0001078207false00010782072024-03-042024-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report: March 4, 2024

(Date of earliest event reported)

_________________________________________

BOWFLEX INC.

(Exact name of registrant as specified in its charter)

__________________________________________

| | | | | | | | |

| Washington | 001-31321 | 94-3002667 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

17750 S.E. 6th Way

Vancouver, Washington 98683

(Address of principal executive offices, including zip code)

(360) 859-2900

(Registrant's telephone number, including area code)

Nautilus, Inc.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

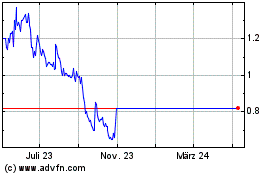

| Common Stock, no par value | BFX | New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐

|

BOWFLEX INC.

FORM 8-K

| | | | | | | | |

| Item 1.01 | | Entry into a Material Definitive Agreement. |

The information set forth below under Item 1.03 of this Current Report on Form 8-K regarding the Stalking Horse Asset Purchase Agreement, DIP Amendment, and SLR Credit Agreement (each as defined below) is incorporated herein by reference.

| | | | | | | | |

| Item 1.03 | | Bankruptcy or Receivership. |

Voluntary Petitions for Bankruptcy

On March 4, 2024 (the “Petition Date”), Bowflex Inc. (the “Company” or the “Debtor”) and certain of its subsidiaries (together, the “Company Parties” or the “Debtors”) filed voluntary petitions (the “Bankruptcy Petitions”) for relief under chapter 11 of title 11 of the United States Code 11 U.S.C. §§ 101–1532 (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of New Jersey (the “Bankruptcy Court”), thereby commencing chapter 11 cases for the Company Parties (the “Chapter 11 Cases”). On the Petition Date, the Company Parties filed a motion with the Bankruptcy Court seeking to jointly administer the Chapter 11 Cases under the lead Debtor’s case In re Bowflex Inc., et al., Case No. 24-12364.

The Company Parties will continue to operate their business as debtors in possession under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court. The Company Parties are seeking approval of various “first day” motions with the Bankruptcy Court, requesting customary relief intended to enable them to continue their ordinary course operations and facilitate an orderly transition of their operations into chapter 11. In addition, the Company Parties filed with the Bankruptcy Court a motion seeking approval of the Stalking Horse Asset Purchase Agreement (as defined and described below). The Debtors intend to sell substantially all of their assets during the Chapter 11 Cases.

The Company cannot be certain that holders of the Company’s common stock (the “Common Stock”) will receive any payment or other distribution on account of those shares following the Chapter 11 Cases.

Additional information about the Chapter 11 Cases is available online at httsp://www.dm.epiq11.com/BowFlex. The information on that website is not incorporated by references and does not constitute part of this Current Report on Form 8-K.

Stalking Horse Asset Purchase Agreement

On March 4, 2024, prior to the filing of the Bankruptcy Petitions, the Company entered into a “stalking horse” asset purchase agreement (the “Stalking Horse Asset Purchase Agreement”) with Johnson Health Tech Retail, Inc. (the “Bidder”) to sell the assets of the Company (the “Acquired Assets”) identified in the Stalking Horse Asset Purchase Agreement, representing substantially all of the assets of the Company, for a total of $37,500,000 in cash at the closing of the transaction, including a deposit of $3,750,000 paid into an escrow account on March 4, 2024, but less closing adjustment amounts for accounts receivable, inventory and certain transfer taxes.

Capitalized terms used but not defined herein shall have the meaning ascribed to such terms in the Stalking Horse Asset Purchase Agreement.

The acquisition of the Acquired Assets by the Bidder pursuant to the Stalking Horse Asset Purchase Agreement is subject to approval by the Bankruptcy Court and an auction to solicit higher or otherwise better bids. On March 4, 2024, the Debtors filed a motion (the “Bidding Procedures Motion”) seeking approval of, among other things, bidding procedures (the “Bidding Procedures”), which will establish procedures for the selection of the highest or otherwise best offer(s) for the sale of the Acquired Assets. Other interested bidders would be permitted to participate in the auction if they submit qualifying offers that are higher or otherwise better than the Stalking Horse Asset Purchase Agreement. The Stalking Horse Asset Purchase Agreement acts as a baseline for competitive bids for the acquisition of the Acquired Assets. The Bidding Procedures Motion additionally seeks Bankruptcy Court approval of the Stalking Horse Asset Purchase Agreement and designation of the Bidder as the “stalking horse” bidder for the Acquired Assets. In accordance with the sale process under section 363 of the Bankruptcy Code (the “Sales Process”), notice of the proposed sale to the Bidder will be given to third parties and competing bids will be solicited. The Company will manage the bidding process and evaluate the bids, in consultation with its advisors and as overseen by the Bankruptcy Court.

The Stalking Horse Asset Purchase Agreement contains customary representations and warranties of the parties and is subject to customary closing conditions, including, among others, (i) the accuracy of representations and warranties of the parties; (ii) material compliance with the obligations of the parties set forth in the Stalking Horse Asset Purchase Agreement; and (iii) the delivery of certain customary closing deliverables.

The Stalking Horse Asset Purchase Agreement may be terminated, subject to certain exceptions: (i) by the mutual written consent of the Company and Bidder; (ii) by the Company or Bidder if the closing has not occurred by April 22, 2024; (iii) by the Company if, incident to the Bidding Procedures Order, the Company accepts and closes on a competing bid for the purchase of all or part of the Acquired Assets; (iv) by the Bidder if (a) the Company consummates a sale of all or part of the Acquired Assets to a Third Party other than the Bidder, or (b) the Company’s Bankruptcy Case is dismissed or converted to one under chapter 7 of the Bankruptcy Code; or (v) by either the Company or Bidder for certain material breaches by the other party of its representations and warranties or covenants that remain uncured. Upon termination of the Stalking Horse Asset Purchase Agreement under certain specified circumstances, the Company will be required to forfeit the Deposit of $3,750,000.

In addition to the forfeiture of the Deposit, in the event that Bidder is not selected as the winning bidder in the auction for the Acquired Assets, the Stalking Horse Asset Purchase Agreement requires the Company to reimburse Bidder for up to $600,000 of the Bidder’s expenses incurred in connection with the bid by the Bidder for the Acquired Assets, and to pay a break up fee of 3.5% of the Purchase Price under the Stalking Horse Asset Purchase Agreement.

The foregoing terms of the Stalking Horse Asset Purchase Agreement remain subject to approval by the Bankruptcy Court, is not complete, and is qualified in its entirety by reference to the full text of the Stalking Horse Asset Purchase Agreement, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.1, and is incorporated herein by reference.

DIP Credit Facility

Subject to the approval of the Bankruptcy Court, the Company and Crystal Financial LLC d/b/a SLR Credit solutions (“SLR”) and its affiliates have agreed to amend their existing Term Loan Credit Agreement (such amendment, the “DIP Amendment”), dated as of November 30, 2022, by and among the Company and Nautilus Fitness Canada, Inc., a British Columbia company and subsidiary of the Company, as borrowers (collectively, the “Borrowers”), and SLR, as administrative agent and a lender (as amended, restated, amended and restated, supplemented or modified and otherwise in effect prior to the DIP Amendment, the “Existing SLR Credit Agreement” and, as amended by the DIP Amendment, the “SLR Credit Agreement”), to, among other things, make available to the Borrowers a debtor-in-possession financing in an aggregate amount up to $25 million, comprised of a $9 million revolving commitment and $16 million term loan reflecting the roll-up of the Company’s pre-petition term loans of approximately $16 million with SLR (the “DIP Facility”). Capitalized terms used but not otherwise defined in this “DIP Credit Facility” section shall have the meanings ascribed to such terms in the SLR Credit Agreement.

