures to evaluate the

performance of Algoma. These terms do not have any standardized

meaning prescribed within IFRS and, therefore, may not be

comparable to similar measures presented by other companies.

Rather, these measures are provided as additional information to

complement those IFRS measures by providing a further understanding

of our financial performance from management’s perspective.

Accordingly, they should not be considered in isolation nor as a

substitute for analysis of our financial information reported under

IFRS.

Adjusted EBITDA, as we define it, refers to net

income (loss) before amortization of property, plant, equipment and

amortization of intangible assets, finance costs, interest on

pension and other post-employment benefit obligations, income

taxes, foreign exchange loss (gain), finance income, carbon tax,

changes in fair value of warrant, earnout and share-based

compensation liabilities, transaction costs, earnout and

share-based compensation liabilities, transaction costs, listing

expense, past service costs – pension, past service costs

–post-employment benefits and share-based compensation related to

Omnibus Long Term Incentive Plan. Adjusted EBITDA margin is

calculated by dividing Adjusted EBITDA by revenue for the

corresponding period. Adjusted EBITDA is not intended to represent

cash flow from operations, as defined by IFRS, and should not be

considered as alternatives to net profit (loss) from operations, or

any other measure of performance prescribed by IFRS. Adjusted

EBITDA, as we define and use it, may not be comparable to Adjusted

EBITDA as defined and used by other companies. We consider Adjusted

EBITDA to be a meaningful measure to assess our operating

performance in addition to IFRS measures. It is included because we

believe it can be useful in measuring our operating performance and

our ability to expand our business and provide management and

investors with additional information for comparison of our

operating results across different time periods and to the

operating results of other companies. Adjusted EBITDA is also used

by analysts and our lenders as a measure of our financial

performance. In addition, we consider Adjusted EBITDA margin to be

a useful measure of our operating performance and profitability

across different time periods that enhance the comparability of our

results. However, these measures have limitations as analytical

tools and should not be considered in isolation from, or as

alternatives to, net income, cash flow from operations or other

data prepared in accordance with IFRS. Because of these

limitations, such measures should not be considered as measures of

discretionary cash available to invest in business growth or to

reduce indebtedness. We compensate for these limitations by relying

primarily on our IFRS results using such measures only as

supplements to such results. See the financial tables below for a

reconciliation of net income (loss) to Adjusted EBITDA.

About Algoma Steel Group Inc.

Based in Sault Ste. Marie, Ontario, Canada,

Algoma is a fully integrated producer of hot and cold rolled steel

products including sheet and plate. Driven by a purpose to build

better lives and a greener future, Algoma is positioned to deliver

responsive, customer-driven product solutions to applications in

the automotive, construction, energy, defense, and manufacturing

sectors. Algoma is a key supplier of steel products to customers in

North America and is the only producer of discrete plate products

in Canada. Its state-of-the-art Direct Strip Production Complex

(“DSPC”) is one of the lowest-cost producers of hot rolled sheet

steel (HRC) in North America.

Algoma is on a transformation journey,

modernizing its plate mill and adopting electric arc technology

that builds on the strong principles of recycling and environmental

stewardship to significantly lower carbon emissions. Today Algoma

is investing in its people and processes, working safely, as a team

to become one of North America's leading producers of green

steel.

As a founding industry in their community,

Algoma is drawing on the best of its rich steelmaking tradition to

deliver greater value, offering North America the comfort of a

secure steel supply and a sustainable future as your partner in

steel.

