As filed with Securities and Exchange Commission on November 7, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SPIRIT AEROSYSTEMS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| |

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

|

20-2436320

(I.R.S. Employer

Identification No.)

|

|

3801 South Oliver

Wichita, Kansas 67210

(316) 526-9000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mindy McPheeters

Senior Vice President, General Counsel & Corporate Secretary

Spirit AeroSystems Holdings, Inc.

3801 South Oliver

Wichita, Kansas 67210

(316) 526-9000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Robert W. Downes

Sullivan & Cromwell LLP

125 Broad Street

New York, New York 10004

(212) 558-4000

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ☒

|

|

|

Accelerated filer ☐

|

|

|

Non-accelerated filer ☐

|

|

|

Smaller reporting company ☐

|

|

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Prospectus

Common Stock

Preferred Stock

Depositary Shares

We may use this prospectus from time to time to offer and sell Class A common stock (“common stock”), preferred stock or depositary shares. We will provide specific terms of any offering of these securities, and the manner in which the securities will be offered, in a supplement to this prospectus. The preferred stock may be convertible into, or exercisable or exchangeable for, our common stock or other series of preferred stock.

You should carefully read this prospectus and the applicable prospectus supplement, as well as the documents incorporated by reference, before you invest. The supplements may add, update or change information contained in this prospectus. This prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement.

Our common stock is listed for trading on the New York Stock Exchange under the symbol “SPR.” We have not yet determined whether any of the other securities that may be offered by this prospectus will be listed on any exchange, inter-dealer quotation system or over-the-counter market. If we decide to seek the listing of any such securities upon issuance, the prospectus supplement relating to those securities will disclose the exchange, quotation system or market on which the securities will be listed.

Investing in our securities involves risks. You should carefully read the section entitled “Risk Factors” beginning on page 2 of this prospectus, the section entitled “Risk Factors” in the applicable prospectus supplement and the risk factors contained in our periodic reports and other information filed with the Securities and Exchange Commission before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 7, 2023

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

ii |

|

|

|

|

|

|

|

|

iv |

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

13

|

|

|

ABOUT THIS PROSPECTUS

In this prospectus, unless the context indicates otherwise, the terms the “Company,” “we,” “us” and “our” refer to Spirit AeroSystems Holdings, Inc. and all entities owned or controlled by Spirit AeroSystems Holdings, Inc.

This prospectus is part of an automatic “shelf” registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”). Under this shelf registration process, we may, from time to time, sell an indeterminate amount of the securities described in this prospectus in one or more offerings.

This prospectus provides you with a general description of the securities we may offer. Each time we offer securities under this shelf registration, we will provide you with a prospectus supplement that will contain specific information about the terms of the offering. When we refer to a “prospectus supplement,” we are also referring to any free writing prospectus or other offering material authorized by us. The prospectus supplement may also supplement, update or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement. The registration statement we filed with the SEC includes exhibits that provide more details of the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC and any accompanying prospectus supplement together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information” before investing. The shelf registration statement, including the exhibits thereto, can be obtained from the SEC’s website at http://www.sec.gov as described under “Where You Can Find More Information.”

As permitted under the rules of the SEC, this prospectus incorporates important information about Spirit AeroSystems Holdings, Inc. that is contained in documents we file with the SEC but that are not included in or delivered with this prospectus. You may obtain copies of these documents, without charge, from the website maintained by the SEC at http://www.sec.gov, as well as other sources. See “Where You Can Find More Information.”

We have not authorized anyone to provide you with information different from that contained in, or incorporated by reference into, this prospectus or any accompanying prospectus supplement or any free writing prospectus. This prospectus, any accompanying prospectus supplement and any free writing prospectus may be used only for the purposes for which they have been published, and no person has been authorized to give any information not contained in, or incorporated by reference into, this prospectus and the accompanying

prospectus supplement or any free writing prospectus. If anyone provides you with different or additional information, you should not rely on it. These securities are not being offered in any state where the offer is not permitted. The information in this prospectus is accurate as of the date on the front cover. The information we have filed and will file with the SEC that is incorporated by reference into this prospectus is accurate as of the filing date of those documents. Our business, financial condition, results of operations and prospects may have changed since those dates and may change again.

We may offer the securities described herein for sale directly to purchasers or through underwriters, broker-dealers or agents. The names of any underwriters, broker-dealers or agents employed in the sale of the securities covered by this prospectus, the principal amount of such securities to be purchased by such underwriters, broker-dealers or agents, and the compensation, if any, of such underwriters, broker-dealers or agents will be set forth in an accompanying prospectus supplement.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein or therein contain “forward-looking statements” that involve many risks and uncertainties. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “aim,” “anticipate,” “believe,” “could,” “continue,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “might,” “objective,” “plan,” “predict,” “project,” “should,” “target,” “will,” “would,” and other similar words, or phrases, or the negative thereof, unless the context requires otherwise. These statements are based on circumstances as of the date on which the statements are made and they reflect management’s current views with respect to future events and are subject to risks and uncertainties, both known and unknown, including, but not limited to, those described in the “Risk Factors” section of our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Our actual results may vary materially from those anticipated in forward-looking statements. We caution investors not to place undue reliance on any forward-looking statements.

