0001392972false00013929722023-07-252023-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 10, 2023

PROS Holdings, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

Delaware |

(State or Other Jurisdiction of Incorporation) |

| | | | |

001-33554 | | | | 76-0168604 |

(Commission File Number) | | | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

3200 Kirby Drive, Suite 600 | Houston | TX | | | | | 77098 | |

(Address of Principal Executive Offices) | | | | | (Zip Code) | |

| | | | | | |

Registrant’s telephone number, including area code | (713) | 335-5151 | |

| | | | | | | | |

| | | | | | | | |

(Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common stock $0.001 par value per share | | PRO | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry Into a Material Definitive Agreement

On October 10, 2023, PROS Holdings, Inc. (“PROS”) settled the previously announced exchange agreements for the exchange of $122.0 million aggregate principal amount of its outstanding 1.00% Convertible Senior Notes due 2024 (the “2024 Notes”) for newly issued $116.8 million aggregate principal amount of its outstanding 2.250% Convertible Senior Notes due 2027 (the “2027 Notes”) (the “Exchanges”). Following the settlement of the Exchanges, $21.7 million in aggregate principal amount of 2024 Notes and $266.8 million in aggregate principal amount of 2027 Notes will remain outstanding with terms unchanged. The 2027 Notes issued in the Exchanges constitute a further issuance of, and form a single series and will be fungible with, the existing 2027 Notes.

The 2027 Notes are unsecured, unsubordinated obligations of the Company and will pay interest semiannually at an annual rate of 2.250% and will be convertible into cash, shares of the Company’s common stock or a combination of cash and shares of the Company’s common stock, at the Company’s election, based on the applicable conversion rate at such time. The 2027 Notes have an initial conversion rate of 23.9137 shares of the Company’s common stock per $1,000 principal amount of 2027 Notes (which is equivalent to an initial conversion price of approximately $41.82 per share of the Company’s common stock). The conversion rate is subject to adjustment in certain circumstances, including in connection with specified fundamental changes. Holders of the 2027 Notes will have the right to require the Company to repurchase all or a portion of their notes upon the occurrence of a fundamental change (as defined in the indenture governing the 2027 Notes) at a purchase price of 100% of their principal amount plus any accrued and unpaid interest. The 2027 Notes will mature on September 15, 2027, unless converted, redeemed or repurchased in accordance with their terms prior to such date. Prior to June 15, 2027, the 2027 Notes will be convertible only upon the satisfaction of certain conditions and during certain periods, and thereafter, at any time prior to the close of business on the second scheduled trading day immediately preceding the maturity date regardless of these conditions.

The description of the 2027 Notes is qualified in its entirety by reference to the full and complete terms of the form of 2027 Notes, which is attached hereto as Exhibit 10.1, and incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information set forth in Item 1.01 is incorporated herein by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities

The 2027 Notes were issued to participants in the Exchanges in a private placement in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act. The Company is relying on this exemption from registration based in part on representations made by participants in the Exchanges. The information set forth in Item 1.01 above is incorporated by reference into this Item 3.02.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | | | | | | | | | | |

| Exhibit No. | | Exhibit Description | | |

| | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| PROS HOLDINGS, INC. |

| | |

| October 10, 2023 | | /s/ Damian W. Olthoff |

| | Damian W. Olthoff |

| | General Counsel and Secretary |

[FACE OF NOTE]

UNLESS THIS CERTIFICATE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITORY TRUST COMPANY, A NEW YORK CORPORATION (“DTC”), TO THE COMPANY OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE, OR PAYMENT, AND ANY CERTIFICATE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC (AND ANY PAYMENT HEREUNDER IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE, OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.

PROS Holdings, Inc.