|

Algoma Steel Group Inc.Condensed Interim

Consolidated Statements of Financial

Position(Unaudited) |

|

As at, |

December 31,2023 |

|

March 31,2023 |

|

expressed in millions of Canadian dollars |

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

Current |

|

|

|

|

|

|

Cash |

$ |

94.7 |

|

|

$ |

247.4 |

|

|

Restricted cash |

|

3.9 |

|

|

|

3.9 |

|

|

Taxes receivable |

|

23.3 |

|

|

|

- |

|

|

Accounts receivable, net |

|

278.7 |

|

|

|

291.2 |

|

|

Inventories |

|

886.6 |

|

|

|

722.7 |

|

|

Prepaid expenses and deposits |

|

49.7 |

|

|

|

94.4 |

|

|

Other assets |

|

6.5 |

|

|

|

6.7 |

|

|

Total current assets |

$ |

1,343.4 |

|

|

$ |

1,366.3 |

|

|

Non-current |

|

|

|

|

|

|

Property, plant and equipment, net |

$ |

1,300.0 |

|

|

$ |

1,081.3 |

|

|

Intangible assets, net |

|

0.8 |

|

|

|

0.9 |

|

|

Other assets |

|

7.4 |

|

|

|

7.1 |

|

|

Total non-current assets |

$ |

1,308.2 |

|

|

$ |

1,089.3 |

|

|

Total assets |

$ |

2,651.6 |

|

|

$ |

2,455.6 |

|

|

Liabilities and Shareholders' Equity |

|

|

|

|

|

|

Current |

|

|

|

|

|

|

Bank indebtedness |

$ |

5.4 |

|

|

$ |

1.9 |

|

|

Accounts payable and accrued liabilities |

|

306.0 |

|

|

|

204.6 |

|

|

Taxes payable and accrued taxes |

|

24.1 |

|

|

|

14.4 |

|

|

Current portion of other long-term liabilities |

|

1.6 |

|

|

|

0.4 |

|

|

Current portion of governmental loans |

|

14.4 |

|

|

|

10.0 |

|

|

Current portion of environmental liabilities |

|

3.8 |

|

|

|

4.5 |

|

|

Warrant liability |

|

58.8 |

|

|

|

57.3 |

|

|

Earnout liability |

|

18.5 |

|

|

|

16.8 |

|

|

Share-based payment compensation liability |

|

34.0 |

|

|

|

33.5 |

|

|

Total current liabilities |

$ |

466.6 |

|

|

$ |

343.4 |

|

|

Non-current |

|

|

|

|

|

|

Long-term governmental loans |

$ |

125.8 |

|

|

$ |

110.4 |

|

|

Accrued pension liability |

|

232.8 |

|

|

|

184.0 |

|

|

Accrued other post-employment benefit obligation |

|

237.7 |

|

|

|

222.9 |

|

|

Other long-term liabilities |

|

16.7 |

|

|

|

3.7 |

|

|

Environmental liabilities |

|

30.5 |

|

|

|

32.3 |

|

|

Deferred income tax liabilities |

|

100.8 |

|

|

|

96.7 |

|

|

Total non-current liabilities |

$ |

744.3 |

|

|

$ |

650.0 |

|

|

Total liabilities |

$ |

1,210.9 |

|

|

$ |

993.4 |

|

|

Shareholders' equity |

|

|

|

|

|

|

Capital stock |

$ |

963.2 |

|

|

$ |

958.4 |

|

|

Accumulated other comprehensive income |

|

227.2 |

|

|

|

313.6 |

|

|

Retained earnings |

|

267.7 |

|

|

|

211.6 |

|

|

Contributed deficit |

|

(17.4 |

) |

|

|

(21.4 |

) |

|

Total shareholders' equity |

$ |

1,440.7 |

|

|

$ |

1,462.2 |

|

|

Total liabilities and shareholders' equity |

$ |

2,651.6 |

|

|

$ |

2,455.6 |

|

|

|

|

|

|

|

|

| Algoma Steel

Group Inc.Condensed Interim Consolidated

Statements of Net (Loss) Income(Unaudited) |

|

|

Three months endedDecember 31, |

|

Nine months endedDecember 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| expressed in

millions of Canadian dollars, except for per share

amounts |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

615.4 |

|

|

$ |

567.8 |

|

|

$ |

2,175.2 |

|

|

$ |

2,101.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

$ |

623.8 |

|

|

$ |

611.8 |

|

|

$ |

1,928.1 |

|

|

$ |

1,758.0 |

|

|

Administrative and selling expenses |

|

28.5 |

|

|

|

21.7 |

|

|

|

82.9 |

|

|

|

74.3 |

|

|

(Loss) income from operations |

$ |

(36.9 |

) |

|

$ |

(65.7 |

) |

|

$ |

164.2 |

|

|

$ |

268.8 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Other (income) and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Finance income |

