- Total Worldwide Sales Were $16.7 Billion, an Increase of 4%

From Third Quarter 2023; Excluding the Impact of Foreign Exchange,

Growth Was 7%

- KEYTRUDA Sales Grew 17% to $7.4 Billion; Excluding the Impact

of Foreign Exchange, Sales Grew 21%

- WINREVAIR Sales Were $149 Million; U.S. Launch of WINREVAIR

Gaining Momentum; Received Approval in the EU

- Animal Health Sales Grew 6% to $1.5 Billion; Excluding the

Impact of Foreign Exchange, Sales Grew 11%

- GAAP EPS Was $1.24; Non-GAAP EPS Was $1.57; GAAP and Non-GAAP

EPS Include a Net Charge of $0.79 per Share Related to Certain

Business Development Transactions

- Achieved Significant Milestones in Vaccine Programs

- CAPVAXIVE Recommended by the CDC’s ACIP for Pneumococcal

Vaccination in Adults 50 Years of Age and Older

- Presented Positive Results From Clinical Studies Evaluating

Clesrovimab (MK-1654), an Investigational RSV Preventative

Monoclonal Antibody for Infants Entering Their First RSV

Season

- Data Presented for Four Approved Medicines and Six Pipeline

Candidates in More Than 20 Types of Cancer at ESMO Congress 2024,

Including Overall Survival Data From KEYNOTE-522 and

KEYNOTE-A18

- Completed Acquisition of Investigational B-Cell Depletion

Therapy, CN201 (MK-1045), From Curon Biopharmaceutical

- Full-Year 2024 Financial Outlook

- Narrows Expected Worldwide Sales Range To Be Between $63.6

Billion and $64.1 Billion

- Now Expects Non-GAAP EPS To Be Between $7.72 and $7.77; Outlook

Reflects a Net Negative Impact of $0.24 per Share Related to

Business Development Transactions With Curon Biopharmaceutical and

Daiichi Sankyo

Merck (NYSE: MRK), known as MSD outside the United States and

Canada, today announced financial results for the third quarter of

2024.

“Our third-quarter results were strong, as we continue to make

progress heading into 2025 and beyond," said Robert M. Davis,

chairman and chief executive officer, Merck. "Our pipeline is

advancing and expanding, demonstrating our success in creating a

sustainable innovation engine, and positioning Merck with a more

diversified portfolio to drive growth. I continue to remain

confident in the strength of our business and our ability to

execute, and I want to thank our colleagues across the globe for

their focus and commitment as we work to create lasting value for

patients, shareholders and all our stakeholders.”

Financial Summary

$ in millions, except EPS amounts

Third Quarter

2024

2023

Change

Change Ex-

Exchange

Sales

$16,657

$15,962

4%

7%

GAAP net income1

3,157

4,745

-33%

-30%

Non-GAAP net income that excludes certain

items1,2*

3,985

5,427

-27%

-23%

GAAP EPS

1.24

1.86

-33%

-30%

Non-GAAP EPS that excludes certain

items2*

1.57

2.13

-26%

-23%

*Refer to table on page 7.

In the third quarter of 2024, total worldwide sales were $16.7

billion, an increase of 4% compared with the third quarter of 2023;

excluding the impact of foreign exchange, growth was 7%. Sales

growth in the third quarter of 2024 was primarily due to increased

usage of KEYTRUDA globally, contributions from new launches,

including WINREVAIR and CAPVAXIVE, and strong growth in Merck’s

Animal Health business. Revenue growth in the third quarter of 2024

was partially offset by lower sales of JANUVIA and JANUMET, lower

combined sales of GARDASIL/GARDASIL 9 and lower sales of LAGEVRIO.

Third-quarter GARDASIL/GARDASIL 9 sales declined year-over-year due

to reduced demand in China; outside of China, the company achieved

double-digit sales growth for GARDASIL/GARDASIL 9 in almost every

major region globally.

For the third quarter of 2024, Generally Accepted Accounting

Principles (GAAP) earnings per share (EPS) assuming dilution was

$1.24 and non-GAAP EPS was $1.57. The declines in GAAP and Non-GAAP

EPS in the third quarter of 2024 versus the prior year were largely

due to a net charge of $0.79 per share in the aggregate for the

acquisition of Eyebiotech Limited (EyeBio) and a related

development milestone, the acquisition of CN201 (now known as

MK-1045) from Curon Biopharmaceutical (Curon), as well as a payment

received from Daiichi Sankyo related to the expansion of the

existing development and commercialization agreement. There were no

significant business development transaction charges in the third

quarter of 2023.

Non-GAAP EPS in both periods excludes acquisition- and

divestiture-related costs, costs related to restructuring programs,

as well as income and losses from investments in equity

securities.

Year-to-date results can be found in the attached tables.

Third-Quarter Sales

Performance

The following table reflects sales of the company’s top products

and significant performance drivers.

Third Quarter

$ in millions

2024

2023

Change

Change Ex- Exchange

Commentary

Total Sales

$16,657

$15,962

4%

7%

Approximately 2 percentage points of the

negative impact of foreign exchange was due to devaluation of

Argentine peso, which was largely offset by inflation-related price

increases, consistent with practice in that market.

Pharmaceutical

14,943

14,263

5%

8%

Increase driven by growth in oncology and

cardiovascular, partially offset by declines in diabetes, vaccines

and virology.

KEYTRUDA

7,429

6,338

17%

21%

Growth driven by increased global uptake

in earlier-stage indications, including triple-negative breast

cancer (TNBC), renal cell carcinoma (RCC) and non-small cell lung

cancer (NSCLC), as well as continued strong global demand from

metastatic indications. Approximately 3 percentage points of the

negative impact of foreign exchange was due to devaluation of

Argentine peso, which was largely offset by inflation-related price

increases.