Interest on revolving loans drawn under the DIP Facility shall accrue at a rate per annum equal to Adjusted Term SOFR plus 8.25%. Loans under the SLR Credit Agreement will mature on the earliest to occur of (x) September 5, 2024 and (y) certain other events related to the Chapter 11 Cases as described in the SLR Credit Agreement. The Borrowers may use the proceeds of the DIP Facility for working capital and general corporate purposes, in each case subject to the Approved Budget. Obligations under the SLR Credit Agreement are guaranteed by certain of the Company’s subsidiaries and secured by a senior, first-priority lien on substantially all of the assets of the Company and certain of its subsidiaries.

The DIP Amendment, among other things, replaces the financial covenants in the Existing SLR Credit Agreement with covenants in respect of Actual Cash Receipts and the Actual Operating Disbursement Amount, in each case as compared to budgeted amounts. The DIP Amendment also decreases certain threshold amounts of certain Events of Default under the Existing SLR Credit Agreement and implements additional negative covenants, milestones and Events of Default related to the Chapter 11 Cases and the Sales Process.

The foregoing description of the DIP Amendment and the SLR Credit Agreement does not purport to be complete and is qualified in its entirety by reference to the full text DIP Amendment, a copy of which will be filed with the U.S Securities and Exchange Commission.

| | | | | | | | |

| Item 203 | | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth under Item 1.03 of this Current Report on Form 8-K regarding the DIP Amendment and SLR Credit Agreement is incorporated herein by reference.

| | | | | | | | |

| Item 7.01 | | Regulation FD Disclosure. |

Press Release

On March 4, 2024, the Company issued a press release announcing, among other things, the commencement of the Chapter 11 Cases. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

The information in this Item 7.01 of the Form 8-K, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Cautionary Statements Regarding Trading in the Company’s Securities

The Company’s securityholders are cautioned that trading in the Company’s Common Stock during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks. Trading prices for the Company’s Common Stock may bear little or no relationship to the actual recovery, if any, by holders thereof in the Company’s Chapter 11 Cases. Accordingly, the Company urges extreme caution with respect to existing and future investments in its Common Stock.

Cautionary Statements Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements (statements which are not historical facts) within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, express or implied forward-looking statements relating to the Company’s statements regarding the process and potential outcomes of the Company’s Chapter 11 Cases, the Company’s expectations regarding the Stalking Horse Asset Purchase Agreement and related bidding procedures and the Bankruptcy Court’s approval thereof, and the Company’s ability to continue to operate as usual during the Chapter 11 Cases. You are cautioned that such statements are not guarantees of future performance and that our actual results may differ materially from those set forth in the forward-looking statements. All of these forward-looking statements are subject to risks and uncertainties that may change at any time. Factors that could cause the Company’s actual expectations to differ materially from these forward-looking statements also include: weaker than expected demand for new or existing products; our ability to timely acquire inventory that meets our quality control standards from sole source foreign manufacturers at acceptable costs; risks associated with current and potential delays, work stoppages, or supply chain disruptions, including shipping delays due to the severe shortage of shipping containers; an inability to pass along or otherwise mitigate the impact of raw material price increases and other cost pressures, including unfavorable currency exchange rates and increased shipping costs; experiencing delays and/or greater than anticipated costs in connection with launch of new products, entry into new markets, or strategic initiatives; our ability to hire and retain key management personnel; changes in consumer fitness trends; changes in the media consumption habits of our target consumers or the effectiveness of our media advertising; a decline in consumer spending due to unfavorable economic conditions; risks related to the impact on our business of the COVID-19 pandemic or similar public health crises; softness in the retail marketplace; availability and timing of capital for financing our strategic initiatives, including being able to raise capital on favorable terms or at all; changes in the financial markets, including changes in credit markets and interest rates that affect our ability to access those markets on favorable terms and the impact of any future impairment. Additional assumptions, risks and uncertainties that could cause actual results to differ materially from those contemplated in these forward-looking statements are described in detail in our registration statements, reports and other filings with the Securities and Exchange Commission, including the “Risk Factors” set forth in our Annual Report on Form 10-K, as supplemented by our quarterly reports on Form 10-Q. Such filings are available on our website or at www.sec.gov. We undertake no obligation to publicly update or revise forward-looking statements to reflect subsequent developments, events, or circumstances, except as may be required under applicable securities laws.

| | | | | | | | |

| Item 9.01 | | Financial Statements and Exhibits. |

| | | | | |

| Exhibit Number | Description |

| Asset Purchase Agreement, by and between Bowflex Inc., Nautilus Fitness Canada, Inc. and Johnson Health Tech Retails, Inc., dated March 4, 2024. |

| Press Release, dated March 4, 2024. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | BOWFLEX INC. |

| | (Registrant) |

| | | |

| March 4, 2024 | | By: | /s/ Aina E. Konold |

| Date | | | Aina E. Konold |

| | | Chief Financial Officer |

| | | (Principal Financial Officer) |

ASSET PURCHASE AGREEMENT

ASSET PURCHASE AGREEMENTBY AND AMONG

BOWFLEX INC.

NAUTILUS FITNESS CANADA, INC.

AND

JOHNSON HEALTH TECH RETAIL, INC.

Dated as of March 4, 2024

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (this “Agreement”) is dated as of March 4, 2024, and entered into by and among BowFlex Inc., a Washington corporation (the “US Seller”), Nautilus Fitness Canada, Inc., a Canadian corporation (the “Canadian Seller” or a “Foreign Seller” and, together with the US Seller, each a “Seller” and collectively, “Sellers”), and Johnson Health Tech Retail, Inc., a Wisconsin corporation (“Purchaser”).

A. Sellers are a global leader in innovative home fitness solutions, including exercise bikes, other cardio equipment, strength training products, and a digital fitness platform (the “Business”).

B. The US Seller plans to file a voluntary petition for relief under Chapter 11 of Title 11 of the United States Code, 11 U.S.C. §§ 101, et seq. (the “Bankruptcy Code”), in the United States Bankruptcy Court for the District of New Jersey (the “Bankruptcy Court”) (the resulting case, the “Bankruptcy Case”).

C. Subject to the terms and conditions of this Agreement, following entry of the Sale Order finding Purchaser as the prevailing bidder at the Auction, Sellers desire to sell, transfer, and assign to Purchaser the Acquired Assets and the Assumed Liabilities, pursuant to the terms and conditions of this Agreement.

D. Sellers and Purchaser have agreed that (i) the sale, transfer and assignment of Acquired Assets and Assumed Liabilities from the US Seller to Purchaser shall be effected pursuant to sections 105, 363 and 365 of the Bankruptcy Code and other applicable provisions of the Bankruptcy Code, the Federal Rules of Bankruptcy Procedure, and the local rules for the Bankruptcy Court, and (ii) the sale, transfer and assignment of Acquired Assets and Assumed Liabilities from the Foreign Seller shall be effected out-of-court and not pursuant to the Bankruptcy Code or any foreign bankruptcy, insolvency, or other proceeding.

NOW, THEREFORE, in consideration of the foregoing premises, the representations, warranties, covenants and agreements contained herein, and certain other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

ARTICLE I

DEFINITIONS

1.1 Definitions.

As used herein, the following terms shall have the following meanings:

“Accounts Receivable” shall mean all accounts receivable of Sellers and other receivables of Sellers (whether or not billed) in the United States and Canada.

“Acquired Assets” means each Seller’s United States and foreign assets as specified on Schedule A hereto.

“Acquisition” has the meaning assigned to that term in the Preamble.

“Adjusted Accounts Receivable” means Accounts Receivable MINUS Accounts Receivable over 150 days past due.

“Agreement” has the meaning assigned to that term in the Preamble.

“Alternative Transaction(s)” shall mean a Third-Party Sale or a Restructuring Transaction.

“Ancillary Agreements” means any certificate, agreement, document or other instrument to be executed and delivered in connection with this Agreement.

“Assigned Contracts” has the meaning assigned to that term in Section 2.1.

“Assumed Liabilities” has the meaning assigned to that term in Section 2.3.

“Assumed Trade Payables” means bona fide trade payables of Seller arising after the date of the Bankruptcy Petition and incurred in the ordinary course of business consistent with past practices through the Closing in respect of goods received or to be received after the date of the Bankruptcy Petition and services rendered or to be rendered after the date of the Bankruptcy Petition.

