UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-40842

VALENS SEMICONDUCTOR LTD.

(Exact name of registrant as specified in its

charter)

8 Hanagar St. POB 7152

Hod Hasharon 4501309

Israel

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒

Form 40-F ☐

EXPLANATORY NOTE

The information in the attached Exhibit 99.1 is

being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated

by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise

set forth herein or as shall be expressly set forth by specific reference in such a filing.

TABLE OF CONTENTS

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

VALENS SEMICONDUCTOR LTD. |

| |

|

|

|

| |

By: |

/s/ Gideon Ben-Zvi |

| |

|

Name: |

Gideon Ben-Zvi |

| |

|

Title: |

Chief Executive Officer |

Date: November 12, 2024

Exhibit 99.1

Valens Semiconductor Outlines Long-Term Growth

and Value Creation Strategy at 2024 Investor Day

Expands leading-edge connectivity solutions

in high-growth industries

Announces long-term financial goals

HOD HASHARON, Israel, November 12, 2024 -- Valens Semiconductor (NYSE:

VLN), a leader in high-performance connectivity, today hosted its 2024 Investor Day in New York City. Management provided an overview

of the Company’s go-forward strategy, growth drivers, product innovation plans and announced new long-term financial goals to deliver

significant shareholder returns.

“As a leader in high-performance connectivity solutions, we are

well-positioned to meet growing global demand for faster, more reliable video experiences,” said Gideon Ben-Zvi, Chief Executive

Officer. “Our chipsets are the hidden gems embedded inside countless devices that are transforming the global digital

experience in how we work, live and learn every day.

“We have a tremendous growth opportunity ahead. Our growth strategy

includes leveraging our core technology to serve new markets undergoing digital transformation, diversifying our revenue sources and augmenting

organic growth with strategic acquisitions that will expand our market reach. We believe this strategy can generate sustainable growth

and create significant long-term value for our shareholders.”

Strategic Growth Drivers and Market Expansion

During the Investor Day presentation, Valens management outlined its

financial goals for 2029 and provided revenue guidance for 2025. Management also discussed its strategy for both organic and inorganic

growth across key verticals that have a combined total addressable market (TAM) of approximately $5.5 billion:

| ● | Video-Conferencing: Valens anticipates growing demand for AI-enabled

intelligent meeting solutions that deliver high-quality video experiences for both remote and in-person meetings. With the ongoing trend

of more video peripherals and more meeting rooms of all sizes, Valens plans to capitalize on its high-speed connectivity solutions, including

its industry-leading USB3 extension offering. The TAM for Video-Conferencing solutions is expected to grow to $350 million by 2029. |

| ● | Automotive: The shift to software-defined vehicles and advanced driver

assistance systems (ADAS) represents a significant growth opportunity for Valens. The Company recently announced three new design wins

with European automotive OEMs that included Valens’ ADAS connectivity chipsets in next-generation vehicles starting in 2026. As

vehicle technology evolves, the demand for high-resolution sensors and real-time data processing continues to grow. The automotive TAM

is expected to reach $4.5 billion by 2029. |

| ● | Industrial Machine Vision: Valens’ chipsets address a critical

competitive need in manufacturing where companies require advanced machine vision capabilities to enhance factory efficiency and inspection

accuracy. Valens’ market-leading VS6320 and VA7000 chips, innovative video and USB connectivity solutions will help advance the

widespread adoption of industrial machine vision. The Industrial Machine Vision TAM is expected to reach $460 million by 2029. |

| ● | Medical: Valens has supplied chipsets to the medical industry for

many years and is now focusing on new opportunities specific to medical endoscopies and the shift to single-use devices for this procedure.

The U.S. FDA is urging this transition to enhance patient safety and eliminate risk factors. Valens’ chipsets offer a simple, reliable

and cost-effective solution for one-time use endoscopies that could meaningfully expedite this important industry transition. The annual

TAM for single-use endoscopes could reach $625 million pending full regulatory approval and market adoption. |

| ● | Acquisitions: Valens plans to augment healthy organic growth with

acquisitions of synergistic companies that are revenue generating with a clear path to profitability mainly in the ProAV, Industrial and

Machine Vision markets. Valens’ robust balance sheet, with more than $133.1 million of cash and cash equivalents as of September

30, 2024, combined with its strong financial discipline, positions the Company to pursue acquisitions that align with its strategy and

goals for long-term growth and profitability. |

2029 Financial Goals

“Looking ahead, we are confident

in our ability to capitalize on opportunities in both existing and new markets. With a talented team and more than 17 years of experience

delivering cutting-edge technology, and a very strong balance sheet, we are well positioned to execute our disciplined growth strategy

and deliver long-term value for our shareholders,” concluded Ben-Zvi.