GARDASIL/GARDASIL 9

2,306

2,585

-11%

-10%

Decline primarily due to lower demand in

China compared with prior year, partially offset by higher sales in

the U.S., driven by public-sector buying patterns, higher pricing

and demand, as well as higher demand in most international

regions.

PROQUAD, M-M-R II and VARIVAX

703

713

-1%

-1%

Decline primarily due to timing of

shipments and lower tenders in Latin America, largely offset by

higher demand in certain international markets.

JANUVIA/JANUMET

482

835

-42%

-38%

Decline primarily due to lower pricing in

the U.S., as well as ongoing generic competition in many

international markets.

BRIDION

420

424

-1%

0%

Relatively flat compared with prior year

due to generic competition in certain international markets,

particularly in Europe and Japan, largely offset by higher demand

and pricing in the U.S.

LAGEVRIO

383

640

-40%

-36%

Decline primarily due to lower demand in

Japan, partially offset by uptake from commercial launch in the

U.S.

Lynparza*

337

299

13%

13%

Growth primarily due to higher global

demand.

Lenvima*

251

260

-3%

-4%

Decline primarily due to timing of

shipments in China in the prior year, partially offset by higher

demand in the U.S.

VAXNEUVANCE

239

214

12%

13%

Growth largely driven by continued uptake

from launches in Europe and Japan, partially offset by lower demand

in the U.S. due to competition.

PREVYMIS

208

157

32%

36%

Growth primarily due to higher global

demand, particularly in the U.S.

ROTATEQ

193

156

24%

25%

Growth primarily due to public-sector

buying patterns in the U.S. and timing of shipments in China.

WINREVAIR

149

-

-

-

Represents continued uptake since launch

in the U.S. in the second quarter.

WELIREG

139

54

156%

157%

Growth primarily driven by higher demand

in the U.S., largely attributable to ongoing uptake of a new

indication.

Animal Health

1,487

1,400

6%

11%

Growth primarily driven by higher demand

and pricing for both Companion Animal and Livestock product

portfolios, as well as sales related to July 2024 acquisition of

Elanco aqua business. Approximately 2 percentage points of the

negative impact of foreign exchange was due to devaluation of

Argentine peso, which was largely offset by inflation-related price

increases.

Livestock

886

874

1%

7%

Growth primarily driven by higher pricing

and higher demand for poultry and swine products, as well as sales

related to acquisition of Elanco aqua business.

Companion Animal

601

526

14%

17%

Growth primarily driven by uptake from new

product launches, including the injectable formulation of BRAVECTO

in certain international markets, as well as higher pricing across

product portfolio. Sales of BRAVECTO were $266 million and $235

million in current and prior year quarters, respectively, which

represented growth of 13%, or 16% excluding impact of foreign

exchange.

Other Revenues**

227

299

-24%

-22%

Decline primarily due to lower payments

received for out-licensing arrangements and lower royalty

income.

*Alliance revenue for this

product represents Merck’s share of profits, which are product

sales net of cost of sales and commercialization costs. **Other

revenues are comprised primarily of revenues from third-party

manufacturing arrangements and miscellaneous corporate revenues,

including revenue-hedging activities.

Third-Quarter Expense, EPS and Related

Information

The table below presents selected expense information.

$ in millions

GAAP

Acquisition- and Divestiture-

Related Costs3

Restructuring Costs

(Income) Loss From Investments

in Equity Securities

Non- GAAP2

Third Quarter 2024

Cost of sales

$4,080

$639

$192

$-

$3,249

Selling, general and administrative

2,731

43

31

-

2,657

Research and development

5,862

24

-

-

5,838

Restructuring costs

56

-

56

-

-

Other (income) expense, net

(162)

(27)

-

58

(193)

Third Quarter 2023

Cost of sales

$4,264

$552

$33

$-

$3,679

Selling, general and administrative

2,519

17

40

-

2,462

Research and development

3,307

10

-

-

3,297

Restructuring costs

126

-

126

-

-

Other (income) expense, net

126

(24)

-

17

133

GAAP Expense, EPS and Related

Information

Gross margin was 75.5% for the third quarter of 2024 compared

with 73.3% for the third quarter of 2023. The increase was

primarily due to the favorable impact of product mix (including

lower royalty rates related to KEYTRUDA and GARDASIL/GARDASIL 9),

partially offset by higher restructuring costs (primarily

reflecting asset impairment charges), as well as higher

amortization of intangible assets.

Selling, general and administrative (SG&A) expenses were

$2.7 billion in the third quarter of 2024, an increase of 8%

compared with the third quarter of 2023. The increase was primarily

due to higher administrative, promotional, selling, and

acquisition-related costs, partially offset by the favorable impact

of foreign exchange.

Research and development (R&D) expenses were $5.9 billion in

the third quarter of 2024, an increase of 77% compared with the

third quarter of 2023. The increase was primarily due to a charge

of $1.35 billion for the acquisition of EyeBio and a $100 million

charge for a related development milestone, as well as a charge of

$750 million to acquire CN201 (MK-1045) from Curon. The increase in

R&D expenses was also driven by higher compensation and benefit

costs, as well as higher clinical development spending. The

increase in R&D expenses was partially offset by the favorable

impact of foreign exchange.

Other (income) expense, net, was $162 million of income in the

third quarter of 2024 compared with $126 million of expense in the

third quarter of 2023. The favorability was primarily due to a $170

million payment received from Daiichi Sankyo related to the

expansion of the existing development and commercialization

agreement, lower exchange losses and lower net interest

expense.

