UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 28, 2024

Everest

Consolidator Acquisition Corporation

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41100 |

|

86-2485792 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

| |

|

4041

MacArthur Blvd

Newport

Beach, California |

|

92660 |

| (Address

of Principal Executive Offices) |

|

(Zip Code) |

(949)

610-0835

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

x |

Written communication pursuant to

Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencements communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which registered |

| Units,

each consisting of one share of Class A common stock and one-half of one warrant |

|

MNTN.U |

|

New York Stock Exchange |

| Class

A common stock, par value $0.0001 per share |

|

MNTN |

|

New

York Stock Exchange |

| Warrants,

each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

MNTN.WS |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

IMPORTANT NOTICES

Additional Information and Where to Find It

This communication relates to the proposed Business

Combination (as defined in the Current Report on Form 8-K filed with the SEC on May 22, 2023) between Everest Consolidator Acquisition

Corporation (the “Company”) and Unifund Financial Technologies, Inc., a Delaware corporation (“New PubCo”), Unifund

Merger Sub Inc., a Delaware corporation and a direct, wholly owned subsidiary of New PubCo, Unifund Holdings, LLC, a Delaware limited

liability company (“Holdings”), Credit Card Receivables Fund Incorporated, an Ohio corporation (“CCRF”), USV,

LLC, an Ohio limited liability company (“USV” and, together with Holdings and CCRF, the “Target Companies”), and

Everest Consolidator Sponsor, LLC, a Delaware limited liability company.

In connection with the Business Combination, New

PubCo and Holdings have filed a registration statement on Form S-4 (File No. 333-273362) relating to the Business Combination with the

SEC (as may be amended or supplemented from time to time, the “Registration Statement”), which includes a proxy statement/prospectus

that will be sent to all of the Company’s stockholders in connection with the Company’s solicitation of proxies for the vote

by the Company’s stockholders regarding the proposed Business Combination and related matters, as is described in the Registration

Statement, and including a prospectus relating to, among other things, the securities to be issued by New PubCo in connection with the

proposed Business Combination. Each of New PubCo and the Company will file other documents regarding the Business Combination with the

SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO READ THE REGISTRATION STATEMENT, THE

PROXY STATEMENT/PROSPECTUS CONTAINED THEREIN AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC BY THE COMPANY

OR NEW PUBCO IN CONNECTION WITH THE BUSINESS COMBINATION AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE BUSINESS COMBINATION.

Investors and security holders will be able to

obtain free copies of the Registration Statement, the proxy statement/prospectus and all other relevant documents filed or that will be

filed with the SEC by the Company or New PubCo through the website maintained by the SEC at www.sec.gov. In addition, the documents filed

by the Company may be obtained free of charge from the Company’s website at www.belayoneverest.com or by written request to the

Company at Everest Consolidator Acquisition Corporation, 4041 MacArthur Boulevard, 4th Floor, Newport Beach, California 92660.

Participants in the Solicitation

The Company and its directors and executive officers

may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the Business

Combination. A list of the names of such directors and executive officers and information regarding their interests in the Business Combination

is included in the Registration Statement. For information regarding the Company’s directors and executive officers, please see

the Company’s Annual Report on Form 10-K, its subsequent Quarterly Reports on Form 10-Q, and the other documents filed (or to be

filed) by the Company and New PubCo from time to time with the SEC. Free copies of these documents may be obtained as described in the

preceding paragraph.

Forward-Looking Statements

This Current Report on Form 8-K (this “Report”)

contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed Business Combination

between the Target Company group (referred to herein, collectively, as “Unifund”) and the Company, including statements regarding

the anticipated benefits of the Business Combination, the anticipated timing of the Business Combination, the future financial condition

and performance of Unifund and the expected financial impacts of the Business Combination (including future revenue and pro forma enterprise

value) on Unifund and its platforms, markets, expected future growth and market opportunities. Unifund’s actual results may differ

from its expectations, estimates and projections (which, in part, are based on certain assumptions) and consequently, you should not rely

on these forward-looking statements as predictions of future events. When used in this Report, the words “estimate,” “project,”

“budget,” “expect,” “anticipate,” “forecast,” “plan,” “intend,”

“believe,” “seeks,” “may,” “will,” “could,” “predicts,” “potential,”

“should,” “future,” “propose,” “continue,” and variations of these words or similar expressions

