UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. 8)*

Nelnet, Inc.

(Name of Issuer)

Class A Common Stock

(Title of Class of Securities)

64031N 10 8

(CUSIP Number)

12/31/2023

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to designate the rule pursuant to which this Schedule is filed:

[ ] Rule 13d-1(b)

[ X ] Rule 13d-1(c)

[ ] Rule 13d-1(d)

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page.

The information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 64031N 10 8

1) Names of Reporting Persons.

Shelby J. Butterfield

2) Check the Appropriate Box if a Member of a Group (See Instructions)

(a) [ ]

(b) [ ]

3) SEC Use Only

4) Citizenship or Place of Organization

United States

Number of 5) Sole Voting Power 168,053 (1) (3)

Shares

Beneficially

Owned 6) Shared Voting Power 2,705,474 (2) (3)

by Each

Reporting

Person 7) Sole Dispositive Power 168,053 (1) (3)

With:

8) Shared Dispositive Power 2,705,474 (2) (3)

9) Aggregate Amount Beneficially

Owned by Each Reporting Person 2,873,527 (3)

10) Check if the Aggregate Amount in Row (9)

Excludes Certain Shares (See Instructions) [ ]

11) Percent of Class Represented by Amount in Row (9) 9.8%

12) Type of Reporting Person (See Instructions) IN

(1) Includes (i) 31,417 shares of Class B common stock (which shares are convertible into the same number of shares of Class A common stock at the option of the holder at any time, with each share of Class A common stock having one vote and each share of Class B common stock having ten votes on all matters to be voted upon by the issuer's shareholders) held by Shelby J. Butterfield, which number of shares reflects annuity distributions of a total of 12,547 shares of Class B common stock to Ms. Butterfield in December 2023 from five separate grantor retained annuity trusts (“GRATs”) established by Ms. Butterfield in 2015, as discussed

below; and (ii) 136,636 shares of Class B common stock held by a family limited liability company controlled by Ms. Butterfield.

(2) Includes (i) 15,370 shares of Class B common stock held by the Estate of Stephen F. Butterfield (the “Butterfield Estate”), for which Ms. Butterfield serves as the personal representative, which number of shares reflects annuity distributions of a total of 8,105 shares of Class B common stock to the Butterfield Estate in December 2023 from two separate GRATs established by Mr. Butterfield in 2015, as discussed below; (ii) 197,946 shares of Class B common stock held by the Stephen F. Butterfield GST Non-Exempt Marital Trust (the “Butterfield GST Non-Exempt Marital Trust”), an estate planning trust for the family of Stephen F. Butterfield, for which trust Ms. Butterfield serves as a co-trustee and Whitetail Rock Capital Management, LLC (“WRCM”), a majority owned subsidiary of the issuer, serves as investment adviser with respect to shares of the issuer’s stock held therein, including shares of the issuer’s stock held by such trust indirectly through Union Financial Services, Inc. (“UFS”) as discussed below (and which Butterfield GST Non-Exempt Marital Trust is included as an additional reporting person in this filing); (iii) 210,047 shares of Class B common stock held by the Butterfield GST Exempt Marital Trust, an estate planning trust for the family of Mr. Butterfield, for which trust Ms. Butterfield serves as a co-trustee and WRCM serves as investment adviser with respect to shares of the issuer’s stock held therein; (iv) 1,586,691 shares of Class B common stock owned by UFS, of which the Butterfield GST Non-Exempt Marital Trust owns 50% of the outstanding capital stock and Michael S. Dunlap, Executive Chairman and a substantial shareholder of the issuer, owns the other 50% of the outstanding capital stock; (v) a total of 495,646 shares of Class B common stock held in six separate GRATs established by Ms. Butterfield in 2015, for which GRATs WRCM serves as investment adviser, which number of shares of Class B common stock reflects annuity distributions in December 2023 from certain of such GRATs to Ms. Butterfield of a total of 12,547 shares of Class B common stock under the terms of such GRATs; (vi) a total of 139,368 shares of Class B common stock held in two separate GRATs established by Mr. Butterfield in 2015, for which GRATs WRCM serves as investment adviser, which number of shares of Class B common stock reflects annuity distributions in December 2023 from such GRATs to the Butterfield Estate of a total of 8,105 shares of Class B common stock under the terms of such GRATs; (vii) a total of 36,788 shares of Class B common stock held in two separate trusts established by Mr. Butterfield in 2015 for the benefit of Ms. Butterfield’s two minor children, for which two separate trusts WRCM serves as investment adviser; (viii) a total of 200 shares of Class B common stock held by Ms. Butterfield as custodian for her two minor children; (ix) 22,908 shares of Class B common stock held by a charitable lead annuity trust (“CLAT”) established by Mr. Butterfield, for which CLAT WRCM serves as investment adviser, which number of shares of Class B common stock reflects an annuity distribution in December 2023 of 5,372 shares of Class B common stock from the CLAT to a charitable organization under Section 501(c)(3) of the Internal Revenue Code, pursuant to the terms of the CLAT; and (x) 510 shares of Class A common stock owned by the Butterfield GST Non-Exempt Marital Trust. Ms. Butterfield disclaims beneficial ownership of such shares except to the extent that Ms. Butterfield actually has or shares voting power or investment power with respect to such shares, and the reporting thereof shall not be construed as an admission that Ms. Butterfield is a beneficial owner of such shares.