The effective tax rate of 22.7% for the third quarter of 2024

includes a 7.2 percentage point combined unfavorable impact related

to the EyeBio and Curon transactions.

GAAP EPS was $1.24 for the third quarter of 2024 compared with

$1.86 for the third quarter of 2023. GAAP EPS in the third quarter

of 2024 includes a net charge of $0.79 per share in the aggregate

for the EyeBio, Curon and Daiichi Sankyo transactions. There were

no significant business development transaction charges in the

third quarter of 2023.

Non-GAAP Expense, EPS and Related

Information

Non-GAAP gross margin was 80.5% for the third quarter of 2024

compared with 77.0% for the third quarter of 2023. The increase was

primarily due to the favorable impact of product mix (including

lower royalty rates related to KEYTRUDA and GARDASIL/GARDASIL

9).

Non-GAAP SG&A expenses were $2.7 billion in the third

quarter of 2024, an increase of 8% compared with the third quarter

of 2023. The increase was primarily due to higher administrative,

promotional and selling costs, partially offset by the favorable

impact of foreign exchange.

Non-GAAP R&D expenses were $5.8 billion in the third quarter

of 2024, an increase of 77% compared with the third quarter of

2023. The increase was primarily due to a charge of $1.35 billion

for the acquisition of EyeBio and a $100 million charge for a

related development milestone, as well as a charge of $750 million

to acquire CN201 (MK-1045) from Curon. The increase in R&D

expenses was also driven by higher compensation and benefit costs,

as well as higher clinical development spending. The increase in

R&D expenses was partially offset by the favorable impact of

foreign exchange.

Non-GAAP other (income) expense, net, was $193 million of income

in the third quarter of 2024 compared with $133 million of expense

in the third quarter of 2023. The favorability was primarily due to

a $170 million payment received from Daiichi Sankyo related to the

expansion of the existing development and commercialization

agreement, lower exchange losses and lower net interest

expense.

The non-GAAP effective tax rate of 21.9% for the third quarter

of 2024 includes a 6.0 percentage point combined unfavorable impact

related to the EyeBio and Curon transactions.

Non-GAAP EPS was $1.57 for the third quarter of 2024 compared

with $2.13 for the third quarter of 2023. Non-GAAP EPS in the third

quarter of 2024 includes a net charge of $0.79 per share in the

aggregate for the EyeBio, Curon and Daiichi Sankyo transactions.

There were no significant business development transaction charges

in the third quarter of 2023.

A reconciliation of GAAP to non-GAAP net income and EPS is

provided in the table that follows.

Third Quarter

$ in millions, except EPS amounts

2024

2023

EPS

GAAP EPS

$1.24

$1.86

Difference

0.33

0.27

Non-GAAP EPS that excludes items listed

below2

$1.57

$2.13

Net Income

GAAP net income1

$3,157

$4,745

Difference

828

682

Non-GAAP net income that excludes items

listed below1,2

$3,985

$5,427

Excluded Items:

Acquisition- and divestiture-related

costs3

$679

$555

Restructuring costs

279

199

Loss from investments in equity

securities

58

17

Decrease to net income

1,016

771

Estimated income tax (benefit) expense

(188)

(89)

Decrease to net income

$828

$682

Pipeline and Portfolio

Highlights

In the third quarter, Merck continued to develop and augment its

strong, diverse pipeline and achieve key regulatory and clinical

milestones.

In cardiovascular disease, Merck continued to build on positive

momentum in its U.S. launch of WINREVAIR. As of the end of

September 2024, more than 3,700 patients have been prescribed

WINREVAIR. The company also received the European Commission’s (EC)

approval of WINREVAIR, in combination with other pulmonary arterial

hypertension (PAH) therapies, for the treatment of adult patients

with PAH with World Health Organization (WHO) functional Class II

to III. WINREVAIR is the first activin signaling inhibitor approved

for the treatment of PAH in Europe. WINREVAIR has launched in

Germany and Merck is working to obtain reimbursement for WINREVAIR

in other countries in the EU, which should occur in most other

major European markets in the second half of 2025.

In oncology, Merck continued to reinforce its leadership in

women’s and earlier stages of cancers and demonstrate progress in

its research pipeline. At the European Society for Medical Oncology

(ESMO) Congress 2024, three of the company’s data presentations

were highlighted during Presidential Symposium sessions. These

included overall survival (OS) data from the Phase 3 KEYNOTE-522

trial in high-risk, early-stage TNBC and from the Phase 3

KEYNOTE-A18 trial (also known as ENGOT-cx11/GOG-3047) in high-risk,

locally advanced cervical cancer. In addition, new positive data on

investigational candidates from Merck’s pipeline were presented,

including for patritumab deruxtecan (HER3-DXd), an antibody-drug

conjugate (ADC) being developed in collaboration with Daiichi

Sankyo, and for sacituzumab tirumotecan (sac-TMT), an anti-TROP2

ADC being developed in collaboration with Kelun-Biotech.

The company also achieved several regulatory milestones,

including new approvals for KEYTRUDA-based regimens in the U.S.,

Europe and Japan. In addition, Merck recently announced top-line

results from the KEYNOTE-689 trial, which marks the first positive

trial in two decades for patients with resected, locally advanced

head and neck squamous cell carcinoma (LA-HNSCC).

In vaccines, the CDC’s Advisory Committee on Immunization

Practices (ACIP) voted in October 2024 to recommend CAPVAXIVE for

individuals 50 to 64 years of age. This decision expanded upon the

initial unanimous recommendation in June 2024 for use of CAPVAXIVE

in adults age 65 and older, among other cohorts.