(or the negative versions of such words or expressions) are intended to identify forward-looking statements. Although these forward-looking

statements are based on assumptions that Unifund and the Company believe are reasonable, these assumptions may be incorrect and are not

guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and

other important factors, many of which are beyond Unifund’s or the Company’s control, that could cause actual results or outcomes

to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results

or outcomes include (i) the inability to complete the Business Combination in a timely manner or at all (including due to the failure

to receive required stockholder approvals, failure to receive governmental or regulatory approvals or the failure of other closing conditions);

(ii) the risk that the Business Combination may not be completed by the Company’s business combination deadline and the potential

failure to obtain an extension of the business combination deadline if sought by the Company; (iii) the inability to recognize the anticipated

benefits of the Business Combination or the failure or to realize estimated pro forma results and underlying assumptions, including with

respect to estimated stockholder redemptions; (iv) the inability to obtain or maintain the listing of the Company’s securities on

a national securities exchange; (v) costs related to the Business Combination; (vi) the effect of the announcement or pendency of the

Business Combination on Unifund’s business or employee relationships, operating results and business generally; (vii) the risk of

difficulties in retaining employees of Unifund as a result of the Business Combination; (viii) the risk that the Business Combination

disrupts current plans and operations of Unifund; (ix) the occurrence of any event, change or other circumstance that could give rise

to the termination of the business combination agreement relating to the Business Combination; (x) the potential inability of Unifund

to manage growth effectively and execute business plans and meet projections; (xi) the ability to implement business plans, forecasts,

and other expectations after the completion of the transaction, and the ability to identify and realize additional opportunities; (xii)

potential litigation involving the Company or Unifund, including the outcome of any legal proceedings that may be instituted against Unifund

or the Company related to the business combination agreement or the Business Combination; (xiii) changes in applicable laws or regulations

affecting Unifund’s business, particularly with respect to regulations enacted by the Federal Trade Commission and Consumer Financial

Protection Bureau; (xiv) risks related to the uncertainty of Unifund’s projected financial information; (xv) general economic and

market conditions impacting demand for Unifund’s services, and in particular economic and market conditions in the financial services

industry in the markets in which Unifund operates; and (xvi) other risks and uncertainties indicated from time to time in the proxy statement/prospectus

relating to the Business Combination, including those under “Risk Factors” therein, and in the Company’s other filings

with the SEC. Neither the Company nor Unifund gives any assurance that any of the Company, Unifund or the combined company will achieve

expectations. The foregoing list of factors is not exhaustive. These forward-looking statements are provided for illustrative purposes

only and are not intended to serve as, and must not be relied on by investors as, a guarantee, an assurance, a prediction or a definitive

statement of fact or probability. You should carefully consider the foregoing factors and the other risks and uncertainties described

in the “Risk Factors” section of the Company’s Annual Report on Form 10-K, its subsequent Quarterly Reports on Form

10-Q, the proxy statement/prospectus related to the transaction, when it becomes available, and other documents filed (or to be filed)

by the Company from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause

actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak

only as of the date they are made. Investors are cautioned not to put undue reliance on forward-looking statements, and Unifund and the

Company assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by securities and other applicable laws.

Item 1.01 Entry into a Material Definitive

Agreement

Amendment No. 3 to the Investment Management

Trust Agreement

As approved by its stockholders at the special

meeting of stockholders held on August 28, 2024 (the “Special Meeting”), the Company entered into a third amendment to the

Investment Management Trust Agreement, dated as of November 23, 2021, as amended by the First Amendment to the Investment Trust Agreement,

dated August 25, 2023, and Second Amendment to the Investment Trust Agreement, dated February 26, 2024, with Equiniti Trust Company, LLC

(the “Trust Agreement”), on August 28, 2024 (the “Trust Amendment”). The Trust Amendment allows the Company to

extend the date by which the Company has to consummate a business combination (the “Combination Period”) up to an additional

three (3) times for one (1) month each time from August 28, 2024 to November 23, 2024 by depositing into the trust account, for each one-month

extension, the lesser of (a) $150,000 and (b) $0.030 per share (the “Extension Payment”) for each then-outstanding share of

the Company’s Class A common stock, par value $0.0001 per share, issued in the IPO (the “Public Shares”) after giving

effect to the redemption of the Public Shares for the redemption price. The foregoing description is qualified in its entirety by reference

to the Trust Amendment, a copy of which is attached as Exhibit 10.1 hereto and is incorporated by reference herein.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change

in Fiscal Year

The information disclosed in Item 5.07 of this

Report under the headings “The Extension Amendment Proposal” is incorporated by reference into this Item 5.03 to the extent

required. On August 28, 2024, to effectuate the Extension Amendment, the Company filed an amendment (the “Extension Amendment”)

to the Company’s Amended and Restated Certificate of Incorporation (as amended, the “Charter”) with the Secretary of

