UPDATE: LSE To Take Full Ownership Of FTSE International

12 Dezember 2011 - 11:00AM

Dow Jones News

London Stock Exchange Group PLC (LSE.LN) said Monday that it

will buy the remaining 50% stake in FTSE International Ltd. that it

doesn't already own for GBP450 million in cash as part of broader

moves to diversify its offering

LSE Chief Executive Xavier Rolet was upbeat about taking full

ownership of the index business, which it has jointly owned with

Pearson for 16 years. "This transaction further delivers on our

diversification strategy, expanding LSEG's existing offering deeper

into indices, derivatives and market data products and services,"

he added.

"Immediately earnings-enhancing, we expect this transaction to

create long-term value and growth for our customers and

shareholders," Rolet said in a statement.

Pearson--which sold its 61% stake in financial market data

provider Interactive Data Corp. for $2 billion before tax last year

in May--said the LSE deal will strengthen the FT Group's "focus on

global business news, analysis and intelligence, increasingly

delivered through subscription models and digital channels."

It marks the publisher's exit from companies that are primarily

providers of financial data.

Pearson CEO Marjorie Scardino said the LSE deal further

strengthens the group's "financial position at a time of

significant macroeconomic turbulence."

"We are freeing up capital for continued investment in a proven

strategy: becoming more digital, more international and more

service-oriented in education, business information and consumer

publishing," she said in a separate statement.

The U.K.-based company--which has extensive educational

publishing operations and publishes the Financial Times newspaper

and Penguin books--plans to use the LSE sale proceeds "to support

and accelerate its strategy, investing in its businesses both

organically and through acquisitions of companies with

complementary content, technology and geographic exposure."

Pearson has made several bolt-on acquisitions over the past 18

months or so, aimed at strengthening its education operations.

Pearson said it expects FTSE to make a total post-tax

contribution to its adjusted earnings of approximately GBP18

million, or 2.2 pence a share, in 2011.

In 2010, FTSE reported total revenue of GBP98.5 million and

total earnings before interest, tax, depreciation and amortization

of GBP40 million. At the end of 2010, FTSE had gross assets of

GBP100.8 million.

The LSE expects cost synergies of GBP100 million annually and

gross revenue synergies of GBP18 million annually by the end of the

third year of full ownership of the FTSE.

The LSE will fund the acquisition from existing resources, but

has also secured GBP350 million from several banks "to maintain

financial flexibility."

Under the terms of the agreement, the LSE will continue to use

the FTSE name. The transaction is expected to close by the first

quarter of 2012.

-By Lilly Vitorovich, Dow Jones Newswires; 44-0-207 842 9290;

lilly.vitorovich@dowjones.com

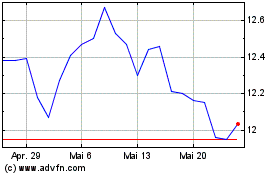

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024