At IDWeek 2024, Merck presented positive results from the Phase

2b/3 trial of clesrovimab (MK-1654), an investigational respiratory

syncytial virus (RSV) preventative monoclonal antibody for infants.

These results support the potential for clesrovimab to become the

first and only single-dose immunization designed to protect infants

with the same dose, regardless of weight, for the duration of their

first RSV season (six months).

In immunology, long-term efficacy and safety data for

tulisokibart (MK-7240), an investigational humanized monoclonal

antibody directed to a novel target, tumor necrosis factor

(TNF)-like cytokine 1A (TL1A), from the Phase 2 ARTEMIS-UC and

APOLLO-CD studies in ulcerative colitis (UC) and Crohn’s disease

(CD), were presented at the United European Gastroenterology (UEG)

Week 2024 Congress. Both studies showed that, at week 50,

maintenance of treatment efficacy was generally observed in 12-week

induction responders. Phase 3 studies in UC and CD are ongoing.

In addition, Merck continued to expand and diversify its

pipeline by securing strategic business development opportunities.

Merck completed its acquisition of CN201 (MK-1045), a

next-generation CD3xCD19 bispecific antibody with potential

applications in B-cell malignancies and autoimmune diseases, from

Curon. Merck also announced the expansion of the global development

and commercialization agreement with Daiichi Sankyo to include

MK-6070, an investigational delta-like ligand 3 (DLL3) targeting

T-cell engager. The companies are planning to evaluate MK-6070 in

combination with ifinatamab deruxtecan (I-DXd) in certain patients

with small cell lung cancer (SCLC), as well as other potential

combinations.

Notable recent news releases on Merck’s pipeline and portfolio

are provided in the table that follows.

Oncology

FDA Approved KEYTRUDA Plus Pemetrexed and

Platinum Chemotherapy as First-Line Treatment for Adult Patients

With Unresectable Advanced or Metastatic Malignant Pleural

Mesothelioma, Based on Results From Phase 3 KEYNOTE-483/CCTG

IND.227 Trial

(Read Announcement)

EC Approved KEYTRUDA Plus Padcev as

First-Line Treatment of Unresectable or Metastatic Urothelial

Carcinoma in Adults, Based on Results From Phase 3

KEYNOTE-A39/EV-302 Trial

(Read Announcement)

KEYTRUDA Received 30th Approval From EC

With Two New Indications in Gynecologic Cancers, Based on Results

From Phase 3 KEYNOTE-868/NRG-GY018 and KEYNOTE-A18 Trials

(Read Announcement)

KEYTRUDA Received New Approvals in Japan

for Certain Patients With NSCLC, Based on Results From Phase 3

KEYNOTE-671 Trial, and for Radically Unresectable Urothelial

Carcinoma, Based on Results From Phase 3 KEYNOTE-A39/EV-302 and

Phase 2 KEYNOTE-052 Trials

(Read Announcement)

KEYTRUDA Plus Chemotherapy Before Surgery

and Continued as Single Agent After Surgery Reduced Risk of Death

by More Than One-Third (34%) Versus Neoadjuvant Chemotherapy in

High-Risk, Early-Stage TNBC, Based on Results From Phase 3

KEYNOTE-522

(Read Announcement)

KEYTRUDA Plus Chemoradiotherapy (CRT)

Reduced Risk of Death by 33% Versus CRT Alone in Patients With

Newly Diagnosed, High-Risk, Locally Advanced Cervical Cancer, Based

on Results From Phase 3 KEYNOTE-A18/ENGOT-cx11/GOG-3047 Trial

(Read Announcement)

KEYTRUDA Ten-Year Data Demonstrated

Sustained OS Benefit Versus Ipilimumab in Advanced Melanoma, Based

on Results From Phase 3 KEYNOTE-006 Trial

(Read Announcement)

KEYTRUDA Plus Lenvima in Combination With

Transarterial Chemoembolization (TACE) Significantly Improved

Progression-Free Survival Compared to TACE Alone in Patients With

Unresectable, Non-Metastatic Hepatocellular Carcinoma, Based on

Results From Phase 3 LEAP-012 Trial

(Read Announcement)

KEYTRUDA Plus Trastuzumab and Chemotherapy

Significantly Improved OS Versus Trastuzumab and Chemotherapy Alone

in First-Line Treatment of Patients With HER2-Positive Advanced

Gastric or GEJ Adenocarcinoma, Based on Results From Phase 3

KEYNOTE-811 Trial

(Read Announcement)

KEYTRUDA Met Primary Endpoint of

Event-Free Survival as Perioperative Treatment Regimen in Patients

With Resected, LA-HNSCC, Based on Results From Phase 3 KEYNOTE-689

Trial

(Read Announcement)

Patritumab Deruxtecan (HER3-DXd)

Demonstrated Statistically Significant Improvement in

Progression-Free Survival Versus Doublet Chemotherapy in Patients

With Locally Advanced or Metastatic EGFR-Mutated NSCLC, Based on

Results From Phase 3 HERTHENA-Lung02 Trial

(Read Announcement)

Ifinatamab Deruxtecan Continued to

Demonstrate Promising Objective Response Rates in Patients With

Extensive-Stage SCLC, Based on Results From Phase 2 IDeate-Lung01

Trial

(Read Announcement)

Merck and Moderna Initiated Phase 3 Trial

Evaluating Adjuvant V940 (mRNA-4157) in Combination With KEYTRUDA

After Neoadjuvant KEYTRUDA and Chemotherapy in Patients With

Certain Types of NSCLC

(Read Announcement)

Merck Initiated Phase 3 Shorespan-007

Trial for Bomedemstat, an Investigational Candidate for the

Treatment of Certain Patients With Essential Thrombocythemia

(Read Announcement)

