0001078207false3/3100010782072024-04-222024-04-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report: April 22, 2024

(Date of earliest event reported)

_________________________________________

BOWFLEX INC.

(Exact name of registrant as specified in its charter)

__________________________________________

| | | | | | | | |

| Washington | 001-31321 | 94-3002667 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

17750 S.E. 6th Way

Vancouver, Washington 98683

(Address of principal executive offices, including zip code)

(360) 859-2900

(Registrant's telephone number, including area code)

Nautilus, Inc.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, no par value | BFX | New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐

|

BOWFLEX INC.

FORM 8-K

| | | | | | | | |

| Item 1.02 | | Termination of a Material Definitive Agreement. |

The information set forth below in Item 2.01 in this Current Report on Form 8-K is hereby incorporated by reference into this Item 1.02.

| | | | | | | | |

| Item 1.03 | | Bankruptcy or Receivership. |

The information set forth below in Item 2.01 in this Current Report on Form 8-K is hereby incorporated by reference into this Item 1.03.

| | | | | | | | |

| Item 2.01 | | Completion of Acquisition or Disposition of Assets. |

As previously disclosed, on March 4, 2024, Bowflex, Inc. (the “Company”) and certain of its subsidiaries (together, the “Company Parties”) filed voluntary petitions (the “Bankruptcy Petitions”) for relief under chapter 11 of title 11 of the United States Code 11 U.S.C. §§ 101–1532 (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of New Jersey (the “Bankruptcy Court”). The chapter 11 cases for the Company Parties (the “Chapter 11 Cases”) are being jointly administered under the caption In re Bowflex Inc., et al., Case No. 24-12364. Through the Chapter 11 Cases, the Company Parties sought to implement a sale of substantially all of their assets pursuant to Section 363 of the Bankruptcy Code.

As previously disclosed, on March 4, 2024, the Company entered into a “stalking horse” asset purchase agreement (the “Asset Purchase Agreement”) with Johnson Health Tech Retail, Inc. to sell the assets of the Company (the “Acquired Assets”) identified in the Asset Purchase Agreement, representing substantially all of the assets of the Company, for a total of $37,500,000 in cash at the closing of the transaction, including a deposit of $3,750,000 paid into an escrow account on March 4, 2024, but less closing adjustment amounts for accounts receivable, inventory and certain transfer taxes. On April 15, 2024, the Bankruptcy Court entered an order authorizing the sale of the Acquired Assets pursuant to the terms of the Asset Purchase Agreement (the “Asset Sale”) and on April 22, 2024, the Asset Sale closed (the “Closing”). There will not be sufficient proceeds from the Asset Sale for common shareholders to receive value for their shares.

On April 22, 2024, proceeds from the Asset Sale were used to repay the Company’s obligations under the existing Term Loan Credit Agreement, dated as of November 30, 2022, as amended, by and among the Company and Nautilus Fitness Canada, Inc., a British Columbia company and subsidiary of the Company, as borrowers, and Crystal Financial LLC d/b/a SLR Credit solutions, as administrative agent and a lender. Immediately upon such repayment, the credit agreement is being terminated.

| | | | | | | | |

| Item 5.02 | | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Effective immediately following the Closing, the following members of the Board of Directors of the Company (the “Board”) resigned as members of the Board: James Barr, IV, Patricia M. Ross, Kelley Hall, and Shailesh Prakash. The resignation of the directors is not because of a disagreement with the Company on any matter relating to the Company’s operations, policies or practices. Anne G. Saunders and Ruby Sharma will remain directors of the Company following the Closing.

James Barr, IV, the Chief Executive Officer of the Company, and Becky L. Alseth, the Chief Marketing Officer of the Company, separated their service with the Company, effective immediately following the Closing, and Aina E. Konold, the Chief Financial Officer of the Company, and John R. Goelz, the Chief Operating Officer of the Company, will separate service with the Company, effective as of May 3, 2024.