“Auction” has the meaning assigned to that term in Section 6.4(a).

“Back-up Bidder” has the meaning assigned to that term in Section 6.4(d).

“Bankruptcy Case” has the meaning assigned to that term in the Preamble.

“Bankruptcy Code” has the meaning assigned to that term in the Preamble.

“Bankruptcy Court” has the meaning assigned to that term in the Preamble.

“Bankruptcy Petition” shall mean the voluntary bankruptcy petition expected to be filed by Seller with the Bankruptcy Court initiating the Bankruptcy Case.

“Bidding Procedures Order” has the meaning assigned to that term in Section 6.2.

“Bidding Protections Trigger” has the meaning assigned to that term in Section 6.5(a).

“BowFlex Privacy Policy” means the Privacy Policy of BowFlex Inc., its brands and wholly owned subsidiaries, last updated November 1, 2023.

“Break-Up Fee” has the meaning assigned to that term in Section 6.5(b).

“Business” has the meaning assigned to that term in the Preamble.

“Business Day” means any day on which commercial banking institutions are open for business in Wilmington, Delaware and Taichung, Taiwan.

“Closing” has the meaning assigned to that term in Section 3.1.

“Closing AR Adjustment Amount” means (in the event that actual Adjusted Accounts Receivable at Closing is less than the Accounts Receivable Forecast) the difference between (i) Adjusted Accounts Receivable Forecast (as set forth in Schedule 1.1 attached hereto), and (ii) the actual Adjusted Accounts Receivable as of the Closing Date.

“Closing Cash” means $37.5 million.

“Closing Date” has the meaning assigned to that term in Section 3.1.

“Closing Inventory Adjustment Amount” means (in the event the book value of Inventory at Closing is less than the Closing Inventory Forecast) 80% of the difference between (i) the book value of Inventory at Closing and (ii) the Closing Inventory Forecast.

“Closing Inventory Forecast” means the closing inventory forecast provided by Seller to the Purchaser as of the date hereof and attached as Schedule 1.1 hereof.

“Confidentiality Agreement” has the meaning assigned to that term in Section 8.16.

“Contracts” means all agreements, contracts, leases, consensual obligations, promises or undertakings, whether written or oral, other than Employee Benefit Plans.

“Cure Amounts” means all amounts, costs and expenses required by the Bankruptcy Court to cure all defaults under the Assigned Contracts so that they may be assumed and assigned to Purchaser pursuant to Sections 363 and 365 of the Bankruptcy Code, subject to any negotiated adjustments agreed to by the applicable Assigned Contract counterparty.

“Customer Information” means all customer lists, client lists, and other customer or client data collected pursuant to the BowFlex Privacy Policy (excluding any such information with respect to customers or clients who have elected to opt-out pursuant to the BowFlex Privacy Policy, applicable law or Order of the Bankruptcy Court); provided, that such customer or client data shall be limited to such customers’ or clients’ name, email address, physical address, gender and date of birth.

“Debtor” shall mean Seller collectively.

“Deposit” has the meaning assigned to that term in Section 2.6.

“DIP Obligations” has the meaning assigned to that term in the DIP Order.

“DIP Order” means the means an interim or final order of the Bankruptcy Court approving the US Seller’s post-petition debtor-in-possession credit facility.

“D&O Claims” means all rights, claims, and causes of action against any director, officer, equity holder, or employee of Seller, and all rights, claims, and causes of action under director and officer, fiduciary, and employment practices and similar insurance policies maintained by Seller.

“Employee Benefit Plans” shall mean (i) all “employee benefit plans” (as defined in Section 3(3) of ERISA), including any employee pension benefit plans; (ii) all employment, consulting, non-competition, employee non-solicitation, employee loan or other compensation agreements, (iii) all collective bargaining agreements, and (iv) all bonus or other incentive compensation, equity or equity-based compensation, stock purchase, deferred compensation, change in control, severance, leave of absence, vacation, salary continuation, medical, life insurance or other death benefit, educational assistance, training, service award, Section 125 cafeteria, dependent care, pension, welfare benefit or other material employee or fringe benefit plans, policies, agreements or arrangements, whether written or unwritten, qualified or

unqualified, funded or unfunded and all underlying insurance policies, trusts and other funding vehicles, in each case currently maintained by or as to which Seller has or could reasonably be expected to have any obligation or liability, contingent or otherwise, thereunder for current or former employees, directors or individual consultants of Seller.

“ERISA” shall mean the Employee Retirement Income Security Act of 1974, as amended from time to time, and regulations and formal guidance issued thereunder.

“Escrow Agent” has the meaning assigned to that term in Section 2.6.

“Escrow Agreement” has the meaning assigned to that term in Section 2.6.

“Estate” shall mean the estate of Debtor created by Section 541 of the Bankruptcy Code upon the filing of the Bankruptcy Petition and in connection with the Bankruptcy Case.

“Estate Causes of Action” shall mean any avoidance or recovery action that belongs to or could have been raised by the Debtor or the debtor-in-possession or its Estate under Article 5 of the Bankruptcy Code; and any and all causes of action, defenses, and counterclaims accruing to the Debtor or that is property of its Estate, based upon facts, circumstances and transactions that occurred prior to the Closing Date, except for (i) causes of action that relate to an Assigned Contract, (ii) causes of action relating to the operation of the Acquired Assets, and (ii) causes of action, defenses and counterclaims arising from breaches of warranty relating to the Acquired Assets.

“Excluded Assets” has the meaning assigned to that term in Section 2.2.

“Executory Contracts and Unexpired Leases” has the meaning assigned to that term in Section 2.1.

“Expense Reimbursement” has the meaning assigned to that term in Section 6.5(a).

“GAAP” means generally accepted accounting principles, consistently applied.

“Governmental Authorization” means any consent, franchise, license, registration, permit, order or approval issued, granted, given or otherwise made available by or under the authority of any Governmental Body or pursuant to any Law, including, as the context may require, any declarations or filings with, or expiration of waiting periods imposed by, any such Governmental Body.

“Governmental Body” means any (i) nation, state, county, city, town, borough, village, district or other jurisdiction, (ii) federal, state, local, municipal, foreign or other government, (iii) governmental or quasi-governmental body of any nature (including any agency, branch, department, board, commission, court, tribunal or other entity exercising governmental or quasi-governmental powers), (iv) multinational organization or body, (v) body exercising, or entitled or purporting to exercise, any administrative, executive, judicial, legislative, police, regulatory or taxing authority or power, or (vi) official of any of the foregoing.

“Intellectual Property” means all trademarks, trade names, corporate names, company names, business names, product or brand names, service marks, patents, copyrights (including but not limited to moral rights), and any applications for or registrations of any of the foregoing, works of authorship, know-how, logos, proprietary information, protocols,

schematics, specifications, software, software code (in any form, including source code and executable or object code), subroutines, techniques, user interfaces, URLs, domain names, web sites, works of authorship and other forms of technology (whether or not embodied in any tangible form and including all tangible embodiments of the foregoing, such as instruction manuals, laboratory notebooks, prototypes, samples, studies and summaries) inventions, trade secrets and any other intellectual property or intangible property that are used in the Business (on a worldwide basis without any geographical restrictions) as presently conducted and any rights relating to any of the foregoing.

“Inventory” means all supplies, goods, materials, work in process, inventory and stock in trade owned by Sellers exclusively for use or sale in the ordinary course of Business, but specifically excluding (1) goods which belong to sublessees, licensees or concessionaires of Seller, and (2) goods held by Sellers on memo, on consignment, or as bailee.

“IP Maintenance Capital” means unpaid costs for patent, trademark, copyright and domain name prosecution, renewals and maintenance that were due prior to Closing, which Seller shall report to Purchaser no less than twenty-four (24) hours prior to Closing.

“Law” means any applicable federal, state, provincial, local, municipal, foreign, international, multinational or other constitution, law, ordinance, principle of common law, code, regulation, statute or treaty.