Merck and Daiichi Sankyo Initiated Phase 3

IDeate-Lung02 Trial of Ifinatamab Deruxtecan in Patients With

Relapsed SCLC

(Read Announcement)

Merck and Exelixis Signed Clinical

Development Collaboration To Evaluate Investigational Zanzalintinib

in Combination With KEYTRUDA in Head and Neck Cancer and in

Combination With WELIREG in RCC

(Read Announcement)

Vaccines

Clesrovimab (MK-1654), an Investigational

RSV Preventative Monoclonal Antibody, Significantly Reduced

Incidence of RSV Disease and Hospitalization in Healthy Preterm and

Full-Term Infants, Based on Results From Phase 2b/3 MK-1654-004

Trial

(Read Announcement)

CDC’s ACIP Recommended CAPVAXIVE for

Pneumococcal Vaccination in Adults 50 Years of Age and Older

(Read Announcement)

CAPVAXIVE Demonstrated Positive Immune

Responses in Adults With Increased Risk for Pneumococcal Disease,

Based on Results From Phase 3 STRIDE-8 Trial

(Read Announcement)

Merck Announced Positive Top-line Results

From Phase 3 Trial Evaluating Efficacy and Safety of GARDASIL 9 in

Japanese Males

(Read Announcement)

Cardiovascular

EC Approved WINREVAIR in Combination With

Other PAH Therapies for the Treatment of PAH in Adult Patients With

Functional Class II-III, Based on Results From Phase 3 STELLAR

Trial

(Read Announcement)

Immunology

Merck Presented New Long-Term Data for

Tulisokibart (MK-7240), an Investigational Anti-TL1A Monoclonal

Antibody, in Inflammatory Bowel Disease at UEG Week 2024

(Read Announcement)

Infectious Diseases

Merck and Gilead Announced Phase 2 Data

Showing a Treatment Switch to an Investigational Oral Once-Weekly

Combination Regimen of Islatravir and Lenacapavir (MK-8591D)

Maintained Viral Suppression in Adults at Week 48

(Read Announcement)

Ophthalmology

Merck and EyeBio Initiated Phase 2b/3

Clinical Trial for MK-3000 for the Treatment of Diabetic Macular

Edema

(Read Announcement)

Sustainability

Highlights

Merck issued its 2023/2024 Impact Report, reaffirming its

commitment to operating responsibly and enabling broad access to

its products. The report noted how the company reached more than

550 million people around the world with its medicines and vaccines

through commercial channels, clinical trials, voluntary licensing

and product donations.

Full-Year 2024 Financial

Outlook

The following table summarizes the company’s full-year financial

outlook.

Full Year 2024

Updated

Prior

Sales*

$63.6 to $64.1 billion

$63.4 to $64.4 billion

Non-GAAP Gross margin2

Approximately 81%

Approximately 81%

Non-GAAP Operating expenses2**

$27.8 to $28.3 billion

$26.8 to $27.6 billion

Non-GAAP Other (income) expense, net2

Approximately $100 million

expense

Approximately $350 million

expense

Non-GAAP Effective tax rate2

16.0% to 17.0%

15.5% to 16.5%

Non-GAAP EPS2***

$7.72 to $7.77

$7.94 to $8.04

Share count (assuming dilution)

Approximately 2.54 billion

Approximately 2.54 billion

*The company does not have any

non-GAAP adjustments to sales.

**Includes one-time R&D

charges of $656 million for Harpoon Therapeutics, Inc. (Harpoon)

acquisition, $1.45 billion for EyeBio acquisition and related

development milestone payment, and $750 million for acquisition of

CN201 (MK-1045) from Curon. Outlook does not assume any additional

significant potential business development transactions.

***Includes net one-time charge

of $1.05 per share in aggregate for the Harpoon, EyeBio and Curon

transactions, and the cash payment received from Daiichi

Sankyo.

Merck has not provided a reconciliation of forward-looking

non-GAAP gross margin, non-GAAP operating expenses, non-GAAP other

(income) expense, net, non-GAAP effective tax rate and non-GAAP EPS

to the most directly comparable GAAP measures, given it cannot

predict with reasonable certainty the amounts necessary for such a

reconciliation, including intangible asset impairment charges,

legal settlements, and gains and losses from investments in equity

securities either owned directly or through ownership interests in

investment funds, without unreasonable effort. These items are

inherently difficult to forecast and could have a significant

impact on the company’s future GAAP results.

Merck continues to experience strong growth, including from

KEYTRUDA, new product launches and Animal Health. As a result,

Merck is narrowing the range of its full-year sales outlook.

Merck now expects its full-year sales to be between $63.6

billion and $64.1 billion, including a negative impact of foreign

exchange of approximately 3 percentage points, at mid-October 2024

exchange rates. Approximately 2 percentage points of the negative

impact of foreign exchange is due to the devaluation of the

Argentine peso, which is being largely offset by inflation-related

price increases, consistent with practice in that market.

Merck now expects its full-year non-GAAP effective income tax

rate to be between 16.0% and 17.0%, which includes an unfavorable

impact related to the one-time charge associated with the

acquisition of CN201 (MK-1045) from Curon.

Merck now expects its full-year non-GAAP EPS to be between $7.72

and $7.77. The outlook includes a negative impact of foreign

exchange of approximately $0.30 per share. The negative impact of

foreign exchange is primarily due to the devaluation of the

Argentine peso, which is being largely offset by inflation-related

price increases, consistent with practice in that market. This

revised non-GAAP EPS range reflects a net charge of $0.24 per share

for the following items not previously included in the outlook:

- The acquisition of CN201 (MK-1045) from Curon.