Based on these strategic initiatives, Valens Semiconductor expects

to achieve the following financial goals by the end of 2029:

| ● | Total revenue is expected to be between $220 - $300 million in 2029, gross

margin of between 50% - 60%: |

| o | Professional Audio-Video revenues of between $90 - $100 million and gross margin between 65% - 75%. |

| o | Industrial Machine Vision revenues of between $35 -$50 million and gross margin between 55% - 65%. |

| o | Automotive revenues of between $65 - $110 million and gross margin between 35% - 45%. |

| o | Acquisitions are expected to contribute revenues of between $30 - $40 million depending on potential acquisition opportunities. |

| ● | Adjusted

EBITDA margin is expected to be between 15% - 20% in 20291 |

| ● | In the following years, Valens expects: |

| o | Significant automotive revenue scale with ADAS deployment within existing and new OEMs. |

| o | Potential upside from single-use endoscopy. |

| 1 | Although we provide guidance for Adjusted EBITDA margin, we

are not able to provide guidance for projected Net profit (loss) margin, the most directly comparable GAAP measures. Certain elements

of Net profit (loss), including share-based compensation expenses and warrant valuations, are not predictable due to the high variability

and difficulty of making accurate forecasts. As a result, it is impractical for us to provide guidance on Net profit (loss) margin or

to reconcile our Adjusted EBITDA margin guidance without unreasonable efforts. Consequently, no disclosure of projected Net profit (loss)

margin is included. For the same reasons, we are unable to address the probable significance of the unavailable information. |

2025 Guidance

| ● | Revenue guidance of $71 - $76 million or 25% - 33% YoY growth. |

| ● | Pro AV - Partial recovery from the inventory digestion cycle, adoption and

commercialization of VS6320 based products for the video conferencing market. |

| ● | Industrial Machine Vision - Design win announcements based on the VS6320

and VA7000. |

| ● | Automotive - New design wins announcements with leading OEMs. |

| ● | Acquisitions - Identify potential synergetic acquisitions and close at least

one, assuming the Company identifies a relevant deal. |

2024 Guidance

| ● | Revenue guidance of $57.2 - $57.5 million. |

| o | Audio-video revenue is expected to be between $32.8 - $33.0 million. |

| o | Automotive revenue is expected to be between $21.4 - $21.5 million. |

| o | Acroname’s revenue is expected to be $3 million. Acroname’s results shall be part of the Audio-Video segment. |

Webcast Replay

A webcast replay of today’s Investor Day presentation will be

available at Valens - Investor Relations and related presentations will remain accessible in the investor relations section of the

Company’s website.

About Valens Semiconductor

Valens Semiconductor (NYSE:VLN) is a leader in high-performance connectivity,

enabling customers to transform the digital experiences of people worldwide. Valens’ chipsets are integrated into countless devices from

leading customers, powering state-of-the-art audio-video installations, next-generation videoconferencing, and enabling the evolution

of ADAS and autonomous driving. Pushing the boundaries of connectivity, Valens sets the standard everywhere it operates, and its technology

forms the basis for the leading industry standards such as HDBaseT® and MIPI A-PHY. For more information, visit https://www.valens.com/.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform

Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,”

“forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,”

“target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical

matters. These forward-looking statements include, but are not limited to, statements regarding our anticipated future results, including

financial results such as financial goals for 2029, potential acquisition opportunities, currency exchange rates, and contract wins, and

future economic and market conditions. These statements are based on various assumptions, whether or not identified in this press release,

and on the current expectations of Valens Semiconductor’s (“Valens”) management and are not predictions of actual performance.

These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on

by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances

are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of

Valens Semiconductor. These forward-looking statements are subject to a number of risks and uncertainties, including the cyclicality of

the semiconductor industry; the effect of inflation and a rising interest rate environment on our customers and industry; the ability

of our customers to absorb inventory; competition in the semiconductor industry, and the failure to introduce new technologies and products

in a timely manner to compete successfully against competitors; if Valens fails to adjust its supply chain volume due to changing market

conditions or fails to estimate its customers’ demand; disruptions in relationships with any one of Valens’ key customers; any difficulty

selling Valens’ products if customers do not design its products into their product offerings; Valens’ dependence on winning selection

processes; even if Valens succeeds in winning selection processes for its products, Valens may not generate timely or sufficient net sales

or margins from those wins; sustained yield problems or other delays or quality events in the manufacturing process of products; our ability

to effectively manage, invest in, grow, and retain our sales force, research and development capabilities, marketing team and other key

personnel; our ability to timely adjust product prices to customers following price increase by the supply chain; our ability to adjust