$ |

(2.4 |

) |

|

$ |

(3.9 |

) |

|

$ |

(8.8 |

) |

|

$ |

(10.4 |

) |

|

Finance costs |

|

5.4 |

|

|

|

4.0 |

|

|

|

15.9 |

|

|

|

13.0 |

|

|

Interest on pension and other post-employment benefit

obligations |

|

4.8 |

|

|

|

5.0 |

|

|

|

14.4 |

|

|

|

12.4 |

|

|

Foreign exchange loss (gain) |

|

14.7 |

|

|

|

10.6 |

|

|

|

14.1 |

|

|

|

(41.2 |

) |

|

Change in fair value of warrant liability |

|

20.4 |

|

|

|

6.4 |

|

|

|

3.2 |

|

|

|

(67.1 |

) |

|

Change in fair value of earnout liability |

|

6.2 |

|

|

|

(0.2 |

) |

|

|

3.5 |

|

|

|

(9.4 |

) |

|

Change in fair value of share-based compensation

liability |

|

11.3 |

|

|

|

(0.2 |

) |

|

|

6.0 |

|

|

|

(19.6 |

) |

| |

$ |

60.4 |

|

|

$ |

21.7 |

|

|

$ |

48.3 |

|

|

$ |

(122.3 |

) |

|

(Loss) income before income taxes |

$ |

(97.3 |

) |

|

$ |

(87.4 |

) |

|

$ |

115.9 |

|

|

$ |

391.1 |

|

|

Income tax (recovery) expense |

|

(12.5 |

) |

|

|

(17.6 |

) |

|

|

38.7 |

|

|

|

72.2 |

|

| Net

(loss) income |

$ |

(84.8 |

) |

|

$ |

(69.8 |

) |

|

$ |

77.2 |

|

|

$ |

318.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net

(loss) income per common share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.78 |

) |

|

$ |

(0.64 |

) |

|

$ |

0.71 |

|

|

$ |

2.50 |

|

|

Diluted |

$ |

(0.78 |

) |

|

$ |

(0.64 |

) |

|

$ |

0.60 |

|

|

$ |

1.66 |

|

| Algoma Steel Group

Inc.Condensed Interim Consolidated Statements of

Cash Flows(Unaudited) |

|

|

Three months endedDecember 31, |

|

Nine months endedDecember 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

expressed in millions of Canadian dollars |

|

|

|

|

|

|

|

|

|

|

|

|

Operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

$ |

(84.8 |

) |

|

$ |

(69.8 |

) |

|

$ |

77.2 |

|

|

$ |

318.9 |

|

|

Items not affecting cash: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation of property, plant and equipment and intangible