Important factors that could cause actual results to differ materially from those reflected in such forward-looking statements and that should be considered in evaluating our outlook include those described in the section captioned “Risk Factors” in our most recent Annual Report on Form 10-K, and any updates to those Risk Factors in our most recent Quarterly Report on Form 10-Q. Those factors are not exhaustive and it is not possible for us to predict all factors that could cause actual results to differ materially from those reflected in our forward-looking statements. Those factors speak only as of the date any forward-looking statement is made, and new factors may emerge or changes to the foregoing factors may occur that could impact our business. As with any projection or forecast, these statements are inherently susceptible to uncertainty and changes in circumstances.

Except to the extent required by law, we undertake no obligation to, and expressly disclaim any obligation to, publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You should review carefully the section captioned “Risk Factors” in this prospectus, the section captioned “Risk Factors” in our most recent Annual Report on Form 10-K, and Current Reports on Form 8-K, including any amendments to such reports, and in the sections captioned “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q for a more complete discussion of these and other factors that may affect our business. In light of such risks and uncertainties, we caution you not to rely on these forward-looking statements in deciding whether to invest in our securities.

PROSPECTUS SUMMARY

This summary highlights some of the information incorporated by reference into this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. You should carefully read this prospectus and the applicable prospectus supplement, including the documents incorporated by reference herein and therein, which are described under “Incorporation by Reference of Certain Documents” and “Where You Can Find More Information.” You should also carefully consider, among other things, the matters discussed in the section entitled “Risk Factors.”

Our Company

We are one of the world’s largest independent non-Original Equipment Manufacturer manufacturers of aerostructures, serving markets for commercial airplanes, military platforms and business/regional jets. With expertise in aluminum and advanced composite manufacturing solutions, our core products include fuselages, integrated wings and wing components, pylons and nacelles. We also serve the aftermarket for commercial and military platforms. In addition to commercial aircraft structures, we also design, engineer, and manufacture structural components for military aircraft and other applications. We are a critical partner to our commercial and defense customers due to the broad range of products and services we currently supply to them across the product lifecycle and our leading design and manufacturing capabilities using both metallic and composite materials. We operate in three principal segments: Commercial, Defense & Space, and Aftermarket.

Our principal offices are located at 3801 South Oliver, Wichita, Kansas 67210 and our telephone number at that address is (316) 526-9000. Our website address is www.spiritaero.com. Information contained on this website is not part of this prospectus and is not incorporated in this prospectus by reference.

RISK FACTORS

An investment in our securities involves risk. Before making an investment decision, you should consider carefully the risks and uncertainties described under “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in the applicable prospectus supplement, and in our most recent Annual Report on Form 10-K, any updates to those Risk Factors in our most recent Quarterly Report on Form 10-Q and Current Reports on Form 8-K, including any amendments to such reports, incorporated in the registration statement of which this prospectus is a part, together with all other information contained and incorporated by reference in this prospectus and the applicable prospectus supplements. In addition to those risk factors, there may be additional risks and uncertainties of which management is not aware or focused on or that management deems immaterial. Our business, financial condition or results of operations could be materially adversely affected by any of these risks and you could lose all or part of your investment. The risks discussed below also include forward-looking statements and our actual results may differ substantially from those discussed in these forward-looking statements. See “Cautionary Statement Regarding Forward-Looking Statements.”

USE OF PROCEEDS

We intend to use the net proceeds from the sales of our securities offered hereby in the manner and for the purposes set forth in the applicable prospectus supplement. Pending any specific application, we may initially use those proceeds for general corporate purposes.

DESCRIPTION OF COMMON STOCK

The following description summarizes the material terms of our common stock. Because this is only a summary, it does not contain all of the information that may be important to you. For a complete description, you should refer to our amended and restated certificate of incorporation (as amended from time to time, our “certificate of incorporation”) and by-laws (as may be amended from time to time, our “by-laws”) and to the applicable provisions of the Delaware General Corporation Law (the “DGCL”).

Overview

Our authorized capital stock consists of:

•

200,000,000 shares of class A common stock, par value $0.01 per share (“common stock”); and

•

10,000,000 shares of preferred stock, par value $0.01 per share.

Voting Rights

On all matters with respect to which the holders of our common stock are entitled to vote, each outstanding share of common stock is entitled to one vote

Dividend Rights

Subject to preferences that may apply to shares of preferred stock outstanding at the time, holders of our outstanding common stock are entitled to any dividend declared by the board of directors out of funds legally available for this purpose.

Preemptive, Conversion or Similar Rights

Holders of our common stock are not entitled to preemptive, conversion or other similar rights to purchase any of our securities.

Right to Receive Liquidation Distributions

Upon our voluntary or involuntary liquidation, dissolution or winding up, the holders of our common stock are entitled to receive pro rata our assets which are legally available for distribution, after payment of all debts and other liabilities and subject to the rights of any holders of preferred stock then outstanding, to the holders of our common stock.

Other Provisions

There are no redemption provisions or sinking fund provisions applicable to the common stock, nor is the common stock subject to calls or assessments by us.

NYSE Listing

Our common stock is listed on the NYSE under the symbol “SPR.”