Effective immediately following the Closing, Robert D. Hoge, the Company’s existing Director, Intellectual Property Counsel, has been appointed as the General Counsel and Chief Wind-Down Officer (“CWDO”) of the Company. Mr. Hoge will continue to receive his annual salary of $205,000 while serving in these positions. There are no arrangements or understandings between Mr. Hoge and any other person pursuant to which he was appointed to serve as General Counsel and CWDO. Mr. Hoge is not a party to any transaction with the Company that would require disclosure under Item 404(a) of Regulation S-K.

| | | | | | | | |

| Item 5.03 | | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

Effective immediately following the Closing, the Board approved an Amendment (the “Amendment”) to the Amended and Restated Bylaws of the Company (as amended, the “Bylaws”) to revise Section 2.2 of the Bylaws to provide that the

number of directors of the Company shall not be less than one director, with the specific number of directors to be set by resolution of the Board. Also effective as of immediately following the Closing, the Board adopted resolutions setting the number of directors of the Board at two directors.

The foregoing description is only a summary of the Amendment to the Bylaws and is qualified in its entirety by reference to the Amendment, which is attached hereto as Exhibit 3.01 and is incorporated herein by reference.

Cautionary Statements Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements (statements which are not historical facts) within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, express or implied forward-looking statements relating to the Company’s statements regarding the Company’s Chapter 11 Cases, the Asset Purchase Agreement, the Bankruptcy Court’s approval and entry of the Sales Order, the closing of the Asset Sale, the proceeds from the Asset Sale, and the Board and executive management changes. You are cautioned that such statements are not guarantees of future performance and that our actual results may differ materially from those set forth in the forward-looking statements. All of these forward-looking statements are subject to risks and uncertainties that may change at any time. Factors that could cause the Company’s actual expectations to differ materially from these forward-looking statements also include: risks inherent in the bankruptcy process, including the outcome of the Chapter 11 Cases; the Company’s financial projections and cost estimates; the Company’s ability to sell any of its remaining assets; and the effect of the Chapter 11 Cases on the Company’s business prospects, financial results and business operations. The Company may not actually achieve the plans, intentions or expectations disclosed in its forward-looking statements, and you should not place undue reliance on its forward-looking statements. Additional assumptions, risks and uncertainties that could cause actual results to differ materially from those contemplated in these forward-looking statements are described in detail in our registration statements, reports and other filings with the Securities and Exchange Commission, including the “Risk Factors” set forth in our Annual Report on Form 10-K, as supplemented by our quarterly reports on Form 10-Q. Such filings are available on our website or at www.sec.gov. We undertake no obligation to publicly update or revise forward-looking statements to reflect subsequent developments, events, or circumstances, except as may be required under applicable securities laws.

| | | | | | | | |

| Item 9.01 | | Financial Statements and Exhibits. |

| | | | | |

| Exhibit Number | Description |

| Amendment to Amended and Restated Bylaws of the Company. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | BOWFLEX INC. |

| | (Registrant) |

| | | |

| April 22, 2024 | | By: | /s/ Aina E. Konold |

| Date | | | Aina E. Konold |

| | | Chief Financial Officer |

| | | (Principal Financial Officer) |

Amendment to

Bowflex, Inc.

Amended and Restated Bylaws

Section 2.2 of the Company’s Amended and Restated Bylaws is hereby amended and restated in its entirety as follows:

2.2 Number of Directors, Qualification. The number of directors of the corporation shall be not less than one (1), the specific number to be set by resolution of the Board of Directors. No reduction of the authorized number of directors shall have the effect of removing any director before that director’s term of office expires. No director need be a shareholder of the corporation or a resident of the State of Washington.

Except as herein amended, the provisions of the Company’s Amended and Restated Bylaws shall remain in full force and effect.

AS APPROVED BY THE BOARD OF DIRECTORS EFFECTIVE: April 22, 2024.

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

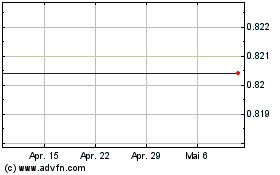

Nautilus (NYSE:NLS)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

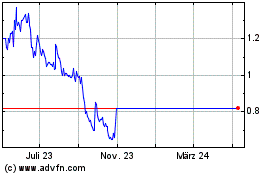

Nautilus (NYSE:NLS)

Historical Stock Chart

Von Mai 2023 bis Mai 2024