- Payment received from Daiichi Sankyo related to the expansion

of the existing development and commercialization agreement.

Consistent with past practice, the financial outlook does not

assume additional significant potential business development

transactions.

Non-GAAP EPS excludes acquisition- and divestiture-related

costs, costs related to restructuring programs, income and losses

from investments in equity securities, as well as a tax benefit in

2024 due to a reduction in reserves for unrecognized income tax

benefits, resulting from the expiration of the statute of

limitations for assessments related to the 2019 federal tax return

year.

Earnings Conference Call

Investors, journalists and the general public may access a live

audio webcast of the earnings conference call on Thursday, October

31, at 9 a.m. ET via this weblink. A replay of the webcast, along

with the sales and earnings news release, supplemental financial

disclosures, and slides highlighting the results, will be available

at www.merck.com.

All participants may join the call by dialing (800) 369-3351

(U.S. and Canada Toll-Free) or (517) 308-9448 and using the access

code 9818590.

About Merck

At Merck, known as MSD outside of the United States and Canada,

we are unified around our purpose: We use the power of leading-edge

science to save and improve lives around the world. For more than

130 years, we have brought hope to humanity through the development

of important medicines and vaccines. We aspire to be the premier

research-intensive biopharmaceutical company in the world – and

today, we are at the forefront of research to deliver innovative

health solutions that advance the prevention and treatment of

diseases in people and animals. We foster a diverse and inclusive

global workforce and operate responsibly every day to enable a

safe, sustainable and healthy future for all people and

communities. For more information, visit www.merck.com and connect

with us on X (formerly Twitter), Facebook, Instagram, YouTube and

LinkedIn.

Forward-Looking Statement of Merck & Co., Inc., Rahway,

N.J., USA

This news release of Merck & Co., Inc., Rahway, N.J., USA

(the “company”) includes “forward-looking statements” within the

meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. These statements are

based upon the current beliefs and expectations of the company’s

management and are subject to significant risks and uncertainties.

There can be no guarantees with respect to pipeline candidates that

the candidates will receive the necessary regulatory approvals or

that they will prove to be commercially successful. If underlying

assumptions prove inaccurate or risks or uncertainties materialize,

actual results may differ materially from those set forth in the

forward-looking statements.

Risks and uncertainties include but are not limited to, general

industry conditions and competition; general economic factors,

including interest rate and currency exchange rate fluctuations;

the impact of pharmaceutical industry regulation and health care

legislation in the United States and internationally; global trends

toward health care cost containment; technological advances, new

products and patents attained by competitors; challenges inherent

in new product development, including obtaining regulatory

approval; the company’s ability to accurately predict future market

conditions; manufacturing difficulties or delays; financial

instability of international economies and sovereign risk;

dependence on the effectiveness of the company’s patents and other

protections for innovative products; and the exposure to

litigation, including patent litigation, and/or regulatory

actions.

The company undertakes no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future events or otherwise. Additional factors that could cause

results to differ materially from those described in the

forward-looking statements can be found in the company’s Annual

Report on Form 10-K for the year ended December 31, 2023 and the

company’s other filings with the Securities and Exchange Commission

(SEC) available at the SEC’s Internet site (www.sec.gov).

Appendix

Generic product names are provided below.

Pharmaceutical

BRIDION (sugammadex) CAPVAXIVE (Pneumococcal

21-valent Conjugate Vaccine) GARDASIL (Human Papillomavirus

Quadrivalent [Types 6, 11, 16 and 18] Vaccine, Recombinant)

GARDASIL 9 (Human Papillomavirus 9-valent Vaccine,

Recombinant) JANUMET (sitagliptin and metformin HCl)

JANUVIA (sitagliptin) KEYTRUDA (pembrolizumab)

LAGEVRIO (molnupiravir) Lenvima (lenvatinib)

Lynparza (olaparib) M-M-R II (Measles, Mumps and

Rubella Virus Vaccine Live) PREVYMIS (letermovir)

PROQUAD (Measles, Mumps, Rubella and Varicella Virus Vaccine

Live) ROTATEQ (Rotavirus Vaccine, Live, Oral, Pentavalent)

VARIVAX (Varicella Virus Vaccine Live) VAXNEUVANCE

(Pneumococcal 15-valent Conjugate Vaccine) VERQUVO

(vericiguat) WELIREG (belzutifan) WINREVAIR

(sotatercept-csrk)

Animal Health

BRAVECTO (fluralaner)

_________________________________

1

Net income attributable to Merck

& Co., Inc.

2

Merck is providing certain 2024

and 2023 non-GAAP information that excludes certain items because

of the nature of these items and the impact they have on the

analysis of underlying business performance and trends. Management

believes that providing this information enhances investors’

understanding of the company’s results because management uses

non-GAAP results to assess performance. Management uses non-GAAP

measures internally for planning and forecasting purposes and to

measure the performance of the company along with other metrics. In

addition, annual employee compensation, including senior

management’s compensation, is derived in part using a non-GAAP

pretax income metric. This information should be considered in

addition to, but not as a substitute for or superior to,

information prepared in accordance with GAAP. For a description of

the non-GAAP adjustments, see Table 2a attached to this

release.

3

Reflects expenses related to

acquisitions of businesses, including the amortization of

intangible assets, intangible asset impairment charges and expense

or income related to changes in the estimated fair value

measurement of liabilities for contingent consideration. Also

includes integration, transaction and certain other costs

associated with acquisitions and divestitures, as well as

amortization of intangible assets related to collaborations and

licensing arrangements.