(3) All amounts in Rows 5-9 are as of December 31, 2023.

CUSIP No. 64031N 10 8

1) Names of Reporting Persons.

Stephen F. Butterfield GST Non-Exempt Marital Trust

2) Check the Appropriate Box if a Member of a Group (See Instructions)

(a) [ ]

(b) [ ]

3) SEC Use Only

4) Citizenship or Place of Organization

Arizona

Number of 5) Sole Voting Power 0

Shares

Beneficially

Owned 6) Shared Voting Power 1,785,147 (1) (2)

by Each

Reporting

Person 7) Sole Dispositive Power 0

With:

8) Shared Dispositive Power 1,785,147 (1) (2)

9) Aggregate Amount Beneficially

Owned by Each Reporting Person 1,785,147 (2)

10) Check if the Aggregate Amount in Row (9)

Excludes Certain Shares (See Instructions) [ ]

11) Percent of Class Represented by Amount in Row (9) 6.3%

12) Type of Reporting Person (See Instructions) OO

(1) Includes (i) 197,946 shares of Class B common stock (which shares are convertible into the same number of shares of Class A common stock at the option of the holder at any time, with each share of Class A common stock having one vote and each share of Class B common stock having ten votes on all matters to be voted upon by the issuer's shareholders) held by the Stephen F. Butterfield GST Non-Exempt Marital Trust (the “Butterfield GST Non-Exempt Marital Trust”), an estate planning trust for the family of Stephen F. Butterfield, for which trust Shelby J. Butterfield serves as a co-trustee and Whitetail Rock Capital

Management, LLC (“WRCM”), a majority owned subsidiary of the issuer, serves as investment adviser with respect to shares of the issuer’s stock held therein, including shares of the issuer’s stock held by such trust indirectly through Union Financial Services, Inc. (“UFS”) as discussed below; (ii) 1,586,691 shares of Class B common stock owned by UFS, of which the Butterfield GST Non-Exempt Marital Trust owns 50% of the outstanding capital stock and Michael S. Dunlap, Executive Chairman and a substantial shareholder of the issuer, owns the other 50% of the outstanding capital stock; and (iii) 510 shares of Class A common stock owned by the Butterfield GST Non-Exempt Marital Trust. The Butterfield GST Non-Exempt Marital Trust disclaims beneficial ownership of such shares except to the extent that the Butterfield GST Non-Exempt Marital Trust actually has or shares voting power or investment power with respect to such shares, and the reporting thereof shall not be construed as an admission that the Butterfield GST Non-Exempt Marital Trust is a beneficial owner of such shares. The shares reported herein as beneficially owned by the Butterfield GST Non-Exempt Marital Trust are also reported herein as beneficially owned by Ms. Butterfield.

(2) All amounts in Rows 6, 8 and 9 are as of December 31, 2023.

Explanatory Note

Shelby J. Butterfield is the surviving spouse of Stephen F. Butterfield, who passed away in 2018 and who had previously reported beneficial ownership of the issuer’s Class A common stock (the class of securities to which this statement relates) beginning after the issuer’s initial public offering and registration of such class of securities under Section 12 of the Act in December 2003, in statements (including amendments thereto) on Schedule 13G, with the most recent annual amendment thereto filed by Mr. Butterfield on February 12, 2018. The previous statements on Schedule 13G for Mr. Butterfield were filed pursuant to Rule 13d-1(d) and Section 13(d)(6)(B) of the Act.

Item 1.

(a) Name of Issuer:

Nelnet, Inc.

(b) Address of Issuer’s Principal Executive Offices:

121 South 13th Street

Suite 100

Lincoln, Nebraska 68508

Item 2.