assets |

|

31.6 |

|

|

|

24.7 |

|

|

|

80.2 |

|

|

|

69.7 |

|

|

Deferred income tax expense (recovery) |

|

17.3 |

|

|

|

4.9 |

|

|

|

6.4 |

|

|

|

(11.2 |

) |

|

Pension funding (in excess of) below expense |

|

(0.5 |

) |

|

|

(0.5 |

) |

|

|

0.4 |

|

|

|

48.3 |

|

|

Post-employment benefit funding in excess of expense |

|

(2.0 |

) |

|

|

(2.3 |

) |

|

|

(5.4 |

) |

|

|

(2.6 |

) |

|

Unrealized foreign exchange loss (gain) on: accrued pension

liability |

|

5.0 |

|

|

|

2.9 |

|

|

|

4.8 |

|

|

|

(13.9 |

) |

|

post-employment benefit obligations |

|

5.1 |

|

|

|

2.6 |

|

|

|

5.1 |

|

|

|

(17.9 |

) |

|

Finance costs |

|

5.4 |

|

|

|

4.0 |

|

|

|

15.9 |

|

|

|

13.0 |

|

|

Interest on pension and other post-employment benefit

obligations |

|

4.8 |

|

|

|

5.0 |

|

|

|

14.4 |

|

|

|

12.4 |

|

|

Interest on finance lease |

|

0.1 |

|

|

|

- |

|

|

|

0.1 |

|

|

|

- |

|

|

Accretion of governmental loans and environmental liabilities |

4.0 |

|

|

|

3.4 |

|

|

|

11.4 |

|

|

|

9.7 |

|

|

Unrealized foreign exchange loss (gain) on government loan

facilities |

|

3.2 |

|

|

|

1.3 |

|

|

|

2.7 |

|

|

|

(8.0 |

) |

|

Increase (decrease) in fair value of warrant liability |

|

20.4 |

|

|

|

6.4 |

|

|

|

3.2 |

|

|

|

(67.1 |

) |

|

Increase (decrease) in fair value of earnout liability |

|

6.2 |

|

|

|

(0.2 |

) |

|

|

3.5 |

|

|

|

(9.4 |

) |

|

Increase (decrease) in fair value of share-based payment

compensation liability |

|

11.3 |

|

|

|

(0.2 |

) |

|

|

6.0 |

|

|

|

(19.6 |

) |

|

Other |

|

2.0 |

|

|

|

0.4 |

|

|

|

5.6 |

|

|

|

(3.2 |

) |

| |

$ |

29.1 |

|

|

$ |

(17.4 |

) |

|

$ |

231.5 |

|

|

$ |

319.1 |

|

|

Net change in non-cash operating working capital |

|

(72.5 |

) |

|

|

(109.9 |

) |

|

|

(51.0 |

) |

|

|

(231.0 |

) |

|

Share-based payment compensation and earnout units settled |

(2.5 |

) |

|

|

- |

|

|

|

(2.5 |

) |

|

|

(4.6 |

) |

|

Environmental liabilities paid |

|

(1.5 |

) |

|

|

(1.3 |

) |

|

|

(4.3 |

) |

|

|

(1.7 |

) |

| Cash

(used in) generated by operating activities |

$ |

(47.4 |

) |

|

$ |

(128.6 |

) |

|

$ |

173.7 |

|

|

$ |

81.8 |

|

|

Investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition of property, plant and equipment |

$ |

(96.5 |

) |

|

$ |

(95.2 |

) |

|

$ |

(369.7 |

) |

|

$ |

(267.7 |

) |

| Cash

used in investing activities |

$ |

(96.5 |

) |

|

$ |

(95.2 |

) |

|

$ |

(369.7 |

) |

|

$ |

(267.7 |

) |

|

Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

Bank indebtedness advanced, net |

$ |

5.1 |

|

|

$ |

12.0 |

|

|

$ |

3.4 |

|

|

$ |

12.3 |

|

|

Transaction costs on bank indebtedness |

|

- |

|

|

|

- |

|

|

|

(1.7 |

) |

|

|

- |

|

|

Governmental loans received |

|

17.0 |

|

|

|

15.0 |

|

|

|

59.3 |

|

|

|

30.2 |

|

|

Repayment of governmental loans |

|

(2.5 |

) |

|

|

(2.5 |

) |

|

|

(7.5 |

) |

|

|

(7.5 |

) |

|

Interest paid |

|

- |

|

|

|

- |

|

|

|

(0.2 |

) |

|

|

(0.1 |

) |

|

Dividends paid |

|

(6.9 |

) |

|

|

(7.0 |

) |

|

|

(20.8 |

) |

|

|

(23.6 |

) |

|

Common shares repurchased and cancelled |

|

- |

|

|

|

(6.5 |

) |

|

|

- |

|

|

|

(553.1 |

) |

|

Other |

|

11.9 |

|

|

|

(2.4 |

) |

|

|

11.6 |

|

|

|

(2.7 |

) |

| Cash

generated by (used in) financing activities |

$ |

24.6 |

|

|

$ |

8.6 |

|

|

$ |

44.1 |

|

|

$ |

(544.5 |

) |

|

Effect of exchange rate changes on cash |

$ |

0.4 |

|

|

$ |

(5.0 |

) |

|

$ |

(0.8 |

) |

|

$ |

59.8 |

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

Decrease in cash |

|

(118.9 |

) |

|

|

(220.2 |

) |

|

|

(152.7 |

) |

|

|

(670.6 |

) |

|

Opening balance |

|

213.6 |

|

|

|

464.9 |

|

|

|

247.4 |

|

|

|

915.3 |

|

|

Ending balance |

$ |

94.7 |

|

|

$ |

244.7 |

|

|

$ |

94.7 |

|

|

$ |

244.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Algoma Steel Group Inc.Reconciliation of