State of the State of Delaware. The foregoing description of the Extension Amendment does not purport to be complete and is qualified

in its entirety by the terms of the Extension Amendment, a copy of which is attached hereto as Exhibit 3.1 and incorporated herein by

reference.

Item 5.07 Submission of Matters to a Vote of Security Holders

On

August 28, 2024, the Company convened the Special Meeting. As of the close of business on July 29, 2024, the record date for the

Special Meeting, there was an aggregate of 11,704,608 shares of the Company’s common stock outstanding (consisting of 7,392,108

Public Shares and 4,312,500 shares of the Company’s Class B common stock, par value $0.0001 per share (“Class B Common Stock”

and, together with the Public Shares, the “Common Stock”)), each of which was entitled to one vote with respect to the proposals

presented at the Special Meeting. A total of 9,349,980 shares of Common Stock, representing approximately 79.9% of the outstanding

shares of Common Stock entitled to vote at the Special Meeting, were present in person or by proxy, constituting a quorum. The proposals

listed below are described in more detail in the Company’s definitive proxy statement, which was filed with the Securities and

Exchange Commission on July 19, 2024. A summary of the proposals presented to and considered by the stockholders of the Company and the

voting results at the Special Meeting is set forth below:

The

Extension Amendment Proposal – To amend the Company’s Charter to provide the Company’s board of directors

with the right to extend (the “Extension”) the Combination Period up to an additional three (3) times for one (1) month each

time, from August 28, 2024 to November 23, 2024 (as extended, the “Extended Date”) (i.e., for a period of time ending 36 months

after the consummation of its initial public offering (the “IPO”)) (the “Extension Amendment Proposal”).

| For |

Against |

Abstain |

| 9,036,451 |

260,929 |

52,600 |

The

Trust Amendment Proposal – To approve the adoption of the Trust Amendment to the Trust Agreement, to allow the Company

to extend the Combination Period up to an additional three (3) times for one (1) month each time from August 28, 2024 to November 23,

2024, the Extended Date, by depositing into the Company’s trust account, for each one-month extension, the Extension Payment for

each then-outstanding share of the Company’s Public Shares after giving effect to the redemption of the Public Shares for the redemption

price (the “Trust Amendment Proposal” and, together with the Extension Amendment Proposal, the “Extension Proposals”).

| For |

Against |

Abstain |

| 9,036,451 |

260,929 |

52,600 |

The

Adjournment Proposal – The proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit

further solicitation and vote of proxies in the event that there are insufficient votes to approve the Extension Proposals or if we determine

that additional time is necessary to effectuate the Extension, was not presented at the Special Meeting, as the Extension Proposals received

a sufficient number of votes for approval.

Stockholders holding 4,546,354 Public Shares,

representing approximately 61.5% of the Public Shares outstanding, exercised their right to redeem such shares for a pro rata portion

of the funds in the Company’s trust account. As a result, approximately $51.6 million (approximately $11.34 per Public

Share) will be removed from the Company’s trust account to pay such redeeming holders of Public Shares. Following the redemptions,

a total of 2,845,754 Public Shares will remain outstanding and eligible for redemption.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Everest Consolidator Acquisition Corporation |

| |

|

|

| |

|

|

| Date: August 28, 2024 |

By: |

/s/ Adam Dooley |

| |

Name: |

Adam Dooley |

| |

Title: |

President and Chief Executive Officer |

Exhibit 3.1

CERTIFICATE OF AMENDMENT TO

THE

AMENDED AND RESTATED CERTIFICATE OF

INCORPORATION OF

EVEREST CONSOLIDATOR ACQUISITION CORPORATION

Everest Consolidator

Acquisition Corporation, a corporation organized and existing under the by virtue of the General Corporation Law of the State of Delaware

(the “DGCL”), does hereby certify:

1. The

name of the corporation is Everest Consolidator Acquisition Corporation. The corporation was originally incorporated pursuant to the DGCL

on March 8, 2021, under the name of Everest Consolidator Acquisition Corporation.