our inventory level due to reduction in demand due to inventory buffers accrued by customers; our expectations regarding the outcome of

any future litigation in which we are named as a party; our ability to adequately protect and defend our intellectual property and other

proprietary rights; our ability to successfully integrate or otherwise achieve anticipated benefits from acquired businesses; the market

price and trading volume of the Valens ordinary shares may be volatile and could decline significantly; political, economic, governmental

and tax consequences associated with our incorporation and location in Israel; and those factors discussed in Valens’ Form 20-F filed

with the SEC on February 28, 2024 under the heading “Risk Factors,” and other documents of Valens filed, or to be filed, with

the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results

implied by these forward-looking statements. There may be additional risks that Valens does not presently know or that Valens currently

believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition,

forward-looking statements reflect Valens’ expectations, plans or forecasts of future events and views as of the date of this press release.

Valens anticipates that subsequent events and developments may cause Valens’ assessments to change. However, while Valens may elect to

update these forward-looking statements at some point in the future, Valens specifically disclaims any obligation to do so. These forward-looking

statements should not be relied upon as representing Valens’ assessment as of any date subsequent to the date of this press release. Accordingly,

undue reliance should not be placed upon the forward-looking statements.

Investor Contacts:

Michal Ben Ari

Investor Relations Manager

Valens Semiconductor Ltd.

Michal.Benari@valens.com

Lisa Fortuna

Senior Vice President

Financial Profiles, Inc.

ValensIR@finprofiles.com

SOURCE Valens Semiconductor

5

Exhibit 99.2

1 Welcome to Valens Semiconductor’s 2024 Investor Day

Forward - Looking Statements Certain statements in this presentation (this "Presentation") are “forward - looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters . These forward - looking statements include, but are not limited to, statements regarding our anticipated future results, including financial results, currency exchange rates, contract wins, future economic and market conditions . These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of Valens’ management and are not predictions of actual performance . These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability . Actual events and circumstances are difficult or impossible to predict and will differ from assumptions . Many actual events and circumstances are beyond the control of Valens . These forward - looking statements are subject to a number of risks and uncertainties, including the cyclicality of the semiconductor industry ; the effect of inflation and a rising interest rate environment on our customers and industry ; the ability of our customers to absorb inventory ; competition in the semiconductor industry, and the failure to introduce new technologies and products in a timely manner to compete successfully against competitors ; if Valens fails to adjust its supply chain volume due to changing market conditions or fails to estimate its customers’ demand ; disruptions in relationships with any one of Valens’ key customers ; any difficulty selling Valens’ products if customers do not design our products into their product offerings ; Valens’ dependence on winning selection processes ; even if Valens succeeds in winning selection processes for its products, Valens may not generate timely or sufficient net sales or margins from those wins ; sustained yield problems or other delays in the manufacturing process of products ; our ability to effectively manage, invest in, grow, and retain our sales force, research and development capabilities, marketing team and other key personnel ; our ability to timely adjust product prices to customers following price increase by the supply chain ; our ability to adjust our inventory level due to reduction in demand due to inventory buffers accrued by customers ; our expectations regarding the outcome of any future litigation in which we are named as a party ; our ability to adequately protect and defend our intellectual property and other proprietary rights ; the market price and trading volume of the Valens ordinary shares may be volatile and could decline significantly ; political, economic, governmental and tax consequences associated with our incorporation and location in Israel ; and those factors discussed in Valens’ Form 20 - F filed with the SEC on February 28 , 2024 under the heading “Risk Factors,” and other documents of Valens filed, or to be filed, with the SEC . If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements . There may be additional risks that Valens does not presently know or that Valens currently believes are immaterial that could also cause actual results to differ from those contained in the forward - looking statements . In addition, forward - looking statements reflect Valens’ expectations, plans or forecasts of future events and views as of the date of this Presentation . Valens anticipates that subsequent events and developments may cause Valens’ assessments to change . However, while Valens may elect to update these forward - looking statements at some point in the future, Valens specifically disclaims any obligation to do so . These forward - looking statements should not be relied upon as representing Valens’ assessment as of any date subsequent to the date of this Presentation . Accordingly, undue reliance should not be placed upon the forward - looking statements .