Anti-Takeover Effects of our Certificate of Incorporation and By-Laws

Our certificate of incorporation and by-laws contain provisions that are intended to enhance the likelihood of continuity and stability in the composition of our board of directors. These provisions also may have the effect of delaying, deferring or preventing a future takeover or change in control unless the takeover or change in control is approved by our board of directors.

Undesignated Preferred Stock

The ability to authorize undesignated preferred stock makes it possible for our board of directors to issue one or more series of preferred stock with voting or other rights or preferences that could impede the success of any attempt to change control of us. This ability may have the effect of deferring hostile takeovers or delaying changes in control or management of our company.

Advance Notice Requirements for Stockholder Proposals and Directors Nominations

Our by-laws provide that stockholders seeking to bring business before an annual or special meeting of stockholders, or to nominate candidates for election as directors at an annual or special meeting, must provide timely notice of their intent in writing. To be timely, a stockholder’s notice must be received at our principal executive offices not later than (a) in connection with an annual meeting, 120 days prior to the anniversary of the date of the immediately preceding annual meeting; provided, that if the date of the annual meeting is more than 30 days before or after the anniversary date of the immediately preceding annual meeting, such notice must be received within 15 days after the public announcement by the company of the date of the annual meeting or (b) in connection with a special meeting, the close of business on the 15th day following the date on which notice of such special meeting is first given to stockholders or public disclosure of the meeting is made (whichever occurs earlier). Our by-laws also specify certain requirements as to the form and content of a stockholder’s notice. These provisions may have the effect of precluding our stockholders from bringing matters before a meeting or from making nominations for directors if the proper procedures are not followed or may discourage or deter a potential acquiror from conducting a solicitation of proxies to elect a slate of directors or otherwise attempting to obtain control of the company.

Call of Special Meetings

Our by-laws provide that, except as otherwise required by law, special meetings of the stockholders may be called only by the board of directors, our chief executive officer, our secretary or record holders of our common stock having not less than 10% of the voting power of all our outstanding common stock upon written request to the secretary. Our by-laws impose certain requirements as to the eligibility of stockholders seeking to call a special meeting and the form and context of a stockholder’s written request. Stockholders are not otherwise permitted to call a special meeting or to require the board of directors to call a special meeting.

Filling of Board Vacancies

Our by-laws authorize only our board of directors to fill vacancies between meetings of the company’s stockholders, including vacancies resulting from newly created directorships or the resignation or removal of directors. This may deter a stockholder from increasing the size of our board and gaining control of our board of directors by filling the resulting vacancies with its own nominees.

Additional Certificate of Incorporation and By-Law Provisions

Stockholder Action by Written Consent

Any action required or permitted to be taken at an annual or special stockholders’ meeting may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, are signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. Such consents must be delivered to us in the manner prescribed by the DGCL.

Delaware “Business Combination” Statute

We have elected not to be subject to Section 203 of the DGCL, which generally prohibits a publicly held Delaware corporation from engaging in various “business combination” transactions with any “interested stockholder” for a period of three years after the date of the transaction in which the person became an “interested stockholder,” unless the transaction is approved by the board of directors before that person becomes an “interested stockholder” or another exception is available. A “business combination” includes mergers, asset sales and other transactions resulting in a financial benefit to a stockholder. An “interested stockholder” is a person who, together with affiliates and associates, owns (or within three years, did own) 15% or more of a corporation’s voting stock. The statute is intended to prohibit or delay the accomplishment of mergers or other takeover or change in control attempts that do not receive the prior approval of the board of directors. By virtue of our decision to elect out of the statute’s provisions, the statute does not apply to us, but we could elect to be subject to Section 203 in the future by amending our certificate of incorporation.

Forum Selection for Certain Lawsuits

Our by-laws provide that, unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware will be, to the fullest extent permitted by law, the sole and exclusive forum for any (i) derivative action or proceeding brought on our behalf, (ii) action asserting a claim of breach of a fiduciary duty owed by any of our directors, officers or other employees to us or our stockholders, creditors or other constituents, (iii) action asserting a claim arising pursuant to any provision of the DGCL, our certificate of incorporation or our by-laws or (iv) action asserting a claim against us or any of our directors, officers or other employees governed by the internal affairs doctrine; provided, however, that, in the event that the Court of Chancery of the State of Delaware lacks jurisdiction over any such action or proceeding, the sole and exclusive forum for such action or proceeding will be the United States District Court for the District of Delaware. Our by-laws also provide that any person or entity purchasing or otherwise acquiring or holding any interest in shares of our capital stock will be deemed to have notice of and consented to this forum selection provision.

Amendments to our Certificate of Incorporation and By-laws

Except where our board of directors is permitted by law or by our certificate of incorporation to act without any action by our stockholders, provisions of our certificate of incorporation may not be adopted, repealed, altered or amended, in whole or in part, without the approval of a majority of the outstanding stock entitled to vote thereon and a majority of the outstanding stock of each class entitled to vote thereon as a class. The holders of the outstanding shares of a particular class of our capital stock are entitled to vote as a class upon any proposed amendment of our certificate of incorporation that would alter or change the relative powers, preferences or participating, optional or other special rights of the shares of such class so as to affect them adversely relative to the holders of any other class. Our by-laws may be amended or repealed and new by-laws may be adopted by a vote of the holders of a majority of the voting power of our common stock or, except to the extent relating to board action related to certain business transactions under the DGCL, the removal of directors and the filling of vacancies on the board of directors, by the board of directors. Any by-laws adopted or amended by the board of directors may be amended or repealed by the stockholders entitled to vote thereon.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Computershare, Inc.