“Liability” means any and all obligations, liabilities, debts and commitments, whether known or unknown, asserted or unasserted, fixed, absolute or contingent, matured or unmatured, accrued or unaccrued, liquidated or unliquidated, due or to become due, whenever or however arising (including, without limitation, whether arising out of any contract or tort based on negligence, strict liability, or otherwise) and whether or not the same would be required by GAAP to be reflected as a liability in financial statements or disclosed in the notes thereto.

“Lien” means any mortgage, deed of trust, lien, pledge, charge, title defect, security interest, pledge, leasehold interest or other legal or equitable encumbrance of any kind.

“Permitted Liens” means (i) Liens arising out of operating leases with third parties to the extent related to an Acquired Asset, and (ii) those Liens set forth on Schedule 1.2.

“Person” means any individual, corporation, partnership, joint venture, trust, association, limited liability company, unincorporated organization, other entity, or governmental body or subdivision, agency, commission or authority thereof.

“Post-Closing Tax Period” means all taxable years or other taxable periods beginning on or after the Closing Date and, with respect to any taxable year or other taxable period beginning before and ending on or after the Closing Date, the portion of such taxable year or period beginning on the Closing Date.

“Pre-Closing Taxes” means all Taxes (other than Transfer Taxes) attributable to the operation of the Business or ownership or operation of the Acquired Assets with respect to any Pre-Closing Tax Period, which shall be calculated in accordance with Section 6.9(c) in the case of any taxable year or other taxable period beginning before and ending on or after the Closing Date

“Pre-Closing Tax Period” means (a) all taxable years or other taxable periods that end before the Closing Date and, (b) with respect to any taxable year or other taxable period

beginning before and ending on or after the Closing Date, the portion of such taxable year or period ending on and including the day before the Closing Date.

“Pro Rata Expenses” means up to $10,000.00 in expenses and costs, consisting of any rent or other occupancy expenses (including utility expenses) or prepaid expenses with respect to any Assigned Contract, in each case, incurred by Seller for the period of the month in which the Closing Date occurs beginning on the first of such month and ending on the Closing Date (for the avoidance of doubt, such proration to be calculated based on the number of days in the month up to, and including the Closing Date, or if such expenses cannot be calculated by day, such other reasonable method as agreed upon by Seller and Purchaser acting in good faith); provided, however, that in the event Purchaser adds any Assigned Contracts after the date of this Agreement, then the cap amount would be adjusted as mutually agreed by Seller and Purchaser. Seller shall deliver to Purchaser a summary of such Pro Rata Expenses (together with reasonable supporting documentation) on or prior to the Closing Date, and Purchaser shall reimburse Seller for such documented expenses within three (3) Business Days of the Closing Date.

“Purchase Price” has the meaning assigned to that term in Section 2.5.

“Purchaser” has the meaning assigned to that term in the Preamble.

“Purchaser Releasing Party” has the meaning assigned to that term in Section 8.12(b).

“Related Claims” has the meaning assigned to that term in Section 8.8

“Restructuring Transaction” means a stand-alone Chapter 11 plan of reorganization under which Seller’s secured lenders receive substantially all equity and debt in the reorganized Seller.

“Sale Order” has the meaning assigned to that term in Section 6.3(a).

“Seller” has the meaning assigned to that term in the Preamble.

“Seller Releasing Party” has the meaning assigned to that term in Section 8.12(a).

“Successful Bidder” has the meaning assigned to that term in the Bidding Procedures Order.

“Tax” or “Taxes” means any federal, state, local, or foreign income, gross receipts, license, payroll, employment, excise, severance, stamp, occupation, premium, windfall profits, environmental, custom duties, capital stock, franchise, profits, withholding, social security (or similar excises), unemployment, disability, ad valorem, real property, personal property, sales, use, transfer, registration, value added, alternative or add-on minimum, estimated, or other tax of any kind whatsoever, including any interest, penalty, or addition thereto, whether disputed or not, by any governmental authority responsible for imposition of any such tax (domestic or foreign).

“Third Party” means a Person other than Purchaser or an Affiliate of Purchaser.

“Third-Party Sale” means a sale of all or substantially all of the Acquired Assets to a Third Party; provided, however, that a Restructuring Transaction shall not constitute a Third-Party Sale.

“Transactions” has the meaning assigned to that term in Section 2.4.

“Transfer Taxes” has the meaning assigned to that term in Section 6.9(a).

“Transferred Employees” has the meaning assigned to that term in Section 6.8(a).

“Trustee” means any trustee or fiduciary appointed to act on behalf of the Debtor or as successor to the Debtor.

“US Accounts Receivable” is set forth in Schedule 1.1 hereto.

ARTICLE II

SALE AND PURCHASE OF ASSETS

2.1 Sale and Purchase of Assets. On the terms and subject to the conditions set forth in this Agreement, on the Closing Date, Purchaser shall purchase from Seller, and Seller shall sell, assign, transfer, convey and deliver to Purchaser, all of Seller’s right, title and interest in the Acquired Assets, to the maximum extent transferable under applicable Law, the Bankruptcy Code or otherwise, as those assets, properties, rights, interests, benefits and privileges exist on the Closing Date, free and clear of any Lien. Without limiting the foregoing, the Acquired Assets shall include all of Seller’s right, title and interest in:

(a) all Contracts, agreements, licenses, leases, warranties, commitments, and purchase and sale orders with respect to personal property, Intellectual Property, real property or otherwise (collectively, “Executory Contracts and Unexpired Leases”), solely to the extent that such Executory Contracts and Unexpired Leases are listed on Schedule 2.1 as designated by Purchaser to be assumed and assigned on the Closing Date in accordance with the Bidding Procedures Order and provided further that Purchaser shall have provided adequate assurance of future performance under Section 365(b)(1)(C) of the Bankruptcy Code with respect to any designated contract (collectively, “Assigned Contracts”), together with the right to receive income in respect of such Assigned Contracts on and after the Closing Date, and any causes of action which may be brought by Seller relating to past or current breaches of the Assigned Contracts; and

(b) the IP Maintenance Capital.

The sale, assignment, transfer, conveyance, and delivery of Acquired Assets and Assumed Liabilities from the US Seller to Purchaser shall be effected pursuant to sections 105, 363 and 365 of the Bankruptcy Code and other applicable provisions of the Bankruptcy Code, the Federal Rules of Bankruptcy Procedure, and the local rules for the Bankruptcy Court, and the sale, assignment, transfer, conveyance, and delivery of Acquired Assets and Assumed Liabilities from the Foreign Seller shall be effected out-of-court and not pursuant to the Bankruptcy Code or any foreign bankruptcy, insolvency, or other proceeding.

2.2 Excluded Assets. Notwithstanding the provisions of Section 2.1 or any other provision of this Agreement, the Acquired Assets do not include, and Seller shall not transfer to Purchaser any of the following assets, properties, rights, interests, benefits and privileges (collectively, the “Excluded Assets”):

(a) all cash, bank deposits, securities and cash equivalents, including for this purpose, all cash and cash equivalents if credited to Seller’s bank accounts prior to or on the Closing Date, other than the IP Maintenance Capital;

(b) all Executory Contracts and Unexpired Leases and the rights associated therewith other than Assigned Contracts;

(c) all corporate minute books and records of internal corporate proceedings, stock transfer ledgers, blank stock certificates, corporate seals, tax and accounting records, work papers and other records relating to the organization or maintenance of the legal existence of Seller;

(d) any books, records or other information related solely and exclusively to the Excluded Assets;

(e) all records that Seller is required by law to retain;

(f) all refunds or credits or deposits of Taxes receivable by Sellers with respect to any Pre-Closing Tax Period, including without limitation any refunds, credits or deposits of Taxes arising as a result of Sellers’ operation of the Business or ownership, operation, utilization or maintenance of the Acquired Assets prior to the Closing Date;

(g) all Estate Causes of Action;

(h) D&O Claims;

(i) all equity interests, or interests convertible into or exchangeable for equity interests, held by Seller (including with respect to subsidiaries);

(j) all claims, cause(s) of action and benefits related to any and all employment agreement(s), Employee Benefit Plans and any arrangement(s) in respect of the foregoing of whatever nature, and including cash and equity;

(k) all assets related to any Employee Benefit Plan; and

(l) all assets, properties and rights identified on Schedule 2.2(l).