2. The

date of filing of the corporation’s original Certificate of Incorporation with the Secretary of State of the State of Delaware was

March 8, 2021, and the date of filing the corporation’s Amended and Restated Certificate of Incorporation with the Secretary

of State of the State of Delaware was November 23, 2021.

3. The

Amended and Restated Certificate of Incorporation was further amended by the Certificate of Amendment to the Amended and Restated Certificate

of Incorporation filed with the Secretary of the State of Delaware on August 24, 2023.

4. The

Amended and Restated Certificate of Incorporation was further amended by the Certificate of Amendment to the Amended and Restated Certificate

of Incorporation filed with the Secretary of the State of Delaware on February 26, 2024.

5. The

Board of Directors of the corporation has duly adopted resolutions setting forth proposed amendments to the Certificate of Incorporation

of the corporation (as amended and restated prior to the date hereof), declaring said amendment to be advisable and in the best interests

of the corporation and its stockholders and authorizing the appropriate officers of the corporation to solicit the consent of the stockholders

therefor, which resolutions setting forth the proposed amendment are substantially as follows:

RESOLVED,

that Section 9.2(d) of Article IX of the Amended and Restated Certificate of Incorporation of the corporation is amended

and restated to read in its entirety as follows:

“In

the event that the Corporation has not completed an initial Business Combination by August 28, 2024, the Board may extend the period

of time to consummate an initial Business Combination by three additional one month periods, up to November 23, 2024 (the latest

such date being referred to as the “Termination Date”); provided that, in each case, the Corporation (or its

affiliates or designees), after providing five business days advance notice prior to the date that the period of time would otherwise

expire, has deposited into the Trust Account the lesser of (a) $150,000 and (b) $0.030 per share (the “Extension

Payment”) for each then-outstanding share of the Corporation’s Class A Common Stock issued in the Offering. The

gross proceeds from such Extension Payments will be added to the proceeds from the Offering held in the Trust Account and shall be used

to fund the redemption of the Offering Shares in accordance with this clause (d). In the event that the Corporation has not consummated

an initial Business Combination by or before the Termination Date, the Corporation shall (i) cease all operations except for the

purpose of winding up, (ii) as promptly as reasonably possible but no more than ten business days thereafter subject to lawfully

available funds therefor, redeem 100% of the Offering Shares, at a per-share price, payable in cash, equal to the quotient obtained by

dividing (A) the aggregate amount then on deposit in the Trust Account, including interest earned on the funds held in the Trust

Account and not previously released to the Corporation to pay its taxes, if any, and expenses related to the administration of the Trust

Account (less up to $100,000 of such net interest to pay dissolution expenses), by (B) the number of then outstanding Offering Shares,

which redemption will completely extinguish the rights of the Public Stockholders (including the right to receive further liquidating

distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject

to the approval of the remaining stockholders and the Board, dissolve and liquidate, subject in each case to the Corporation’s obligations

under the DGCL to provide for claims of creditors and the requirements of other applicable law.”

6. That

thereafter, said amendment was duly adopted in accordance with the provisions of Section 242 of the DGCL by written consent of stockholders

holding the requisite number of shares required by statute given in accordance with and pursuant to Section 228 of the DGCL.

IN WITNESS WHEREOF, the

corporation has caused this Certificate of Amendment to be signed this 28th day of August, 2024.

| |

/s/ Adam Dooley |

| |

Adam Dooley |

| |

Chief Executive Officer |

Exhibit 10.1

AMENDMENT NO. 3 TO THE

INVESTMENT MANAGEMENT TRUST

AGREEMENT

This Amendment

No. 3 (this “Amendment”), dated as of August 28, 2024, to the Investment Management Trust Agreement

(as defined below) is made by and between Everest Consolidator Acquisition Corporation (the “Company”) and Equiniti

Trust Company, LLC, as trustee (“Trustee”). All terms used but not defined herein shall have the meanings assigned

to them in the Trust Agreement.