DESCRIPTION OF PREFERRED STOCK

The following description of outlines some of the provisions of our preferred stock. This information may not be complete in all respects and is qualified in its entirety by reference to our certificate of incorporation and by-laws, and the certificate of designation relating to the applicable series of preferred stock. The specific terms of any series of preferred stock will be described in the applicable prospectus supplement. If so described in a prospectus supplement, the terms of that series of preferred stock may differ from the general description of terms presented below.

General

We are authorized by our certificate of incorporation to issue up to 10,000,000 shares of preferred stock, par value $0.01 per share, in one or more series. Currently, there are no shares of our preferred stock issued and outstanding.

Subject to the restrictions prescribed by law, our board of directors is authorized to fix the number of shares of any series of unissued preferred stock, to determine the designations and the rights, preferences, privileges, restrictions and limitations granted to or imposed upon any series of unissued preferred stock (including dividend rights (which may be cumulative or non-cumulative), voting rights, conversion rights, redemption rights and terms, sinking fund provisions, liquidation preferences and any other relative rights, preferences and limitations of that series) and, within any applicable limits and restrictions established, to increase or decrease the number of shares of such series subsequent to its issue. Before we issue any series of preferred stock, our board of directors will adopt resolutions creating and designating such series as a series of preferred stock. Stockholders will not need to approve these resolutions. The issuance of preferred stock could adversely affect the voting and other rights of holders of our common stock and may have the effect of delaying or preventing a change in control of the Company.

Terms Contained in the Prospectus Supplement

The applicable prospectus supplement will contain the dividend, voting, conversion, redemption, sinking fund, liquidation and other rights, preferences, privileges, restrictions or limitations of any series of preferred stock. The applicable prospectus supplement will describe the following terms of a series of preferred stock:

•

the designation and stated value per share of preferred stock and the number of shares of preferred stock offered;

•

the initial public offering price at which we will issue the preferred stock;

•

whether the shares will be listed on any securities exchange;

•

the dividend rate or method of calculation, the payment dates for dividends and the dates from which dividends will start to cumulate;

•

any voting rights;

•

any conversion rights;

•

any redemption or sinking fund provisions;

•

the amount of liquidation preference per share; and

•

any additional dividend, voting, conversion, redemption, sinking fund, liquidation and other rights or restrictions.

The applicable prospectus supplement may also describe some of the U.S. federal income tax consequences of the purchase and ownership of the series of preferred stock.

No Preemptive Rights

The holders of our preferred stock will have no preemptive rights to buy any additional shares of preferred stock.

Fully Paid and Nonassessable

When we issue shares of our preferred stock, the shares will be fully paid and nonassessable, which means the full purchase price of the shares will have been paid and holders of the shares will not be assessed any additional monies for the shares.

No Restrictions on Transfer

Neither our certificate of incorporation nor our by-laws contains any restrictions on the transfer of our preferred stock. In the case of any transfer of shares, there may be restrictions imposed by applicable securities laws.

Anti-Takeover Effects

The ability to authorize undesignated preferred stock makes it possible for our board of directors to issue one or more series of preferred stock with voting or other rights or preferences that could impede the success of any attempt to change control of us. This ability may have the effect of deferring hostile takeovers or delaying changes in control or management of our company.

DESCRIPTION OF DEPOSITARY SHARES

We may, at our option, elect to offer fractional shares of preferred stock, which we call depositary shares, rather than full shares of preferred stock. If we do, we will issue to the public receipts, called depositary receipts, for depositary shares, each of which will represent a fraction, to be specified in the applicable prospectus supplement, of a share of a particular series of preferred stock. Unless otherwise provided in the prospectus supplement, each owner of a depositary share will be entitled, in proportion to the applicable fractional interest in a share of preferred stock represented by the depositary share, to all the rights and preferences of the preferred stock represented by the depositary share. Those rights include, as applicable, dividend, voting, redemption, conversion and liquidation rights.

The shares of preferred stock underlying the depositary shares will be deposited with a bank or trust company selected by us to act as depositary under a deposit agreement between us, the depositary and the holders of the depositary receipts. The depositary will be the transfer agent, registrar and dividend disbursing agent for the depositary shares.

The depositary shares will be evidenced by depositary receipts issued pursuant to the deposit agreement. Holders of depositary receipts agree to be bound by the deposit agreement, which requires holders to take certain actions such as filing proof of residence and paying certain charges.

The applicable prospectus supplement will identify the depositary, describe the specific terms of any depositary shares and the material terms of the related deposit agreement.

PLAN OF DISTRIBUTION

We may sell the offered securities to one or more underwriters for public offering and sale by them or may sell the offered securities to investors directly or through agents, which agents may be affiliated with us. Any underwriter or agent involved in the offer and sale of the offered securities will be named in the applicable prospectus supplement.

VALIDITY OF SECURITIES

The validity of the securities offered hereby will be passed upon for us by Sullivan & Cromwell LLP, New York, New York. If legal matters in connection with offerings made by this prospectus and any prospectus supplement are passed on by counsel for any underwriters or agents, that counsel will be named in the applicable prospectus supplement.