Notwithstanding anything to the contrary in Section 2.2 above, Purchaser shall have the right, on reasonable request, to obtain copies of any books, records, documents and information reasonably necessary for the acquisition, operation and disposition of the Acquired Assets.

2.3 Assumed Liabilities. Upon the terms and subject to the conditions set forth herein, at the Closing, Purchaser shall assume and shall timely perform and discharge in accordance with their respective terms, solely: (a) all Liabilities and Cure Amounts with respect to the Assigned Contracts, (b) all Liabilities (including for any Tax) that arise on and after the Closing Date with respect to Purchaser’s ownership or operation of the Acquired Assets on and after the Closing Date, and (c) the Pro Rata Expenses (collectively “Assumed Liabilities”).

2.4 Excluded Liabilities. Purchaser, by its execution and delivery of this Agreement and the Ancillary Agreements and its performance of the transactions contemplated by this Agreement and the Ancillary Agreements (the “Transactions”), shall not assume or otherwise be responsible for any Liability other than the Assumed Liabilities. For clarification, the following Liabilities shall be excluded, without limitation: (a) all post-petition accounts payable and accrued post-petition expenses of Seller for work done in the ordinary course of Business (excluding any expenses incurred with respect to the administration of the Bankruptcy Case) which would qualify as administrative priority expenses under Section 503(b) of the Bankruptcy

Code, (b) all Liabilities with respect to Employee Benefit Plans, (c) all Liabilities for wages, compensation, bonuses, deferred compensation, overtime, profit sharing benefits workers’ compensation, 401(k) matching, sick pay, vacation, personal days and severance benefits for Transferred Employees for periods of service occurring prior to the Closing Date, (d) all Liabilities with respect to Assumed Trade Payables, and (e) all third party litigation expenses, settlement costs and attorneys’ fees of the Seller that arise from or related to its shareholders, employees, suppliers, customers, other bidder(s) and/or government authorities.

2.5 Purchase Price. The aggregate consideration for the sale and transfer of the Acquired Assets (the “Purchase Price”) shall be (a) the Closing Cash, and (b) the assumption by Purchaser of the Assumed Liabilities including payment of the Cure Amounts and the Pro Rata Expenses (which such Pro Rata Expenses may be owed to a Seller). At the Closing, Purchaser shall deliver the Closing Cash MINUS the (i) Deposit, the (ii) Closing AR Adjustment Amount, if any, the (iii) Closing Inventory Adjustment Amount, if any, and (iv) the Sellers’ Transfer Tax Reimbursement, if any, to Seller by wire transfer of immediately available funds to accounts designated in writing by Seller.

2.6 Deposit. On the date of this Agreement, Purchaser (or its affiliate) shall deposit with an escrow agent satisfactory to Purchaser (the “Escrow Agent”) $3,750,000 Dollars, representing ten percent (10%) of the Closing Cash (the “Deposit”), by wire transfer which shall be held in escrow pursuant to the Bidding Procedures Order. Purchaser shall enter into an escrow agreement in such form and substance as shall be reasonably agreed upon by Seller, Purchaser and the Escrow Agent. The Deposit shall be credited against the Closing Cash at the Closing if Purchaser is the Successful Bidder for the Acquired Assets. If this Agreement is terminated, then the Deposit shall be forfeited to Seller as liquidated damages, or returned to Purchaser, as applicable, as provided in Article VII.

2.7 Non-Transferrable Acquired Assets. Notwithstanding any other provision of this Agreement to the contrary, this Agreement shall not constitute an agreement to assign any Acquired Asset or any right thereunder if an attempted assignment, without the consent of a Third Party, would constitute a breach or in any way adversely affect the rights of Purchaser or Seller thereunder. If such consent is not obtained or such assignment is not attainable pursuant to an Order of the Bankruptcy Court, then such Acquired Assets shall not be transferred hereunder, and the Closing shall proceed with respect to the remaining Acquired Assets.

ARTICLE III

CLOSING; CONDITIONS TO CLOSING

3.1 Closing. Subject to the terms and conditions of this Agreement, the closing (the “Closing”) of the sale and purchase of the Acquired Assets and the assumption of the Assumed Liabilities is expected to take place on or before 49 days after the filing of the Bankruptcy Petition (unless otherwise agreed by Seller and Purchaser), at a location to be specified by Seller. The time and date upon which the Closing occurs is referred to herein as the “Closing Date.” All transactions at the Closing shall be deemed to take place simultaneously and none shall be deemed to have taken place until all shall have taken place.

3.2 Court Approval Required. Purchaser and Seller acknowledge and agree that the Bankruptcy Court’s entry of the Sale Order shall be required in order to consummate the Transactions, and that the requirement that the Sale Order be entered is a condition that cannot be waived by any party.

3.3 Conditions to Obligations of Purchaser. The obligation of Purchaser to consummate the transactions contemplated by this Agreement is subject to the satisfaction, at or before the Closing, of each of the following conditions, any of which conditions may, except for the condition set forth in Section 3.2, be waived by Purchaser in its sole discretion:

(a) Representations and Warranties. The representations and warranties of Seller set forth in Article IV of this Agreement shall be true and correct in all material respects on the date hereof and on and as of the Closing Date, as though made on and as of the Closing Date (except for representations and warranties made as of a specified date, which shall be true and correct only as of the specified date).

(b) Agreements and Covenants. Seller shall have performed and complied with each material agreement, covenant and obligation required to be performed or complied with by Seller under this Agreement at or before the Closing in all material respects.

(c) Deliveries at Closing. Purchaser shall have received from Seller duly executed assignments, patent assignments, general trademark assignments, lease assignments, bills of sale or certificates of title, dated as of the Closing Date, in form and substance reasonably satisfactory to Purchaser, whereby Seller will transfer to Purchaser free and clear of any Lien (except Permitted Liens and Assumed Liabilities) all of Seller’s right, title and interest in and to the Acquired Assets.

(d) Consents. All material consents, authorizations, or approvals required to be obtained from any Governmental Authority set forth on Schedule 4.3 shall have been obtained and be in full force.

3.4 Conditions to Obligations of Seller. The obligation of Seller to consummate the Transactions is subject to the satisfaction, at or before the Closing, of each of the following conditions, any of which conditions may, except for the condition set forth in Section 3.2, be waived by Seller in its sole discretion:

(a) Representations and Warranties. The representations and warranties of Purchaser set forth in Article V of this Agreement shall be true and correct in all material respects on the date hereof and on and as of the Closing Date, as though made on and as of the Closing Date (except for representations and warranties made as of a specified date, which shall be true and correct only as of the specified date).

(b) Agreements and Covenants. Purchaser shall have performed and complied with each agreement, covenant and obligation required to be performed or complied with by it under this Agreement at or before the Closing in all material respects.

(c) Receipt of Purchase Price. Seller shall have received (i) the Purchase Price (less the Deposit) from Purchaser and (ii) the Deposit from the Escrow Agent.

(d) Orders. The Bankruptcy Court shall have entered the Sale Order.

(e) Deliveries at Closing. Seller shall have received from Purchaser all fully executed instruments or documents as Seller may reasonably request to effect the transfer of the Acquired Assets and assumption of the Assumed Liabilities and to otherwise consummate the Transactions.

(f) Consents. All consents, authorizations, or approvals required to be obtained from any Governmental Authority set forth on Schedule 4.3 shall have been obtained and be in full force.

3.5 Delivery of Possession of Assets. Right to possession of all Acquired Assets shall transfer to Purchaser at the Closing. Purchaser shall bear all risk of loss with respect to the Acquired Assets from and after the Closing.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF SELLER

Sellers, and each of them, represent and warrant to Purchaser, jointly and severally, that the statements contained in this Article IV are true and correct as of the date hereof and will be true and correct in all material respects on the Closing Date.