Net (Loss) Income to Adjusted EBITDA |

|

|

Three months endedDecember

31, |

|

Nine months endedDecember

31, |

|

millions of dollars |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net (loss) income |

$ |

(84.8 |

) |

|

$ |

(69.8 |

) |

|

$ |

77.2 |

|

|

$ |

318.9 |

|

|

Depreciation of property, plant and equipment and amortization

of intangible assets |

|

31.6 |

|

|

|

24.7 |

|

|

|

80.2 |

|

|

|

69.7 |

|

|

Finance costs |

|

5.4 |

|

|

|

4.0 |

|

|

|

15.9 |

|

|

|

13.0 |

|

|

Interest on pension and other post-employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

benefit obligations |

|

4.8 |

|

|

|

5.0 |

|

|

|

14.4 |

|

|

|

12.4 |

|

|

Income taxes |

|

(12.5 |

) |

|

|

(17.6 |

) |

|

|

38.7 |

|

|

|

72.2 |

|

|

Foreign exchange loss (gain) |

|

14.7 |

|

|

|

10.6 |

|

|

|

14.1 |

|

|

|

(41.2 |

) |

|

Finance income |

|

(2.4 |

) |

|

|

(3.9 |

) |

|

|

(8.8 |

) |

|

|

(10.4 |

) |

|

Inventory write-downs(depreciation on property, plant and

equipment in inventory) |

|

(1.3 |

) |

|

|

3.2 |

|

|

|

3.4 |

|

|

|

5.0 |

|

|

Carbon tax |

|

3.5 |

|

|

|

1.2 |

|

|

|

18.2 |

|

|

|

4.3 |

|

|

Increase (decrease) in fair value of warrant liability |

|

20.4 |

|

|

|

6.4 |

|

|

|

3.2 |

|

|

|

(67.1 |

) |

|

Increase (decrease) in fair value of earnout liability |

|

6.2 |

|

|

|

(0.2 |

) |

|

|

3.5 |

|

|

|

(9.4 |

) |

|

Increase (decrease) in fair value of share-based payment

compensation liability |

|

11.3 |

|

|

|

(0.2 |

) |

|

|

6.0 |

|

|

|

(19.6 |

) |

|

Share-based compensation |

|

2.1 |

|

|

|

0.7 |

|

|

|

5.1 |

|

|

|

3.4 |

|

|

Past service costs - pension benefits |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

49.5 |

|

|

Past service costs - post-employment benefits |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

3.8 |

|

| Adjusted EBITDA

(i) |

$ |

(1.0 |

) |

|

$ |

(35.9 |

) |

|

$ |

271.1 |

|

|

$ |

404.5 |

|

| Net (Loss) income

Margin |

|

(13.8 |

%) |

|

|

(12.3 |

%) |

|

|

3.5 |

% |

|

|

15.2 |

% |

| Net (Loss) income /

ton |

$ |

(164.3 |

) |

|

$ |

(152.3 |

) |

|

$ |

47.2 |

|

|

$ |

222.8 |

|

| Adjusted EBITDA Margin

(ii) |

|

(0.2 |

%) |

|

|

(6.3 |

%) |

|

|

12.5 |

% |

|

|

19.3 |

% |

| Adjusted EBITDA /

ton |

$ |

(1.9 |

) |

|

$ |

(78.3 |

) |

|

$ |

165.9 |

|

|

$ |

282.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (i) See "Non-IFRS

Measures" for information regarding the limitations of using

Adjusted EBITDA. |

|

|

|

|

|

|

|

| (ii) Adjusted

EBITDA Margin is Adjusted EBITDA as a percentage of revenue. |

|

|

|

|

|

|

|

|

|

|

For more information, please contact:

Michael MoracaTreasurer & Investor

Relations OfficerAlgoma Steel Group Inc.

Phone: 705.945.3300E-mail: IR@algoma.com

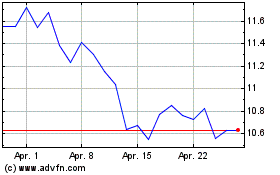

Algoma Steel (TSX:ASTL)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Algoma Steel (TSX:ASTL)

Historical Stock Chart

Von Dez 2023 bis Dez 2024