GAAP and non - GAAP Measures This presentation includes GAAP and non - GAAP measures . Non - GAAP Gross Margin is defined as GAAP Gross Profit excluding share - based compensation, depreciation and amortization expenses, divided by revenue . Non - GAAP Operating Expenses is defined as GAAP Operating Expenses excluding share - based compensation, depreciation and amortization expenses . Adjusted EBITDA is defined as net profit (loss) before financial income (expense), net, income taxes, equity in earnings of investee, depreciation and amortization, further adjusted to exclude share - based compensation, certain batch production incident expenses and change in the fair value of the Forfeiture Shares and earnout liability, which may vary from period - to - period . We caution investors that amounts presented in accordance with our definition of Adjusted EBITDA may not be comparable to similar measures disclosed by other issuers, because not all issuers calculate Adjusted EBITDA in the same manner . Adjusted EBITDA should not be considered as an alternative to net loss or any other performance measures derived in accordance with GAAP or as an alternative to cash flows from operating activities as a measure of our liquidity . For reconciliation of GAAP to non - GAAP measures, see Appendix . Although we provide guidance for Adjusted EBITDA, we are not able to provide guidance for projected Net profit (loss), the most directly comparable GAAP measures . Certain elements of Net profit (loss), including share - based compensation expenses and forfeiture share valuations, are not predictable due to the high variability and difficulty of making accurate forecasts . As a result, it is impractical for us to provide guidance on Net profit (loss) or to reconcile our Adjusted EBITDA guidance without unreasonable efforts . Consequently, no disclosure of projected Net profit (loss) is included . For the same reasons, we are unable to address the probable significance of the unavailable information . Industry and Market Data ; Trademarks, Service Marks and Copyrights In this Presentation, we rely on and refer to certain information and statistics obtained from third - party sources which we believe to be reliable . We have not independently verified the accuracy or completeness of any such third - party information . You are cautioned not to give undue weight to such industry and market data . This Presentation may include trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners . Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM, (c) or (r) symbols, but the Company will assert, to the fullest extent under applicable law, the right of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights .

The High - Performance Connectivity Company The Highest Bandwidth High - speed connectivity for a variety of applications, with no latency. The Lowest Error Rate Reliable, error - free connectivity for Safety - critical systems. The Longest Reach Unprecedented flexibility for system Design over the simplest wiring infrastructure. innovation semiconductor company 2023 Industry Standards $5B 100s 120 2 $84M 40M+ 260 NYSE:VLN 17 TAM Of customers Patents Global Revenues in Chipsets sold Employees Listed fabless Years of

Rough environments EMC, EMI, temperature changes, cable aging Distance limitations Extended reach compromises signal integrity High costs Design, development, infrastructure & maintenance costs Too many cables At our homes, offices, plants & vehicles Installation complexity Time consuming, complex architectures, not plug & play Video resolution Handling high - throughput, time - sensitive content transmission The Pain Points of Wired Connectivity

Medical Industrial Video Conferencing Education Digital Signage Entertainment Automotive Select Customers & Products Empowered by Valens

The Valens Edge: A DSP - Based Approach to Error Handling Backed by 120+ Patents Valens delivers the most optimized connectivity solutions for long - reach, high - resolution video. We provide superior performance wherever others can’t. Sticking to our CORE

The Valens Difference: Best - in - class EMC Performance Legacy connectivity solutions are RESTRICTED by noise, forcing OEMs to: ▪ Reduce bandwidth ▪ Deploy expensive wiring ▪ Shorten cable length ▪ Rely on sub - optimal architecture Valens’ unique approach to noise handling LIBERATES Customers, offering them: ▪ Scalable Bandwidth ▪ Simple Wiring ▪ Long - reach ▪ Flexible Architecture Safe & Resilient Solution without Compromise

Our Strategy for Growth Leveraging our Core to Advance Existing Verticals and Transform New Ones Video Conferencing Automotive Industrial/Machine Vision Medical Established Pro - AV Leadership 1 2 Transforming New Markets Mergers & Acquisitions 3 ▪ Futureproof, scalable technology ▪ Continuously developing new product offering to maintain leadership and increase market share ▪ Strong cash position to support non - organic growth ▪ Focused on accretive, synergetic opportunities $350M TAM by 2028/29 $4.5B TAM by 2029 $460M TAM by 2028/9 $625M TAM 20xx/TBD Video Conferencing Changing the Way We Work, Learn and Live Automotive The Resilient Foundation for Next - Generation Cars Industrial/Machine Vision Advancing Vision - Driven Automation Medical The Potential of Single - Use Endoscopies: An Industry on the Verge of Transformation

▪ Inventor of HDBaseT technology – an audio - video industry standard ▪ Co - Founder of the HDBaseT Alliance, with Samsung, LG and Sony Pictures. Over 200 members developing HDBaseT - enabled products ▪ Market leader with unmatched technology for the distribution of ultra high - resolution video and audio Founding Members Spotlight on Pro - AV Success Valens Created the Leading Industry Standard and Largest Interoperable Ecosystem