2.250% Convertible Senior Note due 2027

No. 2

$116,816,000 (ONE HUNDRED SIXTEEN MILLION EIGHT HUNDRED SIXTEEN THOUSAND DOLLARS)

CUSIP No. 74346Y AG8

ISIN No. US74346YAG89

PROS Holdings, Inc., a corporation duly organized and validly existing under the laws of the State of Delaware (the “Company,” which term includes any successor corporation or other entity under the Indenture referred to on the reverse hereof), for value received hereby promises to pay to CEDE & CO., or registered assigns, the principal sum as set forth in the “Schedule of Exchanges of Notes” attached hereto, which amount, taken together with the principal amounts of all other outstanding Notes, shall not, unless permitted by the Indenture, exceed $266,816,000 in aggregate at any time, in accordance with the rules and procedures of the Depositary, on September 15, 2027, and interest thereon as set forth below.

This Note shall bear interest at the rate of 2.250% per year from September 15, 2023, or from the most recent date to which interest has been paid or provided for to, but excluding, the next scheduled Interest Payment Date until September 15, 2027. Accrued interest on this Note shall be computed on the basis of a 360-day year composed of twelve 30-day months and, for partial months, on the basis of actual days elapsed over a 30-day month. Interest is payable semi-annually in arrears on each March 15 and September 15, commencing on March 15, 2024, to Holders of record at the close of business on the preceding March 1 and September 1 (whether or not such day is a Business Day), respectively. Additional Interest will be payable as set forth in Section 6.03 of the within-mentioned Indenture, and any reference to interest on, or in respect of, any Note therein shall be deemed to include Additional Interest if, in such context, Additional Interest is, was or would be payable pursuant to Section 6.03, and any express mention of the payment of Additional Interest in any provision therein shall not be construed as excluding Additional Interest in those provisions thereof where such express mention is not made.

Any Defaulted Amounts shall to the maximum extent permitted by applicable law accrue interest per annum at the rate borne by the Notes, from, and including, the relevant payment date to, but excluding, the date on which such Defaulted Amounts shall have been paid by the Company, at its election, in accordance with Section 2.03(c) of the Indenture.

The Company shall pay the principal of and interest on this Note, if and so long as such Note is a Global Note, in immediately available funds in lawful money of the United States at the time to the Depositary or its nominee, as the case may be, as the registered Holder of such Note. As provided in and subject to the provisions of the Indenture, the Company shall pay the principal of any Notes (other than Notes that are Global Notes) at the office or agency designated by the Company for that purpose. The Company has initially designated the Trustee as its Paying Agent and Note Registrar in respect of the Notes and its Corporate Trust Office, as a place where Notes may be presented for payment or for registration of transfer and exchange.

Reference is made to the further provisions of this Note set forth on the reverse hereof, including, without limitation, provisions giving the Holder of this Note the right to convert this Note into cash, shares of Common Stock or a combination of cash and shares of Common Stock, as applicable, on the terms and subject to the limitations set forth in the Indenture. Such further provisions shall for all purposes have the same effect as though fully set forth at this place.

This Note, and any claim, controversy or dispute arising under or related to this Note, shall be construed in accordance with and governed by the laws of the State of New York.

In the case of any conflict between this Note and the Indenture, the provisions of the Indenture shall control and govern.

This Note shall not be valid or become obligatory for any purpose until the certificate of authentication hereon shall have been manually signed by the Trustee or a duly authorized authenticating agent under the Indenture.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the Company has caused this Note to be duly executed.

| | | | | | | | | | | | | | | | | |

| | PROS HOLDINGS, INC. | | |

| | | | | |

| | By: | ____________________________________ |

| | | Name: Damian W. Olthoff Title: General Counsel and Secretary | |

| | | | | |

| Dated: October 10, 2023 |

| |

| TRUSTEE’S CERTIFICATE OF AUTHENTICATION |

| |

| WILMINGTON TRUST, NATIONAL ASSOCIATION

as Trustee, certifies that this is one of the Notes described in

the within-named Indenture. |

| |

| By:__________________________________________________ |

| Authorized Signatory |

[REVERSE OF NOTE]

PROS Holdings, Inc.

