CTO Realty Growth Announces Third Quarter 2024 Investment and Leasing Update

08 August 2024 - 10:05PM

CTO Realty Growth, Inc. (NYSE: CTO) (the “Company”) today announced

that it has entered into a purchase and sale agreement for the

acquisition of a three-property portfolio (the “Three Property

Portfolio”) for a purchase price of $137.5 million.

The Three Property Portfolio consists of three

open-air shopping centers located in Charlotte, North Carolina;

Orlando, Florida; and Tampa, Florida, with an aggregate gross

leasable area of approximately 0.9 million square feet which are

approximately 94.2% leased, with a weighted average remaining lease

term of 6.2 years as of August 7, 2024.

Additionally, on August 1, 2024, the Company

completed a $10.0 million preferred equity investment in a real

estate company with a dividend rate of 14.0% per annum and a 1.00%

origination fee. The investment is non-callable for five years,

except upon the occurrence of certain specified events.

Further, the Company has entered into a purchase

and sale agreement for the sale of its Jordan Landing property

located in West Jordan, Utah for $18.0 million. The Company

anticipates that the sale of its Jordan Landing property will close

prior to the end of August 2024. After completion of this

disposition, all the Company’s properties will be located in the

Southeast and Southwest markets of the United States.

Since the beginning of the third quarter, the

Company has executed new leases and renewals totaling approximately

69,000 square feet and, after adjusting for this leasing activity,

the Company’s leased occupancy has increased to 96.0% compared to

94.6% as of June 30, 2024. The Company’s signed not open pipeline

now represents $5.7 million, or 7.2%, of annual in-place cash base

rent as of June 30, 2024.

“We’re pleased to announce the execution of the

purchase and sale agreement for the acquisition of an attractive

portfolio of power and grocery-anchored centers, along with the

continued strong leasing and other transaction activity so far in

the third quarter,” said John P. Albright, President and Chief

Executive Officer of CTO Realty Growth, Inc. “The pending portfolio

acquisition provides us with an opportunity to purchase

complimentary assets in strong markets at an attractive yield and a

basis significantly below replacement cost.”

The acquisition of the Three Property Portfolio

and the disposition of the Company’s Jordan Landing property are

each subject to certain closing conditions, which are not currently

satisfied. Accordingly, there can be no assurances that either of

these transactions will be completed on the terms described in this

press release, or at all.

About CTO Realty Growth,

Inc.

CTO Realty Growth, Inc. is a publicly traded

real estate investment trust that owns and operates a portfolio of

high-quality, retail-based properties located primarily in higher

growth markets in the United States. The Company also externally

manages and owns a meaningful interest in Alpine Income Property

Trust, Inc. (NYSE: PINE), a publicly traded net lease REIT.

Safe Harbor

Certain statements contained in this press

release (other than statements of historical fact) are

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements can typically be identified by words such as “believe,”

“pending,” “estimate,” “expect,” “intend,” “anticipate,” “will,”

“could,” “may,” “should,” “plan,” “potential,” “predict,”

“forecast,” “project,” and similar expressions, as well as

variations or negatives of these words. Examples of forward-looking

statements in this press release include, without limitation,

statements regarding the pending acquisition of the Three Property

Portfolio and the pending disposition of the Company’s Jordan

Landing property.

Although forward-looking statements are made

based upon management’s present expectations and beliefs concerning

future developments and their potential effect on the Company, a

number of factors could cause the Company’s actual results to

differ materially from those set forth in the forward-looking

statements. No assurance can be given that the acquisition of the

Three Property Portfolio or the disposition of the Company’s Jordan

Landing property will be completed on the terms described in this

press release, or at all. The acquisition of the Three Property

Portfolio and the disposition of the Company’s Jordan Landing

property are each subject to the satisfaction of certain closing

conditions, which are not currently satisfied, as well as numerous

other possible events, factors and conditions, many of which are

beyond the control of the Company and not all of which are known to

it, including, without limitation, market conditions and those

described under the heading “Risk Factors” in the Company’s Annual

Report on Form 10-K for the year ended December 31, 2023, which can

be accessed at the SEC’s website at www.sec.gov.

There can be no assurance that future

developments will be in accordance with management’s expectations

or that the effect of future developments on the Company will be

those anticipated by management. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release. The Company undertakes

no obligation to update the information contained in this press

release to reflect subsequently occurring events or

circumstances.

|

Contact: |

Philip R. MaysSenior Vice President, Chief Financial Officer, and

Treasurer(407) 904-3324pmays@ctoreit.com |

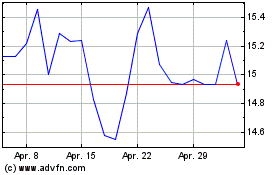

Alpine Income Property (NYSE:PINE)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Alpine Income Property (NYSE:PINE)

Historical Stock Chart

Von Dez 2023 bis Dez 2024