(a) Name of Person Filing:

This Schedule is filed jointly by the following reporting persons:

(i)Shelby J. Butterfield

(ii)Stephen F. Butterfield GST Non-Exempt Marital Trust (the “Butterfield GST Non-Exempt Marital Trust”)

(b) Address of Principal Business Office or, if none, Residence:

The principal business office of Ms. Butterfield and the Butterfield GST Non-Exempt Marital Trust is:

c/o Gallagher & Kennedy

2575 East Camelback Road

Phoenix, Arizona 85016

(c) Citizenship:

Ms. Butterfield is a United States citizen. The Butterfield GST Non-Exempt Marital Trust is governed by Arizona law.

(d) Title of Class of Securities:

Class A Common Stock

(e) CUSIP Number:

64031N 10 8

Item 3. If this statement is filed pursuant to §§ 240.13d-1(b) or 240.13d-2(b) or (c), check whether the person filing is a:

(a) [ ] Broker or dealer registered under section 15 of the Act (15 U.S.C. 78o);

(b) [ ] Bank as defined in section 3(a)(6) of the Act (15 U.S.C. 78c);

(c) [ ] Insurance company as defined in section 3(a)(19) of the Act (15 U.S.C. 78c);

(d) [ ] Investment company registered under section 8 of the Investment Company Act of 1940 (15 U.S.C. 80a-8);

(e) [ ] An investment adviser in accordance with §240.13d-1(b)(1)(ii)(E);

(f) [ ] An employee benefit plan or endowment fund in accordance with § 240.13d-1(b)(1)(ii)(F);

(g) [ ] A parent holding company or control person in accordance with § 240.13d-1(b)(1)(ii)(G);

(h) [ ] A savings associations as defined in Section 3(b) of the Federal Deposit Insurance Act (12 U.S.C. 1813);

(i) [ ] A church plan that is excluded from the definition of an investment company under section 3(c)(14) of the Investment Company Act of 1940 (15 U.S.C. 80a-3);

(j) [ ] A non-U.S. institution in accordance with §240.13d-1(b)(1)(ii)(J);

(k) [ ] Group, in accordance with §240.13d-1(b)(1)(ii)(K).

If filing as a non-U.S. institution in accordance with §240.13d-1(b)(1)(ii)(J), please specify the type of institution: Not applicable.

Item 4. Ownership.

The information required by Items 4(a) – (c) is set forth in Rows 5) – 11) of the cover pages (and the footnotes thereto) for each of the reporting persons and is incorporated herein by reference.

Item 5. Ownership of Five Percent or Less of a Class

If this statement is being filed to report the fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more than five percent of the class of securities, check the following [ ].

Item 6. Ownership of More than Five Percent on Behalf of Another Person

As discussed in footnote (1) to Rows 5) and 7) and in footnote (2) to Rows 6) and 8) on the cover page with respect to Ms. Butterfield above and in footnote (1) to Rows 6) and 8) on the cover page with respect to the Butterfield GST Non-Exempt Marital Trust above, which are incorporated by reference herein, certain securities reported in this statement are held by or on behalf of persons other than the reporting persons, which other persons have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, such securities.

Item 7. Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on By the Parent Holding Company or Control Person

Not applicable.

Item 8. Identification and Classification of Members of the Group

Not applicable.

Item 9. Notice of Dissolution of Group

Not applicable.

Item 10. Certifications

By signing below I certify that, to the best of my knowledge and belief, the securities referred to above were not acquired and are not held for the purpose of or with the effect of changing or influencing the control of the issuer of the securities and were not acquired and are not held in connection with or as a participant in any transaction having that purpose or effect, other than activities solely in connection with a nomination under §240.14a-11.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 13, 2024

Shelby J. Butterfield

/s/ Audra Hoffschneider

Name: Audra Hoffschneider

Title: Attorney-in-Fact*

Stephen F. Butterfield GST Non-Exempt Marital Trust

/s/ Audra Hoffschneider

Name: Audra Hoffschneider

Title: Attorney-in-Fact**

* Pursuant to a power of attorney filed on April 8, 2020 as an exhibit to the initial filing of this statement and incorporated herein by reference.

** Pursuant to the power of attorney filed on May 29, 2020 as an exhibit to amendment no. 4 to this statement and incorporated herein by reference.

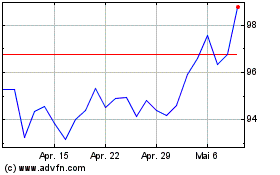

Nelnet (NYSE:NNI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

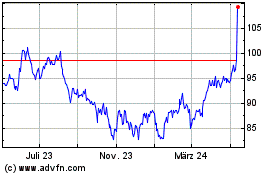

Nelnet (NYSE:NNI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024