Market Drivers ▪ New AI era of intelligent meeting experiences, led by Microsoft Teams and Zoom ▪ Democratization of video conferencing for remote and in - room participants ▪ Growing requirement for bring - your - own - device (BYOD) in huddle and conference rooms ▪ Increased adoption of USB in ProAV installations 1 Future source: Conference Cameras Outlook, Aug 2021; Frost and Sullivan: State of the Global Video Conferencing Devices Market, Dec 2023 2 Frost and Sullivan: State of the Global Video Conferencing Devices Market, Dec 2023 The combination of increased demand for video, proliferation of USB, and the introduction of the Valens VS6320, represent a unique growth opportunity for Valens Video Conferencing: Changing the Way We Work, Learn and Live Opportunity Spotlight $ - $50 $100 $150 $200 $250 $300 $350 $400 2024 2025 2026 2027 2028 2029 Millions TAM by 2028/29 $350M ~8.5m end devices ~17m chips per year Total Addressable Market (TAM) 1 All these trends result in proliferation of video peripherals in in all types of conference rooms. Video conferencing penetration rate to 2x within 5 years 2

Spotlight on Automotive Success Enabling State - of - the - Art Infotainment Systems In Mercedes - Benz Vehicles ▪ On the road with Mercedes since 2020 ▪ The only multi - gig connectivity over unshielded cabling (UTP) Providing Unprecedented Visibility to Truck Drivers Around the World ▪ Exceptional combination of bandwidth and link distances for long vehicles ▪ Operating over the standard tractor - trailer power cable ▪ Commercialization expected during 2025 ▪ 3 OEM Brands ▪ Announced in September, SOP starting at 2026 ▪ Established strong strategic partnership with leading Tier - 1 suppliers and Positions Valens for future design wins with other OEMs looking to adopt the MIPI A - PHY standard First Valens VA7000 Design - Wins, Cements MIPI A - PHY’s Status as The Leading Industry Standard

Automotive OEMs have called for a global standard for next - generation sensor connectivity. That standard is MIPI A - PHY. . ▪ Best - in - class EMC performance ▪ Clear roadmap to ultra - high bandwidth ▪ Simple architecture ▪ End - to - end safety Valens technology was selected as the basis of the A - PHY standard, and the company is the first in the industry to offer A - PHY - compliant chipsets Product Maturity Sensor Integration Data Rate Noise Immunity/ EMC Security Ecosystem Technological Superiority A - PHY Legacy ASA

A - PHY Ecosystem IP & Development Tool Vendors Huashan - 2 A1000 L ADAS Platform EyeQ platform Intel x86 platform SoCs supported by A - PHY ADAS platform Camera & Radar Module Vendors Silicon & SIP Vendors Verification IP AE2010R SerDes test platform Verification IP Supporting A - PHY tech Marlin A200 protocol analyzer Verification IP CIS and SOC test platform Autera & ESIU Data Simulation A - PHY Compliance software NVS2680 ISP EVB SerDes Interface Board (SVM - 06) with A - PHY 6222 Video Dragon - Frame grabbing and generation A - PHY SiP offering VL77 Series A - PHY SerDes SC5501/2 A - PHY SerDes VA7000 Series A - PHY SerDes YT7917/2 A - PHY SerDes A - PHY SerDes CMOS Image Sensor (CIS) integrated A - PHY Satellite radars with A - PHY 3 A - PHY modules A - PHY module FSC300 A - PHY camera A - PHY e - mirror 4D A - PHY radar A - PHY modules A - PHY module FSM:GO modular platform MARS development platform thinCAM train camera head NCM25 - AC module A - PHY module ARDS development platform A - PHY camera Platform Vendors

Market Drivers ▪ Race towards higher levels of ADAS and Software - Defined Vehicles, leading to: ▪ Increasing number of high - resolution sensors ▪ Complex, centralized architectures ▪ Industry striving for standardized connectivity ▪ Platform lifecycle shortened (due to competition from ‘newer’ companies like Tesla and Chinese OEMs) Automotive: The Foundation for Next - Gen ADAS & Autonomous Systems Cameras, radars, lidars, displays Level 2/2+ Feet Off 4 - 14 Level 3 Hands Off 11 - 23 Level 4 Eyes Off 13 - 35 Level 5 Mind Off 19 - 36+ Source: S&P Autonomy Level (Sales) Data, Jan 2023 Only Valens’ error - free connectivity can guarantee passenger safety and provide the resilient foundation upon which OEMs can build the cars of the future Total A ddressable Market (TAM) 1 1.4 billion chips per year TAM by 2029 95m cars 12 sensors per vehicle $4.5B $ - $500 $1,000 $2,000 $1,500 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 2024 2025 2026 2027 2028 2029 Millions Opportunity Spotlight