EXPERTS

The consolidated financial statements of Spirit AeroSystems Holdings, Inc. appearing in Spirit AeroSystems Holdings Inc.’s Annual Report (Form 10-K) for the year ended December 31, 2022 and the effectiveness of Spirit AeroSystems Holdings, Inc.’s internal control over financial reporting as of December 31, 2022 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their reports thereon, included therein, and incorporated herein by reference. Such financial statements are, and audited financial statements to be included in subsequently filed documents will be, incorporated herein in reliance upon the reports of Ernst & Young LLP pertaining to such financial statements and the effectiveness of our internal control over financial reporting as of the respective dates (to the extent covered by consents filed with the Securities and Exchange Commission) given on the authority of such firm as experts in accounting and auditing.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

This prospectus incorporates important information about the Company that is not included in or delivered with this prospectus. We incorporate by reference the documents listed below and any additional documents filed by us with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, to the extent such documents are deemed “filed” for purposes of the Exchange Act after the date of this prospectus and prior to the termination of the offering of any securities under this prospectus:

•

•

•

•

the description of our common stock set forth in our registration statement on Form 8-A filed with the SEC on November 16, 2006, as updated by the description of our common stock included in Exhibit 4.2 to our Annual Report on Form 10-K for the year ended December 31, 2022, together with any amendment or report filed for the purpose of updating such description.

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus. You can obtain any of the documents incorporated by reference through us, the SEC or the SEC’s website, http://www.sec.gov. Documents we have incorporated by reference are available from us without charge, excluding exhibits to those documents unless we have specifically incorporated by reference such exhibits in this prospectus. Any person, including any beneficial owner, to whom this prospectus is delivered, may obtain the documents we have incorporated by reference in, but not delivered with, this prospectus by requesting them by telephone or in writing at the following address:

Spirit AeroSystems Holdings, Inc.

3801 South Oliver

Wichita, Kansas 67210

Attention: Corporate Secretary

(316) 526-9000

This prospectus summarizes documents and other information in a manner we believe to be accurate, but we refer you to the actual documents for a more complete understanding of the information we discuss in this prospectus. In making an investment decision, you must rely on your own examination of such documents, our business and the terms of the offering, including the merits and risks involved. When we refer to this prospectus, we mean not only this prospectus but also any documents which are incorporated or deemed to be incorporated in this prospectus by reference. You should rely only on the information incorporated by reference or provided in this prospectus or any supplement to this prospectus. We have not authorized anyone else to provide you with different information. This prospectus is used to offer and sell the securities referred to in this prospectus, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of the date of this prospectus.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the securities offered hereby. This prospectus, which is a part of the registration statement, does not contain all of the information set forth in the registration statement or the exhibits and schedules filed therewith. For further information with respect to us and our securities offered by this prospectus, please see the registration statement and the exhibits filed with the registration statement. Statements contained in this prospectus regarding the contents of any contract or any other document that is filed as an exhibit to the registration statement are not necessarily complete, and each such statement is qualified in all respects by reference to the full text of such contract or other document that is filed as an exhibit to the registration statement.

We are a reporting company and file annual, quarterly and current reports, proxy statements and other information with the SEC. Our reports, proxy and other information regarding us are available at http://www.sec.gov. Our SEC filings are also available free of charge at our website (www.spiritaero.com). The information on or accessible through our website is not incorporated by reference into this prospectus.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the costs and expenses payable by the registrant in connection with the sale of the securities being registered.

| |

SEC registration fee

|

|

|

|

$ |

(1)

|

|

|

| |

Printing expenses

|

|

|

|

|

(2)

|

|

|

| |

Legal fees and expenses

|

|

|

|

|

(2)

|

|

|

| |

Accounting fees and expenses

|

|

|

|

|

(2)

|

|

|

| |

Miscellaneous

|

|

|

|

|

(2)

|

|

|

| |

Total

|

|

|

|

|

(2)

|

|

|

(1)

The registration fee is deferred in reliance on Rules 456(b) and 457(r).

(2)

These fees and expenses cannot be estimated at this time as they are calculated based on the amount of securities offered and the number of issuances. An estimate of the aggregate expenses in connection with the sale and distribution of the securities being offered will be included in the applicable prospectus supplement.

Item 15. Indemnification of Directors and Officers

The registrant is incorporated under the laws, as amended, of the State of Delaware. Under Section 145 of the Delaware General Corporation Law (the “DGCL”), a corporation may indemnify its directors, officers, employees and agents and its former directors, officers, employees and agents and those who serve, at the corporation’s request, in such capacities with another enterprise, against expenses, including attorneys’ fees, as well as judgments, fines and settlements in nonderivative lawsuits, actually and reasonably incurred in connection with the defense of any action, suit or proceeding in which they or any of them were or are made parties or are threatened to be made parties by reason of their serving or having served in such capacity. The DGCL provides, however, that such person must have acted in good faith and in a manner such person reasonably believed to be in, or not opposed to, the best interests of the corporation and, in the case of a criminal action, such person must have had no reasonable cause to believe his or her conduct was unlawful. In addition, the DGCL does not permit indemnification in an action or suit by or in the right of the corporation, where such person has been adjudged liable to the corporation, unless, and only to the extent that, a court determines that such person fairly and reasonably is entitled to indemnity for costs the court deems proper in light of liability adjudication. Indemnity is mandatory to the extent a claim, issue or matter has been successfully defended.