WHEREAS,

the Company and the Trustee entered into an Investment Management Trust Agreement dated as of November 23, 2021 (the “Initial

Trust Agreement”);

WHEREAS,

the Company and the Trustee entered into the Amendment to the Initial Trust Agreement, dated as of August 24, 2023 (the “First

Amendment”);

WHEREAS,

the Company and the Trustee entered into the Second Amendment to the Initial Trust Agreement, dated as of February 26, 2024 (the

“Second Amendment” and, the Initial Trust Agreement, as amended by the First Amendment and the Second Amendment,

the “Trust Agreement”);

WHEREAS,

Section 1(i) of the Trust Agreement sets forth the terms that govern the liquidation of the Trust Account under the circumstances

described therein;

WHEREAS,

at a Special Meeting of stockholders of the Company held on August 28, 2024, the Company stockholders approved a proposal to amend

(the “Extension Amendment”) the Company’s Amended and Restated Certificate of Incorporation to provide

the Company’s Board of Directors with the right to extend the date by which the Company has to consummate a business combination

up to an additional three (3) times for one (1) month each time, from August 28, 2024 to November 23, 2024; and

WHEREAS,

on the date hereof, the Company is filing the Extension Amendment with the Secretary of State of the State of Delaware.

NOW THEREFORE, IT

IS AGREED:

The Trust Agreement

is hereby amended as follows:

1. Preamble.

The text below hereby replaces the fifth WHEREAS clause in the preamble of the Trust Agreement:

“WHEREAS,

if a Business Combination (as defined below) is not consummated by August 28, 2024, 33 months following the closing of the Offering,

the board of directors of the Company (the “Board”) may extend such period by three (3) one-month periods,

up to a maximum of 36 months in the aggregate following the closing of the Offering, by depositing the lesser of (a) $150,000 and

(b) $0.030 per share issued at the Offering that have not been redeemed into the Trust Account no later than August 28, 2024

(the 33-month anniversary of the Offering, and each succeeding one-month anniversary through and up to November 23, 2024 (each, an

“Applicable Deadline”); and”

2. Section 1(i).

Section 1(i) of the Trust Agreement is hereby amended and restated to read in full as follows:

“(i) Commence liquidation of the Trust Account only after and promptly after receipt of, and only in accordance with, the terms of a letter

(“Termination Letter”), in a form substantially similar to that attached hereto as either Exhibit A or

Exhibit B, signed on behalf of the Company by its President, Chief Executive Officer or Chairman of the board of directors of the

Company or other authorized officer of the Company and complete the liquidation of the Trust Account and distribute the Property in the

Trust Account only as directed in the Termination Letter and the other documents referred to therein; provided, however, that in the event

that a Termination Letter has not been received by the Trustee by the 33-month anniversary of the closing of the Offering or, in the event

that the Company extended the time to complete the Business Combination for up to 36-months from the closing of the Offering but has not

completed the Business Combination within the applicable monthly anniversary of the Closing, (“Last Date”),

the Trust Account shall be liquidated in accordance with the procedures set forth in the Termination Letter attached as Exhibit B

hereto and distributed to the Public Stockholders as of the Last Date.”

[Signature Page Follows]

IN WITNESS WHEREOF, the parties

have duly executed this Amendment to the Investment Management Trust Agreement as of the date first written above.

| EQUINITI TRUST COMPANY, LLC, AS TRUSTEE |

|

| |

|

| |

|

| By: |

/s/ Michael Legregin |

|

| |

Name: Michael Legregin |

|

| |

Title: Senior Vice President |

|

| |

|

| EVEREST CONSOLIDATOR ACQUISITION CORPORATION |

|

| |

|

| By: |

/s/ Adam Dooley |

|

| |

Name: Adam Dooley |

|

| |

Title: Chief Executive Officer |

|

[Signature Page to Amendment No. 3 to IMTA]

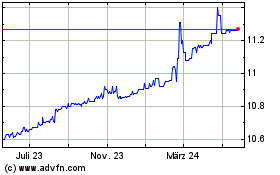

Everest Consolidator Acq... (NYSE:MNTN)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

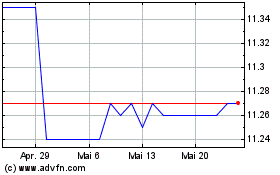

Everest Consolidator Acq... (NYSE:MNTN)

Historical Stock Chart

Von Nov 2023 bis Nov 2024