The combination of Machine Vision trends and Valens’ new offering represents a unique opportunity for the company to expand its customer base in these industries Spotlight on Industrial & Medical Success Valens New Market Enablers Leveraging our Automotive and ProAV Chipsets Industrial PCs and Panels Medical Imaging

Industrial Machine Vision: Advancing Vision - Driven Automation 1 Imaging for Industrial – Machine Vision 2024, Yole Intelligence; custom research, PwC, Apr 2024 3 D imaging and AI in machine vision and medical will require higher - performance connectivity solutions Market Drivers ▪ Rise of machine vision due to: ▪ Increased factory automation addressing workforce shortage and increased cost of labor ▪ Tighter inspection regulations ▪ Increased e - commerce resulting in growth in AMR for warehouses ▪ Medical imaging trending towards robotic - assisted surgeries and edge AI - assisted diagnoses Total Addressable Market (TAM) 1 ~16m industrial/ machine vision devices ~32 million chips per year TAM by 2028/29 $460M $100 $50 $ - $150 $200 $250 $300 $350 $400 $450 $500 2024 2025 2026 2027 2028 2029 Millions Opportunity Spotlight

Market Drivers ▪ Disposable endoscopes eliminate risk of infection (#2 health hazard, 2024, ECRI) ▪ Sterilization is timely, expensive and generates toxic waste (ESG) ▪ Single use will enable procedures to be performed in outpatient clinics $625M TAM - Assuming 50% shift to single use (*3% Today) Single - use Medical: An Industry on the Verge of Transformation 1 Endoscope devices, Grand View Research, Feb 2024; custom research, PwC, Apr 2024 FDA urging transition to single - use endoscopes for enhanced patient safety; expected CAGR of 10%, reaching $2.5b by 2033 While still in the early stages, we identify a unique opportunity for Valens to become one of the enablers for this industry transformation Total Addressable Market (TAM) 1 250m endoscopies per year 125 million chips per year 50% single - use Opportunity Spotlight

One Technology. Infinite Possibilities. VS3000 Series The only uncompressed copper solution for HDMI 2.0 4K@60 4:4:4 extension VS2000 Series Addition of USB opens new applications for Industrial and Medical connectivity VS6320 Chip The market’s only high - performance, single chip solution for USB3.2 extension VS100 Series Breakthrough chipset for ProAV, offering the first standard for long - reach video connectivity VA6000 Series First automotive - grade chipset, powering the Mercedes - Benz MBUX Infotainment systems VA7000 Series The first MIPI A - PHY standard - compliant SerDes on the market 2014 2010 2018 2021 2023 Automotive Machine Vision Industrial, Medical Professional Audio Video 2022 Video Conferencing

23 Financial Overview & Guidance

$59 $54.8 $62.8 $74.5 $57.4 $1.0 $2.1 $7.9 $16.2 $26.8 $16.6 $41.2 $24.6 2019 2020 2021 2022 2023 YTD Sep 2024 $41.2 $56.9 $70.7 $90.7 $84.2 $60.0 Millions Revenues Audio - Video Automotive 2029 Growth Opportunities 2024 Guidance: $ 57.2 - $57.5 Million AV $32.8 – $33.0 Million Automotive $21.4 - $21.5 Million Acroname - $3.0 Million

Revenues *Audio - Video revenues defined as Professional Audio - Video markets (Entertainment, Digital Signage, Education, Video Conferencing) plus Industrial and Medical $11.6 $15.5 $17.1 $18.6 $16.7 $18.4 $19.4 $20.0 $16.4 $15.5 $9.7 $15.8 $7.2 $8.1 $9.4 $1.7 $2.0 $2.0 $2.2 $4.9 $4.1 $3.7 $3.5 $7.5 $8.7 $4.5 $6.1 $4.4 $5.5 $6.6 $30 Millions $17.5 $13.4 $19.1 $20.7 $22.5 $21.6 $23.1 $23.5 $23.9 $24.2 $14.2 $21.9 $11.6 $13.6 2023 Q1 Q2 Q3 Q4 2021 Q1 Q2 Q3 Q4 2022 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2024 $16.0 Q4 2024 Guidance: $16.0 - $16.3 Million $59 $54.8 $62.8 $74.5 $57.4 $1.0 $2.1 $7.9 $16.2 $26.8 $16.6 2019 2020 2021 2022 2023 YTD Sep 2024 $41.2 $24.6 $41.2 $56.9 $70.7 $90.7 $84.2 $60.0 Millions Audio - Video Automotive Audio - Video Automotive Annual Quarterly 2024 Guidance: $57.2 – $ 57.5 Million