2.250% Convertible Senior Note due 2027

This Note is one of a duly authorized issue of Notes of the Company, designated as its 2.250% Convertible Senior Notes due 2027 (the “Notes”), initially limited to the aggregate principal amount of $150,000,000 (subject to increase as permitted under the Indenture) all issued or to be issued under and pursuant to an Indenture dated as of September 15, 2020 (the “Indenture”), between the Company and Wilmington Trust, National Association (the “Trustee”), to which Indenture and all indentures supplemental thereto reference is hereby made for a description of the rights, limitations of rights, obligations, duties and immunities thereunder of the Trustee, the Company and the Holders of the Notes. Additional Notes may be issued in an unlimited aggregate principal amount, subject to certain conditions specified in the Indenture. Capitalized terms used in this Note and not defined in this Note shall have the respective meanings set forth in the Indenture.

In case certain Events of Default shall have occurred and be continuing, the principal of, and interest on, all Notes may be declared, by either the Trustee or Holders of at least 25% in aggregate principal amount of Notes then outstanding, and upon said declaration shall become, due and payable, in the manner, with the effect and subject to the conditions and certain exceptions set forth in the Indenture.

Subject to the terms and conditions of the Indenture, the Company will make all payments and deliveries in respect of the Fundamental Change Repurchase Price on the Fundamental Change Repurchase Date and the principal amount on the Maturity Date, as the case may be, to the Holder who surrenders a Note to a Paying Agent to collect such payments in respect of the Note. The Company will pay cash amounts in money of the United States that at the time of payment is legal tender for payment of public and private debts.

The Indenture contains provisions permitting the Company and the Trustee in certain circumstances, without the consent of the Holders of the Notes, and in certain other circumstances, with the consent of the Holders of not less than a majority in aggregate principal amount of the Notes at the time outstanding, evidenced as in the Indenture provided, to execute supplemental indentures modifying the terms of the Indenture and the Notes as described therein. It is also provided in the Indenture that, subject to certain exceptions, the Holders of a majority in aggregate principal amount of the Notes at the time outstanding may on behalf of the Holders of all of the Notes waive any past Default or Event of Default under the Indenture and its consequences.

No reference herein to the Indenture and no provision of this Note or of the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay or deliver, as the case may be, the principal (including the Redemption Price and the Fundamental Change Repurchase Price, if applicable) of, accrued and unpaid interest on, and the consideration due upon conversion of, this Note at the place, at the respective times, at the rate and in the lawful money or form of Conversion Consideration herein prescribed.

The Notes are issuable in registered form without coupons in denominations of $1,000 principal amount and integral multiples in excess thereof. At the office or agency of the Company referred to on the face hereof, and in the manner and subject to the limitations provided in the Indenture, Notes may be exchanged for a like aggregate principal amount of Notes of other authorized denominations, without payment of any service charge but, if required by the Company or Trustee, with payment of a sum sufficient to cover any transfer or similar tax that may be imposed in connection therewith as a result of the name of the Holder of the new Notes issued upon such exchange of Notes being different from the name of the Holder of the old Notes surrendered for such exchange.

The Notes shall be redeemable at the Company’s option on or after September 15, 2024 in accordance with the terms and subject to the conditions specified in the Indenture. No sinking fund is provided for the Notes.

Upon the occurrence of a Fundamental Change prior to the Maturity Date, the Holder has the right, at such Holder’s option exercised in the manner specified in the Indenture, to require the Company to repurchase for cash all of such Holder’s Notes or any portion thereof (in principal amounts of $1,000 or integral multiples in excess thereof) on the Fundamental Change Repurchase Date at a price equal to the Fundamental Change Repurchase Price.

Subject to the provisions of the Indenture, the Holder hereof has the right, at its option, during certain periods and upon the occurrence of certain conditions specified in the Indenture, prior to the close of business on the second Scheduled Trading Day immediately preceding the Maturity Date, to convert any Notes or portion thereof that is $1,000 or an integral multiple in excess thereof, into, at the Company’s election, cash, shares of Common Stock or a combination of cash and shares of Common Stock, as applicable, as set forth in the Indenture at the Conversion Rate specified in the Indenture and as adjusted from time to time as provided in the Indenture.

