SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number 1-14926

KT Corporation

(Translation of registrant’s name into English)

90, Buljeong-ro,

Bundang-gu,

Seongnam-si,

Gyeonggi-do,

Korea

(Address of

principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| Dated: November 8, 2024 |

| KT Corporation |

|

|

| By: |

|

/s/ Youngkyoon Yun |

| Name: Youngkyoon Yun |

| Title: Vice President |

|

|

| By: |

|

/s/ Sanghyun Cho |

| Name: Sanghyun Cho |

| Title: Director |

3Q24 Earnings Release

Disclaimer This presentation has been prepared by KT Corp.(the

“Company”) in accordance with K-IFRS. This presentation contains forward-looking statements, which are subject to risks, uncertainties, and assumptions. This presentation is being presented solely for your information and is subject to

change without notice. No presentation or warranty, expressed or implied, is made and no reliance should be placed on the accuracy, actuality, fairness, or completeness of the information presented. If you have any questions related to this

material, please contact the IR department. Tel: +82-70-4193-4036 2

Contents 1 3Q24 Highlights 2 Financial Highlights 3 Business Overview 4

Appendix

1 3Q24 Highlights Strong B2C/B2B businesses and accelerated growth of real

estate, DC/Cloud Financials Cons. Sep. Revenue Revenue 6,654.6bn (YoY -0.6%) 4,765.0bn (YoY +2.0%) Operating Operating 464.1bn (YoY +44.2%) 338.9bn (YoY +75.1%) Profit Profit Accelerate transformation into AICT Company through business restructuring

Management Strategy AX Capabilities Value-Up ✓ Strategic Partnership with Microsoft(9/28)✓ FY2028 Consolidated ROE Target 9%~10% of 2023 - AICT Transformation: FY2028 AI/IT rev. up 3x - Joint development and GTM* of Korean AI/Cloud

services - Increase Profitability: FY2028 Cons. OP Margin 9% - New opportunities with establishment of specialized AX company - Liquidate Non-Core Assets (including idle real estate) - Joint R&D and fostering of AI specialists - Enhance Capital

Efficiency: KRW 1tr share buyback & * Go-To-Market Strategy cancellation between FY2025~2028 ✓ Workforce Restructuring for AICT Transformation Shareholder Return - Establishment of 2 Network-specialized subsidiaries - Special voluntary

retirement program ✓ 3Q24 Quarterly Dividend Paid(10/31) - DPS: KRW 500 (3Q Cumulative DPS: KRW1,500) 4

Contents 1 3Q24 Highlights 2 Financial Highlights 3 Business Overview 4

Appendix

K-IFRS / Consolidated 1 Income Statement • Rev. -0.6% YoY due to

decline in content subsidiaries despite growth in Telco/real estate/data center • OP +44.2% due to base effect of 3Q23 wage negotiations and continued growth of core businesses (Unit: KRW bn) 3Q23 2Q24 3Q24 QoQ YoY Operating Revenue 6,697.4

6,546.4 6,654.6 1.7% -0.6% Service Revenue 5,842.5 5,776.6 5,752.0 -0.4% -1.5% Sale of goods 855.0 769.8 902.7 17.3% 5.6% Operating Expense 6,375.5 6,052.4 6,190.5 2.3% -2.9% Operating Income 321.9 494.0 464.1 -6.0% 44.2% Margin 4.8% 7.5% 7.0%

-0.6%p 2.2%p 1 Margin 5.5% 8.6% 8.1% -0.5%p 2.6%p Non-op. Income/Loss 28.4 62.7 45.0 -28.3% 58.3% Income before taxes 350.3 556.7 509.1 -8.6% 45.3% Net Income 288.3 410.5 383.2 -6.7% 32.9% Margin 4.3% 6.3% 5.8% -0.5%p 1.5%p EBITDA 1,259.9 1,460.2

1,428.9 -2.1% 13.4% Margin 18.8% 22.3% 21.5% -0.8%p 2.7%p 1 1) OP Margin = Operating Income/Service Revenue 6

K-IFRS / Consolidated 2 Operating Expenses • Op. expenses -2.9% YoY,

due to decrease in labor cost, selling expense, general expense, and cost of service (Unit: KRW bn) 3Q23 2Q24 3Q24 QoQ YoY Operating Expenses 6,375.5 6,052.4 6,190.5 2.3% -2.9% 1,191.0 1,213.2 1,118.3 -7.8% -6.1% Labor Cost General Expense 2,732.8