MERCK & CO., INC. CONSOLIDATED STATEMENT OF INCOME -

GAAP (AMOUNTS IN MILLIONS, EXCEPT PER SHARE FIGURES)

(UNAUDITED) Table 1 GAAP %

Change GAAP % Change

3Q24

3Q23

Sep YTD 2024 Sep YTD 2023 Sales

$

16,657

$

15,962

4

%

$

48,544

$

45,485

7

%

Costs, Expenses and Other Cost of sales

4,080

4,264

-4

%

11,365

12,214

-7

%

Selling, general and administrative

2,731

2,519

8

%

7,952

7,700

3

%

Research and development

5,862

3,307

77

%

13,354

20,904

-36

%

Restructuring costs

56

126

-56

%

258

344

-25

%

Other (income) expense, net

(162

)

126

*

(151

)

388

* Income Before Taxes

4,090

5,620

-27

%

15,766

3,935

* Taxes on Income

929

870

2,377

2,332

Net Income

3,161

4,750

-33

%

13,389

1,603

* Less: Net Income Attributable to Noncontrolling Interests

4

5

15

12

Net Income Attributable to Merck & Co., Inc.

$

3,157

$

4,745

-33

%

$

13,374

$

1,591

* Earnings per Common Share Assuming Dilution

$

1.24

$

1.86

-33

%

$

5.26

$

0.62

* Average Shares Outstanding Assuming Dilution

2,541

2,546

2,543

2,549

Tax Rate

22.7

%

15.5

%

15.1

%

59.3

%

* 100% or greater

MERCK & CO., INC.

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024 GAAP TO NON-GAAP

RECONCILIATION (AMOUNTS IN MILLIONS, EXCEPT PER SHARE

FIGURES) (UNAUDITED) Table 2a

GAAP Acquisition and Divestiture-Related Costs (1)

Restructuring Costs (2) (Income) Loss from Investments in

Equity Securities Certain Other Items Adjustment

Subtotal Non-GAAP Third Quarter Cost of

sales

$

4,080

639

192

831

$

3,249

Selling, general and administrative

2,731

43

31

74

2,657

Research and development

5,862

24

24

5,838

Restructuring costs

56

56

56

–

Other (income) expense, net

(162

)

(27

)

58

31

(193

)

Income Before Taxes

4,090

(679

)

(279

)

(58

)

(1,016

)

5,106

Income Tax Provision (Benefit)

929

(129

)

(3

)

(46

)

(3

)

(13

)

(3

)

(188

)

1,117

Net Income

3,161

(550

)

(233

)

(45

)

(828

)

3,989

Net Income Attributable to Merck & Co., Inc.

3,157

(550

)

(233

)

(45

)

(828

)

3,985

Earnings per Common Share Assuming Dilution

$

1.24

(0.22

)

(0.09

)

(0.02

)

(0.33

)

$

1.57

Tax Rate

22.7

%

21.9

%

Sep YTD Cost of sales

$

11,365

1,708

374

2,082

$

9,283

Selling, general and administrative

7,952

88

67

155

7,797

Research and development

13,354

60

2

62

13,292

Restructuring costs

258

258

258

–

Other (income) expense, net

(151

)

(48

)

(107

)

(155

)

4

Income Before Taxes

15,766

(1,808

)

(701

)

107

(2,402

)

18,168

Income Tax Provision (Benefit)

2,377

(350

)

(3

)

(118

)

(3

)

23

(3

)

(259

)

(4

)

(704

)

3,081

Net Income

13,389

(1,458

)

(583

)

84

259

(1,698

)

15,087

Net Income Attributable to Merck & Co., Inc.

13,374

(1,458

)

(583

)

84

259

(1,698

)

15,072

Earnings per Common Share Assuming Dilution

$

5.26

(0.57

)

(0.23

)

0.03

0.10

(0.67

)

$

5.93

Tax Rate

15.1

%

17.0

%

Only the line items that are affected by non-GAAP

adjustments are shown. Merck is providing certain non-GAAP

information that excludes certain items because of the nature of

these items and the impact they have on the analysis of underlying

business performance and trends. Management believes that providing

non-GAAP information enhances investors’ understanding of the

company’s results because management uses non-GAAP measures to

assess performance. Management uses non-GAAP measures internally

for planning and forecasting purposes and to measure the

performance of the company along with other metrics. In addition,

annual employee compensation, including senior management’s

compensation, is derived in part using a non-GAAP pretax income

metric. The non-GAAP information presented should be considered in

addition to, but not as a substitute for or superior to,

information prepared in accordance with GAAP. (1) Amounts included

in cost of sales primarily reflect expenses for the amortization of

intangible assets. Amounts included in selling, general and

administrative expenses reflect integration, transaction and

certain other costs related to acquisitions and divestitures.

Amounts included in research and development expenses primarily

reflect the amortization of intangible assets and Animal Health

intangible asset impairment charges. Amounts included in other

(income) expense, net, primarily reflect royalty income related to

the prior termination of the Sanofi-Pasteur MSD joint venture. (2)

Amounts primarily include employee separation costs, accelerated

depreciation and asset impairments associated with facilities to be

closed or divested related to activities under the company's formal

restructuring programs. (3) Represents the estimated tax impacts on

the reconciling items based on applying the statutory rate of the

originating territory of the non-GAAP adjustments. (4) Represents a

benefit due to a reduction in reserves for unrecognized income tax

benefits resulting from the expiration of the statute of

limitations for assessments related to the 2019 federal tax return

year.