The registrant’s certificate of incorporation and by-laws provide for the elimination of personal liability of its directors and the indemnification of its directors and officers, each to the fullest extent permitted by the DGCL. The registrant has entered into indemnification agreements with certain of its directors and officers that may require the registrant, among other things, to indemnify such officers and directors against certain liabilities that may arise by reason of their status or service as directors, officers or employees of the registrant and to advance the expenses incurred by such parties as a result of any threatened claims or proceedings brought against them as to which they could be indemnified. The registrant’s directors and officers are also covered by insurance policies maintained against certain liabilities for actions taken in their capacities as such, including liabilities under the Securities Act or the Exchange Act.

Item 16. Exhibits

EXHIBIT INDEX

| |

Exhibit

Number

|

|

|

Exhibit

|

|

|

Incorporated by

Reference to the

Following Documents

|

|

| |

1.1

|

|

|

Form of Underwriting Agreement

|

|

|

*

|

|

| |

4.1

|

|

|

|

|

|

Exhibit 3.1 to the registrant’s Current Report on Form 8-K, filed on May 1, 2017

|

|

| |

4.2

|

|

|

|

|

|

Exhibit 3.1 to the registrant’s Current Report on Form 8-K, filed on January 27, 2023

|

|

| |

4.3

|

|

|

Form of Certificate of Designations

|

|

|

*

|

|

| |

4.4

|

|

|

Form of Deposit Agreement

|

|

|

*

|

|

| |

4.5

|

|

|

Form of Depositary Receipt

|

|

|

Included in Exhibit 4.3

|

|

| |

5.1

|

|

|

|

|

|

**

|

|

| |

23.1

|

|

|

|

|

|

(included in Exhibit 5.1)**

|

|

| |

23.2

|

|

|

|

|

|

**

|

|

| |

24.1

|

|

|

|

|

|

(included on the signature page of this Registration Statement)

|

|

| |

107

|

|

|

|

|

|

**

|

|

*

To be filed by amendment to the Registration Statement or incorporated by reference from documents to be filed with the SEC under the Exchange Act.

**

Filed herewith.

Item 17. Undertakings

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to the registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (1)(i), (ii) and (iii) do not apply if the information required to be included in a post-effective amendment by these paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are

incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided,however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities: The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be

deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) That insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the provisions described in Item 15, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Wichita, State of Kansas, on the 7th day of November, 2023.

SPIRIT AEROSYSTEMS HOLDINGS, INC.

By:

/s/ Mark J. Suchinski

Name: Mark J. Suchinski

Senior Vice President and Chief Financial Officer

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below, hereby constitutes and appoints Mark J. Suchinski and Mindy McPheeters or either one of them, such person’s true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments to the Registration Statement, including post-effective amendments, and registration statements filed pursuant to Rule 462 under the Securities Act of 1933, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the SEC, and does hereby grant unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or their or his or her substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| |

Signature

|

|

|

Title

|

|

|

Date

|

|

| |

/s/ Patrick Shanahan

Patrick Shanahan

|

|

|

Director, Interim President and Interim Chief Executive Officer

(Principal Executive Officer)

|

|

|

November 7, 2023

|

|

| |

/s/ Mark J. Suchinski

Mark J. Suchinski

|

|

|

Senior Vice President and Chief Financial Officer

(Principal Financial Officer)

|

|

|

November 7, 2023

|

|

| |

/s/ Damon Ward

Damon Ward

|

|

|

Vice President and Corporate Controller (Principal Accounting Officer)

|

|

|

November 7, 2023

|

|

| |

/s/ Robert Johnson

Robert Johnson

|

|

|

Director, Chairman of the Board

|

|

|

November 7, 2023

|

|

| |

/s/ Stephen Cambone

Stephen Cambone

|

|

|

Director

|

|

|

November 7, 2023

|

|

| |

/s/ Irene M. Esteves

Irene M. Esteves

|

|

|

Director

|

|

|

November 7, 2023

|

|

| |

Signature

|

|

|

Title

|

|

|

Date

|

|

| |

/s/ William Fitzgerald

William Fitzgerald

|

|

|

Director

|

|

|

November 7, 2023

|

|

| |

/s/ Paul Fulchino

Paul Fulchino

|

|

|

Director

|

|

|

November 7, 2023

|

|

| |

/s/ Ronald Kadish

Ronald Kadish

|

|

|

Director

|

|

|

November 7, 2023

|

|

| |

/s/ John L. Plueger

John L. Plueger

|

|

|

Director

|

|

|

November 7, 2023

|

|

| |

/s/ James Ray Jr.

James Ray Jr.

|

|

|

Director

|

|

|

November 7, 2023

|

|

| |

/s/ Laura Wright

Laura Wright

|

|

|

Director

|

|

|

November 7, 2023

|

|

Exhibit 5.1

[Letterhead of Sullivan &

Cromwell LLP]

November 7, 2023

Spirit AeroSystems Holdings, Inc.,

3801 South Oliver,

Wichita, Kansas 67210.