2,708.3 2,675.0 -1.2% -2.1% - Depreciation 937.9 966.2 964.8 -0.1% 2.9% 784.5 656.6 717.5 9.3% -8.5% Cost of Service Selling Expense 623.2 600.8 600.8 0.0% -3.6% Cost of Goods sold 1,044.0 873.5 1,078.9 23.5% 3.3% [Selling Expense (KT Separate)]

(Unit: KRW bn) ]] 3Q23 2Q24 3Q24 QoQ YoY 636.4 618.6 623.9 0.9% -2.0% Selling Expense 7

K-IFRS / Consolidated 3 Balance Sheet • Net debt/equity ratio

decreased by YoY 8.2%p. (Unit: KRW bn) Sept 30, 2023 Jun 30, 2024 Sept 30, 2024 QoQ YoY 43,974.8 43,144.4 42,750.4 -0.9% -2.8% Assets 3,786.7 Cash & Cash equivalents 3,110.4 3,953.9 4.4% 27.1% 24,162.5 Liabilities 25,253.1 23,564.0 -2.5% -6.7%

Borrowings 10,309.5 10,150.6 9,768.6 -3.8% -5.2% 18,981.9 Equity 18,721.7 19,186.4 1.1% 2.5% 1,564.5 Capital Stock 1,564.5 1,564.5 0.0% 0.0% Net Debt 7,199.1 6,363.9 5,814.7 -8.6% -19.2% Debt / Equity 134.9% 127.3% 122.8% -4.5%p -12.1%p Net Debt /

Equity 38.5% 33.5% 30.3% -3.2%p -8.2%p 134.9% 131.1% 130.1% 129.8% 127.0% 127.3% 124.3% 124.8% 122.6% 122.5% 121.5% 122.8% 118.7%117.9% 115.4% Debt/Equity 부채비율 순부채비율 Net Debt/Equity

46.6% 44.6% 42.9% 40.6% 41.0% 39.5% 38.5% 38.5% 37.4% 33.0% 32.7% 33.5% 32.4% 30.3% 29.7% 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 8

K-IFRS / Separate and major subsidiaries 4 CAPEX • ’24.3Q

Total CAPEX Execution: KRW 1,416.0bn (KT Separate), KRW 617.8 bn (Major Subsidiaries) (Unit: KRW bn) 3,533 3,452 3,319 692 782 907 2,034 ■ Major Subsidiaries’ CAPEX Includes Finance, Media, Cloud/IDC, 618 2,760 2,721 Real Estate, etc.

2,412 1,416 ■ KT Separate CAPEX Access network, Backbone Network, 2021 2022 2023 3Q24Cum. B2B and etc. KT 주요 Major그룹사 Subsidiaries 9

Contents 1 3Q24 Highlights 2 Financial Highlights 3 Business Overview 4

Appendix

K-IFRS / Separate 1 KT - Wireless • Wireless service revenue +2.0%

YoY with increased 5G penetration (76.3%) and MVNO/roaming • Continued expansion of customer base, through online-focused promotions and new online-only plans (Unit: KRW bn) 3Q23 2Q24 3Q24 QoQ YoY Wireless 1,708.1 1,765.1 1,740.4 -1.4% 1.9%

Wireless Service 1,623.3 1,677.9 1,656.5 -1.3% 2.0% Interconnection 84.8 87.2 83.9 -3.7% -1.0% Wireless Subscribers (Unit: Thousands) 24,903 24,897 24,834 24,904 25,203 9,408 10,251 9,722 9,948 10,093 Handset(5G) 4,183 3,795 3,184 3,519 3,364 (exc.

5G) Handset(5G외) 4,562 4,144 4,242 4,313 4,276 2nd device & IoT MVNO 7,168 7,207 7,138 7,091 7,134 3Q23 4Q23 1Q24 2Q24 3Q24 11

K-IFRS / Separate 2 KT - Fixed Line • Broadband rev. +0.4% YoY due

to expansion in premium plans and value-added services • Media rev. -1.2% YoY due to decrease in PPV and advertising revenue despite net subscriber additions (Unit: KRW bn) 3Q23 2Q24 3Q24 QoQ YoY Fixed Line 1,330.1 1,316.6 1,312.6 -0.3% -1.3%

Broadband 619.4 618.5 622.2 0.6% 0.4% Media 524.4 522.6 518.2 -0.8% -1.2% Home Telephony 186.3 175.6 172.2 -1.9% -7.6% Broadband Subscribers IPTV Subscribers (Unit: Thousands) (Unit: Thousands) % Subscribers 가입자수 GiGA