MERCK & CO., INC. FRANCHISE / KEY PRODUCT

SALES (AMOUNTS IN MILLIONS) (UNAUDITED) Table

3

2024

2023

3Q Sep YTD 1Q 2Q 3Q Sep

YTD 1Q 2Q 3Q Sep YTD Nom %

Ex-Exch % Nom % Ex-Exch % TOTAL SALES

(1)

$15,775

$16,112

$16,657

$48,544

$14,487

$15,035

$15,962

$45,485

4

7

7

10

PHARMACEUTICAL

14,006

14,408

14,943

43,358

12,721

13,457

14,263

40,442

5

8

7

10

Oncology Keytruda

6,947

7,270

7,429

21,646

5,795

6,271

6,338

18,403

17

21

18

22

Alliance Revenue – Lynparza (2)

292

317

337

947

275

310

299

884

13

13

7

8

Alliance Revenue – Lenvima (2)

255

249

251

755

232

242

260

734

-3

-4

3

3

Welireg

85

126

139

349

42

50

54

146

156

157

138

139

Alliance Revenue – Reblozyl (3)

71

90

100

261

43

47

52

142

91

91

84

84

Vaccines (4) Gardasil/Gardasil 9

2,249

2,478

2,306

7,032

1,972

2,458

2,585

7,015

-11

-10

-

3

ProQuad/M-M-R II/Varivax

570

617

703

1,891

528

582

713

1,823

-1

-1

4

4

Vaxneuvance

219

189

239

647

106

168

214

488

12

13

33

34

RotaTeq

216

163

193

572

297

131

156

584

24

25

-2

-1

Pneumovax 23

61

59

68

188

96

92

140

327

-51

-51

-42

-40

Hospital Acute Care Bridion

440

455

420

1,315

487

502

424

1,413

-1

-

-7

-6

Prevymis

174

188

208

570

129

143

157

430

32

36

33

36

Dificid

73

92

96

261

65

76

74

215

31

31

21

21

Zerbaxa

56

62

64

182

50

54

53

157

22

25

16

19

Noxafil

56

45

41

141

60

55

51

167

-20

-13

-15

-5

Cardiovascular Alliance Revenue - Adempas/Verquvo (5)

98

106

102

306

99

68

92

259

11

11

18

18

Winrevair

70

149

219

-

-

-

-

Adempas (6)

70

72

72

214

59

65

65

189

11

13

13

15

Virology Lagevrio

350

110

383

843

392

203

640

1,236

-40

-36

-32

-27

Isentress/Isentress HD

111

89

102

302

123

136

119

377

-14

-10

-20

-16

Delstrigo

56

60

65

180

44

50

54

148

21

25

22

26

Pifeltro

42

39

42

123

34

38

37

109

14

15

13

14

Neuroscience Belsomra

46

53

78

177

56

63

58

176

35

40

-

7

Immunology Simponi

184

172

189

545

180

180

179

539

5

7

1

2

Remicade

39

35

41

115

51

48

45

144

-9

-5

-20

-16

Diabetes (7) Januvia

419

405

278

1,102

551

511

581

1,642

-52

-49

-33

-30

Janumet

251

224

204

679

329

354

255

937

-20

-13

-28

-23

Other Pharmaceutical (8)

576

573

644

1,796

626

560

568

1,758

13

15

2

5

ANIMAL HEALTH

1,511

1,482

1,487

4,480

1,491

1,456

1,400

4,347

6

11

3

7

Livestock

850

837

886

2,573

849

807

874

2,530

1

7

2

7

Companion Animal

661

645

601

1,907

642

649

526

1,817

14

17

5

7

Other Revenues (9)

258

222

227

706

275

122

299

696

-24

-22

2

4

Sum of quarterly amounts may not equal

year-to-date amounts due to rounding. (1) Only select products are

shown. (2) Alliance Revenue represents Merck’s share of profits,

which are product sales net of cost of sales and commercialization

costs. (3) Alliance Revenue represents royalties. (4) Total

Vaccines sales were $3,424 million, $3,656 million and $3,675

million in the first, second and third quarter of 2024,

respectively, and $3,133 million, $3,557 million and $4,002 million

in the first, second and third quarter of 2023, respectively. (5)

Alliance Revenue represents Merck's share of profits from sales in

Bayer's marketing territories, which are product sales net of cost

of sales and commercialization costs. (6) Net product sales in

Merck's marketing territories. (7) Total Diabetes sales were $745

million, $715 million and $592 million in the first, second and

third quarter of 2024, respectively, and $950 million, $951 million

and $924 million in the first, second and third quarter of 2023,

respectively. (8) Includes Pharmaceutical products not individually

shown above. (9) Other Revenues are comprised primarily of revenues

from third-party manufacturing arrangements and miscellaneous

corporate revenues, including revenue-hedging activities. Other

Revenues related to the receipt of upfront and milestone payments

for out-licensed products were $61 million, $15 million and $15

million in the first, second and third quarter of 2024,

respectively, and $51 million, $3 million and $65 million in the

first, second and third quarter of 2023, respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031033115/en/

Media Contacts: Robert Josephson (203) 914-2372

robert.josephson@merck.com Michael Levey (215) 872-1462

michael.levey@merck.com Investor Contacts: Peter Dannenbaum (732)

594-1579 peter.dannenbaum@merck.com Steven Graziano (732) 594-1583

steven.graziano@merck.com

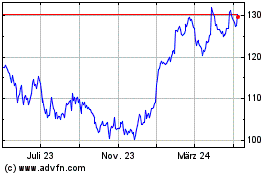

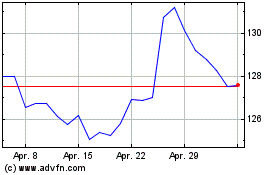

Merck (NYSE:MRK)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Merck (NYSE:MRK)

Historical Stock Chart

Von Dez 2023 bis Dez 2024