Ladies and Gentlemen:

In connection with the registration under the Securities

Act of 1933 (the “Act”) of an indeterminate number of (i) shares of Class A common stock, par value $0.01 per share

(the “Common Stock”), of Spirit AeroSystems Holdings, Inc., a Delaware corporation (the “Company”), (ii) shares

of preferred stock, par value $0.01 per share (the “Preferred Stock”), of the Company, and (iii) depositary shares representing

the Preferred Stock (the “Depositary Shares” and, together with the Common Stock and the Preferred Stock, the “Securities”)

pursuant to a Registration Statement on Form S-3 (as amended from time to time, the “Registration Statement”), we, as

your counsel, have examined such corporate records, certificates and other documents, and such questions of law, as we have considered

necessary or appropriate for the purposes of this opinion.

Upon the basis of such examination it is our opinion

that:

(1) Common

Stock. When the Registration Statement has become effective under the Act, when the terms of the sale of the Common Stock have been

duly established in conformity with the Company’s certificate of incorporation so as not to violate any applicable law or result

in a default under or breach of any agreement or instrument binding upon the Company and so as to comply with any requirement or restriction

imposed by any court or governmental body having jurisdiction over the Company and to include a number of shares of Common Stock to be

issued not in excess of the number of shares of Common Stock then authorized and not outstanding or reserved for issuance, and when the

Common Stock has been duly issued and sold for a price per share determined by the Company’s Board of Directors, or a duly authorized

committee thereof, that is not less than the par value thereof, and if all the foregoing actions are taken pursuant to authority granted

in resolutions duly adopted by the Company’s Board of Directors, or a duly authorized committee thereof, the Common Stock will be

validly issued, fully paid and nonassessable. The Common Stock covered by the opinion in this paragraph includes any Common Stock that

may be issued upon exercise or otherwise pursuant to the terms of any other Securities.

| Spirit AeroSystems

Holdings, Inc. |

-2- |

(2) Preferred

Stock. When the Registration Statement has become effective under the Act, when the terms of the Preferred Stock and of their issue

and sale have been duly established in conformity with the Company’s certificate of incorporation so as not to violate any applicable

law or result in a default under or breach of any agreement or instrument binding upon the Company and so as to comply with any requirement

or restriction imposed by any court or governmental body having jurisdiction over the Company and to include a number of shares of Preferred

Stock to be issued not in excess of the number of shares of Preferred Stock then authorized and not outstanding or reserved for issuance,

when a certificate of designations with respect to the Preferred Stock has been duly filed with the Secretary of State of the State of

Delaware, and when the Preferred Stock has been duly issued and sold for a price per share determined by the Company’s Board of

Directors, or a duly authorized committee thereof, that is not less than the par value thereof, and if all the foregoing actions are taken

pursuant to authority granted in resolutions duly adopted by the Company’s Board of Directors, or a duly authorized committee thereof,

the Preferred Stock will be validly issued, fully paid and nonassessable. The Preferred Stock covered by the opinion in this paragraph

includes any Preferred Stock that may be issued upon exercise or otherwise pursuant to the terms of any other Securities.

(3) Depositary

Shares. When the Registration Statement has become effective under the Act, when the terms of the deposit agreement under which the

Depositary Shares are to be issued have been duly established and the deposit agreement has been duly authorized, executed and delivered,

when the terms of the Depositary Shares and of their issuance and sale have been duly established in conformity with the deposit agreement,

when the Preferred Stock represented by the Depositary Shares has been duly authorized, validly issued and duly delivered to the depositary

and when the depositary receipts evidencing the Depositary Shares have been duly issued against deposit of the Preferred Stock in accordance

with the deposit agreement and issued and sold for a price determined by the Company’s Board of Directors, or a duly authorized

committee thereof, that is not less than the par value of the underlying shares of Preferred Stock represented thereby, and if all the

foregoing actions are taken pursuant to authority granted in resolutions duly adopted by the Company’s Board of Directors, or a

duly authorized committee thereof, and so as not to violate any applicable law or result in a default under or breach of any agreement

or instrument binding upon the Company and so as to comply with any requirement or restriction imposed by any court or governmental body

having jurisdiction over the Company, the depositary receipts evidencing the Depositary Shares will be validly issued and will entitle

the holders thereof to the rights specified in the Depositary Shares and the deposit agreement, subject to bankruptcy, insolvency, fraudulent

transfer, reorganization, moratorium and similar laws of general applicability relating to or affecting creditors’ rights and to

general equity principles. The Depositary Shares covered by the opinion in this paragraph include any Depositary Shares that may be issued

upon exercise or otherwise pursuant to the terms of any other Securities.

| Spirit AeroSystems Holdings, Inc. |

-3- |

In rendering the foregoing opinion, we are not passing

upon, and assume no responsibility for, any disclosure in the Registration Statement or any related prospectus or prospectus supplement

or other offering material relating to the offer and sale of the Securities.

The foregoing opinion is limited to the Federal laws

of the United States, the laws of the State of New York and the General Corporation Law of the State of Delaware, and we are expressing

no opinion as to the effect of the laws of any other jurisdiction.