비중(%) 9,440 9,928 9,430 9,899 9,862 9,423 9,827 9,810 9,418 9,409 68.9% 68.7% 68.5% 68.3% 68.0% 3Q23 4Q23 1Q24 2Q24 3Q24 3Q23 4Q23 1Q24 2Q24 3Q24 12

K-IFRS / Separate 3 KT - B2B Services • B2B Service rev. +2.5% YoY

with focus on service-based businesses despite streamlining low-profit businesses (Unit: KRW bn) 3Q23 2Q24 3Q24 QoQ YoY 903.8 882.7 926.4 4.9% 2.5% B2B Service 77.9 83.6 89.6 7.3% 15.1% Real Estate, etc. Corp. Broadband/Data Revenue Revenue of 5

Major Growth Drivers (Unit: KRW bn) (Unit: KRW bn) 327.0 323.5 324.2 321.6 318.1 119.3 YoY +0.8% YoY +27.0% 96.0 93.9 92.8 QoQ -0.9% QoQ +24.2% 73.7 3Q23 4Q23 1Q24 2Q24 3Q24 3Q23 4Q23 1Q24 2Q24 3Q24 ※ Corp. Broadband/data rev includes: ※

5 Major Growth Drivers include: Leased line, Kornet, VPN, Global data AICC, IoT, Smart Mobility, Smart Space, Energy Biz. 13

K-IFRS / Consolidated(each subsidiary) 4 Major Subsidiaries • kt

cloud rev. +6.8% YoY, with increased demand for data centers and expansion of DBO* business *DBO(Design-Build-Operate): a project where a single contractor is appointed to design, build and operate a data center for a certain period • kt

estate rev. +3.6% YoY, due to steady growth of hotel and office rentals (Unit: KRW bn) Revenue of Major Subsidiaries (consolidated) 3Q23 2Q24 3Q24 QoQ YoY BC Card 995.7 977.7 931.4 -4.7% -6.5% Skylife 260.5 254.6 256.9 0.9% -1.4% Content

Subsidiaries1 191.1 135.4 156.2 15.4% -18.3% kt cloud 193.8 180.1 207.0 14.9% 6.8% KT Estate 142.3 155.8 147.5 -5.3% 3.6% 1) Nasmedia(PlayD incl.), KT Studiogenie(Genie music, Storywiz, and others incl.) (Unit: KRW bn) Subsidiaries’ OP

Contribution 135.1 128.4 125.2 112.7 69.3 3Q23 4Q23 1Q24 2Q24 3Q24 14

Contents 1 3Q24 Highlights 2 Financial Highlights 3 Business Overview 4

Appendix

1 K-IFRS Income Statement (Unit: KRW bn) Consolidated 3Q23 4Q23 1Q24 2Q24

3Q24 KT Separate 3Q23 4Q23 1Q24 2Q24 3Q24 Operating revenue 6,697.4 6,687.6 6,654.6 6,546.4 6,654.6 Operating revenue 4,673.0 4,592.0 4,694.8 4,548.3 4,765.0 Service revenue 5,842.5 5,720.2 5,722.7 5,776.6 5,752.0 Service revenue 4,020.0 3,941.2

4,040.6 4,048.0 4,069.0 653.0 650.8 654.2 500.3 696.0 Sale of goods 855.0 967.4 931.9 769.8 902.7 Handset revenue Operating expense 6,375.5 6,422.0 6,148.1 6,052.4 6,190.5 Operating expense 4,479.5 4,395.7 4,301.0 4,189.4 4,426.1 Cost of Service

5,331.5 5,372.9 5,101.2 5,178.9 5,111.6 Cost of Service 3,808.8 3,707.6 3,624.7 3,696.8 3,688.7 Labor cost 1,191.0 1,157.8 1,100.9 1,213.2 1,118.3 Labor cost 634.6 530.5 540.7 631.3 534.6 1,828.6 1,925.0 1,777.1 1,804.2 1,832.7 General expense

2,732.8 2,843.7 2,674.2 2,708.3 2,675.0 General expense Cost of service 784.5 725.5 726.5 656.6 717.5 Cost of service 695.2 594.2 673.2 630.6 685.6 Selling expense 623.2 645.9 599.6 600.8 600.8 Selling expense 650.4 657.9 633.7 630.7 635.7 Cost of