79.0% 76.4% 71.6% 69.9% 62.5% 58.8% 2019 2020 2021 2022 2023 YTD Sep 2024 80.8% 79.5% 77.9% 78.4% 77.1% 73.9% - 26.4% - 6.3% 21.2% 30.7% 31.1% 36.2% 2019 2020 2021 2022 2023 YTD Sep 2024 Gross Margin Gross Margin Per Segment Company’s Gross Margin Annual Revenues Per Segment (% of total revenue) 98.3% 96.3% 88.8% 82.1% 68.2% 59.7% 1.7% 3.7% 11.2% 17.9% 31.8% 40.3% 2 01 9 2 02 0 2 02 1 2 02 2 2 02 3 Y TD Sep 2 02 4 Audio - Video Automotive Audio - Video Automotive

Revenue Diversity Across Customers YTD SEP 2024 FY - 2023 Customer A 17% Customer C 8% Customer D 8% Other 35% Customer A 16% Customer B 6% Customer C 8% Customer D 8% Customer E 1% Customer F 7% Customer G 13% Customer H 7% Other 34% Customer F 5% Customer B 11% FY - 2023 | 197 YTD Sep 2024 | 179 Total Number of Customers Customer E 7% Customer H 5% Customer G 2%

Key Financial Data YTD SEP 2024 Q3 - 2024 Q2 - 2024 Q1 - 2024 Annual 2023 US$ Millions $41.2 $16.0 $13.6 $11.6 $84.2 Company Revenue $24.6 $9.4 $8.1 $7.2 $57.4 Audio - Video $16.6 $6.6 $5.5 $4.4 $26.8 Automotive 58.8% 56.4% 61.4% 59.0% 62.5% Company GAAP Gross Margin % 78.0% 70.2% 75.4% 77.2% 77.1% Audio - Video 38.9% 37.0% 40.9% 29.1% 31.1% Automotive $(17.4) $(5.1) $(5.2) $(7.1) $ (10.3) Adjusted EBITDA (Loss) 1 $(0.28) $(0.10) $(0.08) $(0.10) $(0.19) Loss Per Share 2024 Annual Guidance 2 ▪ Revenue : $57.2 - $57.5 Million ▪ Gross Margin : 58.0% - 60.0% ▪ Adjusted EBITDA 1 : $(22.3) - $(21.4) Million Fourth Quarter 2024 Guidance 2 ▪ Revenue : $16.0 - $16.3 Million ▪ Gross Margin : 58.0% - 62.0% ▪ Adjusted EBITDA 1 : $(4.9) - $(4.0) Million 1, 2 see disclaimer

174.4 148.4 142.0 133.1 - 20 40 60 80 100 120 140 160 180 200 Millions 9.3 23.8 13.8 11.7 - 5.0 10.0 15.0 20.0 25.0 30.0 Millions 183.3 163.7 158.8 136.1 - 120.0 100.0 80.0 60.0 40.0 20.0 140.0 160.0 180.0 200.0 Millions Inventory Level Working Capital 2 Cash Balance 1 1 Cash Balance is defined as cash, cash equivalents and short - term deposits. 2 Working Capital is defined as Total Current Assets less Total Current Liabilities.

Sales & Product Life Cycle Evaluation Process Customers Product Development Customers Product Mass Production 36 - 60 6 - 9 6 Pro AV 120 108 96 84 72 60 48 36 24 12 0 Months 60 - 72 9 - 12 6 - 12 Industrial Machine Vision 120 108 96 84 72 60 48 36 24 12 0 Months 60 - 72 24 - 30 12 - 18 Automotive 120 108 96 84 72 60 48 36 24 12 0 Months

Long Term Growth Drivers ▪ Video Conferencing ▪ Signal Distribution ▪ Projectors ▪ Display Pro AV ▪ Machine Vision ▪ Industrial ▪ Medical Imaging Industrial Machine Vision ▪ ADAS Initial Ramp Up ▪ Infotainment ▪ Long Vehicles Automotive $57.2 - $57.5 Million Revenue 2024 $220 - $300 Million Revenue Goals 2029 ▪ Potential Acquisitions Non - Organic Growth ADAS Deployment & Single Use Endoscopy Potential Upside CAGR ~30% - ~40% 2034

Long - Term Financial Goals – Pro AV 2024 Guidance 2029 Revenue $90 - $100 Ramp up from 2025 Gross Margin 65% - 75% $31.8 - $32 1 Assumptions: ▪ End of inventory digestion cycle ▪ Adoption of the VS6320, mainly in the video conferencing vertical ▪ Growth of the video conferencing market – hybrid work and education Millions 1 Excluding revenues from acquired company and from Industrial Machine Vision segment.