We have relied as to certain factual matters on information

obtained from public officials, officers of the Company and other sources believed by us to be responsible, and we have assumed all other

governing documents under which the Securities are to be issued will have been duly authorized, executed and delivered by all parties

thereto other than the Company and that the signatures on documents examined by us are genuine. We have also assumed that the issuance

or delivery by the Company of any securities other than the Securities, or of any other property, upon exercise or otherwise pursuant

to the terms of the Securities will be effected pursuant to authority granted in resolutions duly adopted by the Company’s Board

of Directors, or a duly authorized committee thereof, and so as not to violate any applicable law or result in a default under or breach

of any agreement or instrument binding on the Company and so as to comply with any requirement or restriction imposed by any court or

governmental body having jurisdiction over the Company. We have further assumed that the authority granted in resolutions duly adopted

by the Company’s Board of Directors, or a duly authorized committee thereof, will remain in effect at all relevant times and that

no Securities will be issued or other action taken in contravention of any applicable limit established pursuant to such resolutions from

time to time. Finally, with respect to any shares of Common Stock or Preferred Stock issued in uncertificated form, we have assumed that

such shares will have been duly recorded by a transfer agent and duly registered by a registrar thereof in the direct registration system

of the Company and that the notice required by Section 151(f) of the General Corporation Law of the State of Delaware will have

been given to the holders of such shares within a reasonable time following the issuance thereof.

| Spirit AeroSystems Holdings, Inc. |

-4- |

We hereby consent to the filing of this opinion as

an exhibit to the Registration Statement and to the reference to us under the heading “Validity of Securities” in the Prospectus.

In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7

of the Act.

| |

Very truly yours, |

| |

|

| |

/s/ SULLIVAN & CROMWELL LLP |

Exhibit 23.2

Consent of Independent Registered Public Accounting

Firm

We consent to the reference to our firm under the caption

“Experts” in this Registration Statement (Form S-3) and related Prospectus of Spirit AeroSystems Holdings, Inc.

for the registration of 200,000,000 shares of its common stock and 10,000,000 shares of preferred stock and to the incorporation by reference

therein of our reports dated February 17, 2023, with respect to the consolidated financial statements of Spirit AeroSystems

Holdings, Inc., and the effectiveness of internal control over financial reporting of Spirit AeroSystems Holdings, Inc., included

in its Annual Report (Form 10-K) for the year ended December 31, 2022, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Wichita, Kansas

November 7, 2023

Exhibit 107

Calculation of Filing Fee Tables

Form S-3

(Form Type)

Spirit AeroSystems Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward

Securities

| |

Security

Type |

Security

Class Title |

Fee

Calculation

or Carry Forward

Rule |

Amount

Registered |

Proposed

Maximum

Offering

Price Per

Unit |

Maximum

Aggregate

Offering

Price |

Fee

Rate |

Amount

of

Registration

Fee |

Carry

Forward

Form Type |

Carry

Forward

File

Number |

Carry

Forward

Initial

Effective

Date |

Filing

Fee

Previously Paid in

Connection with

Unsold Securities

to be Carried

Forward |

| Newly

Registered Securities |

| Fees

to be Paid |

Equity |

Class A

common stock, par value $0.01 per share |

Rule 456(b) and

Rule 457(r) (1) |

(2) |

(2) |

(2) |

(1) |

(1) |

|

|

|

|

| |

Equity |

Preferred

Stock, par value $0.01 per share |

Rule 456(b) and

Rule 457(r) (1) |

(2) |

(2) |

(2) |

(1) |

(1) |

|

|

|

|

| |

Equity |

Depositary

Shares (3) |

Rule 456(b) and

Rule 457(r) (1) |

(2) |

(2) |

(2) |

(1) |

(1) |

|

|

|

|

| Fees

Previously Paid |

N/A |

N/A |

N/A |

N/A |

N/A |

N/A |

|

N/A |

|

|

|

|

| Carry

Forward Securities |

| Carry

Forward Securities |

N/A |

N/A |

N/A |

N/A |

|

N/A |

|

|

N/A |

N/A |

N/A |

N/A |

| |

Total

Offering Amounts |

|

(2) |

|

(1) |

|

|

|

|

| |

Total

Fees Previously Paid |

|

|

|

N/A |

|

|

|

|

| |

Total

Fee Offsets |

|

|

|

N/A |

|

|

|

|

| |

Net

Fee Due |

|

|

|

(1) |

|

|

|

|

(1) The registrant is relying on

Rules 456(b) and 457(r) under the Securities Act of 1933, as amended, in connection with this Registration Statement,

and in accordance therewith, is deferring payment of all of the registration fee. The registrant will calculate the registration fee

applicable to an offer of securities pursuant to this Registration Statement based on the fee payment rate in effect on the date of such

fee payment.

(2) An unspecified aggregate initial

offering price and number of securities of each identified class is being registered and may from time to time be offered at unspecified

prices.

(3) Each depositary share will be

issued under a deposit agreement, will represent an interest in a fractional share or multiple shares of preferred stock and will be

evidenced by a depositary receipt.

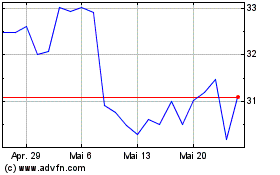

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024