Goods sold 1,044.0 1,049.1 1,046.9 873.5 1,078.9 Cost of Devices sold 670.6 688.1 676.3 492.6 737.3 Operating income 321.9 265.6 506.5 494.0 464.1 Operating income 193.5 196.3 393.8 358.8 338.9 N-OP income (loss) 28.4 -277.6 22.5 62.7 45.0 N-OP

income (loss) 34.7 -91.6 72.4 50.3 69.2 N-OP income 255.0 105.8 323.1 325.8 35.8 N-OP income 226.7 50.0 309.0 260.0 32.5 N-OP expense N-OP expense 192.0 141.6 236.6 209.7 -36.7 223.7 340.7 310.9 260.1 -11.1 Equity Method (G/L) -2.8 -42.7 10.2 -3.0

-1.9 Income bf tax 350.3 -12.0 529.0 556.7 509.1 Income bf tax 228.2 104.8 466.1 409.2 408.0 Income tax 62.0 29.7 136.0 146.2 125.9 Income tax 17.6 7.0 112.1 94.7 98.2 210.6 97.8 354.0 314.5 309.8 Net income 288.3 -41.7 393.0 410.5 383.2 Net income

NI contribution to KT 264.3 54.4 375.5 393.0 357.3 EBITDA 1,259.9 1,279.2 1,480.2 1,460.2 1,428.9 979.9 1,031.5 1,199.1 1,162.9 1,144.8 EBITDA EBITDA Margin 21.0% 22.5% 25.5% 25.6% 24.0% EBITDA Margin 18.8% 19.1% 22.2% 22.3% 21.5% 16

2 K-IFRS Balance Sheet (Unit: KRW bn) Consolidated 3Q23 4Q23 1Q24 2Q24

3Q24 KT Separate 3Q23 4Q23 1Q24 2Q24 3Q24 Assets 43,974.8 42,710.0 42,710.0 43,144.4 42,750.4 Assets 30,814.8 30,308.9 30,334.8 30,464.8 29,957.1 7,505.4 7,088.6 7,578.4 7,451.7 7,447.7 Current assets 15,520.6 14,518.2 14,997.4 15,175.2 15,197.0

Current assets Cash & cash equivalents 3,110.4 2,879.6 3,000.7 3,786.7 3,953.9 Cash & cash equi. 1,477.3 1,242.0 1,331.6 1,722.5 1,608.7 3,425.8 3,190.3 3,546.3 3,097.6 3,275.6 Trade & other receivables 4,515.4 4,287.3 4,571.4 4,161.7

4,304.2 Trade & other rec. 276.6 368.1 310.3 404.1 264.6 Inventories 707.4 912.3 899.1 964.0 903.2 Inventories Other current asset 7,187.3 6,438.9 6,526.2 6,262.7 6,035.7 Other current asset 2,325.6 2,288.2 2,390.2 2,227.5 2,298.8 -

Prepaid_Contract cost 1,270.3 1,252.1 1,249.2 1,233.6 1,236.7 - Prepaid_Contract cost 1,360.3 1,340.2 1,335.4 1,312.5 1,318.3 - Contract assets 590.7 581.8 620.4 611.1 625.6 - Contract assets 527.0 535.8 540.2 548.6 542.0 Non-current assets 28,454.1

28,191.8 27,712.6 27,969.2 27,553.4 Non-current assets 23,309.4 23,220.4 22,756.4 23,013.1 22,509.4 Trade & other rec 406.0 451.7 381.2 398.4 357.0 Trade & other rec 322.1 370.7 298.8 321.1 278.2 Tangible assets 14,669.9 14,872.1 14,585.7

14,591.7 14,509.1 Tangible assets 11,288.5 11,492.8 11,214.3 11,264.4 11,185.6 Other current assets 13,378.2 12,868.1 12,745.7 12,979.1 12,687.3 Other current assets 10,753.0 10,380.2 10,281.4 10,472.9 10,116.8 - Prepaid_Contract cost 486.0 475.4

465.1 471.4 485.2 - Prepaid_Contract cost 478.7 464.2 451.9 453.8 475.3 - Contract assets 248.7 240.1 229.3 226.3 225.3 - Contract assets 227.5 219.1 207.4 204.1 201.7 Liabilities 25,253.1 24,148.9 24,127.8 24,162.5 23,564.0 Liabilities 15,831.4

15,265.4 15,335.6 15,166.7 14,513.1 6,925.2 6,957.5 7,477.8 7,315.1 8,074.9 Current liabilities 13,478.5 13,147.5 14,046.1 14,095.2 14,644.5 Current liabilities 5,021.2 4,459.0 4,864.3 4,694.7 4,421.5 Trade & other payables 9,264.6 8,054.9