Terms used in this Note and defined in the Indenture are used herein as therein defined.

ABBREVIATIONS

The following abbreviations, when used in the inscription of the face of this Note, shall be construed as though they were written out in full according to applicable laws or regulations:

| | | | | | | | |

| TEN COM | = | as tenants in common |

| UNIF GIFT MIN ACT | = | Uniform Gifts to Minors Act |

| CUST | = | Custodian |

| TEN ENT | = | as tenants by the entireties |

| JT TEN | = | joint tenants with right of survivorship and not as tenants in common |

Additional abbreviations may also be used though not in the above list.

SCHEDULE OF EXCHANGES OF NOTES

PROS Holdings, Inc.

2.250% Convertible Senior Notes due 2027

The initial principal amount of this Global Note is ONE HUNDRED SIXTEEN MILLION EIGHT HUNDRED SIXTEEN THOUSAND DOLLARS ($116,816,000). The following increases or decreases in this Global Note have been made:

| | | | | | | | | | | | | | |

| Date of exchange | Amount of decrease in principal amount of this Global Note | Amount of increase in principal amount of this Global Note | Principal amount of this Global Note following such decrease or increase | Signature of authorized signatory of Trustee or Custodian |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[FORM OF NOTICE OF CONVERSION]

| | | | | | | | |

| To: | PROS Holdings, Inc. | |

| | |

| To: | Wilmington Trust National Association | |

| 277 Park Avenue | |

| New York, NY 10172 | |

| | |

| Attn: | PROS Holdings, Inc. Administrator | |

| | |

The undersigned registered owner of this Note hereby exercises the option to convert this Note, or the portion hereof (that is $1,000 principal amount or an integral multiple in excess thereof) below designated, into, at the Company’s election, cash, shares of Common Stock or a combination of cash and shares of Common Stock, as applicable, in accordance with the terms of the Indenture referred to in this Note, and directs that any cash payable and any shares of Common Stock issuable and deliverable upon such conversion, together with any cash for any fractional share, and any Notes representing any unconverted principal amount hereof, be issued and delivered to the registered Holder hereof unless a different name has been indicated below. If any shares of Common Stock or any portion of this Note not converted are to be issued in the name of a Person other than the undersigned, the undersigned will pay all documentary, stamp or similar issue or transfer taxes, if any in accordance with Section 14.02(d) and Section 14.02(e) of the Indenture. Any amount required to be paid to the undersigned on account of interest accompanies this Note. Capitalized terms used herein but not defined shall have the meanings ascribed to such terms in the Indenture.

| | | | | | | | | | | |

| | | |

| Dated: | | | |

| | | |

| | | |

| | | |

| | | Signature(s) |

| | |

| Signature Guarantee | | |

| Signature(s) must be guaranteed by an eligible Guarantor Institution (banks, stock brokers, savings and loan associations and credit unions) with membership in an approved signature guarantee medallion program pursuant to Securities and Exchange Commission Rule 17Ad-15 if shares of Common Stock are to be issued, or Notes are to be delivered, other than to and in the name of the registered holder. | | |

| | | | | | | | | | | |

| Fill in for registration of shares if to be issued, and Notes if to be delivered, other than to and in the name of the registered holder: | | | |

| | | |

| (Name) | | | |

| | | |

| (Street Address) | | | |

| | | |

(City, State and Zip Code)