4.1 Organization, Good Standing and Power. Such Seller and each of its subsidiaries is validly existing and in good standing under the laws of the jurisdiction of its formation. Subject to the applicable provisions of the Bankruptcy Code, such Seller and each of its subsidiaries has the power to own its properties and carry on its business as now being conducted and is qualified or licensed to do business in each jurisdiction in which the nature of its business or the ownership or leasing of its properties makes such qualification or licensing necessary.

4.2 Authority Relative to this Agreement; Execution and Binding Effect. Such Seller and each of its subsidiaries has full power and authority to execute and deliver this Agreement and the Ancillary Agreements and, subject to receipt of any necessary Bankruptcy Court approval in accordance with the Bankruptcy Code, to consummate the Transactions. The execution and delivery of this Agreement and the Ancillary Agreements and the consummation of the Transactions have been duly and validly approved and adopted by the board of directors or managers, as applicable, of such Seller (and in the case of Canadian Seller only, a resolution of the shareholder) and each of its subsidiaries, and, except for Bankruptcy Court approval or as set forth on Schedule 4.3, no other proceedings or approvals on the part of such Seller or its subsidiaries are necessary to approve this Agreement and the Ancillary Agreements and to consummate the Transactions. This Agreement has been duly and validly executed and delivered by each such Seller. Assuming due authorization, execution and delivery by Purchaser, this Agreement constitutes, and each of the Ancillary Agreements at the Closing will constitute, the valid and binding obligation of Sellers, enforceable against each Seller in accordance with their terms, except as such enforcement may be limited by (a) the effect of bankruptcy, insolvency, reorganization, receivership, conservatorship, arrangement, moratorium or other laws affecting or relating to the rights of creditors generally, or (b) the rules governing the availability of specific performance, injunctive relief or other equitable remedies and general principles of equity, regardless of whether considered in a proceeding in equity or at law.

4.3 Governmental and Other Consents. Except for the receipt of any necessary Bankruptcy Court approval in accordance with the Bankruptcy Code and as set forth on Schedule 4.3, no consent, notice, authorization or approval of, or exemption by, or filing with or notifications to any Governmental Authority or any other Person, whether pursuant to contract or otherwise, is required in connection with the execution and delivery by such Seller of this Agreement and the Ancillary Agreements and the consummation of the Transactions.

4.4 Assets. Such Seller has good and valid title to the Acquired Assets being sold by them. Upon the terms and subject to the conditions contained in this Agreement and subject to

requisite Bankruptcy Court approvals and the terms of the Sale Order, at the Closing, each Seller shall transfer and deliver to Purchaser good and valid title to the Acquired Assets held by them, free and clear of all Liens. Other than as set forth on Schedule 4.4, none of US Seller’s subsidiaries (with the exception of the Canadian Seller) own any of the Acquired Assets or any Intellectual Property.

4.5 IP Litigation. Other than as set forth on Schedule 4.5, there are no pending and threatened claims in respect of or challenges (including oppositions) to the validity of any Intellectual Property of the Seller.

ARTICLE V

REPRESENTATIONS AND WARRANTIES OF PURCHASER

Purchaser represents and warrants to Seller that the statements contained in this Article V are true and correct as of the date hereof and will be true and correct in all material respects on the Closing Date.

5.1 Organization, Good Standing and Power. Purchaser is validly existing and in good standing under the laws of the state of its formation. Purchaser has the power to own its properties and carry on its business as now being conducted and is qualified or licensed to do business in each jurisdiction in which the nature of its business or the ownership or leasing of its properties makes such qualification or licensing necessary.

5.2 Authority Relative to this Agreement; Execution and Binding Effect. Purchaser has full power and authority to execute and deliver this Agreement and the Ancillary Agreements and to consummate the Transactions. The execution and delivery of this Agreement and the Ancillary Agreements and the consummation of the Transactions have been duly and validly approved and adopted by all necessary action of Purchaser and no other proceedings or approvals (shareholder, member or otherwise) on the part of Purchaser are necessary to approve this Agreement and the Ancillary Agreements and to consummate the Transactions. This Agreement has been duly and validly executed and delivered by Purchaser. Assuming due authorization, execution and delivery by Seller, this Agreement constitutes, and each of the Ancillary Agreements at the Closing will constitute, the valid and binding obligation of Purchaser, enforceable against Purchaser in accordance with their terms.

5.3 Governmental and Other Consents. No consent, notice, authorization or approval of, or exemption by, or filing with or notifications to any Governmental Authority or any other Person, whether pursuant to contract or otherwise, is required in connection with the execution and delivery by Purchaser of this Agreement and the Ancillary Agreements and the consummation of the Transactions.

5.4 Financial Ability. Purchaser and its affiliates have cash available that is sufficient to enable it to pay the Deposit and the Purchase Price and all other amounts otherwise payable to consummate the Transactions pursuant to and in accordance with this Agreement.

ARTICLE VI

COVENANTS

6.1 Operation of Business. Subject to the requirements of, and the obligations imposed upon, US Seller as debtor-in-possession and pursuant to the Bankruptcy Code and except as otherwise contemplated by this Agreement or the Bidding Procedures Order or as

required to comply with the debtor-in-possession financing obtained by Seller and except for any usual and customary disruptions that may occur as a result of the filing of the Bankruptcy Case, Sellers shall operate the Business in the ordinary course; and consistent with such operation, shall use commercially reasonable efforts to maintain the goodwill associated with the Business, prevent the impairment and degradation of the value of the Acquired Assets, and maintain relationships with the employees, customers and suppliers of the Business.

6.2 Bidding Procedures and Orders. The purchase and sale of the Acquired Assets from the US Seller will be subject to competitive bidding in accordance with the terms of the order approving the sale and bidding procedures entered by the Bankruptcy Court (the “Bidding Procedures Order”).

6.3 Sale Order.

(a) Prior to the Closing, and subject to the provisions of this Agreement, Purchaser and US Seller shall use their commercially reasonable efforts to obtain entry of an order or orders by the Bankruptcy Court pursuant to Sections 363 and 365 of the Bankruptcy Code (the “Sale Order”), which shall approve of this Agreement and the transactions described herein, and which shall be (1) in form and substance reasonably acceptable to the Purchaser and (2) contain the following provisions in terms reasonably acceptable to the parties (it being understood that certain of such provisions may be contained in either the findings of fact or conclusions of law to be made by the Bankruptcy Court as part of the Sale Order):

(i) that US Seller may sell, transfer and assign the Acquired Assets and assume and assign the Assigned Contracts to Purchaser pursuant to this Agreement and Bankruptcy Code, as applicable;

(ii) the transfers of the Acquired Assets by US Seller to Purchaser (A) vest or will vest Purchaser with all right, title and interest of US Seller in and to the Acquired Assets, free and clear of all Liens (except for the Assumed Liabilities and Permitted Liens), and (B) constitute transfers for reasonably equivalent value and fair consideration under the Bankruptcy Code;

(iii) the transactions contemplated by this Agreement are undertaken by Purchaser and US Seller at arm’s length, without collusion and in good faith within the meaning of Section 363(m) of the Bankruptcy Code, and the Purchaser and US Seller is entitled to the protections of Section 363(m) of the Bankruptcy Code;

(iv) a determination that selling the Acquired Assets free and clear of all Liens is in the best interest of the US Seller’s Estate.

(b) If the Sale Order or any other orders of the Bankruptcy Court relating to this Agreement shall be appealed by any person (or a petition for certiorari or motion for rehearing or reargument shall be filed with respect thereto), each party hereto agrees to use commercially reasonable efforts to obtain an expedited resolution of such appeal; provided, however, that nothing herein shall preclude the parties hereto from consummating the Transactions if the Sale Order shall have been entered and has not been stayed in which event Purchaser shall be able to assert the benefits of Section 363(m) of the Bankruptcy Code.