Revenue Millions Long - Term Financial Goals – Industrial Machine Vision $35 - $50 $1 2024 Guidance 2029 Ramp Up from 2026 - 2027 Gross Margin 55% - 65% Assumptions: ▪ Adoption of the VS6320 and the VA7000 in the Industrial Machine Vision Market

Revenue Millions Long - Term Financial Goals – Automotive $21.4 - $21.5 $65 - $110 2024 Guidance 2029 Ramp Up from 2027 - 2028 Gross Margin 35% - 45% Assumptions: ▪ Commercialization of ADAS based models ▪ Adoption of the A - PHY standard

Recent Acquisition Pioneer in advanced automation and control technologies Applications: M&A Strategy $133 million cash to execute on our M&A strategy Focus on companies generating revenue with clear path for profitability, mainly in the ProAV and Industrial and Machine Vision markets 2029 revenue goal of $30 - $40 Million – depending on potential acquisition opportunities Mergers and Acquisitions Synergy: Enabling Valens to expand its position in the industrial and Audio - Video markets with Acroname’s leading high - end programmable USB hubs, switches, and test automation systems 2024 Revenue (starting from June 1, 2024) expected to be above $3 million Industrial Robotic control - systems Audio - Video conference rooms Flexibility to move quickly Highly selective Synergistic opportunities

Long Term Financial Goals - Summary (*) During June 1 st to Dec 2024 Gross Margin Profile Ramp Up Year Revenue (Millions) 2029 Revenue (Millions) 2024 Pro AV 65% - 75% 2025 $90 – $100 $31.5 - $31.6 55% - 65% 2026 - 2027 $35 – $50 $1.0 Industrial Machine Vision 35% - 45% 2027 - 2028 $65 – $110 $21.4 - $21.5 Automotive – Infotainment, ADAS, Long Vehicles 50% - 60% 2025 - 2026 $30 – $40 $3.3 - $3.4 (*) New Acquisitions TBD 2027 - 2028 TBD Potential Upside – Single Use Endoscopy 50% - 60% $220 – $300 $57.2 - $57.5 Total 15% - 20% Adjusted EBITDA Margin

2025 Guidance and Goals Revenue Guidance $71 - $76 Million ~25% - 33% growth ProAv Partial recovery from the inventory digestion cycle Adoption and commercialization of VS6320 based products for the video conferencing market Industrial Machine Vision Design Wins announcements based on the VS6320 and VA7000 Automotive New Design Wins announcements with leading OEMs Acquisitions Identify potential synergetic acquisitions And close at least one, assuming identifying relevant deal

Summary Revenue Growth Target of X 4 - 6 within 5 years Diversification Among different verticals and industries Design Wins Cycles Long sales and products life cycle provides long term customer engagement and good visibility Profitable Business Model Goals: Gross Margin >50% Adjusted EBITDA Margin >15% Strong Cash Balance Allows executing both the organic and the nonorganic growth opportunities

39 Thank You!

40 Appendix - GAAP to Non - GAAP Reconciliation Q1/23 Q2/23 Q3/23 Q4/23 Q1/24 Q2/24 Q3/24 15,793 14,934 8,338 13,527 6,815 8,344 9,045 GAAP gross margin 58 118 114 121 116 180 446 Depreciation and amortization 187 197 198 207 231 243 238 Share - based compensation 16,038 15,249 8,650 13,855 7,162 8,767 9,729 NON - GAAP gross margin - 5,377 - 4,582 - 12,492 2,790 - 10,042 - 8,869 - 10,355 GAAP net loss 379 414 400 439 456 480 823 Depreciation and amortization 3,822 3,987 3,708 3,509 3,764 3,735 3,760 Share - based compensation - 191 - 601 - 368 - 4,477 - 1,234 - 540 - 1,885 Financial income, net 19 26 16 51 17 21 14 Income Taxes - 3 - 4 - 6 - 5 - 5 - 12 - 4 Equity in earnings of investee - 1,507 - 22 - 89 - 95 - 25 - 10 - 3 Change in fair value of Forfeiture Shares 0 0 0 0 0 28 264 Change in earnout liability 0 0 0 0 0 0 2,249 Certain batch production incident expenses - 2,858 - 782 - 8,831 2,212 - 7,069 - 5,167 - 5,137 Adjusted EBITDA

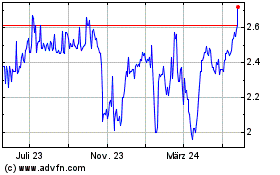

Valens Semiconductor (NYSE:VLN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

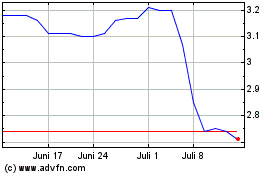

Valens Semiconductor (NYSE:VLN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024