Two Harbors to Use ICE’s Encompass Digital Mortgage Platform in Servicing Retention Strategy via Direct-to-Consumer Lending Channel

06 August 2024 - 3:00PM

Business Wire

Encompass chosen for comprehensive

capabilities, configurability, and rapid implementation

Intercontinental Exchange, Inc. (NYSE: ICE), a

leading global provider of technology and data, today announced

that Two Harbors Investment Corp.(NYSE:TWO) (“Two Harbors”), an MSR

+ Agency RMBS real estate investment trust, has selected the

Encompass® digital mortgage platform to support their new

direct-to-consumer recapture originations channel. Part of ICE’s

end-to-end digital housing finance ecosystem, Encompass is the

mortgage industry’s leading digital platform for lenders to

originate, service, sell and purchase loans faster – all from a

single system of record.

Since acquiring RoundPoint Mortgage Servicing LLC (“RoundPoint”)

in 2023, Two Harbors has become the eighth largest servicer of

conventional loans in the country. The decision to expand into

mortgage loan originations is key to their strategy of retaining

servicing customers when interest rates drop and borrowers begin to

refinance their loans. After a thorough search, Two Harbors

identified Encompass as their platform partner in their effort to

build out a direct-to-consumer channel to streamline origination

workflows and provide an exceptional borrower experience.

“The built-in configurability and smooth implementation process

with ICE meant that we were able to begin offering loans to our

customers at RoundPoint within several months of our decision to go

with Encompass,” said Bill Greenberg, Two Harbors’ President and

CEO. “We’re planning to continue to take advantage of the

additional capabilities and greater efficiencies within the

integrated ICE technology ecosystem. When we consider the scope of

what we can achieve together, the possibilities are exciting and

will be beneficial to our customers.”

Encompass is key to the ICE end-to-end mortgage technology

ecosystem, which is digitizing the entire real estate and housing

finance lifecycle to create a better experience for lenders,

homeowners, and investors. ICE is committed to investing in new

innovations that help companies drive operational efficiencies

across their entire business with visibility and control.

“We’re proud that Two Harbors chose the Encompass digital

lending platform as they strategically expand their mortgage

offerings.” said Tim Bowler, President of ICE Mortgage Technology.

“ICE’s technology will help them better meet the needs of borrowers

in this continuously evolving market. Two Harbors has been able to

quickly deliver for their customers – a testament to our ongoing

commitment to innovation that both helps mortgage companies operate

more efficiently and delivers a better experience to the American

homeowner.”

About Two Harbors Investment Corp.

Two Harbors Investment Corp., a Maryland corporation, is a real

estate investment trust that invests in mortgage servicing rights,

residential mortgage-backed securities and other financial assets.

Two Harbors is headquartered in St. Louis Park, Minn.

About RoundPoint Mortgage Servicing LLC

RoundPoint Mortgage Servicing LLC is a non-bank mortgage

servicing and origination company founded in 2007. In 2023,

RoundPoint was acquired by Two Harbors Investment Corp. (NYSE:

TWO). RoundPoint has offices in Fort Mill, S.C. and Coppell,

Texas.

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune

500 company that designs, builds, and operates digital networks

that connect people to opportunity. We provide financial technology

and data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges

-- including the New York Stock Exchange -- and clearing

houses help people invest, raise capital and manage risk. We

offer some of the world’s largest markets to trade and clear energy

and environmental products. Our fixed income, data services

and execution capabilities provide information, analytics and

platforms that help our customers streamline processes and

capitalize on opportunities. At ICE Mortgage Technology, we

are transforming U.S. housing finance, from initial consumer

engagement through loan production, closing, registration and the

long-term servicing relationship. Together, ICE transforms,

streamlines, and automates industries to connect our customers to

opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here. Key Information Documents for

certain products covered by the EU Packaged Retail and

Insurance-based Investment Products Regulation can be accessed on

the relevant exchange website under the heading “Key Information

Documents (KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 -- Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2023, as

filed with the SEC on February 8, 2024.

Category: Mortgage Technology

ICE-CORP

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806682704/en/

ICE Media Contact Mitch Cohen mitch.cohen@ice.com

+1 704-890-8158

ICE Investor Contact: Katia Gonzalez

katia.gonzalez@ice.com +1 (678) 981-3882

Two Harbors Investment Corp. Investor and Media Contact:

Margaret Karr Head of Investor Relations and Communications

Margaret.Karr@twoharborsinvestment.com +1 (612) 453-4080

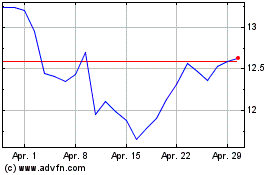

Two Harbors Investment (NYSE:TWO)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Two Harbors Investment (NYSE:TWO)

Historical Stock Chart

Von Dez 2023 bis Dez 2024