6.4 Overbid Procedures; Adequate Assurance.

(a) US Seller and Purchaser acknowledge that this Agreement and the sale of the Acquired Assets by the US Seller is subject to Bankruptcy Court approval. Purchaser and US Seller acknowledge that the US Seller must take reasonable steps to demonstrate that it has sought to obtain the highest or otherwise best price for the Acquired Assets, including giving notice thereof to the creditors of the US Seller and other interested parties, providing information about the Business to prospective bidders, entertaining higher and better offers from such prospective bidders, and, in the event that additional qualified prospective bidders desire to bid for the Acquired Assets, conducting an auction (the “Auction”) for purposes of determining the highest or otherwise best price for the Acquired Assets. US Seller further acknowledges that “best price” may not necessarily equal the “highest price.”

(b) The bidding procedures to be employed with respect to this Agreement and any Auction shall be those set forth in the Bidding Procedures Order. Purchaser agrees to be bound by and accept the terms and conditions of the Bidding Procedures Order as approved by the Bankruptcy Court. Purchaser agrees and acknowledges that the US Seller may continue soliciting inquiries, proposals or offers for the Acquired Assets in connection with any alternative transaction pursuant to the terms of the Bidding Procedures Order, and agrees and acknowledges that the bidding procedures contained in the Bidding Procedures Order may be supplemented by other customary procedures not inconsistent with the matters otherwise set forth therein and the terms of this Agreement, subject to advance notice to Purchaser to the extent practicable. For clarification, the US Seller and Purchaser agree that, subject to the Bidding Procedures Order, Purchaser shall have the right to participate in the Auction, and to change the terms and conditions of its bid in any and all overbid procedures.

(c) If an Auction is conducted, and Purchaser is not the prevailing bidder at the Auction but is the next highest bidder at the Auction, Purchaser shall serve as a back-up bidder (the “Back-Up Bidder”) and keep Purchaser’s bid to consummate the Transactions on the terms and conditions set forth in this Agreement (as the same may be improved upon in the Auction) open and irrevocable, notwithstanding any right of Purchaser to otherwise terminate this Agreement pursuant to Article VII. Following the Sale Hearing, if the prevailing bidder in the Auction fails to consummate the Third-Party Sale as a result of a breach or failure to perform on the part of such prevailing bidder and the purchase agreement with such prevailing bidder is terminated, the Back-Up Bidder (as the next highest bidder at the Auction) will be deemed to have the new prevailing bid, and the US Seller will be authorized, without further order of the Bankruptcy Court, to consummate the Transactions on the terms and conditions set forth in this Agreement (as the same may be improved upon in the Auction) with the Back-Up Bidder so long as Purchaser has not previously terminated this Agreement in accordance with its terms.

(d) Purchaser shall provide adequate assurance as required under the Bankruptcy Code of the future performance by Purchaser of each Assigned Contract. Purchaser agrees that it will, and will cause its Affiliates to, promptly take all actions reasonably required to assist in obtaining a Bankruptcy Court finding that there has been an adequate demonstration of adequate assurance of future performance under the Assigned Contracts, including furnishing affidavits, non-confidential financial information and other reasonable documentation or information for filing with the Bankruptcy Court and making Purchaser’s Representatives available to testify as to such adequate assurance before the Bankruptcy Court.

(e) The US Seller and Purchaser agree, and relevant Bankruptcy Court filings shall reflect the fact that the provisions of this Agreement, including this Section and Section 6.5, are reasonable, were a material inducement to Purchaser to enter into this Agreement and are designed to achieve the highest and best price for the Acquired Assets.

(f) Nothing in this Agreement, including this Section, shall require any director or officer of either Seller to violate their fiduciary duties to such Seller. No action or inaction on the part of any director or officer of either Seller that such director or officer reasonably believes is required by their fiduciary duties to such Seller shall be limited or precluded by this Agreement; provided, however, that no such action or inaction shall prevent Purchaser from exercising any termination rights it may have hereunder as a result of such action or inaction.

6.5 Expense Reimbursement; Break-Up Fee. Sellers acknowledge that Purchaser made a substantial investment of management time and incurred substantial out-of-pocket expenses in connection with negotiation and execution of the Agreement, its due diligence of the Business, the Acquired Assets and the Assumed Liabilities in Purchaser’s effort to consummate the Transactions contemplated hereby, and Purchaser’s efforts have substantially benefitted Sellers and will benefit the Sellers and the bankruptcy estate of the US Seller through the submission of the offer that is reflected in this Agreement and that will serve as the minimum bid as to which other potential bidders may rely, thus increasing the likelihood that the price at which the Acquired Assets are sold would be maximized. In consideration thereof, and as compensation for the value provided to Sellers sand the Estate of the US Seller, the Sellers agree to the following:

(a) If (i) an Auction takes place and Purchaser is not identified as the Successful Bidder, (ii) at the time the Successful Bidder is identified, Purchaser is not in material breach of this Agreement (or, in the event that Purchaser is identified as the Back-Up Bidder, Purchaser is not in material breach of this Agreement at the time the Expense Reimbursement would otherwise be payable), (iii) Purchaser has not terminated this Agreement (other than in accordance with Section 7.1(d)), and (iv) any Alternative Transaction is consummated (collectively, the “Bid Protections Trigger”), then, Purchaser will be entitled to receive from Sellers, subject to an Order of the Bankruptcy Court authorizing such payment by the US Seller, an amount in cash equal to the reasonable and documented out-of-pocket expenses incurred by Purchaser in connection with its negotiation and consummation of the Transactions, which amount shall not exceed six hundred thousand dollars ($600,000) in the aggregate (the “Expense Reimbursement”).

(b) In addition to any payments that may be due pursuant to Subsection (a) above, in the event of the occurrence of the Bid Protections Trigger, the Sellers shall also, and subject to an Order of the Bankruptcy Court authorizing such payment by the US Seller, pay to Purchaser a fee in an amount equal to three and a half percent (3.5%) of the Purchase Price (the “Break-Up Fee”).

(c) If the Expense Reimbursement and the Break-Up Fee become payable pursuant to subsections (a) and (b) above, such Expense Reimbursement and payment of the Break-Up Fee shall be made by wire transfer of immediately available funds to an account designated by Purchaser, and such payment shall be made on the closing date of any Alternative Transaction. The claim of Purchaser in respect of the Expense Reimbursement and the Break-Up Fee (which shall not require further Bankruptcy Court approval) shall survive termination of this Agreement and shall constitute a super-priority administrative expense claim, senior to all other administrative expense claims of Seller, as administrative expenses under Sections 503 and 507(b) of the Bankruptcy Code in the Bankruptcy Case (except those administrative expenses granted to the lenders under the Debtors’ post-petition debtor in possession financing facility and the adequate protection claims of the lenders under the pre-petition credit facilities).

(d) For the avoidance of doubt, (i) no Expense Reimbursement or Break-Up Fee shall be payable, and Purchaser shall not seek payment of any Expense Reimbursement or Break-Up Fee, prior to consummation of a Third-Party Sale and (iii) in no event shall Seller be obligated to pay the Expense Reimbursement or Break-Up Fee on more than one occasion.

(e) the US Seller shall file and seek entry of orders by the Bankruptcy Court approving the Expense Reimbursement and the Break-Up Fee as set forth herein.

(f) Each of the Parties acknowledges and agrees that: (i) the agreements contained in this Section are an integral part of the Transactions and this Agreement; (ii) the Break-Up Fee is not a penalty, but rather liquidated damages in a reasonable amount that will reasonably compensate Purchaser in the circumstances in which such Break-Up Fee is payable for the efforts and resources expended and opportunities foregone by Purchaser while negotiating and pursuing the Transactions and this Agreement and in reasonable reliance on this Agreement and on the reasonable expectation of the consummation of the transactions contemplated hereby, which amount would otherwise be impossible to calculate with precision; and (iii) the Break-Up Fee and Expense Reimbursement shall be Purchaser’s sole recourse in connection with this Agreement and the Ancillary Agreements in the event this Agreement is terminated prior to the Closing.