Please print name and address | | | |

| | Principal amount to be converted (if less than all): $ ,000 | |

| | | |

| | NOTICE: The above signature(s) of the Holder(s) hereof must correspond with the name as written upon the face of the Note in every particular without alteration or enlargement or any change whatever. | |

| | | |

| | Social Security or Other Taxpayer

Identification Number | |

[FORM OF FUNDAMENTAL CHANGE REPURCHASE NOTICE]

| | | | | | | | |

| To: | PROS Holdings, Inc. | |

| | |

| To: | Wilmington Trust National Association | |

| 277 Park Avenue | |

| New York, NY 10172 | |

| | |

| Attn: | PROS Holdings, Inc. Administrator | |

| | |

The undersigned registered owner of this Note hereby acknowledges receipt of a notice from PROS Holdings, Inc. (the “Company”) as to the occurrence of a Fundamental Change with respect to the Company and specifying the Fundamental Change Repurchase Date and requests and instructs the Company to pay to the registered holder hereof in accordance with Section 15.02 of the Indenture referred to in this Note (1) the entire principal amount of this Note, or the portion thereof (that is $1,000 principal amount or an integral multiple in excess thereof) below designated, and (2) if such Fundamental Change Repurchase Date does not fall during the period after a Regular Record Date and on or prior to the corresponding Interest Payment Date, accrued and unpaid interest, if any, thereon to, but excluding, such Fundamental Change Repurchase Date. Capitalized terms used herein but not defined shall have the meanings ascribed to such terms in the Indenture.

In the case of Physical Notes, the certificate numbers of the Notes to be repurchased are as set forth below:

| | | | | | | | | | | | | | |

| | | | |

| Dated: | | | |

| | | | |

| | | | Signature(s) |

| | | | |

| | | | Social Security or Other Taxpayer Identification Number |

| | | | Principal amount to be repaid (if less than all): $________,000 |

| | | | NOTICE: The above signature(s) of the Holder(s) hereof must correspond with the name as written upon the face of the Note in every particular without alteration or enlargement or any change whatever. |

ATTACHMENT 3

[FORM OF ASSIGNMENT AND TRANSFER]

| | | | | | | | |

| To: | PROS Holdings, Inc. | |

| | |

| To: | Wilmington Trust National Association | |

| 277 Park Avenue | |

| New York, NY 10172 | |

| | |

| Attn: | PROS Holdings, Inc. Administrator | |

| | |

For value received ____________________ hereby sell(s), assign(s) and transfer(s) unto _____________________ (please insert social security or Taxpayer Identification Number of assignee) the within Note, and hereby irrevocably constitutes and appoints ______________________ attorney to transfer the said Note on the books of PROS Holdings, Inc. (the “Company”), with full power of substitution in the premises.

In connection with any transfer of the within Note occurring prior to the Resale Restriction Termination Date, as defined in the Indenture governing such Note, the undersigned confirms that such Note is being transferred:

□ To the Company or a subsidiary thereof; or

□ Pursuant to a registration statement that has become or been declared effective under the Securities Act of 1933, as amended; or

□ Pursuant to and in compliance with Rule 144A under the Securities Act of 1933, as amended; or

□ Pursuant to and in compliance with Rule 144 under the Securities Act of 1933, as amended, or any other available exemption from the registration requirements of the Securities Act of 1933, as amended.

| | | | | | | | | | | | | | |

| Dated: | | | |

| | | | |

| | | | Signature(s) |

| | | | |

| Signature Guarantee | | Social Security or Other Taxpayer Identification Number |

| Signature(s) must be guaranteed by an eligible Guarantor Institution (banks, stock brokers, savings and loan associations and credit unions) with membership in an approved signature guarantee medallion program pursuant to Securities and Exchange Commission Rule 17Ad-15 if Notes are to be delivered, other than to and in the name of the registered holder. | | |

NOTICE: The signature on the assignment must correspond with the name as written upon the face of the Note in every particular without alteration or enlargement or any change whatever.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

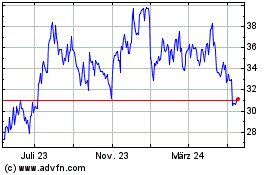

Pros (NYSE:PRO)

Historical Stock Chart

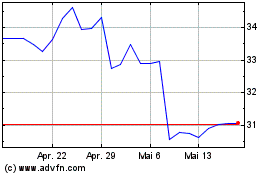

Von Apr 2024 bis Mai 2024

Pros (NYSE:PRO)

Historical Stock Chart

Von Mai 2023 bis Mai 2024