Regal-Beloit Offers Common Stock - Analyst Blog

13 Dezember 2012 - 4:30PM

Zacks

Headquartered in Beloit, Wisconsin,

Regal-BeloitCorporation

(RBC) recently issued a public offering of 2,750,000 shares of its

common stock. The electrical and mechanical motion control products

manufacturer also intends to provide the underwriters an option to

buy up to an added 412,500 shares of common stock in order to cover

over-allotments.

Underwriters to this offering are

Credit Suisse Securities (USA) LLC, a subsidiary of Credit

Suisse (CS) and Robert W. Baird & Co. Incorporated.

The proceeds from the offerings are expected to aid the company’s

future acquisitions along with other general corporate and working

capital expenses.

The latest capital raising

initiatives are likely to help the company minimize its total debt

burden to a considerable extent. Further, the company will be able

to raise its capital ratios with this capital spending which in

turn will facilitate the company’s future growth prospects and

acquisition opportunities. The strategic efforts are also aimed at

increasing the liquidity of the company.

However, even though liquidity will

improve in the short-term for the company, an increase in the

number of outstanding shares may prove to be an extra burden for

Regal-Beloit in the long run, considering its steady and regular

dividend payout strategy.

Earlier, the company had reported

adjusted diluted earnings per share of $1.32 in the third quarter

of 2012 compared to $1.31 per share in the year-ago quarter and

$1.50 in the second quarter of 2012. The results failed to meet the

Zacks Consensus Estimate of $1.37 per share.

Exiting the third quarter,

Regal-Beloit’s cash and cash equivalents were $185.8 million versus

$190.9 million in the previous quarter. Long-term debt at the end

of 3Q12 was $781.7 million versus $899.8 million at the end of the

previous quarter.

In a different story, the company

recently announced to pay its third-quarter dividend of $0.19 per

share. The dividend will be paid on January 18, 2013, to

shareholders of record as of December 28, 2012.

Regal-Beloit is operating in a

highly competitive industry. Some of the competitors in electric

motor, power generation and mechanical motion control markets are

ABB Ltd. (ABB) and Emerson Electric

Co. (EMR) who enjoy greater financial and other resources

than the company.

The current Zacks Consensus

Estimates of Regal-Beloit for the fourth quarter of 2012 and for

2012 are 73 cents and $4.71, representing year-over-year growth of

(21.0%) and 0.1%, respectively. The company currently retains a

Zacks #3 Rank, which translates into a short-term ‘Hold’ rating.

However, we are maintaining a long-term ‘Neutral’ recommendation on

the stock.

ABB LTD-ADR (ABB): Free Stock Analysis Report

CREDIT SUISSE (CS): Free Stock Analysis Report

EMERSON ELEC CO (EMR): Free Stock Analysis Report

REGAL BELOIT (RBC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

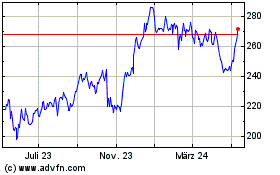

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

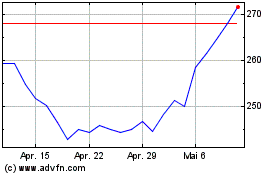

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024