6.6 Access to Facilities, Personnel, and Information.

(a) Prior to the Closing, Sellers shall permit representatives of Purchaser to have reasonable access during regular business hours and upon reasonable notice, and in a manner so as not to interfere with the normal business operations of Sellers, to all premises, property, books, records (including Tax records), Contracts, and documents of or pertaining to the Business (provided that any representatives of Purchaser shall be subject to the confidentiality obligations under the Confidentiality Agreement or otherwise agree in writing to be bound by the terms of such Confidentiality Agreement applicable to Purchaser thereunder) and Acquired Assets. If requested, Purchaser shall be permitted to conduct a physical inspection of Inventory within 10 business days of the Closing.

(b) From the Closing Date through and including the seventh (7th) anniversary of the Closing Date, Purchaser shall grant Sellers, the Trustee, and their respective representatives reasonable access to the books and records transferred to Purchaser pursuant to this Agreement during regular business hours and upon reasonable notice for the purpose of allowing Sellers or its successors, the Trustee or their respective representatives to perform the duties necessary for the liquidation of the Debtor’s Estate, in the case of the US Seller, or of the remaining assets of the Foreign Seller, in the case of the Foreign Seller. To the extent reasonably required by Sellers, Purchaser shall make one or more of the Transferred Employees available to each Seller to assist in such Seller’s wind-down of its Estate or the Foreign Seller, as applicable, provided that such access does not unreasonably interfere with the conduct of the Business by Purchaser.

6.7 Further Assurances. Purchaser and Sellers shall use commercially reasonable efforts to take such further actions and execute such other documents as may be reasonably required to fulfill the conditions to Closing and, after Closing, to fully effect the transactions contemplated by this Agreement and the Ancillary Agreements and further secure to each party the rights intended to be conferred hereby and thereby; provided, however, that nothing in this Section shall prohibit Sellers or their Affiliates from ceasing operations or winding up its affairs following the Closing. Purchaser shall use commercially reasonable efforts to cooperate with Sellers and provide US Seller with information reasonably sufficient to enable Seller to

demonstrate adequate assurance of future performance (as required by Section 365 of the Bankruptcy Code) as to Purchaser.

6.8 Employee Matters.

(a) Purchaser reserves the right to make offers of employment with or to provide consulting services to Purchaser or an affiliate of Purchaser to certain employees of Seller, effective only as of the Closing, and subject to Purchaser’s right to interview such Seller employees and require successful completion of customary employee background checks and drug testing prior to offering employment to any such employee (such employees who are hired or retained by Purchaser or an affiliate, the “Transferred Employees”). Within two (2) Business Days following entry of the Sale Order finding Purchaser as the prevailing bidder at the Auction, Purchaser shall begin interviews with Seller employees for the purpose of determining whether to offer such Seller employees post-Closing employment or the opportunity to provide post-Closing consulting services. Seller shall terminate the employment of all Transferred Employees as of immediately prior to the Closing and reasonably assist Purchaser in effecting the change of employment or service of the Transferred Employees as of the Closing in an orderly fashion. Purchaser’s obligations under this Agreement are not conditioned upon any particular employees agreeing to employment with or to provide consulting services to Purchaser. All claims and liabilities, of whatever nature, arising from any relationship between the Seller (and its affiliates), on the one hand, and any of the Transferred Employees, on the other hand, including any unpaid compensation and several obligations, shall be the sole responsibility of the Seller. The parties acknowledge that Seller may choose to send WARN Act notices to some or all of the employees of the Seller and its subsidiaries, at any time deemed appropriate by the Seller.

(b) Nothing in this Agreement shall constitute any commitment, Contract or understanding (expressed or implied) of any obligation on the part of Purchaser to a post-Closing employment relationship of any fixed term or duration or upon any terms or conditions other than those that Purchaser may establish pursuant to individual offers of employment. Nothing in this Agreement shall be deemed to prevent or restrict in any way the right of Purchaser to terminate, reassign, promote or demote any of the Transferred Employees after the Closing or to change adversely or favorably the title, powers, duties, responsibilities, functions, locations, salaries, future benefits, other compensation or terms or conditions of Purchaser’s employment of such employees.

(c) If any of the arrangements described in this Section are determined by any Governmental Body to be prohibited by applicable Law, Purchaser and Seller shall modify such arrangements to as closely as possible reflect their expressed intent and retain the allocation of economic benefits and burdens to the parties contemplated herein in a manner that is not prohibited by applicable Law.

(d) Notwithstanding anything in this Section to the contrary, nothing contained herein, whether express or implied, shall be treated as an amendment or other modification of any Employee Benefit Plan or employee benefit plan maintained by Purchaser or any of its affiliates, or shall limit the right of Purchaser to amend, terminate or otherwise modify any Employee Benefit Plan or employee benefit plan maintained by Purchaser or any of its affiliates following the Closing Date. If (i) a party other than the parties hereto makes a claim or takes other action to enforce any provision in this Agreement as an amendment to any Employee Benefit Plan or employee benefit plan maintained by Purchaser or any of its affiliates, and (ii) such provision is deemed to be an amendment to such Employee Benefit Plan or employee benefit plan maintained by Purchaser or any of its affiliates even though not explicitly designated as such in this Agreement, then, solely with respect to the Employee Benefit Plan or employee

benefit plan maintained by Purchaser or any of its affiliates at issue, such provision shall lapse retroactively and shall have no amendatory effect with respect thereto.

6.9 Tax Matters.

(a) All sales, use, transfer, stamp, conveyance, value added or other similar Taxes, duties, excises or governmental charges imposed by any Tax authority, domestic or foreign, and all recording or filing fees, notarial fees and other similar costs of Closing (“Transfer Taxes”) will be borne by Purchaser and the Purchase Price is exclusive of Transfer Taxes. All unpaid Pre-Closing Taxes shall be borne by the Seller. If any Seller is required by Law to collect any Transfer Taxes from Purchaser, Purchaser shall pay such Transfer Taxes to the applicable Seller concurrent with the payment of any amount payable pursuant to this Agreement. The applicable Seller shall remit all Transfer Taxes to the relevant Governmental Body in accordance with applicable Law. If Purchaser is required to collect any Transfer Taxes from either Seller or such Seller has not paid any Transfer Taxes it is obligated to pay, such Seller shall pay such Transfer Taxes to the Purchaser concurrent with the payment of any amount payable pursuant to this Agreement, or Purchaser may deduct such Transfer Taxes from the Closing Cash (the “Sellers’ Transfer Tax Reimbursement”).

(b) Purchaser and Seller shall negotiate in good faith, on or prior to the Closing Date, an allocation of the Purchase Price among the Acquired Assets. Purchaser and Seller shall each file all Tax returns (and IRS Form 8594, if applicable) on the basis of such agreed upon allocation, as it may be amended, and no party shall thereafter take a Tax return position inconsistent with such allocation unless such inconsistent position shall arise out of or through an audit or other inquiry or examination by the Internal Revenue Service or other Governmental Body responsible for Taxes.

(c) For purposes of this Agreement, with respect to Taxes attributable to any taxable year or other taxable period beginning before and ending on or after the Closing Date, (i) Taxes imposed on a periodic basis in respect of the Acquired Assets (such as property taxes) shall be allocated between the Pre-Closing Tax Period and the Post-Closing Tax Period pro rata on the basis of the number of days in such period, and (ii) Taxes (other than periodic Taxes) in respect of the Acquired Assets for the Pre-Closing Tax Period shall be computed as if such taxable period ended as of the end of day before the Closing Date.

(d) If applicable, Canadian Seller and Purchaser shall, as soon as possible after the Closing Date, jointly execute an election in prescribed form under section 22 of the Income Tax Act (Canada) with respect to the sale of the Accounts Receivable and shall designate therein the portion of the Purchase Price allocated to the Accounts Receivable from Canadian Seller in the allocation provided for in Section 6.9(b) as consideration paid by Purchaser for such Accounts Receivable. Canadian Seller and Purchaser shall each file such election (and any documentation necessary or desirable to give effect thereto) forthwith after the execution thereof (and, in any event, with their respective Tax returns for the taxation year in which the Closing Date occurs).