8,282.4 8,052.3 7,712.9 Trade & other payables 1,173.8 1,725.2 1,914.9 1,789.5 2,860.3 Short-term borrowings 2,368.7 3,058.6 3,538.6 3,595.0 4,358.7 Short-term borrowings Others 1,845.2 2,033.9 2,225.1 2,447.9 2,572.9 Others 730.2 773.3 698.5

830.8 793.0 - Contract liabilities 245.2 229.2 239.3 231.2 230.6 - Contract liabilities 222.6 223.9 227.0 206.9 210.5 Non-current liabilities 11,774.6 11,001.4 10,081.7 10,067.3 8,919.5 Non-current liabilities 8,906.2 8,307.9 7,857.9 7,851.6 6,438.2

Trade & other payables 856.0 819.6 554.1 556.2 573.4 Trade & other payables 1,337.9 1,364.8 1,074.2 1,063.8 1,010.2 Long-term borrowings 7,940.8 7,159.6 6,612.8 6,555.6 5,409.9 Long-term borrowings 6,497.5 5,834.7 5,652.2 5,675.7 4,290.7

Others 2,977.9 3,022.3 2,914.8 2,955.4 2,936.2 Others 1,070.8 1,108.4 1,131.5 1,112.0 1,137.3 - Contract liabilities 37.2 49.6 48.7 43.6 48.7 - Contract liabilities 32.4 35.8 36.0 26.4 32.9 Equity 18,721.7 18,561.1 18,582.2 18,981.9 19,186.4 Equity

14,983.4 15,043.5 14,999.2 15,298.1 15,444.1 Retained earnings 14,570.7 14,494.4 14,361.5 14,452.7 14,675.2 Retained earnings 12,541.3 12,544.4 12,390.5 12,404.2 12,579.2 17

K-IFRS / Separate 3 Subscribers (Unit: Thousands) Wireless Subscribers 3Q

23 4Q 23 1Q 24 2Q 24 3Q 24 QoQ YoY Total 24,903 24,897 24,834 24,904 25,203 1.2% 1.2% - MNO 17,735 17,759 17,743 17,770 17,997 1.3% 1.5% - MVNO 7,168 7,138 7,091 7,134 7,207 1.0% 0.5% 1) 5G Handset 9,408 9,722 9,948 10,093 10,251 1.6% 9.0% 2) Churn

rate 1.1% 1.1% 1.1% 1.0% 1.0% 0.0%p -0.1%p 3) 34,560 0.2% 2.1% ARPU (KRW) 33,838 34,302 34,461 34,507 nd 1) 5G Handset : Retroactively applied from 1Q23 based on the change of subscriber disclosure criteria by the MSIT (excludes 5G 2 Device and 5G

IoT) 2) Churn rate : Based on MNO subscribers (excludes IoT) 3) ARPU = Wireless revenue* / Wireless subscribers** * Wireless revenue(3G, LTE, 5G incl.): Revenue of Voice/Data usage (Interconnection/Subscription fee exc.), VAS, Contract/ Bundled

Discounts, and etc. incl. ** Wireless subscribers: Based on MSIT’s guidelines for average billed subscribers in quarter (IoT/M2M exc.) (Unit: Thousands) Fixed Line Subscribers 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 QoQ YoY Telephony 12,184 12,035

11,903 11,748 11,616 -1.1% -4.7% - PSTN 8,960 8,820 8,673 8,526 8,395 -1.5% -6.3% - VoIP 3,225 3,215 3,230 3,222 3,222 0.0% -0.1% Broadband 9,810 9,827 9,862 9,899 9,928 0.3% 1.2% IPTV (GTV+GTS) 9,430 9,409 9,418 9,423 9,440 0.2% 0.1% ※ Number

of IPTV subscribers above differs from MSIT figures that follow the IPTV law - Number of KT pay TV subscribers in 2H 2023 is 8,827,392 (6-month average) 18

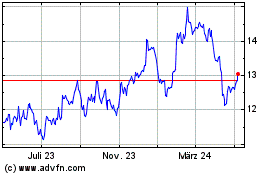

KT (NYSE:KT)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

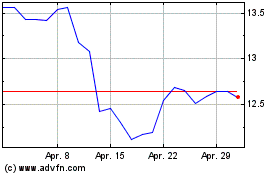

KT (NYSE:KT)

Historical Stock Chart

Von Jan 2024 bis Jan 2025