Form 8-K/A - Current report: [Amend]

07 November 2024 - 4:39PM

Edgar (US Regulatory)

0000108516true00001085162024-11-052024-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

Date of Report (Date of earliest event reported): November 05, 2024 |

WORTHINGTON ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Ohio |

001-08399 |

31-1189815 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

200 West Old Wilson Bridge Road |

|

Columbus, Ohio |

|

43085 |

(Address of principal executive offices) |

|

(Zip Code) |

|

|

Registrant’s Telephone Number, Including Area Code: (614) 438-3210 |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Shares, Without Par Value |

|

WOR |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

|

|

This Current Report on Form 8-K/A (this “Amendment”) updates information disclosed in the Current Report on Form 8-K filed by Worthington Enterprises, Inc. (the “Company”) on October 8, 2024 (the “Original Filing”) disclosing, among other things, the appointment of a new chief executive officer and a new chief financial officer. The sole purpose of this Amendment is to disclose the Company’s decision regarding the compensation of the officers being appointed. No other changes have been made to the Original Filing and this Amendment should be read in conjunction with the Original Filing. This Amendment was previously filed on November 6, 2024, and is being refiled to correct an error with the link to Exhibit 10.3. |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

As reported in the Original Filing, the Company announced that, effective as of November 1, 2024 (the “Effective Date”), the Board of Directors of the Company (the “Board”) appointed Joseph B. Hayek as President and Chief Executive Officer (“CEO”) of the Company and a member of the Board, and Colin J. Souza as Vice President and Chief Financial Officer (“CFO”) of the Company. The terms of Mr. Hayek’s and Mr. Souza’s respective compensation arrangements had not been determined as of the Original Filing, so this Amendment is being filed to disclose the terms of Mr. Hayek’s compensation as CEO and Mr. Souza’s compensation as CFO.

Base Salary and Annual Cash Incentive Bonus Award

On November 5, 2024, the Compensation Committee of the Board approved the following base salaries and annual cash incentive bonus awards (the “bonus”) for the 12-month performance period ending May 31, 2025 (“fiscal 2025”). The salaries are effective as of November 1, 2024, and any fiscal 2025 bonus that is earned will be prorated for the portion of the performance period during which the executive serves in his new role.

|

|

|

|

|

|

|

Annual Base Salary |

Annual Cash Incentive Bonus Awards for the Fiscal Year Performance Period ending May 31, 2025: |

|

Threshold |

Target |

Maximum |

Mr. Hayek |

$725,000 |

$375,000 |

$750,000 |

$1,500,000 |

Mr. Souza |

$300,000 |

$125,000 |

$250,000 |

$500,000 |

The last three columns show the annualized potential payouts that may be earned under the executive’s bonus award based on the achievement of specified levels of corporate performance for fiscal 2025. The bonus payouts that may be earned are tied to achieving specified levels (threshold, target and maximum) of corporate adjusted return on assets and corporate adjusted EBITDA for fiscal 2025, with each performance measure carrying a 50% weighting. For all calculations, restructuring and impairment charges and other selected items are to be excluded, and results are to be adjusted to eliminate the impact of inventory holding gains and losses. If the performance level with respect to either performance measure falls between threshold and target or between target and maximum, the portion of the bonus award associated with that performance measure will be linearly prorated. If the threshold level is not reached for a performance measure, no bonus will be paid as to that performance measure. Any bonus payouts will be made within a reasonable time following the end of the performance period. In the event of a change in control of the Company (followed by actual or constructive termination of the executive’s employment with the Company during the performance period), the bonus award would be considered to be earned and will be paid at target levels.

Long-Term Performance Awards:

On November 5, 2024, the Compensation Committee of the Board also determined that the long-term performance share awards and the long-term cash performance awards for Mr. Hayek and Mr. Souza under the Company’s 1997 Long-Term Incentive Plan (the “1997 LTIP”) for the three-fiscal-year performance period from June 1, 2024 to May 31, 2027 shall remain unchanged from the award amounts approved in June 2024, which are as follows:

|

|

|

|

|

Mr. Hayek |

Threshold |

Target |

Maximum |

Performance Share Award |

3,350 shares |

6,700 shares |

13,400 shares |

Cash Performance Award |

$326,000 |

$652,000 |

$1,304,000 |

|

|

|

|

Mr. Souza |

Threshold |

Target |

Maximum |

|

|

|

|

|

Performance Share Award |

400 shares |

800 shares |

1,600 shares |

Cash Performance Award |

$37,500 |

$75,000 |

$150,000 |

Potential payouts in respect of the long-term performance share award and the long-term cash performance award for each executive are tied to achieving specified levels (threshold, target and maximum) of cumulative corporate economic value added for the three-fiscal-year performance period and earnings per share growth over that performance period, with each performance measure carrying a 50% weighting. Restructuring and impairment charges and other selected items are to be excluded, and results are to be adjusted to eliminate the impact of inventory holding gains or losses. If the performance level with respect to either performance measure falls between threshold and target or between target and maximum, the portion of the awards associated with that performance measure will be linearly prorated. If the threshold level is not reached for a performance measure, no portion of the awards associated with that performance measure will be paid or distributed. Termination of employment results in forfeiture of long-term cash performance awards and long-term performance share awards, except if termination is due to death, disability or retirement, a pro rata payout will be made for performance periods ending 24 months or less after termination of employment based on the number of months of employment completed by the executive during the performance period before the effective date of termination, provided that the applicable performance goals are achieved. No payout will be made for performance periods ending more than 24 months after termination of employment. If a change in control (as defined in the 1997 LTIP) occurs, followed by termination of employment, all long-term cash performance awards and long-term performance share awards will be payable in full at the target level and will be immediately settled or distributed.

Time-Based Restricted Stock Award

On November 5, 2024, the Compensation Committee of the Board also approved time-based restricted stock awards (the “restricted shares”) covering 19,200 common shares for Mr. Hayek and 4,600 common shares for Mr. Souza pursuant to the Company’s Amended and Restated 2024 Long-Term Incentive Plan (the “2024 LTIP”). The restricted shares will be held in escrow by the Company and may not be sold, transferred, pledged, assigned or otherwise alienated or hypothecated until the restrictions thereon have lapsed. Subject to the continued employment of the executive, the restrictions on the restricted shares will lapse and the restricted shares will become fully vested on the third anniversary of the grant date. Any unvested restricted shares will become fully vested if the executive dies or becomes disabled, as determined by the Compensation Committee. Upon a change in control (as defined in the 2024 LTIP), the restrictions on the restricted shares will lapse and the restricted shares will become fully vested if the executive’s employment is terminated within two years after the change in control by the Company without cause or by the executive due to an adverse change in his employment terms. If the executive’s employment with the Company terminates for any other reason, the restricted shares will be forfeited. During the time between the grant date and the vesting date of the restricted shares, the executive may exercise full voting rights in respect of the restricted shares and dividends will be accrued and paid in respect of the restricted shares on the vesting date, if the underlying restricted shares vest.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits: The following exhibits are included with this Form 8‑K:

|

|

|

|

Exhibit No. |

|

Description |

|

|

|

10.1 |

|

Worthington Enterprises, Inc. Amended and Restated 1997 Long-Term Incentive Plan (reflects First Amendment, Second Amendment, Third Amendment and Fourth Amendment thereto), incorporated herein by reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K filed with the SEC on October 1, 2019.* |

10.2 |

|

Summary of Annual Cash Incentive Bonus Awards, Long-Term Performance Awards, Stock Options and Restricted Common Shares granted in Fiscal 2025 for Named Executive Officers, incorporated herein by reference to Exhibit 10.33 to the Company’s Annual Report on Form 10-K filed with the SEC on July 30, 2024.* |

10.3 |

|

Worthington Enterprises, Inc. 2024 Long-Term Incentive Plan, incorporated herein by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on September 30, 2024.* |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Indicates management contract or compensatory plan or arrangement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

WORTHINGTON ENTERPRISES, INC. |

|

|

|

|

Date: |

November 7, 2024 |

By: |

/s/Patrick J. Kennedy |

|

|

|

Patrick J. Kennedy, Vice President -

General Counsel and Secretary |

v3.24.3

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

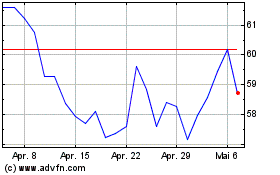

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

Von Dez 2023 bis Dez 2024